Key Insights

The Japan hair care market, valued at approximately $7.2 billion in its base year of 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 3.71%. This indicates a dynamic market where strategic innovation is key to sustained success. While the overall market is maturing, specific segments demonstrate significant resilience and growth potential. Hair colorants, propelled by evolving fashion trends and a demand for personalized beauty solutions, are poised for strong performance. Concurrently, the demand for high-performance conditioners and specialized styling products tailored to diverse hair types and needs is expected to remain robust. The increasing digital adoption among Japanese consumers, coupled with the convenience of online platforms, is driving substantial growth in the E-Commerce distribution channel, positioning it as a dominant market force.

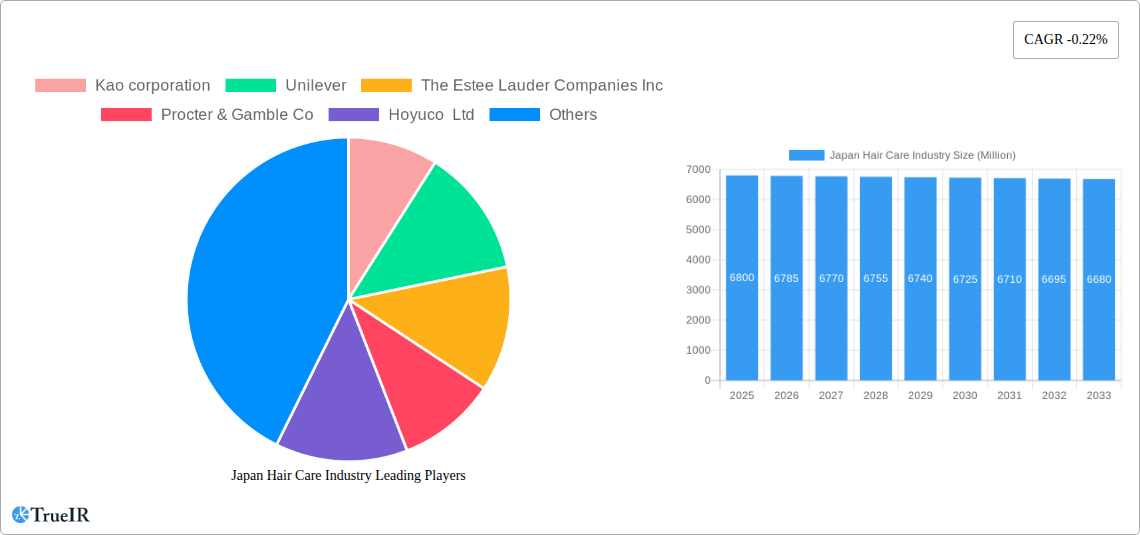

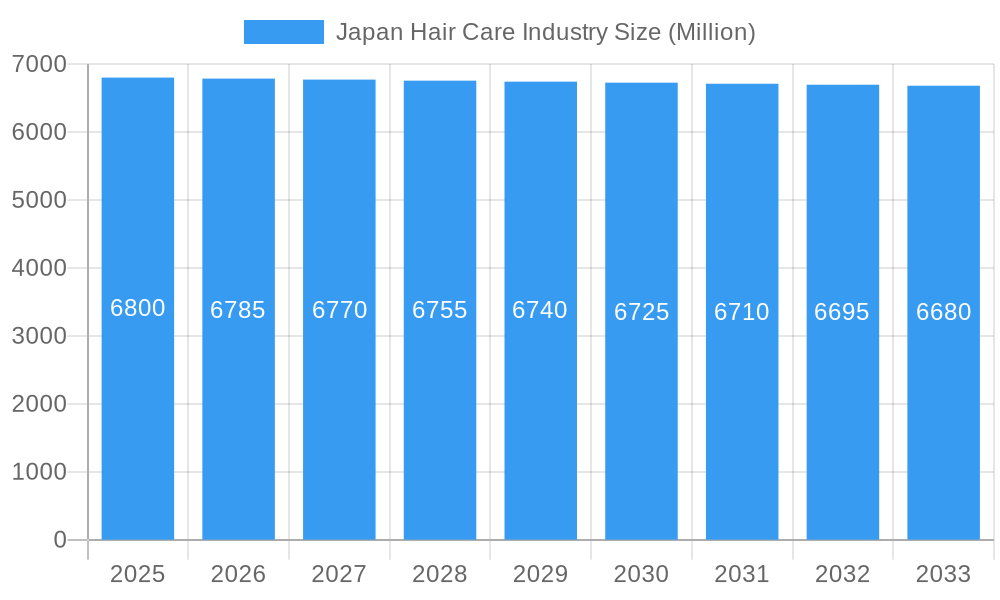

Japan Hair Care Industry Market Size (In Billion)

Several influencing factors shape the Japan hair care market landscape. The demographic shift towards an aging population may increase demand for restorative and anti-aging hair care solutions. Conversely, younger demographics are increasingly embracing vibrant hair colors and innovative styling techniques, presenting a counter-trend. Leading industry players, including Kao Corporation, Unilever, The Estee Lauder Companies Inc., Procter & Gamble Co., and L'Oreal SA, are engaged in intense competition, emphasizing product innovation, sustainability initiatives, and the strategic utilization of digital channels to connect with consumers. Market saturation and the mature nature of established product categories present current restraints. However, significant opportunities lie within niche segments, premium product offerings, and solutions addressing specific hair concerns such as thinning or damage, catering to a discerning consumer base seeking effective and advanced hair care solutions.

Japan Hair Care Industry Company Market Share

This report provides a dynamic, SEO-optimized overview of the Japan Hair Care Industry, detailing market size, growth, and forecasts for immediate use.

Japan Hair Care Industry Market Structure & Competitive Landscape

The Japan hair care market is characterized by a highly consolidated structure, with major global and domestic players vying for dominance. The concentration ratio is estimated to be over 70%, driven by significant brand loyalty and substantial R&D investments. Innovation is a critical differentiator, with companies continuously launching new hair care products and advanced formulations. Regulatory impacts are closely monitored, particularly concerning ingredient safety and environmental sustainability. The threat of product substitutes is moderate, as specialized hair care solutions offer unique benefits. End-user segmentation is increasingly nuanced, with a growing demand for personalized and targeted solutions for diverse hair types and concerns. Mergers & Acquisitions (M&A) trends indicate strategic moves to acquire innovative technologies or expand market reach. The historical period (2019-2024) saw steady growth, with the base year (2025) representing a pivotal point for future expansion. The study period (2019-2033) encompasses a comprehensive analysis of market evolution.

- Market Concentration: Dominated by a few key players, leading to intense competition for market share.

- Innovation Drivers: Focus on premiumization, natural ingredients, and sustainable packaging for Japan hair care solutions.

- Regulatory Impacts: Stringent quality control and labeling requirements influence product development.

- Product Substitutes: While shampoos and conditioners remain core, specialized treatments are gaining traction.

- End-User Segmentation: Growing demand for anti-aging, scalp care, and customized hair solutions.

- M&A Trends: Strategic acquisitions to enhance product portfolios and technological capabilities, particularly in Japanese hair styling products and hair colorants.

Japan Hair Care Industry Market Trends & Opportunities

The Japan hair care industry is poised for robust expansion, with an estimated market size of XX Million in the base year (2025) and projected to reach XX Million by the forecast period (2025-2033). This growth is fueled by a Compound Annual Growth Rate (CAGR) of XX%. A significant trend is the increasing market penetration of premium and specialized hair care products, driven by evolving consumer preferences for efficacy and personalized solutions. Technological advancements are revolutionizing the industry, with a surge in demand for products incorporating natural ingredients, advanced scientific formulations, and sustainable packaging. The e-commerce channel has emerged as a dominant force, facilitating wider reach and direct consumer engagement for Japan hair growth products and hair damage repair. Consumer behavior is increasingly influenced by social media trends and online reviews, creating opportunities for brands to build direct relationships and foster community. Furthermore, the aging population in Japan is contributing to the growth of anti-aging hair care and scalp health solutions. The competitive landscape is dynamic, with both established giants and agile startups innovating to capture market share. Opportunities abound for brands that can effectively address specific consumer needs, embrace digital marketing strategies, and offer sustainable hair treatment options. The historical period (2019-2024) laid the groundwork for these current trends, with the estimated year (2025) marking a crucial point for strategic planning. The comprehensive study period (2019-2033) allows for a thorough examination of these evolving market dynamics.

Dominant Markets & Segments in Japan Hair Care Industry

The Japan hair care industry exhibits distinct dominance across various segments, offering lucrative opportunities for stakeholders. Shampoos continue to be the largest product segment, driven by their foundational role in daily hair care routines. However, the conditioners segment is experiencing significant growth due to an increasing consumer focus on hair health and repair. Within the broader other hair care products category, specialized treatments, serums, and scalp care solutions are showing substantial expansion. The hair colorants segment is also robust, with a rising demand for at-home coloring solutions and salon-quality products.

The e-commerce distribution channel has emerged as the dominant force, capturing a significant market share due to its convenience, wide product availability, and direct consumer engagement capabilities. This channel is particularly crucial for reaching younger demographics and facilitating the purchase of niche Japan hair care brands. Specialist retailers also hold a considerable share, offering expert advice and premium product selections. Hypermarket/Supermarkets and Pharmacies cater to a broad consumer base seeking convenience and accessibility for everyday hair styling products and treatments.

- Leading Product Segments:

- Shampoos: Consistent high demand as a staple hair care item.

- Conditioners: Rapidly growing segment driven by enhanced hair health and repair needs.

- Other Hair Care Products: Strong expansion in specialized treatments, serums, and scalp care.

- Hair Colorants: Steady demand for both at-home and professional-grade solutions.

- Dominant Distribution Channels:

- E-Commerce: Leading channel due to convenience, reach, and direct-to-consumer engagement for natural hair care Japan.

- Specialist Retailers: High value for premium products and expert consultation.

- Hypermarket/Supermarkets: Broad accessibility for mass-market products.

- Pharmacies: Growing channel for medicated and health-focused hair care.

Japan Hair Care Industry Product Analysis

Product innovation in the Japan hair care industry is driven by advanced formulations, natural ingredient integration, and personalized solutions. Companies are focusing on technological advancements in shampoos and conditioners to address specific concerns like hair loss, damage, and aging. The hair colorants segment sees innovation in gentler formulas and long-lasting dyes. Styling gel and hair spray categories are evolving with improved hold, texture, and heat protection properties. Competitive advantages are derived from scientifically proven efficacy, premium ingredient sourcing, and sustainable packaging, aligning with growing consumer consciousness for eco-friendly hair care Japan.

Key Drivers, Barriers & Challenges in Japan Hair Care Industry

Key Drivers: The Japan hair care market is propelled by several key drivers. Technological advancements in product formulation and delivery systems are creating more effective and specialized solutions. The economic factor of rising disposable incomes and a growing middle class fuels demand for premium Japan hair styling products. Increasing consumer awareness regarding hair health and the desire for personalized solutions are significant drivers, leading to the popularity of scalp care products Japan. Policy-driven factors, such as government support for the beauty industry and relaxed regulations on certain cosmetic ingredients, also contribute to market growth.

Barriers & Challenges: Despite growth, the industry faces significant barriers. Supply chain issues, including the sourcing of raw materials and logistical complexities, can impact production and costs. Regulatory hurdles related to product safety, labeling, and import/export procedures present challenges for both domestic and international players. Competitive pressures are intense, with numerous domestic and global brands vying for consumer attention, leading to price sensitivity and the need for continuous innovation. The high cost of research and development for novel formulations also acts as a restraint.

Growth Drivers in the Japan Hair Care Industry Market

Growth in the Japan hair care industry is primarily driven by technological advancements leading to more effective and personalized products, such as those focusing on scalp health Japan. The economic factor of a discerning consumer base willing to invest in premium and specialized hair care solutions significantly fuels market expansion. Regulatory frameworks that encourage innovation and ensure product safety also play a crucial role. The increasing demand for natural and sustainable hair care products represents a substantial growth catalyst, aligning with global trends and domestic consumer preferences for eco-friendly hair care Japan.

Challenges Impacting Japan Hair Care Industry Growth

Challenges impacting the Japan hair care industry growth include stringent regulatory complexities governing cosmetic products, which necessitate rigorous testing and compliance. Supply chain issues, particularly related to the sourcing of premium and organic ingredients, can create vulnerabilities. Intense competitive pressures from established brands and emerging players require continuous product innovation and marketing investment. Furthermore, the economic climate and fluctuating consumer spending power can impact the demand for premium hair repair Japan products.

Key Players Shaping the Japan Hair Care Industry Market

- Kao Corporation

- Unilever

- The Estee Lauder Companies Inc

- Procter & Gamble Co

- Hoyuco Ltd

- Lion Corporation

- L'Oreal SA

- Mandom Corp

- Henkel AG & Co. KGaA

- Shiseido Co Ltd

Significant Japan Hair Care Industry Industry Milestones

- 2019: Increased consumer focus on scalp health leads to a surge in targeted scalp care product launches.

- 2020: The COVID-19 pandemic accelerates the adoption of at-home hair coloring and treatment products, boosting the hair colorants segment.

- 2021: Growing consumer demand for natural and sustainable hair care Japan prompts major brands to reformulate products with eco-friendly ingredients and packaging.

- 2022: E-commerce platforms become increasingly dominant for Japan hair care products, with brands investing heavily in online marketing and direct-to-consumer strategies.

- 2023: Innovations in hair growth and anti-aging treatments gain significant traction, catering to an aging population and increased awareness of hair longevity.

- 2024: Continued expansion of the "clean beauty" movement influencing product development and consumer purchasing decisions.

Future Outlook for Japan Hair Care Industry Market

The future outlook for the Japan hair care industry is exceptionally promising, driven by persistent consumer demand for innovation and personalization. Strategic opportunities lie in further developing scalp care solutions, expanding the natural and sustainable hair care Japan portfolio, and leveraging e-commerce for direct consumer engagement. The market is expected to witness continued growth in the premium and specialized segments, particularly those addressing concerns like hair aging and damage. Investments in advanced formulations and effective marketing strategies will be crucial for brands aiming to capture a larger share of this dynamic and evolving Japanese hair care market.

Japan Hair Care Industry Segmentation

-

1. Product

- 1.1. Hair Colorants

- 1.2. Hair Spray

- 1.3. Conditioners

- 1.4. Styling Gel

- 1.5. Shampoos

- 1.6. Other Hair Care Products

-

2. Distribution Channel

- 2.1. E-Commerce

- 2.2. Specialist Retailers

- 2.3. Hypermarket/Supermarkets

- 2.4. Convenience Stores

- 2.5. Pharmacies

- 2.6. Other Distribution Channels

Japan Hair Care Industry Segmentation By Geography

- 1. Japan

Japan Hair Care Industry Regional Market Share

Geographic Coverage of Japan Hair Care Industry

Japan Hair Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Increased Concerns Toward Hair Care

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Hair Care Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Hair Colorants

- 5.1.2. Hair Spray

- 5.1.3. Conditioners

- 5.1.4. Styling Gel

- 5.1.5. Shampoos

- 5.1.6. Other Hair Care Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. E-Commerce

- 5.2.2. Specialist Retailers

- 5.2.3. Hypermarket/Supermarkets

- 5.2.4. Convenience Stores

- 5.2.5. Pharmacies

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kao corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Unilever

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Estee Lauder Companies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Procter & Gamble Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hoyuco Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lion Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'Oreal SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mandom Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henkel AG & Co KGa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shiseido Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kao corporation

List of Figures

- Figure 1: Japan Hair Care Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Hair Care Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Hair Care Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Japan Hair Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Japan Hair Care Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Hair Care Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Japan Hair Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Japan Hair Care Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Hair Care Industry?

The projected CAGR is approximately 3.71%.

2. Which companies are prominent players in the Japan Hair Care Industry?

Key companies in the market include Kao corporation, Unilever, The Estee Lauder Companies Inc, Procter & Gamble Co, Hoyuco Ltd, Lion Corporation, L'Oreal SA, Mandom Corp, Henkel AG & Co KGa, Shiseido Co Ltd.

3. What are the main segments of the Japan Hair Care Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Increased Concerns Toward Hair Care.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Hair Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Hair Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Hair Care Industry?

To stay informed about further developments, trends, and reports in the Japan Hair Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence