Key Insights

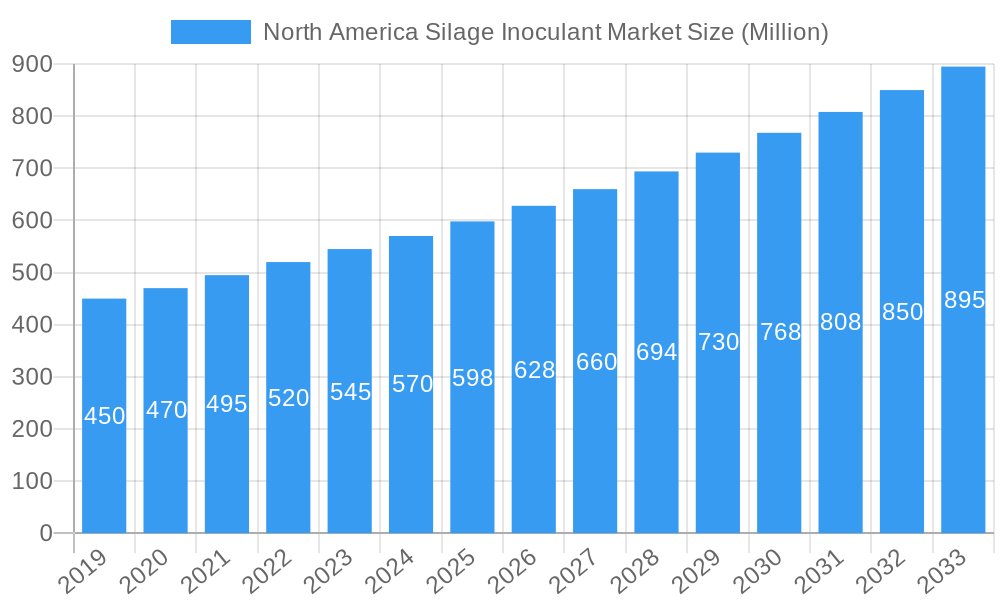

The North America Silage Inoculant Market is projected for substantial expansion, driven by the increasing adoption of advanced silage management and the demand for high-quality animal feed. With an estimated Compound Annual Growth Rate (CAGR) of 6.28%, the market is anticipated to reach a valuation of 131.07 million by 2033, based on the 2025 base year. Key growth drivers include heightened farmer awareness of inoculant benefits for improved feed digestibility, reduced spoilage, and enhanced animal productivity. The escalating need for efficient nutrient utilization in animal diets and the pursuit of sustainable agricultural practices that minimize feed waste are significant market catalysts. Modern farming techniques and a greater focus on animal health and welfare further support the demand for effective silage preservation solutions.

North America Silage Inoculant Market Market Size (In Million)

The market segmentation includes inoculant type, application, and geography. Homolactic bacteria, such as Lactobacillus Plantarum, are expected to lead in inoculant types due to their proven efficacy in lactic acid production, facilitating rapid pH drop and superior silage fermentation. Cereals like corn and barley are anticipated to hold a substantial share in applications, reflecting their widespread use as primary silage crops. Geographically, the United States is expected to maintain its leading position, owing to its extensive livestock operations and advanced agricultural infrastructure. Emerging trends, including the development of novel inoculant formulations with enhanced performance and the integration of precision agriculture in silage management, will shape the market's trajectory. However, fluctuating raw material costs and the need for increased farmer education on optimal inoculant application may present moderate challenges.

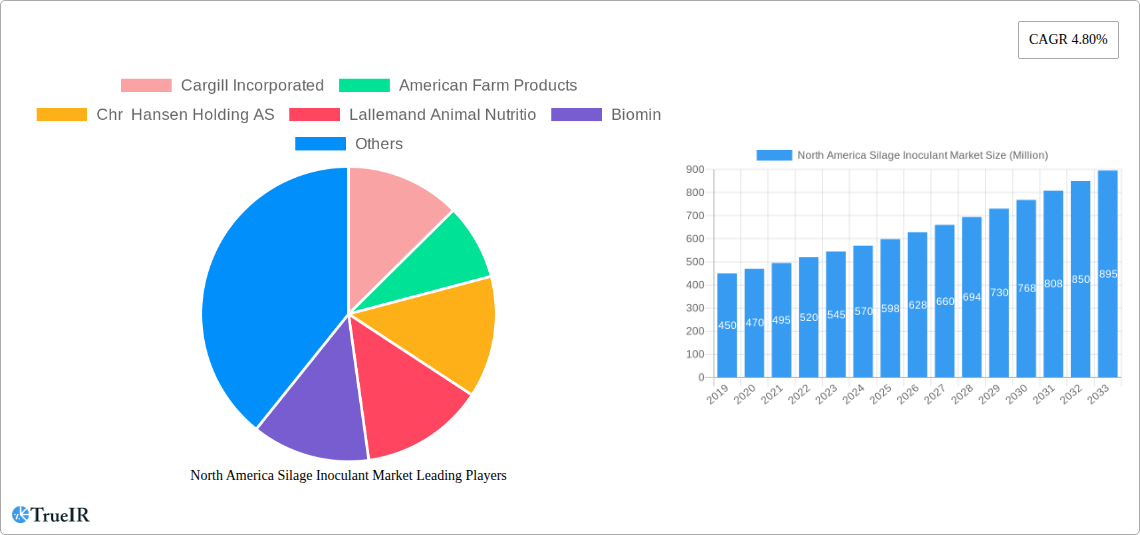

North America Silage Inoculant Market Company Market Share

This report offers an in-depth analysis of the North America Silage Inoculant Market, providing critical insights for stakeholders. Covering the historical period and projecting growth through 2033, this research identifies key market drivers, segment performance, competitive strategies, and future opportunities across the United States, Canada, and Mexico.

North America Silage Inoculant Market Market Structure & Competitive Landscape

The North America Silage Inoculant Market exhibits a moderately concentrated structure, characterized by the presence of both established global players and specialized regional manufacturers. Innovation is a primary driver, with companies investing significantly in research and development to introduce more effective and targeted inoculant strains. Regulatory landscapes, primarily concerning animal feed additives and agricultural practices, play a crucial role in market entry and product approval. Substitute products, such as mechanical ensiling techniques and alternative preservation methods, present a competitive challenge, though their efficacy is often surpassed by advanced inoculant formulations. End-user segmentation is driven by the diverse needs of livestock operations, from large-scale feedlots to smaller dairy farms, each seeking specific improvements in forage quality and feed efficiency. Mergers and acquisitions (M&A) are notable trends, as larger companies seek to consolidate market share, expand their product portfolios, and gain access to new technologies and distribution networks. For instance, the period has seen strategic alliances aimed at enhancing product offerings and market reach. The market concentration ratio is estimated to be around 60% among the top five players, underscoring the competitive intensity. M&A activities have averaged 2-3 significant deals annually over the historical period, indicating ongoing consolidation efforts.

North America Silage Inoculant Market Market Trends & Opportunities

The North America Silage Inoculant Market is experiencing robust growth, driven by an increasing awareness of the economic and nutritional benefits of high-quality silage. Projections indicate a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. This growth is underpinned by several key trends. Technological advancements are at the forefront, with a continuous focus on developing inoculants that improve aerobic stability, reduce spoilage losses, and enhance nutrient digestibility. This includes the innovation of new bacterial strains and the optimization of existing ones, leading to improved fermentation processes and higher feed value. Consumer preferences are also indirectly influencing the market, as the demand for efficient and sustainable livestock production practices grows. Farmers are increasingly adopting silage inoculants to maximize the nutritional output of their forage crops, thereby improving animal health and productivity. Competitive dynamics are intensifying, pushing companies to differentiate through product efficacy, technical support, and integrated solutions. The market penetration rate for silage inoculants is estimated to be around 75% across commercial livestock operations in North America, with significant room for growth in smaller farms and in specific crop types. The rising cost of feed ingredients and the drive for cost-effective animal nutrition solutions further bolster the adoption of silage inoculants. Opportunities lie in developing region-specific inoculant formulations tailored to local crop varieties and climatic conditions. Furthermore, the integration of digital technologies for on-farm silage management and decision support systems presents a significant avenue for market expansion. The emphasis on reducing methane emissions from livestock operations also positions high-quality silage, facilitated by inoculants, as a crucial component of sustainable farming.

Dominant Markets & Segments in North America Silage Inoculant Market

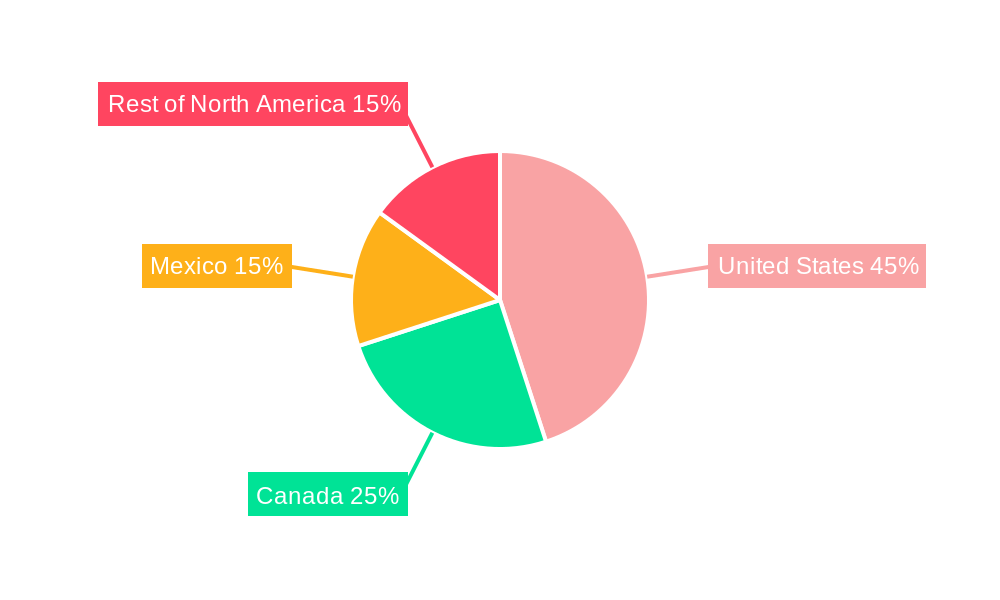

The United States stands as the dominant market within the North America Silage Inoculant Market, accounting for an estimated 65% of the total market share. This dominance is attributable to its vast agricultural landscape, extensive livestock population, and advanced farming practices. Within the United States, the Corn belt region, where corn silage is a staple feed, represents a particularly significant sub-market.

Dominant Segments:

Type: Homolactic Bacteria

- Lactobacillus Plantarum: This strain is highly prevalent due to its broad efficacy in silage fermentation, leading to rapid pH drop and efficient lactic acid production. Its ability to tolerate a wide range of environmental conditions makes it a preferred choice for various forage types.

- Pediococcus Pentosaceus: Often used in conjunction with other bacteria, it contributes to consistent fermentation and improved aerobic stability.

- Enterococcus Faecium: Known for its role in reducing spoilage and improving silage preservation, contributing to higher feed quality.

- Other Homolactic Bacteria: This category includes other beneficial strains that enhance fermentation characteristics and nutritional value.

Application: Cereals

- Corn: This is the largest application segment by volume, driven by its high yield and energy content, making it a primary forage source for cattle. The consistent demand for corn silage fuels significant inoculant consumption.

- Barley, Oats, Wheat, Sorghum: These cereal grains also represent important application areas, particularly in regions where corn cultivation is less viable or for specific livestock dietary needs.

Geography:

- United States: As mentioned, the sheer scale of its agricultural operations and livestock numbers makes it the leading market. Factors such as government support for sustainable agriculture and technological adoption rates contribute to its dominance.

- Canada: A significant contributor, with a strong dairy and beef industry, driving demand for high-quality forage. Its cold climate necessitates effective silage preservation techniques.

- Mexico: Emerging as a growing market, with increasing adoption of modern agricultural practices and a rising demand for animal protein.

Key Growth Drivers:

- Infrastructure: The well-established agricultural infrastructure and robust supply chains in the United States and Canada facilitate the widespread distribution and adoption of silage inoculants.

- Policies: Government initiatives promoting efficient livestock production, food security, and sustainable farming practices indirectly support the silage inoculant market.

- Technological Advancements: Continuous innovation in bacterial strains and formulation technologies by key players like Chr Hansen Holding AS and Lallemand Animal Nutritio further drives segment growth.

- Economic Factors: The rising cost of alternative feed ingredients and the need for cost-effective animal nutrition solutions encourage the adoption of silage inoculants to maximize forage utilization.

The Heterolactic Bacteria segment, while smaller, is also experiencing growth, particularly Lactobacillus Buchneri, which is crucial for improving aerobic stability and preventing spoilage. The Pulses segment, including alfalfa and clover, and Other Crops like grasses and canola, are also contributing to market diversification. The demand for improved silage quality for ruminant diets is a consistent theme across all applications.

North America Silage Inoculant Market Product Analysis

Product innovation in the North America Silage Inoculant Market centers on developing highly specific microbial blends that enhance fermentation efficiency, aerobic stability, and nutrient availability in ensiled forages. Key technological advancements include the identification and cultivation of novel bacterial strains with superior performance characteristics, such as enhanced lactic acid production, rapid pH drop, and resistance to spoilage organisms. Competitive advantages are gained through products offering guaranteed results, extended shelf life, and ease of application. For instance, Lallemand Animal Nutrition's MAGNIVA product line emphasizes improved aerobic stability and consistency. Companies are also focusing on developing inoculants tailored to specific crop types and farm conditions, offering customized solutions. This focus on precision agriculture and tailored nutrition ensures optimal forage preservation and improved animal health and productivity.

Key Drivers, Barriers & Challenges in North America Silage Inoculant Market

Key Drivers: The North America Silage Inoculant Market is propelled by several key drivers. Technologically, the continuous innovation in microbial strains and formulations by leading companies like Chr Hansen Holding AS and Lallemand Animal Nutritio is a significant growth catalyst. Economically, the increasing cost of alternative feed ingredients and the need for efficient livestock production to meet rising global protein demand are pushing farmers towards maximizing forage quality. Policy-driven factors, such as government support for sustainable agriculture and improved animal welfare, also encourage the adoption of silage inoculants. The rising awareness among farmers about the economic benefits of reduced spoilage and improved feed conversion ratios is a crucial market enabler.

Barriers & Challenges: Despite the positive outlook, several barriers and challenges impact market growth. Supply chain issues, including the availability of specific raw materials and the logistics of cold-chain transportation for some inoculant products, can pose difficulties. Regulatory hurdles, although generally favorable, can involve lengthy approval processes for new products in certain jurisdictions. Competitive pressures from established players and the emergence of new entrants, coupled with price sensitivity among some end-users, can affect market expansion. Furthermore, a lack of awareness or understanding of the benefits of silage inoculants among a segment of smaller-scale farmers can limit adoption.

Growth Drivers in the North America Silage Inoculant Market Market

Key growth drivers in the North America Silage Inoculant Market are multifaceted. Technologically, the ongoing research and development efforts by companies such as Cargill Incorporated and Kemin Industries Inc. to introduce more potent and targeted bacterial strains are paramount. Economically, the rising global demand for animal protein necessitates greater efficiency in livestock farming, making high-quality silage an indispensable component. This, coupled with the increasing cost of conventional feed ingredients, drives the need for superior forage preservation to maximize nutrient utilization and reduce waste. Regulatory tailwinds, supporting sustainable agricultural practices and animal health, indirectly favor the adoption of silage inoculants as a tool for improved feed quality and reduced environmental impact. The growing focus on precision agriculture and data-driven farm management is also creating opportunities for advanced inoculant solutions that integrate with digital farm platforms.

Challenges Impacting North America Silage Inoculant Market Growth

Several challenges impact the growth of the North America Silage Inoculant Market. Regulatory complexities, while generally supportive, can introduce delays in new product approvals and require adherence to varying standards across different regions within North America. Supply chain issues, ranging from the sourcing of specialized microbial cultures to the efficient and cost-effective distribution of products, can create bottlenecks. Competitive pressures are significant, with established players like Lallemand Animal Nutritio and ADM Animal Nutrition vying for market share, often leading to price competition that can impact profit margins. Furthermore, educating a portion of the farming community, particularly smaller operations, about the consistent and quantifiable economic benefits of silage inoculants remains an ongoing challenge, requiring sustained outreach and demonstration of efficacy.

Key Players Shaping the North America Silage Inoculant Market Market

- Cargill Incorporated

- American Farm Products

- Chr Hansen Holding AS

- Lallemand Animal Nutritio

- Biomin

- Vita Plus

- Kemin Industries Inc

- AGRI KING

- Corteva Agriscience

- ADM Animal Nutrition

Significant North America Silage Inoculant Market Industry Milestones

- October 2021: BASF and Cargill expanded their partnership to develop and market innovative enzyme-based solutions for the animal feed industry, indirectly impacting the broader animal nutrition landscape and potentially influencing silage quality solutions.

- September 2020: Lallemand Animal Nutrition launched its new MAGNIVA forage inoculants for producers in the United States and Canada. These inoculants help producers control silage quality and deliver consistency every year, directly bolstering the market with innovative product offerings.

- December 2019: DM Animal Nutrition, a division of Archer Daniels Midland Company, opened a new Animal Nutrition Technology Center in Decatur, Illinois. The industry-leading facility builds to enhance customer collaboration and develop fully-tailored nutrition solutions, signifying a commitment to R&D and customer-centric product development in the animal nutrition sector.

Future Outlook for North America Silage Inoculant Market Market

The future outlook for the North America Silage Inoculant Market is highly optimistic, driven by persistent demand for enhanced livestock productivity and sustainable farming practices. Strategic opportunities lie in the development of next-generation inoculants that offer even greater precision in fermentation control, improved aerobic stability, and enhanced nutritional benefits. The integration of digital technologies for real-time silage monitoring and data analytics presents a significant avenue for growth, enabling farmers to optimize their ensiling processes. Furthermore, an increasing focus on reducing the environmental footprint of livestock farming will likely favor silage inoculants that contribute to more efficient feed utilization and reduced methane emissions. The expansion of product offerings into niche crop types and the development of region-specific formulations tailored to diverse climatic and agricultural conditions will also shape the market's trajectory. Continued investment in research and development by key players, alongside strategic collaborations and potential acquisitions, will further solidify the market's growth path.

North America Silage Inoculant Market Segmentation

-

1. Type

-

1.1. Homolactic Bacteria

- 1.1.1. Lactobacillus Plantarum

- 1.1.2. Pediococcus Pentosaceus

- 1.1.3. Enterococcus Faecium

- 1.1.4. Other Homolactic Bacteria

-

1.2. Heterolactic Bacteria

- 1.2.1. Lactobacillus Buchneri

- 1.2.2. Lactobacillus Brevis

- 1.2.3. Propionibacteria Freundenreichii

- 1.2.4. Other Heterolactic Bacteria

-

1.1. Homolactic Bacteria

-

2. Application

-

2.1. Cereals

- 2.1.1. Corn

- 2.1.2. Barley

- 2.1.3. Oats

- 2.1.4. Wheat

- 2.1.5. Sorghum

- 2.1.6. Other Applications

-

2.2. Pulses

- 2.2.1. Peas

- 2.2.2. Clover

- 2.2.3. Alfalfa

- 2.2.4. Other Pulses

-

2.3. Other Crops

- 2.3.1. Grasses

- 2.3.2. Canola

-

2.1. Cereals

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Silage Inoculant Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Silage Inoculant Market Regional Market Share

Geographic Coverage of North America Silage Inoculant Market

North America Silage Inoculant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Growth in Industrial Production of Livestock

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Homolactic Bacteria

- 5.1.1.1. Lactobacillus Plantarum

- 5.1.1.2. Pediococcus Pentosaceus

- 5.1.1.3. Enterococcus Faecium

- 5.1.1.4. Other Homolactic Bacteria

- 5.1.2. Heterolactic Bacteria

- 5.1.2.1. Lactobacillus Buchneri

- 5.1.2.2. Lactobacillus Brevis

- 5.1.2.3. Propionibacteria Freundenreichii

- 5.1.2.4. Other Heterolactic Bacteria

- 5.1.1. Homolactic Bacteria

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cereals

- 5.2.1.1. Corn

- 5.2.1.2. Barley

- 5.2.1.3. Oats

- 5.2.1.4. Wheat

- 5.2.1.5. Sorghum

- 5.2.1.6. Other Applications

- 5.2.2. Pulses

- 5.2.2.1. Peas

- 5.2.2.2. Clover

- 5.2.2.3. Alfalfa

- 5.2.2.4. Other Pulses

- 5.2.3. Other Crops

- 5.2.3.1. Grasses

- 5.2.3.2. Canola

- 5.2.1. Cereals

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Homolactic Bacteria

- 6.1.1.1. Lactobacillus Plantarum

- 6.1.1.2. Pediococcus Pentosaceus

- 6.1.1.3. Enterococcus Faecium

- 6.1.1.4. Other Homolactic Bacteria

- 6.1.2. Heterolactic Bacteria

- 6.1.2.1. Lactobacillus Buchneri

- 6.1.2.2. Lactobacillus Brevis

- 6.1.2.3. Propionibacteria Freundenreichii

- 6.1.2.4. Other Heterolactic Bacteria

- 6.1.1. Homolactic Bacteria

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cereals

- 6.2.1.1. Corn

- 6.2.1.2. Barley

- 6.2.1.3. Oats

- 6.2.1.4. Wheat

- 6.2.1.5. Sorghum

- 6.2.1.6. Other Applications

- 6.2.2. Pulses

- 6.2.2.1. Peas

- 6.2.2.2. Clover

- 6.2.2.3. Alfalfa

- 6.2.2.4. Other Pulses

- 6.2.3. Other Crops

- 6.2.3.1. Grasses

- 6.2.3.2. Canola

- 6.2.1. Cereals

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Homolactic Bacteria

- 7.1.1.1. Lactobacillus Plantarum

- 7.1.1.2. Pediococcus Pentosaceus

- 7.1.1.3. Enterococcus Faecium

- 7.1.1.4. Other Homolactic Bacteria

- 7.1.2. Heterolactic Bacteria

- 7.1.2.1. Lactobacillus Buchneri

- 7.1.2.2. Lactobacillus Brevis

- 7.1.2.3. Propionibacteria Freundenreichii

- 7.1.2.4. Other Heterolactic Bacteria

- 7.1.1. Homolactic Bacteria

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cereals

- 7.2.1.1. Corn

- 7.2.1.2. Barley

- 7.2.1.3. Oats

- 7.2.1.4. Wheat

- 7.2.1.5. Sorghum

- 7.2.1.6. Other Applications

- 7.2.2. Pulses

- 7.2.2.1. Peas

- 7.2.2.2. Clover

- 7.2.2.3. Alfalfa

- 7.2.2.4. Other Pulses

- 7.2.3. Other Crops

- 7.2.3.1. Grasses

- 7.2.3.2. Canola

- 7.2.1. Cereals

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Homolactic Bacteria

- 8.1.1.1. Lactobacillus Plantarum

- 8.1.1.2. Pediococcus Pentosaceus

- 8.1.1.3. Enterococcus Faecium

- 8.1.1.4. Other Homolactic Bacteria

- 8.1.2. Heterolactic Bacteria

- 8.1.2.1. Lactobacillus Buchneri

- 8.1.2.2. Lactobacillus Brevis

- 8.1.2.3. Propionibacteria Freundenreichii

- 8.1.2.4. Other Heterolactic Bacteria

- 8.1.1. Homolactic Bacteria

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cereals

- 8.2.1.1. Corn

- 8.2.1.2. Barley

- 8.2.1.3. Oats

- 8.2.1.4. Wheat

- 8.2.1.5. Sorghum

- 8.2.1.6. Other Applications

- 8.2.2. Pulses

- 8.2.2.1. Peas

- 8.2.2.2. Clover

- 8.2.2.3. Alfalfa

- 8.2.2.4. Other Pulses

- 8.2.3. Other Crops

- 8.2.3.1. Grasses

- 8.2.3.2. Canola

- 8.2.1. Cereals

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Silage Inoculant Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Homolactic Bacteria

- 9.1.1.1. Lactobacillus Plantarum

- 9.1.1.2. Pediococcus Pentosaceus

- 9.1.1.3. Enterococcus Faecium

- 9.1.1.4. Other Homolactic Bacteria

- 9.1.2. Heterolactic Bacteria

- 9.1.2.1. Lactobacillus Buchneri

- 9.1.2.2. Lactobacillus Brevis

- 9.1.2.3. Propionibacteria Freundenreichii

- 9.1.2.4. Other Heterolactic Bacteria

- 9.1.1. Homolactic Bacteria

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cereals

- 9.2.1.1. Corn

- 9.2.1.2. Barley

- 9.2.1.3. Oats

- 9.2.1.4. Wheat

- 9.2.1.5. Sorghum

- 9.2.1.6. Other Applications

- 9.2.2. Pulses

- 9.2.2.1. Peas

- 9.2.2.2. Clover

- 9.2.2.3. Alfalfa

- 9.2.2.4. Other Pulses

- 9.2.3. Other Crops

- 9.2.3.1. Grasses

- 9.2.3.2. Canola

- 9.2.1. Cereals

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cargill Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 American Farm Products

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Chr Hansen Holding AS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lallemand Animal Nutritio

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Biomin

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vita Plus

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kemin Industries Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AGRI KING

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Corteva Agriscience

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ADM Animal Nutrition

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Cargill Incorporated

List of Figures

- Figure 1: North America Silage Inoculant Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Silage Inoculant Market Share (%) by Company 2025

List of Tables

- Table 1: North America Silage Inoculant Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America Silage Inoculant Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: North America Silage Inoculant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Silage Inoculant Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Silage Inoculant Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: North America Silage Inoculant Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: North America Silage Inoculant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Silage Inoculant Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: North America Silage Inoculant Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: North America Silage Inoculant Market Revenue million Forecast, by Application 2020 & 2033

- Table 11: North America Silage Inoculant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Silage Inoculant Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: North America Silage Inoculant Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: North America Silage Inoculant Market Revenue million Forecast, by Application 2020 & 2033

- Table 15: North America Silage Inoculant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: North America Silage Inoculant Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: North America Silage Inoculant Market Revenue million Forecast, by Type 2020 & 2033

- Table 18: North America Silage Inoculant Market Revenue million Forecast, by Application 2020 & 2033

- Table 19: North America Silage Inoculant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: North America Silage Inoculant Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Silage Inoculant Market?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the North America Silage Inoculant Market?

Key companies in the market include Cargill Incorporated, American Farm Products, Chr Hansen Holding AS, Lallemand Animal Nutritio, Biomin, Vita Plus, Kemin Industries Inc, AGRI KING, Corteva Agriscience, ADM Animal Nutrition.

3. What are the main segments of the North America Silage Inoculant Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 131.07 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Growth in Industrial Production of Livestock.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2021, BASF and Cargill expanded their partnership to develop and market innovative enzyme-based solutions for the animal feed industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Silage Inoculant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Silage Inoculant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Silage Inoculant Market?

To stay informed about further developments, trends, and reports in the North America Silage Inoculant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence