Key Insights

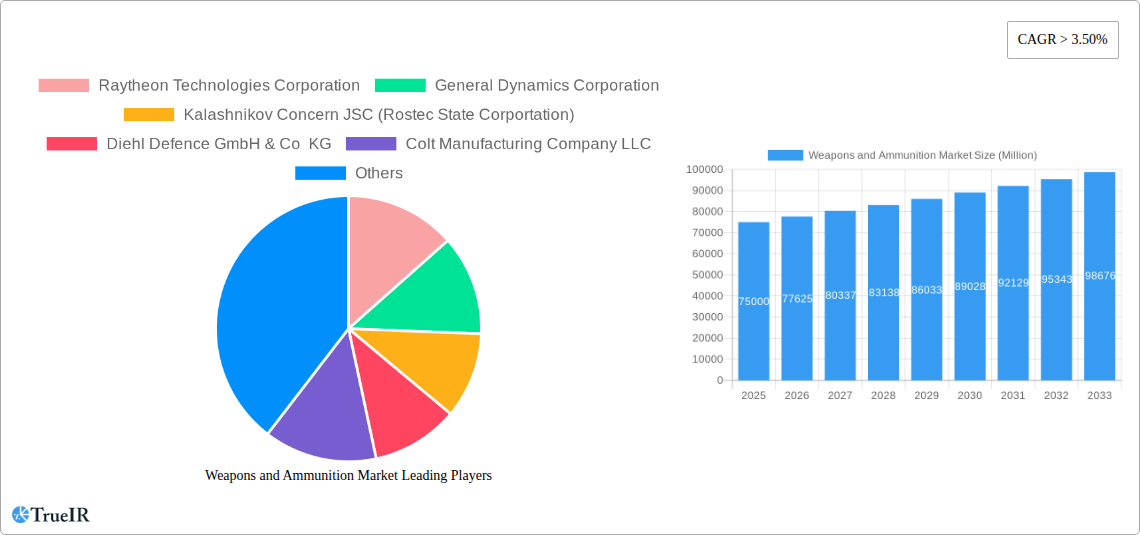

The global Weapons and Ammunition Market is projected for significant expansion, driven by heightened geopolitical tensions, increased defense spending, and the ongoing need for military modernization worldwide. With a market size valued at $69.35 billion in the base year 2025 and a Compound Annual Growth Rate (CAGR) of 7.51% through 2033, the sector is poised for sustained growth. Key drivers include demand for advanced small arms, portable explosives for asymmetric warfare, and the integration of smart technologies into weapon systems. The evolving complexities of modern defense scenarios necessitate enhanced ammunition capabilities across all calibers to support diverse operational platforms, from aerial and naval to terrestrial. Strategic investments in research and development focus on innovating next-generation weaponry with superior performance, accuracy, and safety.

Weapons and Ammunition Market Market Size (In Billion)

Market dynamics are also influenced by trends such as the proliferation of unmanned aerial vehicles (UAVs) and their specialized munitions, the adoption of directed energy weapons, and the growing emphasis on modular weapon systems. Potential restraints include stringent arms trade regulations, ethical considerations, and high R&D and manufacturing costs. Nevertheless, persistent global security concerns and the strategic imperative to maintain a technological defense edge will ensure a dynamic and expanding Weapons and Ammunition Market. The competitive landscape features established players and emerging innovators focused on product differentiation and strategic alliances.

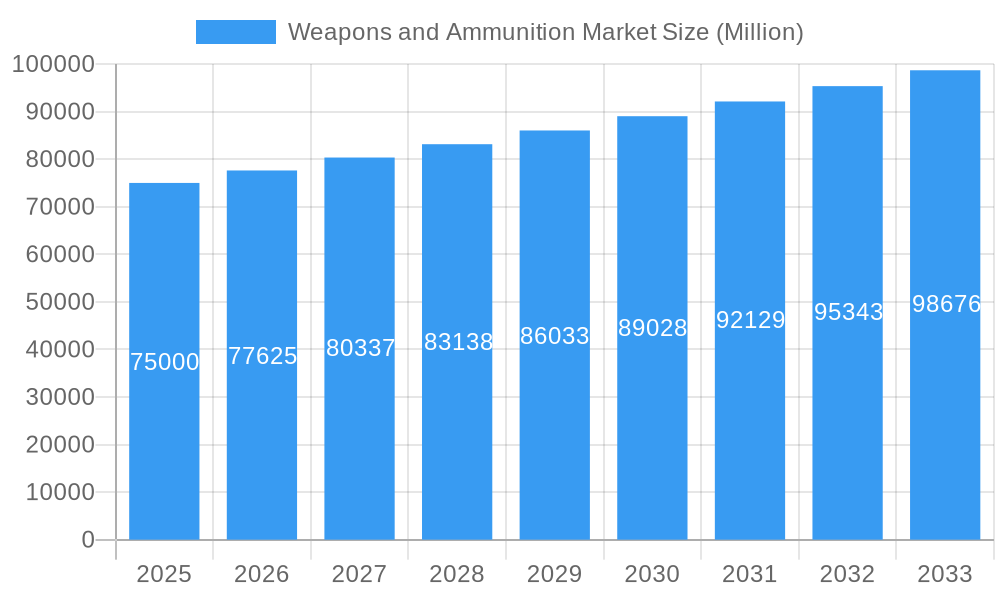

Weapons and Ammunition Market Company Market Share

This comprehensive market report offers granular analysis of the global weapons and ammunition market, covering the historical period (2019-2024), the base year (2025), and a forecast period extending to 2033. Designed for industry professionals, defense strategists, and investors, the report provides unparalleled insights into market dynamics, competitive strategies, technological advancements, and future growth trajectories. Analysis includes critical segments: Weapon Type (Small Arms, Rifles, Machine Guns, Portable Explosives, Other), Caliber (Small, Medium, Large), and Platform (Aerial, Terrestrial, Naval).

Weapons and Ammunition Market Market Structure & Competitive Landscape

The weapons and ammunition market exhibits a moderately concentrated structure, characterized by the presence of major global defense contractors alongside specialized niche manufacturers. Innovation drivers are primarily fueled by advancements in materials science, miniaturization of electronics, enhanced lethality, and improved accuracy, all driven by the relentless pursuit of superior defense capabilities. Regulatory impacts are significant, with stringent export controls, national security policies, and international arms treaties shaping market access and product development. Product substitutes, while limited in direct tactical applications, can emerge in the form of advanced non-lethal technologies or shifting geopolitical doctrines. End-user segmentation is predominantly driven by national defense forces, followed by law enforcement agencies and, to a lesser extent, civilian security providers. Mergers and acquisitions (M&A) trends are cyclical, often driven by consolidation for greater R&D efficiency, market share expansion, or the acquisition of specialized technologies. Recent M&A activities have focused on integrating cyber capabilities with traditional weapon systems and securing supply chain resilience. For instance, the consolidation within major defense conglomerates signifies a strategic move towards offering comprehensive defense solutions. The market concentration ratio is estimated to be around 60% for the top five players, with a steady volume of M&A transactions averaging 20-30 per year globally over the historical period.

Weapons and Ammunition Market Market Trends & Opportunities

The global weapons and ammunition market is poised for sustained growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This robust expansion is underpinned by escalating geopolitical tensions, increasing defense budgets across key nations, and the continuous modernization of armed forces. Technological shifts are prominently featuring the integration of artificial intelligence (AI) and machine learning (ML) into weapon systems, enabling autonomous targeting, enhanced situational awareness, and predictive maintenance. The rise of precision-guided munitions, smart ammunition, and directed-energy weapons represents a significant leap in lethality and effectiveness. Consumer preferences, within the context of defense procurement, are leaning towards systems offering greater versatility, interoperability, and reduced logistical footprints. The demand for lightweight, modular weapon platforms capable of rapid deployment and adaptation to diverse combat scenarios is also escalating. Competitive dynamics are intensifying, with a focus on developing next-generation capabilities that provide a decisive advantage. Opportunities abound in the development of advanced simulation and training systems, cybersecurity for defense platforms, and sustainable manufacturing practices for munitions. The market penetration rate for advanced weapon systems is steadily increasing as nations prioritize technological superiority. The increasing adoption of unmanned aerial vehicles (UAVs) integrated with sophisticated weapon payloads also presents a substantial growth avenue, blurring the lines between traditional aerial platforms and autonomous combat systems. Furthermore, the demand for enhanced small arms with improved ergonomics, reduced recoil, and integrated sighting systems continues to be a stable growth driver. The proliferation of asymmetric warfare tactics also necessitates the development of specialized munitions and weaponry to counter emerging threats. The ongoing evolution of battlefield doctrines, emphasizing networked warfare and multi-domain operations, will further propel the demand for interoperable and intelligent weapon systems.

Dominant Markets & Segments in Weapons and Ammunition Market

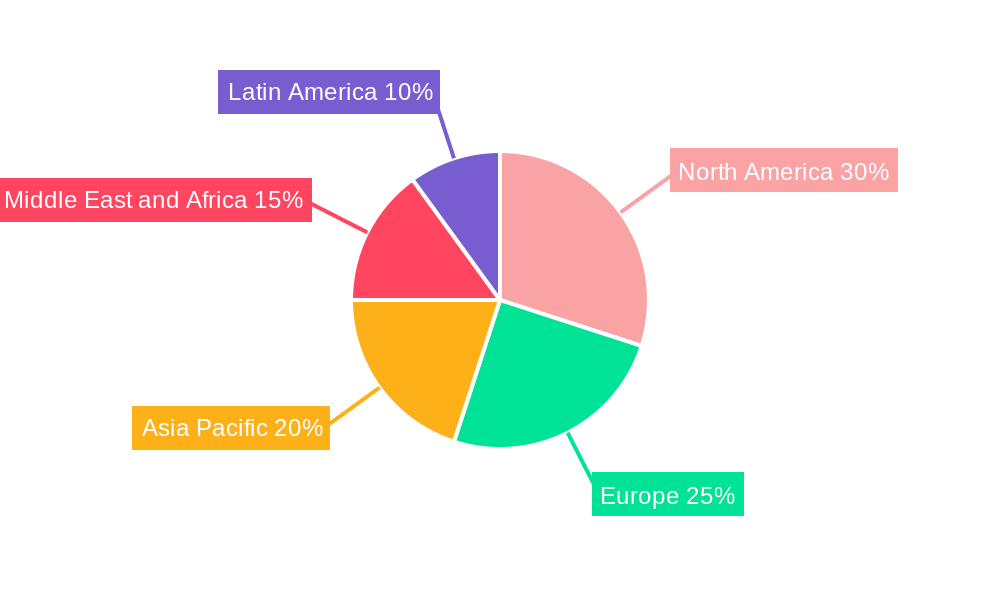

The Terrestrial platform segment is currently the dominant force in the weapons and ammunition market, driven by the vast requirements of ground forces worldwide. Within this segment, Rifles and Machine Guns constitute the largest portions of the Weapon Type category, reflecting their fundamental role in infantry operations. The Medium Caliber segment also holds significant sway, encompassing artillery, anti-tank weapons, and vehicle-mounted armaments crucial for offensive and defensive operations. Geographically, North America and Europe have historically led market expenditure due to robust defense spending and established manufacturing bases. However, the Asia-Pacific region is emerging as a significant growth engine, fueled by increasing defense modernization programs in countries like India, China, and South Korea, alongside a growing number of regional security initiatives.

- Weapon Type Dominance:

- Rifles: Essential for individual soldier firepower, with continuous demand for improved accuracy, ergonomics, and modularity.

- Machine Guns: Critical for sustained suppressive fire and area denial, with ongoing development in lighter, more controllable variants.

- Portable Explosives: Including grenades and man-portable anti-tank systems, vital for close-quarters combat and asymmetrical warfare scenarios.

- Caliber Dominance:

- Medium Caliber: Encompasses a wide range of artillery, autocannons, and anti-materiel weapons, critical for land-based engagements.

- Small Caliber: Pertains to small arms ammunition, representing a high-volume, consistent demand.

- Platform Dominance:

- Terrestrial: Constitutes the largest share due to the fundamental role of ground forces in defense and security. Key growth drivers include modernization of existing fleets, development of armored personnel carriers, and advanced infantry fighting vehicles.

- Aerial: Growing rapidly with the integration of advanced weaponry onto drones and fighter jets, driven by the need for precision strike capabilities and air superiority.

- Naval: Experiencing steady growth with the demand for naval strike missiles, torpedoes, and defensive weapon systems for surface vessels and submarines.

The increasing emphasis on territorial defense, border security, and the counter-insurgency operations in various regions will continue to fuel the demand for terrestrial-based weapon systems. Simultaneously, the evolving nature of aerial warfare and the growing importance of naval power projection are contributing to significant growth within their respective platform segments.

Weapons and Ammunition Market Product Analysis

Product innovation in the weapons and ammunition market is characterized by a focus on enhancing accuracy, lethality, and operational efficiency. Key advancements include the development of smart ammunition with integrated guidance systems, reducing collateral damage and increasing first-hit probabilities. Furthermore, the integration of advanced optics, lightweight materials, and modular designs in rifles and machine guns offers significant competitive advantages by improving soldier performance and adaptability. Ammunition manufacturers are also investing in developing more potent and specialized rounds, such as armor-piercing or frangible projectiles, to counter evolving threats. The application of these innovations spans all segments, from small arms designed for urban combat to large-caliber munitions for strategic bombardment.

Key Drivers, Barriers & Challenges in Weapons and Ammunition Market

The weapons and ammunition market is propelled by several key drivers: escalating geopolitical tensions and regional conflicts necessitate increased defense spending and military modernization, stimulating demand for advanced weaponry. Technological advancements, including AI integration and precision-guided munitions, create a demand for upgraded systems. Government initiatives and defense contracts, such as the Australian government's acquisition of new weapon systems worth USD 675.80 million, are significant economic stimuli.

Key challenges impacting growth include stringent international arms control regulations and export restrictions that limit market access. Supply chain disruptions, as witnessed with raw material sourcing and manufacturing complexities, can lead to production delays and increased costs. Intense competition among established players and emerging defense contractors also presents a barrier, driving down profit margins. The high cost of research and development for sophisticated weapon systems requires substantial capital investment.

Growth Drivers in the Weapons and Ammunition Market Market

Significant growth drivers in the weapons and ammunition market are primarily shaped by the global security landscape. Increasing geopolitical tensions and the rise of regional conflicts are compelling nations to bolster their defense capabilities, leading to heightened demand for modern weaponry and ammunition. Technological advancements, particularly in areas like guided munitions, drone warfare integration, and advanced targeting systems, are creating a strong impetus for armed forces to upgrade their existing arsenals. Furthermore, government defense procurement policies and substantial budget allocations for military modernization programs, exemplified by contracts for advanced weapon systems, provide a consistent stream of revenue and drive market expansion. The ongoing evolution of warfare doctrines, emphasizing network-centric operations and precision strikes, also fuels the demand for interoperable and intelligent defense solutions.

Challenges Impacting Weapons and Ammunition Market Growth

The weapons and ammunition market faces several significant barriers to growth. Stringent international regulations and export controls imposed by various countries create substantial hurdles for market access and cross-border trade, complicating global sales and distribution. Supply chain vulnerabilities, including the sourcing of specialized raw materials and the manufacturing of complex components, can lead to production delays and increased costs, impacting delivery timelines and profitability. Intense competitive pressures among global defense giants and emerging players necessitate continuous innovation and cost optimization, potentially squeezing profit margins. The high capital investment required for research and development of cutting-edge defense technologies also presents a substantial financial challenge for many companies.

Key Players Shaping the Weapons and Ammunition Market Market

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Kalashnikov Concern JSC (Rostec State Corportation)

- Diehl Defence GmbH & Co KG

- Colt Manufacturing Company LLC

- MBDA

- FN Herstal

- Denel SOC Ltd

- Rafael Advanced Defense Systems Ltd

- Nammo AS

- Saab AB

- Heckler and Koch GmbH

- BAE Systems plc

Significant Weapons and Ammunition Market Industry Milestones

- January 2023: The Australian government announced the acquisition of new weapon systems to boost the country's defense capabilities, awarding USD 675.80 million in contracts to CEA and Kongsberg Gruppen ASA for advanced weapon systems, including High Mobility Artillery Rocket Systems (HIMARS) and naval strike missiles.

- April 2022: The US Army signed a 10-year production contract with Sig Sauer, Inc. for the manufacturing and delivery of two Next Generation Squad Weapon variations (the XM250 Automatic Rifle and the XM5 Rifle) and the 6.8 Common Cartridge Family of Ammunition.

Future Outlook for Weapons and Ammunition Market Market

The future outlook for the weapons and ammunition market is characterized by continued innovation and strategic expansion. The increasing adoption of smart technologies, including AI-powered targeting and autonomous systems, will redefine combat capabilities and drive demand for sophisticated weaponry. Geopolitical realignments and the ongoing emphasis on national security will sustain robust defense spending, particularly in emerging economies. Opportunities lie in the development of directed-energy weapons, advanced missile defense systems, and modular, adaptable platforms that cater to diverse operational needs. The market is expected to witness a steady CAGR, driven by a persistent need for technological superiority and enhanced defense readiness across global armed forces.

Weapons and Ammunition Market Segmentation

-

1. Weapon Type

- 1.1. Small Arms

- 1.2. Rifles

- 1.3. Machine Guns

- 1.4. Portable Explosives

- 1.5. Other Weapon Types

-

2. Caliber

- 2.1. Small Caliber

- 2.2. Medium Caliber

- 2.3. Large Caliber

-

3. Platform

- 3.1. Aerial

- 3.2. Terrestrial

- 3.3. Naval

Weapons and Ammunition Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Weapons and Ammunition Market Regional Market Share

Geographic Coverage of Weapons and Ammunition Market

Weapons and Ammunition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. An Increase in Demand for Newer Generation Portable Explosive Weapon Systems Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Weapons and Ammunition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Weapon Type

- 5.1.1. Small Arms

- 5.1.2. Rifles

- 5.1.3. Machine Guns

- 5.1.4. Portable Explosives

- 5.1.5. Other Weapon Types

- 5.2. Market Analysis, Insights and Forecast - by Caliber

- 5.2.1. Small Caliber

- 5.2.2. Medium Caliber

- 5.2.3. Large Caliber

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Aerial

- 5.3.2. Terrestrial

- 5.3.3. Naval

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Weapon Type

- 6. North America Weapons and Ammunition Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Weapon Type

- 6.1.1. Small Arms

- 6.1.2. Rifles

- 6.1.3. Machine Guns

- 6.1.4. Portable Explosives

- 6.1.5. Other Weapon Types

- 6.2. Market Analysis, Insights and Forecast - by Caliber

- 6.2.1. Small Caliber

- 6.2.2. Medium Caliber

- 6.2.3. Large Caliber

- 6.3. Market Analysis, Insights and Forecast - by Platform

- 6.3.1. Aerial

- 6.3.2. Terrestrial

- 6.3.3. Naval

- 6.1. Market Analysis, Insights and Forecast - by Weapon Type

- 7. Europe Weapons and Ammunition Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Weapon Type

- 7.1.1. Small Arms

- 7.1.2. Rifles

- 7.1.3. Machine Guns

- 7.1.4. Portable Explosives

- 7.1.5. Other Weapon Types

- 7.2. Market Analysis, Insights and Forecast - by Caliber

- 7.2.1. Small Caliber

- 7.2.2. Medium Caliber

- 7.2.3. Large Caliber

- 7.3. Market Analysis, Insights and Forecast - by Platform

- 7.3.1. Aerial

- 7.3.2. Terrestrial

- 7.3.3. Naval

- 7.1. Market Analysis, Insights and Forecast - by Weapon Type

- 8. Asia Pacific Weapons and Ammunition Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Weapon Type

- 8.1.1. Small Arms

- 8.1.2. Rifles

- 8.1.3. Machine Guns

- 8.1.4. Portable Explosives

- 8.1.5. Other Weapon Types

- 8.2. Market Analysis, Insights and Forecast - by Caliber

- 8.2.1. Small Caliber

- 8.2.2. Medium Caliber

- 8.2.3. Large Caliber

- 8.3. Market Analysis, Insights and Forecast - by Platform

- 8.3.1. Aerial

- 8.3.2. Terrestrial

- 8.3.3. Naval

- 8.1. Market Analysis, Insights and Forecast - by Weapon Type

- 9. Latin America Weapons and Ammunition Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Weapon Type

- 9.1.1. Small Arms

- 9.1.2. Rifles

- 9.1.3. Machine Guns

- 9.1.4. Portable Explosives

- 9.1.5. Other Weapon Types

- 9.2. Market Analysis, Insights and Forecast - by Caliber

- 9.2.1. Small Caliber

- 9.2.2. Medium Caliber

- 9.2.3. Large Caliber

- 9.3. Market Analysis, Insights and Forecast - by Platform

- 9.3.1. Aerial

- 9.3.2. Terrestrial

- 9.3.3. Naval

- 9.1. Market Analysis, Insights and Forecast - by Weapon Type

- 10. Middle East and Africa Weapons and Ammunition Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Weapon Type

- 10.1.1. Small Arms

- 10.1.2. Rifles

- 10.1.3. Machine Guns

- 10.1.4. Portable Explosives

- 10.1.5. Other Weapon Types

- 10.2. Market Analysis, Insights and Forecast - by Caliber

- 10.2.1. Small Caliber

- 10.2.2. Medium Caliber

- 10.2.3. Large Caliber

- 10.3. Market Analysis, Insights and Forecast - by Platform

- 10.3.1. Aerial

- 10.3.2. Terrestrial

- 10.3.3. Naval

- 10.1. Market Analysis, Insights and Forecast - by Weapon Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Raytheon Technologies Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Dynamics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kalashnikov Concern JSC (Rostec State Corportation)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Diehl Defence GmbH & Co KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colt Manufacturing Company LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MBDA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FN Herstal

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Denel SOC Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rafael Advanced Defense Systems Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nammo AS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Saab A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Heckler and Koch GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BAE Systems plc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Raytheon Technologies Corporation

List of Figures

- Figure 1: Global Weapons and Ammunition Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Weapons and Ammunition Market Revenue (billion), by Weapon Type 2025 & 2033

- Figure 3: North America Weapons and Ammunition Market Revenue Share (%), by Weapon Type 2025 & 2033

- Figure 4: North America Weapons and Ammunition Market Revenue (billion), by Caliber 2025 & 2033

- Figure 5: North America Weapons and Ammunition Market Revenue Share (%), by Caliber 2025 & 2033

- Figure 6: North America Weapons and Ammunition Market Revenue (billion), by Platform 2025 & 2033

- Figure 7: North America Weapons and Ammunition Market Revenue Share (%), by Platform 2025 & 2033

- Figure 8: North America Weapons and Ammunition Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Weapons and Ammunition Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Weapons and Ammunition Market Revenue (billion), by Weapon Type 2025 & 2033

- Figure 11: Europe Weapons and Ammunition Market Revenue Share (%), by Weapon Type 2025 & 2033

- Figure 12: Europe Weapons and Ammunition Market Revenue (billion), by Caliber 2025 & 2033

- Figure 13: Europe Weapons and Ammunition Market Revenue Share (%), by Caliber 2025 & 2033

- Figure 14: Europe Weapons and Ammunition Market Revenue (billion), by Platform 2025 & 2033

- Figure 15: Europe Weapons and Ammunition Market Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Europe Weapons and Ammunition Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Weapons and Ammunition Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Weapons and Ammunition Market Revenue (billion), by Weapon Type 2025 & 2033

- Figure 19: Asia Pacific Weapons and Ammunition Market Revenue Share (%), by Weapon Type 2025 & 2033

- Figure 20: Asia Pacific Weapons and Ammunition Market Revenue (billion), by Caliber 2025 & 2033

- Figure 21: Asia Pacific Weapons and Ammunition Market Revenue Share (%), by Caliber 2025 & 2033

- Figure 22: Asia Pacific Weapons and Ammunition Market Revenue (billion), by Platform 2025 & 2033

- Figure 23: Asia Pacific Weapons and Ammunition Market Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Asia Pacific Weapons and Ammunition Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Weapons and Ammunition Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Weapons and Ammunition Market Revenue (billion), by Weapon Type 2025 & 2033

- Figure 27: Latin America Weapons and Ammunition Market Revenue Share (%), by Weapon Type 2025 & 2033

- Figure 28: Latin America Weapons and Ammunition Market Revenue (billion), by Caliber 2025 & 2033

- Figure 29: Latin America Weapons and Ammunition Market Revenue Share (%), by Caliber 2025 & 2033

- Figure 30: Latin America Weapons and Ammunition Market Revenue (billion), by Platform 2025 & 2033

- Figure 31: Latin America Weapons and Ammunition Market Revenue Share (%), by Platform 2025 & 2033

- Figure 32: Latin America Weapons and Ammunition Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Weapons and Ammunition Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Weapons and Ammunition Market Revenue (billion), by Weapon Type 2025 & 2033

- Figure 35: Middle East and Africa Weapons and Ammunition Market Revenue Share (%), by Weapon Type 2025 & 2033

- Figure 36: Middle East and Africa Weapons and Ammunition Market Revenue (billion), by Caliber 2025 & 2033

- Figure 37: Middle East and Africa Weapons and Ammunition Market Revenue Share (%), by Caliber 2025 & 2033

- Figure 38: Middle East and Africa Weapons and Ammunition Market Revenue (billion), by Platform 2025 & 2033

- Figure 39: Middle East and Africa Weapons and Ammunition Market Revenue Share (%), by Platform 2025 & 2033

- Figure 40: Middle East and Africa Weapons and Ammunition Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Weapons and Ammunition Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Weapons and Ammunition Market Revenue billion Forecast, by Weapon Type 2020 & 2033

- Table 2: Global Weapons and Ammunition Market Revenue billion Forecast, by Caliber 2020 & 2033

- Table 3: Global Weapons and Ammunition Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 4: Global Weapons and Ammunition Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Weapons and Ammunition Market Revenue billion Forecast, by Weapon Type 2020 & 2033

- Table 6: Global Weapons and Ammunition Market Revenue billion Forecast, by Caliber 2020 & 2033

- Table 7: Global Weapons and Ammunition Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 8: Global Weapons and Ammunition Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Weapons and Ammunition Market Revenue billion Forecast, by Weapon Type 2020 & 2033

- Table 12: Global Weapons and Ammunition Market Revenue billion Forecast, by Caliber 2020 & 2033

- Table 13: Global Weapons and Ammunition Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 14: Global Weapons and Ammunition Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Russia Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Weapons and Ammunition Market Revenue billion Forecast, by Weapon Type 2020 & 2033

- Table 21: Global Weapons and Ammunition Market Revenue billion Forecast, by Caliber 2020 & 2033

- Table 22: Global Weapons and Ammunition Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 23: Global Weapons and Ammunition Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: India Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: South Korea Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Weapons and Ammunition Market Revenue billion Forecast, by Weapon Type 2020 & 2033

- Table 30: Global Weapons and Ammunition Market Revenue billion Forecast, by Caliber 2020 & 2033

- Table 31: Global Weapons and Ammunition Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 32: Global Weapons and Ammunition Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Brazil Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Weapons and Ammunition Market Revenue billion Forecast, by Weapon Type 2020 & 2033

- Table 36: Global Weapons and Ammunition Market Revenue billion Forecast, by Caliber 2020 & 2033

- Table 37: Global Weapons and Ammunition Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 38: Global Weapons and Ammunition Market Revenue billion Forecast, by Country 2020 & 2033

- Table 39: United Arab Emirates Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Israel Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Weapons and Ammunition Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Weapons and Ammunition Market?

The projected CAGR is approximately 7.51%.

2. Which companies are prominent players in the Weapons and Ammunition Market?

Key companies in the market include Raytheon Technologies Corporation, General Dynamics Corporation, Kalashnikov Concern JSC (Rostec State Corportation), Diehl Defence GmbH & Co KG, Colt Manufacturing Company LLC, MBDA, FN Herstal, Denel SOC Ltd, Rafael Advanced Defense Systems Ltd, Nammo AS, Saab A, Heckler and Koch GmbH, BAE Systems plc.

3. What are the main segments of the Weapons and Ammunition Market?

The market segments include Weapon Type, Caliber, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.35 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

An Increase in Demand for Newer Generation Portable Explosive Weapon Systems Drive the Market Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: The Australian government announced the acquisition of new weapon systems to boost the country's defense capabilities. The government awarded USD 675.80 million in contracts to CEA and Kongsberg Gruppen ASA for the supply of advanced weapon systems. Under the contract, CEA will deliver High Mobility Artillery Rocket Systems (HIMARS) for Army, and Kongsberg will deliver naval strike missiles for Royal Australian Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Weapons and Ammunition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Weapons and Ammunition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Weapons and Ammunition Market?

To stay informed about further developments, trends, and reports in the Weapons and Ammunition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence