Key Insights

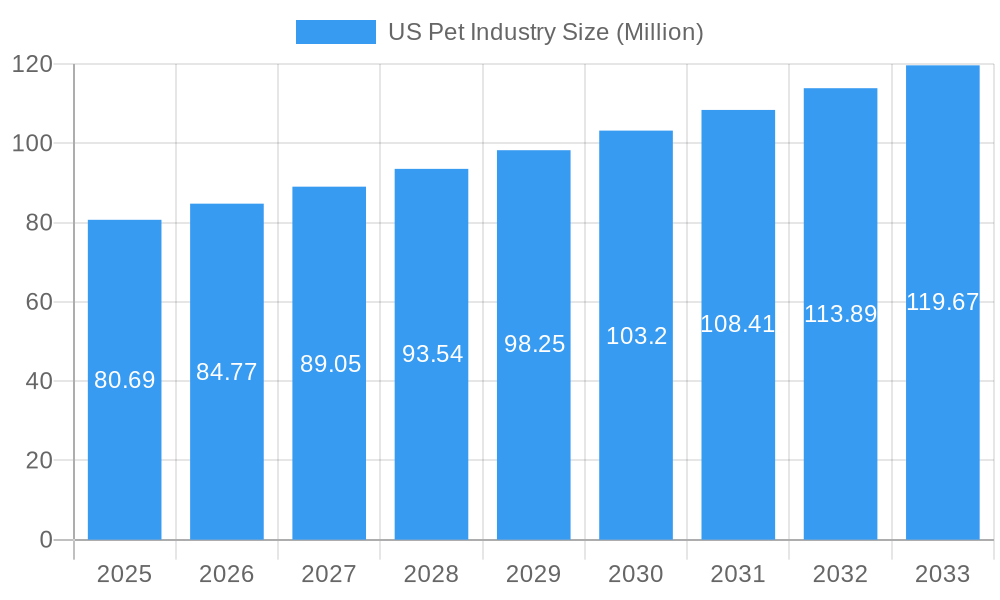

The US pet industry is experiencing robust growth, projected to reach a significant market size of $80.69 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.06% through 2033. This expansion is fueled by an increasing humanization of pets, where owners increasingly view their animals as family members, leading to higher spending on premium products and services. Key drivers include the rising adoption rates of both dogs and cats, coupled with a growing awareness of pet health and wellness, which translates to demand for specialized nutrition, supplements, and advanced veterinary care. The "humanization" trend also significantly influences product innovation, pushing for more natural, organic, and ethically sourced pet foods and treats. Furthermore, the convenience offered by online retail stores is a substantial contributor, allowing for easier access to a wider range of pet supplies and medications. This growing market presents lucrative opportunities for companies focusing on innovation, quality, and customer-centric approaches.

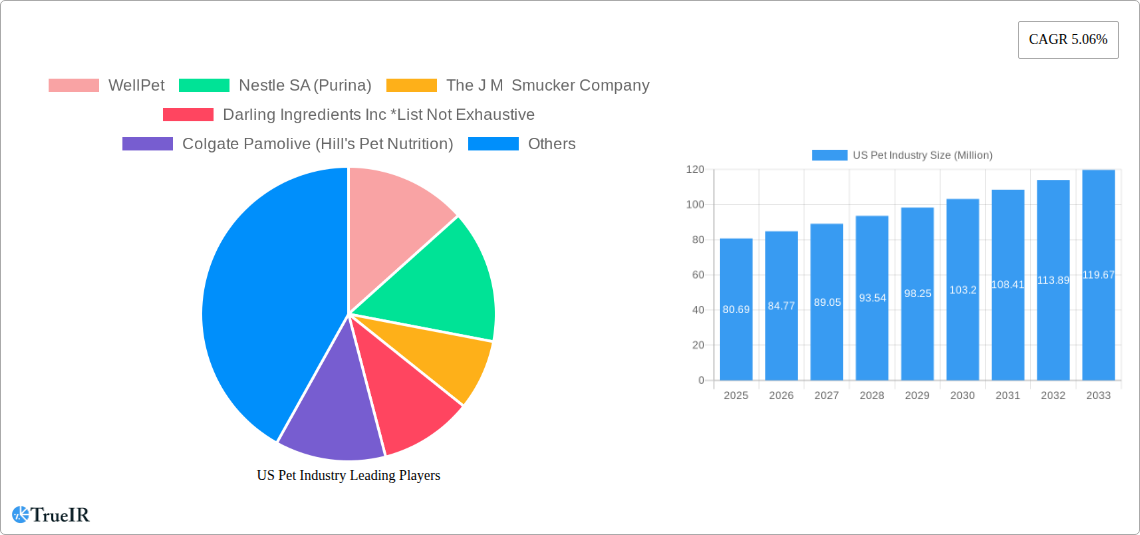

US Pet Industry Market Size (In Million)

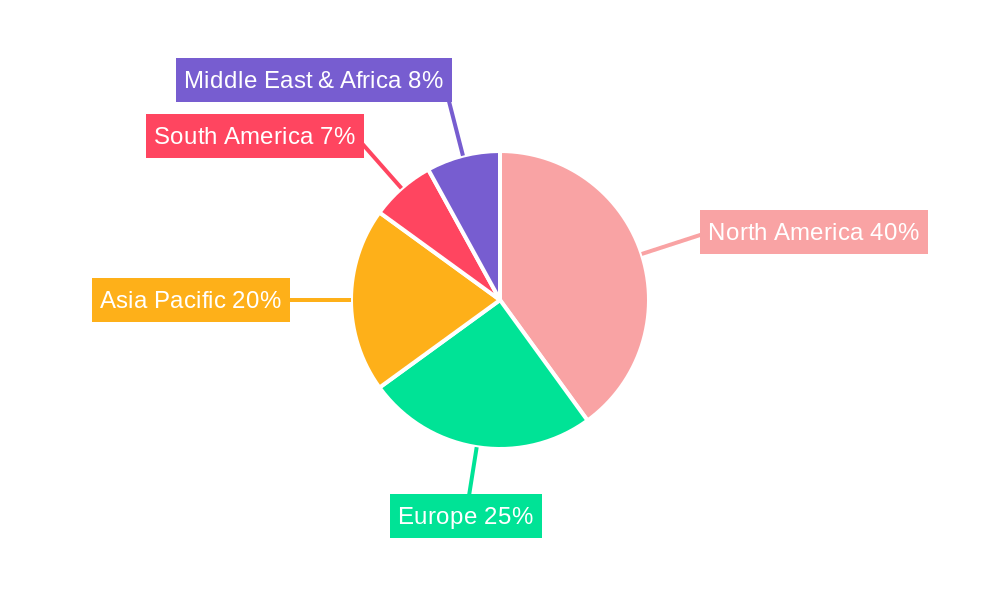

The market is segmented across various pet types, with dogs and cats dominating, followed by birds, freshwater fish, and other pet types. Product categories are led by pet food, followed by supplies/over-the-counter (OTC) medicine, and other specialized product types. Distribution channels are evolving, with online retail stores rapidly gaining market share alongside traditional supermarkets/hypermarkets and specialty stores. Restraints, such as economic downturns and rising operational costs, are present but are largely offset by the strong emotional bond between owners and their pets, which often prioritizes pet care expenditure. Leading companies like Nestle SA (Purina), Mars Inc., and Colgate-Palmolive (Hill's Pet Nutrition) are at the forefront, investing in research and development to cater to the evolving needs of pet owners and their beloved companions. The North American region, particularly the United States, is the largest contributor to this market, with significant potential also identified in the Asia Pacific region due to increasing disposable incomes and pet ownership.

US Pet Industry Company Market Share

Here's a dynamic, SEO-optimized report description for the US Pet Industry, designed for immediate use without modification:

US Pet Industry Market Structure & Competitive Landscape

The US Pet Industry exhibits a dynamic market structure, characterized by a moderate to high level of concentration within key segments, driven by significant innovation and increasing regulatory scrutiny. Key players such as Nestlé SA (Purina), Mars Inc., The J M Smucker Company, and Colgate-Palmolive (Hill's Pet Nutrition) command substantial market share, alongside emerging forces like Blue Buffalo Co Ltd. and WellPet. The market's innovation drivers are predominantly centered around premiumization, health and wellness, and sustainable product offerings, fueled by substantial R&D investments. Regulatory impacts are growing, with increased focus on pet food safety standards, ingredient transparency, and labeling requirements influencing product development and market entry strategies. Product substitutes, while present in some categories (e.g., DIY pet treats), are largely outpaced by the demand for convenience and specialized nutrition. End-user segmentation highlights a growing demand for specialized diets, age-specific products, and life-stage formulations for dogs and cats. Mergers and acquisitions (M&A) activity remains a significant trend, with approximately 20-30 notable M&A deals observed annually over the historical period, indicating a strategic consolidation and expansion drive among leading companies seeking to broaden portfolios and enhance market reach. This report delves into these structural elements, providing a comprehensive overview of the competitive forces shaping the US pet industry.

US Pet Industry Market Trends & Opportunities

The US Pet Industry is poised for robust growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033, reaching an estimated market size of over $150 Billion by the forecast end. This expansion is fueled by a confluence of evolving consumer preferences, technological advancements, and a deepening human-animal bond. The trend towards pet humanization continues to dominate, with pet owners increasingly treating their companions as integral family members, leading to a surge in demand for premium, health-focused, and specialized products. This includes a significant rise in sales for natural, organic, and sustainably sourced pet foods, as well as advanced veterinary diets and supplements. Technological shifts are profoundly impacting the industry, with the proliferation of e-commerce platforms revolutionizing distribution channels and providing consumers with unparalleled convenience and access to a wider array of products. Online retail stores are expected to capture over 40% of the market share by 2033. Furthermore, advancements in pet wearables, smart pet feeders, and AI-powered diagnostic tools are creating new market opportunities and enhancing the overall pet care experience. Competitive dynamics are intensifying, with both established giants and agile startups innovating rapidly to capture evolving consumer demands. The market penetration rate for pet insurance is also expected to rise steadily, reflecting a growing commitment to comprehensive pet wellness. Opportunities abound in niche segments such as personalized nutrition, eco-friendly pet products, and services catering to the aging pet population. The industry's ability to adapt to these dynamic trends will be crucial for sustained success and market leadership.

Dominant Markets & Segments in US Pet Industry

The dominant market within the US Pet Industry is unequivocally driven by Dog ownership, accounting for approximately 60% of the total pet population and contributing a proportional share to market revenue. This segment’s growth is propelled by the enduring popularity of canine companions, coupled with a rising trend in adopting larger breeds and a continued demand for specialized dog food formulations catering to breed-specific needs, life stages, and health conditions. Following closely, the Cat segment represents a significant and growing portion of the market, driven by their independent nature and suitability for urban living.

In terms of product type, Food remains the undisputed leader, generating over 70% of the industry's revenue. This dominance is sustained by the fundamental need for sustenance, with a strong underlying trend towards premium, natural, and therapeutic pet food options. Supplies/OTC Medicine forms the second-largest segment, encompassing a vast array of products from toys and grooming supplies to flea and tick treatments, reflecting the holistic approach to pet care.

The Online Retail Stores distribution channel is experiencing the most rapid expansion, projected to surpass 40% market share by 2033. This surge is attributed to unparalleled convenience, extensive product selection, competitive pricing, and direct-to-consumer models that resonate strongly with modern pet owners. Specialty Stores, while still significant, are adapting to the online shift by offering enhanced customer experiences, expert advice, and curated product selections. Supermarkets/Hypermarkets continue to hold a substantial share, particularly for staple food items and mass-market supplies, but are facing increasing pressure from online channels.

Key growth drivers in the dominant segments include robust consumer spending on pets, increased adoption rates, and the ongoing humanization trend that elevates pet care to a priority expenditure. Infrastructure supporting e-commerce, such as efficient logistics networks and sophisticated online platforms, plays a critical role in the online segment's dominance. Favorable policies promoting pet welfare and responsible ownership also indirectly bolster market growth across all segments.

US Pet Industry Product Analysis

Product innovations in the US Pet Industry are primarily focused on enhancing pet health, well-being, and owner convenience. This includes the development of novel, high-protein, and grain-free food formulations, probiotics and prebiotics for gut health, and specialized diets for pets with allergies or specific medical conditions. Technological advancements are evident in the creation of smart pet feeders that monitor food intake, GPS tracking collars for pet safety, and innovative grooming tools designed for ease of use and effectiveness. Competitive advantages are being carved out by companies that can demonstrate scientific backing for their product claims, utilize sustainable sourcing and packaging, and offer personalized solutions tailored to individual pet needs. The market fit for these innovations is strong, driven by an informed consumer base increasingly willing to invest in premium and health-oriented pet products.

Key Drivers, Barriers & Challenges in US Pet Industry

Key Drivers:

- Pet Humanization: Owners increasingly view pets as family, driving demand for premium and specialized products.

- Economic Stability: Disposable income directly correlates with spending on non-essential pet goods and services.

- Technological Advancements: E-commerce, smart devices, and innovative product formulations expand market reach and appeal.

- Rising Pet Ownership: Increasing adoption rates, especially among Millennials and Gen Z, fuel market growth.

- Health and Wellness Focus: Growing awareness of pet health leads to demand for nutritious food, supplements, and preventive care.

Key Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical events and global demand fluctuations can impact ingredient availability and logistics, leading to estimated cost increases of 5-10% in certain raw materials.

- Regulatory Compliance: Evolving food safety standards and ingredient labeling requirements necessitate ongoing investment in R&D and manufacturing processes, potentially increasing operational costs.

- Intense Competition: A crowded market requires significant marketing expenditure and innovation to differentiate products.

- Economic Downturns: While resilient, a severe economic recession could lead to reduced discretionary spending on premium pet products.

- Sustainability Pressures: Growing consumer demand for eco-friendly products can necessitate costly shifts in sourcing and packaging.

Growth Drivers in the US Pet Industry Market

The US Pet Industry's growth is propelled by the pervasive trend of pet humanization, where owners increasingly invest in premium, health-conscious products and services for their animal companions, viewing them as family members. Economic stability and rising disposable incomes across key demographics allow for increased discretionary spending on pets, from high-quality food and treats to advanced healthcare and specialized accessories. Technological innovation plays a crucial role, with e-commerce platforms expanding accessibility, smart pet devices enhancing care, and advancements in veterinary science driving demand for innovative health solutions and preventive measures. Furthermore, the continuous influx of new pet owners, particularly among younger generations, creates a sustained demand for a wide range of pet products and services.

Challenges Impacting US Pet Industry Growth

Despite its robust growth, the US Pet Industry faces significant challenges. Supply chain vulnerabilities, including ingredient sourcing and logistical complexities, can lead to product shortages and price volatility, impacting profitability and consumer access. Evolving and stringent regulatory frameworks concerning pet food safety, ingredient transparency, and product labeling require continuous adaptation and investment, potentially increasing compliance costs and development timelines. Intense market competition from both established corporations and agile startups necessitates substantial marketing and R&D expenditure to maintain brand visibility and product relevance, putting pressure on profit margins. Furthermore, potential economic downturns, although the pet industry has historically shown resilience, could still dampen consumer spending on non-essential premium pet products.

Key Players Shaping the US Pet Industry Market

- WellPet

- Nestlé SA (Purina)

- The J M Smucker Company

- Darling Ingredients Inc

- Colgate-Palmolive (Hill's Pet Nutrition)

- Pure and Natural Pet

- United Pet Group Inc

- Diamond Pet Foods

- Blue Buffalo Co Ltd

- Mars Inc

Significant US Pet Industry Industry Milestones

- 2019 March: Blue Buffalo Co Ltd. acquired by General Mills, signaling consolidation in the premium pet food sector.

- 2020 May: Mars Petcare launches a new sustainability initiative focused on reducing environmental impact across its supply chain.

- 2021 January: Nestlé Purina introduces a new line of veterinary therapeutic diets leveraging advanced research in pet nutrition.

- 2022 April: The rise of DTC (Direct-to-Consumer) online pet food brands accelerates, challenging traditional retail models.

- 2023 July: Diamond Pet Foods invests heavily in expanding its production capacity to meet growing demand.

- 2024 February: The J M Smucker Company divests its portion of the pet food business, focusing on core competencies.

- 2024 September: Emerging trend of personalized pet nutrition plans gains significant traction among consumers.

Future Outlook for US Pet Industry Market

The future outlook for the US Pet Industry is exceptionally bright, projected for sustained double-digit growth through 2033. Strategic opportunities lie in the continued expansion of premium and specialized nutrition segments, including functional foods and supplements catering to pet health and longevity. The e-commerce channel will remain a critical growth catalyst, demanding further innovation in online customer experience and subscription-based models. Furthermore, the integration of technology, such as AI-driven personalized recommendations and advanced pet health monitoring devices, will unlock new avenues for market penetration and consumer engagement. The industry is poised to benefit from an increasing focus on sustainability and ethical sourcing, rewarding companies that can align their operations with these evolving consumer values.

US Pet Industry Segmentation

-

1. Pet Type

- 1.1. Dog

- 1.2. Cat

- 1.3. Bird

- 1.4. Fresh Water Fish

- 1.5. Other Pet Types

-

2. Product Type

- 2.1. Food

- 2.2. Supplies/OTC Medicine

- 2.3. Other Product Types

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

US Pet Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Pet Industry Regional Market Share

Geographic Coverage of US Pet Industry

US Pet Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Increase in the Number of Pet Owners and Increased Expenditures on Pets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Pet Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Pet Type

- 5.1.1. Dog

- 5.1.2. Cat

- 5.1.3. Bird

- 5.1.4. Fresh Water Fish

- 5.1.5. Other Pet Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Food

- 5.2.2. Supplies/OTC Medicine

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Pet Type

- 6. North America US Pet Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Pet Type

- 6.1.1. Dog

- 6.1.2. Cat

- 6.1.3. Bird

- 6.1.4. Fresh Water Fish

- 6.1.5. Other Pet Types

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Food

- 6.2.2. Supplies/OTC Medicine

- 6.2.3. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Pet Type

- 7. South America US Pet Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Pet Type

- 7.1.1. Dog

- 7.1.2. Cat

- 7.1.3. Bird

- 7.1.4. Fresh Water Fish

- 7.1.5. Other Pet Types

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Food

- 7.2.2. Supplies/OTC Medicine

- 7.2.3. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Pet Type

- 8. Europe US Pet Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Pet Type

- 8.1.1. Dog

- 8.1.2. Cat

- 8.1.3. Bird

- 8.1.4. Fresh Water Fish

- 8.1.5. Other Pet Types

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Food

- 8.2.2. Supplies/OTC Medicine

- 8.2.3. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Pet Type

- 9. Middle East & Africa US Pet Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Pet Type

- 9.1.1. Dog

- 9.1.2. Cat

- 9.1.3. Bird

- 9.1.4. Fresh Water Fish

- 9.1.5. Other Pet Types

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Food

- 9.2.2. Supplies/OTC Medicine

- 9.2.3. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Pet Type

- 10. Asia Pacific US Pet Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Pet Type

- 10.1.1. Dog

- 10.1.2. Cat

- 10.1.3. Bird

- 10.1.4. Fresh Water Fish

- 10.1.5. Other Pet Types

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Food

- 10.2.2. Supplies/OTC Medicine

- 10.2.3. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Pet Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WellPet

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA (Purina)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The J M Smucker Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Darling Ingredients Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colgate Pamolive (Hill's Pet Nutrition)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pure and Natural Pet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United Pet Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Diamond Pet Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Blue Buffalo Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mars Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WellPet

List of Figures

- Figure 1: Global US Pet Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Pet Industry Revenue (Million), by Pet Type 2025 & 2033

- Figure 3: North America US Pet Industry Revenue Share (%), by Pet Type 2025 & 2033

- Figure 4: North America US Pet Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America US Pet Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America US Pet Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America US Pet Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America US Pet Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Pet Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Pet Industry Revenue (Million), by Pet Type 2025 & 2033

- Figure 11: South America US Pet Industry Revenue Share (%), by Pet Type 2025 & 2033

- Figure 12: South America US Pet Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 13: South America US Pet Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America US Pet Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America US Pet Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America US Pet Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Pet Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Pet Industry Revenue (Million), by Pet Type 2025 & 2033

- Figure 19: Europe US Pet Industry Revenue Share (%), by Pet Type 2025 & 2033

- Figure 20: Europe US Pet Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Europe US Pet Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe US Pet Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe US Pet Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe US Pet Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Pet Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Pet Industry Revenue (Million), by Pet Type 2025 & 2033

- Figure 27: Middle East & Africa US Pet Industry Revenue Share (%), by Pet Type 2025 & 2033

- Figure 28: Middle East & Africa US Pet Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa US Pet Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa US Pet Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa US Pet Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa US Pet Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Pet Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Pet Industry Revenue (Million), by Pet Type 2025 & 2033

- Figure 35: Asia Pacific US Pet Industry Revenue Share (%), by Pet Type 2025 & 2033

- Figure 36: Asia Pacific US Pet Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Asia Pacific US Pet Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific US Pet Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific US Pet Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific US Pet Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Pet Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Pet Industry Revenue Million Forecast, by Pet Type 2020 & 2033

- Table 2: Global US Pet Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global US Pet Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global US Pet Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Pet Industry Revenue Million Forecast, by Pet Type 2020 & 2033

- Table 6: Global US Pet Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global US Pet Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global US Pet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Pet Industry Revenue Million Forecast, by Pet Type 2020 & 2033

- Table 13: Global US Pet Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global US Pet Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global US Pet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Pet Industry Revenue Million Forecast, by Pet Type 2020 & 2033

- Table 20: Global US Pet Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global US Pet Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global US Pet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Pet Industry Revenue Million Forecast, by Pet Type 2020 & 2033

- Table 33: Global US Pet Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global US Pet Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global US Pet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Pet Industry Revenue Million Forecast, by Pet Type 2020 & 2033

- Table 43: Global US Pet Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global US Pet Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global US Pet Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Pet Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Pet Industry?

The projected CAGR is approximately 5.06%.

2. Which companies are prominent players in the US Pet Industry?

Key companies in the market include WellPet, Nestle SA (Purina), The J M Smucker Company, Darling Ingredients Inc *List Not Exhaustive, Colgate Pamolive (Hill's Pet Nutrition), Pure and Natural Pet, United Pet Group Inc, Diamond Pet Foods, Blue Buffalo Co Ltd, Mars Inc.

3. What are the main segments of the US Pet Industry?

The market segments include Pet Type, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 80.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Increase in the Number of Pet Owners and Increased Expenditures on Pets.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Pet Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Pet Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Pet Industry?

To stay informed about further developments, trends, and reports in the US Pet Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence