Key Insights

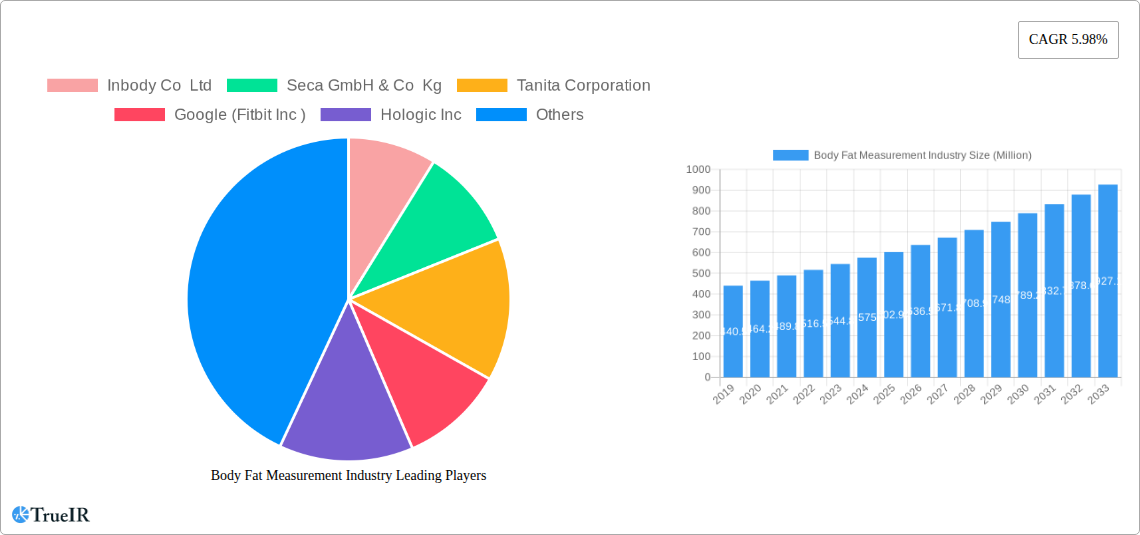

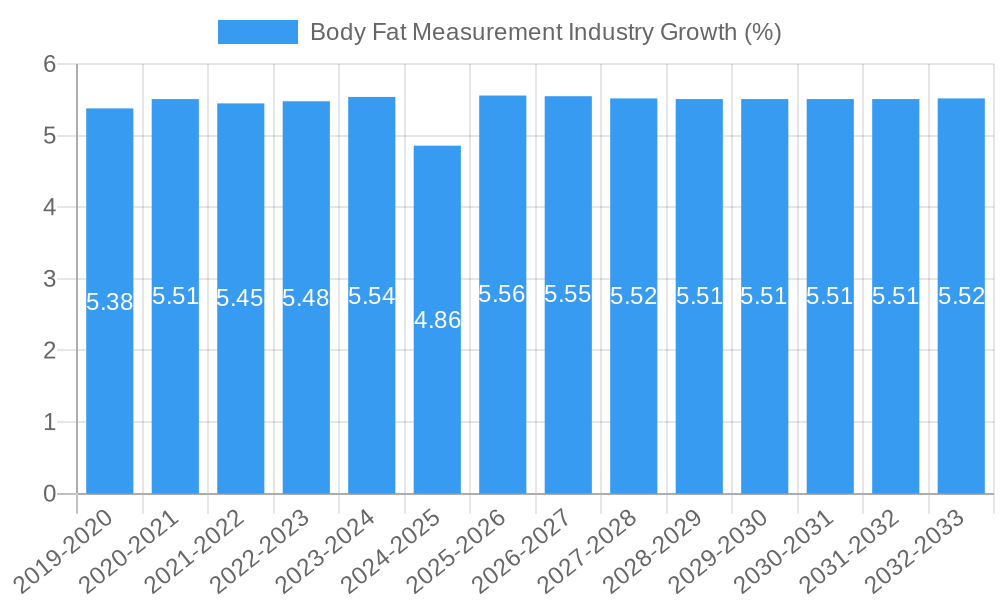

The global Body Fat Measurement Industry is poised for robust expansion, projected to reach a significant market size of USD 602.94 million. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 5.98% over the forecast period of 2025-2033. A primary driver for this upward trajectory is the escalating global awareness surrounding health and wellness, leading individuals to increasingly monitor their body composition beyond mere weight. This is further fueled by the rising prevalence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions, prompting a greater demand for accurate body fat assessment tools among both consumers and healthcare professionals. The integration of advanced technologies, including bio-impedance analysis and dual-energy X-ray absorptiometry (DXA), into user-friendly devices is democratizing access to sophisticated body composition analysis, making it more accessible for personal use in fitness clubs, wellness centers, and even at home. The growing emphasis on personalized fitness and nutrition plans, backed by data-driven insights from body fat measurements, is also a significant contributor to market expansion.

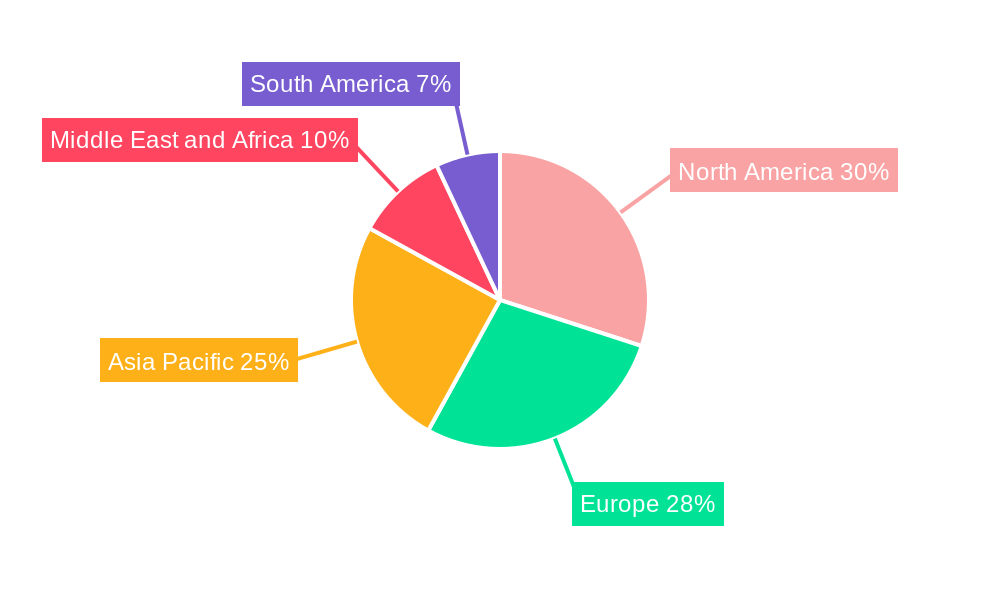

The market is segmented by product type, with Bio-impedance Analyzers leading the pack due to their accuracy, affordability, and ease of use. Other prominent segments include Skinfold Calipers and Hydrostatic Weighing Equipment, catering to different user needs and budget considerations. Air Displacement Plethysmography and DXA systems represent premium options, often found in clinical and research settings where high precision is paramount. End-user adoption is widespread, with Hospitals and Academic and Research Centers leveraging these technologies for clinical diagnosis and scientific studies, while Fitness Clubs and Wellness Centers are integrating them to offer comprehensive client assessments and personalized training programs. The United States is expected to be a dominant force in North America, mirroring global trends, while Europe and Asia Pacific, particularly China and India, are anticipated to exhibit substantial growth driven by increasing disposable incomes and heightened health consciousness. Despite the promising outlook, certain restraints, such as the initial cost of advanced equipment for some end-users and the need for standardized protocols for consistent results across different devices, may slightly temper the pace of growth in specific segments.

This comprehensive body fat measurement industry report provides an in-depth analysis of the global market, encompassing a bio-impedance analyzer market deep dive, body composition analysis trends, and the burgeoning fitness technology market. Leveraging high-volume keywords such as "body fat percentage calculator," "lean body mass measurement," and "health and wellness devices," this report is meticulously optimized for search engines, ensuring maximum visibility for industry professionals, researchers, and investors seeking actionable intelligence.

The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, building upon a robust historical period of 2019–2024. Expect to find detailed insights into market size, segmentation, competitive landscape, technological advancements, and future growth trajectories. This report is designed for immediate use without any further modification.

Body Fat Measurement Industry Market Structure & Competitive Landscape

The body fat measurement industry exhibits a moderately consolidated market structure, with leading players like Inbody Co Ltd, Seca GmbH & Co Kg, and Tanita Corporation holding significant market share. Innovation remains a primary driver, fueled by ongoing advancements in bio-impedance analysis (BIA) technology, leading to more accurate, accessible, and user-friendly devices. Regulatory impacts are gradually increasing, particularly concerning data privacy and medical device certifications, influencing product development and market entry strategies. Product substitutes, while present in the form of less precise methods, are increasingly being outpaced by the technological sophistication and data richness offered by advanced body composition analyzers.

The end-user segmentation reveals a strong demand from fitness clubs and wellness centers, driven by the growing consumer focus on health and personalized fitness plans. Hospitals are also significant adopters, utilizing these devices for patient monitoring and treatment efficacy assessment. Academic and research centers leverage these tools for in-depth physiological studies. Mergers and acquisitions (M&A) are an emerging trend, as larger companies seek to expand their product portfolios and geographical reach, consolidating the market and driving further innovation. The overall concentration ratio is estimated to be around 60% held by the top five players.

Body Fat Measurement Industry Market Trends & Opportunities

The global body fat measurement market is experiencing robust growth, projected to reach an estimated value of $3.5 Billion by 2025, with a projected compound annual growth rate (CAGR) of 12.5% from 2025 to 2033. This expansion is underpinned by a confluence of evolving consumer preferences, technological innovation, and increasing health consciousness worldwide. Consumers are no longer solely focused on weight loss but are increasingly interested in understanding their overall body composition, including lean body mass, body water percentage, and visceral fat levels. This shift in perspective is driving demand for sophisticated and accurate body composition analysis tools beyond traditional scales.

Technological advancements are at the forefront of market evolution. Bio-impedance analysis (BIA) technology continues to be refined, offering improved accuracy and portability. Innovations in sensor technology, data analytics, and connectivity are enhancing the user experience and enabling seamless integration with other health and fitness platforms. Wearable devices incorporating advanced body composition monitoring capabilities are gaining traction, offering continuous insights into an individual's health metrics. This trend is significantly impacting the wearable fitness tracker market and expanding the reach of body fat measurement devices into everyday life.

The competitive landscape is dynamic, with established players continuously innovating and new entrants emerging, particularly from the technology sector, such as Google (Fitbit Inc.). The growing emphasis on preventative healthcare and personalized wellness plans presents substantial opportunities for market players. The integration of AI and machine learning for data interpretation and personalized recommendations further amplifies the value proposition of these devices. Emerging markets, particularly in Asia-Pacific and Latin America, are poised for significant growth due to rising disposable incomes, increasing awareness of health issues, and a growing middle class actively seeking health and fitness solutions. The market penetration rate for advanced body fat measurement devices, currently at approximately 15%, is expected to climb significantly as affordability and accessibility improve.

Dominant Markets & Segments in Body Fat Measurement Industry

The bio-impedance analyzer (BIA) segment is the undisputed leader within the body fat measurement industry, accounting for over 65% of the global market revenue in 2025. This dominance stems from the technology's inherent advantages: non-invasiveness, relative affordability, ease of use, and progressively improving accuracy. BIA devices are now capable of providing detailed breakdowns of body composition, including muscle mass, fat mass, bone mass, and total body water, making them a versatile tool for various end-users.

Product:

- Bio-impedance Analyzer: Leading segment due to technological advancements and broad applicability.

- Skinfold Calipers: Still relevant in specialized fields like sports science, but declining in broader consumer and clinical markets due to user dependency and lower precision.

- Hydrostatic Weighing Equipment: Highly accurate but expensive and time-consuming, limiting its use to research and specialized clinical settings.

- Air Displacement Plethysmography (Bod Pod): Offers high accuracy and speed, but cost and size remain barriers for widespread adoption.

- Dual Energy X-ray Absorptiometry (DXA): Considered the gold standard for bone density and body composition, but its high cost and radiation exposure restrict it primarily to medical and advanced research facilities.

End User:

- Fitness Clubs and Wellness Centers: This segment represents a substantial growth engine, driven by the increasing consumer demand for personalized fitness programs and health monitoring. The ability of BIA devices to provide actionable data for trainers and clients makes them indispensable in these settings. The market size for this segment is projected to reach $1.2 Billion by 2025.

- Hospitals: The healthcare sector utilizes body composition analysis for patient diagnostics, monitoring chronic conditions like obesity and metabolic syndrome, and assessing nutritional status. The accuracy and reliability of BIA devices are crucial for clinical decision-making.

- Academic and Research Centers: These institutions are crucial for validating new technologies and understanding the long-term health implications of body composition, driving innovation and scientific advancement.

- Other End Users: This category includes home users, corporate wellness programs, and athletic organizations, all contributing to the diversified growth of the market.

Geographically, North America continues to be the largest market for body fat measurement devices, driven by a well-established fitness culture, high disposable incomes, and early adoption of health technologies. However, the Asia-Pacific region is emerging as the fastest-growing market, fueled by rising health awareness, increasing prevalence of lifestyle diseases, and significant government initiatives promoting healthcare infrastructure. The market size in Asia-Pacific is expected to witness a CAGR of 15.8% during the forecast period.

Body Fat Measurement Industry Product Analysis

The body fat measurement industry is characterized by continuous product innovation, primarily centered around enhancing the accuracy, portability, and data analytics capabilities of bio-impedance analyzers (BIA). These devices now offer multi-frequency BIA for deeper tissue penetration and more precise measurements of intracellular and extracellular water. Advanced algorithms are being integrated to provide more detailed insights, such as segmental body composition analysis (e.g., arms, legs, trunk) and estimations of muscle quality. The application of these products extends beyond simple fat percentage calculation, aiding in the assessment of hydration levels, metabolic health, and even nutritional deficiencies. Competitive advantages are increasingly derived from user-friendly interfaces, seamless integration with mobile applications for data tracking and visualization, and clinical validation that attests to their reliability in various healthcare and fitness settings.

Key Drivers, Barriers & Challenges in Body Fat Measurement Industry

Key Drivers:

- Rising Health and Wellness Consciousness: A global surge in awareness about the detrimental effects of obesity and related chronic diseases (diabetes, cardiovascular disease) is a primary market driver. Consumers are actively seeking tools to monitor their health proactively.

- Technological Advancements in BIA: Continuous improvements in BIA technology, leading to more accurate, affordable, and user-friendly devices, are making these tools accessible to a broader population.

- Growth of the Fitness and Wellness Sector: The expanding fitness industry, including gyms, personal training, and wellness centers, creates a strong demand for body composition analysis to guide personalized fitness and nutrition plans.

- Increasing Prevalence of Lifestyle Diseases: The global rise in conditions like obesity, type 2 diabetes, and cardiovascular diseases necessitates better monitoring tools, positioning body fat measurement devices as crucial diagnostic and tracking aids.

Barriers and Challenges:

- Accuracy Concerns and Calibration Issues: While improving, the accuracy of some BIA devices can still be influenced by factors like hydration levels, food intake, and ambient temperature, leading to potential user skepticism.

- Regulatory Hurdles: Obtaining medical device certifications in different regions can be a time-consuming and costly process, especially for new market entrants.

- Cost of Advanced Technologies: While BIA is becoming more affordable, advanced technologies like DXA and Air Displacement Plethysmography remain expensive, limiting their widespread adoption.

- Data Privacy and Security: As devices collect sensitive personal health data, ensuring robust data privacy and security measures is paramount to maintaining user trust and compliance with regulations like GDPR and HIPAA. The cost associated with ensuring these measures can be a significant barrier for smaller companies.

Growth Drivers in the Body Fat Measurement Industry Market

The body fat measurement industry market is propelled by several key drivers. The escalating global focus on preventative healthcare and proactive health management significantly fuels demand for personal health monitoring devices. Technological innovation, particularly in bio-impedance analysis (BIA), is making devices more accurate, user-friendly, and accessible, driving adoption across consumer and professional markets. The burgeoning fitness and wellness sector, with its emphasis on personalized training and nutrition, provides a strong ecosystem for body composition analysis tools. Furthermore, increasing awareness of the link between body fat percentage and chronic diseases is compelling individuals to invest in solutions that offer detailed health insights.

Challenges Impacting Body Fat Measurement Industry Growth

Despite robust growth, the body fat measurement industry faces several challenges. Achieving consistent accuracy across diverse user populations and environmental conditions remains a persistent technical challenge for bio-impedance analyzers (BIA). Regulatory complexities and the need for compliance with evolving healthcare standards in different geographical regions can slow down market penetration and product development. Supply chain disruptions, exacerbated by global events, can impact manufacturing timelines and product availability, potentially leading to increased costs. Intense competitive pressures, especially from new entrants offering innovative yet potentially unproven technologies, necessitate continuous investment in research and development and robust marketing strategies to maintain market share.

Key Players Shaping the Body Fat Measurement Industry Market

- Inbody Co Ltd

- Seca GmbH & Co Kg

- Tanita Corporation

- Google (Fitbit Inc.)

- Hologic Inc

- Cosmed Srl

- Withings

- Koninklijke Philips NV

- EatSmart Inc

- Omron Healthcare Inc

- Charder Electronic Co Ltd

- Bodystat Ltd

Significant Body Fat Measurement Industry Industry Milestones

- January 2023: InBody reported supplying body composition analysis devices to the United States Marine Corps. The company will provide InBody's bioelectrical impedance analysis (BIA) technology devices to assess the fitness of marines, highlighting the growing adoption in professional and governmental sectors.

- April 2022: InBody, a company specializing in body composition technology, launched the BWA 2.0 body water analyzer, which provides data on how body composition and body water affect well-being, showcasing product innovation focused on holistic health metrics.

Future Outlook for Body Fat Measurement Industry Market

- January 2023: InBody reported supplying body composition analysis devices to the United States Marine Corps. The company will provide InBody's bioelectrical impedance analysis (BIA) technology devices to assess the fitness of marines, highlighting the growing adoption in professional and governmental sectors.

- April 2022: InBody, a company specializing in body composition technology, launched the BWA 2.0 body water analyzer, which provides data on how body composition and body water affect well-being, showcasing product innovation focused on holistic health metrics.

Future Outlook for Body Fat Measurement Industry Market

The future outlook for the body fat measurement industry is exceptionally bright, driven by continued technological advancements and a global shift towards personalized health and wellness. The integration of AI and machine learning will further enhance data interpretation, offering predictive insights and personalized recommendations, thereby increasing the value proposition for end-users. The proliferation of smart home devices and wearables will embed body composition monitoring seamlessly into daily life, expanding the consumer health tech market. Emerging economies present significant untapped potential, as increasing disposable incomes and growing health awareness drive demand for advanced health monitoring solutions. Strategic partnerships between technology providers, healthcare institutions, and fitness organizations will be crucial for market expansion and the development of integrated health ecosystems.

Body Fat Measurement Industry Segmentation

-

1. Product

- 1.1. Bio-impedance Analyzer

- 1.2. Skinfold Calipers

- 1.3. Hydrostatic Weighing Equipment

- 1.4. Air Displacement Plethysmography

- 1.5. Dual Energy X-ray Absorptiometry

- 1.6. Other Products

-

2. End User

- 2.1. Hospitals

- 2.2. Fitness Clubs and Wellness Centers

- 2.3. Academic and Research Centers

- 2.4. Other End Users

Body Fat Measurement Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Body Fat Measurement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Large Pool of Obese Patients and Increasing Prevalence of Metabolic Disorders; Technological Advancements; Rising Awareness for Health and Fitness

- 3.3. Market Restrains

- 3.3.1. High Equipment Costs; Inconsistency and Inaccuracy in Different Analyzers

- 3.4. Market Trends

- 3.4.1. The Bio-impedance Analyzer Segment is Expected to Hold a Significant Market Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bio-impedance Analyzer

- 5.1.2. Skinfold Calipers

- 5.1.3. Hydrostatic Weighing Equipment

- 5.1.4. Air Displacement Plethysmography

- 5.1.5. Dual Energy X-ray Absorptiometry

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Fitness Clubs and Wellness Centers

- 5.2.3. Academic and Research Centers

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Bio-impedance Analyzer

- 6.1.2. Skinfold Calipers

- 6.1.3. Hydrostatic Weighing Equipment

- 6.1.4. Air Displacement Plethysmography

- 6.1.5. Dual Energy X-ray Absorptiometry

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Fitness Clubs and Wellness Centers

- 6.2.3. Academic and Research Centers

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Bio-impedance Analyzer

- 7.1.2. Skinfold Calipers

- 7.1.3. Hydrostatic Weighing Equipment

- 7.1.4. Air Displacement Plethysmography

- 7.1.5. Dual Energy X-ray Absorptiometry

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Fitness Clubs and Wellness Centers

- 7.2.3. Academic and Research Centers

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Bio-impedance Analyzer

- 8.1.2. Skinfold Calipers

- 8.1.3. Hydrostatic Weighing Equipment

- 8.1.4. Air Displacement Plethysmography

- 8.1.5. Dual Energy X-ray Absorptiometry

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Fitness Clubs and Wellness Centers

- 8.2.3. Academic and Research Centers

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Bio-impedance Analyzer

- 9.1.2. Skinfold Calipers

- 9.1.3. Hydrostatic Weighing Equipment

- 9.1.4. Air Displacement Plethysmography

- 9.1.5. Dual Energy X-ray Absorptiometry

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Fitness Clubs and Wellness Centers

- 9.2.3. Academic and Research Centers

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Bio-impedance Analyzer

- 10.1.2. Skinfold Calipers

- 10.1.3. Hydrostatic Weighing Equipment

- 10.1.4. Air Displacement Plethysmography

- 10.1.5. Dual Energy X-ray Absorptiometry

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Fitness Clubs and Wellness Centers

- 10.2.3. Academic and Research Centers

- 10.2.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Body Fat Measurement Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Inbody Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Seca GmbH & Co Kg

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Tanita Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Google (Fitbit Inc )

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hologic Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cosmed Srl

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Withings

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Koninklijke Philips NV

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 EatSmart Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Omron Healthcare Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Charder Electronic Co Ltd*List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Bodystat Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Inbody Co Ltd

List of Figures

- Figure 1: Global Body Fat Measurement Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Body Fat Measurement Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Body Fat Measurement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Body Fat Measurement Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Body Fat Measurement Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Body Fat Measurement Industry Revenue (Million), by Product 2024 & 2032

- Figure 19: Europe Body Fat Measurement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 20: Europe Body Fat Measurement Industry Revenue (Million), by End User 2024 & 2032

- Figure 21: Europe Body Fat Measurement Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Body Fat Measurement Industry Revenue (Million), by Product 2024 & 2032

- Figure 25: Asia Pacific Body Fat Measurement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: Asia Pacific Body Fat Measurement Industry Revenue (Million), by End User 2024 & 2032

- Figure 27: Asia Pacific Body Fat Measurement Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Pacific Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Body Fat Measurement Industry Revenue (Million), by Product 2024 & 2032

- Figure 31: Middle East and Africa Body Fat Measurement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 32: Middle East and Africa Body Fat Measurement Industry Revenue (Million), by End User 2024 & 2032

- Figure 33: Middle East and Africa Body Fat Measurement Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East and Africa Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Body Fat Measurement Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: South America Body Fat Measurement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: South America Body Fat Measurement Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: South America Body Fat Measurement Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: South America Body Fat Measurement Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Body Fat Measurement Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Body Fat Measurement Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Body Fat Measurement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Body Fat Measurement Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Body Fat Measurement Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Body Fat Measurement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 32: Global Body Fat Measurement Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 33: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Body Fat Measurement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 38: Global Body Fat Measurement Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 39: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Body Fat Measurement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 47: Global Body Fat Measurement Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Body Fat Measurement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 56: Global Body Fat Measurement Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 57: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Body Fat Measurement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 62: Global Body Fat Measurement Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 63: Global Body Fat Measurement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Body Fat Measurement Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Body Fat Measurement Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Body Fat Measurement Industry?

Key companies in the market include Inbody Co Ltd, Seca GmbH & Co Kg, Tanita Corporation, Google (Fitbit Inc ), Hologic Inc, Cosmed Srl, Withings, Koninklijke Philips NV, EatSmart Inc, Omron Healthcare Inc, Charder Electronic Co Ltd*List Not Exhaustive, Bodystat Ltd.

3. What are the main segments of the Body Fat Measurement Industry?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 602.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Large Pool of Obese Patients and Increasing Prevalence of Metabolic Disorders; Technological Advancements; Rising Awareness for Health and Fitness.

6. What are the notable trends driving market growth?

The Bio-impedance Analyzer Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

High Equipment Costs; Inconsistency and Inaccuracy in Different Analyzers.

8. Can you provide examples of recent developments in the market?

January 2023: InBody reported supplying body composition analysis devices to the United States Marine Corps. The company will provide InBody's bioelectrical impedance analysis (BIA) technology devices to assess the fitness of marines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Body Fat Measurement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Body Fat Measurement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Body Fat Measurement Industry?

To stay informed about further developments, trends, and reports in the Body Fat Measurement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence