Key Insights

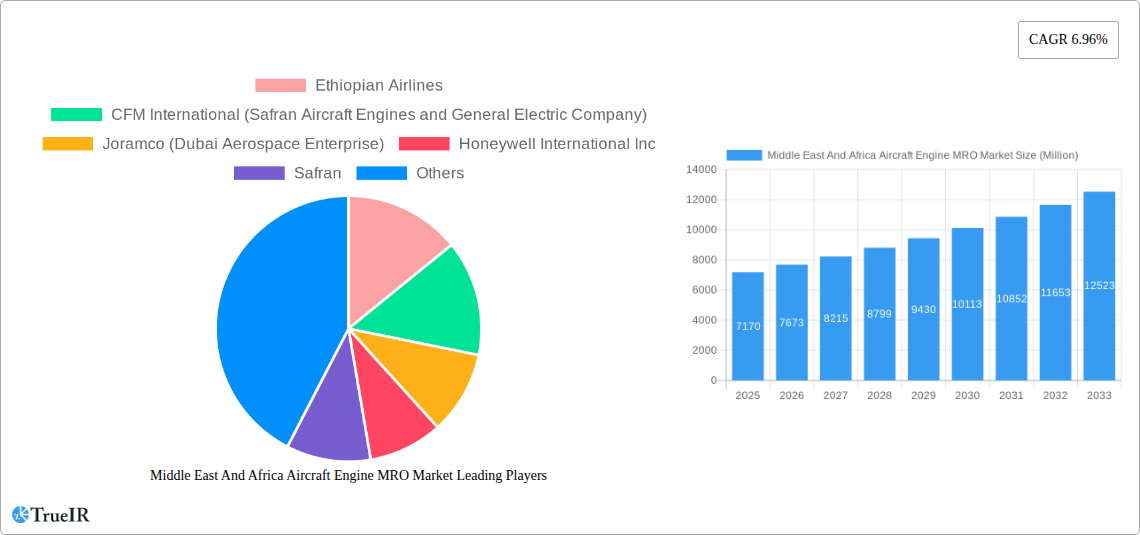

The Middle East and Africa (MEA) Aircraft Engine Maintenance, Repair, and Overhaul (MRO) market is poised for robust expansion, projected to reach a valuation of USD 7.17 billion by 2025. This significant growth trajectory is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.96%, indicating a dynamic and expanding sector. A primary driver for this growth is the escalating demand for air travel across the region, spurred by increasing disposable incomes, growing tourism, and expanding trade routes. As more aircraft enter service and existing fleets age, the need for comprehensive engine MRO services becomes paramount to ensure operational efficiency, safety, and compliance with stringent aviation regulations. Furthermore, the proactive investments in aviation infrastructure and the establishment of new airlines and cargo operations within the MEA region are creating a fertile ground for sustained MRO service demand. This burgeoning market is characterized by a growing trend towards outsourcing MRO services by airlines, enabling them to focus on core competencies while leveraging specialized expertise. Moreover, advancements in engine technology and the increasing complexity of modern aircraft engines necessitate sophisticated MRO solutions, further fueling market expansion.

Middle East And Africa Aircraft Engine MRO Market Market Size (In Billion)

The MEA Aircraft Engine MRO market is experiencing a wave of strategic alliances and technological innovations. Major players are investing in advanced repair techniques and digital solutions to enhance turnaround times and cost-effectiveness. The region's strategic geographical location, acting as a vital hub for international travel, significantly contributes to the sustained demand for MRO services as aircraft undergo frequent maintenance between long-haul flights. Key segments, including production analysis, consumption analysis, import/export dynamics, and price trend analysis, are all indicative of a healthy market. The increasing number of aircraft deliveries to airlines in the Middle East and Africa directly translates to a growing need for engine MRO as these fleets mature. While the market is driven by growth, potential restraints such as the high cost of specialized MRO equipment and the availability of skilled labor need to be strategically addressed by industry stakeholders to maintain the upward momentum. The competitive landscape features a mix of global MRO giants and emerging regional players, fostering innovation and service differentiation.

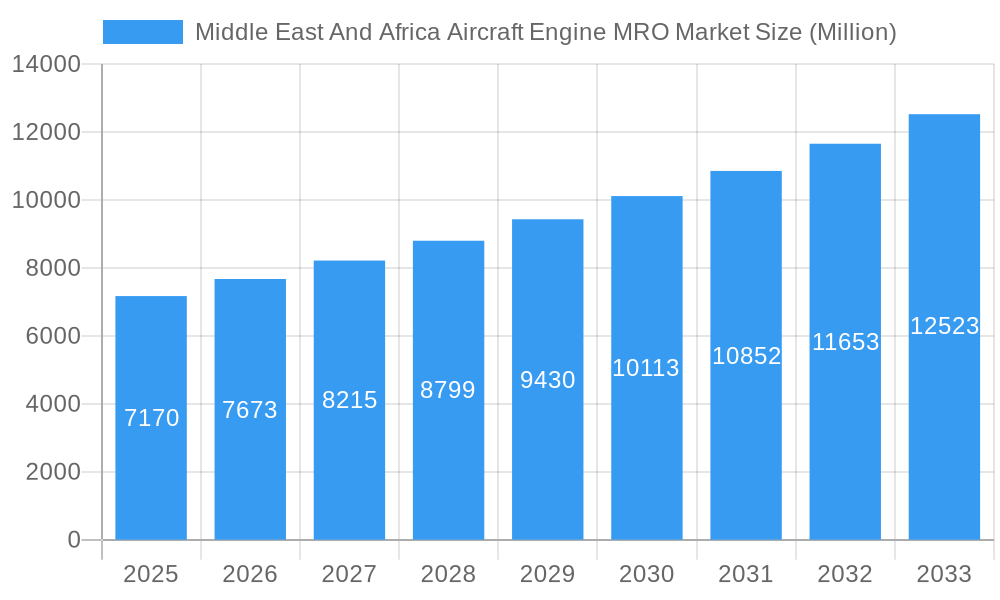

Middle East And Africa Aircraft Engine MRO Market Company Market Share

Here is a dynamic, SEO-optimized report description for the Middle East and Africa Aircraft Engine MRO Market, structured as requested.

Middle East And Africa Aircraft Engine MRO Market Market Structure & Competitive Landscape

The Middle East and Africa (MEA) aircraft engine MRO market is characterized by a moderately concentrated structure, with a few key global players holding significant market share alongside a growing number of regional service providers and specialized MRO shops. The innovation drivers are primarily fueled by advancements in engine technology, the increasing complexity of newer generation engines, and the demand for predictive maintenance solutions to enhance aircraft availability and reduce operational costs. Regulatory impacts are a crucial consideration, with aviation authorities in the MEA region enforcing stringent safety and airworthiness standards that influence MRO practices and certifications. The product substitutes are limited in the core engine overhaul segment, but aftermarket parts, component repair, and innovative service packages can be considered as alternative approaches to traditional full engine overhauls. End-user segmentation is largely driven by airline fleets (commercial passenger and cargo airlines), followed by business aviation and military operators, each with distinct MRO requirements and service level agreements. Mergers and acquisition (M&A) trends are indicative of market consolidation and the pursuit of expanded service capabilities and geographic reach. Over the historical period (2019-2024), there have been approximately 15 significant M&A activities focused on expanding MRO capabilities and securing long-term contracts. The market concentration ratio (CR4) for the top four players is estimated at 65% in 2025, highlighting a strong presence of major players.

Middle East And Africa Aircraft Engine MRO Market Market Trends & Opportunities

The Middle East and Africa aircraft engine MRO market is projected to experience robust growth, driven by a confluence of factors including expanding air travel, fleet modernization, and increasing demand for specialized maintenance services. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, reaching an estimated market size of over $5,500 Million by 2033. This expansion is fueled by the increasing number of aircraft deliveries in the region and the aging of existing fleets, necessitating more frequent and extensive engine maintenance. Technological shifts are playing a pivotal role, with the integration of digital solutions, AI-powered diagnostics, and advanced materials science transforming MRO processes. The adoption of these technologies aims to enhance efficiency, reduce turnaround times, and improve the reliability of aircraft engines. Consumer preferences are leaning towards Original Equipment Manufacturer (OEM)-approved services and third-party MROs offering competitive pricing and flexible service models. Competitive dynamics are intensifying, with both global MRO giants and burgeoning regional players vying for market share. Opportunities abound in areas such as the repair and overhaul of next-generation engines (e.g., LEAP, GTF), the provision of line maintenance services, and the development of specialized capabilities for freighter aircraft engines. Furthermore, the growing focus on sustainability in aviation is creating opportunities for MRO providers offering environmentally friendly repair techniques and material recycling. The market penetration rate for advanced MRO technologies is expected to reach over 40% by 2030, indicating a significant shift towards digitalized and data-driven maintenance.

Dominant Markets & Segments in Middle East And Africa Aircraft Engine MRO Market

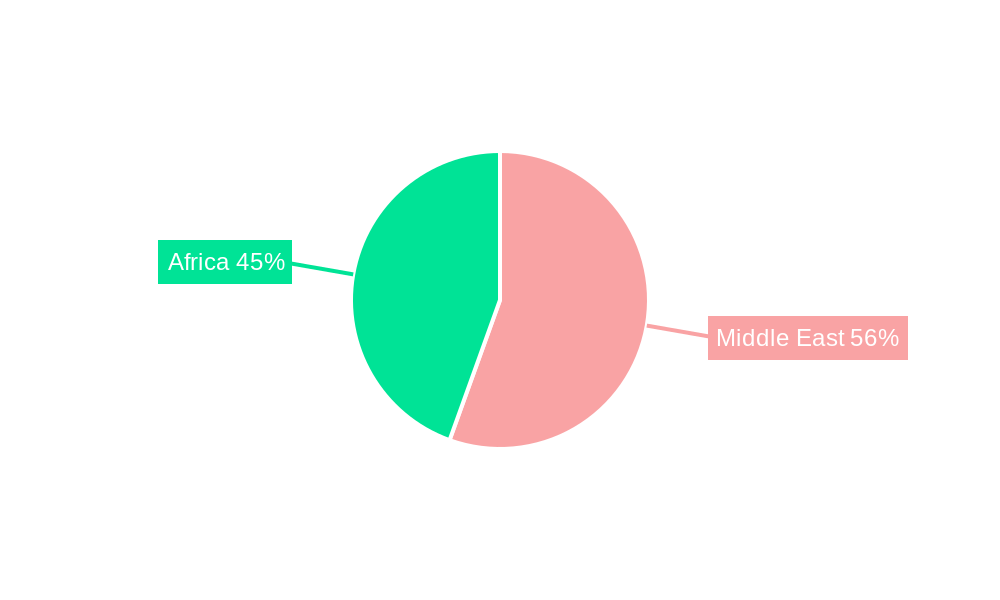

The Middle East region, particularly countries like the United Arab Emirates and Saudi Arabia, currently dominates the Middle East and Africa aircraft engine MRO market. This dominance is attributed to several key growth drivers, including the presence of major international airlines with expansive fleets, significant investments in aviation infrastructure, and favorable government policies promoting the growth of the aviation sector.

- Production Analysis: The Middle East region leads in engine production and assembly capabilities, with strategic partnerships and joint ventures contributing to this segment. The estimated production output of engine components and related services in the Middle East is projected to reach over $1,800 Million in 2025.

- Consumption Analysis: Consumption of MRO services is heavily influenced by the operational tempo of airline fleets. The Middle East's status as a global aviation hub, with major carriers operating extensive routes, drives substantial demand for engine MRO. Consumption analysis in 2025 is estimated to be over $3,200 Million.

- Import Market Analysis (Value & Volume): The MEA region relies on imports for specialized engine components and advanced MRO technologies. The import market value for aircraft engine MRO services and parts is estimated at over $1,500 Million in 2025, with a volume of approximately 3,500 metric tons. Key import drivers include the need for specialized tooling and expertise not always available domestically.

- Export Market Analysis (Value & Volume): While the region is a net importer of many MRO services, certain hubs are emerging as export centers for specific engine types or component repairs. The export market value is estimated at over $700 Million in 2025, with a volume of approximately 1,200 metric tons. This segment is poised for growth as regional MRO providers gain international certifications and expertise.

- Price Trend Analysis: Price trends in the MEA aircraft engine MRO market are influenced by labor costs, parts availability, technological advancements, and the competitive landscape. The average price per engine overhaul is estimated to range between $1.5 Million to $3.0 Million, depending on engine type and service scope. Prices are expected to see a modest increase of 2-3% annually due to inflation and demand-supply dynamics.

Middle East And Africa Aircraft Engine MRO Market Product Analysis

The product analysis in the MEA aircraft engine MRO market centers on the comprehensive services offered for various engine types, from turbofan to turboprop. Innovations are focused on extending engine life, improving fuel efficiency, and reducing downtime through advanced diagnostics and predictive maintenance technologies. Competitive advantages are derived from specialized repair capabilities, rapid turnaround times, and customized service packages tailored to the unique operational needs of airlines in the region. The market fit is strong for services related to CFM56, V2500, GE90, and the newer generation LEAP and GTF engines.

Key Drivers, Barriers & Challenges in Middle East And Africa Aircraft Engine MRO Market

Key Drivers: The MEA aircraft engine MRO market is propelled by the rapid expansion of air travel, fleet modernization initiatives, and the strategic focus on developing robust aviation ecosystems in countries like the UAE and Saudi Arabia. The increasing number of aircraft deliveries from OEMs and the aging of existing fleets necessitate significant MRO investments. Furthermore, government support for aviation infrastructure and a growing demand for specialized maintenance services are critical growth catalysts. Technological advancements in engine design and the adoption of digital MRO solutions are also key drivers.

Barriers & Challenges: Supply chain disruptions, particularly for critical spare parts, pose a significant challenge. The stringent regulatory environment and the need for constant compliance with international aviation standards require substantial investment and expertise. The availability of skilled labor and the retention of highly specialized technicians remain a concern. Competitive pressures from established global players and emerging regional MROs can impact pricing and market access. The upfront cost of investing in advanced MRO technologies and facilities can also be a barrier for smaller operators.

Growth Drivers in the Middle East And Africa Aircraft Engine MRO Market Market

The growth of the MEA aircraft engine MRO market is predominantly driven by the expansion of commercial aviation, evidenced by the increasing passenger and cargo traffic in the region. Fleet modernization programs by major airlines, aimed at incorporating more fuel-efficient and technologically advanced aircraft, are creating a consistent demand for MRO services for both new and existing engines. Government initiatives to diversify economies and promote aviation as a key sector are also significant contributors, leading to infrastructure development and the establishment of new MRO facilities. Furthermore, the growing trend towards outsourcing MRO services by airlines to specialized third-party providers presents substantial growth opportunities.

Challenges Impacting Middle East And Africa Aircraft Engine MRO Market Growth

Several challenges are impacting the growth trajectory of the MEA aircraft engine MRO market. Navigating complex and evolving regulatory frameworks across different countries within the region can be a significant hurdle. Supply chain vulnerabilities, especially in sourcing specialized parts and materials, can lead to extended turnaround times and increased operational costs. The intense competition among global and regional MRO providers also exerts downward pressure on pricing and profit margins. Additionally, a shortage of highly skilled and certified aircraft engine technicians, coupled with the high cost of training and retaining such talent, remains a persistent issue that can constrain service capacity and expansion plans.

Key Players Shaping the Middle East And Africa Aircraft Engine MRO Market Market

- Ethiopian Airlines

- CFM International (Safran Aircraft Engines and General Electric Company)

- Joramco (Dubai Aerospace Enterprise)

- Honeywell International Inc

- Safran

- Lockheed Martin Corporation

- Pratt & Whitney (RTX Corporation)

- EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group)

- Sanad (Mubadala Investment Company)

- 6 2 Other Players

- Lufthansa Technik AG (Lufthansa Group)

- Rolls-Royce plc

- Emirates Engineering (Emirates Group)

- Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd

- AMMROC (Edge)

- General Electric Company

- STS Aviation Group

- Saudia Aerospace Engineering Industries

Significant Middle East And Africa Aircraft Engine MRO Market Industry Milestones

- 2019: Ethiopian Airlines expands its engine MRO capabilities, investing in new facilities and training programs to service a wider range of CFM engines.

- 2020: Dubai Aerospace Enterprise (DAE) through its subsidiary Joramco, secures a significant long-term contract for engine MRO services with a major Middle Eastern carrier.

- 2021: Honeywell International Inc. announces a strategic partnership with a regional airline to provide advanced engine component repair and overhaul services.

- 2021: Sanad (Mubadala Investment Company) completes a significant acquisition, expanding its engine MRO portfolio and geographic reach within the MEA region.

- 2022: Rolls-Royce plc inaugurates a new engine service center in the Middle East, focusing on its Trent engine family.

- 2022: AMMROC (Edge) announces the expansion of its capabilities to include the maintenance of newer generation aircraft engines.

- 2023: EGYPTAIR MAINTENANCE & ENGINEERING invests in state-of-the-art diagnostic tools to enhance its engine troubleshooting and repair services.

- 2023: Safran Aircraft Engines and General Electric Company (CFM International) announce plans to jointly expand their MRO network in the Middle East to support LEAP engine operators.

- 2024: Lufthansa Technik AG strengthens its presence in the region by signing new service agreements with multiple airlines for comprehensive engine MRO solutions.

- 2024: Emirates Engineering enhances its in-house capabilities for advanced engine repairs and modifications.

Future Outlook for Middle East And Africa Aircraft Engine MRO Market Market

The future outlook for the Middle East and Africa aircraft engine MRO market is exceptionally promising, driven by sustained air travel growth and ongoing fleet expansions. Key growth catalysts include the increasing adoption of digital MRO technologies, such as AI and IoT, for predictive maintenance and operational efficiency. Strategic investments in local MRO capabilities and a focus on developing specialized expertise for next-generation engines will further bolster the market. Opportunities will arise from the demand for sustainable MRO practices and the potential for emerging markets within Africa to establish and grow their MRO infrastructure. Overall, the market is poised for significant expansion and technological advancement.

Middle East And Africa Aircraft Engine MRO Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East And Africa Aircraft Engine MRO Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Aircraft Engine MRO Market Regional Market Share

Geographic Coverage of Middle East And Africa Aircraft Engine MRO Market

Middle East And Africa Aircraft Engine MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Aircraft Engine MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CFM International (Safran Aircraft Engines and General Electric Company)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Joramco (Dubai Aerospace Enterprise)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Safran

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lockheed Martin Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pratt & Whitney (RTX Corporation)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sanad (Mubadala Investment Company)6 2 Other Players

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lufthansa Technik AG (Lufthansa Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rolls-Royce plc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Emirates Engineering (Emirates Group)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AMMROC (Edge)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 General Electric Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 STS Aviation Group

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Saudia Aerospace Engineering Industries

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Middle East And Africa Aircraft Engine MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Aircraft Engine MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Aircraft Engine MRO Market?

The projected CAGR is approximately 6.96%.

2. Which companies are prominent players in the Middle East And Africa Aircraft Engine MRO Market?

Key companies in the market include Ethiopian Airlines, CFM International (Safran Aircraft Engines and General Electric Company), Joramco (Dubai Aerospace Enterprise), Honeywell International Inc, Safran, Lockheed Martin Corporation, Pratt & Whitney (RTX Corporation), EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group), Sanad (Mubadala Investment Company)6 2 Other Players, Lufthansa Technik AG (Lufthansa Group), Rolls-Royce plc, Emirates Engineering (Emirates Group), Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd, AMMROC (Edge), General Electric Company, STS Aviation Group, Saudia Aerospace Engineering Industries.

3. What are the main segments of the Middle East And Africa Aircraft Engine MRO Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.17 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Aircraft Engine MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Aircraft Engine MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Aircraft Engine MRO Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Aircraft Engine MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence