Key Insights

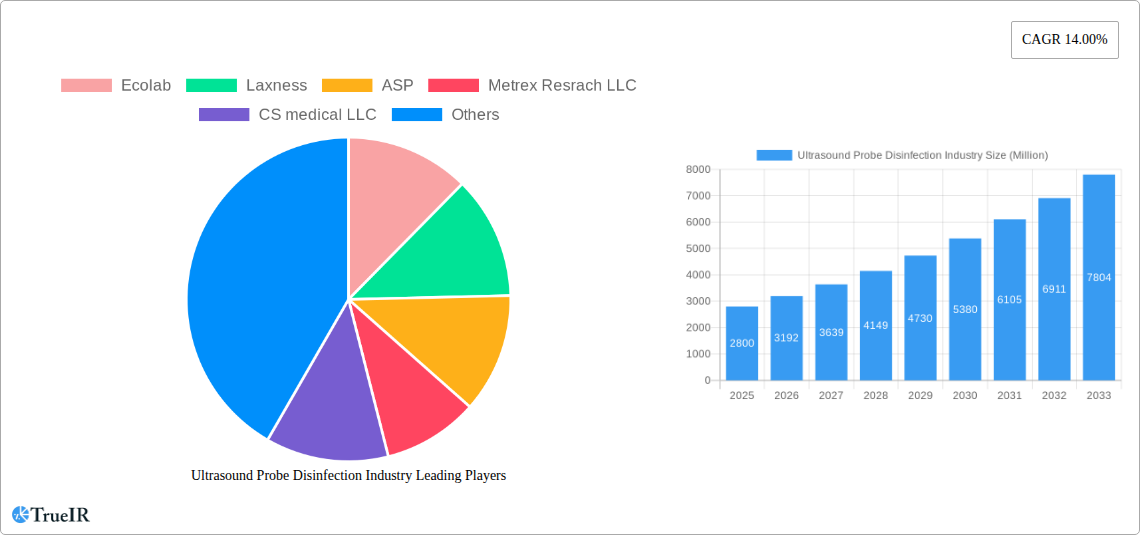

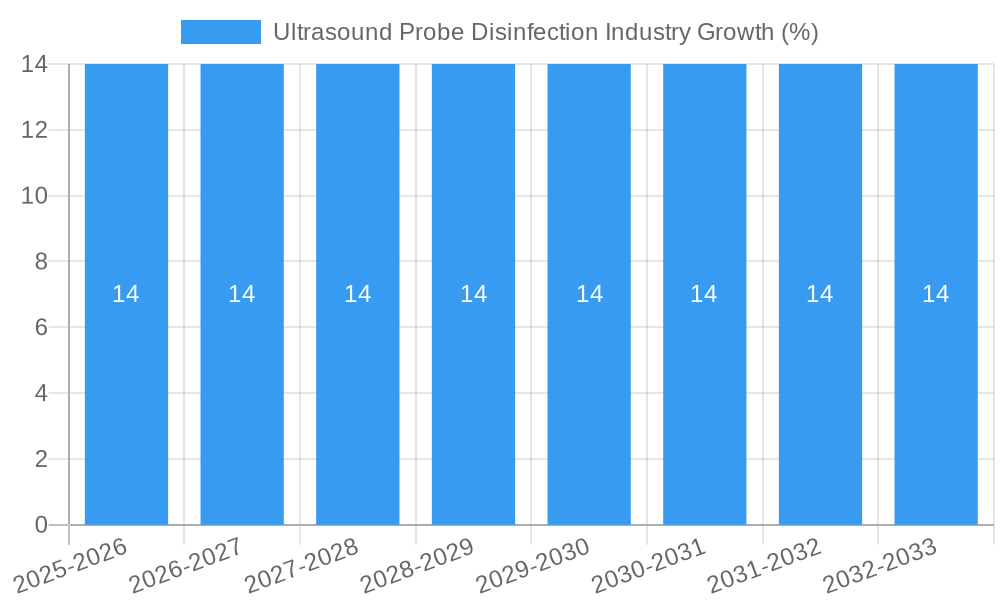

The global Ultrasound Probe Disinfection market is poised for remarkable expansion, projected to reach a substantial market size of approximately USD 2.8 billion by 2025, and grow at a Compound Annual Growth Rate (CAGR) of 14.00% through 2033. This robust growth is primarily driven by the escalating incidence of healthcare-associated infections (HAIs) and the critical need for stringent infection control protocols in medical settings. The increasing adoption of ultrasound technology across various medical disciplines, coupled with growing awareness among healthcare providers regarding probe contamination risks, further fuels market demand. Key product segments, including instruments, consumables, and services, all contribute significantly to the market’s momentum, with consumables and advanced disinfection systems expected to see particularly strong uptake. The market also benefits from technological advancements in disinfection methods, such as UV-C light and automated reprocessing systems, which offer enhanced efficacy and reduced turnaround times.

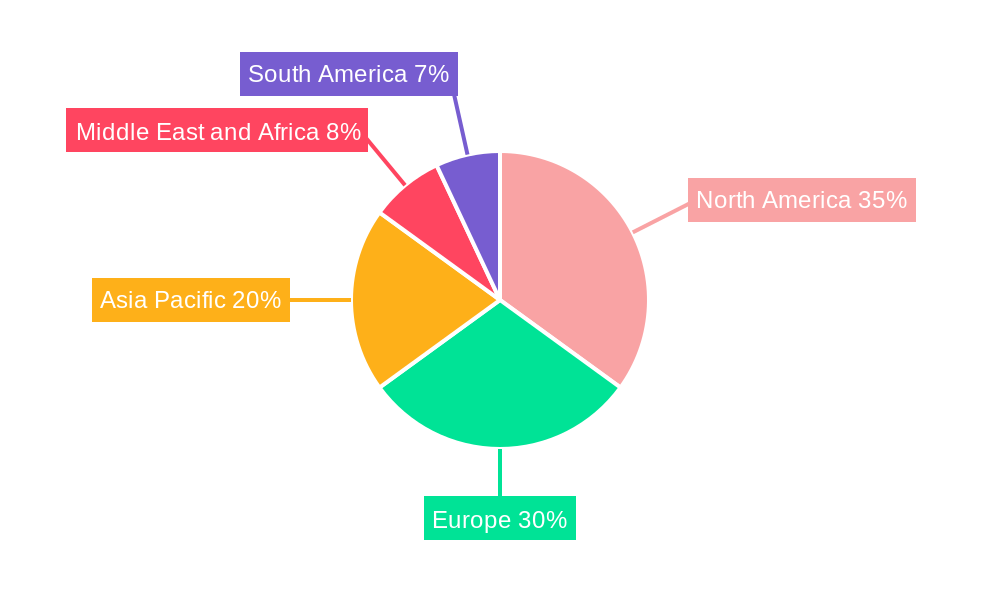

The market is segmented across critical processes like intermediate/low-level disinfection and high-level disinfection, catering to diverse clinical needs. Probe types such as linear, convex, and phased array transducers are integral to ultrasound procedures, necessitating effective disinfection solutions for each. End-users, including hospitals, diagnostic laboratories, ambulatory care centers, and research institutes, are increasingly investing in sophisticated disinfection equipment and protocols to ensure patient safety and maintain regulatory compliance. Geographically, North America and Europe currently lead the market due to advanced healthcare infrastructure and stringent regulatory frameworks. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by rapid healthcare modernization, increasing medical tourism, and a growing focus on infection prevention in emerging economies. Key industry players are actively involved in product innovation, strategic collaborations, and market expansion to capture a significant share of this dynamic and expanding market.

This in-depth market research report provides an exhaustive analysis of the global ultrasound probe disinfection industry, covering historical trends, current market dynamics, and future projections. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report offers unparalleled insights for stakeholders seeking to understand and capitalize on this critical segment of the healthcare market. Leveraging high-volume keywords such as "ultrasound probe disinfection," "high-level disinfection," "infection control," and "medical device reprocessing," this report is meticulously crafted for optimal SEO performance and audience engagement within the industry. The estimated market size for ultrasound probe disinfection is projected to reach a significant xx Million by 2025, with robust growth anticipated throughout the forecast period.

Ultrasound Probe Disinfection Industry Market Structure & Competitive Landscape

The ultrasound probe disinfection industry is characterized by a dynamic market structure with a moderate concentration of key players. Innovation drivers are primarily focused on developing faster, more effective, and user-friendly disinfection solutions to combat healthcare-associated infections (HAIs). Regulatory impacts, particularly stricter guidelines from bodies like the FDA and EMA, are pushing manufacturers towards advanced technologies and comprehensive validation processes. Product substitutes, such as single-use probes, exist but face cost and environmental challenges. End-user segmentation reveals a strong reliance on hospitals and diagnostic laboratories due to higher probe utilization and stringent infection control protocols. Mergers and acquisitions (M&A) are becoming increasingly prevalent as larger companies seek to consolidate market share and expand their product portfolios. For instance, the market has witnessed several strategic partnerships and acquisitions aimed at integrating novel disinfection technologies. Quantitative data suggests a concentration ratio of xx% among the top five players in 2025, with an estimated M&A volume of xx Million in the historical period (2019-2024).

Ultrasound Probe Disinfection Industry Market Trends & Opportunities

The global ultrasound probe disinfection market is experiencing robust growth, driven by an increasing awareness of infection prevention and control, coupled with the expanding use of ultrasound imaging across various medical specialties. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, reaching an estimated xx Million by the end of the forecast period. Technological shifts are a major trend, with a significant move towards automated disinfection systems, UV-C disinfection technologies, and digital tracking solutions that ensure compliance and traceability. Consumer preferences are leaning towards solutions that offer efficacy, speed, ease of use, and environmental sustainability. Competitive dynamics are intensifying, with companies investing heavily in research and development to introduce next-generation disinfection technologies. The market penetration rate for advanced disinfection methods is steadily increasing, particularly in developed economies, presenting significant opportunities for market expansion.

Dominant Markets & Segments in Ultrasound Probe Disinfection Industry

Dominant markets within the ultrasound probe disinfection industry are driven by factors such as healthcare infrastructure, regulatory stringency, and the prevalence of diagnostic procedures.

- Geographic Dominance: North America and Europe currently lead the market, attributed to well-established healthcare systems, high adoption rates of advanced medical technologies, and stringent infection control mandates. Asia-Pacific is emerging as a rapidly growing region, fueled by expanding healthcare access and increasing investments in medical infrastructure.

- Product Segment Dominance: The Instruments segment, encompassing automated disinfection cabinets and UV-C disinfection systems, is expected to exhibit the highest growth due to its efficiency and comprehensive disinfection capabilities. Consumables, such as disinfectants and wipes, will continue to be a significant contributor, driven by routine usage.

- Process Segment Dominance: High-level disinfections are crucial and will remain the dominant process, driven by the critical nature of ultrasound probes used in invasive procedures. Intermediate/Low-level disinfection will cater to less critical applications.

- Probe Type Dominance: Linear Transducers are widely used in superficial imaging and vascular studies, leading to their dominance in disinfection volume. Phased Array Transducers and Convex Transducers also represent substantial segments.

- End User Dominance: Hospitals and Diagnostic Laboratories are the largest end-user segment due to their extensive use of ultrasound equipment and strict infection control requirements. Ambulatory care centers and research institutes also contribute significantly to market demand.

Key growth drivers include increasing healthcare expenditure, rising incidence of HAIs, and the growing demand for minimally invasive diagnostic and therapeutic procedures. Policies mandating robust infection control practices further bolster the market.

Ultrasound Probe Disinfection Industry Product Analysis

Product innovation in the ultrasound probe disinfection industry is centered on enhancing efficacy, speed, and user convenience. Automated disinfection systems, including cabinet-based and UV-C technologies, offer superior microbial kill rates and reduce manual labor, providing a competitive advantage. Innovations in chemical disinfectants focus on broader spectrum efficacy, faster contact times, and improved material compatibility to protect sensitive probe components. Digital solutions for tracking and logging disinfection cycles are gaining traction, offering critical validation and compliance benefits. The competitive advantage lies in products that demonstrate superior performance, cost-effectiveness, and seamless integration into existing clinical workflows.

Key Drivers, Barriers & Challenges in Ultrasound Probe Disinfection Industry

Key Drivers:

- Technological Advancements: Development of automated, faster, and more effective disinfection technologies, including UV-C and advanced chemical formulations.

- Increasing HAIs: Growing global concern over healthcare-associated infections and their associated costs is a significant market driver.

- Regulatory Mandates: Stringent government regulations and guidelines promoting proper probe reprocessing.

- Expanding Ultrasound Use: Proliferation of ultrasound imaging in diagnostics and therapeutics across various medical disciplines.

- Aging Population: An increasing elderly population often requires more diagnostic procedures, including ultrasounds.

Key Barriers & Challenges:

- High Initial Investment: The cost of advanced automated disinfection equipment can be a barrier for smaller facilities.

- Regulatory Compliance: Navigating complex and evolving regulatory landscapes across different regions.

- User Training and Adoption: Ensuring proper training and consistent adherence to disinfection protocols by healthcare professionals.

- Probe Material Compatibility: Developing disinfectants that are effective against pathogens without damaging sensitive probe materials.

- Supply Chain Disruptions: Potential for interruptions in the supply of disinfectants and components, impacting market availability. Quantifiable impacts of regulatory hurdles can lead to delays in product approvals by xx months on average.

Growth Drivers in the Ultrasound Probe Disinfection Industry Market

Key growth drivers in the ultrasound probe disinfection market are multifaceted, encompassing technological innovation, economic factors, and evolving policy landscapes. The development of novel disinfection technologies, such as advanced UV-C systems and automated reprocessing units, significantly boosts market growth by offering enhanced efficacy and reduced turnaround times. Economically, increasing healthcare expenditure globally, particularly in emerging economies, fuels demand for diagnostic imaging and, consequently, disinfection solutions. Furthermore, evolving regulatory mandates and guidelines from health authorities worldwide, emphasizing patient safety and infection prevention, act as powerful catalysts for market expansion. The growing adoption of ultrasound in an increasing number of medical specialties also contributes to sustained demand.

Challenges Impacting Ultrasound Probe Disinfection Industry Growth

Several challenges impact the growth of the ultrasound probe disinfection industry. Regulatory complexities and the need for rigorous validation can lead to lengthy product approval processes and increased R&D costs. Supply chain vulnerabilities, particularly for specialized disinfectants and components, can create availability issues and price volatility. Intense competitive pressures among established players and emerging companies necessitate continuous innovation and cost-effectiveness, potentially squeezing profit margins. The high initial investment required for advanced automated disinfection systems can be a significant barrier for smaller healthcare facilities and those in resource-limited settings. Furthermore, ensuring consistent and correct usage by healthcare professionals remains a perpetual challenge, requiring ongoing training and quality control measures.

Key Players Shaping the Ultrasound Probe Disinfection Industry Market

- Ecolab

- Laxness

- ASP

- Metrex Research LLC

- CS Medical LLC

- Tristel plc

- Germitec

- CIVCO Medical Solutions

- Borer Chemie AG

- Nanosonics

- Soluscope

- Whitely

- Medisound

Significant Ultrasound Probe Disinfection Industry Industry Milestones

- May 2022: Germitec secured EUR 11 Million in financing, fueling European and international commercial expansion and strengthening its position in the UV-C-based High-Level disinfection market, estimated at EUR 245 Million.

- June 2021: Nanosonics launched its Auditpro digital infection prevention product platform at APIC 2021, offering enhanced compliance and quality management for infection preventers.

Future Outlook for Ultrasound Probe Disinfection Industry Market

- May 2022: Germitec secured EUR 11 Million in financing, fueling European and international commercial expansion and strengthening its position in the UV-C-based High-Level disinfection market, estimated at EUR 245 Million.

- June 2021: Nanosonics launched its Auditpro digital infection prevention product platform at APIC 2021, offering enhanced compliance and quality management for infection preventers.

Future Outlook for Ultrasound Probe Disinfection Industry Market

The future outlook for the ultrasound probe disinfection industry is exceptionally promising, driven by sustained global demand for effective infection control solutions. Strategic opportunities lie in the continued development and adoption of advanced technologies like AI-powered disinfection monitoring and eco-friendly chemical formulations. The growing emphasis on patient safety and the increasing prevalence of diagnostic ultrasound procedures worldwide will continue to fuel market expansion. Emerging markets present significant untapped potential, offering avenues for growth through localized product offerings and strategic partnerships. The increasing integration of digital platforms for traceability and compliance will further solidify the market's trajectory towards enhanced efficiency and superior patient care.

Ultrasound Probe Disinfection Industry Segmentation

-

1. Product

- 1.1. Instrument

- 1.2. Consumables

- 1.3. Services

-

2. Process

- 2.1. Intermediate/ Low-level disinfection

- 2.2. High-level disinfections

-

3. Probe Type

- 3.1. Linear Transducers

- 3.2. Convex Transducers

- 3.3. Phased Array Transducers

-

4. End User

- 4.1. Hospitals and Diagnostic Laboratories

- 4.2. Ambulatory care centers

- 4.3. Research and academic institutes

Ultrasound Probe Disinfection Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Ultrasound Probe Disinfection Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Ultra Sound Imaging Procedures; Increasing incidence of Hospital Acquired Infections

- 3.3. Market Restrains

- 3.3.1. High Cost of Automated Probe Reprocess; Lack of Awareness About Probe Reprocessing

- 3.4. Market Trends

- 3.4.1. The Hospitals and Diagnostic Laboratories Segment is Expected to Hold a Major Market Share in the Ultrasound Probe Disinfection Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Instrument

- 5.1.2. Consumables

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Process

- 5.2.1. Intermediate/ Low-level disinfection

- 5.2.2. High-level disinfections

- 5.3. Market Analysis, Insights and Forecast - by Probe Type

- 5.3.1. Linear Transducers

- 5.3.2. Convex Transducers

- 5.3.3. Phased Array Transducers

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Hospitals and Diagnostic Laboratories

- 5.4.2. Ambulatory care centers

- 5.4.3. Research and academic institutes

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Instrument

- 6.1.2. Consumables

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Process

- 6.2.1. Intermediate/ Low-level disinfection

- 6.2.2. High-level disinfections

- 6.3. Market Analysis, Insights and Forecast - by Probe Type

- 6.3.1. Linear Transducers

- 6.3.2. Convex Transducers

- 6.3.3. Phased Array Transducers

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Hospitals and Diagnostic Laboratories

- 6.4.2. Ambulatory care centers

- 6.4.3. Research and academic institutes

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Instrument

- 7.1.2. Consumables

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Process

- 7.2.1. Intermediate/ Low-level disinfection

- 7.2.2. High-level disinfections

- 7.3. Market Analysis, Insights and Forecast - by Probe Type

- 7.3.1. Linear Transducers

- 7.3.2. Convex Transducers

- 7.3.3. Phased Array Transducers

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Hospitals and Diagnostic Laboratories

- 7.4.2. Ambulatory care centers

- 7.4.3. Research and academic institutes

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Instrument

- 8.1.2. Consumables

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Process

- 8.2.1. Intermediate/ Low-level disinfection

- 8.2.2. High-level disinfections

- 8.3. Market Analysis, Insights and Forecast - by Probe Type

- 8.3.1. Linear Transducers

- 8.3.2. Convex Transducers

- 8.3.3. Phased Array Transducers

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Hospitals and Diagnostic Laboratories

- 8.4.2. Ambulatory care centers

- 8.4.3. Research and academic institutes

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Instrument

- 9.1.2. Consumables

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Process

- 9.2.1. Intermediate/ Low-level disinfection

- 9.2.2. High-level disinfections

- 9.3. Market Analysis, Insights and Forecast - by Probe Type

- 9.3.1. Linear Transducers

- 9.3.2. Convex Transducers

- 9.3.3. Phased Array Transducers

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Hospitals and Diagnostic Laboratories

- 9.4.2. Ambulatory care centers

- 9.4.3. Research and academic institutes

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Instrument

- 10.1.2. Consumables

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Process

- 10.2.1. Intermediate/ Low-level disinfection

- 10.2.2. High-level disinfections

- 10.3. Market Analysis, Insights and Forecast - by Probe Type

- 10.3.1. Linear Transducers

- 10.3.2. Convex Transducers

- 10.3.3. Phased Array Transducers

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Hospitals and Diagnostic Laboratories

- 10.4.2. Ambulatory care centers

- 10.4.3. Research and academic institutes

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Ultrasound Probe Disinfection Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ecolab

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Laxness

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 ASP

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Metrex Resrach LLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 CS medical LLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Tristel plc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Germitec*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 CIVCO Medical solutions

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Borer Chemie AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Nanosonics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Soluscope

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Whitely

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Medisound

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Ecolab

List of Figures

- Figure 1: Global Ultrasound Probe Disinfection Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Ultrasound Probe Disinfection Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Ultrasound Probe Disinfection Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Ultrasound Probe Disinfection Industry Revenue (Million), by Process 2024 & 2032

- Figure 15: North America Ultrasound Probe Disinfection Industry Revenue Share (%), by Process 2024 & 2032

- Figure 16: North America Ultrasound Probe Disinfection Industry Revenue (Million), by Probe Type 2024 & 2032

- Figure 17: North America Ultrasound Probe Disinfection Industry Revenue Share (%), by Probe Type 2024 & 2032

- Figure 18: North America Ultrasound Probe Disinfection Industry Revenue (Million), by End User 2024 & 2032

- Figure 19: North America Ultrasound Probe Disinfection Industry Revenue Share (%), by End User 2024 & 2032

- Figure 20: North America Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Ultrasound Probe Disinfection Industry Revenue (Million), by Product 2024 & 2032

- Figure 23: Europe Ultrasound Probe Disinfection Industry Revenue Share (%), by Product 2024 & 2032

- Figure 24: Europe Ultrasound Probe Disinfection Industry Revenue (Million), by Process 2024 & 2032

- Figure 25: Europe Ultrasound Probe Disinfection Industry Revenue Share (%), by Process 2024 & 2032

- Figure 26: Europe Ultrasound Probe Disinfection Industry Revenue (Million), by Probe Type 2024 & 2032

- Figure 27: Europe Ultrasound Probe Disinfection Industry Revenue Share (%), by Probe Type 2024 & 2032

- Figure 28: Europe Ultrasound Probe Disinfection Industry Revenue (Million), by End User 2024 & 2032

- Figure 29: Europe Ultrasound Probe Disinfection Industry Revenue Share (%), by End User 2024 & 2032

- Figure 30: Europe Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Ultrasound Probe Disinfection Industry Revenue (Million), by Product 2024 & 2032

- Figure 33: Asia Pacific Ultrasound Probe Disinfection Industry Revenue Share (%), by Product 2024 & 2032

- Figure 34: Asia Pacific Ultrasound Probe Disinfection Industry Revenue (Million), by Process 2024 & 2032

- Figure 35: Asia Pacific Ultrasound Probe Disinfection Industry Revenue Share (%), by Process 2024 & 2032

- Figure 36: Asia Pacific Ultrasound Probe Disinfection Industry Revenue (Million), by Probe Type 2024 & 2032

- Figure 37: Asia Pacific Ultrasound Probe Disinfection Industry Revenue Share (%), by Probe Type 2024 & 2032

- Figure 38: Asia Pacific Ultrasound Probe Disinfection Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Asia Pacific Ultrasound Probe Disinfection Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Asia Pacific Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue (Million), by Product 2024 & 2032

- Figure 43: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue Share (%), by Product 2024 & 2032

- Figure 44: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue (Million), by Process 2024 & 2032

- Figure 45: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue Share (%), by Process 2024 & 2032

- Figure 46: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue (Million), by Probe Type 2024 & 2032

- Figure 47: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue Share (%), by Probe Type 2024 & 2032

- Figure 48: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue (Million), by End User 2024 & 2032

- Figure 49: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue Share (%), by End User 2024 & 2032

- Figure 50: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: South America Ultrasound Probe Disinfection Industry Revenue (Million), by Product 2024 & 2032

- Figure 53: South America Ultrasound Probe Disinfection Industry Revenue Share (%), by Product 2024 & 2032

- Figure 54: South America Ultrasound Probe Disinfection Industry Revenue (Million), by Process 2024 & 2032

- Figure 55: South America Ultrasound Probe Disinfection Industry Revenue Share (%), by Process 2024 & 2032

- Figure 56: South America Ultrasound Probe Disinfection Industry Revenue (Million), by Probe Type 2024 & 2032

- Figure 57: South America Ultrasound Probe Disinfection Industry Revenue Share (%), by Probe Type 2024 & 2032

- Figure 58: South America Ultrasound Probe Disinfection Industry Revenue (Million), by End User 2024 & 2032

- Figure 59: South America Ultrasound Probe Disinfection Industry Revenue Share (%), by End User 2024 & 2032

- Figure 60: South America Ultrasound Probe Disinfection Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: South America Ultrasound Probe Disinfection Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 4: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Probe Type 2019 & 2032

- Table 5: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: GCC Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Brazil Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Argentina Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 34: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 35: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Probe Type 2019 & 2032

- Table 36: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 37: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Canada Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Mexico Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 43: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Probe Type 2019 & 2032

- Table 44: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 45: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Italy Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 53: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 54: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Probe Type 2019 & 2032

- Table 55: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 56: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Japan Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: India Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Australia Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Korea Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 64: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 65: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Probe Type 2019 & 2032

- Table 66: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 67: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 68: GCC Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Africa Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Middle East and Africa Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 72: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 73: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Probe Type 2019 & 2032

- Table 74: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 75: Global Ultrasound Probe Disinfection Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Brazil Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Argentina Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of South America Ultrasound Probe Disinfection Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultrasound Probe Disinfection Industry?

The projected CAGR is approximately 14.00%.

2. Which companies are prominent players in the Ultrasound Probe Disinfection Industry?

Key companies in the market include Ecolab, Laxness, ASP, Metrex Resrach LLC, CS medical LLC, Tristel plc, Germitec*List Not Exhaustive, CIVCO Medical solutions, Borer Chemie AG, Nanosonics, Soluscope, Whitely, Medisound.

3. What are the main segments of the Ultrasound Probe Disinfection Industry?

The market segments include Product, Process, Probe Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Ultra Sound Imaging Procedures; Increasing incidence of Hospital Acquired Infections.

6. What are the notable trends driving market growth?

The Hospitals and Diagnostic Laboratories Segment is Expected to Hold a Major Market Share in the Ultrasound Probe Disinfection Market.

7. Are there any restraints impacting market growth?

High Cost of Automated Probe Reprocess; Lack of Awareness About Probe Reprocessing.

8. Can you provide examples of recent developments in the market?

In May 2022, Germitec expanded its business with a financing round of EUR 11 Million from leading French investors in the health sector. European and international commercial expansion plans were launched to strengthen the position of UV-C-based High-Level disinfection in a market estimated at EUR 245 Million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultrasound Probe Disinfection Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultrasound Probe Disinfection Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultrasound Probe Disinfection Industry?

To stay informed about further developments, trends, and reports in the Ultrasound Probe Disinfection Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence