Key Insights

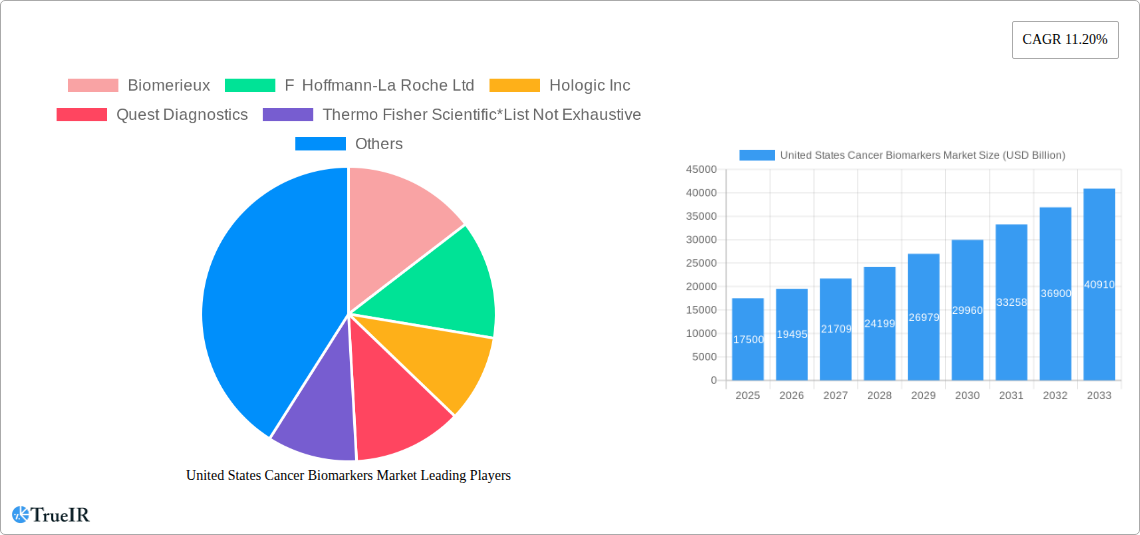

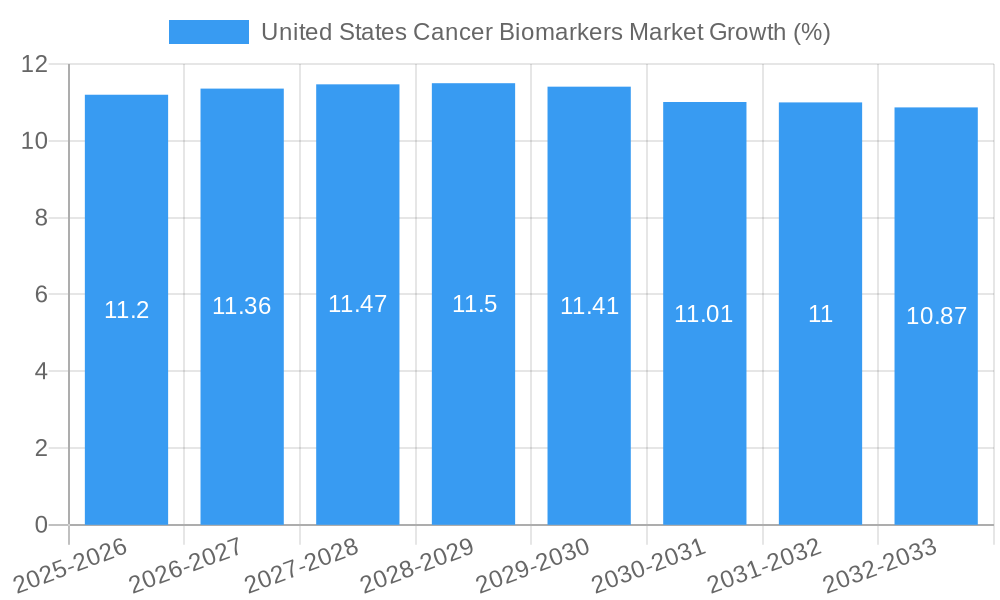

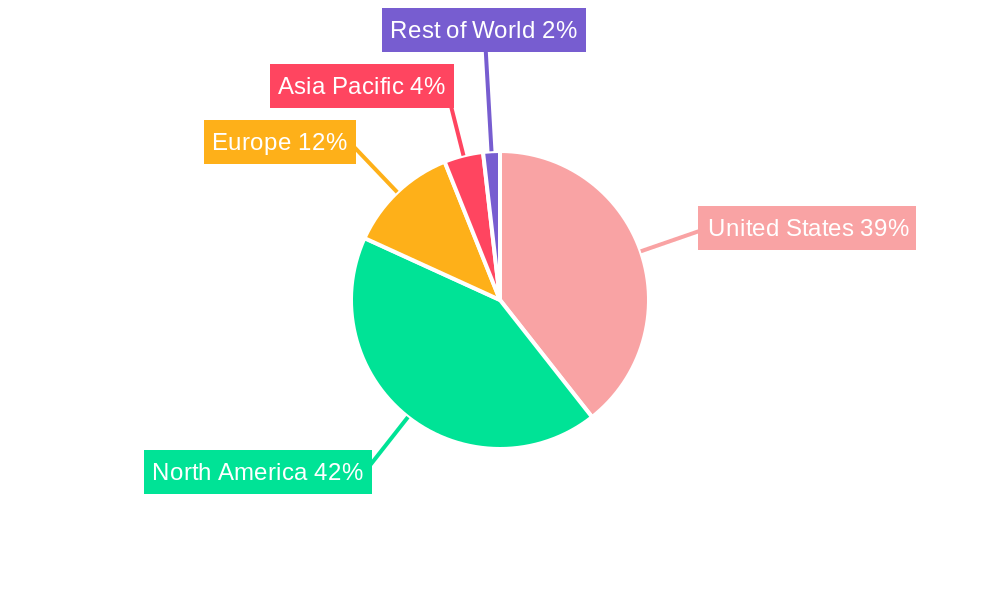

The United States cancer biomarkers market is poised for significant expansion, driven by an estimated market size of approximately $15-20 billion in 2025. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 11.20%, indicating a dynamic and expanding sector. The increasing prevalence of various cancers, including prostate, breast, lung, and colorectal cancers, necessitates advanced diagnostic and prognostic tools, fueling demand for reliable biomarkers. Technological advancements in OMICS technologies, such as genomics and proteomics, alongside sophisticated immunoassays and imaging technologies, are crucial drivers. These innovations enable the identification and validation of novel biomarkers, leading to more personalized and effective cancer treatment strategies. The growing emphasis on early detection, precision medicine, and companion diagnostics further amplifies the market's growth trajectory, promising substantial opportunities for stakeholders within the U.S. healthcare ecosystem.

The market's expansion will be characterized by an increasing adoption of both protein and genetic biomarkers, reflecting a comprehensive approach to cancer detection and management. Profiling technologies like OMICS are expected to lead the technological advancements, offering deeper insights into the molecular underpinnings of cancer. While the market is exceptionally promising, potential restraints may include the high cost of biomarker development and validation, regulatory hurdles, and the need for widespread clinical integration and physician education. Nevertheless, the strong commitment to cancer research and development within the United States, coupled with increasing healthcare expenditure, will likely mitigate these challenges. Key players like F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific, and Abbott Laboratories Inc. are at the forefront, investing heavily in R&D and strategic collaborations to capitalize on this burgeoning market. The focus on improving patient outcomes through earlier and more accurate diagnosis will continue to be the primary catalyst for growth in the coming years.

United States Cancer Biomarkers Market: Comprehensive Market Insights and Forecast (2019-2033)

This in-depth report provides an exhaustive analysis of the United States Cancer Biomarkers Market, a rapidly expanding sector driven by advancements in diagnostics, personalized medicine, and increasing cancer prevalence. The study covers the historical period from 2019 to 2024, the base and estimated year of 2025, and forecasts growth through 2033. Explore critical market dynamics, key segments, competitive landscape, and future projections essential for stakeholders in the diagnostics, pharmaceuticals, and healthcare industries. The US cancer diagnostics market is experiencing significant traction due to early disease detection initiatives and the rising demand for targeted therapies.

United States Cancer Biomarkers Market Market Structure & Competitive Landscape

The United States Cancer Biomarkers Market exhibits a moderately consolidated structure, characterized by the presence of both established global players and emerging niche companies. Innovation serves as a primary driver, with significant investments in research and development focused on identifying novel biomarkers for early diagnosis, prognosis, and treatment selection. Regulatory impacts, primarily from the FDA, play a crucial role in shaping market entry and product approval processes, ensuring the reliability and efficacy of diagnostic tools. Product substitutes, though present in the form of traditional diagnostic methods, are increasingly being complemented or replaced by advanced biomarker-based tests, particularly for complex cancers. End-user segmentation highlights the growing adoption across clinical laboratories, hospitals, research institutions, and pharmaceutical companies. Mergers and acquisitions (M&A) are prevalent, driven by the desire to expand product portfolios, gain access to new technologies, and consolidate market share. For instance, recent years have witnessed an estimated 5-10 M&A activities annually, reflecting the strategic importance of this market. Concentration ratios are influenced by the dominance of a few key players in specific biomarker categories, while smaller firms focus on specialized applications.

United States Cancer Biomarkers Market Market Trends & Opportunities

The United States Cancer Biomarkers Market is poised for robust expansion, driven by a confluence of technological advancements, shifting healthcare paradigms, and evolving consumer preferences. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, reaching an estimated value of over USD 35 Billion by 2033. Technological shifts are primarily characterized by the rapid integration of next-generation sequencing (NGS) for genetic biomarker discovery, the increasing sophistication of proteomic and metabolomic analyses, and the refined application of imaging technologies for in-situ biomarker identification. These advancements are enabling more precise and personalized cancer detection and management strategies.

Consumer preferences are increasingly leaning towards proactive health management and early disease intervention. Patients are more informed about the benefits of early diagnosis and personalized treatment, creating a heightened demand for sensitive and specific biomarker tests. This trend is further amplified by the growing awareness surrounding the economic and human costs of late-stage cancer diagnosis. The competitive dynamics within the US cancer screening market are intensifying, with companies focusing on developing comprehensive biomarker panels, companion diagnostics, and liquid biopsy solutions. The adoption of AI and machine learning in biomarker discovery and data interpretation is a significant trend, promising to accelerate the identification of novel diagnostic and prognostic markers.

Furthermore, the increasing prevalence of cancer in the United States, coupled with an aging population, presents a sustained demand for effective diagnostic tools. Government initiatives promoting cancer research and early detection programs are also contributing to market growth. The shift towards value-based healthcare models incentivizes the use of biomarkers that can accurately predict treatment response, thereby reducing healthcare expenditure and improving patient outcomes. The development of companion diagnostics, which link specific biomarkers to targeted therapies, is a major growth opportunity, facilitating the adoption of personalized medicine. The market penetration rate of advanced biomarker tests is steadily increasing, moving beyond specialized research settings into routine clinical practice. The market is also witnessing a rise in the development of biomarkers for rare cancers and for monitoring treatment efficacy and recurrence.

Dominant Markets & Segments in United States Cancer Biomarkers Market

The United States Cancer Biomarkers Market is characterized by the dominance of specific segments driven by disease prevalence, technological maturity, and clinical utility.

Disease Segmentation:

- Breast Cancer: This segment holds a significant share due to its high incidence rates among women and the availability of well-established protein biomarkers (e.g., HER2, ER, PR) and genetic markers (e.g., BRCA1/BRCA2) for diagnosis, prognosis, and treatment selection. The continuous research into novel biomarkers for sub-typing and predicting response to endocrine and targeted therapies fuels its dominance.

- Lung Cancer: With lung cancer being a leading cause of cancer-related deaths, this segment is a major market driver. The identification of actionable genetic mutations (e.g., EGFR, ALK, KRAS) and the development of companion diagnostics for targeted therapies and immunotherapies have propelled its growth. The increasing use of liquid biopsies for non-small cell lung cancer (NSCLC) diagnosis and monitoring further solidifies its position.

- Prostate Cancer: This segment benefits from widespread screening initiatives, particularly the use of Prostate-Specific Antigen (PSA) as a widely recognized protein biomarker. Ongoing research into more specific and accurate protein and genetic biomarkers for early detection and risk stratification, especially for aggressive forms of the disease, contributes to its sustained market presence.

- Colorectal Cancer: The widespread adoption of screening programs, including fecal occult blood tests and more recently, stool-based DNA tests and blood-based biomarkers, positions colorectal cancer as a key segment. The development of biomarkers for early detection and monitoring of recurrence remains a focus area.

- Others: This broad category encompasses a rapidly growing number of other cancer types, including ovarian cancer, pancreatic cancer, melanoma, and hematological malignancies. Advances in understanding the molecular landscape of these cancers are leading to the discovery and clinical validation of novel biomarkers, presenting significant future growth opportunities.

Type Segmentation:

- Protein Biomarkers: This segment has historically been dominant due to the availability of established protein markers (e.g., PSA, CA-125, HER2) and the maturity of immunoassay technologies. These biomarkers are crucial for diagnosis, monitoring treatment response, and detecting recurrence across various cancer types.

- Genetic Biomarkers: This segment is experiencing the fastest growth, driven by the widespread adoption of Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR). Genetic biomarkers, including mutations, gene expression profiles, and epigenetic alterations, are critical for personalized medicine, targeted therapy selection, and understanding cancer predisposition.

- Other Types: This category includes emerging biomarkers such as circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), microRNAs, and exosomal biomarkers. These novel biomarkers hold immense potential for non-invasive early detection, real-time monitoring of treatment response, and detection of minimal residual disease.

Profiling Technology Segmentation:

- OMICS Technology: This is the fastest-growing segment, encompassing genomics, proteomics, transcriptomics, and metabolomics. These technologies are instrumental in identifying novel biomarkers and understanding the complex molecular mechanisms of cancer. The decreasing cost and increasing throughput of OMICS platforms are fueling their adoption.

- Immunoassays: This segment remains a cornerstone of cancer biomarker detection, including ELISA, Western blotting, and immunohistochemistry. These techniques are widely used for detecting protein biomarkers and are crucial for both research and clinical diagnostics due to their specificity and sensitivity.

- Imaging Technology: While not solely biomarker-focused, advanced imaging techniques like PET, MRI, and CT scans, when combined with radiotracers that target specific biomarkers, play a vital role in tumor detection, staging, and monitoring treatment response. Innovations in molecular imaging are enhancing their diagnostic power.

- Cytogenetics: Techniques like fluorescence in situ hybridization (FISH) and chromosomal microarray analysis are important for detecting chromosomal abnormalities associated with certain cancers, aiding in diagnosis, prognosis, and treatment decisions, particularly in hematological malignancies and certain solid tumors.

United States Cancer Biomarkers Market Product Analysis

- Protein Biomarkers: This segment has historically been dominant due to the availability of established protein markers (e.g., PSA, CA-125, HER2) and the maturity of immunoassay technologies. These biomarkers are crucial for diagnosis, monitoring treatment response, and detecting recurrence across various cancer types.

- Genetic Biomarkers: This segment is experiencing the fastest growth, driven by the widespread adoption of Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR). Genetic biomarkers, including mutations, gene expression profiles, and epigenetic alterations, are critical for personalized medicine, targeted therapy selection, and understanding cancer predisposition.

- Other Types: This category includes emerging biomarkers such as circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), microRNAs, and exosomal biomarkers. These novel biomarkers hold immense potential for non-invasive early detection, real-time monitoring of treatment response, and detection of minimal residual disease.

Profiling Technology Segmentation:

- OMICS Technology: This is the fastest-growing segment, encompassing genomics, proteomics, transcriptomics, and metabolomics. These technologies are instrumental in identifying novel biomarkers and understanding the complex molecular mechanisms of cancer. The decreasing cost and increasing throughput of OMICS platforms are fueling their adoption.

- Immunoassays: This segment remains a cornerstone of cancer biomarker detection, including ELISA, Western blotting, and immunohistochemistry. These techniques are widely used for detecting protein biomarkers and are crucial for both research and clinical diagnostics due to their specificity and sensitivity.

- Imaging Technology: While not solely biomarker-focused, advanced imaging techniques like PET, MRI, and CT scans, when combined with radiotracers that target specific biomarkers, play a vital role in tumor detection, staging, and monitoring treatment response. Innovations in molecular imaging are enhancing their diagnostic power.

- Cytogenetics: Techniques like fluorescence in situ hybridization (FISH) and chromosomal microarray analysis are important for detecting chromosomal abnormalities associated with certain cancers, aiding in diagnosis, prognosis, and treatment decisions, particularly in hematological malignancies and certain solid tumors.

United States Cancer Biomarkers Market Product Analysis

The United States Cancer Biomarkers Market is witnessing a surge in innovative products, primarily driven by advancements in molecular diagnostics. Key product innovations include multiplex biomarker panels capable of simultaneously detecting multiple cancer indicators, thereby improving diagnostic accuracy and efficiency. The development of highly sensitive liquid biopsy assays for detecting circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs) represents a significant leap forward, offering non-invasive early detection and monitoring capabilities. Companion diagnostics, designed to identify patients who will benefit from specific targeted therapies or immunotherapies, are gaining prominence, enabling truly personalized treatment strategies. These products offer competitive advantages by providing earlier, more accurate diagnoses, predicting treatment response, and guiding therapeutic decisions, ultimately improving patient outcomes and reducing healthcare costs.

Key Drivers, Barriers & Challenges in United States Cancer Biomarkers Market

The United States Cancer Biomarkers Market is propelled by several key drivers, including the escalating incidence of cancer, a growing emphasis on personalized medicine, and continuous technological advancements in diagnostic platforms like Next-Generation Sequencing (NGS) and liquid biopsies. Favorable reimbursement policies for diagnostic tests and increasing government funding for cancer research also contribute significantly.

However, the market faces considerable barriers and challenges. Regulatory hurdles for new biomarker assays, particularly for companion diagnostics, can prolong time-to-market. The high cost of developing and implementing advanced biomarker testing can limit accessibility, especially for smaller healthcare providers and underserved populations. Issues related to data standardization, interpretation, and ethical considerations surrounding genetic information also pose challenges. Furthermore, the need for robust clinical validation and real-world evidence to support the utility of novel biomarkers can be a time-consuming and expensive process. Competition from established diagnostic methods and the potential for over-diagnosis and overtreatment due to broad screening are also concerns.

Growth Drivers in the United States Cancer Biomarkers Market Market

Key growth drivers in the United States Cancer Biomarkers Market are manifold, primarily stemming from technological innovation and evolving clinical needs. The relentless pursuit of personalized medicine, which tailors treatments to an individual's genetic makeup and specific cancer profile, is a paramount driver. This fuels demand for genetic and proteomic biomarkers that can predict drug response and identify therapeutic targets. Advances in cancer genomics and liquid biopsy technologies are making earlier and more accurate cancer detection a reality, significantly expanding the addressable market. Furthermore, increasing government support for cancer research and early detection initiatives, coupled with favorable reimbursement policies for advanced diagnostic tests, are providing substantial impetus. The growing awareness among healthcare professionals and patients about the benefits of early diagnosis and targeted therapies is also a critical factor.

Challenges Impacting United States Cancer Biomarkers Market Growth

The United States Cancer Biomarkers Market faces several significant challenges that impact its growth trajectory. Stringent regulatory pathways for the approval of novel diagnostic tests, especially those linked to therapeutic interventions, can lead to extended development timelines and increased costs. The high expense associated with implementing and utilizing cutting-edge biomarker technologies, such as comprehensive genomic profiling, can create accessibility issues, particularly for smaller clinics and hospitals, and for patients with limited insurance coverage. Ensuring consistent data quality, standardization across different platforms, and the complex interpretation of large datasets generated by OMICS technologies remain ongoing challenges. Ethical considerations related to genetic privacy and the responsible use of biomarker information also require careful navigation. Moreover, the market is susceptible to competitive pressures from established diagnostic players and the need for rigorous clinical validation to demonstrate the real-world utility and cost-effectiveness of new biomarkers.

Key Players Shaping the United States Cancer Biomarkers Market Market

- Abbott Laboratories Inc

- Agilent Technologies

- Biomerieux

- 23andMe

- F Hoffmann-La Roche Ltd

- Hologic Inc

- Illumina Inc

- Quest Diagnostics

- Thermo Fisher Scientific

Significant United States Cancer Biomarkers Market Industry Milestones

- 2021: FDA approval of multiple new companion diagnostics for targeted therapies, enhancing personalized cancer treatment.

- 2022: Significant advancements in liquid biopsy technology, enabling earlier detection of several cancer types through ctDNA analysis.

- 2022: Increased investment in AI and machine learning for biomarker discovery, accelerating the identification of novel diagnostic markers.

- 2023: Launch of comprehensive genomic profiling panels for broader cancer type coverage, aiding in treatment selection.

- 2024: Expansion of CPT codes for advanced cancer biomarker testing, improving reimbursement and accessibility.

- Ongoing: Continuous research and development in the identification of novel biomarkers for rare cancers and for predicting immunotherapy response.

Future Outlook for United States Cancer Biomarkers Market Market

The future outlook for the United States Cancer Biomarkers Market is exceptionally promising, driven by continued innovation and the increasing integration of biomarker-based diagnostics into routine clinical practice. The market is expected to witness substantial growth, fueled by the expansion of liquid biopsy applications for early detection, recurrence monitoring, and treatment selection across a wider array of cancers. Advancements in multi-omics approaches will uncover novel, more precise biomarkers, leading to a deeper understanding of cancer heterogeneity. The growing adoption of artificial intelligence and machine learning will further accelerate biomarker discovery and diagnostic algorithm development. Strategic collaborations between diagnostic companies, pharmaceutical firms, and academic institutions will be crucial for accelerating the translation of research findings into clinically actionable tests. The increasing focus on preventative oncology and early intervention will solidify the role of biomarkers in reducing cancer morbidity and mortality.

United States Cancer Biomarkers Market Segmentation

-

1. Disease

- 1.1. Prostate Cancer

- 1.2. Breast Cancer

- 1.3. Lung Cancer

- 1.4. Colorectal Cancer

- 1.5. Others

-

2. Type

- 2.1. Protein Biomarkers

- 2.2. Genetic Biomarkers

- 2.3. Other Types

-

3. Profiling Technology

- 3.1. OMICS Technology

- 3.2. Imaging Technology

- 3.3. Immunoassays

- 3.4. Cytogenetics

United States Cancer Biomarkers Market Segmentation By Geography

- 1. United States

United States Cancer Biomarkers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Burden of Cancer in the US; Increasing Focus on Innovative Drug Development

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Diagnosis and Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Lung Cancer Segment is Expected to Hold a Major Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Disease

- 5.1.1. Prostate Cancer

- 5.1.2. Breast Cancer

- 5.1.3. Lung Cancer

- 5.1.4. Colorectal Cancer

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Protein Biomarkers

- 5.2.2. Genetic Biomarkers

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 5.3.1. OMICS Technology

- 5.3.2. Imaging Technology

- 5.3.3. Immunoassays

- 5.3.4. Cytogenetics

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Disease

- 6. Northeast United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 7. Southeast United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 8. Midwest United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 9. Southwest United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 10. West United States Cancer Biomarkers Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Biomerieux

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 F Hoffmann-La Roche Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hologic Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Quest Diagnostics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 23andMe

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Illumina Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abbott Laboratories Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Biomerieux

List of Figures

- Figure 1: United States Cancer Biomarkers Market Revenue Breakdown (USD Billion, %) by Product 2024 & 2032

- Figure 2: United States Cancer Biomarkers Market Share (%) by Company 2024

List of Tables

- Table 1: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Region 2019 & 2032

- Table 2: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Disease 2019 & 2032

- Table 3: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Type 2019 & 2032

- Table 4: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Profiling Technology 2019 & 2032

- Table 5: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Region 2019 & 2032

- Table 6: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Country 2019 & 2032

- Table 7: Northeast United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 8: Southeast United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 9: Midwest United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 10: Southwest United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 11: West United States Cancer Biomarkers Market Revenue (USD Billion) Forecast, by Application 2019 & 2032

- Table 12: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Disease 2019 & 2032

- Table 13: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Type 2019 & 2032

- Table 14: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Profiling Technology 2019 & 2032

- Table 15: United States Cancer Biomarkers Market Revenue USD Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cancer Biomarkers Market?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the United States Cancer Biomarkers Market?

Key companies in the market include Biomerieux, F Hoffmann-La Roche Ltd, Hologic Inc, Quest Diagnostics, Thermo Fisher Scientific*List Not Exhaustive, 23andMe, Illumina Inc, Abbott Laboratories Inc, Agilent Technologies.

3. What are the main segments of the United States Cancer Biomarkers Market?

The market segments include Disease, Type, Profiling Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX USD Billion as of 2022.

5. What are some drivers contributing to market growth?

; Increased Burden of Cancer in the US; Increasing Focus on Innovative Drug Development.

6. What are the notable trends driving market growth?

Lung Cancer Segment is Expected to Hold a Major Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost of Diagnosis and Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cancer Biomarkers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cancer Biomarkers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cancer Biomarkers Market?

To stay informed about further developments, trends, and reports in the United States Cancer Biomarkers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence