Key Insights

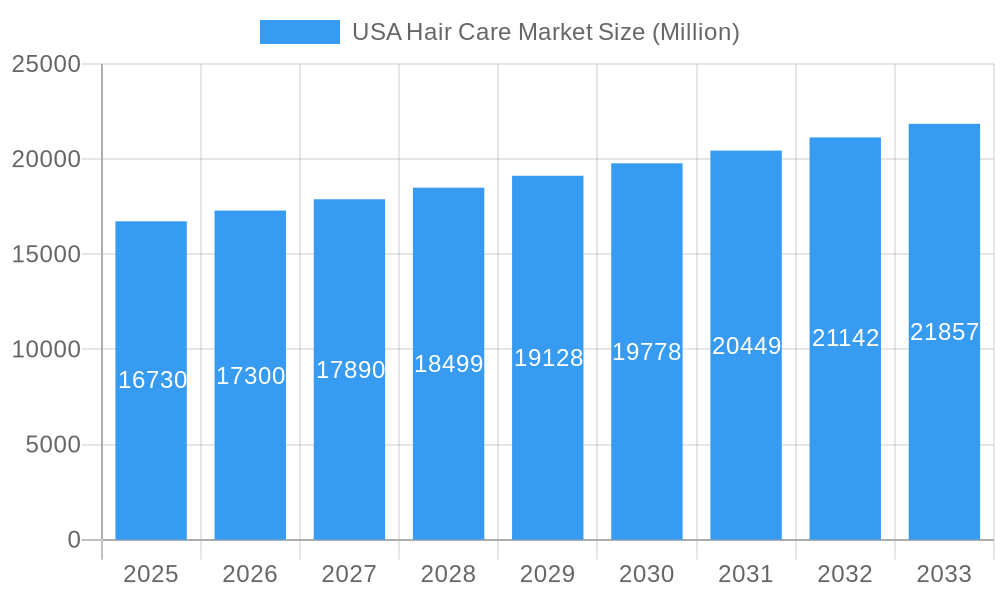

The United States hair care market is poised for sustained growth, projected to reach approximately $16.73 million by 2025. This expansion is driven by a confluence of factors including increasing consumer demand for premium and specialized hair products, a growing awareness of hair health and wellness, and the continuous innovation in product formulations and ingredients. Key product segments such as shampoos and conditioners are expected to maintain their dominance, supported by the introduction of advanced formulations targeting specific concerns like hair loss, scalp health, and color protection. Furthermore, the rising popularity of hair styling agents, fueled by evolving beauty trends and a greater emphasis on personal grooming, will contribute significantly to market revenue. This dynamic landscape is also being shaped by the increasing adoption of organic, natural, and sustainable hair care solutions, aligning with broader consumer preferences for eco-conscious products.

USA Hair Care Market Market Size (In Billion)

The market's growth trajectory is further bolstered by evolving distribution channels. While traditional retail avenues like supermarkets and specialty stores remain crucial, online retail platforms are witnessing a surge in adoption, offering consumers unparalleled convenience and access to a wider array of brands and products. This shift towards e-commerce is particularly pronounced among younger demographics and is expected to be a primary engine of future market expansion. Key players in the market, including global giants like Procter & Gamble, L'Oréal SA, and Unilever PLC, are actively investing in research and development, strategic partnerships, and targeted marketing campaigns to capture market share. Emerging trends such as personalized hair care solutions, the integration of technological advancements like AI-driven diagnostics, and the demand for multi-functional products are expected to shape the competitive environment, presenting both opportunities and challenges for established and new entrants.

USA Hair Care Market Company Market Share

Unlocking Growth: USA Hair Care Market Report 2025-2033 - Comprehensive Insights & Opportunities

This in-depth report delivers a dynamic and SEO-optimized analysis of the USA Hair Care Market, covering the historical period from 2019 to 2024 and projecting significant growth through 2033. Leveraging high-volume keywords essential for industry professionals, investors, and market strategists, this report provides unparalleled insights into market structure, trends, dominant segments, product innovations, key players, and future outlook. Understand the forces shaping this multi-billion dollar industry, from evolving consumer preferences and technological advancements to regulatory landscapes and competitive strategies.

USA Hair Care Market Market Structure & Competitive Landscape

The USA Hair Care Market is characterized by a moderately concentrated structure, with key players investing heavily in research and development to drive innovation. The hair care market size in the US is a significant driver for new product formulations and advanced ingredient technologies. Regulatory impacts, primarily concerning ingredient safety and labeling, influence product development and marketing strategies. Product substitutes, such as DIY hair treatments and salon services, pose a competitive challenge, necessitating continuous product differentiation and value proposition enhancement. End-user segmentation, based on hair type, concerns (e.g., hair loss, dandruff), and demographic profiles, allows for targeted product development and marketing campaigns. Mergers and acquisitions (M&A) trends reveal a strategic consolidation among larger players to expand portfolios, acquire innovative technologies, and enhance market reach, contributing to the overall market evolution. Hair care market analysis USA indicates a robust M&A landscape with an average of xx M&A deals per year in the historical period.

USA Hair Care Market Market Trends & Opportunities

The USA Hair Care Market is poised for substantial growth, projected to reach a valuation of over $XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is fueled by a confluence of factors, including an increasing consumer focus on personalized hair care solutions, driven by a desire for products that cater to specific hair types, concerns, and styling preferences. The rising popularity of natural and organic ingredients, coupled with a demand for sustainable and eco-friendly packaging, is reshaping product formulations and brand positioning. Technological shifts are evident in the advent of advanced delivery systems, such as micro-encapsulation for enhanced ingredient efficacy, and the integration of artificial intelligence (AI) in product recommendations and virtual try-on experiences. Online hair care sales USA have seen a significant surge, becoming a dominant distribution channel and offering consumers unparalleled convenience and access to a wider array of products. Competitive dynamics are intensifying, with brands differentiating through product innovation, ingredient transparency, and direct-to-consumer (DTC) strategies. The growing influence of social media and digital influencers is also playing a pivotal role in shaping consumer perceptions and driving purchasing decisions. The market penetration rate for specialized hair care solutions, such as anti-aging hair products and scalp treatments, is steadily increasing, indicating a maturing consumer base that is willing to invest in premium and scientifically-backed hair care. Emerging opportunities lie in the development of niche product categories, such as microbiome-friendly hair care and personalized hair care subscriptions, catering to evolving consumer demands for tailored wellness and beauty solutions. The overall market trajectory is indicative of a resilient and dynamic industry poised for continued expansion and innovation.

Dominant Markets & Segments in USA Hair Care Market

Within the USA Hair Care Market, the Shampoo segment consistently holds a dominant position, driven by its status as a foundational hair care product with high purchase frequency. Consumers rely on shampoos for basic cleansing and increasingly for targeted treatments addressing issues like dandruff, hair fall, and scalp health. The Online Retail Stores distribution channel has emerged as a leading force, offering unparalleled convenience, a vast selection of brands and products, and competitive pricing. This channel's growth is further propelled by the ease of product discovery through user reviews and personalized recommendations.

Product Type Dominance:

- Shampoo: Continues to lead due to its essential nature and diverse functional formulations. Key growth drivers include increasing demand for sulfate-free, natural, and medicated shampoos.

- Conditioner: A close second, essential for hair hydration and manageability, with growth fueled by a demand for specific benefits like detangling, frizz control, and deep conditioning.

- Hair Styling Agent: Experiencing robust growth due to evolving fashion trends and the desire for versatile styling options, with innovation in heat protection and long-hold formulas.

- Hair Colorant: Sustained demand driven by self-expression and the trend of at-home coloring, with an increasing preference for ammonia-free and natural-based formulations.

- Hair Oil: Witnessing significant expansion as consumers embrace natural ingredients for hair nourishment, shine, and treatment of dryness and damage.

Distribution Channel Dominance:

- Online Retail Stores: Leading due to convenience, wider product availability, competitive pricing, and personalized shopping experiences. Policies promoting e-commerce and digital infrastructure development are key enablers.

- Supermarkets/Hypermarkets: Remain a strong channel for mass-market accessibility and impulse purchases, benefiting from wide shelf presence and promotional activities.

- Specialty Stores: Cater to niche markets and premium products, driven by expert advice and curated selections, including professional salon brands and high-end organic lines.

USA Hair Care Market Product Analysis

The USA Hair Care Market is defined by continuous product innovation, focusing on enhanced efficacy, natural ingredients, and personalized solutions. Innovations range from advanced anti-hair fall formulations utilizing scientifically proven actives to sophisticated hair styling agents offering long-lasting hold with heat protection. The competitive advantage for brands lies in their ability to leverage cutting-edge technology, such as micro-encapsulation for sustained release of beneficial ingredients, and the integration of naturally derived components to meet consumer demand for cleaner beauty. Applications span across therapeutic, aesthetic, and protective hair care needs, addressing a wide spectrum of consumer concerns and desires.

Key Drivers, Barriers & Challenges in USA Hair Care Market

Key Drivers: The USA Hair Care Market is propelled by several key drivers. Technological advancements in ingredient science and product formulation are leading to more effective and specialized products. Growing consumer awareness and demand for natural, organic, and sustainable hair care products are a significant growth catalyst. The increasing disposable income and a strong emphasis on personal grooming and appearance further boost market expansion. Policy initiatives supporting product safety and innovation also contribute positively.

Barriers & Challenges: Significant challenges impact the market's growth trajectory. Intense competition from both established and emerging brands necessitates continuous innovation and aggressive marketing. Stringent regulatory requirements for product safety and efficacy can increase development costs and time-to-market. Supply chain disruptions and the rising cost of raw materials can affect profitability and product availability. Furthermore, evolving consumer preferences and the need to adapt to new trends require agility and strategic foresight.

Growth Drivers in the USA Hair Care Market Market

The USA Hair Care Market is experiencing robust growth driven by several interconnected factors. Technological advancements are at the forefront, with innovations in ingredient sourcing, formulation techniques, and delivery systems enhancing product efficacy and consumer appeal. The increasing consumer inclination towards natural, organic, and sustainable hair care solutions is a powerful economic and ethical driver, compelling brands to reformulate and adopt eco-friendly practices. Furthermore, supportive government policies, such as those promoting product safety standards and fair trade, create a conducive environment for market expansion. The rising disposable income and a growing emphasis on self-care and aesthetic appeal are also significant economic contributors to the market's upward trend.

Challenges Impacting USA Hair Care Market Growth

The growth of the USA Hair Care Market faces several significant challenges. Regulatory complexities surrounding ingredient approvals and product claims can impose stringent compliance costs and prolong product launch cycles. Supply chain vulnerabilities, exacerbated by global events and geopolitical factors, can lead to raw material shortages and price volatility, impacting manufacturing and distribution. Intense competitive pressures from both multinational corporations and agile indie brands necessitate continuous investment in marketing, R&D, and brand differentiation. The rapidly evolving consumer preferences, influenced by social media trends and a demand for hyper-personalized solutions, require brands to be highly adaptable and responsive to stay relevant in this dynamic market.

Key Players Shaping the USA Hair Care Market Market

- Henkel AG & Co KGaA

- The Estee Lauder Companies Inc

- Procter & Gamble Co

- Shiseido Company Limited

- Amway Corporation

- Garnier

- Moroccanoil

- Unilever PLC

- L'Oreal SA

- Natura & Co

- Kao Corporation

Significant USA Hair Care Market Industry Milestones

- August 2022: Procter & Gamble's brand, Head & Shoulders, launched a new shampoo range for dry scalp care. The company launched a few more hair care shampoos with different properties like smooth, silky, and anti-hair fall shampoos.

- September 2021: L'Oréal filed a patent on its natural sugar-based curly hair styling formula. An international beauty major, the company developed a hair styling formulation for curly hair from a blend of sugar compounds and plant fiber, offering a natural and lightweight alternative to film-forming polymer and silicone products.

- August 2021: Procter & Gamble formally launched its newest hair care brand, Nou. It is sold through Walmart and expanded to other stores in the United States.

Future Outlook for USA Hair Care Market Market

The future outlook for the USA Hair Care Market is exceptionally promising, driven by sustained demand for innovative and personalized solutions. Growth catalysts include the continued expansion of the e-commerce channel, the increasing consumer preference for clean and sustainable beauty products, and the integration of advanced technologies like AI for personalized hair diagnostics and product recommendations. Opportunities for market players lie in tapping into niche segments, such as scalp health, scientifically-backed hair regeneration, and customizable subscription services. The market is expected to witness further consolidation through strategic partnerships and acquisitions, fostering an environment ripe for both established giants and innovative startups to thrive.

USA Hair Care Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Styling Agent

- 1.4. Hair Colorant

- 1.5. Hair Oil

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

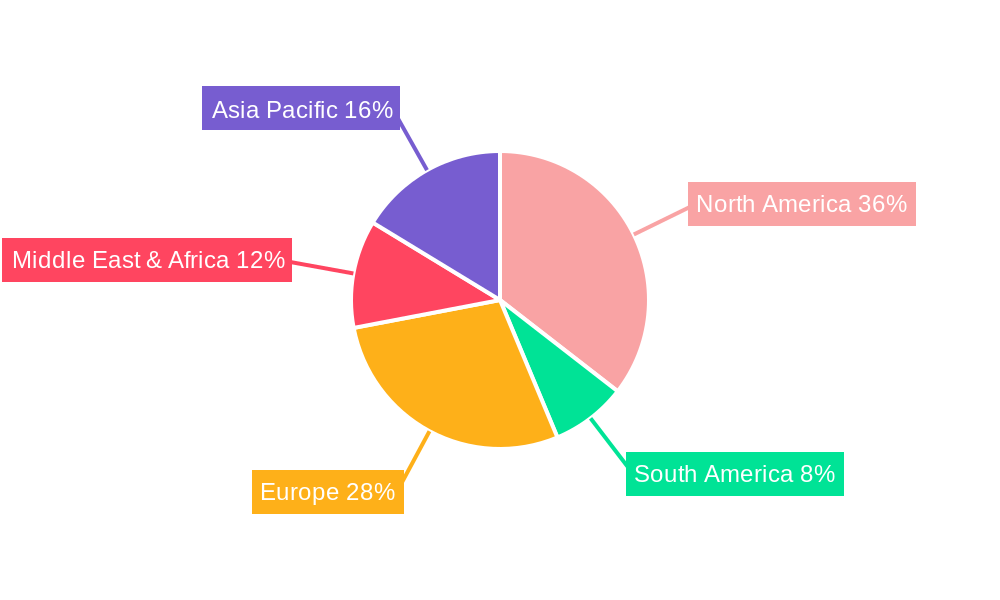

USA Hair Care Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Hair Care Market Regional Market Share

Geographic Coverage of USA Hair Care Market

USA Hair Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Minimalist and Clean Beauty Trend; Popularity of Effective and Smart Skincare

- 3.3. Market Restrains

- 3.3.1. Easy Access to Alternative Options

- 3.4. Market Trends

- 3.4.1. Escalating Expenditure on Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Hair Care Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Styling Agent

- 5.1.4. Hair Colorant

- 5.1.5. Hair Oil

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America USA Hair Care Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Shampoo

- 6.1.2. Conditioner

- 6.1.3. Hair Styling Agent

- 6.1.4. Hair Colorant

- 6.1.5. Hair Oil

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America USA Hair Care Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Shampoo

- 7.1.2. Conditioner

- 7.1.3. Hair Styling Agent

- 7.1.4. Hair Colorant

- 7.1.5. Hair Oil

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe USA Hair Care Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Shampoo

- 8.1.2. Conditioner

- 8.1.3. Hair Styling Agent

- 8.1.4. Hair Colorant

- 8.1.5. Hair Oil

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa USA Hair Care Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Shampoo

- 9.1.2. Conditioner

- 9.1.3. Hair Styling Agent

- 9.1.4. Hair Colorant

- 9.1.5. Hair Oil

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific USA Hair Care Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Shampoo

- 10.1.2. Conditioner

- 10.1.3. Hair Styling Agent

- 10.1.4. Hair Colorant

- 10.1.5. Hair Oil

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Estee Lauder Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Procter & Gamble Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shiseido Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amway Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Garnier*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Moroccanoil

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Unilever PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 L'Oreal SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Natura & Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kao Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global USA Hair Care Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Hair Care Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America USA Hair Care Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America USA Hair Care Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America USA Hair Care Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America USA Hair Care Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America USA Hair Care Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America USA Hair Care Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: South America USA Hair Care Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America USA Hair Care Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America USA Hair Care Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America USA Hair Care Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America USA Hair Care Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe USA Hair Care Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe USA Hair Care Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe USA Hair Care Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe USA Hair Care Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe USA Hair Care Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe USA Hair Care Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa USA Hair Care Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa USA Hair Care Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa USA Hair Care Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa USA Hair Care Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa USA Hair Care Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa USA Hair Care Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific USA Hair Care Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific USA Hair Care Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific USA Hair Care Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific USA Hair Care Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific USA Hair Care Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific USA Hair Care Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global USA Hair Care Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global USA Hair Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global USA Hair Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global USA Hair Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 29: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global USA Hair Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global USA Hair Care Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global USA Hair Care Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global USA Hair Care Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific USA Hair Care Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Hair Care Market?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the USA Hair Care Market?

Key companies in the market include Henkel AG & Co KGaA, The Estee Lauder Companies Inc, Procter & Gamble Co, Shiseido Company Limited, Amway Corporation, Garnier*List Not Exhaustive, Moroccanoil, Unilever PLC, L'Oreal SA, Natura & Co, Kao Corporation.

3. What are the main segments of the USA Hair Care Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Minimalist and Clean Beauty Trend; Popularity of Effective and Smart Skincare.

6. What are the notable trends driving market growth?

Escalating Expenditure on Hair Care Products.

7. Are there any restraints impacting market growth?

Easy Access to Alternative Options.

8. Can you provide examples of recent developments in the market?

In August 2022: Proctor & Gamble's brand, Head & Shoulders, launched a new shampoo range for dry scalp care. The company launched a few more hair care shampoos with different properties like smooth, silky, and anti-hair fall shampoos.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Hair Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Hair Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Hair Care Market?

To stay informed about further developments, trends, and reports in the USA Hair Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence