Key Insights

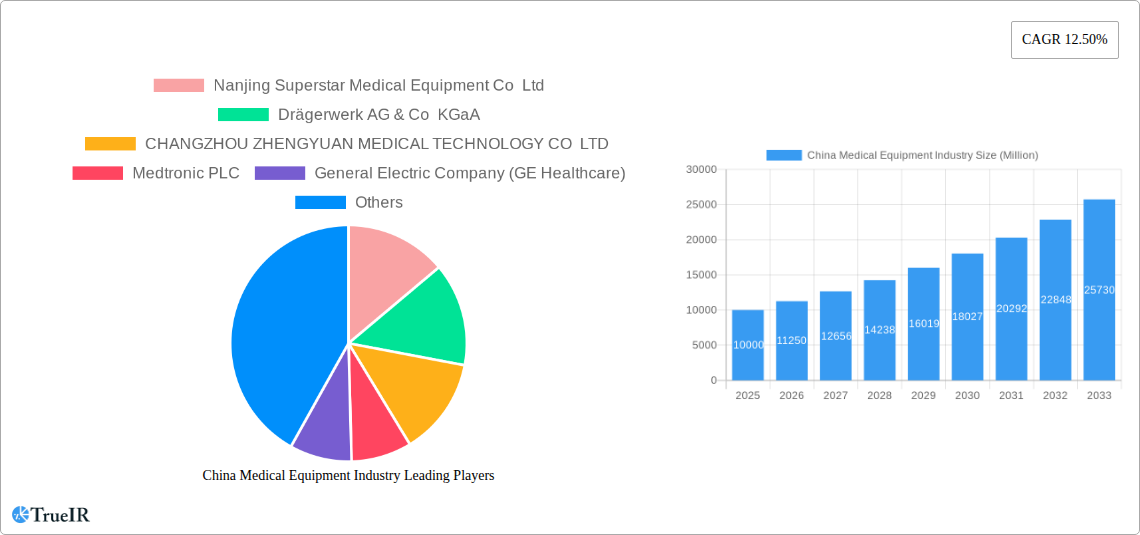

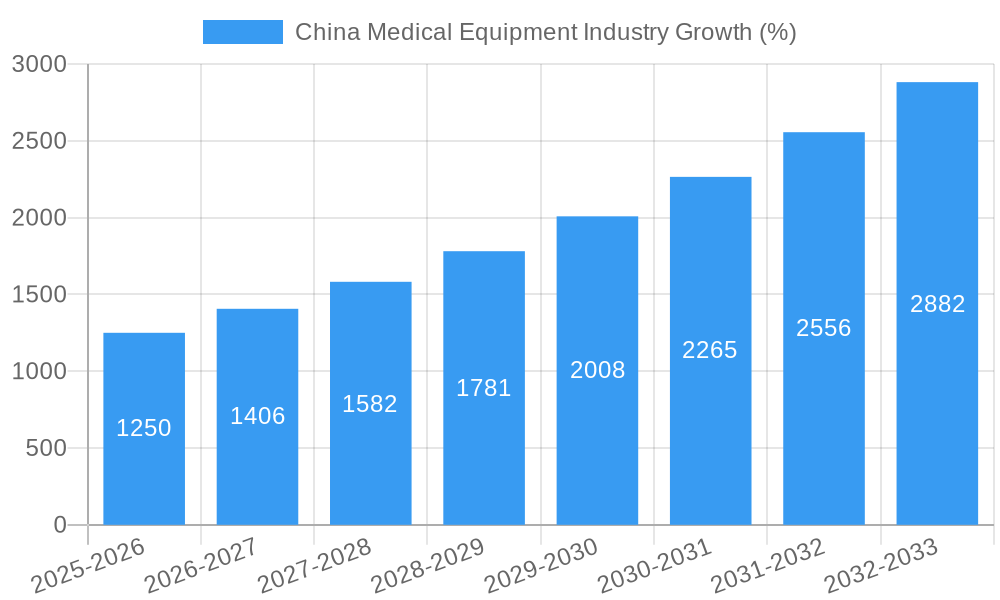

The China medical equipment market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 12.50% from 2025 to 2033. This significant expansion is driven by several key factors. Firstly, China's rapidly aging population necessitates increased healthcare infrastructure and advanced medical technology. Secondly, rising disposable incomes and heightened health awareness among Chinese citizens fuel demand for superior medical care and sophisticated equipment. Government initiatives promoting healthcare modernization and technological advancements further bolster market growth. Specific segments experiencing rapid expansion include diagnostic and monitoring devices, particularly those incorporating advanced technologies like AI and IoT for improved accuracy and efficiency. The disposable segment within other therapeutic devices also shows considerable promise due to growing surgical procedures and increasing emphasis on infection control. While challenges exist, including stringent regulatory hurdles and competition from established international players, the overall outlook remains positive. The market's growth trajectory suggests significant investment opportunities for both domestic and international companies, particularly those focusing on innovation and catering to the evolving needs of the Chinese healthcare sector. Continued focus on technological advancement, strategic partnerships, and localization efforts are crucial for success within this dynamic market.

The competitive landscape is shaped by a mix of multinational corporations and domestic manufacturers. Key players like Medtronic, GE Healthcare, and Philips leverage their technological expertise and global reach to capture market share. Meanwhile, domestic companies such as Nanjing Superstar Medical Equipment Co Ltd and CHANGZHOU ZHENGYUAN MEDICAL TECHNOLOGY CO LTD benefit from familiarity with the local market and government support. The market is characterized by both intense competition and opportunities for collaboration, with strategic alliances and mergers and acquisitions expected to shape the industry's future. Further expansion is anticipated in areas such as telehealth and remote patient monitoring, driven by technological advancements and the growing need for accessible and efficient healthcare delivery. Focus on affordability and accessibility of cutting-edge technologies will be a critical differentiator for success in the coming years.

China Medical Equipment Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic China medical equipment industry, projecting robust growth from 2019 to 2033. Leveraging extensive market research and data analysis, this report offers invaluable insights for investors, industry professionals, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Historical data from 2019-2024 provides a strong foundation for future projections. The market is expected to reach xx Million by 2033.

China Medical Equipment Industry Market Structure & Competitive Landscape

The China medical equipment market exhibits a complex interplay of domestic and multinational players, shaping a competitive landscape marked by both consolidation and innovation. The market concentration, measured by the Herfindahl-Hirschman Index (HHI), is estimated to be xx in 2025, indicating a moderately concentrated market. This concentration is driven by the presence of established global players like General Electric Company (GE Healthcare), Koninklijke Philips NV, and Medtronic PLC, alongside rapidly growing domestic companies such as Nanjing Superstar Medical Equipment Co Ltd and CHANGZHOU ZHENGYUAN MEDICAL TECHNOLOGY CO LTD.

- Market Concentration: The HHI is estimated at xx in 2025, with a projected increase to xx by 2033 due to ongoing M&A activity.

- Innovation Drivers: Government initiatives promoting technological advancements in medical devices, coupled with increasing demand for advanced diagnostic and therapeutic solutions, are significant innovation drivers.

- Regulatory Impacts: Stringent regulatory approvals and quality standards influence market entry and product development strategies. The recent streamlining of certain regulatory processes is expected to accelerate market growth.

- Product Substitutes: The market sees limited direct substitutes, though the adoption of alternative treatment methods (e.g., telehealth) might indirectly impact demand.

- End-User Segmentation: The market is segmented based on hospitals, clinics, diagnostic centers, and home healthcare settings. Hospitals represent the largest segment, accounting for approximately xx Million in revenue in 2025.

- M&A Trends: The past five years have witnessed an increasing number of mergers and acquisitions, with a total transaction value exceeding xx Million. This trend is expected to continue as larger companies seek to expand their market share and product portfolios.

China Medical Equipment Industry Market Trends & Opportunities

The China medical equipment market is experiencing robust growth, driven by several key factors. The market size, valued at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several key trends:

- Rising Healthcare Expenditure: A significant increase in per capita healthcare spending is directly driving demand for advanced medical equipment.

- Technological Advancements: The adoption of advanced technologies like AI-powered diagnostics, minimally invasive surgical tools, and telehealth solutions is revolutionizing the healthcare landscape.

- Favorable Government Policies: Government initiatives aimed at improving healthcare infrastructure and access are creating a favorable environment for market expansion.

- Growing Prevalence of Chronic Diseases: The increasing incidence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is further boosting demand for diagnostic and therapeutic medical equipment.

- Shifting Consumer Preferences: Consumers are increasingly demanding high-quality, technologically advanced medical equipment, leading to greater adoption of premium products.

- Competitive Dynamics: Intense competition among domestic and international players is leading to innovation and improved product offerings. This competitive environment is expected to maintain downward pressure on prices for some products.

- Market Penetration: The market penetration rate for several medical devices remains relatively low, signifying substantial untapped potential for future growth. For example, penetration of advanced imaging technologies is expected to increase by xx% over the forecast period.

Dominant Markets & Segments in China Medical Equipment Industry

The China medical equipment market exhibits strong regional variations. Coastal regions, particularly those with established healthcare infrastructure, such as Guangdong, Jiangsu and Zhejiang provinces, are leading the market. Within the segmented market, Diagnostic and Monitoring Devices represent the largest segment, capturing approximately xx Million in 2025.

- Key Growth Drivers for Diagnostic and Monitoring Devices:

- Government initiatives focused on improving early detection and diagnosis of diseases.

- Increasing adoption of advanced diagnostic technologies such as molecular diagnostics, imaging systems and remote patient monitoring devices.

- Expansion of healthcare infrastructure and the construction of new hospitals and clinics.

- Key Growth Drivers for Other Therapeutic Devices (Disposables):

- Growing demand for single-use medical devices to prevent infections and improve patient safety.

- Rising adoption of minimally invasive surgical procedures which increases the demand for disposable medical devices.

- Government support for improving hygiene and infection control practices in healthcare facilities.

- Market Dominance Analysis: The dominance of Diagnostic and Monitoring Devices is attributed to the high prevalence of chronic diseases and the increasing emphasis on early detection and accurate diagnosis. The Disposable segment is experiencing high growth but is still a smaller segment overall due to its use in a narrower range of procedures.

China Medical Equipment Industry Product Analysis

The China medical equipment market showcases a wide array of products, from basic diagnostic tools to sophisticated imaging systems and advanced therapeutic devices. Technological advancements are driving innovation across various segments, improving accuracy, efficiency, and safety. Key innovations include the miniaturization of medical devices, the incorporation of artificial intelligence and machine learning, and the development of personalized medicine solutions. These improvements enhance patient care and streamline medical procedures while increasing the overall market value.

Key Drivers, Barriers & Challenges in China Medical Equipment Industry

Key Drivers: Technological advancements, expanding healthcare infrastructure, rising disposable incomes and government support for healthcare improvement are key drivers. The government's focus on strengthening the country's healthcare system through funding initiatives is a significant contributing factor. Specific policies such as the National Reimbursement Drug List directly impact market access and growth of specific products.

Key Challenges & Restraints: Regulatory hurdles, particularly for foreign companies seeking market entry, remain a significant challenge. Supply chain disruptions and price pressures also impact market dynamics. These constraints, combined with intense competition among domestic and international players, pose significant challenges for market growth. For instance, supply chain disruptions in 2022 impacted the availability of certain crucial components, leading to production delays.

Growth Drivers in the China Medical Equipment Industry Market

Technological advancements, rising healthcare expenditure, and supportive government policies are key growth drivers. Increased demand for advanced diagnostic and therapeutic devices and expansion of healthcare infrastructure further contribute. The inclusion of innovative products in the National Reimbursement Drug List significantly boosts market access and adoption.

Challenges Impacting China Medical Equipment Industry Growth

Regulatory complexities, stringent approval processes for new medical devices, and supply chain vulnerabilities pose significant challenges. Price controls and intense competition from domestic manufacturers exert downward pressure on pricing. The need for substantial investments in R&D to meet evolving technological advancements and to meet international standards also presents an obstacle for some market participants.

Key Players Shaping the China Medical Equipment Industry Market

- Nanjing Superstar Medical Equipment Co Ltd

- Drägerwerk AG & Co KGaA

- CHANGZHOU ZHENGYUAN MEDICAL TECHNOLOGY CO LTD

- Medtronic PLC

- General Electric Company (GE Healthcare)

- Koninklijke Philips NV

- ResMed Inc

- Teleflex Incorporated

- Fisher & Paykel Healthcare Ltd

Significant China Medical Equipment Industry Industry Milestones

- August 2022: Nuance Pharma received CDE approval for its Ensifentrine IND application for COPD treatment. This signifies progress in developing new treatments for prevalent diseases.

- June 2022: AstraZeneca's planned manufacturing facility in Qingdao for Breztri inhaler reflects investment in the Chinese market and signals confidence in the growth potential of COPD treatments.

Future Outlook for China Medical Equipment Industry Market

The China medical equipment market is poised for continued growth, driven by factors such as increasing healthcare spending, technological advancements, and government support. Strategic opportunities exist for companies that can leverage technological innovation, expand their product portfolios, and navigate the regulatory landscape effectively. The market's expansion is expected to be significant, with substantial growth potential across various segments and regions.

China Medical Equipment Industry Segmentation

-

1. Type

- 1.1. Diagnostic and Monitoring Devices

- 1.2. Therapeutic Devices

- 1.3. Disposables

-

2. Application

- 2.1. Respiratory Care

- 2.2. Cardiovascular Care

- 2.3. Anesthesia and Critical Care

- 2.4. Diabetes Management

- 2.5. Orthopedics and Traumatology

-

3. Region

- 3.1. Asia-Pacific

- 3.2. Europe

- 3.3. North America

- 3.4. Latin America

- 3.5. Middle East and Africa

China Medical Equipment Industry Segmentation By Geography

- 1. China

China Medical Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Prevalence of Respiratory Disorders

- 3.2.2 such as COPD

- 3.2.3 TB

- 3.2.4 and Asthma; Technological Advancements and Increasing Applications in Homecare Setting

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. The Pulse Oximeters Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Medical Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic Devices

- 5.1.3. Disposables

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Respiratory Care

- 5.2.2. Cardiovascular Care

- 5.2.3. Anesthesia and Critical Care

- 5.2.4. Diabetes Management

- 5.2.5. Orthopedics and Traumatology

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia-Pacific

- 5.3.2. Europe

- 5.3.3. North America

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nanjing Superstar Medical Equipment Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Drägerwerk AG & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CHANGZHOU ZHENGYUAN MEDICAL TECHNOLOGY CO LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company (GE Healthcare)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koninklijke Philips NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ResMed Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Teleflex Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fisher & Paykel Healthcare Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Nanjing Superstar Medical Equipment Co Ltd

List of Figures

- Figure 1: China Medical Equipment Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Medical Equipment Industry Share (%) by Company 2024

List of Tables

- Table 1: China Medical Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Medical Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: China Medical Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: China Medical Equipment Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: China Medical Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: China Medical Equipment Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: China Medical Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Medical Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: China Medical Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: China Medical Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: China Medical Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China Medical Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: China Medical Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: China Medical Equipment Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 15: China Medical Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: China Medical Equipment Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: China Medical Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 18: China Medical Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 19: China Medical Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Medical Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Medical Equipment Industry?

The projected CAGR is approximately 12.50%.

2. Which companies are prominent players in the China Medical Equipment Industry?

Key companies in the market include Nanjing Superstar Medical Equipment Co Ltd, Drägerwerk AG & Co KGaA, CHANGZHOU ZHENGYUAN MEDICAL TECHNOLOGY CO LTD , Medtronic PLC, General Electric Company (GE Healthcare), Koninklijke Philips NV, ResMed Inc, Teleflex Incorporated, Fisher & Paykel Healthcare Ltd.

3. What are the main segments of the China Medical Equipment Industry?

The market segments include Type, Application, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders. such as COPD. TB. and Asthma; Technological Advancements and Increasing Applications in Homecare Setting.

6. What are the notable trends driving market growth?

The Pulse Oximeters Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

In August 2022, Nuance Pharma received the Center for Drug Evaluation (CDE) approval for its Investigational New Drug (IND) application supporting its pivotal clinical trial of Ensifentrine for the maintenance treatment of chronic obstructive pulmonary disease (COPD) in mainland China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Medical Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Medical Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Medical Equipment Industry?

To stay informed about further developments, trends, and reports in the China Medical Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence