Key Insights

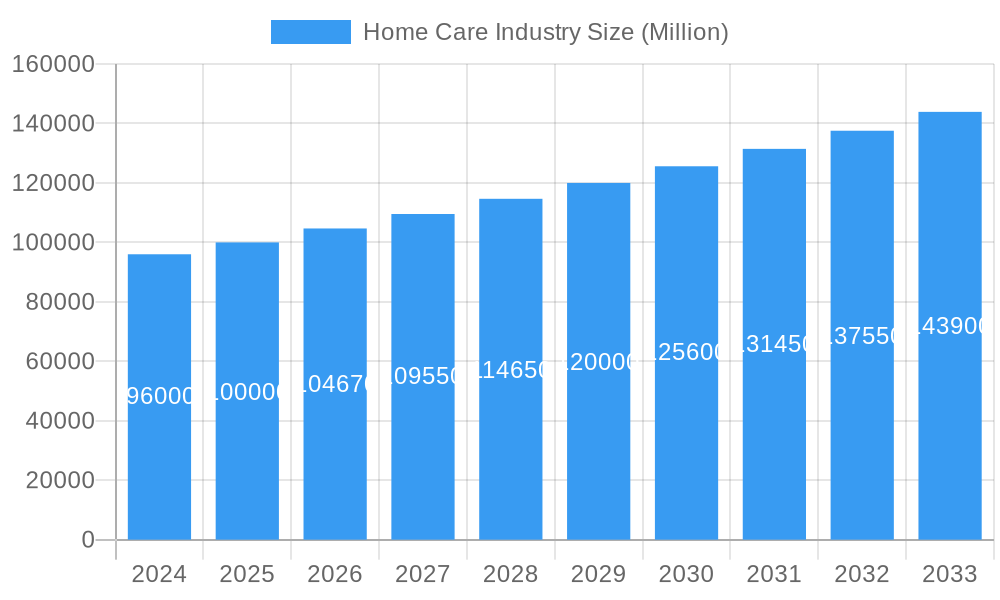

The global Home Care Industry is projected for significant expansion. In 2025, the market size is estimated at $309.94 billion, with an anticipated Compound Annual Growth Rate (CAGR) of 8.9% through 2033. This growth is fueled by population increases, rising disposable income, and heightened consumer awareness of hygiene and sanitation. Demand for efficacious, convenient, and sustainable home care products is a key driver. Air care is experiencing growth due to increased focus on indoor air quality, while laundry care remains a strong segment driven by detergent and fabric care innovations. Surface care benefits from a focus on germ protection and disinfection. E-commerce is transforming distribution, offering consumers wider access and product selection.

Home Care Industry Market Size (In Billion)

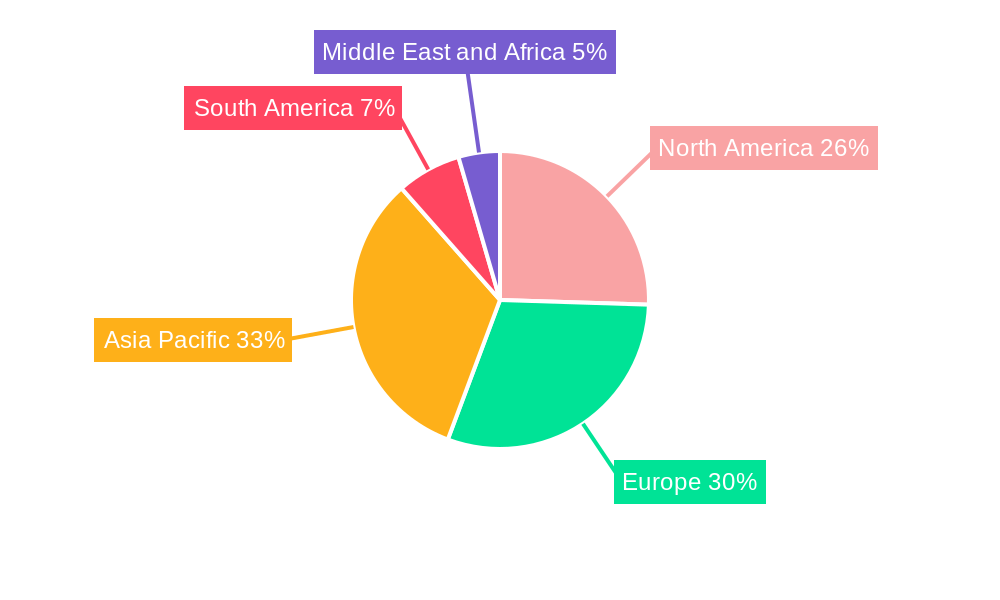

Challenges for the industry include rising raw material costs, impacting profit margins, and stringent environmental regulations. Consumers increasingly seek eco-friendly alternatives, pushing manufacturers toward sustainable product development and packaging. Key global players like Procter & Gamble, Unilever, and Reckitt Benckiser, alongside regional brands, dominate the competitive landscape. These companies are prioritizing product differentiation, strategic partnerships, and innovative solutions. The Asia Pacific region, particularly China and India, represents a high-growth market due to its substantial consumer base and rapid urbanization.

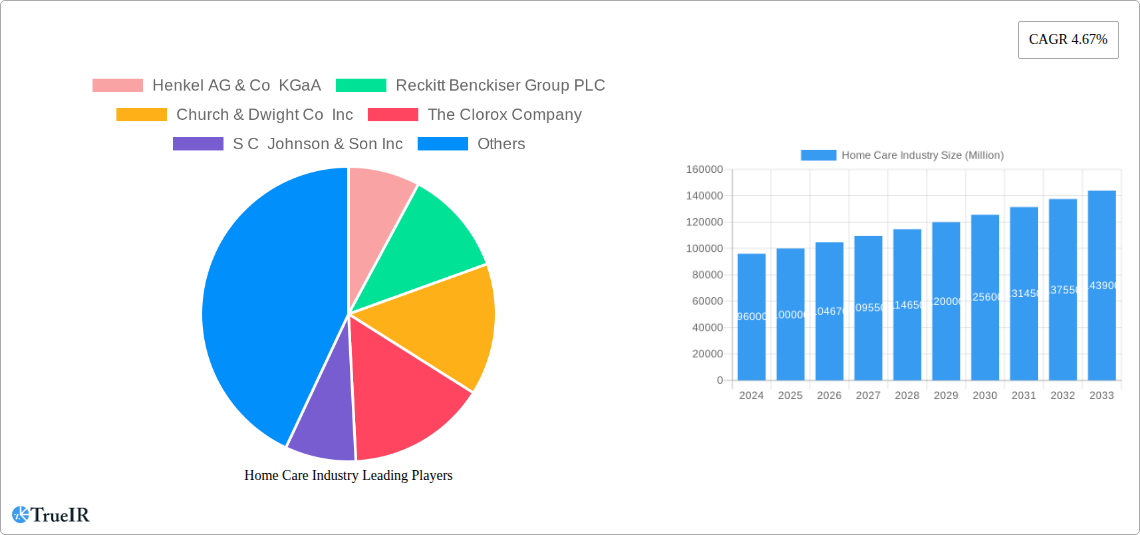

Home Care Industry Company Market Share

This dynamic, SEO-optimized report description details the Home Care Industry's market size, growth, and forecast for enhanced search visibility and industry engagement.

Home Care Industry Market Structure & Competitive Landscape

The global Home Care Industry is characterized by a moderately concentrated market structure, driven by continuous innovation and increasing consumer demand for sustainable and effective cleaning solutions. Key industry players like Procter & Gamble Company, Unilever PLC, and Reckitt Benckiser Group PLC command significant market share, influencing product development and pricing strategies. The market's competitive intensity is fueled by a growing number of smaller, agile companies focusing on niche segments and eco-friendly formulations. Regulatory landscapes, particularly concerning chemical safety and environmental impact, play a crucial role in shaping product innovation and market entry. The threat of product substitutes, especially from DIY cleaning solutions and emerging bio-based alternatives, is also a factor, pushing established brands to invest heavily in research and development. End-user segmentation highlights a strong demand for products catering to specific cleaning needs, from laundry care to surface and toilet care. Mergers and acquisitions (M&A) trends indicate a strategic consolidation phase, with companies acquiring smaller innovative brands to expand their product portfolios and market reach. In the historical period of 2019-2024, M&A activity saw a significant volume, contributing to market consolidation and the introduction of new technologies. Concentration ratios are estimated to be in the range of 50-60% for the top five players.

Home Care Industry Market Trends & Opportunities

The Home Care Industry is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, with the market size expected to reach over $500 Billion by 2025. This expansion is underpinned by several transformative trends. Technological shifts are at the forefront, with advancements in eco-friendly formulations, smart dispensing systems, and biodegradable packaging significantly influencing consumer choices. The rise of the "green consumer" is a dominant force, driving demand for plant-based, non-toxic, and sustainable home care products. This shift is compelling manufacturers to invest in R&D for cleaner ingredients and reduced environmental footprints, moving away from traditional fossil-derived chemicals. Consumer preferences are evolving rapidly, with an increasing emphasis on efficacy, convenience, and product safety, particularly in households with children and pets. The "convenience economy" is also impacting the market, with a growing demand for ready-to-use solutions and multi-functional products.

Competitive dynamics are intensifying as both multinational corporations and emerging brands vie for market share. Strategic collaborations and acquisitions are common, as companies seek to leverage each other's strengths and expand their global presence. The online retail channel has emerged as a critical growth avenue, offering unparalleled reach and personalized consumer experiences. E-commerce platforms are increasingly becoming a primary touchpoint for product discovery and purchase, necessitating strong digital marketing strategies and efficient supply chain management. The growing awareness of hygiene and sanitation, further amplified by recent global health events, continues to be a significant market driver. Innovations in laundry care, with a focus on stain removal and fabric care, alongside advancements in dishwashing detergents and surface cleaners, are crucial for sustained market penetration. Opportunities abound in developing personalized cleaning solutions, subscription-based models, and products that address specific consumer concerns like allergies and sensitive skin. The penetration rate of premium and eco-friendly products is steadily increasing across all segments, signaling a maturing market that values both performance and planetary well-being.

Dominant Markets & Segments in Home Care Industry

The Laundry Care segment is anticipated to remain a dominant force within the Home Care Industry, driven by consistent consumer demand and continuous innovation in detergent technologies. Within this segment, liquid detergents are expected to maintain a higher market share than powders due to their ease of use and perceived efficacy in lower temperatures. The Surface Care segment also presents significant growth opportunities, fueled by an increasing focus on hygiene and the development of specialized cleaners for various surfaces, including wood, glass, and electronics. The Air Care segment is experiencing a resurgence, with consumers seeking to enhance their home environments with pleasant fragrances and air purification solutions.

Geographically, Asia-Pacific is emerging as a key growth region, attributed to rapid urbanization, rising disposable incomes, and increasing awareness of hygiene standards. Countries like China and India represent substantial markets for home care products. Within distribution channels, Supermarkets/Hypermarkets continue to be a primary channel for reaching a broad consumer base. However, Online Retail Stores are rapidly gaining traction, offering convenience and a wider product selection, particularly for specialized or premium home care items. The growth of online channels is a critical factor for market players to leverage for expanding their reach and engaging with consumers directly. Infrastructure development, government policies promoting consumer goods, and rising consumer spending power are significant growth drivers. The widespread availability of innovative products catering to diverse needs, coupled with increasing adoption of advanced cleaning technologies, further solidifies the dominance of these segments.

Home Care Industry Product Analysis

Product innovation in the Home Care Industry is largely driven by sustainability and enhanced efficacy. Companies are investing in developing plant-based formulations, biodegradable packaging, and concentrated products that minimize waste and environmental impact. Key applications span across laundry care, dishwashing, surface cleaning, and air care, with a growing emphasis on multi-functional products that offer convenience and cost-effectiveness. Competitive advantages are increasingly derived from eco-friendly certifications, superior cleaning performance, and unique fragrance profiles. Technological advancements in enzyme technology for detergents and advanced surfactant systems for surface cleaners are key differentiators.

Key Drivers, Barriers & Challenges in Home Care Industry

Key Drivers:

- Growing Consumer Awareness: Increasing demand for hygiene, sanitation, and eco-friendly products propels market growth.

- Technological Advancements: Innovations in formulations, packaging, and delivery systems enhance product efficacy and sustainability.

- Rising Disposable Incomes: Higher purchasing power in emerging economies translates to increased spending on premium home care products.

- Urbanization: Concentrated populations in urban areas drive demand for convenience-oriented cleaning solutions.

Key Barriers & Challenges:

- Intense Competition: A highly competitive landscape with established players and emerging brands pressures profit margins.

- Regulatory Compliance: Stringent regulations regarding chemical safety, labeling, and environmental impact can increase R&D and production costs.

- Supply Chain Disruptions: Volatility in raw material prices and logistics can impact product availability and cost-effectiveness.

- Consumer Price Sensitivity: While demand for premium products is rising, a significant segment remains price-sensitive, limiting the adoption of higher-priced sustainable options.

Growth Drivers in the Home Care Industry Market

The Home Care Industry market is primarily propelled by a confluence of technological, economic, and demographic factors. The escalating global awareness regarding hygiene and sanitation, amplified by health concerns, is a significant catalyst. Technological advancements are leading to the development of innovative, high-performance, and environmentally conscious cleaning solutions, such as biodegradable detergents and smart cleaning devices. Economically, rising disposable incomes in developing nations are fueling consumer spending on premium and specialized home care products. Furthermore, favorable government policies promoting consumer welfare and environmental sustainability can also act as significant growth drivers, encouraging innovation and market expansion.

Challenges Impacting Home Care Industry Growth

Several barriers and restraints pose challenges to the sustained growth of the Home Care Industry. Intense competition within the market, characterized by price wars and aggressive marketing by both multinational corporations and smaller brands, can compress profit margins. Regulatory complexities surrounding chemical safety, ingredient disclosure, and environmental impact necessitate significant investment in compliance, potentially hindering innovation for smaller players. Supply chain volatility, including fluctuating raw material costs and geopolitical factors, can disrupt production and distribution, leading to increased operational expenses. Moreover, shifts in consumer preferences towards natural and DIY cleaning solutions, driven by concerns about chemical exposure and environmental footprint, present a competitive challenge to conventional product offerings.

Key Players Shaping the Home Care Industry Market

- Henkel AG & Co KGaA

- Reckitt Benckiser Group PLC

- Church & Dwight Co Inc

- The Clorox Company

- S C Johnson & Son Inc

- Unilever PLC

- Himalaya Global Holdings Ltd

- Procter & Gamble Company

- Kao Corporation

- Alticor Global Holdings Inc (Amway Corp)

Significant Home Care Industry Industry Milestones

- December 2021: Unilever launched a new plant-based hand dishwashing product under its Lux brand. The product is prepared using plant-derived ingredients and has no fossil-derived chemicals.

- September 2021: Hindustan Unilever Ltd announced that its famous detergent brand Surf Excel has transitioned to recyclable bottles made from 50% post-consumer recycled plastic while using 100% biodegradable actives in its formulations.

- July 2021: Hindustan Unilever launched an in-store vending machine, Smart Fill, for its home care products. The vending machine was installed at Reliance Smart Acme Mall in Mumbai as a pilot project.

Future Outlook for Home Care Industry Market

The future outlook for the Home Care Industry is highly positive, driven by an increasing focus on sustainable and eco-friendly product innovations. Key growth catalysts include the rising consumer demand for health and hygiene-conscious products, coupled with the growing acceptance of advanced cleaning technologies. Strategic opportunities lie in expanding the market reach through online retail channels, developing personalized cleaning solutions, and catering to niche consumer segments. The market is expected to witness significant potential in emerging economies as disposable incomes rise and awareness regarding advanced home care practices increases, ensuring a robust growth trajectory for the foreseeable future.

Home Care Industry Segmentation

-

1. Product Type

- 1.1. Air Care

- 1.2. Dishwashing

- 1.3. Bleach

- 1.4. Insecticides

- 1.5. Laundry Care

- 1.6. Surface Care

- 1.7. Toilet Care

- 1.8. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Home Care Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Home Care Industry Regional Market Share

Geographic Coverage of Home Care Industry

Home Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovative Launches; Hair Concerns Among Consumers

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Inclination for Home Hygiene

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Care Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Air Care

- 5.1.2. Dishwashing

- 5.1.3. Bleach

- 5.1.4. Insecticides

- 5.1.5. Laundry Care

- 5.1.6. Surface Care

- 5.1.7. Toilet Care

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Home Care Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Air Care

- 6.1.2. Dishwashing

- 6.1.3. Bleach

- 6.1.4. Insecticides

- 6.1.5. Laundry Care

- 6.1.6. Surface Care

- 6.1.7. Toilet Care

- 6.1.8. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Home Care Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Air Care

- 7.1.2. Dishwashing

- 7.1.3. Bleach

- 7.1.4. Insecticides

- 7.1.5. Laundry Care

- 7.1.6. Surface Care

- 7.1.7. Toilet Care

- 7.1.8. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Home Care Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Air Care

- 8.1.2. Dishwashing

- 8.1.3. Bleach

- 8.1.4. Insecticides

- 8.1.5. Laundry Care

- 8.1.6. Surface Care

- 8.1.7. Toilet Care

- 8.1.8. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Home Care Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Air Care

- 9.1.2. Dishwashing

- 9.1.3. Bleach

- 9.1.4. Insecticides

- 9.1.5. Laundry Care

- 9.1.6. Surface Care

- 9.1.7. Toilet Care

- 9.1.8. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Home Care Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Air Care

- 10.1.2. Dishwashing

- 10.1.3. Bleach

- 10.1.4. Insecticides

- 10.1.5. Laundry Care

- 10.1.6. Surface Care

- 10.1.7. Toilet Care

- 10.1.8. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Reckitt Benckiser Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Church & Dwight Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Clorox Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 S C Johnson & Son Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unilever PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Himalaya Global Holdings Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Procter & Gamble Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kao Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alticor Global Holdings Inc (Amway Corp)*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Home Care Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Home Care Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Home Care Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Home Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Home Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Home Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Home Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Home Care Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Home Care Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Home Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Home Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Home Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Home Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Home Care Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Home Care Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Home Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Home Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Home Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Home Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Home Care Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Home Care Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Home Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Home Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Home Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Home Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Home Care Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Home Care Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Home Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Home Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Home Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Home Care Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Care Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Home Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Home Care Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Home Care Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Home Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Home Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Home Care Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Home Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Home Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Italy Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Spain Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Home Care Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Home Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Home Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Home Care Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Home Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Home Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Home Care Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Home Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Home Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: South Africa Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Home Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Care Industry?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Home Care Industry?

Key companies in the market include Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, Church & Dwight Co Inc, The Clorox Company, S C Johnson & Son Inc, Unilever PLC, Himalaya Global Holdings Ltd, Procter & Gamble Company, Kao Corporation, Alticor Global Holdings Inc (Amway Corp)*List Not Exhaustive.

3. What are the main segments of the Home Care Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 309.94 billion as of 2022.

5. What are some drivers contributing to market growth?

Innovative Launches; Hair Concerns Among Consumers.

6. What are the notable trends driving market growth?

Increasing Inclination for Home Hygiene.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

December 2021: Unilever launched a new plant-based hand dishwashing product under its Lux brand. The product is prepared using plant-derived ingredients and has no fossil-derived chemicals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Care Industry?

To stay informed about further developments, trends, and reports in the Home Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence