Key Insights

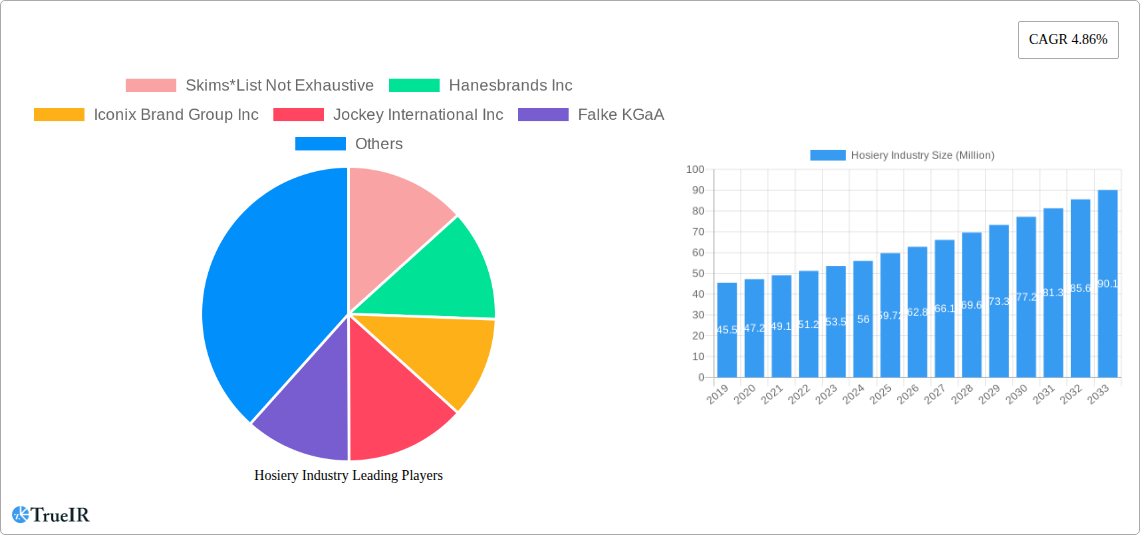

The global hosiery market is poised for steady growth, projected to reach a significant market size driven by evolving fashion trends and increasing consumer demand for comfort and style. With a Compound Annual Growth Rate (CAGR) of approximately 4.86%, the market is expected to witness sustained expansion throughout the forecast period. Key drivers fueling this growth include the rising influence of athleisure wear, where socks and knee-highs are integral fashion statements, and the increasing disposable incomes in emerging economies, leading to greater spending on apparel accessories. Furthermore, the burgeoning online retail sector is democratizing access to a wider variety of hosiery products, catering to diverse consumer preferences and making it easier for niche brands to reach their target audiences. The emphasis on premium materials, innovative designs, and sustainable manufacturing practices is also shaping market dynamics, with consumers increasingly seeking high-quality and ethically produced hosiery.

Hosiery Industry Market Size (In Million)

Despite the positive outlook, certain factors could moderate growth. The highly competitive nature of the market, with numerous established players and new entrants, may put pressure on profit margins. Fluctuations in raw material prices, particularly for cotton and synthetic fibers, can also impact manufacturing costs and pricing strategies. However, the industry is adept at adapting. Innovations in fabric technology, such as moisture-wicking and compression features, are continuously being introduced, enhancing product functionality and appeal across various end-users. The expansion of distribution channels, especially the continued dominance of online retail and the strategic placement of hosiery in supermarkets and specialty stores, ensures widespread availability. The market's segmentation by product type, including body stockings, socks, knee highs, and hold-ups, along with its segmentation by end-user (men and women), highlights the diverse needs being met.

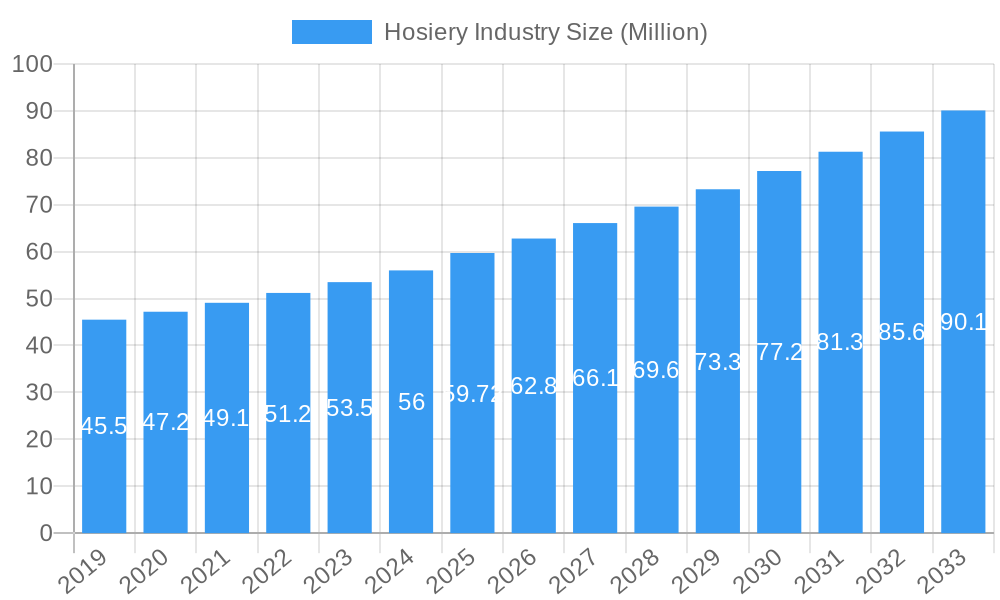

Hosiery Industry Company Market Share

This comprehensive report delves into the dynamic hosiery market, providing an in-depth analysis of its structure, trends, and future outlook from 2019 to 2033. With a base year of 2025 and a robust forecast period of 2025–2033, this study leverages high-volume keywords to enhance search rankings and engage industry stakeholders. Discover critical insights into socks, tights, body stockings, and other hosiery products, segmented by men's and women's end-users and various distribution channels, including online retail stores, supermarkets/hypermarkets, and specialty stores.

Hosiery Industry Market Structure & Competitive Landscape

The global hosiery market, valued at an estimated XX Million in 2025, exhibits a moderately concentrated structure. Key players like Hanesbrands Inc., Falke KGaA, and Gilfin S P A (Golden Lady Company S P A) hold significant market share, but a rising number of niche and sustainable brands are increasing competitive intensity. Innovation drivers are predominantly focused on material science, sustainable sourcing, and comfort-enhancing designs, as exemplified by Falke's pressure-free sock technology and Heist Studios' use of recycled materials. Regulatory impacts are largely related to product safety standards and growing consumer demand for eco-friendly production. Product substitutes, while present in the form of other legwear and even alternative footwear, face limited direct competition due to the unique functional and fashion aspects of hosiery. End-user segmentation reveals a strong dominance of the women's segment, though the men's hosiery market is experiencing steady growth. Mergers and acquisitions (M&A) activity, while not consistently high, often target brands with strong e-commerce presence or innovative product lines, reflecting a strategic consolidation trend. Estimated M&A volumes in the historical period (2019-2024) reached XX Million.

Hosiery Industry Market Trends & Opportunities

The global hosiery market is poised for substantial growth, projected to reach an estimated XX Million by 2033, driven by a compound annual growth rate (CAGR) of approximately XX% from 2025 to 2033. This expansion is fueled by evolving consumer preferences, technological advancements in material and manufacturing processes, and the increasing penetration of online retail channels. The socks segment continues to be the largest contributor, driven by both functional and fashion-oriented purchases. Technological shifts are prominently seen in the development of advanced performance fabrics, moisture-wicking technologies, and enhanced durability, catering to the growing demand for athletic and specialized hosiery. Consumer preferences are increasingly leaning towards sustainable hosiery, with a rising demand for products made from recycled materials and produced through eco-conscious manufacturing processes. This trend presents significant opportunities for brands that prioritize ethical production and transparent supply chains. Competitive dynamics are intensifying, with both established players and emerging direct-to-consumer (DTC) brands vying for market share. The rise of athleisure and the continued integration of fashion into everyday wear further bolster the demand for diverse and stylish hosiery options, from compression socks to designer tights. The market penetration rate for specialized hosiery, such as medical compression stockings, is also expected to increase with greater awareness of their health benefits. The overall market size in the historical period (2019-2024) was approximately XX Million.

Dominant Markets & Segments in Hosiery Industry

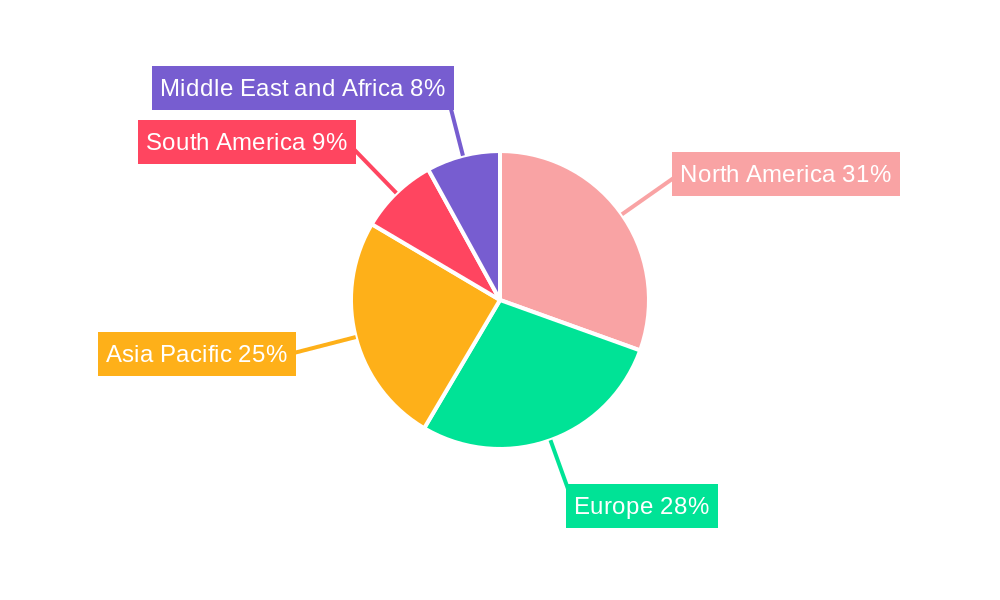

The women's segment overwhelmingly dominates the global hosiery market, driven by a wide array of product categories and fashion trends. Within product types, socks represent the largest and most dynamic segment, encompassing everything from everyday wear to specialized athletic and fashion-driven options. Knee highs and hold-ups also maintain significant market share, catering to specific fashion needs and functionalities. The online retail stores distribution channel is experiencing rapid growth, surpassing traditional specialty stores and supermarkets/hypermarkets in terms of market penetration and sales volume. This shift is attributed to the convenience, wider selection, and competitive pricing offered by e-commerce platforms. Geographically, North America and Europe currently hold the largest market shares, owing to higher disposable incomes and well-established fashion industries. However, the Asia-Pacific region is exhibiting the fastest growth, fueled by a burgeoning middle class, increasing urbanization, and a growing awareness of fashion and wellness trends. Key growth drivers in leading regions include:

- North America: Strong consumer spending, established brands, and a mature e-commerce infrastructure.

- Europe: High demand for premium and sustainable hosiery, coupled with advanced manufacturing capabilities.

- Asia-Pacific: Rapid urbanization, rising disposable incomes, and increasing adoption of online shopping, particularly in countries like China and India.

The dominance of online retail is further accentuated by the ability of consumers to easily access a vast array of body stockings, socks, knee highs, and hold-ups from various brands, facilitating informed purchase decisions based on price, reviews, and product specifications.

Hosiery Industry Product Analysis

The hosiery industry is characterized by continuous product innovation, driven by advancements in textile technology and evolving consumer demands. Key innovations include the development of advanced performance socks with enhanced breathability, moisture-wicking properties, and targeted compression zones for athletes. Sustainable materials like recycled polyester and nylon are gaining traction, appealing to environmentally conscious consumers and offering competitive advantages to brands prioritizing eco-friendly production. The versatility of body stockings, knee highs, and hold-ups extends beyond basic functionality to encompass fashion statements, with diverse patterns, textures, and colors becoming increasingly popular. The market fit for these products is strong, catering to both functional needs and aesthetic preferences across a broad spectrum of consumers.

Key Drivers, Barriers & Challenges in Hosiery Industry

The hosiery industry is propelled by several key drivers, including the rising disposable incomes globally, which fuels consumer spending on apparel and accessories. The growing popularity of athleisure wear and the increasing emphasis on fashion and personal grooming also contribute significantly to market growth. Technological advancements in fabric manufacturing, leading to more comfortable, durable, and specialized hosiery, act as a powerful growth catalyst. Furthermore, the expansion of e-commerce channels provides wider market access and convenience for consumers, driving sales.

Conversely, the industry faces several barriers and challenges. Fluctuations in raw material prices, particularly for cotton and synthetic fibers, can impact manufacturing costs and profitability. Intense competition from both established global brands and agile regional players exerts downward pressure on pricing. Stringent regulations regarding material sourcing and product safety in certain regions can also pose compliance hurdles. Supply chain disruptions, as witnessed in recent global events, can affect production timelines and inventory management, leading to potential shortages or delays. The threat of counterfeit products entering the market also undermines brand value and consumer trust.

Growth Drivers in the Hosiery Industry Market

The hosiery industry market is experiencing robust growth driven by several interconnected factors. The burgeoning athleisure trend continues to fuel demand for comfortable and performance-oriented socks and legwear. Technological advancements in yarn development and fabric construction are enabling the creation of specialized hosiery with enhanced benefits like compression, moisture-wicking, and temperature regulation. Economic growth in emerging markets is leading to increased disposable income, allowing a larger consumer base to invest in fashion-forward and comfort-enhancing hosiery. Furthermore, a growing consumer consciousness around sustainability and ethical production practices is creating opportunities for brands that embrace eco-friendly materials and manufacturing processes, thus acting as a significant growth catalyst.

Challenges Impacting Hosiery Industry Growth

Despite the positive growth trajectory, the hosiery industry faces several significant challenges. Volatility in the prices of raw materials like cotton and synthetic fibers directly impacts production costs and can squeeze profit margins for manufacturers. The highly competitive landscape, with numerous global and local players, leads to price wars and challenges in maintaining brand differentiation. Evolving consumer preferences, while a driver of innovation, can also be a challenge if brands fail to adapt quickly enough to new trends and demand for specific product attributes. Additionally, supply chain disruptions, including logistics issues and geopolitical uncertainties, can lead to production delays and inventory management complexities, impacting the timely availability of products to consumers. Regulatory compliance across different regions, particularly concerning product labeling and material composition, adds another layer of complexity for global manufacturers.

Key Players Shaping the Hosiery Industry Market

- Hanesbrands Inc.

- Iconix Brand Group Inc

- Jockey International Inc

- Falke KGaA

- Gilfin S P A (Golden Lady Company S P A)

- Lanvin Group (Wolford AG)

- Spanx Inc

- Heist Studios

- CSP International Fashion Group S P A

- Carolina Hosiery Mill Inc (Carolina Ultimate Real Tree)

- G-III Apparel Group (Donna Karan International)

- Skims

Significant Hosiery Industry Industry Milestones

- May 2022: Falke Introduced New Pressure-Free Running Socks. Falke's new Pressure-Free sock incorporates a unique design feature to reduce the potential hotspot across the bridge of the foot. Falke has inserted a striated pad of channels on top of the foot that may move dynamically in response to foot movements. This helps to spread movement pressure and relieve pressure buildup in this area. This innovation signifies a focus on performance and comfort in athletic hosiery.

- October 2021: The Heist Studios brand unveiled four novel sustainable tights in its AW21 product range. Each product has been sustainably manufactured with the help of recycled Elastane and Polyamide to sustain the brand's essence. This highlights a growing trend towards eco-friendly materials and production in the fashion hosiery segment.

- September 2021: SKIMS, the shapewear brand, launched its first sock collection. The socks come in four different fabrics and styles. There are four categories: Hosiery, Everyday, Sport, and Slouch. The socks will also be available in various lengths, including ankle, mid-calf, and crew, as well as multiple colors. This launch demonstrates the expansion of established brands into new product categories and the integration of hosiery into broader lifestyle offerings.

Future Outlook for Hosiery Industry Market

The future outlook for the hosiery industry is exceptionally promising, driven by a confluence of strategic opportunities and sustained market potential. The continued evolution of fashion, with an increasing emphasis on comfort and personal expression, will ensure a steady demand for diverse hosiery products. The growing consumer awareness regarding sustainability will further propel the adoption of eco-friendly materials and ethical manufacturing practices, creating a competitive advantage for environmentally conscious brands. Technological advancements in fabric innovation, such as smart textiles and personalized fit technologies, are expected to unlock new product possibilities and enhance consumer experience. The expanding e-commerce landscape will continue to be a critical growth catalyst, providing global reach and accessibility. Strategic collaborations, targeted product development for niche markets like specialized athletic wear and medical compression, and a focus on data-driven consumer insights will be crucial for players aiming to capitalize on the market's upward trajectory. The industry is poised for continued innovation and expansion, solidifying its position as a vital segment within the broader apparel market.

Hosiery Industry Segmentation

-

1. Product Type

- 1.1. Body stockings

- 1.2. Socks

- 1.3. Knee highs, Hold-ups

- 1.4. Other Product Types

-

2. End-User

- 2.1. Men

- 2.2. Women

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

Hosiery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Hosiery Industry Regional Market Share

Geographic Coverage of Hosiery Industry

Hosiery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Innovative Garments Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hosiery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Body stockings

- 5.1.2. Socks

- 5.1.3. Knee highs, Hold-ups

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Men

- 5.2.2. Women

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Hosiery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Body stockings

- 6.1.2. Socks

- 6.1.3. Knee highs, Hold-ups

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Men

- 6.2.2. Women

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Hosiery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Body stockings

- 7.1.2. Socks

- 7.1.3. Knee highs, Hold-ups

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Men

- 7.2.2. Women

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Hosiery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Body stockings

- 8.1.2. Socks

- 8.1.3. Knee highs, Hold-ups

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Men

- 8.2.2. Women

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Hosiery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Body stockings

- 9.1.2. Socks

- 9.1.3. Knee highs, Hold-ups

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Men

- 9.2.2. Women

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Hosiery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Body stockings

- 10.1.2. Socks

- 10.1.3. Knee highs, Hold-ups

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Men

- 10.2.2. Women

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Skims*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hanesbrands Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Iconix Brand Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jockey International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Falke KGaA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gilfin S P A (Golden Lady Company S P A)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lanvin Group (Wolford AG)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Spanx Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Heist Studios

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CSP International Fashion Group S P A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Carolina Hosiery Mill Inc (Carolina Ultimate Real Tree)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 G-III Apparel Group (Donna Karan International)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Skims*List Not Exhaustive

List of Figures

- Figure 1: Global Hosiery Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Hosiery Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Hosiery Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Hosiery Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 5: North America Hosiery Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Hosiery Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Hosiery Industry Revenue (Million), by End-User 2025 & 2033

- Figure 8: North America Hosiery Industry Volume (K Units), by End-User 2025 & 2033

- Figure 9: North America Hosiery Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Hosiery Industry Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America Hosiery Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: North America Hosiery Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 13: North America Hosiery Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Hosiery Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Hosiery Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Hosiery Industry Volume (K Units), by Country 2025 & 2033

- Figure 17: North America Hosiery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Hosiery Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Hosiery Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 20: Europe Hosiery Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 21: Europe Hosiery Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Hosiery Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Hosiery Industry Revenue (Million), by End-User 2025 & 2033

- Figure 24: Europe Hosiery Industry Volume (K Units), by End-User 2025 & 2033

- Figure 25: Europe Hosiery Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 26: Europe Hosiery Industry Volume Share (%), by End-User 2025 & 2033

- Figure 27: Europe Hosiery Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: Europe Hosiery Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 29: Europe Hosiery Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Hosiery Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: Europe Hosiery Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Hosiery Industry Volume (K Units), by Country 2025 & 2033

- Figure 33: Europe Hosiery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Hosiery Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Hosiery Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Hosiery Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Hosiery Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Hosiery Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Hosiery Industry Revenue (Million), by End-User 2025 & 2033

- Figure 40: Asia Pacific Hosiery Industry Volume (K Units), by End-User 2025 & 2033

- Figure 41: Asia Pacific Hosiery Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 42: Asia Pacific Hosiery Industry Volume Share (%), by End-User 2025 & 2033

- Figure 43: Asia Pacific Hosiery Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Asia Pacific Hosiery Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Hosiery Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Hosiery Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific Hosiery Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Hosiery Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: Asia Pacific Hosiery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Hosiery Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Hosiery Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 52: South America Hosiery Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 53: South America Hosiery Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: South America Hosiery Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: South America Hosiery Industry Revenue (Million), by End-User 2025 & 2033

- Figure 56: South America Hosiery Industry Volume (K Units), by End-User 2025 & 2033

- Figure 57: South America Hosiery Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 58: South America Hosiery Industry Volume Share (%), by End-User 2025 & 2033

- Figure 59: South America Hosiery Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 60: South America Hosiery Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 61: South America Hosiery Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: South America Hosiery Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: South America Hosiery Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Hosiery Industry Volume (K Units), by Country 2025 & 2033

- Figure 65: South America Hosiery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Hosiery Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Hosiery Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 68: Middle East and Africa Hosiery Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 69: Middle East and Africa Hosiery Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Middle East and Africa Hosiery Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Middle East and Africa Hosiery Industry Revenue (Million), by End-User 2025 & 2033

- Figure 72: Middle East and Africa Hosiery Industry Volume (K Units), by End-User 2025 & 2033

- Figure 73: Middle East and Africa Hosiery Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 74: Middle East and Africa Hosiery Industry Volume Share (%), by End-User 2025 & 2033

- Figure 75: Middle East and Africa Hosiery Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 76: Middle East and Africa Hosiery Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 77: Middle East and Africa Hosiery Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Middle East and Africa Hosiery Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Middle East and Africa Hosiery Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Hosiery Industry Volume (K Units), by Country 2025 & 2033

- Figure 81: Middle East and Africa Hosiery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Hosiery Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hosiery Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Hosiery Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global Hosiery Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Hosiery Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 5: Global Hosiery Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Hosiery Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Hosiery Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Hosiery Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Global Hosiery Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Hosiery Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: Global Hosiery Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Hosiery Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 13: Global Hosiery Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Hosiery Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Hosiery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Hosiery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: United States Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Canada Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Mexico Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Rest of North America Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of North America Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 25: Global Hosiery Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Hosiery Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: Global Hosiery Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 28: Global Hosiery Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 29: Global Hosiery Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Hosiery Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Hosiery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Hosiery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Spain Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Germany Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Germany Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: France Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: France Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Italy Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Italy Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Russia Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Russia Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Global Hosiery Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 48: Global Hosiery Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 49: Global Hosiery Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 50: Global Hosiery Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 51: Global Hosiery Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 52: Global Hosiery Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 53: Global Hosiery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Hosiery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 55: China Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: China Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Japan Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Japan Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 59: India Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: India Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Australia Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Australia Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Rest of Asia Pacific Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Global Hosiery Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 66: Global Hosiery Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 67: Global Hosiery Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 68: Global Hosiery Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 69: Global Hosiery Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 70: Global Hosiery Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 71: Global Hosiery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Hosiery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 73: Brazil Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Argentina Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 79: Global Hosiery Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 80: Global Hosiery Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 81: Global Hosiery Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 82: Global Hosiery Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 83: Global Hosiery Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 84: Global Hosiery Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 85: Global Hosiery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 86: Global Hosiery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 87: South Africa Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: South Africa Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Saudi Arabia Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Saudi Arabia Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Middle East and Africa Hosiery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Middle East and Africa Hosiery Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hosiery Industry?

The projected CAGR is approximately 4.86%.

2. Which companies are prominent players in the Hosiery Industry?

Key companies in the market include Skims*List Not Exhaustive, Hanesbrands Inc, Iconix Brand Group Inc, Jockey International Inc, Falke KGaA, Gilfin S P A (Golden Lady Company S P A), Lanvin Group (Wolford AG), Spanx Inc, Heist Studios, CSP International Fashion Group S P A, Carolina Hosiery Mill Inc (Carolina Ultimate Real Tree), G-III Apparel Group (Donna Karan International).

3. What are the main segments of the Hosiery Industry?

The market segments include Product Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Innovative Garments Dominates the Market.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In May 2022, Falke Introduced New Pressure-Free Running Socks. Falke's new Pressure-Free sock incorporates a unique design feature to reduce the potential hotspot across the bridge of the foot. Falke has inserted a striated pad of channels on top of the foot that may move dynamically in response to foot movements. This helps to spread movement pressure and relieve pressure buildup in this area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hosiery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hosiery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hosiery Industry?

To stay informed about further developments, trends, and reports in the Hosiery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence