Key Insights

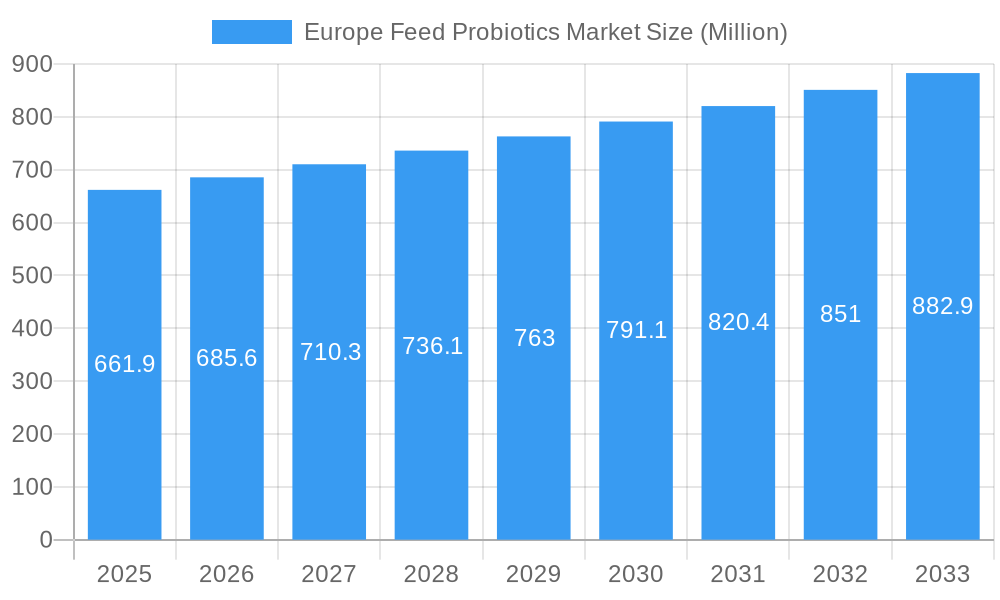

The European Feed Probiotics Market is projected to reach $661.9 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.7% through 2033. This growth is driven by the rising demand for sustainable, antibiotic-free animal feed. Growing consumer awareness of antibiotic residues in food is accelerating the adoption of probiotics for enhanced animal gut health, improved feed efficiency, and strengthened immune systems. Favorable regulatory policies in Europe promoting feed additive use, including probiotics, are further stimulating market penetration. The poultry and aquaculture sectors are key growth drivers due to high feed consumption and the continuous need for improved animal welfare and productivity.

Europe Feed Probiotics Market Market Size (In Million)

Market dynamics are influenced by the development of novel probiotic strains for specific animal species and innovations in delivery mechanisms to ensure higher probiotic survival and efficacy. Challenges include the cost-effectiveness of probiotics versus traditional additives and the need for extensive farmer education. However, the strong trend towards sustainable and health-conscious animal agriculture in Europe, alongside ongoing research in microbial solutions for animal nutrition, is expected to propel the market forward.

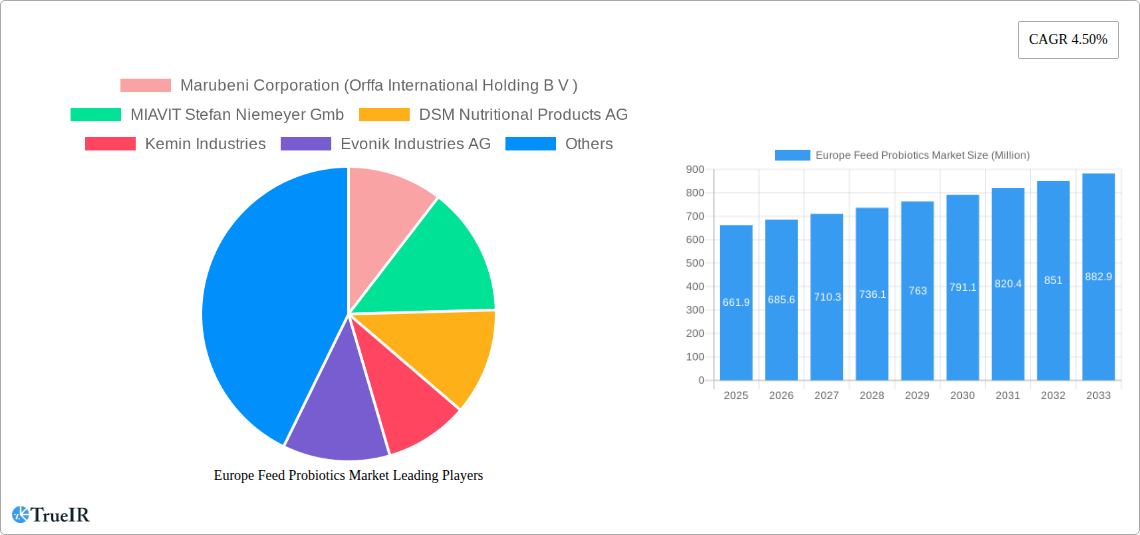

Europe Feed Probiotics Market Company Market Share

Europe Feed Probiotics Market Analysis: Projections and Key Trends (2019–2033)

This comprehensive report analyzes the Europe Feed Probiotics Market from 2019 to 2033. With a 2025 base year, it examines market dynamics, competitive strategies, and emerging opportunities. The market is anticipated to expand significantly, driven by demand for sustainable animal farming and a move towards antibiotic-free feed. The market size is expected to reach €2,200 million by 2033, with a CAGR of 8.5%.

Europe Feed Probiotics Market Market Structure & Competitive Landscape

The Europe Feed Probiotics Market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Innovation remains a critical driver, pushing the development of novel probiotic strains with enhanced efficacy and specific applications across various animal species. Regulatory frameworks, while evolving, play a crucial role in shaping market entry and product approval processes. The increasing consumer demand for antibiotic-free animal products and greater transparency in the food chain is directly influencing the adoption of feed probiotics. Product substitutes, primarily antibiotics and other feed additives, are continuously being evaluated against the efficacy and long-term benefits of probiotics. The end-user segmentation, encompassing poultry, swine, ruminants, and aquaculture, reveals distinct growth potentials and adoption rates based on regional farming practices and economic factors. Mergers and acquisitions (M&A) are also a notable trend, with companies seeking to consolidate their market position, expand their product portfolios, and gain access to new technologies and geographical markets. The volume of M&A activities in the historical period (2019-2024) is estimated at over 10 significant deals, indicating a robust consolidation phase. Concentration ratios for the top 5 players are estimated to be around 55%.

Europe Feed Probiotics Market Market Trends & Opportunities

The Europe Feed Probiotics Market is witnessing a robust expansion, driven by a confluence of factors that are reshaping the animal nutrition landscape. The estimated market size for Europe Feed Probiotics in 2025 stands at €1,250 million, with significant growth anticipated to reach €2,200 million by 2033, reflecting a CAGR of 8.5% over the forecast period. This growth is underpinned by a pronounced shift away from antibiotic growth promoters (AGPs) in animal feed, spurred by regulatory pressures and growing consumer awareness regarding antimicrobial resistance (AMR). Technological advancements are at the forefront of market evolution. Research and development efforts are focused on identifying and isolating novel probiotic strains with tailored functionalities, such as improved gut health, enhanced nutrient absorption, and boosted immune responses. This includes the application of advanced fermentation techniques and genetic sequencing to optimize probiotic efficacy. Consumer preferences are increasingly leaning towards ethically produced and sustainably sourced animal protein. Feed probiotics contribute to this trend by promoting animal welfare, reducing the need for antibiotics, and potentially decreasing the environmental footprint of livestock farming through improved feed conversion ratios. Competitive dynamics are intensifying, with established players investing heavily in R&D and strategic partnerships to gain a competitive edge. Emerging players are also entering the market, often with specialized probiotic solutions for niche applications. Opportunities abound in the development of region-specific probiotic formulations that address local disease challenges and farming conditions. Furthermore, the integration of digital solutions in animal health and nutrition presents a significant avenue for growth, enabling better monitoring, customized feeding strategies, and data-driven insights for farmers. The penetration rate of feed probiotics in the European animal feed market is currently estimated at 30%, with substantial room for growth as awareness and acceptance continue to rise.

Dominant Markets & Segments in Europe Feed Probiotics Market

The Europe Feed Probiotics Market is characterized by distinct regional dominance and segment preferences, driven by a combination of animal husbandry practices, economic factors, and regulatory landscapes. Within the Sub Additive category, Lactobacilli and Bifidobacteria currently command the largest market share, accounting for approximately 60% of the total probiotic additive market. Their established efficacy in improving gut health and digestion across various animal species makes them the go-to choices for feed manufacturers. Enterococcus and Streptococcus also hold significant market presence, particularly in specific animal applications where their unique benefits are leveraged.

Geographically, Germany, France, and the United Kingdom are the dominant markets within Europe. These countries exhibit high livestock density, advanced agricultural infrastructure, and a strong consumer demand for high-quality, safe animal protein. Their robust regulatory frameworks encourage the adoption of scientifically validated feed additives like probiotics.

In terms of animal segmentation, the Poultry sector, encompassing broilers and layers, represents the largest and fastest-growing segment, contributing over 40% of the total market revenue. This dominance is fueled by the high volume of poultry production in Europe and the segment's susceptibility to gut health issues, making probiotics an essential tool for maintaining flock health and optimizing feed conversion.

The Swine segment follows closely, driven by similar concerns about gut health and the imperative to reduce antibiotic reliance in pig farming. Efforts to improve feed efficiency and minimize mortality rates further boost the demand for probiotics in this sector.

The Ruminants segment, including beef and dairy cattle, also presents substantial growth opportunities. While adoption rates may be slower compared to poultry and swine due to different digestive systems, the increasing focus on improving milk production, reducing methane emissions, and enhancing overall animal well-being is propelling the use of probiotics.

Aquaculture is an emerging segment with immense potential, especially for fish and shrimp farming. The intensive nature of aquaculture operations often leads to stress and disease outbreaks, making probiotics a valuable tool for disease prevention and improved growth performance. The "Other Aquaculture Species" sub-segment is expected to witness particularly rapid expansion as research into species-specific probiotics matures.

Key growth drivers across these dominant markets and segments include:

- Stringent Regulations on Antibiotics: European Union directives and national policies aimed at combating antimicrobial resistance are a primary catalyst for probiotic adoption.

- Growing Consumer Demand for Antibiotic-Free Products: This directly translates into higher demand for feed solutions that support animal health without relying on antibiotics.

- Focus on Animal Welfare and Health: Probiotics contribute to improved gut integrity, immune function, and overall animal well-being, aligning with societal expectations.

- Economic Benefits: Enhanced feed conversion ratios, reduced mortality rates, and improved growth performance translate into tangible economic benefits for farmers.

- Technological Advancements in Probiotic Strain Development: Continuous innovation in identifying and producing more effective and targeted probiotic strains enhances their appeal and application.

Europe Feed Probiotics Market Product Analysis

The Europe Feed Probiotics Market is characterized by a continuous stream of product innovations focused on enhancing efficacy, specificity, and ease of application. Companies are actively developing novel probiotic strains, often combinations of Lactobacilli, Bifidobacteria, and other beneficial bacteria, tailored for specific animal species and production stages. These advanced formulations aim to improve gut health, boost immune responses, enhance nutrient absorption, and mitigate the effects of stress and pathogens. Competitive advantages are being built on the scientific validation of these products, demonstrating clear improvements in growth performance, feed conversion ratios, and disease resistance in target animals such as poultry, swine, ruminants, and aquaculture species. The integration of probiotics into feed premixes and water-soluble formulations also enhances their market accessibility and adoption.

Key Drivers, Barriers & Challenges in Europe Feed Probiotics Market

The Europe Feed Probiotics Market is propelled by several key drivers, including increasing awareness of antimicrobial resistance (AMR) and the subsequent reduction in antibiotic use in animal agriculture. This regulatory push, coupled with growing consumer demand for antibiotic-free meat, dairy, and fish products, creates a significant market pull for probiotic solutions. Technological advancements in strain selection, fermentation, and formulation are leading to more effective and targeted products. Furthermore, the economic benefits derived from improved feed efficiency and reduced mortality rates incentivize adoption among farmers.

However, the market faces notable barriers and challenges. Regulatory hurdles, while encouraging the reduction of antibiotics, can also create complex approval processes for new probiotic strains and formulations, impacting time-to-market. Supply chain complexities, particularly for live microbial products, require careful management to ensure product viability and efficacy. The higher upfront cost of probiotics compared to traditional feed additives can also be a restraint, especially for smaller farms with tight margins. Competitive pressures from established antibiotic solutions and the need for extensive scientific validation to build trust among end-users remain significant challenges.

Growth Drivers in the Europe Feed Probiotics Market Market

The growth of the Europe Feed Probiotics Market is primarily driven by the escalating global concern over antimicrobial resistance (AMR) and the subsequent tightening of regulations on antibiotic usage in animal feed. This regulatory shift is a paramount catalyst, directly encouraging the adoption of alternative solutions like probiotics. Complementing this is a strong and evolving consumer preference for animal products free from antibiotic residues, pushing the demand for healthier and more sustainable farming practices. Technological advancements in identifying and producing highly specific and effective probiotic strains are continuously improving product performance and expanding their application across diverse animal species, including poultry, swine, ruminants, and aquaculture. The economic advantages of probiotics, such as enhanced feed conversion ratios, reduced mortality, and improved overall animal health, further solidify their appeal to farmers seeking to optimize profitability.

Challenges Impacting Europe Feed Probiotics Market Growth

Despite the robust growth potential, the Europe Feed Probiotics Market confronts several significant challenges that can impede its expansion. The intricate and often lengthy regulatory approval processes for new probiotic strains and products across different European countries present a considerable barrier, delaying market entry and increasing development costs. Ensuring the consistent viability and efficacy of live probiotic cultures throughout the complex feed supply chain, from manufacturing to farm application, remains a logistical challenge. Furthermore, the initial investment required for probiotics can be higher than that of conventional feed additives, potentially limiting adoption for some price-sensitive producers, especially in less economically developed regions. Building consistent trust and demonstrating tangible return on investment to a broad spectrum of farmers, who may be accustomed to traditional methods, requires sustained educational efforts and robust scientific evidence.

Key Players Shaping the Europe Feed Probiotics Market Market

- Marubeni Corporation (Orffa International Holding B V)

- MIAVIT Stefan Niemeyer Gmb

- DSM Nutritional Products AG

- Kemin Industries

- Evonik Industries AG

- Kerry Group Plc

- Cargill Inc

- CHR Hansen A/S

- IFF (Danisco Animal Nutrition)

- Adisseo

Significant Europe Feed Probiotics Market Industry Milestones

- October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries.

- July 2022: Kemin Industries has introduced Enterosure probiotic products to control the growth of pathogenic bacteria in poultry and livestock.

- July 2022: Cargill has extended its partnership with Innovafeed to provide aquafarmers with innovative and nutritious ingredients, including additives.

Future Outlook for Europe Feed Probiotics Market Market

The future outlook for the Europe Feed Probiotics Market is exceptionally promising, driven by persistent demand for sustainable and antibiotic-free animal protein production. Strategic opportunities lie in the continuous innovation of species-specific probiotic solutions that address emerging disease challenges and optimize animal performance. The integration of digital technologies for better monitoring and personalized nutrition will further enhance the value proposition of probiotics. The market is expected to witness further consolidation through strategic partnerships and acquisitions as companies aim to expand their product portfolios and geographical reach. Continued research into the gut microbiome and its intricate relationship with animal health will unlock new avenues for probiotic applications, solidifying their role as indispensable components in modern animal nutrition. The market's trajectory indicates sustained growth, with probiotics becoming an increasingly integral part of responsible and efficient animal farming across Europe.

Europe Feed Probiotics Market Segmentation

-

1. Sub Additive

- 1.1. Bifidobacteria

- 1.2. Enterococcus

- 1.3. Lactobacilli

- 1.4. Pediococcus

- 1.5. Streptococcus

- 1.6. Other Probiotics

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

Europe Feed Probiotics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

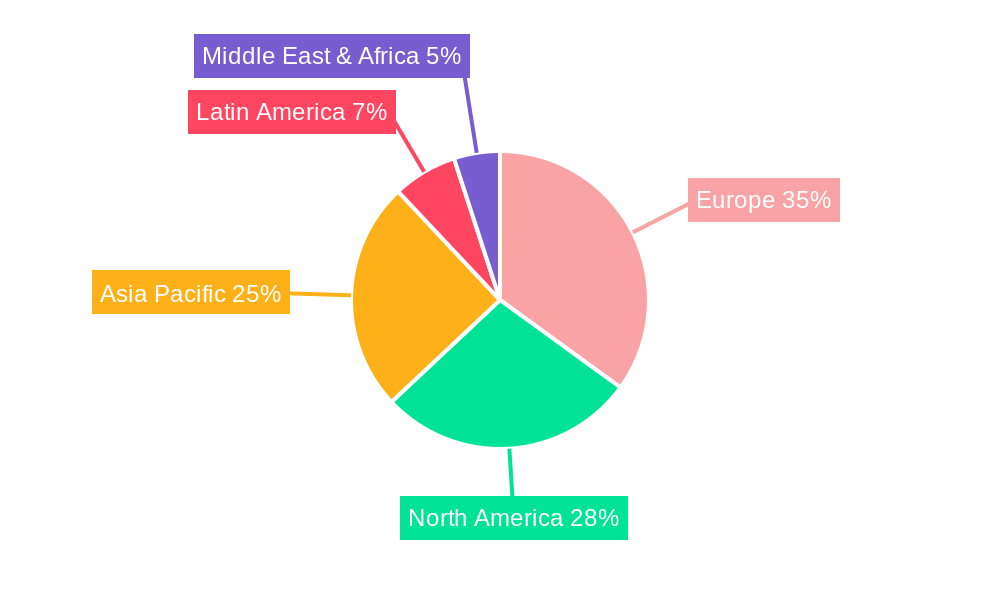

Europe Feed Probiotics Market Regional Market Share

Geographic Coverage of Europe Feed Probiotics Market

Europe Feed Probiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Feed Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Bifidobacteria

- 5.1.2. Enterococcus

- 5.1.3. Lactobacilli

- 5.1.4. Pediococcus

- 5.1.5. Streptococcus

- 5.1.6. Other Probiotics

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marubeni Corporation (Orffa International Holding B V )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MIAVIT Stefan Niemeyer Gmb

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DSM Nutritional Products AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kemin Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Evonik Industries AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Group Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cargill Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CHR Hansen A/S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Marubeni Corporation (Orffa International Holding B V )

List of Figures

- Figure 1: Europe Feed Probiotics Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Feed Probiotics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Feed Probiotics Market Revenue million Forecast, by Sub Additive 2020 & 2033

- Table 2: Europe Feed Probiotics Market Revenue million Forecast, by Animal 2020 & 2033

- Table 3: Europe Feed Probiotics Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Feed Probiotics Market Revenue million Forecast, by Sub Additive 2020 & 2033

- Table 5: Europe Feed Probiotics Market Revenue million Forecast, by Animal 2020 & 2033

- Table 6: Europe Feed Probiotics Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Feed Probiotics Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Feed Probiotics Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Europe Feed Probiotics Market?

Key companies in the market include Marubeni Corporation (Orffa International Holding B V ), MIAVIT Stefan Niemeyer Gmb, DSM Nutritional Products AG, Kemin Industries, Evonik Industries AG, Kerry Group Plc, Cargill Inc, CHR Hansen A/S, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the Europe Feed Probiotics Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD 661.9 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries.July 2022: Kemin Industries has introduced Enterosure probiotic products to control the growth of pathogenic bacteria in poultry and livestock.July 2022: Cargill has extended its partnership with Innovafeed to provide aquafarmers with innovative and nutritious ingredients, including additives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Feed Probiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Feed Probiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Feed Probiotics Market?

To stay informed about further developments, trends, and reports in the Europe Feed Probiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence