Key Insights

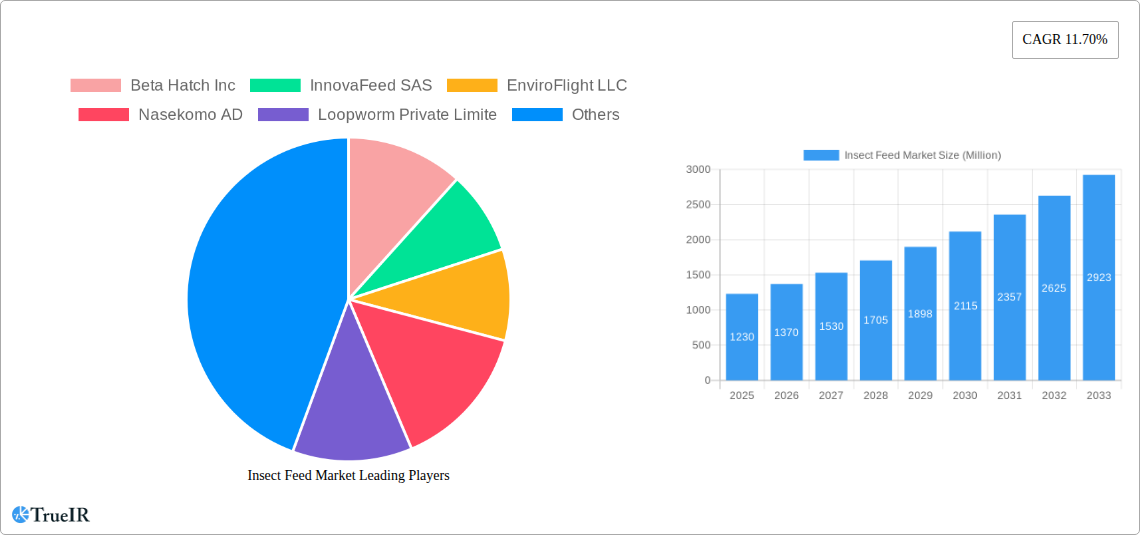

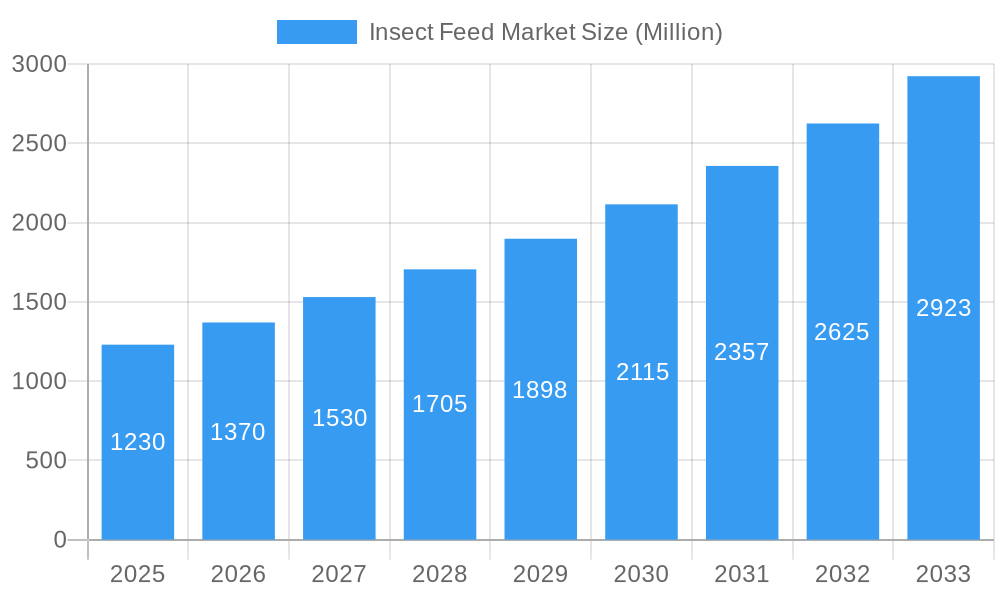

The global Insect Feed Market is experiencing robust growth, projected to reach a substantial USD 1.23 billion in 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 11.70% during the forecast period of 2025-2033. This expansion is primarily fueled by the escalating demand for sustainable and environmentally friendly protein sources in animal nutrition. Key drivers include the increasing global population, leading to higher demand for livestock and aquaculture products, and the growing awareness of the environmental footprint of traditional feed ingredients like soy and fishmeal. The poultry and aquaculture segments are expected to lead this growth, driven by their large scale and the proven benefits of insect protein in improving animal health, growth rates, and feed conversion efficiency. Furthermore, advancements in insect farming technologies, including automated rearing systems and efficient processing techniques, are making insect-based feed more cost-effective and scalable, thereby accelerating market adoption. Regulatory support and increasing investments from both established feed manufacturers and innovative startups are also significantly contributing to the market's upward trajectory.

Insect Feed Market Market Size (In Billion)

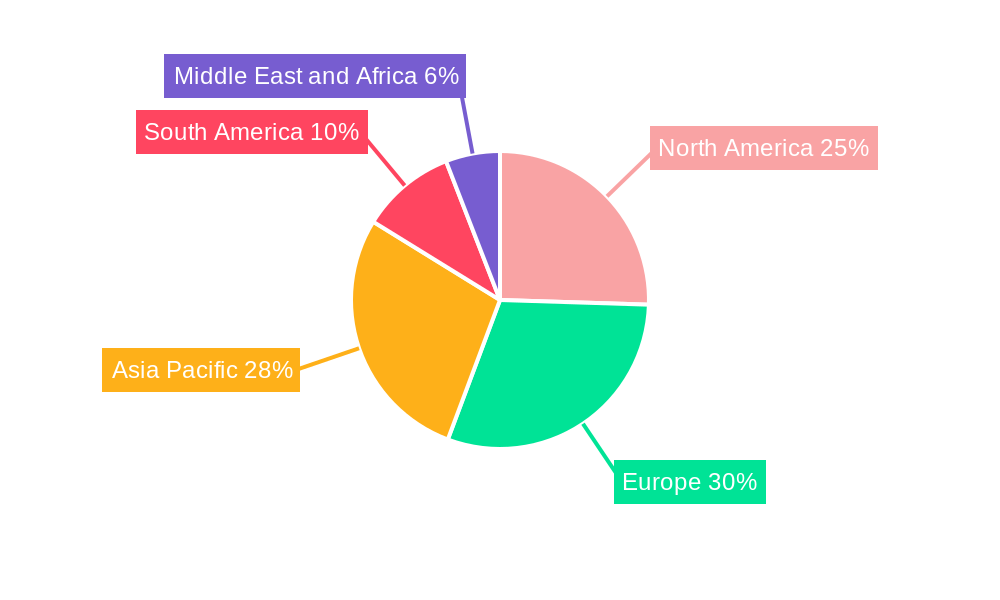

The insect feed industry is characterized by dynamic trends, including a strong emphasis on the utilization of various insect species such as black soldier fly larvae, mealworms, and crickets, each offering unique nutritional profiles and sustainability advantages. Companies are actively investing in research and development to optimize rearing processes, enhance the nutritional value of insect ingredients, and explore novel applications in pet food and human food sectors, although animal feed remains the dominant application. Challenges such as scaling production to meet growing demand, ensuring consistent quality and safety standards, and navigating evolving regulatory landscapes are being addressed through technological innovation and industry collaboration. Geographically, the Asia Pacific region is anticipated to emerge as a significant market due to its large agricultural base and increasing adoption of sustainable farming practices, while Europe and North America are expected to maintain strong growth driven by regulatory initiatives and consumer demand for eco-friendly products. The competitive landscape is intensifying with numerous startups and established players vying for market share, focusing on product innovation, strategic partnerships, and geographical expansion.

Insect Feed Market Company Market Share

This comprehensive report delves into the dynamic Insect Feed Market, offering in-depth analysis of its structure, competitive landscape, key trends, opportunities, dominant segments, and future outlook. Leveraging high-volume search terms such as "insect protein," "sustainable animal feed," "larvae meal," and "arthropod feed," this report is meticulously crafted for industry professionals seeking to understand market dynamics, investment opportunities, and strategic growth avenues. The study covers the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033.

Insect Feed Market Market Structure & Competitive Landscape

The Insect Feed Market is characterized by a growing but moderately concentrated competitive landscape. Initial market entry has seen a surge in innovative startups alongside established players exploring insect-derived protein as a sustainable alternative. Regulatory frameworks are still evolving globally, influencing market entry and product development significantly. Key innovation drivers include the quest for reduced environmental impact, improved animal health, and the need for novel protein sources in response to traditional feed ingredient volatility. Product substitutes, primarily conventional protein sources like soybean meal and fishmeal, still hold substantial market share but face increasing scrutiny regarding sustainability and price fluctuations. The end-user segmentation is driven by the distinct nutritional needs and market demands of aquaculture, poultry, and swine, with emerging applications in other animal types also gaining traction. Mergers and acquisitions (M&A) activity, while not yet at peak levels, is expected to accelerate as larger feed manufacturers seek to integrate insect protein capabilities and secure supply chains. Current M&A volumes stand at approximately $50 Million, signaling early consolidation. The market concentration ratio is estimated to be around 35%, indicating room for new entrants and further competition.

Insect Feed Market Market Trends & Opportunities

The Insect Feed Market is poised for substantial expansion, projected to grow from an estimated market size of $500 Million in 2025 to over $5,000 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 30%. This remarkable growth is fueled by an escalating global demand for sustainable and environmentally friendly protein sources for animal feed. Technological advancements in insect farming, including optimized rearing conditions, automated processing, and improved larval feed conversion ratios, are significantly reducing production costs and increasing efficiency. Consumer preferences are shifting towards ethically sourced and environmentally conscious products, creating a ripple effect that demands sustainable practices throughout the animal protein value chain, including animal feed. Regulatory bodies worldwide are increasingly recognizing the potential of insect protein, leading to the development of supportive policies and certifications that further legitimize its use.

The competitive dynamics are intensifying, with companies innovating across various stages of the insect protein value chain, from breeding and rearing to processing and final product formulation. Opportunities abound in developing specialized insect-based feeds tailored to the specific nutritional requirements of different animal types, enhancing growth rates and animal health. Furthermore, the valorization of insect by-products, such as chitin and oils, for applications in pharmaceuticals, cosmetics, and bio-fertilizers, presents lucrative diversification avenues. The circular economy model, where insects consume organic waste streams to produce high-value protein, is a key trend, aligning with global sustainability goals and offering a compelling solution to waste management challenges. As the market matures, strategic partnerships and collaborations between insect farmers, feed manufacturers, and livestock producers will be crucial for scaling production and ensuring market penetration. The market penetration rate for insect feed is currently estimated at 5%, with significant room for growth across all animal segments.

Dominant Markets & Segments in Insect Feed Market

The Insect Feed Market is witnessing robust growth across its primary segments, with Aquaculture emerging as a particularly dominant and high-potential area. This dominance is driven by the inherent sustainability challenges faced by traditional aquaculture feed, particularly the overreliance on finite fishmeal resources. Insect meal offers a biologically comparable and sustainable alternative, rich in essential amino acids and fatty acids crucial for fish and shrimp growth. Key growth drivers in the aquaculture segment include:

- Infrastructure Development: Increasing investment in large-scale insect farming facilities specifically designed to meet the high volume demands of the aquaculture industry.

- Supportive Policies: Government initiatives and research funding aimed at promoting insect-based feeds for aquaculture due to their environmental benefits and contribution to food security.

- Nutritional Benefits: Scientifically proven advantages of insect protein in improving feed conversion ratios, growth performance, and immune responses in farmed fish and crustaceans.

While aquaculture leads, the Poultry segment also demonstrates significant traction. The high protein requirements and rapid growth cycles of poultry make insect meal an attractive ingredient. The industry is actively seeking alternatives to conventional soy-based feeds, driven by concerns about deforestation and allergenicity. Growth drivers for poultry include:

- Cost-Effectiveness: As insect farming scales, the cost of insect meal is becoming more competitive with traditional protein sources.

- Health and Welfare: Research indicates that insect protein can enhance gut health and reduce the need for antibiotics in poultry.

- Consumer Acceptance: Growing consumer awareness of sustainable food production is indirectly influencing demand for responsibly sourced poultry feed.

The Swine segment is another key area of growth, with insect meal offering a protein-rich alternative for piglet and grower diets. The environmental footprint of traditional swine feed production is a significant concern, pushing the industry towards more sustainable inputs.

- Waste-to-Protein Potential: The ability of insects to efficiently convert organic waste into valuable protein aligns with the circular economy principles favored by the swine industry.

- Nutritional Equivalence: Studies are demonstrating the efficacy of insect meal in meeting the amino acid profiles required for optimal swine development.

Other Animal Types, including pet food and even niche applications like reptile and insectivore pet diets, represent a burgeoning market. The premiumization of pet food and the increasing demand for natural and sustainable ingredients are strong catalysts for insect-based pet food.

Geographically, Europe is currently leading the Insect Feed Market due to its proactive regulatory environment, strong commitment to sustainability, and significant investment in research and development. Countries like the Netherlands, France, and the UK are at the forefront of insect farming and adoption. North America and Asia-Pacific are rapidly emerging markets, with increasing R&D activities and policy shifts indicating substantial future growth potential.

Insect Feed Market Product Analysis

Innovations in the Insect Feed Market are centered on optimizing larval growth, processing techniques, and the nutritional profile of insect-derived products. Companies are developing proprietary insect strains with enhanced protein content and faster growth cycles, alongside advanced rearing systems that improve efficiency and reduce operational costs. Insect meal, primarily derived from species like the Black Soldier Fly (BSF) and mealworms, is gaining traction for its high protein content (up to 60%) and balanced amino acid profile, making it a viable substitute for fishmeal and soybean meal. Applications are expanding beyond traditional animal feed into high-value segments like pet food and aquaculture. Competitive advantages lie in the reduced environmental footprint, lower resource intensity compared to conventional protein production, and the potential for co-product utilization, such as chitin and oils, for diverse industrial applications.

Key Drivers, Barriers & Challenges in Insect Feed Market

Key Drivers:

- Sustainability Imperative: Growing global pressure to reduce the environmental impact of animal agriculture, including greenhouse gas emissions, land use, and water consumption.

- Resource Scarcity: Volatility and increasing costs of traditional protein sources like fishmeal and soybean meal, driven by overfishing and land constraints.

- Technological Advancements: Innovations in insect rearing techniques, automation, and processing are improving efficiency and scalability.

- Favorable Regulatory Environment: Evolving legislation in key markets is gradually permitting and encouraging the use of insect protein in animal feed.

- Nutritional Value: High protein content and essential amino acid profiles of insect meal align with the nutritional needs of various livestock.

Barriers & Challenges:

- Regulatory Hurdles: Inconsistent and complex regulatory frameworks across different regions create market access challenges and can slow down adoption.

- Scalability and Cost: Achieving cost-competitiveness with established feed ingredients at a large industrial scale remains a significant challenge.

- Consumer Perception: Public perception and acceptance of insect-based products, particularly in direct-to-consumer applications, can be a limiting factor.

- Supply Chain Development: Establishing robust, consistent, and traceable supply chains for insect farming and processing requires significant investment and infrastructure.

- Pathogen and Contaminant Risks: Ensuring the safety and purity of insect feed through rigorous testing and quality control is paramount.

Growth Drivers in the Insect Feed Market Market

The Insect Feed Market is propelled by a confluence of powerful growth drivers. The escalating global demand for sustainable protein for animal feed, driven by increasing meat consumption and the environmental footprint of conventional feed production, stands as a primary catalyst. Technological innovations in insect rearing, including automated systems and optimized feed conversion, are enhancing efficiency and reducing production costs, making insect protein increasingly viable. Favorable regulatory developments in key markets are opening doors for broader adoption. Furthermore, the inherent nutritional superiority of insect meal, boasting high protein content and essential amino acids, positions it as a superior alternative to conventional ingredients. The circular economy model, where insects convert organic waste into valuable protein, offers a dual solution for waste management and sustainable resource utilization, further fueling market expansion.

Challenges Impacting Insect Feed Market Growth

Despite its promising trajectory, the Insect Feed Market faces several challenges impacting its growth. Regulatory complexities and inconsistencies across different countries and regions can hinder market entry and widespread adoption. The current high cost of production relative to conventional feed ingredients, though declining, remains a significant barrier for large-scale commercial use. Supply chain development, from sourcing feedstock for insects to consistent production and distribution of finished products, requires substantial investment and infrastructure build-out. Public perception and acceptance of insect-based products, while improving, can still present challenges, particularly in certain consumer markets. Ensuring the consistent quality, safety, and traceability of insect feed products through robust testing and certifications is also critical for building trust and mitigating risks.

Key Players Shaping the Insect Feed Market Market

- Beta Hatch Inc

- InnovaFeed SAS

- EnviroFlight LLC

- Nasekomo AD

- Loopworm Private Limited

- nextProtein

- Protix BV

- Hipromine SA

- Alltech Coppens BV

- Ynsect

- Hexafly Enterprises Limited

- Enterra Feed Corporation

Significant Insect Feed Market Industry Milestones

- 2019: European Food Safety Authority (EFSA) publishes scientific opinions on the safety of insect larvae as feed.

- 2020: InnovaFeed announces a significant funding round to expand its production capacity for insect protein.

- 2021: Beta Hatch secures funding to scale its insect farming operations and develop new insect-based ingredients.

- 2022: EnviroFlight LLC launches insect meal and oil for aquaculture feed applications.

- 2022: Protix BV announces partnerships to integrate insect protein into the global feed supply chain.

- 2023: Nasekomo AD secures investment for its insect farming technology aimed at animal feed production.

- 2023: Loopworm Private Limited announces plans for large-scale insect farming facilities in India.

- 2023: Ynsect obtains regulatory approval for its insect protein for use in pet food in several key markets.

- 2024: Alltech Coppens BV introduces insect-based ingredients for aquaculture diets.

- 2024: Enterra Feed Corporation expands its insect farming capacity to meet growing demand.

Future Outlook for Insect Feed Market Market

The future outlook for the Insect Feed Market is exceptionally promising, driven by an increasing global imperative for sustainable and circular economy solutions. Strategic opportunities lie in further technological innovation to reduce production costs, enhance nutritional profiles, and optimize waste valorization. Investments in large-scale, automated insect farming facilities will be crucial for meeting the growing demand from aquaculture, poultry, and swine sectors. The development of specialized insect-based feeds tailored to specific animal needs and life stages will unlock new market segments. Furthermore, supportive government policies, continued research into the benefits of insect protein, and increasing consumer acceptance will solidify insect feed's position as a mainstream ingredient. The market is expected to witness significant consolidation through M&A as larger players seek to secure market share and technological expertise, paving the way for a more sustainable and resilient animal feed industry.

Insect Feed Market Segmentation

-

1. Animal Type

- 1.1. Aquaculture

- 1.2. Poultry

- 1.3. Swine

- 1.4. Other Animal Types

Insect Feed Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Egypt

- 5.3. Rest of Middle East and Africa

Insect Feed Market Regional Market Share

Geographic Coverage of Insect Feed Market

Insect Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. High Feed Conversion Ratio of Insects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Insect Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Aquaculture

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Insect Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Aquaculture

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Europe Insect Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Aquaculture

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Asia Pacific Insect Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Aquaculture

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. South America Insect Feed Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Aquaculture

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Middle East and Africa Insect Feed Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Aquaculture

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Beta Hatch Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 InnovaFeed SAS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EnviroFlight LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nasekomo AD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Loopworm Private Limite

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 nextProtein

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Protix BV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hipromine SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alltech Coppens BV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ynsect

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hexafly Enterprises Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Enterra Feed Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Beta Hatch Inc

List of Figures

- Figure 1: Global Insect Feed Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Insect Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: North America Insect Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Insect Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Insect Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Insect Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 7: Europe Insect Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 8: Europe Insect Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Insect Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Insect Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: Asia Pacific Insect Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Asia Pacific Insect Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Insect Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Insect Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: South America Insect Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: South America Insect Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Insect Feed Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Insect Feed Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 19: Middle East and Africa Insect Feed Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 20: Middle East and Africa Insect Feed Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Insect Feed Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Insect Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global Insect Feed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Insect Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: Global Insect Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Insect Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 10: Global Insect Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Germany Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Russia Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Insect Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Global Insect Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Insect Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 24: Global Insect Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Brazil Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Argentina Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Insect Feed Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 29: Global Insect Feed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: United Arab Emirates Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Egypt Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa Insect Feed Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insect Feed Market?

The projected CAGR is approximately 11.70%.

2. Which companies are prominent players in the Insect Feed Market?

Key companies in the market include Beta Hatch Inc, InnovaFeed SAS, EnviroFlight LLC, Nasekomo AD, Loopworm Private Limite, nextProtein, Protix BV, Hipromine SA, Alltech Coppens BV, Ynsect, Hexafly Enterprises Limited, Enterra Feed Corporation.

3. What are the main segments of the Insect Feed Market?

The market segments include Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

High Feed Conversion Ratio of Insects.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insect Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insect Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insect Feed Market?

To stay informed about further developments, trends, and reports in the Insect Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence