Key Insights

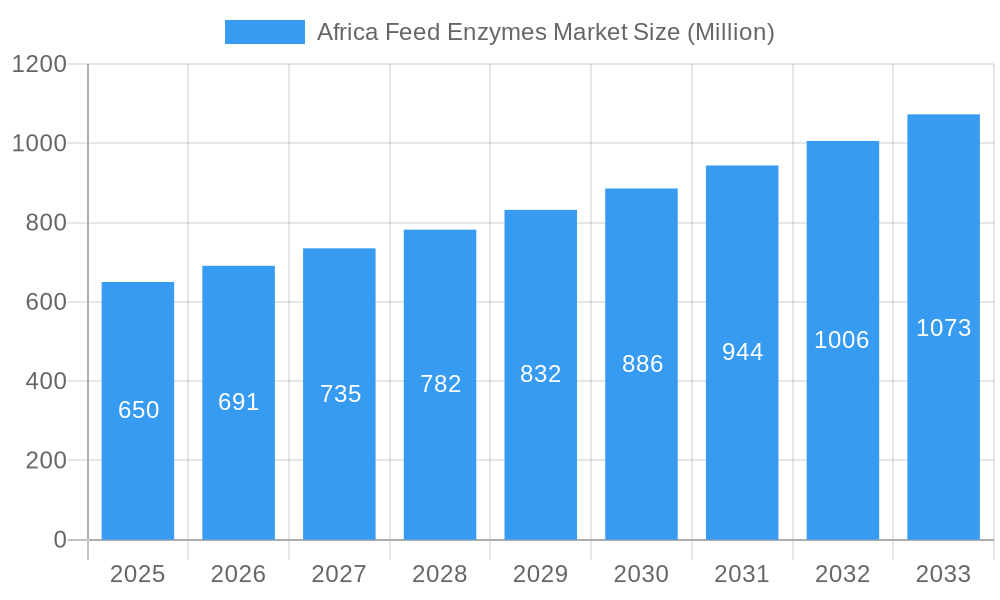

The African feed enzymes market is projected for substantial growth, expected to reach 69.99 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.28% through 2033. This expansion is driven by increasing demand for animal protein due to population growth and rising disposable incomes. Key drivers include the adoption of advanced animal nutrition for improved feed digestibility, nutrient absorption, and enhanced animal health and performance. The poultry sector is anticipated to dominate, leveraging enzyme benefits for broiler and layer feeds. Aquaculture presents a significant emerging area, focusing on sustainable and cost-effective feed solutions. Phytase enzyme adoption, crucial for phosphorus utilization and environmental benefit, is a notable trend.

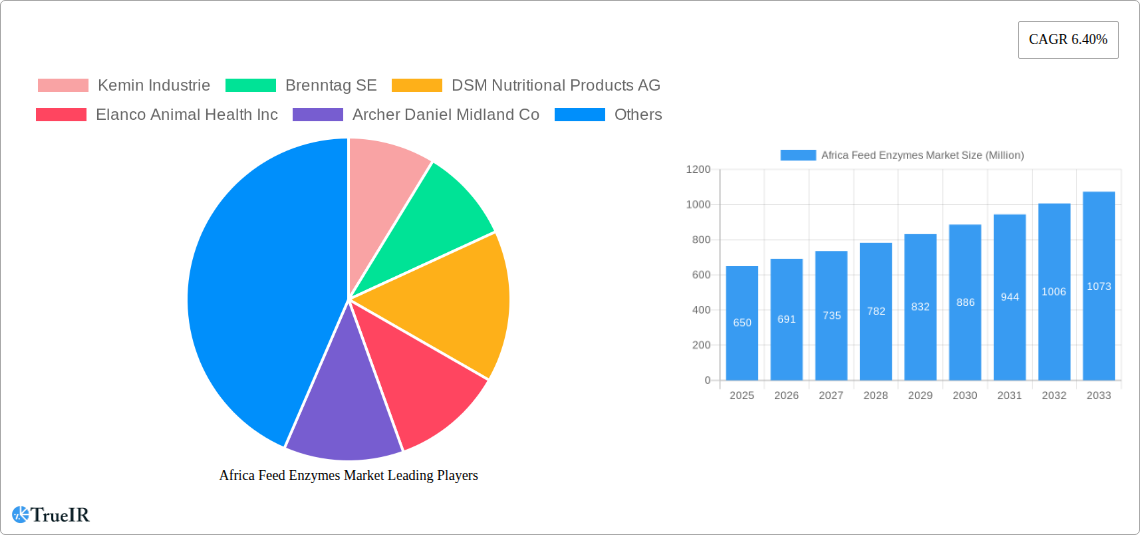

Africa Feed Enzymes Market Market Size (In Million)

Challenges include the high cost of enzyme formulations and limited regional awareness and technical expertise. Regulatory hurdles and generic product availability may also impact dynamics. However, continuous innovation in enzyme technology, including thermostable and effective formulations, coupled with government initiatives promoting modern livestock farming, are expected to mitigate these challenges. Companies are prioritizing strategic collaborations and product development tailored to the African market, emphasizing cost-efficiency and animal welfare.

Africa Feed Enzymes Market Company Market Share

Africa Feed Enzymes Market: Enhancing Sustainable Protein Production (2019-2033)

This report analyzes the dynamic Africa Feed Enzymes Market, its growth trajectory, key trends, and competitive landscape from 2019 to 2033. Valued at approximately 69.99 million in the base year 2025, the market is set for significant expansion, driven by the growing demand for efficient animal protein production, heightened awareness of animal welfare, and the necessity for sustainable agricultural practices across the continent. The report offers in-depth analysis of market segmentation by enzyme sub-additive, animal type, and geographical regions, providing critical insights into industry developments, competitive strategies, and future market outlook.

Africa Feed Enzymes Market Market Structure & Competitive Landscape

The Africa Feed Enzymes Market is characterized by a moderately concentrated structure, with several key global players vying for market share alongside emerging regional manufacturers. Innovation serves as a primary driver, with companies continuously investing in research and development to introduce novel enzyme solutions that enhance feed digestibility, nutrient absorption, and overall animal health. Regulatory impacts, while evolving, are increasingly favoring the adoption of feed enzymes due to their role in reducing environmental pollution and improving animal welfare. Product substitutes, such as improved feed formulations and feed additives, exist but often lack the specific, targeted benefits offered by enzymes. The end-user segmentation spans poultry, ruminants, swine, and aquaculture, each with distinct needs and growth potentials. Mergers and acquisitions (M&A) trends are evident as larger players seek to consolidate their market position, expand their product portfolios, and gain access to new geographical markets within Africa. For instance, XX M&A deals were recorded in the historical period (2019-2024), indicating a strategic consolidation drive. Concentration ratios suggest that the top 5 players hold approximately XX% of the market. The landscape is a blend of established multinational corporations and a growing number of local enterprises responding to specific African agricultural challenges.

Africa Feed Enzymes Market Market Trends & Opportunities

The Africa Feed Enzymes Market is experiencing a robust expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This growth is underpinned by a confluence of critical trends and emerging opportunities. The increasing global and regional demand for affordable and sustainable animal protein sources is a primary catalyst, directly fueling the need for more efficient animal feed formulations, where enzymes play a pivotal role in maximizing nutrient utilization and reducing feed waste. Technological advancements in enzyme production, including genetic engineering and fermentation processes, are leading to the development of more potent, specific, and cost-effective enzyme solutions. This includes the emergence of multi-enzyme products that address a broader range of nutritional challenges.

Consumer preferences are also shifting, with a growing emphasis on ethically produced and environmentally sustainable animal products. Feed enzymes contribute significantly to this by reducing the environmental footprint of livestock farming, primarily through decreased nitrogen and phosphorus excretion. The competitive dynamics are intensifying, marked by strategic partnerships, product innovations, and market penetration efforts by both global and local players. Opportunities abound for companies that can offer tailored enzyme solutions addressing specific African feedstuffs and animal husbandry practices. For instance, the high prevalence of fibrous feed ingredients in some African regions presents a significant opportunity for carbohydrase enzymes.

Furthermore, the expansion of the aquaculture sector across many African nations opens a substantial new market for specialized feed enzymes designed to improve feed conversion ratios and disease resistance in fish and shrimp. The growing middle class in Africa, with its increasing disposable income, is driving higher consumption of meat and dairy products, thus boosting the demand for animal feed and, consequently, feed enzymes. The drive towards vertical integration within the African animal feed industry also presents an opportunity for feed enzyme suppliers to establish stronger relationships with feed millers and integrators. Market penetration rates for feed enzymes, while still lower than in developed regions, are steadily increasing, indicating significant untapped potential.

The development of advanced enzyme formulations that can withstand varying processing conditions and storage temperatures in diverse African climates is another key trend. Moreover, the increasing focus on animal gut health and immunity, driven by research linking gut microbiome to overall animal well-being and productivity, is creating demand for enzymes that can modulate the gut environment and enhance immune responses. The potential to leverage digital technologies for precision feeding and customized enzyme application represents a future opportunity to further optimize animal nutrition and farm profitability.

Dominant Markets & Segments in Africa Feed Enzymes Market

The Africa Feed Enzymes Market exhibits clear dominance within specific segments, driven by prevailing agricultural practices, economic factors, and regional demand patterns.

Dominant Animal Segment:

- Poultry: This segment consistently holds the largest market share within Africa, driven by its rapid growth cycles, relatively lower capital investment requirements compared to other livestock, and widespread adoption across both commercial and smallholder farming systems.

- Broiler: The high demand for chicken meat, a readily available and affordable protein source, makes broiler production a cornerstone of African animal agriculture. Feed enzymes, particularly phytases and carbohydrases, are crucial for optimizing feed efficiency, reducing feed costs, and improving growth rates in broilers.

- Layer: With the increasing demand for eggs as a dietary staple, the layer segment also represents a significant market. Enzymes that enhance calcium and phosphorus utilization and improve overall hen health contribute to sustained egg production and quality.

- Other Poultry Birds: This includes turkeys and ducks, which are gaining traction in certain regions and contribute to the overall poultry segment's growth.

Dominant Enzyme Sub-Additive Segment:

- Phytases: These enzymes are paramount due to the high reliance on plant-based feed ingredients like maize and soybean meal, which are rich in phytate phosphorus. Phytases unlock this unavailable phosphorus, reducing the need for inorganic phosphate supplementation, thereby lowering feed costs and mitigating phosphorus pollution in the environment. The widespread use of phytase is a key growth driver.

- Carbohydrases: With the significant use of cereal grains as feed ingredients, carbohydrases (e.g., xylanases, beta-glucanases) are essential for breaking down non-starch polysaccharides (NSPs). This improves the digestibility of feed, reduces gut viscosity, and enhances nutrient absorption, leading to improved animal performance.

Dominant Geographic Region/Country:

- Southern Africa (e.g., South Africa, Nigeria): These regions often exhibit more developed commercial livestock industries, greater adoption of modern farming technologies, and established feed manufacturing sectors, leading to higher demand for feed enzymes. Significant investments in animal protein production infrastructure and favorable policies supporting agricultural modernization contribute to their dominance. The presence of larger integrated feed operations and a more sophisticated understanding of animal nutrition further bolster demand.

- North Africa (e.g., Egypt, Morocco): Driven by a growing population and rising disposable incomes, these countries are witnessing an expansion in their poultry and ruminant sectors, creating a substantial market for feed enzymes. Government initiatives aimed at enhancing food security and promoting livestock production also play a crucial role.

Key Growth Drivers in Dominant Segments:

- Poultry: Increasing demand for affordable protein, rapid flock turnover, and the need to optimize feed conversion ratios.

- Phytases: High phosphorus content in common African feed ingredients, rising costs of inorganic phosphorus, and environmental regulations.

- Carbohydrases: Widespread use of cereals, benefits in improving gut health and nutrient utilization, and reducing anti-nutritional factors.

- Southern/North Africa: Commercialization of livestock farming, technological adoption, government support for agriculture, and growing consumer demand for animal products.

Africa Feed Enzymes Market Product Analysis

Product innovation in the Africa Feed Enzymes Market is heavily focused on enhancing the efficacy and application of enzymes tailored to African feedstuffs and farming conditions. Key advancements include the development of multi-enzyme formulations that address a wider spectrum of nutritional challenges, improving the digestibility of complex carbohydrates, proteins, and phytates simultaneously. Novel enzyme preparations are also being engineered for improved thermostability, ensuring their efficacy through feed processing stages like pelleting. Companies are also introducing enzyme solutions that support animal gut health, boost immune responses, and reduce the environmental impact of livestock by optimizing nutrient utilization. These innovations offer significant competitive advantages by enabling more cost-effective and sustainable animal protein production across the continent.

Key Drivers, Barriers & Challenges in Africa Feed Enzymes Market

Key Drivers:

- Growing Demand for Animal Protein: Africa's burgeoning population and rising middle class are significantly increasing the demand for meat, dairy, and eggs, necessitating more efficient animal production.

- Economic Feed Conversion: Feed enzymes are crucial for improving the digestibility of feed, allowing animals to extract more nutrients, thereby reducing feed costs and increasing farm profitability. This is a major economic driver.

- Focus on Sustainability: Enzymes contribute to sustainable agriculture by reducing nutrient excretion (e.g., phosphorus, nitrogen), thereby minimizing environmental pollution and the reliance on inorganic nutrient supplements.

- Technological Advancements: Continuous research and development are leading to more effective and specific enzyme solutions, expanding their applicability and benefits.

Barriers & Challenges:

- Cost Sensitivity: Despite the long-term economic benefits, the initial cost of feed enzymes can be a barrier for smallholder farmers with limited capital.

- Awareness and Education: A lack of awareness and understanding regarding the benefits of feed enzymes among some farmers and feed millers can hinder adoption.

- Regulatory Frameworks: Inconsistent or underdeveloped regulatory frameworks for feed additives across different African countries can pose challenges for market entry and standardization.

- Supply Chain and Distribution: Establishing robust and efficient supply chains to deliver enzymes to remote agricultural regions across the vast African continent can be complex and costly.

- Feed Quality Variability: The inconsistent quality and composition of raw feed ingredients across different regions can impact the efficacy of enzyme formulations, requiring adaptable solutions.

Growth Drivers in the Africa Feed Enzymes Market Market

The Africa Feed Enzymes Market is propelled by several key growth drivers. Technologically, the development of more potent and application-specific enzymes, including multi-enzyme formulations and enzymes targeting specific gut health benefits, is expanding the market's potential. Economically, the escalating demand for animal protein, coupled with the need to improve feed conversion ratios and reduce feed costs for enhanced farm profitability, directly translates into increased demand for feed enzymes. Policy-driven factors, such as government initiatives aimed at boosting food security, promoting sustainable agriculture, and improving livestock productivity, are creating a more favorable market environment. For instance, policies encouraging reduced reliance on imported feed supplements indirectly favor the adoption of feed enzymes that improve nutrient utilization from local feedstuffs.

Challenges Impacting Africa Feed Enzymes Market Growth

Several barriers and restraints challenge the growth of the Africa Feed Enzymes Market. Regulatory complexities and the lack of harmonized standards for feed additives across various African nations can impede market access and product registration. Supply chain issues, including logistical challenges in reaching remote agricultural areas and the risk of product degradation due to temperature fluctuations, pose significant hurdles. Competitive pressures from established global players and the emergence of local manufacturers offering lower-cost alternatives also impact market dynamics. Furthermore, the price sensitivity of many African farmers, especially smallholders, can make the adoption of feed enzymes difficult, even when long-term economic benefits are evident.

Key Players Shaping the Africa Feed Enzymes Market Market

- Kemin Industries

- Brenntag SE

- DSM Nutritional Products AG

- Elanco Animal Health Inc

- Archer Daniel Midland Co

- BASF SE

- Alltech Inc

- Cargill Inc

- IFF (Danisco Animal Nutrition)

- Adisseo

Significant Africa Feed Enzymes Market Industry Milestones

- January 2022: DSM-Novozymes alliance introduced Hiphorius, a next-generation phytase designed to support profitable and sustainable protein output for poultry producers.

- December 2021: BASF and Cargill expanded their animal nutrition partnership, extending into additional markets and enhancing research, development, and feed enzyme distribution agreements.

- December 2021: BASF launched Natupulse TS, an enzyme product for animal feed aimed at improving feed digestibility and promoting more sustainable production practices.

Future Outlook for Africa Feed Enzymes Market Market

The future outlook for the Africa Feed Enzymes Market is exceptionally promising, driven by sustained growth catalysts. The projected increase in demand for animal protein will remain a primary growth engine. Strategic opportunities lie in developing and marketing enzyme solutions tailored to the unique African feed matrix, addressing specific nutritional deficiencies and anti-nutritional factors present in local ingredients. Market penetration will be further enhanced by increased farmer education and extension services demonstrating the economic and sustainability benefits of enzyme supplementation. The growing emphasis on animal welfare and the reduction of environmental impact from livestock farming will also fuel demand for advanced enzyme technologies. Investments in local production and distribution networks are expected to play a crucial role in unlocking the vast market potential across the continent.

Africa Feed Enzymes Market Segmentation

-

1. Sub Additive

- 1.1. Carbohydrases

- 1.2. Phytases

- 1.3. Other Enzymes

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Beef Cattle

- 2.3.2. Dairy Cattle

- 2.3.3. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

Africa Feed Enzymes Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Feed Enzymes Market Regional Market Share

Geographic Coverage of Africa Feed Enzymes Market

Africa Feed Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Feed Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Carbohydrases

- 5.1.2. Phytases

- 5.1.3. Other Enzymes

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Beef Cattle

- 5.2.3.2. Dairy Cattle

- 5.2.3.3. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kemin Industrie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brenntag SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DSM Nutritional Products AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Elanco Animal Health Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniel Midland Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alltech Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cargill Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kemin Industrie

List of Figures

- Figure 1: Africa Feed Enzymes Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Africa Feed Enzymes Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Feed Enzymes Market Revenue million Forecast, by Sub Additive 2020 & 2033

- Table 2: Africa Feed Enzymes Market Revenue million Forecast, by Animal 2020 & 2033

- Table 3: Africa Feed Enzymes Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Africa Feed Enzymes Market Revenue million Forecast, by Sub Additive 2020 & 2033

- Table 5: Africa Feed Enzymes Market Revenue million Forecast, by Animal 2020 & 2033

- Table 6: Africa Feed Enzymes Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Feed Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Feed Enzymes Market?

The projected CAGR is approximately 3.28%.

2. Which companies are prominent players in the Africa Feed Enzymes Market?

Key companies in the market include Kemin Industrie, Brenntag SE, DSM Nutritional Products AG, Elanco Animal Health Inc, Archer Daniel Midland Co, BASF SE, Alltech Inc, Cargill Inc, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the Africa Feed Enzymes Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.99 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

January 2022: Hiphorius is a new generation of phytase introduced by the DSM-Novozymes alliance. It is a comprehensive phytase solution created to assist poultry producers in achieving lucrative and sustainable protein output.December 2021: BASF and Cargill extended their animal nutrition partnership by introducing additional markets, research and development capabilities, and feed enzymes distribution agreements.December 2021: BASF launched Natupulse TS, an enzyme product for animal feed that increases the feed's digestibility and ensures a more sustainable production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Feed Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Feed Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Feed Enzymes Market?

To stay informed about further developments, trends, and reports in the Africa Feed Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence