Key Insights

The Asia-Pacific feed premix market is projected for significant expansion, anticipated to reach $17.56 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 6.4%. This growth is primarily attributed to the surging demand for high-quality animal protein driven by a growing population and rising disposable incomes across the region. Key drivers include enhanced awareness among livestock farmers concerning the benefits of feed premixes for improving animal health, feed conversion efficiency, and overall farm profitability. The poultry and ruminant sectors are expected to spearhead this growth, given their substantial contribution to the regional meat and dairy supply chains. Government initiatives supporting sustainable animal husbandry and stringent feed quality regulations will further accelerate the adoption of advanced feed premix solutions. Innovations in premix formulations, addressing specific nutritional needs and emerging challenges such as antimicrobial resistance through natural alternatives like antioxidants and amino acids, will be pivotal.

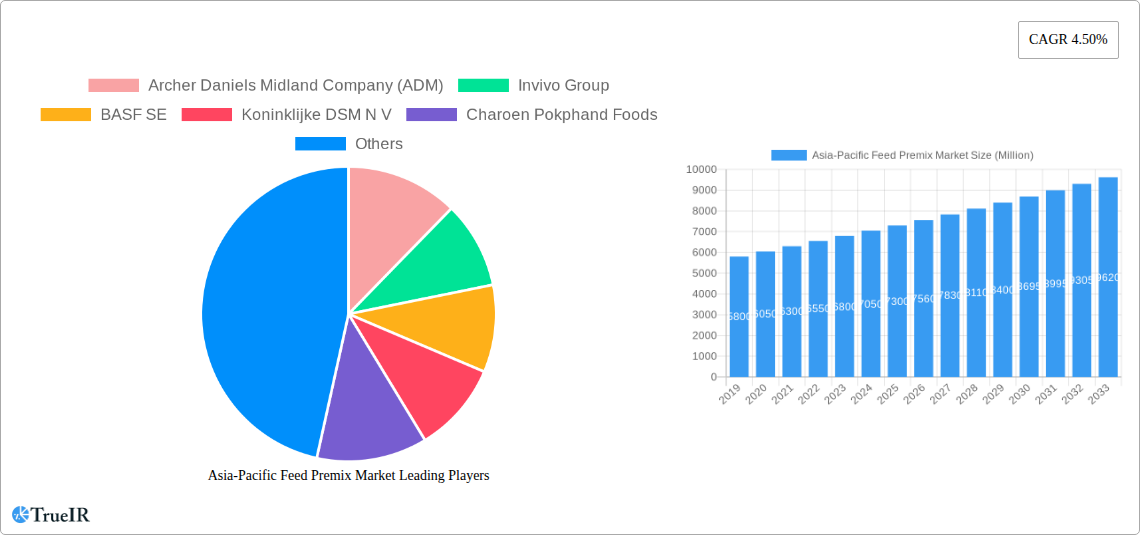

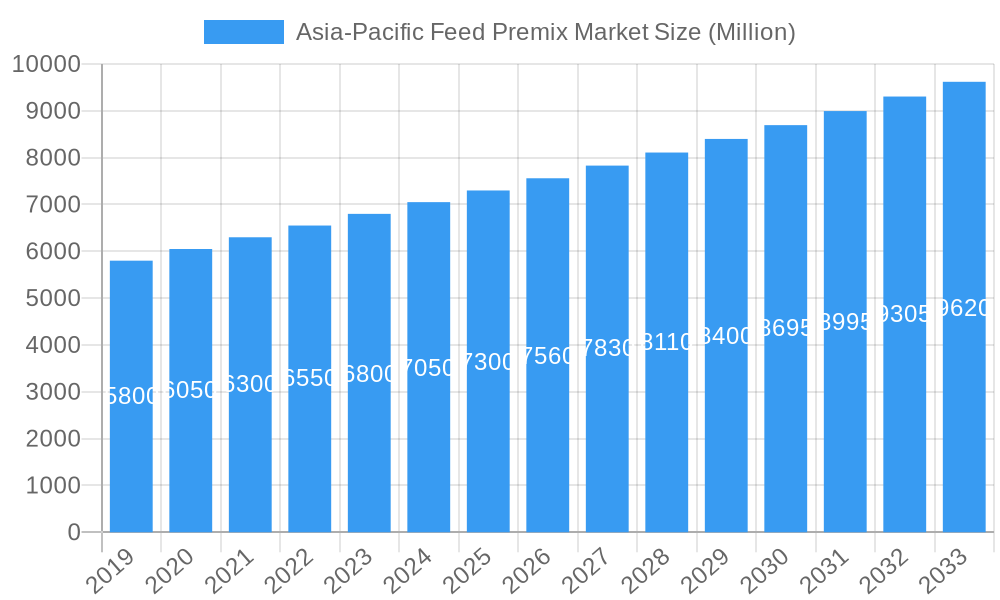

Asia-Pacific Feed Premix Market Market Size (In Billion)

The market features prominent global and regional players including Archer Daniels Midland Company (ADM), Invivo Group, BASF SE, and Cargill Inc. These companies are actively pursuing research and development to launch innovative products and expand market presence through strategic partnerships and acquisitions. China and India are anticipated to lead market growth due to their extensive livestock populations and expanding animal feed industries. While opportunities abound, challenges such as fluctuating raw material costs and end-user price sensitivity may arise. However, the trend towards industrialized animal farming, coupled with increasing emphasis on animal welfare and food safety, is expected to ensure a positive growth trajectory for the Asia-Pacific feed premix market. Continued focus on segments like antibiotics, vitamins, and minerals, alongside emerging interest in specialized blends and functional ingredients, will define market dynamics.

Asia-Pacific Feed Premix Market Company Market Share

This report provides a comprehensive analysis of the Asia-Pacific Feed Premix Market, detailing market structure, trends, dominant segments, product insights, key drivers, challenges, and the competitive landscape. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is designed for industry professionals seeking strategic growth opportunities and a deep understanding of this evolving sector.

Asia-Pacific Feed Premix Market Market Structure & Competitive Landscape

The Asia-Pacific Feed Premix Market is characterized by a moderately concentrated structure, with a few major global players holding a significant market share, alongside a growing number of regional and local manufacturers. Innovation drivers are primarily focused on developing highly bioavailable and cost-effective premixes, catering to specific animal nutritional needs and disease prevention. Regulatory impacts, particularly concerning animal health, food safety, and ingredient usage, play a crucial role in shaping market entry and product development strategies. Product substitutes, such as complete feeds and individual feed additives, present a competitive challenge, although premixes offer a consolidated and precisely balanced nutritional solution. End-user segmentation, dominated by poultry and swine farming, is a key consideration for manufacturers. Mergers and acquisitions (M&A) have been observed as strategic moves by larger entities to expand their geographical reach, product portfolios, and technological capabilities within the region. For instance, the period saw an estimated xx Million USD in M&A transactions as companies consolidated their market positions. Key companies like Archer Daniels Midland Company (ADM), Invivo Group, BASF SE, and Koninklijke DSM N V are actively engaged in strategic partnerships and acquisitions to fortify their presence. The competitive landscape is further defined by varying levels of technological adoption and R&D investments among market participants, leading to a dynamic interplay of competition and collaboration.

Asia-Pacific Feed Premix Market Market Trends & Opportunities

The Asia-Pacific Feed Premix Market is poised for substantial growth, with an estimated market size projected to reach xx Billion USD by 2033, driven by a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. Several overarching trends are shaping this trajectory. Firstly, the escalating demand for animal protein across the region, fueled by a burgeoning population and rising disposable incomes, is a primary growth catalyst. This surge in demand necessitates improved livestock productivity and health, directly boosting the consumption of feed premixes. Technological advancements are a critical factor, with a growing emphasis on precision nutrition and the development of functional premixes that offer enhanced immune support, gut health benefits, and improved feed conversion ratios. The integration of digital technologies, such as AI-driven formulation software and traceability solutions, is also gaining traction, optimizing premix production and delivery.

Consumer preferences are evolving, with an increasing awareness of food safety and animal welfare driving the demand for high-quality, sustainably produced animal feed. This translates into a greater demand for premixes that are free from harmful additives and contribute to the overall health and well-being of animals. The competitive dynamics are intensifying, with established global players expanding their footprint through strategic alliances and localized production, while emerging regional players are focusing on niche markets and innovative product offerings. Opportunities abound in the development of specialized premixes for aquaculture, a rapidly growing segment in many Asia-Pacific countries. Furthermore, the increasing adoption of advanced farming practices and the growing awareness of the economic benefits of using high-quality premixes among smallholder farmers present significant market penetration opportunities. The shift towards antibiotic-free production is also creating demand for alternative growth promoters and immune boosters within premixes.

Dominant Markets & Segments in Asia-Pacific Feed Premix Market

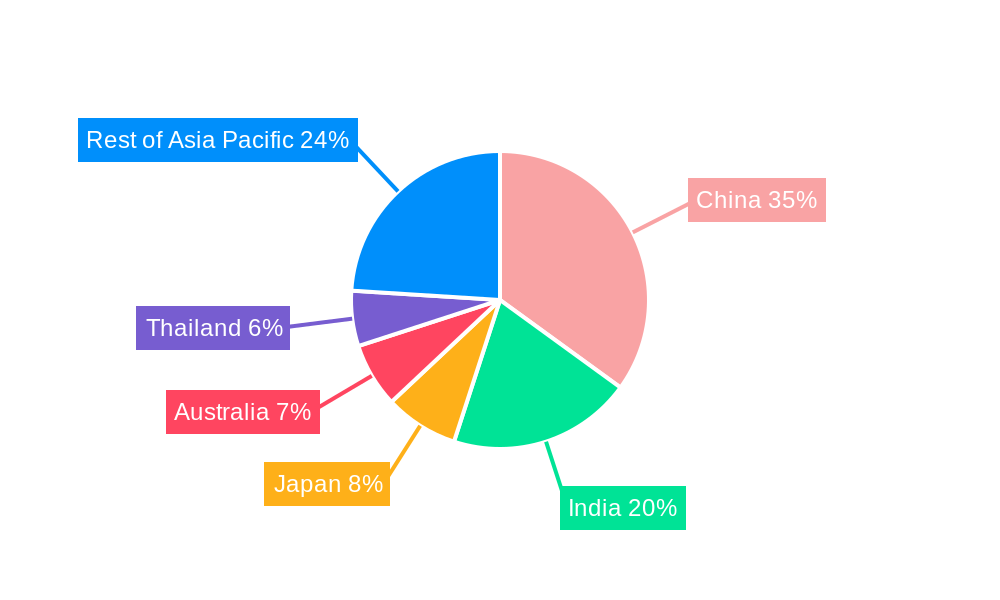

China stands out as the dominant market within the Asia-Pacific Feed Premix sector, accounting for an estimated 35% of the regional market share in 2025. This dominance is underpinned by its massive livestock population, particularly in poultry and swine, coupled with significant government support for modernizing its agricultural industry and ensuring food security. The increasing adoption of advanced feed technologies and the growing consumer demand for safe and high-quality meat products are further fueling China's market leadership.

Within the Ingredient Type segment, Amino Acids are expected to witness the highest growth, driven by the increasing understanding of their crucial role in optimizing animal growth, improving feed efficiency, and reducing nitrogen excretion, thereby contributing to environmental sustainability. The segment is projected to grow at a CAGR of approximately 6.5% during the forecast period. Minerals and Vitamins remain foundational to feed premixes and will continue to command significant market share due to their essential roles in animal health and productivity.

Regarding Animal Type, Poultry represents the largest and fastest-growing segment, driven by the region's insatiable demand for poultry meat and eggs. The intensive nature of poultry farming necessitates precise nutritional management, making feed premixes indispensable. The segment is estimated to contribute over 40% of the total market revenue by 2033. Swine farming also holds a substantial share, closely following poultry in terms of demand for advanced feed solutions. Aquaculture is emerging as a high-growth segment, particularly in Southeast Asian countries, owing to increasing seafood consumption and the expansion of fish and shrimp farming operations.

Geographically, beyond China, India is a rapidly expanding market, driven by its large agricultural base and increasing investments in animal husbandry to meet domestic protein demands. Thailand, with its robust animal feed industry and significant export market for animal products, also plays a crucial role. The Rest of Asia-Pacific, encompassing countries like Vietnam, Indonesia, and the Philippines, presents a fragmented yet collectively significant market with considerable growth potential due to ongoing agricultural development and rising disposable incomes.

Asia-Pacific Feed Premix Market Product Analysis

Product innovation in the Asia-Pacific Feed Premix Market is largely focused on enhanced bioavailability, targeted delivery systems, and the incorporation of functional ingredients. Companies are investing in advanced encapsulation technologies to protect sensitive vitamins and minerals, ensuring their efficacy through the digestive tract. The development of premixes with improved antioxidant properties to enhance animal health and reduce spoilage in feed is a key area of innovation. Furthermore, there is a growing trend towards developing specialized premixes that address specific challenges such as heat stress in poultry, gut health in swine, and disease resistance in aquaculture. Competitive advantages are being carved out through R&D leading to products that offer superior feed conversion ratios, reduced environmental impact, and improved animal welfare outcomes, aligning with evolving industry demands and consumer expectations.

Key Drivers, Barriers & Challenges in Asia-Pacific Feed Premix Market

Key Drivers:

- Rising Demand for Animal Protein: A growing global population and increasing disposable incomes in the Asia-Pacific region are driving a substantial increase in the consumption of meat, dairy, and eggs, consequently boosting demand for animal feed and premixes.

- Technological Advancements in Animal Husbandry: The adoption of modern farming techniques, including precision nutrition and automated feeding systems, necessitates high-quality and precisely formulated feed premixes.

- Government Initiatives and Regulations: Supportive government policies aimed at improving livestock productivity, ensuring food safety, and promoting sustainable agriculture are indirectly driving the feed premix market.

- Focus on Animal Health and Disease Prevention: Increased awareness and investment in animal health management are leading to a greater demand for premixes that enhance immunity and prevent common diseases.

Barriers & Challenges:

- Fluctuating Raw Material Prices: The volatility in the prices of key raw materials used in premix production, such as vitamins, amino acids, and minerals, can impact profitability and lead to price fluctuations for end-users.

- Stringent Regulatory Frameworks: Navigating the complex and varying regulatory landscapes across different Asia-Pacific countries regarding feed additive approvals, labeling, and safety standards can be a significant hurdle.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and logistical challenges can disrupt the supply chain for raw materials and finished premixes, impacting availability and costs.

- Price Sensitivity of End-Users: While the benefits of quality premixes are recognized, a segment of the market, particularly smaller farms, remains price-sensitive, which can limit the adoption of premium products.

- Counterfeit Products: The presence of counterfeit or substandard feed premixes in certain markets can damage the reputation of legitimate manufacturers and pose risks to animal health and food safety.

Growth Drivers in the Asia-Pacific Feed Premix Market Market

The Asia-Pacific Feed Premix Market is experiencing robust growth driven by several interconnected factors. Economically, the rising middle class and increasing disposable incomes are fueling higher per capita consumption of animal protein, creating a fundamental demand for efficient animal production. Technologically, advancements in animal nutrition science are leading to the development of more specialized and effective premixes, such as those incorporating probiotics, prebiotics, and novel growth promoters, which improve feed conversion ratios and animal health. Regulatory tailwinds are also significant, with governments across the region implementing policies to enhance food security and animal welfare, which often translate into incentives for adopting modern animal husbandry practices, including the use of high-quality feed premixes.

Challenges Impacting Asia-Pacific Feed Premix Market Growth

Despite the promising growth trajectory, the Asia-Pacific Feed Premix Market faces considerable challenges. Regulatory complexities, with each country having its own set of approval processes and standards for feed additives, can be a significant barrier to market entry and expansion. Supply chain vulnerabilities, exacerbated by global economic uncertainties and logistical bottlenecks, pose a continuous threat to the consistent availability and cost-effectiveness of raw materials. Competitive pressures are intensifying, not only from established global players but also from an increasing number of local manufacturers offering more cost-competitive solutions, particularly in price-sensitive segments of the market. Furthermore, the ongoing debate and evolving regulations surrounding the use of antibiotics in animal feed are necessitating substantial investment in research and development for antibiotic alternatives.

Key Players Shaping the Asia-Pacific Feed Premix Market Market

- Archer Daniels Midland Company (ADM)

- Invivo Group

- BASF SE

- Koninklijke DSM N V

- Charoen Pokphand Foods

- Cargill Inc

- BDT Group

- ForFramers B V

- Danish Agro

- De Hues Group

- Godrej Agrovet Limited

Significant Asia-Pacific Feed Premix Market Industry Milestones

- 2019: Increased focus on R&D for antibiotic-free growth promoters by leading companies.

- 2020: Emergence of advanced digital platforms for feed formulation and farm management in China and India.

- 2021: Significant M&A activities as larger players sought to consolidate market share and expand product portfolios.

- 2022: Growing demand for functional feed premixes offering enhanced immune support and gut health benefits across Southeast Asia.

- 2023: Introduction of sustainable sourcing initiatives for key raw materials by major feed premix manufacturers.

- 2024: Increased regulatory scrutiny on traceability and quality control of feed additives in several Asia-Pacific nations.

Future Outlook for Asia-Pacific Feed Premix Market Market

The future outlook for the Asia-Pacific Feed Premix Market is exceptionally bright, driven by sustained demand for animal protein and continuous innovation. Strategic opportunities lie in developing specialized premixes tailored for the burgeoning aquaculture sector and for livestock operations transitioning towards antibiotic-free production. The market will likely witness further consolidation through M&A as companies aim to achieve economies of scale and expand their geographical reach. Investments in research and development will continue to focus on creating more sustainable, efficient, and health-promoting feed solutions, including the integration of advanced biotechnologies. The increasing adoption of digital tools for precision nutrition and supply chain management will also define the future landscape, promising greater efficiency and enhanced product quality for the Asia-Pacific feed industry.

Asia-Pacific Feed Premix Market Segmentation

-

1. Ingredient Type

- 1.1. Antibiotics

- 1.2. Vitamins

- 1.3. Antioxidants

- 1.4. Amino Acids

- 1.5. Minerals

- 1.6. Other Ingredient Types

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Acquaculture

- 2.5. Other Animal

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Thailand

- 3.6. Rest of Asia-Pacific

Asia-Pacific Feed Premix Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Thailand

- 6. Rest of Asia Pacific

Asia-Pacific Feed Premix Market Regional Market Share

Geographic Coverage of Asia-Pacific Feed Premix Market

Asia-Pacific Feed Premix Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for High Value Animal Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Antibiotics

- 5.1.2. Vitamins

- 5.1.3. Antioxidants

- 5.1.4. Amino Acids

- 5.1.5. Minerals

- 5.1.6. Other Ingredient Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Acquaculture

- 5.2.5. Other Animal

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Thailand

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Thailand

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. China Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Antibiotics

- 6.1.2. Vitamins

- 6.1.3. Antioxidants

- 6.1.4. Amino Acids

- 6.1.5. Minerals

- 6.1.6. Other Ingredient Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Acquaculture

- 6.2.5. Other Animal

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Thailand

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. India Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Antibiotics

- 7.1.2. Vitamins

- 7.1.3. Antioxidants

- 7.1.4. Amino Acids

- 7.1.5. Minerals

- 7.1.6. Other Ingredient Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Acquaculture

- 7.2.5. Other Animal

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Thailand

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Japan Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Antibiotics

- 8.1.2. Vitamins

- 8.1.3. Antioxidants

- 8.1.4. Amino Acids

- 8.1.5. Minerals

- 8.1.6. Other Ingredient Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Acquaculture

- 8.2.5. Other Animal

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Thailand

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Australia Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Antibiotics

- 9.1.2. Vitamins

- 9.1.3. Antioxidants

- 9.1.4. Amino Acids

- 9.1.5. Minerals

- 9.1.6. Other Ingredient Types

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Acquaculture

- 9.2.5. Other Animal

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Thailand

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Thailand Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10.1.1. Antibiotics

- 10.1.2. Vitamins

- 10.1.3. Antioxidants

- 10.1.4. Amino Acids

- 10.1.5. Minerals

- 10.1.6. Other Ingredient Types

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Acquaculture

- 10.2.5. Other Animal

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Thailand

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11. Rest of Asia Pacific Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11.1.1. Antibiotics

- 11.1.2. Vitamins

- 11.1.3. Antioxidants

- 11.1.4. Amino Acids

- 11.1.5. Minerals

- 11.1.6. Other Ingredient Types

- 11.2. Market Analysis, Insights and Forecast - by Animal Type

- 11.2.1. Ruminant

- 11.2.2. Poultry

- 11.2.3. Swine

- 11.2.4. Acquaculture

- 11.2.5. Other Animal

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Australia

- 11.3.5. Thailand

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Archer Daniels Midland Company (ADM)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Invivo Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 BASF SE

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Koninklijke DSM N V

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Charoen Pokphand Foods

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Cargill Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 BDT Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ForFramers B V

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Danish Agro

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 De Hues Grou

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Godrej Agrovet Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Archer Daniels Midland Company (ADM)

List of Figures

- Figure 1: Asia-Pacific Feed Premix Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Feed Premix Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 2: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 6: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 10: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 14: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 18: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 19: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 22: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 23: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 26: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 27: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Feed Premix Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Asia-Pacific Feed Premix Market?

Key companies in the market include Archer Daniels Midland Company (ADM), Invivo Group, BASF SE, Koninklijke DSM N V, Charoen Pokphand Foods, Cargill Inc, BDT Group, ForFramers B V, Danish Agro, De Hues Grou, Godrej Agrovet Limited.

3. What are the main segments of the Asia-Pacific Feed Premix Market?

The market segments include Ingredient Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Demand for High Value Animal Protein.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Feed Premix Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Feed Premix Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Feed Premix Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Feed Premix Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence