Key Insights

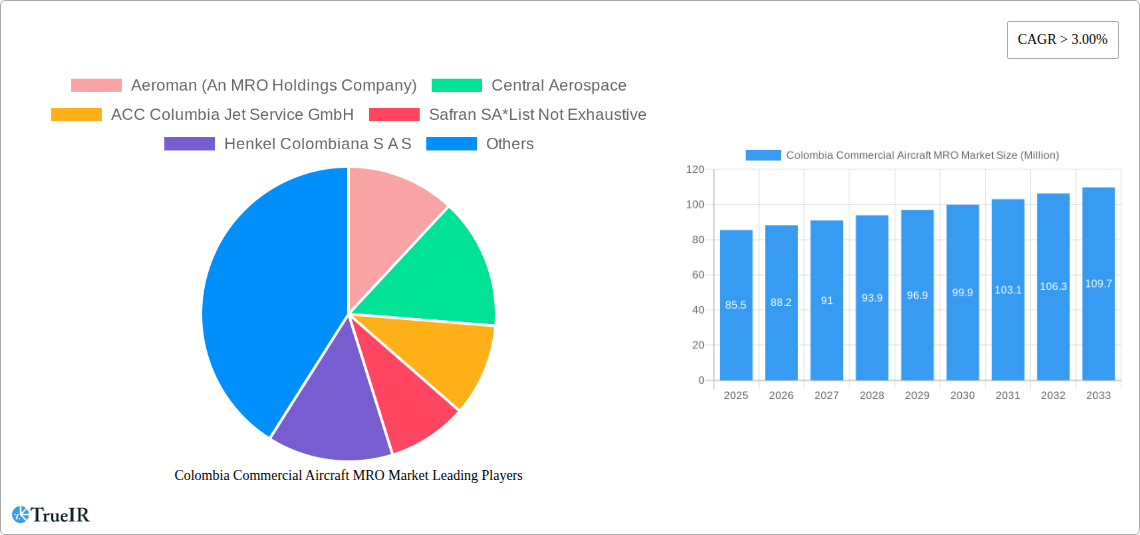

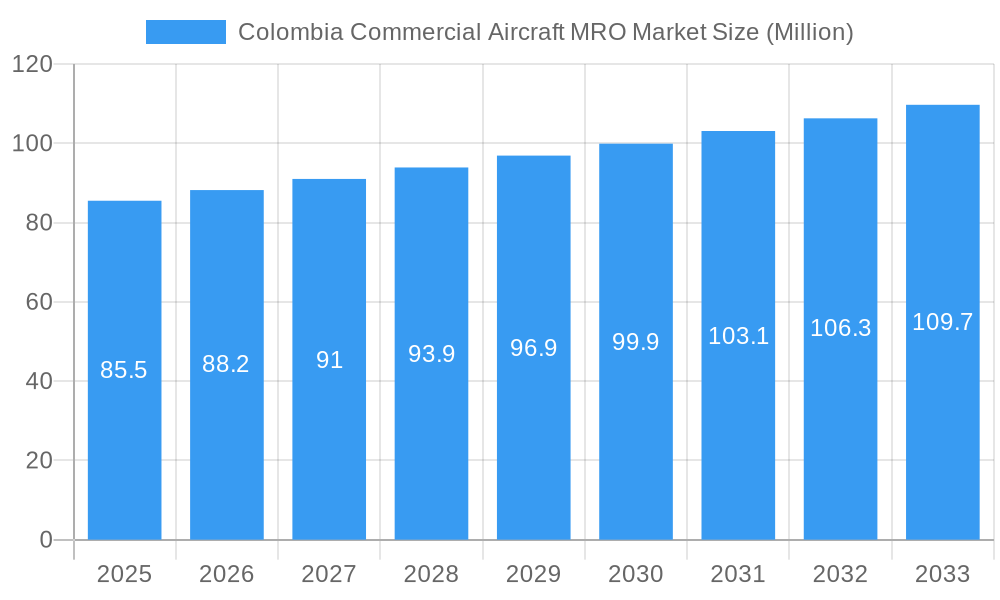

The Colombia Commercial Aircraft MRO (Maintenance, Repair, and Overhaul) market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 through 2033. This upward trajectory, driven by a confluence of factors including the increasing fleet size of commercial aircraft operating within and through Colombia, and the growing complexity of modern aviation technologies, underscores the sector's vital role in supporting the nation's aviation infrastructure. The market’s value, estimated to be substantial in the tens of millions of USD for 2025, will be significantly influenced by the escalating demand for specialized maintenance services across airframes, engines, components, and line maintenance. This heightened activity is largely fueled by the need to ensure the airworthiness and operational efficiency of a growing commercial aviation fleet, essential for both domestic connectivity and international trade. Key players such as Aeroman (An MRO Holdings Company), Central Aerospace, and Safran SA are strategically positioned to capitalize on these opportunities, investing in advanced capabilities and expanding their service portfolios to meet the evolving needs of airlines operating in the region.

Colombia Commercial Aircraft MRO Market Market Size (In Million)

Furthermore, evolving industry trends, including the increasing adoption of predictive maintenance technologies and the growing emphasis on component lifecycle management, are reshaping the MRO landscape in Colombia. Airlines are increasingly seeking MRO providers who can offer integrated solutions, encompassing everything from routine checks and repairs to complex overhauls and component upgrades. This shift necessitates a focus on innovation and technological advancement within the MRO sector. While the market is driven by these positive indicators, it is not without its challenges. Potential restraints may include the availability of skilled labor, the cost of advanced tooling and technology, and stringent regulatory compliance requirements. Nevertheless, the inherent demand for reliable and efficient aircraft maintenance, coupled with the strategic importance of aviation to Colombia's economy, suggests a dynamic and promising future for the commercial aircraft MRO market in the country. The expansion of existing MRO facilities and the potential entry of new service providers will likely intensify competition, driving service quality and cost-effectiveness.

Colombia Commercial Aircraft MRO Market Company Market Share

This comprehensive report delves into the dynamic Colombia Commercial Aircraft MRO Market, offering an in-depth analysis of its current state and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this study provides critical insights for stakeholders navigating this evolving industry. The report examines market size, growth drivers, emerging trends, and competitive strategies within the commercial aircraft Maintenance, Repair, and Overhaul (MRO) sector in Colombia.

The Colombia Commercial Aircraft MRO Market is experiencing significant expansion, driven by a growing fleet, increasing air travel demand, and a rising focus on operational efficiency and safety. This report utilizes high-volume keywords such as "aircraft maintenance Colombia," "commercial aviation MRO," "Colombia aviation services," and "airframe MRO Colombia" to enhance search visibility and reach a broad industry audience. It also incorporates specific segment analyses for "engine MRO Colombia," "component MRO Colombia," and "line maintenance Colombia."

The report provides detailed projections for market size and growth, supported by meticulous research and expert analysis, offering actionable intelligence for aviation stakeholders, including airlines, MRO providers, component manufacturers, and investors.

Colombia Commercial Aircraft MRO Market Market Structure & Competitive Landscape

The Colombia Commercial Aircraft MRO Market exhibits a moderately fragmented structure, characterized by the presence of established global players and emerging local service providers. Innovation is a key differentiator, with companies focusing on advanced diagnostic tools, predictive maintenance solutions, and the adoption of digital technologies to streamline MRO processes. Regulatory impacts, primarily from civil aviation authorities, are significant, ensuring adherence to stringent safety and operational standards. Product substitutes are limited within the core MRO services, with a strong emphasis on OEM-certified repairs and specialized expertise. End-user segmentation primarily involves full-service carriers, low-cost carriers, and cargo airlines, each with distinct MRO requirements. Mergers and acquisitions (M&A) trends are anticipated to grow as larger entities seek to expand their service portfolios and geographical reach within the Colombian market. Concentration ratios are expected to shift as strategic alliances and partnerships become more prevalent.

- Market Concentration: Moderate, with a mix of large international MROs and specialized local providers.

- Innovation Drivers: Digitalization, AI-powered diagnostics, advanced materials, and sustainable MRO practices.

- Regulatory Impacts: Stringent safety protocols, airworthiness directives, and compliance with international aviation standards.

- Product Substitutes: Limited, with a strong preference for OEM-approved parts and certified repairs.

- End-User Segmentation: Full-service airlines, low-cost carriers, cargo operators, and business aviation.

- M&A Trends: Increasing consolidation to achieve economies of scale and broader service offerings.

Colombia Commercial Aircraft MRO Market Market Trends & Opportunities

The Colombia Commercial Aircraft MRO market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period of 2025–2033. This expansion is underpinned by several compelling trends and significant opportunities. The increasing demand for air travel in Colombia, recovering strongly post-pandemic, directly translates to higher fleet utilization and, consequently, a greater need for routine and heavy maintenance services. This surge in activity necessitates efficient and reliable MRO solutions across all segments, including airframe, engine, component, and line maintenance.

Technological shifts are profoundly influencing the MRO landscape. The adoption of digital tools, such as predictive maintenance powered by artificial intelligence and machine learning, is becoming paramount. These technologies enable MRO providers to forecast potential component failures before they occur, minimizing costly unplanned downtime for airlines and enhancing overall operational safety and efficiency. Furthermore, advancements in materials science and repair techniques are leading to more sustainable and cost-effective solutions for aircraft components.

Consumer preferences, in this context, are evolving towards service providers that offer integrated solutions, faster turnaround times, and transparent pricing. Airlines are increasingly looking for MRO partners that can provide end-to-end support, from routine inspections to complex engine overhauls, thereby optimizing their operational budgets. The growing fleet of modern aircraft, such as the Airbus A320neo and Boeing 737 MAX, equipped with more sophisticated systems, also presents a significant opportunity for MRO providers specializing in these platforms. The Colombian government's commitment to developing its aviation infrastructure and fostering a conducive business environment further bolsters market potential. Opportunities also lie in developing specialized MRO capabilities for regional aircraft and expanding services to cater to the growing cargo aviation sector. The increasing emphasis on sustainability within the aviation industry is creating a demand for eco-friendly MRO practices, such as the use of greener chemicals and waste reduction initiatives, offering a unique niche for innovative providers. The Colombia commercial aircraft MRO market size is projected to reach xx Million by 2033, a substantial increase from its 2025 valuation.

Dominant Markets & Segments in Colombia Commercial Aircraft MRO Market

The Colombia Commercial Aircraft MRO Market demonstrates distinct dominance across various segments and geographical focuses. While the entire nation is the primary market, the operational hubs of major airlines, particularly around Bogotá and Medellín, represent the most significant centers for MRO activities. This concentration is driven by the presence of extensive airline operations, supporting infrastructure, and skilled labor pools.

Within the MRO Type segmentation, Component MRO is a particularly dominant and rapidly growing segment. The sheer volume and complexity of aircraft components, coupled with their shorter life cycles compared to airframes or engines, necessitate continuous and specialized repair and overhaul services. Advancements in component technology, leading to more intricate and sensitive parts, further fuel the demand for highly specialized Component MRO expertise.

Line Maintenance also holds a substantial share, owing to its critical role in ensuring day-to-day operational continuity. Daily checks, minor repairs, and pre-flight inspections are essential for airlines to maintain their flight schedules, making efficient and readily available line maintenance services indispensable. The increasing flight frequencies and network expansions by Colombian carriers directly translate to higher demand for these services.

The Airframe MRO segment, encompassing heavy checks and structural repairs, remains a cornerstone of the market. As the average age of aircraft fleets increases and airlines aim to maximize the lifespan of their assets, demand for comprehensive airframe maintenance services is sustained. The introduction of new aircraft types also requires MRO providers to adapt and develop capabilities for these modern platforms.

While Engine MRO represents the most technically demanding and capital-intensive segment, its dominance is driven by the high cost of engine overhauls and the critical impact of engine performance on operational efficiency and safety. The increasing complexity of modern turbofan engines requires specialized repair facilities and highly skilled technicians.

Key growth drivers in these dominant segments include:

- Infrastructure Development: Expansion and modernization of airports and dedicated MRO facilities.

- Skilled Workforce Development: Investment in training programs to produce certified MRO technicians and engineers.

- Airline Fleet Growth: Increasing numbers of commercial aircraft operating in and out of Colombia.

- OEM Support Agreements: Growing trend of airlines partnering with original equipment manufacturers (OEMs) for specialized MRO solutions, as evidenced by recent industry developments.

- Technological Advancements: Adoption of digital tools for diagnostics, predictive maintenance, and streamlined workflow management.

- Government Policies: Supportive aviation policies aimed at fostering local MRO capabilities and attracting investment.

Colombia Commercial Aircraft MRO Market Product Analysis

The Colombia Commercial Aircraft MRO market's product offerings are centered around a comprehensive suite of services designed to maintain the airworthiness and operational efficiency of commercial aircraft. These services encompass everything from routine checks and minor repairs to extensive overhauls of airframes, engines, and components. Technological advancements are increasingly shaping these products, with a growing emphasis on predictive maintenance solutions utilizing AI and machine learning for early fault detection and proactive repairs. The application of advanced diagnostic tools, specialized repair techniques, and the use of innovative materials are enhancing the longevity and reliability of aircraft parts. Competitive advantages are being built on faster turnaround times, cost-effectiveness, adherence to stringent safety standards, and the provision of integrated MRO solutions that cover multiple aspects of aircraft maintenance. The market is also witnessing a trend towards eco-friendlier MRO practices, aligning with global sustainability initiatives.

Key Drivers, Barriers & Challenges in Colombia Commercial Aircraft MRO Market

The Colombia Commercial Aircraft MRO Market is propelled by several key drivers. Technologically, the adoption of digital solutions like AI for predictive maintenance and advanced diagnostic tools enhances efficiency and reduces downtime. Economically, the recovering and growing demand for air travel in Colombia directly translates to increased fleet utilization and a higher need for MRO services. Policy-driven factors, such as government initiatives to boost the aviation sector and attract foreign investment in MRO capabilities, also play a crucial role. The presence of major airlines operating modern fleets necessitates continuous maintenance, creating a stable demand base.

However, the market also faces significant barriers and challenges. Supply chain issues, including the availability and lead times for specialized parts and components, can lead to delays and increased costs. Regulatory hurdles, while essential for safety, can sometimes be complex and time-consuming to navigate, requiring MRO providers to maintain strict compliance standards. Competitive pressures from both established global MRO providers and emerging local players can impact pricing and market share. The need for substantial capital investment in advanced infrastructure and specialized equipment also presents a barrier for new entrants. Furthermore, a shortage of highly skilled and certified MRO technicians in specific niches can constrain growth.

Growth Drivers in the Colombia Commercial Aircraft MRO Market Market

Key growth drivers for the Colombia Commercial Aircraft MRO market include the robust recovery and expansion of air travel demand, leading to increased fleet utilization and subsequent maintenance needs. The ongoing fleet modernization by Colombian airlines, incorporating newer and more technologically advanced aircraft, creates demand for specialized MRO services aligned with these platforms. Government support for the aviation sector, aiming to develop local MRO capabilities and attract investment, provides a conducive environment for growth. Furthermore, the strategic geographical location of Colombia as a hub for regional air travel positions it to benefit from increased cross-border operations requiring extensive MRO support. The growing emphasis on passenger safety and operational efficiency by airlines necessitates adherence to high MRO standards, driving demand for quality services.

Challenges Impacting Colombia Commercial Aircraft MRO Market Growth

Challenges impacting the Colombia Commercial Aircraft MRO market growth primarily stem from the inherent complexities of the aviation industry. Regulatory complexities, while crucial for safety, can sometimes impose stringent and evolving compliance requirements that necessitate significant investment and operational adjustments. Global supply chain disruptions, a persistent issue in recent years, can lead to extended lead times for critical spare parts and components, impacting turnaround times and increasing operational costs for MRO providers. Intense competitive pressures, both from established international MRO giants and a growing number of local service providers, can squeeze profit margins and necessitate continuous innovation and cost optimization strategies. The substantial capital investment required for state-of-the-art MRO facilities and specialized equipment also presents a barrier to entry and a challenge for smaller players seeking to scale their operations. Moreover, a consistent supply of highly skilled and certified aviation technicians remains a critical challenge.

Key Players Shaping the Colombia Commercial Aircraft MRO Market Market

- Aeroman (An MRO Holdings Company)

- Central Aerospace

- ACC Columbia Jet Service GmbH

- Safran SA

- Henkel Colombiana S A S

- Nediar InnLab

- Avianca Cargo

- SGS (Société Générale de Surveillance SA)

- Indaer Aviation Technical Services S A S

Significant Colombia Commercial Aircraft MRO Market Industry Milestones

- November 2022: Safran Nacelles signed a four-year agreement with Avianca for the support of the nacelles of the airline's Airbus A320neo powered by CFM International LEAP-1A turbofan engines. Under the agreement, the airline will get OEM-guaranteed MRO solutions at the Safran Nacelles repair station. This agreement highlights the growing trend of OEM-integrated MRO solutions and strengthens Safran's presence in the Colombian market.

- April 2022: Ultra Air, a new Colombian airline, selected Airbus' flight hours services (FHS) for its A320 aircraft fleet. Airbus will provide parts pooling, on-site stock at the airline's main base in Medellin, engineering services, and components maintenance. This development underscores the increasing reliance on comprehensive service packages and strategic partnerships between airlines and aircraft manufacturers for MRO support.

Future Outlook for Colombia Commercial Aircraft MRO Market Market

The future outlook for the Colombia Commercial Aircraft MRO Market is highly promising, driven by sustained air travel recovery and the increasing sophistication of commercial aircraft. Strategic opportunities lie in the expansion of specialized MRO capabilities for next-generation aircraft and the adoption of advanced digital technologies, such as AI-driven predictive maintenance and augmented reality for technician training and support. The market potential is further amplified by the Colombian government's commitment to fostering a robust aviation ecosystem, which includes incentives for local MRO development and infrastructure enhancements. As airlines increasingly seek to optimize operational costs and enhance fleet reliability, integrated MRO solutions and long-term service agreements will become even more critical. The growing focus on sustainability within the aviation industry also presents an avenue for growth for MRO providers offering eco-friendly solutions. The market is expected to witness a rise in strategic collaborations and partnerships aimed at sharing expertise and resources to meet the evolving demands of the industry.

Colombia Commercial Aircraft MRO Market Segmentation

-

1. MRO Type

- 1.1. Airframe

- 1.2. Engine

- 1.3. Component

- 1.4. Line

Colombia Commercial Aircraft MRO Market Segmentation By Geography

- 1. Colombia

Colombia Commercial Aircraft MRO Market Regional Market Share

Geographic Coverage of Colombia Commercial Aircraft MRO Market

Colombia Commercial Aircraft MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Air Traffic Across Colombia Propels the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Commercial Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe

- 5.1.2. Engine

- 5.1.3. Component

- 5.1.4. Line

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aeroman (An MRO Holdings Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Central Aerospace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ACC Columbia Jet Service GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Henkel Colombiana S A S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nediar InnLab

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avianca Cargo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGS (Société Générale de Surveillance SA)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Indaer Aviation Technical Services S A S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Aeroman (An MRO Holdings Company)

List of Figures

- Figure 1: Colombia Commercial Aircraft MRO Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Colombia Commercial Aircraft MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by MRO Type 2020 & 2033

- Table 2: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by MRO Type 2020 & 2033

- Table 4: Colombia Commercial Aircraft MRO Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Commercial Aircraft MRO Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Colombia Commercial Aircraft MRO Market?

Key companies in the market include Aeroman (An MRO Holdings Company), Central Aerospace, ACC Columbia Jet Service GmbH, Safran SA*List Not Exhaustive, Henkel Colombiana S A S, Nediar InnLab, Avianca Cargo, SGS (Société Générale de Surveillance SA), Indaer Aviation Technical Services S A S.

3. What are the main segments of the Colombia Commercial Aircraft MRO Market?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Air Traffic Across Colombia Propels the Market Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Safran Nacelles signed a four-year agreement with Avianca for the support of the nacelles of the airline's Airbus A320neo powered by CFM International LEAP-1A turbofan engines. Under the agreement, the airline will get OEM-guaranteed MRO solutions at the Safran Nacelles repair station.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Commercial Aircraft MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Commercial Aircraft MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Commercial Aircraft MRO Market?

To stay informed about further developments, trends, and reports in the Colombia Commercial Aircraft MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence