Key Insights

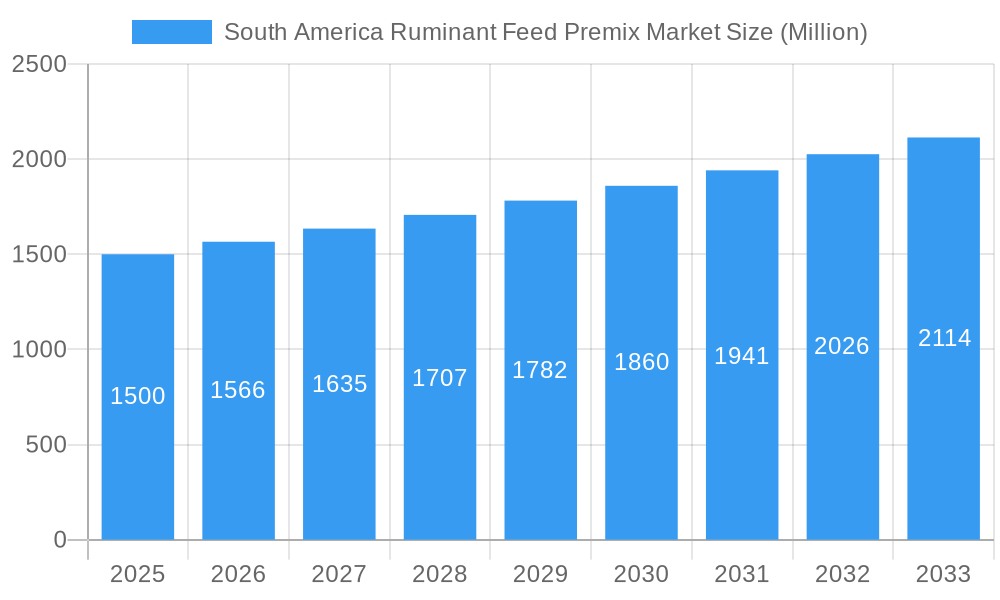

The South America Ruminant Feed Premix Market is poised for significant expansion, projected to reach an estimated USD 1.5 billion in 2025, with a robust CAGR of 4.4% expected to drive sustained growth through 2033. This upward trajectory is primarily fueled by the increasing demand for high-quality ruminant products, including beef and dairy, across the region. Growing awareness among livestock farmers regarding the benefits of feed premixes in enhancing animal health, improving feed conversion ratios, and ultimately boosting profitability acts as a key market driver. Furthermore, advancements in feed formulation technologies and the development of specialized premixes tailored to specific ruminant needs, such as those for dairy cows, beef cattle, and sheep, are contributing to market momentum. The emphasis on animal welfare and the stringent regulations surrounding livestock production also necessitate the use of scientifically formulated premixes to ensure optimal nutrient delivery and disease prevention.

South America Ruminant Feed Premix Market Market Size (In Billion)

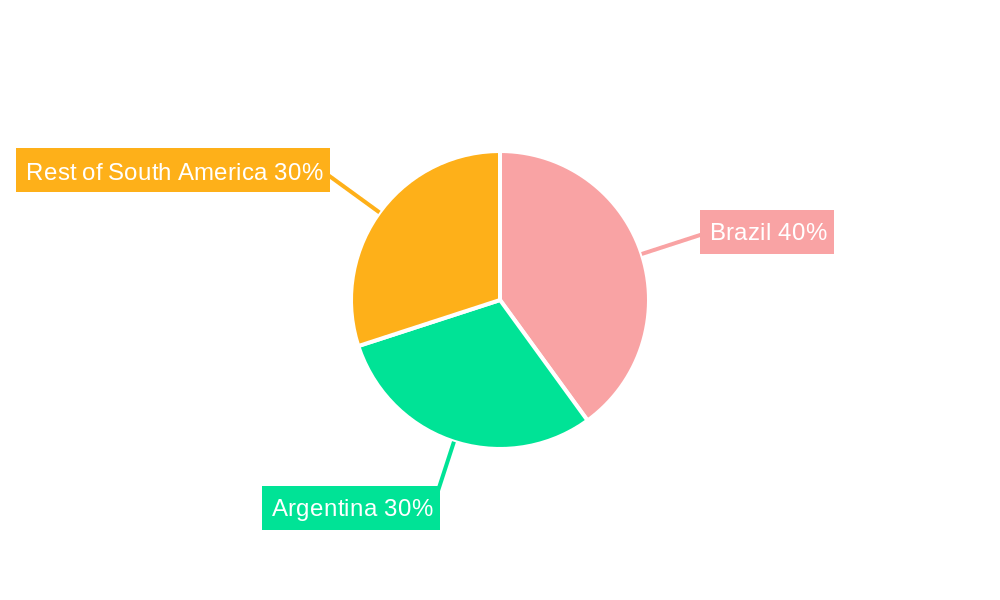

The market is segmented into various ingredient types, with antibiotics, vitamins, antioxidants, amino acids, and minerals forming the core components of feed premixes. These ingredients play crucial roles in supporting immune function, promoting growth, and improving the overall productivity of ruminant animals. Geographically, Brazil and Argentina represent major markets due to their substantial cattle populations and established agricultural sectors. The rest of South America also presents considerable growth potential as livestock farming intensifies. Key industry players are actively engaged in research and development to introduce innovative solutions and expand their market presence. While the market benefits from strong demand and technological advancements, factors such as fluctuating raw material prices and the increasing adoption of alternative feeding strategies could pose potential challenges. However, the overarching trend of escalating global protein demand and the continuous need for efficient livestock management are expected to sustain the positive growth outlook for the South America Ruminant Feed Premix Market.

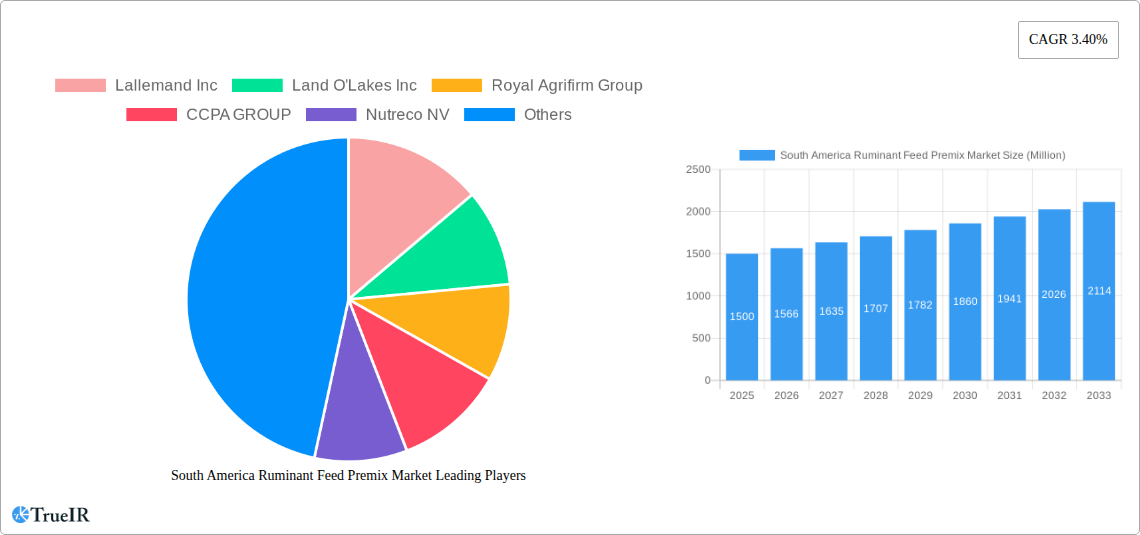

South America Ruminant Feed Premix Market Company Market Share

Here is the SEO-optimized report description for the South America Ruminant Feed Premix Market, designed for high search rankings and industry engagement, with no placeholders and all values in billions.

South America Ruminant Feed Premix Market Market Structure & Competitive Landscape

The South America Ruminant Feed Premix Market is characterized by a moderate to high level of concentration, with key players like Cargill Inc., Nutreco NV, and BASF SE holding significant market shares. Innovation drivers are predominantly focused on enhancing animal health, improving feed efficiency, and meeting evolving regulatory standards. The market is influenced by diverse regulatory landscapes across Brazil, Argentina, and the rest of South America, impacting product approvals and ingredient usage. Product substitutes, while limited in the context of specialized premixes, include basic feed ingredients and in-house feed formulation. End-user segmentation is primarily driven by cattle (beef and dairy), sheep, and goat farming operations, each with distinct nutritional requirements. Merger and acquisition (M&A) activities have been on a steady rise, with an estimated volume of $1.5 billion in disclosed transactions during the historical period (2019-2024), as larger entities seek to consolidate market presence and expand their product portfolios. Concentration ratios are estimated to be around 65% for the top five players. The competitive landscape is further shaped by the increasing demand for natural and sustainable premix solutions, pushing manufacturers to invest in research and development for advanced formulations.

South America Ruminant Feed Premix Market Market Trends & Opportunities

The South America Ruminant Feed Premix Market is poised for robust growth, projected to reach an estimated market size of $15.7 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.8% from the base year 2025. This expansion is fueled by several interconnected trends and emerging opportunities. A primary driver is the escalating global demand for animal protein, particularly beef and dairy, which directly translates to increased consumption of ruminant feed and, consequently, feed premixes. South America, being a major beef and dairy producer, stands to benefit significantly from this trend. Technological shifts are evident in the development of precision nutrition solutions, where customized premixes are designed to optimize animal performance based on specific genetic profiles, age, and physiological stages. The integration of digital technologies for feed management and monitoring is also gaining traction, enabling better tracking of feed intake and animal health, thus creating opportunities for premix suppliers who can offer data-driven solutions.

Consumer preferences are increasingly leaning towards ethically sourced and sustainably produced animal products. This sentiment is driving demand for premixes that support animal welfare and minimize environmental impact. Manufacturers are responding by developing premixes with reduced reliance on antibiotics, incorporating probiotics, prebiotics, and essential oils. The competitive dynamics within the market are intensifying, with a notable trend towards consolidation and strategic partnerships aimed at expanding market reach and technological capabilities. Opportunities exist for companies that can offer innovative, cost-effective, and scientifically validated premix solutions. The growing adoption of advanced farming practices, coupled with government initiatives to boost livestock productivity, further underpins the positive market trajectory. Market penetration rates for specialized ruminant feed premixes are expected to rise considerably as awareness of their benefits in enhancing herd health, fertility, and overall productivity spreads across the region. Furthermore, the burgeoning middle class in South America is increasing demand for higher-quality animal protein, creating a sustained growth avenue for the ruminant feed premix market.

Dominant Markets & Segments in South America Ruminant Feed Premix Market

The South America Ruminant Feed Premix Market exhibits significant dominance in specific geographical regions and ingredient segments, driven by distinct factors.

Geography:

- Brazil: This nation is the undisputed leader in the South American ruminant feed premix market, projected to account for over 45% of the total market revenue by 2033. Brazil's dominance stems from its vast cattle population, its position as a leading global exporter of beef, and significant advancements in its livestock farming infrastructure. Government policies supporting agricultural innovation and substantial investments in modern dairy and beef operations further bolster its market leadership. The demand for high-quality feed premixes to enhance productivity and animal health in large-scale commercial farms is a key growth driver.

- Argentina: Following Brazil, Argentina holds the second-largest share in the market. Its strong tradition in cattle ranching, coupled with an increasing focus on improving feed efficiency for export-oriented beef production, contributes to its substantial market presence. Investments in research and development of advanced animal nutrition solutions are also prevalent in Argentina, aligning with the global trend towards sustainable and efficient livestock farming.

- Rest of South America: This segment, encompassing countries like Colombia, Uruguay, Chile, and Peru, represents a rapidly growing market. Increasing adoption of modern livestock management practices, growing domestic demand for animal protein, and supportive government policies aimed at enhancing agricultural output are fueling the expansion of the ruminant feed premix market in these nations.

Ingredient Type:

- Minerals: Minerals represent the largest and most dominant segment within the ruminant feed premix market, accounting for an estimated 35% of the total market share. Essential macro and micro-minerals are critical for a wide range of physiological functions in ruminants, including bone development, reproductive health, and immune system support. The consistent and high demand for these fundamental nutrients in daily animal diets drives this segment's dominance.

- Amino Acids: This segment is experiencing rapid growth, driven by the need to optimize protein utilization and improve growth rates in cattle. As the focus shifts towards precision nutrition, the demand for specific amino acids to complement forage-based diets is increasing significantly.

- Vitamins: Vitamins are crucial for overall animal health, immune function, and metabolic processes. The segment is robust due to the essential role of various vitamins in preventing deficiency diseases and enhancing animal resilience.

- Antibiotics: While historically significant, the use of antibiotics as growth promoters is facing increasing scrutiny and regulatory restrictions. However, their role in disease prevention and treatment remains important, albeit with a trend towards judicious use and the development of antibiotic-free alternatives.

- Antioxidants: With growing awareness of oxidative stress in livestock and its impact on health and productivity, the demand for antioxidants in feed premixes is on the rise, especially in intensive farming systems.

- Other Ingredients: This encompasses a diverse range of additives such as enzymes, probiotics, prebiotics, and toxin binders, which are gaining traction due to their role in improving gut health, nutrient digestibility, and overall animal well-being.

South America Ruminant Feed Premix Market Product Analysis

The South America Ruminant Feed Premix Market is witnessing continuous product innovation focused on enhancing ruminant health, productivity, and sustainability. Key advancements include the development of highly bioavailable mineral and vitamin formulations that improve absorption and reduce excretion, thereby optimizing nutrient utilization and minimizing environmental impact. The integration of novel amino acid profiles tailored for specific production phases and genetic types of cattle, sheep, and goats is a significant trend. Furthermore, there's a growing emphasis on premixes containing functional ingredients like probiotics, prebiotics, and essential oils, designed to improve gut health, boost immunity, and reduce the need for antibiotics. These innovative products offer competitive advantages by addressing the evolving needs of modern livestock farming for efficient, healthy, and environmentally conscious animal production.

Key Drivers, Barriers & Challenges in South America Ruminant Feed Premix Market

Key Drivers: The primary forces propelling the South America Ruminant Feed Premix Market are the escalating global demand for animal protein, particularly beef and dairy, which directly boosts the need for efficient livestock production. Technological advancements in precision nutrition and animal health are creating opportunities for specialized and high-performance premixes. Supportive government policies aimed at enhancing agricultural productivity and export capabilities in major ruminant-producing nations like Brazil and Argentina also act as significant catalysts. The increasing adoption of modern farming practices and a growing awareness among farmers about the benefits of scientifically formulated feed premixes in improving herd health, fertility, and overall economic returns are further driving market growth.

Barriers & Challenges: Key challenges impacting the market include the volatile nature of commodity prices, which can affect the cost-effectiveness of premixes for farmers. Regulatory complexities and varying standards across different South American countries can pose hurdles for market entry and product standardization. Supply chain disruptions, exacerbated by logistical challenges in vast geographical areas and potential geopolitical instability, can impact the timely availability of raw materials and finished products. Intense competition among numerous domestic and international players, coupled with the pressure to maintain competitive pricing while investing in R&D, presents a significant challenge. Furthermore, a segment of the market still relies on traditional feeding methods, requiring continuous education and outreach to promote the adoption of advanced premixes.

Growth Drivers in the South America Ruminant Feed Premix Market Market

Several key drivers are fueling the growth of the South America Ruminant Feed Premix Market. Economically, the rising global demand for high-quality animal protein, especially beef and dairy, is a primary impetus. This is complemented by significant investments in modernizing livestock farming infrastructure across the region, particularly in Brazil and Argentina. Technologically, the continuous innovation in precision nutrition, leading to the development of customized premixes designed to optimize animal health, growth, and reproductive efficiency, is a major growth catalyst. Regulatory support in some countries, aimed at boosting agricultural exports and ensuring animal welfare standards, also plays a crucial role. Furthermore, the increasing adoption of advanced farming techniques by producers seeking to enhance their profitability and competitiveness is driving the demand for advanced feed solutions.

Challenges Impacting South America Ruminant Feed Premix Market Growth

Despite the positive growth trajectory, several challenges impact the South America Ruminant Feed Premix Market. Regulatory complexities and the lack of standardized regulations across different South American nations can create barriers to market entry and product uniformity. Supply chain vulnerabilities, including logistical hurdles in vast and sometimes remote agricultural regions, can lead to delays and increased costs. Fluctuations in the prices of raw materials used in premix production, such as vitamins, minerals, and amino acids, pose a significant challenge in maintaining stable pricing and profit margins. Intense competition from established global players and emerging local manufacturers necessitates continuous innovation and cost optimization. Additionally, the presence of a segment of traditional farmers who may be slow to adopt new technologies and scientifically formulated feed premixes presents an educational and market penetration challenge.

Key Players Shaping the South America Ruminant Feed Premix Market Market

- Lallemand Inc

- Land O'Lakes Inc

- Royal Agrifirm Group

- CCPA GROUP

- Nutreco NV

- BASF SE

- ICC

- Cargill Inc

- Cladan Animal Nutrition and Welfar

Significant South America Ruminant Feed Premix Market Industry Milestones

- 2019: Increased focus on antibiotic-free premix formulations by major manufacturers in response to growing consumer demand for antibiotic-free meat and dairy products.

- 2020: Launch of advanced mineral premixes with enhanced bioavailability, leading to improved animal absorption and reduced environmental impact.

- 2021: Significant investments in R&D for gut health solutions, including the development of novel probiotic and prebiotic blends for ruminants.

- 2022: Introduction of digital feed management platforms integrated with premix solutions, enabling precision nutrition and data-driven farm management.

- 2023: Expansion of production capacities by key players in Brazil and Argentina to meet growing regional demand for high-quality feed premixes.

- 2024: Emergence of strategic partnerships focused on sustainable sourcing of raw materials and the development of eco-friendly premix formulations.

Future Outlook for South America Ruminant Feed Premix Market Market

The future outlook for the South America Ruminant Feed Premix Market is exceptionally promising, driven by sustained demand for animal protein, continuous technological advancements, and a growing emphasis on sustainable and ethical farming practices. Strategic opportunities lie in the development and market penetration of precision nutrition solutions tailored to specific regional breeds and production systems. The expansion of antibiotic-free and functional ingredient-based premixes is expected to gain further momentum. Companies that can navigate the evolving regulatory landscape, optimize supply chains, and offer innovative, cost-effective, and scientifically validated products are well-positioned for significant growth and market leadership. The increasing adoption of digital technologies in agriculture will also create avenues for integrated solutions that combine premixes with advanced monitoring and management systems, enhancing overall farm efficiency and profitability.

South America Ruminant Feed Premix Market Segmentation

-

1. Ingredient Type

- 1.1. Antibiotics

- 1.2. Vitamins

- 1.3. Antioxidants

- 1.4. Amino Acids

- 1.5. Minerals

- 1.6. Other Ingredients

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

South America Ruminant Feed Premix Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Ruminant Feed Premix Market Regional Market Share

Geographic Coverage of South America Ruminant Feed Premix Market

South America Ruminant Feed Premix Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Feed Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Ruminant Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Antibiotics

- 5.1.2. Vitamins

- 5.1.3. Antioxidants

- 5.1.4. Amino Acids

- 5.1.5. Minerals

- 5.1.6. Other Ingredients

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. Brazil South America Ruminant Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Antibiotics

- 6.1.2. Vitamins

- 6.1.3. Antioxidants

- 6.1.4. Amino Acids

- 6.1.5. Minerals

- 6.1.6. Other Ingredients

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Argentina South America Ruminant Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Antibiotics

- 7.1.2. Vitamins

- 7.1.3. Antioxidants

- 7.1.4. Amino Acids

- 7.1.5. Minerals

- 7.1.6. Other Ingredients

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Rest of South America South America Ruminant Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Antibiotics

- 8.1.2. Vitamins

- 8.1.3. Antioxidants

- 8.1.4. Amino Acids

- 8.1.5. Minerals

- 8.1.6. Other Ingredients

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Lallemand Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Land O'Lakes Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Royal Agrifirm Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 CCPA GROUP

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Nutreco NV

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BASF SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 ICC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Cargill Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Cladan Animal Nutrition and Welfar

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Lallemand Inc

List of Figures

- Figure 1: South America Ruminant Feed Premix Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Ruminant Feed Premix Market Share (%) by Company 2025

List of Tables

- Table 1: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 2: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 5: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 8: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 11: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: South America Ruminant Feed Premix Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Ruminant Feed Premix Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the South America Ruminant Feed Premix Market?

Key companies in the market include Lallemand Inc, Land O'Lakes Inc, Royal Agrifirm Group, CCPA GROUP, Nutreco NV, BASF SE, ICC, Cargill Inc, Cladan Animal Nutrition and Welfar.

3. What are the main segments of the South America Ruminant Feed Premix Market?

The market segments include Ingredient Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Feed Production Drives the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Ruminant Feed Premix Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Ruminant Feed Premix Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Ruminant Feed Premix Market?

To stay informed about further developments, trends, and reports in the South America Ruminant Feed Premix Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence