Key Insights

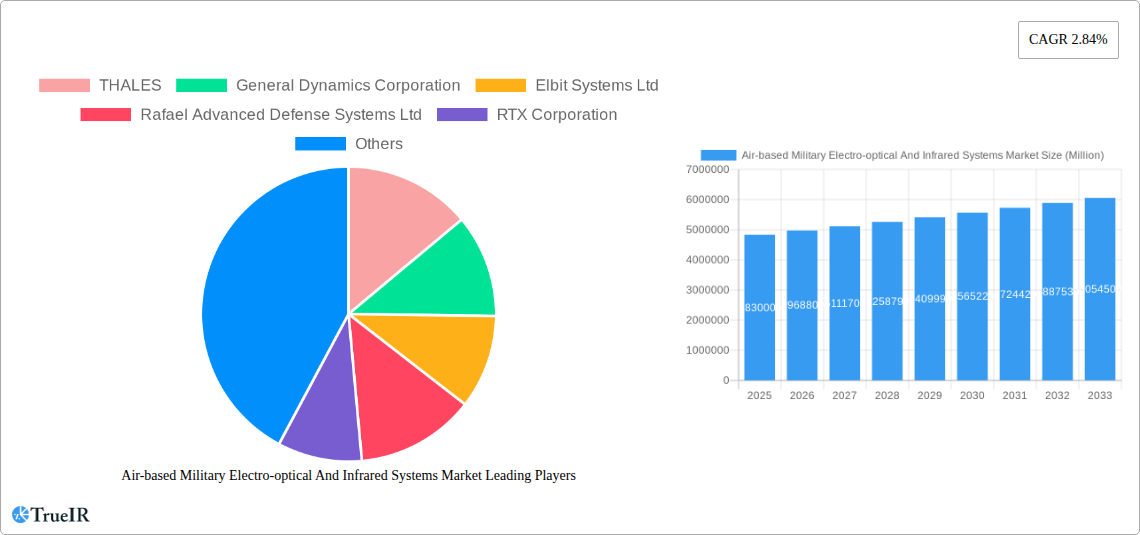

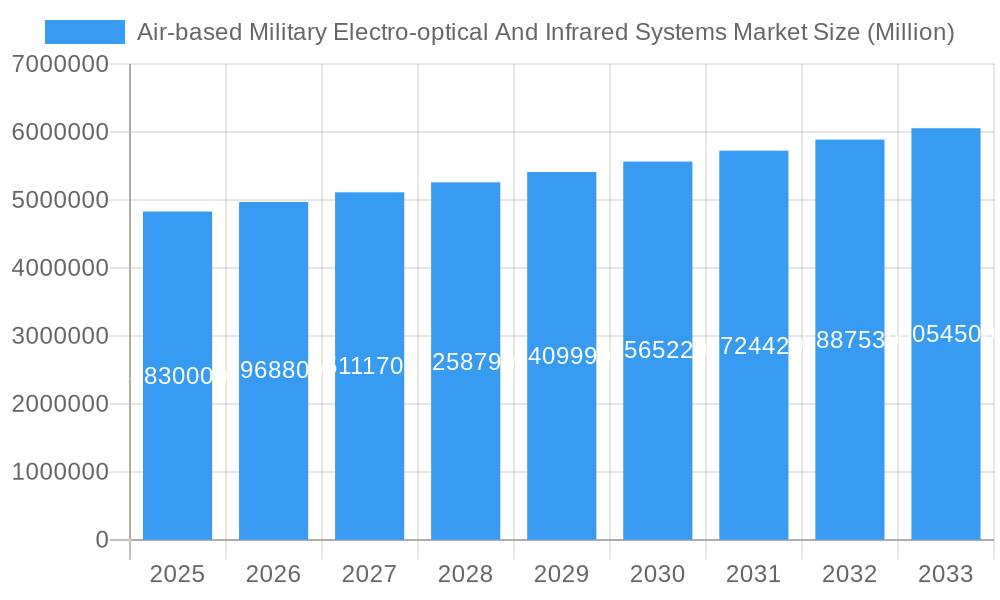

The Air-based Military Electro-optical and Infrared (EO/IR) Systems market is poised for steady expansion, currently valued at USD 4.83 million. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 2.84% throughout the forecast period from 2025 to 2033. The market is driven by the increasing need for advanced situational awareness and target acquisition capabilities in modern aerial defense platforms. Escalating geopolitical tensions and the continuous evolution of aerial warfare necessitate sophisticated EO/IR systems for surveillance, reconnaissance, and targeting. Innovations in multi-spectral and hyper-spectral imaging technologies are key enablers, offering enhanced performance in diverse environmental conditions and the ability to detect subtle signatures. The integration of AI and machine learning into these systems is further boosting their analytical power and reducing operator workload, thus driving adoption.

Air-based Military Electro-optical And Infrared Systems Market Market Size (In Million)

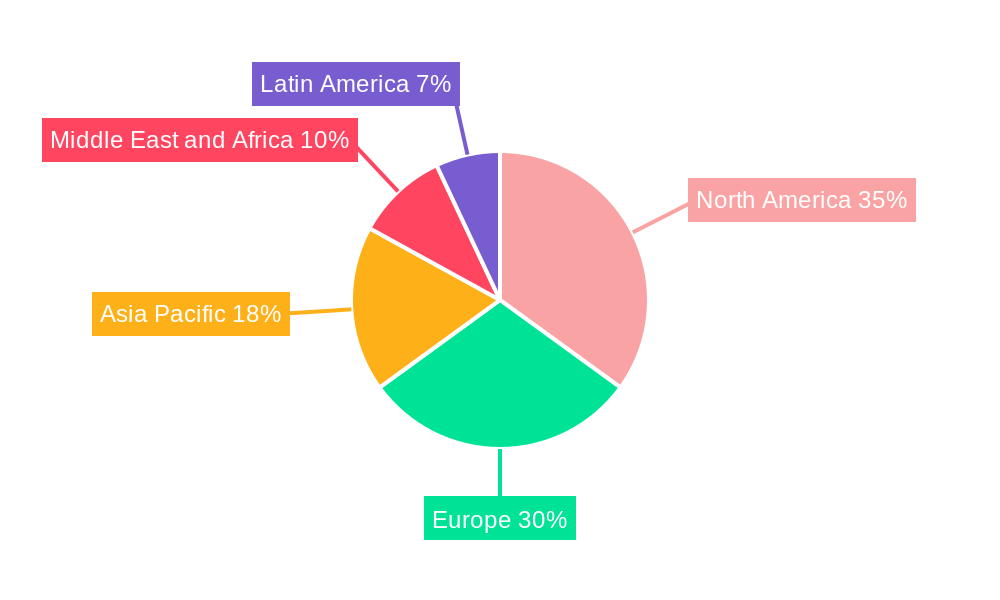

The market's trajectory is shaped by several key trends, including the miniaturization of EO/IR components for integration into smaller aerial platforms like drones and unmanned aerial vehicles (UAVs), and the development of networked warfare capabilities where data from EO/IR systems is seamlessly shared across different assets. However, challenges such as the high cost of advanced technology development and procurement, coupled with stringent regulatory frameworks governing military technology, can act as restraints. Despite these hurdles, the unwavering commitment of major defense players like Thales, General Dynamics Corporation, and Northrop Grumman Corporation to research and development, alongside significant government investments in defense modernization, suggests a robust and sustained market expansion across major regions like North America and Europe, with Asia Pacific emerging as a significant growth contributor.

Air-based Military Electro-optical And Infrared Systems Market Company Market Share

Air-based Military Electro-optical and Infrared Systems Market: In-depth Analysis and Future Projections (2019–2033)

This comprehensive report delivers an unparalleled deep dive into the Air-based Military Electro-optical and Infrared (EO/IR) Systems Market, providing critical insights for stakeholders navigating this rapidly evolving sector. Covering the extensive study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this analysis leverages high-volume SEO keywords to maximize visibility and engagement. We explore market dynamics, technological advancements, regional dominance, and the strategic landscapes of key players. Expect detailed quantitative data, qualitative analysis, and forward-looking projections, essential for strategic planning and investment decisions in military EO/IR technology.

Air-based Military Electro-optical And Infrared Systems Market Market Structure & Competitive Landscape

The Air-based Military EO/IR Systems Market exhibits a moderately concentrated structure, characterized by a blend of large, established defense contractors and agile, specialized technology providers. Innovation remains a primary driver, fueled by the relentless demand for enhanced battlefield awareness, intelligence, surveillance, and reconnaissance (ISR) capabilities. Key players are continuously investing in research and development to incorporate advanced AI/ML for faster data processing, improved target recognition, and reduced operator workload. Regulatory impacts are significant, with stringent export controls and national security mandates shaping market access and product development. Product substitutes, while limited in direct performance, can emerge from advancements in alternative sensing modalities or software-defined solutions. End-user segmentation is crucial, with defense ministries and armed forces across various nations being the primary consumers, prioritizing specific platform integration needs (e.g., fighter jets, UAVs, helicopters). Mergers and acquisitions (M&A) are a recurring theme as companies seek to consolidate market share, acquire proprietary technologies, and expand their product portfolios. For instance, an estimated 20-30 M&A deals are observed annually within the broader defense electronics sector, with a significant portion impacting EO/IR capabilities. Concentration ratios are estimated to be around CR4 of 40-50% for key sub-segments like advanced targeting pods.

Air-based Military Electro-optical And Infrared Systems Market Market Trends & Opportunities

The Air-based Military EO/IR Systems Market is poised for robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period (2025–2033). This expansion is underpinned by increasing global defense spending, driven by geopolitical tensions and the persistent need for superior situational awareness in modern warfare. Technological advancements are at the forefront, with a significant shift towards more sophisticated imaging technologies, including Multi-Spectral and Hyper-Spectral sensors, offering enhanced threat detection and identification capabilities even in challenging environmental conditions. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is transforming data analysis, enabling real-time threat assessment and reducing operator fatigue. The proliferation of Unmanned Aerial Vehicles (UAVs) as critical ISR platforms is creating substantial demand for compact, lightweight, and high-performance EO/IR systems. Furthermore, the modernization of existing air fleets across major military powers necessitates upgrades to their EO/IR payloads, presenting ongoing opportunities. Emerging market penetration rates for advanced EO/IR systems on new airframes are estimated to reach 85% by 2030. Consumer preferences, defined by military end-users, are increasingly leaning towards systems offering multi-functionality, network-centric warfare compatibility, and superior resolution and range. The competitive landscape is intensifying, with companies differentiating themselves through innovative sensor fusion, advanced processing, and robust system integration capabilities. Opportunities also lie in servicing and upgrading legacy systems, ensuring their continued relevance and performance. The market penetration for advanced EO/IR systems in new military aircraft acquisitions is projected to be over 90% by the end of the forecast period, indicating a strong adoption trend. The global market size is expected to grow from approximately USD 12 Billion in 2025 to an estimated USD 20 Billion by 2033. This growth is a direct reflection of the increasing importance of real-time, high-fidelity data for strategic decision-making in airborne military operations. The evolving nature of threats, from conventional military engagements to asymmetric warfare and counter-terrorism operations, further accentuates the demand for sophisticated EO/IR solutions. The development of next-generation systems capable of operating in contested electromagnetic environments and providing deeper battlefield insights will be a key differentiator.

Dominant Markets & Segments in Air-based Military Electro-optical And Infrared Systems Market

The North American region, particularly the United States, stands as the dominant market for Air-based Military Electro-optical and Infrared Systems. This dominance is propelled by substantial defense budgets, a strong emphasis on technological superiority, and continuous investment in advanced military platforms. The region's commitment to maintaining a technological edge in aerospace and defense ensures a consistent demand for cutting-edge EO/IR solutions.

Key Growth Drivers in North America:

- Significant Defense Expenditures: The United States consistently allocates a substantial portion of its GDP to defense, driving innovation and procurement of advanced military hardware, including EO/IR systems. Estimated annual defense spending in the region exceeds USD 800 Billion.

- Technological Advovation: A robust ecosystem of defense contractors and research institutions fosters rapid development and adoption of advanced technologies, such as AI integration and advanced sensor capabilities.

- Platform Modernization Programs: Ongoing upgrades and replacement of aging military aircraft fleets, including fighter jets, bombers, and surveillance aircraft, require sophisticated EO/IR payloads.

- Unmanned Systems Proliferation: The extensive use of UAVs for reconnaissance, surveillance, and strike missions creates a substantial market for miniaturized and high-performance EO/IR systems. The US military operates over 11,000 UAVs, a significant driver for sensor demand.

- Geopolitical Imperatives: The need to address evolving global threats and maintain military readiness fuels sustained demand for advanced ISR capabilities.

Within the Imaging Technology segment, Multi-Spectral imaging currently holds a larger market share due to its established capabilities and widespread application across various military platforms. However, Hyper-Spectral imaging is rapidly gaining traction and is projected to experience significant growth.

Analysis of Imaging Technology Dominance:

- Multi-Spectral Imaging: This technology offers a broad spectrum of light capture, enabling the differentiation of various materials and objects based on their spectral signatures. Its applications include target detection, camouflage identification, and battlefield assessment. The market for multi-spectral systems is estimated to be around USD 6 Billion in 2025, representing over 50% of the total market. Key growth drivers include its integration into existing systems and its proven reliability in diverse operational scenarios.

- Hyper-Spectral Imaging: This advanced form of imaging captures a much narrower and more contiguous spectral band, providing highly detailed spectral information. This allows for more precise identification and classification of targets, including subtle distinctions between similar materials or the detection of specific chemical signatures. The hyper-spectral segment, while smaller, is projected to grow at a CAGR of 8.5%, reaching an estimated USD 4.5 Billion by 2033. Growth in this segment is driven by its potential for enhanced intelligence gathering, border security applications, and the detection of hidden threats. The increasing demand for precise target identification in complex environments is a major catalyst.

Air-based Military Electro-optical And Infrared Systems Market Product Analysis

The Air-based Military EO/IR Systems Market is characterized by continuous product innovation focused on enhanced resolution, extended range, improved targeting accuracy, and multi-sensor fusion capabilities. Leading products include advanced targeting pods, reconnaissance sensors, and surveillance systems integrated into fighter jets, drones, and helicopters. These systems leverage cutting-edge technologies like cooled infrared detectors, advanced optical designs, and sophisticated image processing algorithms. Competitive advantages are derived from miniaturization, reduced power consumption, increased environmental resilience, and seamless integration with existing command and control networks. The focus is on providing actionable intelligence in real-time, enabling rapid decision-making and enhancing operational effectiveness in diverse mission profiles.

Key Drivers, Barriers & Challenges in Air-based Military Electro-optical And Infrared Systems Market

The Air-based Military EO/IR Systems Market is propelled by several key drivers. Technologically, the relentless pursuit of superior ISR capabilities, enhanced situational awareness, and the integration of AI/ML for advanced data analysis are paramount. Economically, rising global defense budgets and modernization initiatives by various nations provide significant impetus. Policy-driven factors, such as national security strategies and the demand for interoperable defense systems, also play a crucial role. Specific examples include the widespread adoption of EO/IR systems on new UAV platforms and the upgrading of existing fighter jet fleets.

Challenges impacting growth include stringent regulatory hurdles, particularly export control regulations, which can limit market access for certain technologies. Supply chain complexities and the reliance on specialized components can lead to delays and increased costs. Competitive pressures from established players and emerging technologies necessitate continuous innovation. Quantifiable impacts of these challenges can include extended procurement timelines and increased R&D investments to meet compliance standards. For instance, a single export license approval can take 6-12 months.

Growth Drivers in the Air-based Military Electro-optical And Infrared Systems Market Market

Key growth drivers for the Air-based Military EO/IR Systems Market include the increasing demand for advanced ISR capabilities driven by evolving geopolitical landscapes and the need for superior battlefield awareness. Technological advancements, such as the integration of artificial intelligence and machine learning for enhanced data processing and target identification, are significant catalysts. The rapid proliferation and increasing sophistication of unmanned aerial systems (UAS) also fuel demand for miniaturized and high-performance EO/IR payloads. Furthermore, ongoing modernization programs for existing military aircraft fleets across various nations are creating sustained market opportunities.

Challenges Impacting Air-based Military Electro-optical And Infrared Systems Market Growth

Challenges impacting the growth of the Air-based Military EO/IR Systems Market are multifaceted. Regulatory complexities, including stringent export control laws and national security restrictions, can significantly hamper market access and slow down product adoption. Supply chain disruptions, particularly for specialized electronic components and rare earth materials, pose a constant threat to production timelines and cost management. Intense competitive pressures necessitate substantial R&D investments to maintain a technological edge, leading to higher development costs. Furthermore, the integration of new systems with legacy platforms can present technical compatibility challenges, requiring additional engineering efforts and resources.

Key Players Shaping the Air-based Military Electro-optical And Infrared Systems Market Market

- THALES

- General Dynamics Corporation

- Elbit Systems Ltd

- Rafael Advanced Defense Systems Ltd

- RTX Corporation

- HENSOLDT AG

- Leonardo S p A

- Northrop Grumman Corporation

- IA

- Saab AB

- Teledyne FLIR LLC

Significant Air-based Military Electro-optical And Infrared Systems Market Industry Milestones

- 2021/Q3: RTX Corporation's subsidiary, Collins Aerospace, announces the development of a new generation of advanced targeting systems for fighter aircraft.

- 2022/Q1: Elbit Systems Ltd unveils a novel uncooled thermal imaging sensor for enhanced drone surveillance capabilities.

- 2022/Q4: Leonardo S.p.A. secures a significant contract for the supply of multi-mission radar and electro-optical systems for a new European naval patrol aircraft program.

- 2023/Q2: Teledyne FLIR LLC introduces a compact and powerful airborne infrared camera system designed for a wide range of unmanned platforms.

- 2024/Q1: HENSOLDT AG expands its portfolio with advanced multi-spectral imaging solutions for airborne reconnaissance applications.

Future Outlook for Air-based Military Electro-optical And Infrared Systems Market Market

The future outlook for the Air-based Military EO/IR Systems Market is highly positive, driven by ongoing technological advancements and increasing global defense investments. The continued integration of AI, machine learning, and advanced sensor fusion will lead to more autonomous and intelligent ISR capabilities. The growth of unmanned systems will remain a significant catalyst, demanding increasingly sophisticated and miniaturized EO/IR solutions. Opportunities will also arise from the retrofitting of legacy platforms and the development of systems for next-generation fighter jets and surveillance aircraft. Strategic collaborations and partnerships will be crucial for companies to navigate the complex regulatory landscape and maintain a competitive edge, ensuring sustained growth and market expansion.

Air-based Military Electro-optical And Infrared Systems Market Segmentation

-

1. Imaging Technology

- 1.1. Multi-Spectral

- 1.2. Hyper-Spectral

Air-based Military Electro-optical And Infrared Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Israel

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Air-based Military Electro-optical And Infrared Systems Market Regional Market Share

Geographic Coverage of Air-based Military Electro-optical And Infrared Systems Market

Air-based Military Electro-optical And Infrared Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Hyper-spectral Segment is Projected to Showcase Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air-based Military Electro-optical And Infrared Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 5.1.1. Multi-Spectral

- 5.1.2. Hyper-Spectral

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 6. North America Air-based Military Electro-optical And Infrared Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 6.1.1. Multi-Spectral

- 6.1.2. Hyper-Spectral

- 6.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 7. Europe Air-based Military Electro-optical And Infrared Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 7.1.1. Multi-Spectral

- 7.1.2. Hyper-Spectral

- 7.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 8. Asia Pacific Air-based Military Electro-optical And Infrared Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 8.1.1. Multi-Spectral

- 8.1.2. Hyper-Spectral

- 8.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 9. Latin America Air-based Military Electro-optical And Infrared Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 9.1.1. Multi-Spectral

- 9.1.2. Hyper-Spectral

- 9.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 10. Middle East and Africa Air-based Military Electro-optical And Infrared Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 10.1.1. Multi-Spectral

- 10.1.2. Hyper-Spectral

- 10.1. Market Analysis, Insights and Forecast - by Imaging Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 THALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Dynamics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elbit Systems Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rafael Advanced Defense Systems Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RTX Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HENSOLDT AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leonardo S p A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Northrop Grumman Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Saab AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teledyne FLIR LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 THALES

List of Figures

- Figure 1: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Imaging Technology 2025 & 2033

- Figure 3: North America Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Imaging Technology 2025 & 2033

- Figure 4: North America Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Imaging Technology 2025 & 2033

- Figure 7: Europe Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Imaging Technology 2025 & 2033

- Figure 8: Europe Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Imaging Technology 2025 & 2033

- Figure 11: Asia Pacific Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Imaging Technology 2025 & 2033

- Figure 12: Asia Pacific Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Imaging Technology 2025 & 2033

- Figure 15: Latin America Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Imaging Technology 2025 & 2033

- Figure 16: Latin America Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Imaging Technology 2025 & 2033

- Figure 19: Middle East and Africa Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Imaging Technology 2025 & 2033

- Figure 20: Middle East and Africa Air-based Military Electro-optical And Infrared Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Air-based Military Electro-optical And Infrared Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Imaging Technology 2020 & 2033

- Table 2: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Imaging Technology 2020 & 2033

- Table 4: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Imaging Technology 2020 & 2033

- Table 8: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Imaging Technology 2020 & 2033

- Table 15: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: China Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Imaging Technology 2020 & 2033

- Table 22: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Mexico Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Latin America Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Imaging Technology 2020 & 2033

- Table 27: Global Air-based Military Electro-optical And Infrared Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Israel Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Saudi Arabia Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Air-based Military Electro-optical And Infrared Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air-based Military Electro-optical And Infrared Systems Market?

The projected CAGR is approximately 2.84%.

2. Which companies are prominent players in the Air-based Military Electro-optical And Infrared Systems Market?

Key companies in the market include THALES, General Dynamics Corporation, Elbit Systems Ltd, Rafael Advanced Defense Systems Ltd, RTX Corporation, HENSOLDT AG, Leonardo S p A, Northrop Grumman Corporation, IA, Saab AB, Teledyne FLIR LLC.

3. What are the main segments of the Air-based Military Electro-optical And Infrared Systems Market?

The market segments include Imaging Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.83 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Hyper-spectral Segment is Projected to Showcase Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air-based Military Electro-optical And Infrared Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air-based Military Electro-optical And Infrared Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air-based Military Electro-optical And Infrared Systems Market?

To stay informed about further developments, trends, and reports in the Air-based Military Electro-optical And Infrared Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence