Key Insights

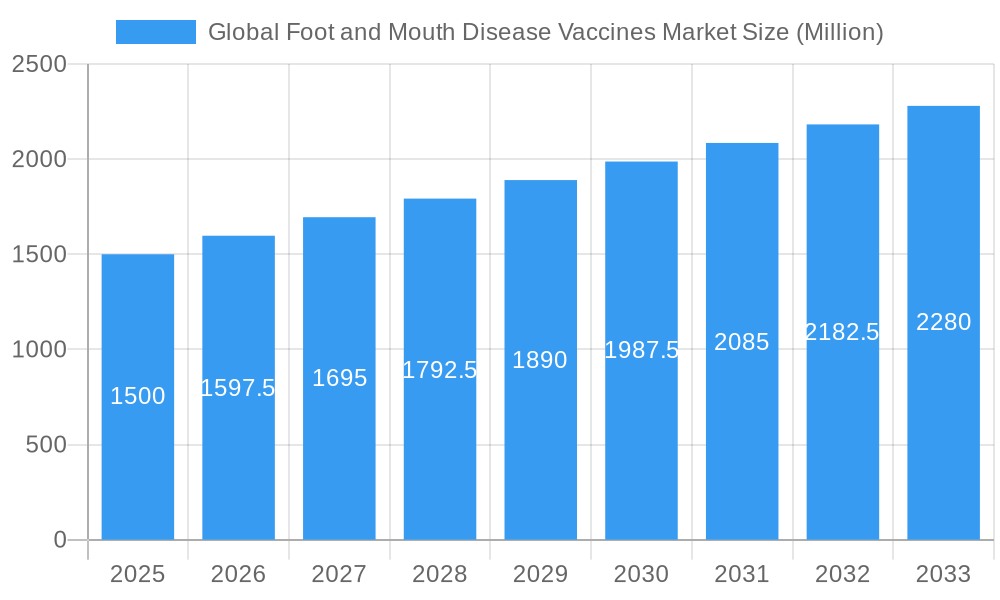

The global Foot and Mouth Disease (FMD) vaccines market is projected to reach $6.76 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 8.46% through 2033. This expansion is driven by persistent FMD outbreaks in key livestock regions, a growing emphasis on animal health and biosecurity, and the increasing global demand for animal protein. Proactive vaccination programs are becoming essential for governments and livestock producers to mitigate the significant economic impact of FMD. Advancements in vaccine technology, leading to more effective and safer products, alongside stricter regulations and enhanced disease surveillance, further fuel market growth.

Global Foot and Mouth Disease Vaccines Market Market Size (In Billion)

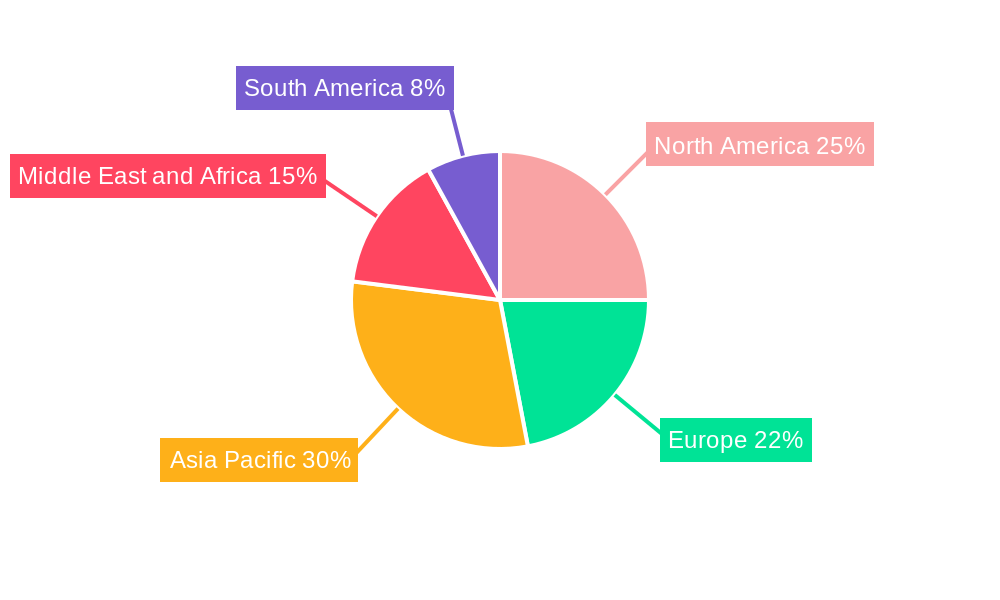

Key market drivers include recurring FMD outbreaks, particularly in Asia Pacific and Africa, necessitating immediate and widespread vaccination campaigns. The growing importance of FMD-free status for export markets also stimulates vaccine adoption. The market is segmented into conventional and emergency vaccines, with conventional vaccines currently dominating due to routine use in endemic areas. However, demand for emergency vaccines is anticipated to increase during outbreak periods. Geographically, Asia Pacific, with its large livestock population and endemic FMD, is a substantial market. North America and Europe contribute significantly through extensive livestock populations and proactive disease management. Challenges, such as high vaccine production and distribution costs in remote areas, cold chain management, and potential side effects, are being addressed through innovation and improved logistics.

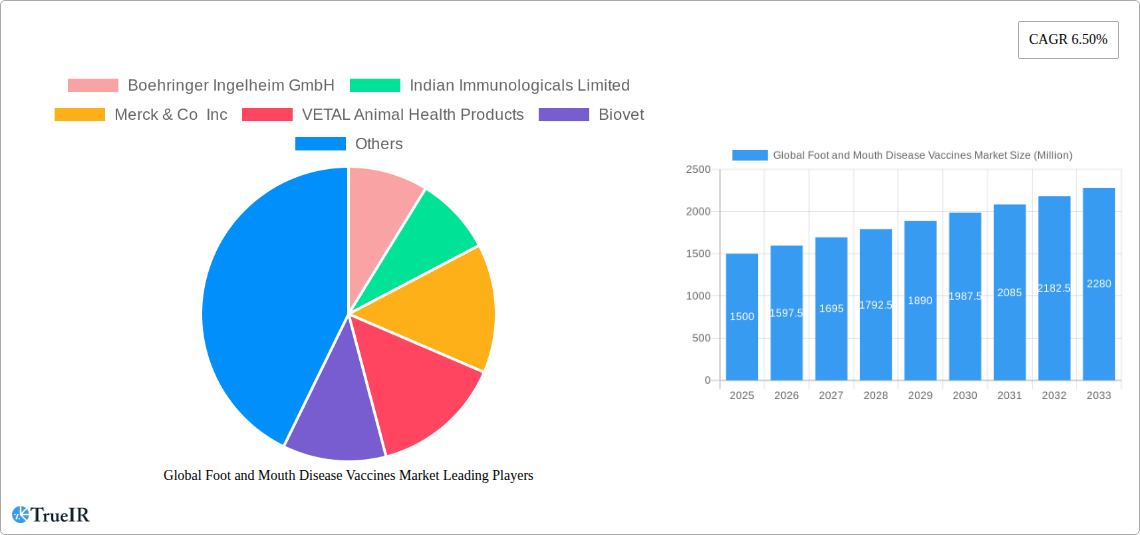

Global Foot and Mouth Disease Vaccines Market Company Market Share

Gain comprehensive insights into the global Foot and Mouth Disease (FMD) vaccines market. This analysis covers the period from the base year 2025 to 2033, detailing market dynamics, growth drivers, segmentation, and competitive strategies. The FMD vaccines market size is set for substantial growth, propelled by increasing livestock populations and the ongoing threat of FMD outbreaks globally. This report offers actionable intelligence for stakeholders aiming to leverage opportunities within the critical animal health sector.

Global Foot and Mouth Disease Vaccines Market Market Structure & Competitive Landscape

The global foot and mouth disease vaccines market exhibits a moderately concentrated structure, with key players investing heavily in research and development to combat the highly contagious nature of Foot and Mouth Disease. Innovation is a primary driver, focusing on developing more effective and longer-lasting vaccines, as well as exploring novel delivery mechanisms. Regulatory frameworks play a crucial role, influencing vaccine approval processes and market access. The threat of product substitutes, while present in the form of biosecurity measures and improved animal husbandry, is generally outweighed by the efficacy of vaccination programs. End-user segmentation by animal type – cattle, sheep and goat, pig, and others – highlights distinct market needs and adoption rates. Mergers and acquisitions (M&A) activity, though not extensively detailed here, are expected to shape market consolidation and enhance competitive advantages. An estimated xx million FMD vaccines were procured globally in the historical period, with projected growth driven by increasing demand for disease prevention.

Global Foot and Mouth Disease Vaccines Market Market Trends & Opportunities

The global foot and mouth disease vaccines market is poised for robust expansion, driven by escalating livestock populations across key agricultural regions and a heightened awareness of FMD’s devastating economic impact. The market size is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, reaching an estimated value of over $X,XXX million by the end of the forecast period. Technological advancements are a significant trend, with ongoing research into improved vaccine formulations that offer broader serotype coverage and enhanced immunogenicity. Consumer preferences are increasingly leaning towards preventative healthcare for livestock, underscoring the demand for reliable FMD vaccination strategies. Competitive dynamics are characterized by strategic collaborations and product differentiation, with companies vying for market share through a combination of efficacy, cost-effectiveness, and robust distribution networks. Opportunities lie in addressing unmet needs in emerging markets, developing vaccines against lesser-prevalent FMD serotypes, and leveraging advancements in biotechnology for more efficient vaccine production. The market penetration rate for FMD vaccines is expected to rise as governments and industry bodies emphasize disease eradication and control programs.

Dominant Markets & Segments in Global Foot and Mouth Disease Vaccines Market

The global foot and mouth disease vaccines market is dominated by regions with substantial cattle populations and significant investments in animal health infrastructure, notably Asia Pacific and Latin America. Within the product segmentation, Conventional Vaccines hold a commanding market share due to their established efficacy and widespread availability. However, the demand for Emergency Vaccines is also on the rise, particularly in regions prone to sudden FMD outbreaks. In terms of animal type, Cattle represent the largest segment, owing to their high susceptibility to FMD and their critical role in the global meat and dairy industries. Sheep and goat segments also contribute significantly to market growth, driven by government-led vaccination programs and the economic importance of these animals in many economies. Pig vaccination is crucial in preventing the spread of FMD within intensive farming systems. Key growth drivers across these segments include:

- Infrastructure Development: Investment in cold chain logistics and veterinary services in developing nations.

- Government Policies: Subsidized vaccination programs and stringent import/export regulations for livestock.

- Disease Surveillance: Enhanced FMD surveillance systems that trigger timely vaccination campaigns.

- Livestock Density: High concentrations of susceptible animals in commercial farms.

- Economic Impact Awareness: Recognition of FMD's potential to cripple agricultural economies, driving preventive measures.

The Asia Pacific region, particularly countries like India and China, is a powerhouse in the FMD vaccines market due to its vast livestock population and ongoing efforts to control FMD. Latin America, with its significant beef exports, also presents a strong market, emphasizing the need for FMD-free status.

Global Foot and Mouth Disease Vaccines Market Product Analysis

Product innovation in the global foot and mouth disease vaccines market centers on developing vaccines with improved antigen stability, broader serotype coverage, and reduced side effects. Conventional Vaccines, primarily inactivated virus vaccines, remain the mainstay. However, advancements are being made in emergency vaccine development, which are crucial for rapid containment during outbreaks. Competitive advantages are gained through superior vaccine efficacy, cost-effectiveness for mass vaccination campaigns, and robust supply chains that ensure availability even in remote areas. Technological advancements are also focusing on subunit vaccines and DNA vaccines, which promise enhanced safety and efficacy profiles, although their market penetration is still nascent.

Key Drivers, Barriers & Challenges in Global Foot and Mouth Disease Vaccines Market

Key Drivers:

- Increasing Livestock Numbers: Growing global demand for meat and dairy products fuels an expanding livestock population, increasing the need for FMD prevention.

- Government Initiatives: Strong government backing through national disease control programs and vaccination mandates is a significant growth catalyst. For example, the launch of the second phase of the National Animal Disease Control Programme on foot and mouth disease (NADCP) in Nagaland, India, in August 2022, underscores this trend.

- Economic Impact of FMD: The severe economic consequences of FMD outbreaks, including trade restrictions and reduced productivity, incentivize proactive vaccination.

- Technological Advancements: Continuous innovation in vaccine development, leading to more effective and safer FMD vaccines.

Barriers & Challenges:

- Regulatory Hurdles: Complex and varied regulatory approval processes across different countries can slow down market entry for new vaccines.

- Cold Chain Management: Maintaining the cold chain for vaccine transport and storage, especially in regions with limited infrastructure, poses a significant challenge.

- FMD Serotype Diversity: The existence of multiple FMD virus serotypes necessitates the development of polyvalent vaccines or serotype-specific vaccines, increasing complexity and cost.

- Vaccine Efficacy and Duration: Ensuring long-term immunity and addressing potential variations in vaccine efficacy among different animal breeds and environmental conditions.

- Cost of Vaccination: The substantial cost associated with mass vaccination campaigns can be a barrier for some farmers and governments.

Growth Drivers in the Global Foot and Mouth Disease Vaccines Market Market

Key growth drivers in the global foot and mouth disease vaccines market are multifaceted, encompassing technological, economic, and regulatory factors. Technologically, the ongoing development of more potent and broadly protective FMD vaccines is a significant impetus. Economically, the escalating value of global livestock production and the increasing demand for meat and dairy products directly translate into a higher need for animal disease prevention, including FMD vaccination. Regulatory drivers are equally critical; governments worldwide are implementing and reinforcing national animal disease control programs, recognizing FMD as a major threat to food security and economic stability. For instance, the Indonesian government's launch of a livestock vaccination program in June 2022, in response to a surge in FMD infections, highlights the proactive stance taken by governments to mitigate the impact of the disease.

Challenges Impacting Global Foot and Mouth Disease Vaccines Market Growth

Several challenges can impede the growth of the global foot and mouth disease vaccines market. Regulatory complexities, including stringent approval processes and varying national standards, can create significant hurdles for vaccine manufacturers. Supply chain issues, particularly the maintenance of an unbroken cold chain for temperature-sensitive vaccines, remain a persistent concern, especially in developing regions with less robust infrastructure. Competitive pressures, while driving innovation, can also lead to pricing challenges and market access limitations. Furthermore, the cost of implementing and sustaining large-scale FMD vaccination programs can be substantial, potentially limiting widespread adoption in resource-constrained areas. The emergence of new FMD virus strains or shifts in existing ones can also necessitate costly vaccine updates and re-registration processes.

Key Players Shaping the Global Foot and Mouth Disease Vaccines Market Market

- Boehringer Ingelheim GmbH

- Indian Immunologicals Limited

- Merck & Co Inc

- VETAL Animal Health Products

- Biovet

- Biogenesis Bago

- Brilliant Bio Pharma Pvt Ltd

- Limor de Colombia

- VECOL S A

- Ceva Sante Animale

- China Animal Husbandry Group

Significant Global Foot and Mouth Disease Vaccines Market Industry Milestones

- August 2022: The Nagaland government in India launched the second phase of the National Animal Disease Control Programme on foot and mouth disease (NADCP), signifying a governmental commitment to FMD eradication through vaccination.

- June 2022: The Indonesian government launched a livestock vaccination program as the number of cattle infected with foot and mouth disease surged to more than 151,000, illustrating the critical role of timely intervention and vaccination campaigns in combating widespread outbreaks.

Future Outlook for Global Foot and Mouth Disease Vaccines Market Market

The future outlook for the global foot and mouth disease vaccines market is exceptionally positive, driven by a confluence of factors including escalating global livestock populations and a heightened awareness of FMD's devastating economic repercussions. Strategic opportunities abound in emerging markets where FMD control is a growing priority, alongside the potential for advancements in vaccine technology, such as the development of thermostable vaccines and those offering broader serotype protection. Government initiatives and international collaborations aimed at FMD eradication will continue to fuel market growth, creating a sustained demand for effective FMD vaccines. The market is expected to witness increased investment in research and development to address evolving FMD strains and improve vaccine efficacy, positioning the sector for significant expansion in the coming years.

Global Foot and Mouth Disease Vaccines Market Segmentation

-

1. Product

- 1.1. Conventional Vaccines

- 1.2. Emergency Vaccines

-

2. Animal Type

- 2.1. Cattle

- 2.2. Sheep and goat

- 2.3. Pig

- 2.4. Others

Global Foot and Mouth Disease Vaccines Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Foot and Mouth Disease Vaccines Market Regional Market Share

Geographic Coverage of Global Foot and Mouth Disease Vaccines Market

Global Foot and Mouth Disease Vaccines Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Zoonotic Diseases; Increasing Demand for Animal Product; Rising R&D Activities in Animal Healthcare

- 3.3. Market Restrains

- 3.3.1. High Storage Costs for Vaccines

- 3.4. Market Trends

- 3.4.1. Cattle Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Foot and Mouth Disease Vaccines Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Conventional Vaccines

- 5.1.2. Emergency Vaccines

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Cattle

- 5.2.2. Sheep and goat

- 5.2.3. Pig

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Foot and Mouth Disease Vaccines Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Conventional Vaccines

- 6.1.2. Emergency Vaccines

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Cattle

- 6.2.2. Sheep and goat

- 6.2.3. Pig

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Foot and Mouth Disease Vaccines Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Conventional Vaccines

- 7.1.2. Emergency Vaccines

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Cattle

- 7.2.2. Sheep and goat

- 7.2.3. Pig

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Foot and Mouth Disease Vaccines Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Conventional Vaccines

- 8.1.2. Emergency Vaccines

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Cattle

- 8.2.2. Sheep and goat

- 8.2.3. Pig

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Foot and Mouth Disease Vaccines Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Conventional Vaccines

- 9.1.2. Emergency Vaccines

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Cattle

- 9.2.2. Sheep and goat

- 9.2.3. Pig

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Foot and Mouth Disease Vaccines Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Conventional Vaccines

- 10.1.2. Emergency Vaccines

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Cattle

- 10.2.2. Sheep and goat

- 10.2.3. Pig

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Indian Immunologicals Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck & Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 VETAL Animal Health Products

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biovet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Biogenesis Bago

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Brilliant Bio Pharma Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Limor de Colombia

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 VECOL S A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ceva Sante Animale*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 China Animal Husbandry Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim GmbH

List of Figures

- Figure 1: Global Global Foot and Mouth Disease Vaccines Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 5: North America Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Product 2025 & 2033

- Figure 9: Europe Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 11: Europe Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Europe Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 17: Asia Pacific Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Asia Pacific Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East and Africa Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 23: Middle East and Africa Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East and Africa Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Product 2025 & 2033

- Figure 27: South America Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 29: South America Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: South America Global Foot and Mouth Disease Vaccines Market Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Global Foot and Mouth Disease Vaccines Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 6: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 12: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 21: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 30: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Product 2020 & 2033

- Table 35: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 36: Global Foot and Mouth Disease Vaccines Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Global Foot and Mouth Disease Vaccines Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Foot and Mouth Disease Vaccines Market?

The projected CAGR is approximately 8.46%.

2. Which companies are prominent players in the Global Foot and Mouth Disease Vaccines Market?

Key companies in the market include Boehringer Ingelheim GmbH, Indian Immunologicals Limited, Merck & Co Inc, VETAL Animal Health Products, Biovet, Biogenesis Bago, Brilliant Bio Pharma Pvt Ltd, Limor de Colombia, VECOL S A, Ceva Sante Animale*List Not Exhaustive, China Animal Husbandry Group.

3. What are the main segments of the Global Foot and Mouth Disease Vaccines Market?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.76 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Zoonotic Diseases; Increasing Demand for Animal Product; Rising R&D Activities in Animal Healthcare.

6. What are the notable trends driving market growth?

Cattle Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Storage Costs for Vaccines.

8. Can you provide examples of recent developments in the market?

In August 2022, the Nagaland government in India launched the second phase of the National Animal Disease Control Programme on foot and mouth disease (NADCP).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Foot and Mouth Disease Vaccines Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Foot and Mouth Disease Vaccines Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Foot and Mouth Disease Vaccines Market?

To stay informed about further developments, trends, and reports in the Global Foot and Mouth Disease Vaccines Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence