Key Insights

The South Korean cosmetics market is projected to achieve a valuation of USD 18.39 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.4%. This growth is propelled by escalating consumer demand for innovative skincare and makeup, influenced by South Korea's global beauty leadership and consistent high personal care spending. The market is characterized by evolving consumer preferences, advancements in product formulation, and a robust distribution network increasingly favoring online channels. Demand for personalized and sustainable beauty solutions further fuels this upward trend.

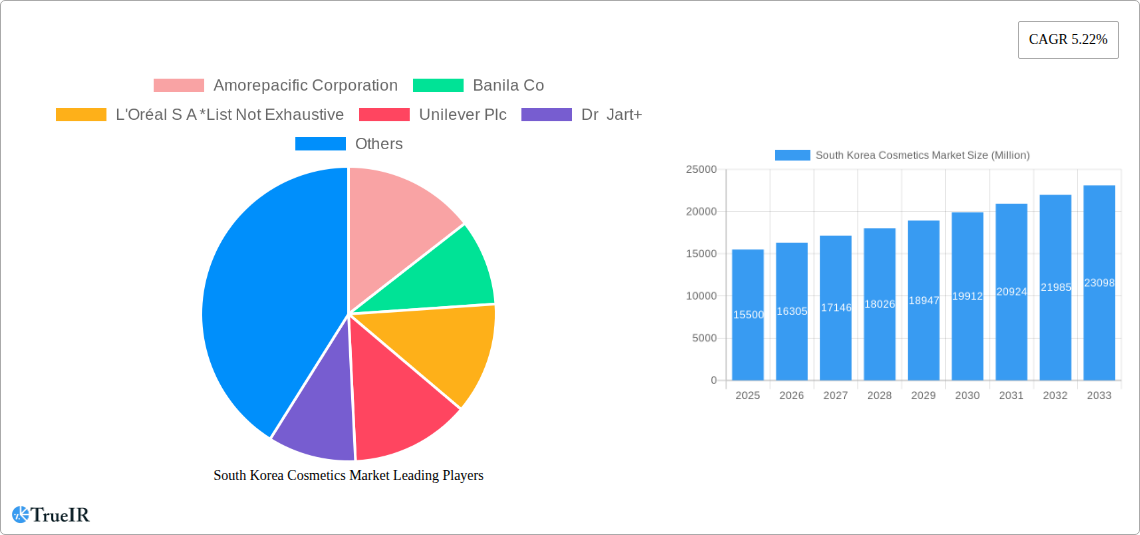

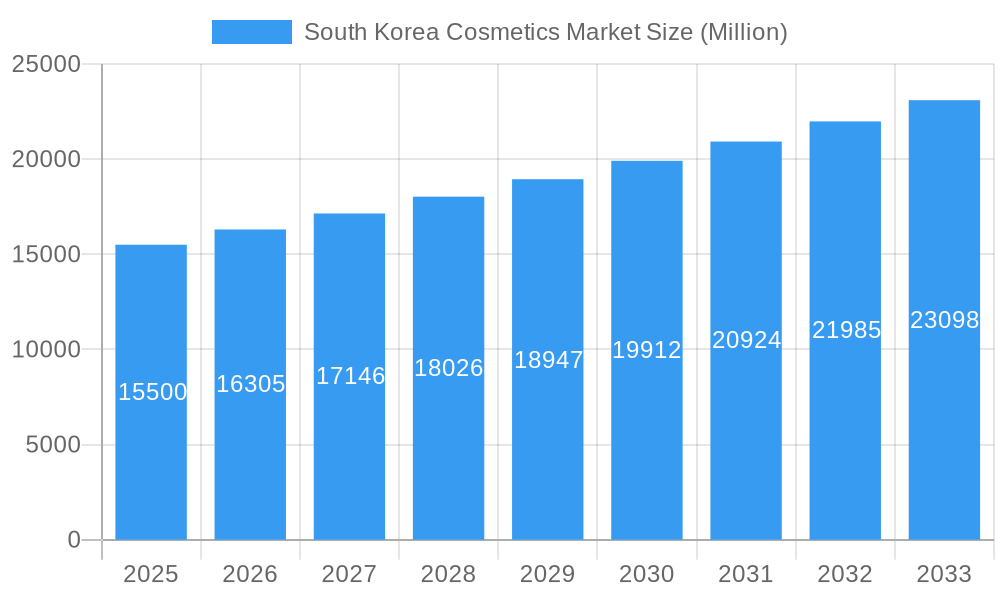

South Korea Cosmetics Market Market Size (In Billion)

Key market segments include a strong emphasis on skincare and hair care, alongside robust growth in color cosmetics. Facial care and color cosmetics demonstrate notable innovation. Distribution is dominated by specialty stores and online retail, catering to convenience and specialized needs. While premium products maintain a significant share, mass-market offerings are expanding accessibility. Leading companies such as Amorepacific Corporation, L'Oréal S.A., and Unilever Plc are actively shaping the competitive landscape through strategic product development and marketing tailored to the South Korean consumer.

South Korea Cosmetics Market Company Market Share

This report offers a comprehensive analysis of the South Korea cosmetics market, detailing market dynamics, from skincare and premium product trends to the impact of online retail. Covering a study period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025–2033, this analysis provides crucial intelligence for strategic decision-making. Examine market size expansion, technological innovations, and the competitive environment shaped by key players like Amorepacific Corporation, L'Oréal S.A., and Unilever Plc.

South Korea Cosmetics Market Market Structure & Competitive Landscape

The South Korea cosmetics market is characterized by a moderately consolidated structure, with a few key players holding significant market share, while a vibrant ecosystem of smaller brands and indie labels fosters intense competition and innovation. Market concentration is influenced by major conglomerates like Amorepacific Corporation and LG Household & Health Care, which leverage extensive R&D capabilities and established distribution networks. Innovation drivers are predominantly centered around advancements in K-beauty science, ingredient technology, and the integration of smart beauty devices. Regulatory impacts, primarily from the Ministry of Food and Drug Safety (MFDS), focus on product safety and labeling, influencing product development and market entry strategies. Product substitutes are abundant, particularly within the broader personal care and wellness sectors, necessitating continuous differentiation and value addition. End-user segmentation is increasingly granular, with a strong focus on personalized solutions and niche market demands. M&A trends are evident, with larger entities acquiring innovative startups to expand their portfolios and tap into emerging consumer segments. For instance, Amorepacific's acquisition of Tata Harper in September 2022 signifies a strategic move to bolster its luxury and clean beauty offerings. While specific concentration ratios are proprietary, anecdotal evidence suggests the top 5 companies command over 60% of the market. M&A volumes have seen a steady increase, with an estimated XX number of significant deals in the historical period, indicating strategic consolidation and expansion efforts.

South Korea Cosmetics Market Market Trends & Opportunities

The South Korea cosmetics market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This expansion is fueled by a confluence of evolving consumer preferences, technological breakthroughs, and a dynamic competitive landscape. The market size is projected to reach an impressive $XX Billion by 2033, up from an estimated $XX Billion in 2025. A significant trend is the escalating demand for personalized beauty solutions, driven by advanced diagnostic tools and bespoke product formulations. This creates substantial opportunities for brands that can offer tailored experiences and products.

Technological shifts are profoundly impacting the industry. The integration of AI and big data analytics for personalized recommendations and product development is becoming increasingly prevalent. Furthermore, the rise of smart beauty devices, exemplified by L'Oréal Group's innovations like Colorsonic and Copyright introduced in January 2022, signals a move towards at-home beauty solutions and enhanced professional salon experiences. These devices not only offer convenience but also deliver superior results, catering to the discerning South Korean consumer.

Consumer preferences are increasingly leaning towards clean beauty, sustainability, and ethical sourcing. Brands that can demonstrate a commitment to eco-friendly packaging, natural ingredients, and transparent supply chains will gain a competitive edge. The heightened awareness of ingredient efficacy and scientific validation of product claims also plays a crucial role. Consumers are actively seeking products backed by research and clinical studies.

The competitive dynamics are shaped by a blend of established giants and agile indie brands. While large corporations like Amorepacific Corporation and LG Household & Health Care continue to dominate through broad product portfolios and extensive marketing efforts, smaller brands are carving out niches by focusing on specific ingredients, unique formulations, or distinct brand narratives. Opportunities abound for brands that can effectively leverage social media marketing, influencer collaborations, and direct-to-consumer (DTC) models to reach younger demographics. The K-beauty phenomenon continues to exert global influence, presenting export opportunities for South Korean brands willing to tap into international markets. The growing disposable income and a culture that highly values appearance further underpin the market's upward trajectory, creating a fertile ground for innovation and expansion.

Dominant Markets & Segments in South Korea Cosmetics Market

The South Korea cosmetics market exhibits clear dominance across several key segments, driven by deep-seated consumer habits and evolving lifestyle trends.

Product Type Dominance:

Skin Care Products: This segment is the undisputed leader, consistently demonstrating the highest market share and projected growth.

- Facial Care Products: Including serums, moisturizers, sunscreens, and treatments, facial care accounts for the largest portion of the skincare market. The Korean consumer's pursuit of flawless, radiant skin is a primary driver.

- Body Care Products: While secondary to facial care, body care, encompassing lotions, creams, and body washes, is experiencing steady growth due to increased consumer focus on holistic wellness.

- Lip Care Products: Driven by trends in lip contouring and hydration, this sub-segment is gaining traction.

Cosmetics/Make-up Products: This segment holds a significant, though generally secondary, position to skincare.

- Facial Cosmetics: Foundations, concealers, and primers remain popular, with a focus on achieving a dewy, natural finish.

- Eye Cosmetics: Eyeliners, mascaras, and eyeshadows continue to be strong performers, reflecting the importance of eye makeup in the K-beauty aesthetic.

- Lip and Nail Make-up Products: Trends in lip tints, matte lipsticks, and nail art contribute to the sustained popularity of these sub-segments.

Category Dominance:

- Premium Products: While mass-market products have a broad reach, the premium products category exhibits exceptional growth and higher profit margins. Consumers are increasingly willing to invest in high-quality formulations, advanced ingredients, and exclusive brand experiences. This is further supported by the K-beauty culture that often equates advanced skincare with premium offerings.

Distribution Channel Dominance:

- Online Retail Channels: This channel has emerged as the most dominant and fastest-growing distribution method. The convenience of e-commerce, coupled with the extensive reach of online platforms and social media integration, makes it the preferred choice for a significant portion of consumers.

- Key Growth Drivers:

- Widespread internet and smartphone penetration.

- Seamless integration with social media for product discovery and purchase.

- Competitive pricing and frequent online promotions.

- Personalized recommendations and virtual try-on features.

- Key Growth Drivers:

- Specialty Stores: These stores, often featuring curated selections of K-beauty brands, remain highly influential, offering expert advice and an immersive brand experience.

- Supermarkets/Hypermarkets & Convenience Stores: These channels cater to mass-market accessibility for everyday beauty essentials.

- Pharmacies/Drug Stores: Growing in importance, particularly for dermatologically tested and functional skincare products.

Dominant Region: The entire South Korea cosmetics market is a single, dominant geographical market, with its influence radiating globally. Within South Korea, metropolitan areas like Seoul and its surrounding Gyeonggi Province represent the highest consumption hubs, driven by higher disposable incomes and concentrated retail infrastructure.

South Korea Cosmetics Market Product Analysis

The South Korea cosmetics market is a hotbed of product innovation, driven by a relentless pursuit of efficacy and aesthetic appeal. Leading companies are investing heavily in advanced ingredient research, focusing on scientifically proven actives like hyaluronic acid, peptides, and ceramides, alongside novel botanical extracts. The integration of cutting-edge technology, such as microencapsulation for targeted delivery and fermentation techniques for enhanced bioavailability, provides a significant competitive advantage. Consumers are increasingly seeking multi-functional products that offer skincare benefits alongside makeup coverage, such as tinted sunscreens or hydrating lipsticks. The market's adaptability to emerging trends, like the demand for "glass skin" or "clean beauty" formulations, ensures a continuous stream of relevant and desirable products.

Key Drivers, Barriers & Challenges in South Korea Cosmetics Market

Key Drivers: The South Korea cosmetics market is propelled by several potent forces. Foremost among these is the advanced R&D and innovation capacity of domestic and international companies, consistently delivering novel formulations and product categories. The strong cultural emphasis on appearance and self-care, coupled with rising disposable incomes, significantly boosts consumer spending on beauty products. Furthermore, the global appeal of K-beauty trends acts as a powerful export driver and influences domestic product development. Government support for the beauty industry, including R&D grants and export promotion initiatives, also plays a crucial role. The increasing demand for personalized beauty solutions and the growing awareness and adoption of clean and sustainable beauty practices represent significant growth catalysts.

Barriers & Challenges: Despite its robust growth, the market faces several hurdles. Intense market competition, with a constant influx of new brands and products, necessitates continuous differentiation and substantial marketing investment. Regulatory complexities, although focused on safety, can pose challenges for new product introductions and ingredient approvals, requiring meticulous compliance. Supply chain vulnerabilities, particularly in sourcing specialized ingredients and managing distribution logistics, can impact production timelines and costs. The rapidly changing consumer preferences require brands to be agile and responsive, posing a challenge in staying ahead of trends. Furthermore, the increasing cost of raw materials and manufacturing can put pressure on profit margins.

Growth Drivers in the South Korea Cosmetics Market Market

The South Korea cosmetics market's growth is predominantly fueled by relentless technological innovation in product formulation and application, exemplified by advanced skincare ingredients and smart beauty devices. Economically, rising disposable incomes and a cultural predisposition towards self-grooming and aesthetic enhancement create strong consumer demand. Policy-driven factors, such as government support for the beauty industry and initiatives promoting export growth, provide a conducive business environment. The pervasive influence of the global K-beauty phenomenon continues to drive demand for Korean cosmetic products both domestically and internationally, creating significant export opportunities. Furthermore, the increasing consumer preference for personalized beauty solutions and a strong focus on sustainable and ethical beauty practices are emerging as key growth engines.

Challenges Impacting South Korea Cosmetics Market Growth

The South Korea cosmetics market grapples with several challenges that temper its otherwise impressive growth trajectory. Intense market competition from both established giants and agile indie brands leads to crowded shelves and necessitates significant marketing expenditure to capture consumer attention. Regulatory hurdles, while essential for consumer safety, can slow down the introduction of new products and ingredients, requiring substantial compliance efforts. Supply chain disruptions, particularly in sourcing specialized ingredients and managing logistics, can lead to increased costs and production delays. The rapidly evolving consumer preferences, often driven by fleeting social media trends, demand constant product innovation and marketing agility, posing a significant strategic challenge for companies. Finally, increasing raw material costs and manufacturing expenses can put pressure on profit margins, requiring careful cost management.

Key Players Shaping the South Korea Cosmetics Market Market

- Amorepacific Corporation

- Banila Co

- L'Oréal S A

- Unilever Plc

- Dr Jart+

- PFD Co Ltd

- The Face Shop (LG Household & Health Care)

- Clubclio Co Ltd

- Nature Republic

- SON&PARK

Significant South Korea Cosmetics Market Industry Milestones

- January 2022: The L'Oréal Group introduced Colorsonic and Copyright, two innovative, portable beauty technology devices for hair coloring applications aimed at both consumers and professional hairstylists.

- September 2022: Amorepacific announced the strategic acquisition of Tata Harper, a prominent luxury clean beauty brand, significantly expanding its presence in the Americas and Europe and bolstering its clean skincare portfolio.

- May 2021: Amorepacific launched 'Bathbot,' a customized bath bomb service, allowing customers to select from 14 different flavor and fragrance options, enhancing in-store experiential retail.

Future Outlook for South Korea Cosmetics Market Market

The future outlook for the South Korea cosmetics market remains exceptionally bright, characterized by sustained innovation and expanding global influence. Growth catalysts include the continued rise of personalized beauty technologies, offering bespoke solutions driven by AI and data analytics. The increasing consumer demand for sustainable and ethically produced products will further shape market offerings, presenting opportunities for brands committed to eco-friendly practices and transparent sourcing. The enduring appeal of K-beauty will continue to drive export growth, solidifying South Korea's position as a global beauty powerhouse. Strategic acquisitions and partnerships are expected to intensify as companies seek to expand their portfolios and market reach. The market is projected to witness significant growth driven by a blend of advanced product development, digital engagement strategies, and a keen understanding of evolving consumer values.

South Korea Cosmetics Market Segmentation

-

1. Product Type

-

1.1. Personal Care Products

-

1.1.1. Hair Care

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioner

- 1.1.1.3. Others

-

1.1.2. Skin Care

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

-

1.1.3. Bath and Shower

- 1.1.3.1. Shower Gels

- 1.1.3.2. Soaps

-

1.1.4. Oral Care

- 1.1.4.1. Toothbrush

- 1.1.4.2. Toothpaste

- 1.1.4.3. Mouthwashes and Rinses

- 1.1.5. Men's Grooming Products

- 1.1.6. Deodrants and Antiperspirants

-

1.1.1. Hair Care

-

1.2. Cosmetics/Make-up Products

- 1.2.1. Facial Cosmetics

- 1.2.2. Eye Cosmetics

- 1.2.3. Lip and Nail Make-up Products

- 1.2.4. Hair Styling and Coloring

-

1.1. Personal Care Products

-

2. Category

- 2.1. Premium Products

- 2.2. Mass Products

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience Stores

- 3.4. Pharmacies/Drug Stores

- 3.5. Online Retail Channels

- 3.6. Other Distribution Channels

South Korea Cosmetics Market Segmentation By Geography

- 1. South Korea

South Korea Cosmetics Market Regional Market Share

Geographic Coverage of South Korea Cosmetics Market

South Korea Cosmetics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Growing Demand for Halal Cosmetics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Cosmetics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care Products

- 5.1.1.1. Hair Care

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioner

- 5.1.1.1.3. Others

- 5.1.1.2. Skin Care

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.3. Bath and Shower

- 5.1.1.3.1. Shower Gels

- 5.1.1.3.2. Soaps

- 5.1.1.4. Oral Care

- 5.1.1.4.1. Toothbrush

- 5.1.1.4.2. Toothpaste

- 5.1.1.4.3. Mouthwashes and Rinses

- 5.1.1.5. Men's Grooming Products

- 5.1.1.6. Deodrants and Antiperspirants

- 5.1.1.1. Hair Care

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Facial Cosmetics

- 5.1.2.2. Eye Cosmetics

- 5.1.2.3. Lip and Nail Make-up Products

- 5.1.2.4. Hair Styling and Coloring

- 5.1.1. Personal Care Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Premium Products

- 5.2.2. Mass Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience Stores

- 5.3.4. Pharmacies/Drug Stores

- 5.3.5. Online Retail Channels

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amorepacific Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Banila Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 L'Oréal S A *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dr Jart+

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PFD Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Face Shop (LG Household & Health Care)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clubclio Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nature Republic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SON&PARK

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amorepacific Corporation

List of Figures

- Figure 1: South Korea Cosmetics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Cosmetics Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Cosmetics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Cosmetics Market Revenue billion Forecast, by Category 2020 & 2033

- Table 3: South Korea Cosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Cosmetics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South Korea Cosmetics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: South Korea Cosmetics Market Revenue billion Forecast, by Category 2020 & 2033

- Table 7: South Korea Cosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: South Korea Cosmetics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Cosmetics Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the South Korea Cosmetics Market?

Key companies in the market include Amorepacific Corporation, Banila Co, L'Oréal S A *List Not Exhaustive, Unilever Plc, Dr Jart+, PFD Co Ltd, The Face Shop (LG Household & Health Care), Clubclio Co Ltd, Nature Republic, SON&PARK.

3. What are the main segments of the South Korea Cosmetics Market?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.39 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Growing Demand for Halal Cosmetics.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

January 2022: The L'Oréal Group introduced Colorsonic and Copyright, two cutting-edge innovations in beauty technology for customers and hairstylists. Both are portable, light devices with color applications. Colorsonic is for consumer use and Copyright for hair salons.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Cosmetics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Cosmetics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Cosmetics Market?

To stay informed about further developments, trends, and reports in the South Korea Cosmetics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence