Key Insights

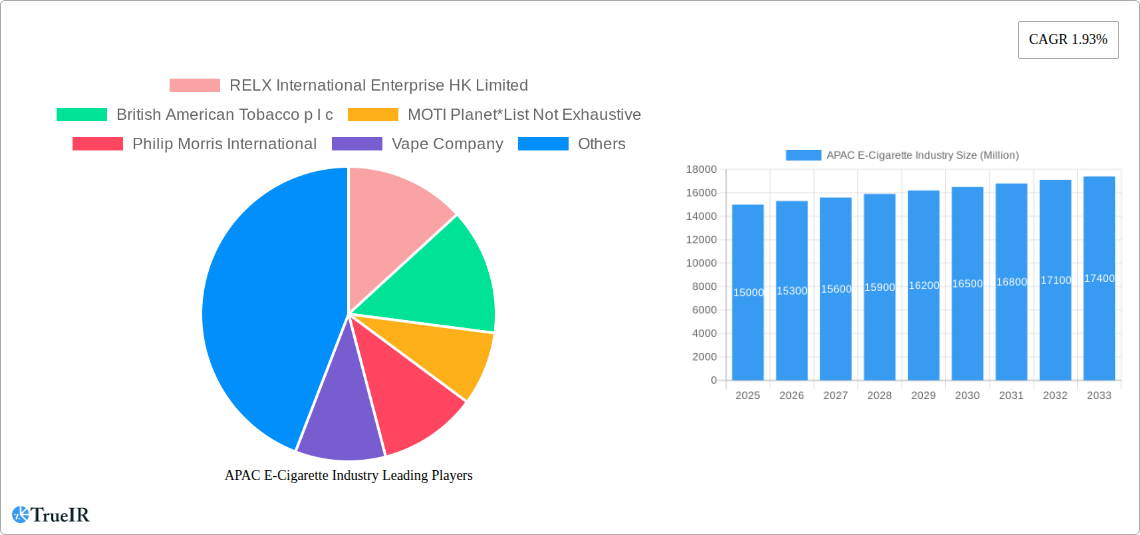

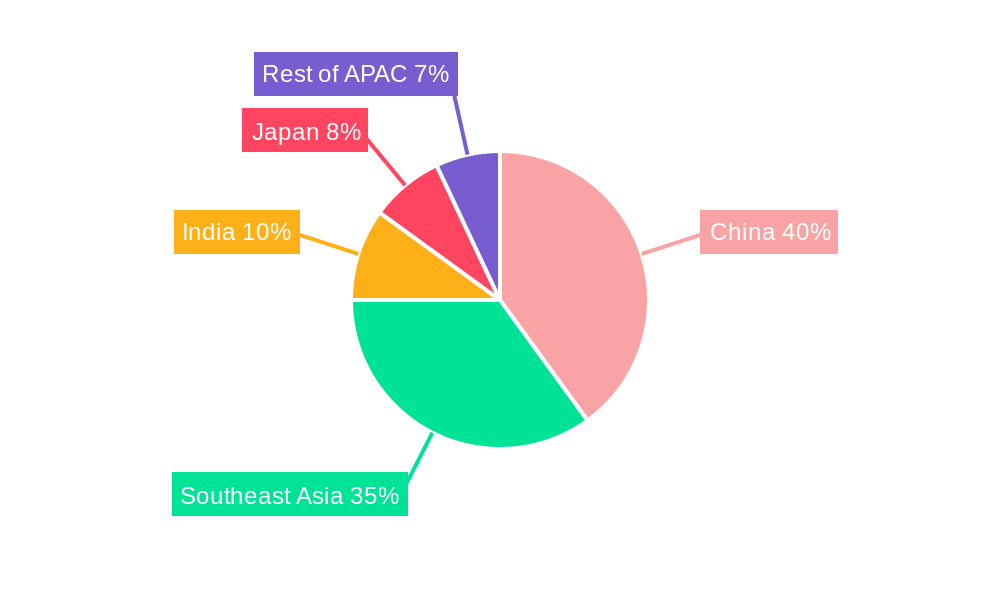

The Asia-Pacific (APAC) e-cigarette market is poised for growth, with a projected Compound Annual Growth Rate (CAGR) of 1.8%. This expansion is fueled by increased awareness of vaping as a harm reduction tool compared to traditional cigarettes and the rising prevalence of smoking across numerous APAC nations. While China is anticipated to be a significant growth engine due to its large population and evolving regulations, strict controls could also present challenges. Southeast Asian countries like Indonesia, the Philippines, and Thailand offer substantial potential, driven by a youthful, tech-savvy demographic adopting innovative vaping products and flavors. Key challenges include regulatory inconsistencies, varying consumer understanding of vaping's risks and benefits, and concerns regarding youth access. The market predominantly favors e-cigarette devices and e-liquids, with online retail channels experiencing increased adoption, especially in more developed APAC economies. A competitive landscape is evident, featuring established global brands and emerging local players, all vying for market share through innovation. The future trajectory of the APAC e-cigarette market will depend on balancing consumer demand for alternatives with public health-focused regulations and ongoing product innovation.

APAC E-Cigarette Industry Market Size (In Billion)

Navigating the diverse APAC market requires country-specific strategies. Businesses must understand individual regulatory frameworks, tailor product offerings to local tastes, and implement robust public relations initiatives to address health concerns and promote responsible vaping. Success hinges on balancing market opportunities, regulatory obstacles, and evolving consumer behavior. Growth is expected to be stronger in regions with less stringent regulations and higher smoking rates, while markets with stricter controls may see more moderate expansion, underscoring the need for tailored market approaches.

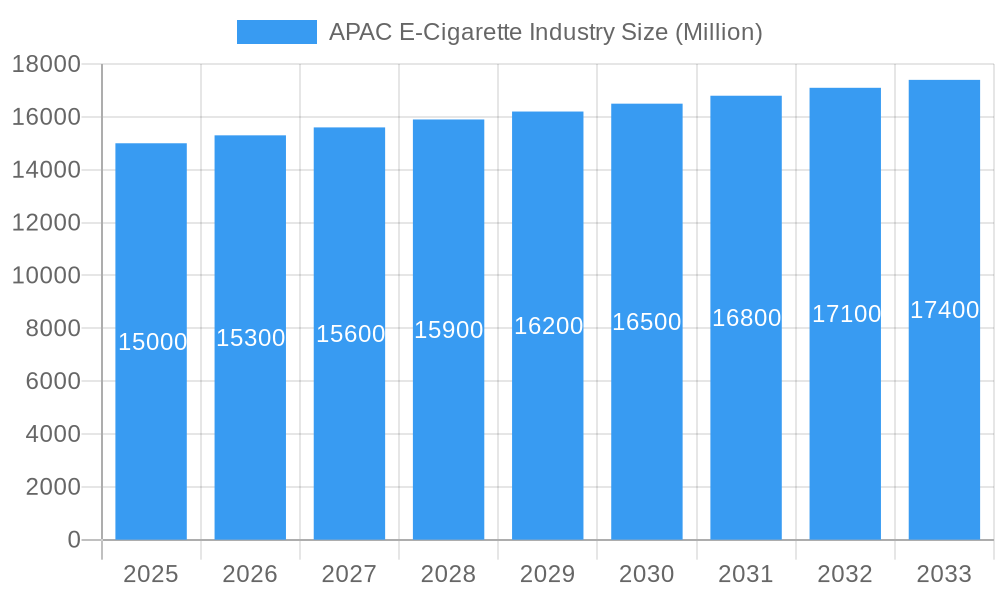

APAC E-Cigarette Industry Company Market Share

APAC E-Cigarette Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the booming APAC e-cigarette industry, offering invaluable insights for investors, industry professionals, and strategists. Analyzing the market from 2019 to 2033, with a focus on 2025, this report leverages comprehensive data and expert analysis to illuminate growth trajectories, key players, and future opportunities. The report covers market size, segmentation, competitive landscape, technological advancements, regulatory impacts, and key challenges shaping this rapidly evolving sector. Prepare to gain a competitive edge with this data-rich, strategically insightful resource.

APAC E-Cigarette Industry Market Structure & Competitive Landscape

This section analyzes the APAC e-cigarette market's structure, exploring concentration levels, innovation drivers, regulatory influences, and competitive dynamics. We examine the impact of product substitutes and M&A activity, alongside end-user segmentation, providing both quantitative and qualitative insights into market dynamics.

Market Concentration: The APAC e-cigarette market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players hold significant market share, but the presence of smaller, innovative companies indicates a dynamic competitive landscape.

Innovation Drivers: Continuous innovation in device technology, e-liquid flavors, and product design drives market growth. The development of innovative heating technologies, such as those utilized in Philip Morris International’s IQOS, and advancements in disposable e-cigarette design are key drivers.

Regulatory Impacts: Varying regulatory frameworks across APAC nations significantly impact market access and growth. Stringent regulations in some countries constrain expansion, while more lenient approaches in others foster rapid growth. The ongoing evolution of regulations presents both opportunities and challenges for industry participants.

Product Substitutes: Traditional cigarettes and other nicotine delivery systems represent the primary substitutes for e-cigarettes. The competitive landscape also includes other emerging nicotine alternatives, creating pressure on e-cigarette manufacturers.

End-User Segmentation: The APAC e-cigarette market targets a diverse user base, including former smokers, current smokers seeking alternatives, and younger demographics. Understanding the nuances of each segment is crucial for effective market penetration.

M&A Trends: The e-cigarette sector has witnessed significant M&A activity in recent years, with larger companies seeking to expand their portfolios and consolidate market share. The volume of M&A deals is predicted to reach xx Million USD in 2025.

APAC E-Cigarette Industry Market Trends & Opportunities

This section delves into the market’s growth trajectory, technological shifts, consumer preferences, and competitive landscape. We analyze market size and penetration rates, complemented by comprehensive data on CAGR (Compound Annual Growth Rate) and crucial market dynamics.

The APAC e-cigarette market is experiencing robust growth, driven by increasing awareness of e-cigarettes as a potential harm-reduction tool, changing consumer preferences, and technological advancements. The market is projected to reach xx Million USD in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Market penetration rates vary significantly across different countries within the region due to diverse regulatory environments and consumer behaviors. The increasing popularity of disposable e-cigarettes is contributing significantly to market expansion, alongside a growing demand for high-quality e-liquids and innovative device designs. The rise of online retail channels is further fueling market growth, making products accessible to a wider consumer base. However, strong competition and evolving regulatory landscapes continue to pose challenges.

Dominant Markets & Segments in APAC E-Cigarette Industry

This section identifies the leading regions, countries, and segments within the APAC e-cigarette industry, examining key growth drivers for each.

Leading Regions/Countries: [Insert dominant regions/countries with supporting data and analysis. Include market share data for each].

Product Type:

- E-cigarette Devices: Growth is driven by increasing demand for innovative devices offering enhanced user experience and technological features, such as improved battery life, temperature control, and customizable settings.

- E-liquid: The market is fueled by diverse flavor preferences and increasing consumer demand for high-quality, regulated products.

Distribution Channel:

- Offline Retail Stores: Traditional retail channels remain significant, but their market share is being challenged by the rapid expansion of online sales.

- Online Retail Stores: Online channels offer increased convenience and accessibility to a wider customer base, contributing to significant market growth.

APAC E-Cigarette Industry Product Analysis

The APAC e-cigarette market showcases a wide array of products, encompassing diverse device types and e-liquid flavors. Technological advancements focus on improving battery life, enhancing flavor delivery, and creating more user-friendly interfaces. Disposable devices have become increasingly popular, offering convenience and affordability. The market's competitive landscape fosters continuous innovation, with companies striving to differentiate their products through unique features and improved performance.

Key Drivers, Barriers & Challenges in APAC E-Cigarette Industry

Key Drivers: Technological advancements in device design and e-liquid formulations are primary drivers. Shifting consumer preferences towards harm reduction strategies and increasing awareness of e-cigarettes as a potential alternative to traditional cigarettes contribute significantly to market expansion. The growth of online retail channels also plays a critical role.

Challenges: Stringent regulations vary across APAC countries, imposing significant hurdles to market entry and expansion. Supply chain disruptions can impact product availability and pricing. Intense competition among established and emerging players creates a dynamic and often challenging market environment. Concerns regarding the long-term health effects of e-cigarettes also present a barrier to growth.

Growth Drivers in the APAC E-Cigarette Industry Market

Technological innovation, changing consumer preferences, and expanding online retail channels are key growth drivers. Relaxation of regulatory environments in certain markets further contributes to market expansion. The increasing acceptance of e-cigarettes as a harm reduction tool fuels the market.

Challenges Impacting APAC E-Cigarette Industry Growth

Regulatory uncertainties and inconsistencies across the APAC region pose a substantial challenge. Supply chain vulnerabilities and potential disruptions can negatively impact production and market supply. Intense competition, both domestic and international, necessitates strategic maneuvering to maintain market share.

Key Players Shaping the APAC E-Cigarette Industry Market

- RELX International Enterprise HK Limited

- British American Tobacco p l c

- MOTI Planet

- Philip Morris International

- Vape Company

- Smoore International Holdings Ltd

- JUUL Labs Inc

- Imperial Brands

- Japan Tobacco International

- Vaping Gadget Limited

Significant APAC E-Cigarette Industry Milestones

- November 2022: Moti Planet launches MOTI K Pro in Malaysia, showcasing several new products at the International Electronic Cigarettes Exhibitions. This signifies significant market expansion efforts in a key APAC nation.

- August 2021: Philip Morris International launches IQOS ILUMA, highlighting innovation in heated tobacco devices and expansion of smoke-free product offerings.

- August 2021: Japan Tobacco Inc. launches Ploom X, a next-generation heated tobacco device, expanding its presence in the Japanese market.

Future Outlook for APAC E-Cigarette Industry Market

The APAC e-cigarette market holds immense potential for growth. Continued technological advancements, evolving consumer preferences, and strategic expansion into new markets will drive future market expansion. While regulatory challenges remain, the market is poised for significant growth, particularly in regions with more relaxed regulations and increasing consumer adoption. Opportunities exist for companies that effectively navigate regulatory complexities, innovate in product development, and establish strong brand presence.

APAC E-Cigarette Industry Segmentation

-

1. Product Type

- 1.1. E-cigarette Devices

- 1.2. E-liquid

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

-

3. Geography

- 3.1. New Zealand

- 3.2. Bangladesh

- 3.3. Indonesia

- 3.4. Rest of Asia-Pacific

APAC E-Cigarette Industry Segmentation By Geography

- 1. New Zealand

- 2. Bangladesh

- 3. Indonesia

- 4. Rest of Asia Pacific

APAC E-Cigarette Industry Regional Market Share

Geographic Coverage of APAC E-Cigarette Industry

APAC E-Cigarette Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism

- 3.3. Market Restrains

- 3.3.1. Presence of counterfeit products

- 3.4. Market Trends

- 3.4.1. Demand for Nicotine-free Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. E-cigarette Devices

- 5.1.2. E-liquid

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. New Zealand

- 5.3.2. Bangladesh

- 5.3.3. Indonesia

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. New Zealand

- 5.4.2. Bangladesh

- 5.4.3. Indonesia

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. New Zealand APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. E-cigarette Devices

- 6.1.2. E-liquid

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. New Zealand

- 6.3.2. Bangladesh

- 6.3.3. Indonesia

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Bangladesh APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. E-cigarette Devices

- 7.1.2. E-liquid

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. New Zealand

- 7.3.2. Bangladesh

- 7.3.3. Indonesia

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Indonesia APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. E-cigarette Devices

- 8.1.2. E-liquid

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. New Zealand

- 8.3.2. Bangladesh

- 8.3.3. Indonesia

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Asia Pacific APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. E-cigarette Devices

- 9.1.2. E-liquid

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. New Zealand

- 9.3.2. Bangladesh

- 9.3.3. Indonesia

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 RELX International Enterprise HK Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 British American Tobacco p l c

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MOTI Planet*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Philip Morris International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vape Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Smoore International Holdings Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JUUL Labs Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Imperial Brands

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Japan Tobacco International

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Vaping Gadget Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 RELX International Enterprise HK Limited

List of Figures

- Figure 1: Global APAC E-Cigarette Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: New Zealand APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: New Zealand APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: New Zealand APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: New Zealand APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Indonesia APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Indonesia APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Indonesia APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC E-Cigarette Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC E-Cigarette Industry?

The projected CAGR is approximately 1.8%.

2. Which companies are prominent players in the APAC E-Cigarette Industry?

Key companies in the market include RELX International Enterprise HK Limited, British American Tobacco p l c, MOTI Planet*List Not Exhaustive, Philip Morris International, Vape Company, Smoore International Holdings Ltd, JUUL Labs Inc, Imperial Brands, Japan Tobacco International, Vaping Gadget Limited.

3. What are the main segments of the APAC E-Cigarette Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 423.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism.

6. What are the notable trends driving market growth?

Demand for Nicotine-free Products.

7. Are there any restraints impacting market growth?

Presence of counterfeit products.

8. Can you provide examples of recent developments in the market?

November 2022: Moti Planet expanded its business operation in the Malaysian market by launching its flagship product MOTI K Pro. At International Electronic Cigarettes Exhibitions in Malaysia, the company has also presented other products such as MIOTI X Mini, and MOTI X Play, as well as disposable new products MOTI BOTO 6000, MOTI Box R7000, and the industry's first replaceable disposable electronic cigarettes were also presented in exhibitions i.e., MOTI One 4000.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC E-Cigarette Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC E-Cigarette Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC E-Cigarette Industry?

To stay informed about further developments, trends, and reports in the APAC E-Cigarette Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence