Key Insights

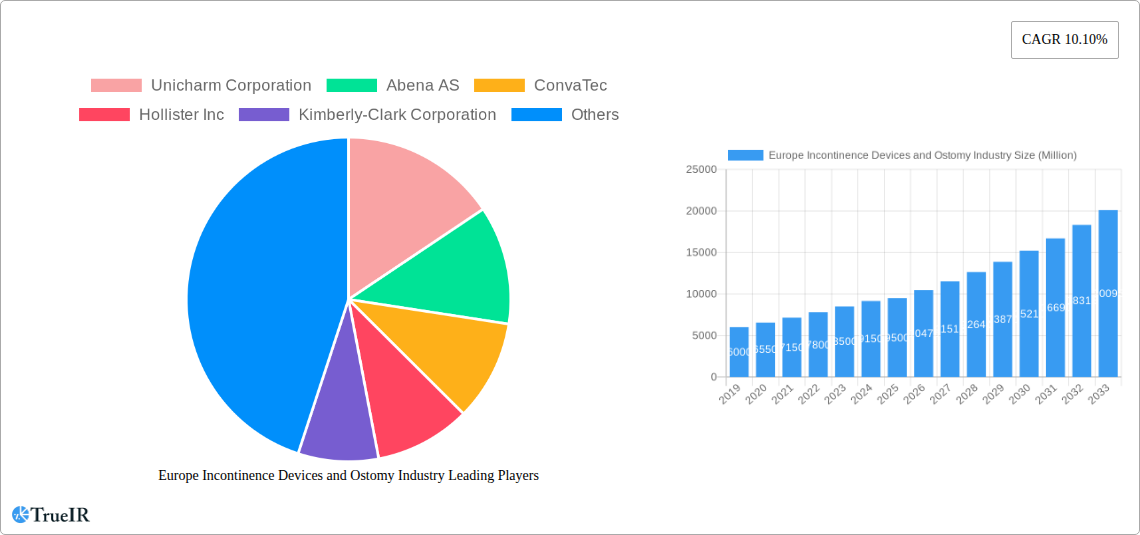

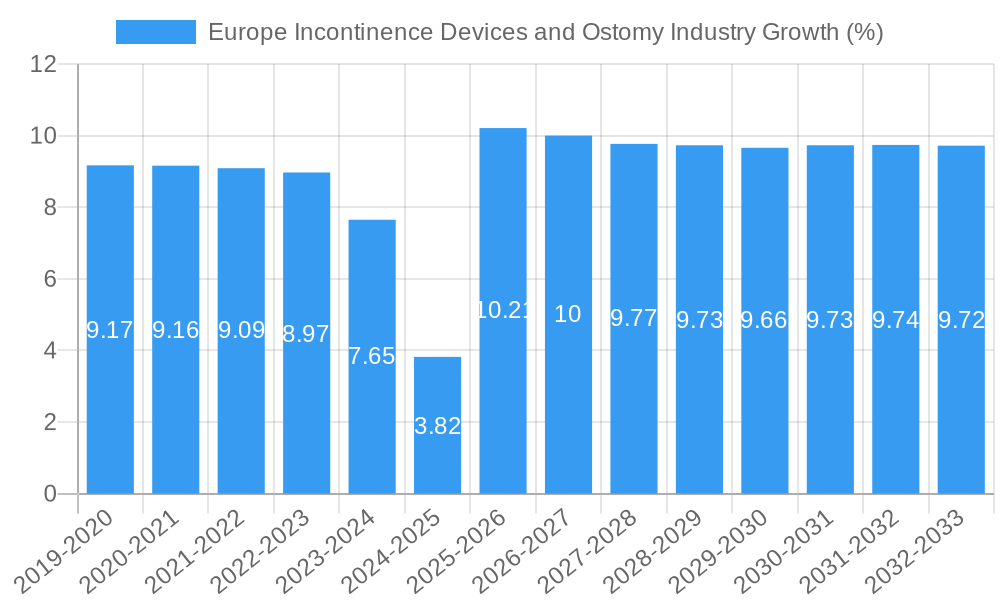

The European Incontinence Devices and Ostomy Industry is experiencing robust expansion, projected to reach a substantial market size of approximately USD 9,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 10.10%. This growth is primarily fueled by an aging population across Europe, leading to a higher prevalence of incontinence-related conditions. Furthermore, advancements in product innovation, including more discreet and comfortable absorbent products and sophisticated ostomy bag technologies, are significantly driving market adoption. The increasing awareness and reduced stigma surrounding incontinence and ostomy care also contribute to higher demand, as individuals are more willing to seek and utilize appropriate medical devices. Key market drivers include the rising incidence of chronic diseases such as colorectal cancer and Crohn's disease, which often necessitate ostomy procedures, and the increasing healthcare expenditure in European nations, enabling greater access to these essential medical supplies.

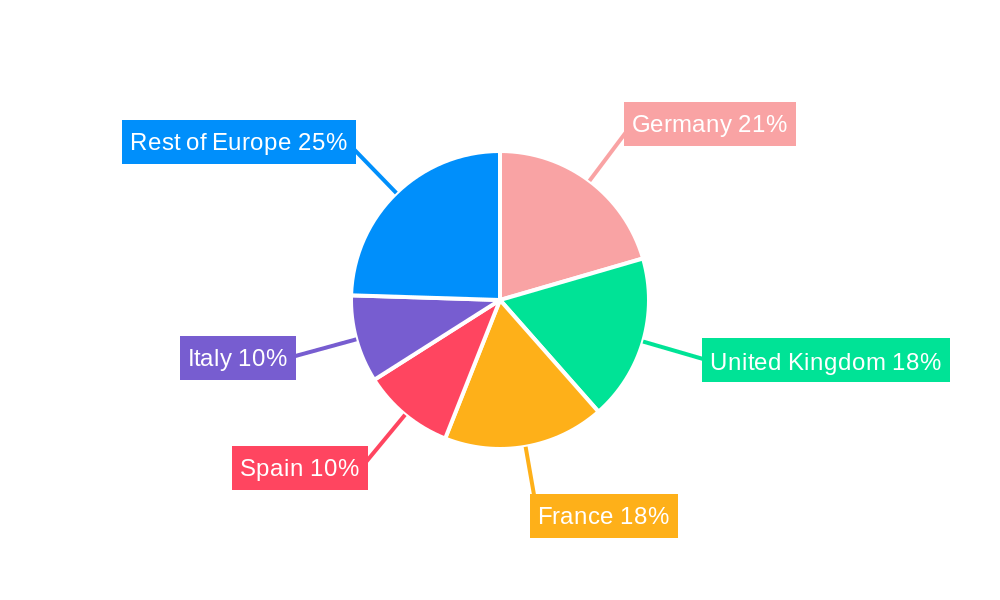

The market is strategically segmented to address diverse patient needs. Within Incontinence Care Products, Absorbents represent a dominant segment due to their widespread use. The Ostomy Care Products segment is also a significant contributor, with Ostomy Bags, including colostomy, ileostomy, and urostomy bags, leading the sub-segments. Applications span critical health conditions like Bladder Cancer, Colorectal Cancer, Crohn's Disease, Kidney Stones, and Chronic Kidney Failure, highlighting the integral role these devices play in patient quality of life. Leading global players such as Unicharm Corporation, Abena AS, ConvaTec, and Kimberly-Clark Corporation are actively competing, driving innovation and market penetration. Geographically, strong economies like Germany, the United Kingdom, and France are expected to spearhead market growth, supported by well-developed healthcare infrastructures and a higher propensity for adopting advanced medical technologies. Restraints, such as the cost of advanced products and reimbursement challenges in certain regions, are being mitigated by continuous product development and advocacy for improved patient access.

Europe Incontinence Devices and Ostomy Industry Market Report: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth market research report provides a thorough analysis of the Europe incontinence devices and ostomy industry, offering critical insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. Covering the period from 2019 to 2033, with a base year of 2025, this report leverages high-volume keywords to enhance SEO rankings and engage industry professionals. It meticulously dissects market structure, trends, dominant segments, product innovations, growth drivers, challenges, key players, significant milestones, and the future outlook.

Europe Incontinence Devices and Ostomy Industry Market Structure & Competitive Landscape

The European incontinence devices and ostomy market exhibits a moderately concentrated structure, characterized by the presence of both established global players and emerging regional manufacturers. Innovation is a key driver, with companies continuously investing in research and development to enhance product efficacy, user comfort, and discreetness. Regulatory frameworks, such as those mandated by the European Union, play a significant role in shaping product standards, quality control, and market access, ensuring patient safety and promoting fair competition. Product substitutes, while present in some basic absorbent categories, are largely limited in the advanced ostomy care and specialized incontinence management segments where brand loyalty and product performance are paramount. End-user segmentation is critical, with demand driven by an aging population, increasing prevalence of chronic diseases, and rising awareness of ostomy care solutions. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain market share, and achieve economies of scale. For instance, recent M&A activities in the broader healthcare and medical device sectors reflect a consolidation trend that could impact this specific industry. The market's evolution is also influenced by shifts in healthcare reimbursement policies and the increasing adoption of home-based care solutions.

Europe Incontinence Devices and Ostomy Industry Market Trends & Opportunities

The Europe incontinence devices and ostomy market is experiencing robust growth, propelled by an aging demographic and a rising incidence of conditions necessitating these products. The market size is projected to expand significantly, driven by an estimated Compound Annual Growth Rate (CAGR) of approximately 5.8% between 2025 and 2033. Technological advancements are at the forefront of market trends, with a growing demand for smart incontinence devices that offer real-time monitoring and data analytics, enabling proactive care management. Innovations in ostomy care include the development of more secure and discreet ostomy bags, advanced skin barrier formulations to prevent irritation, and user-friendly irrigation systems. Consumer preferences are increasingly leaning towards products that offer enhanced comfort, discretion, and convenience, thereby improving the quality of life for individuals managing these conditions. The competitive dynamics are characterized by intense innovation and strategic collaborations aimed at capturing market share. Opportunities abound for companies that can offer integrated solutions, combining advanced product technology with digital health platforms for personalized patient support and caregiver assistance. The increasing awareness and de-stigmatization surrounding incontinence and ostomy management are also significant market penetration drivers. Furthermore, the growing adoption of e-commerce channels for discreet purchasing is expanding market reach and accessibility. The focus on sustainable and eco-friendly product alternatives is also emerging as a key trend, presenting opportunities for manufacturers to innovate in this area.

Dominant Markets & Segments in Europe Incontinence Devices and Ostomy Industry

Within the European continent, Germany, France, and the United Kingdom represent dominant markets for incontinence devices and ostomy products, driven by their large aging populations, advanced healthcare infrastructures, and high per capita healthcare expenditure. These countries demonstrate a strong demand for a wide array of products, reflecting a mature market.

Product Type Dominance:

Incontinence Care Products:

- Absorbents: This segment remains the largest and most consistently growing, encompassing adult diapers, pads, and liners. The increasing prevalence of urinary and fecal incontinence across various age groups fuels this dominance. Key growth drivers include the development of highly absorbent materials and discreet designs that cater to active lifestyles.

- Incontinence Bags: While smaller than absorbents, this sub-segment is crucial for specific applications and is experiencing steady growth.

- Other Product Types: This includes products like bed protectors and cleansing wipes, which complement the primary incontinence management solutions.

Ostomy Care Products:

- Ostomy Bags: This is the core segment within ostomy care.

- Colostomy Bags: Demand is substantial due to the prevalence of colorectal cancer and inflammatory bowel diseases.

- Ileostomy Bags: Driven by conditions like Crohn's disease and surgical interventions.

- Urostomy Bags: Linked to bladder cancer, kidney issues, and congenital anomalies.

- Skin Barriers: Essential for protecting the skin around the stoma, this segment sees consistent demand due to the critical need for skin integrity maintenance. Innovations in hypoallergenic and long-lasting barrier materials are key growth drivers.

- Irrigation Products: Growing in popularity as a management option for certain ostomy types, offering increased control and normalcy for some users.

- Other Ostomy Products: Includes accessories like belts, pouches, and deodorizers.

- Ostomy Bags: This is the core segment within ostomy care.

Application Dominance:

- Colorectal Cancer: This remains a leading application driving demand for ostomy products, particularly colostomy bags, due to the high incidence of surgical interventions.

- Chronic Kidney Failure: This condition, especially in its later stages, can lead to urinary incontinence, increasing the demand for incontinence care products.

- Bladder Cancer: A significant driver for urostomy procedures and subsequent demand for urostomy bags and related care products.

- Crohn's Disease: Frequently necessitates ileostomy surgery, thus contributing significantly to the demand for ileostomy bags and associated supplies.

- Kidney Stone: While not always directly leading to ostomy, complications from severe kidney stones can sometimes require urinary diversion, indirectly impacting the market.

The market dominance is further reinforced by proactive healthcare policies promoting early diagnosis and treatment of underlying conditions, improved patient education initiatives, and the growing availability of advanced ostomy and incontinence management solutions through both traditional medical supply channels and online platforms.

Europe Incontinence Devices and Ostomy Industry Product Analysis

Product innovation in the Europe incontinence devices and ostomy industry centers on enhancing user experience and improving clinical outcomes. Key advancements include the development of ultra-absorbent materials for incontinence products that offer superior leakage protection and skin dryness, alongside more discreet and comfortable designs. For ostomy care, innovations focus on sophisticated one-piece and two-piece systems with advanced skin barriers that promote skin health and reduce irritation. Emerging technologies also include smart devices with integrated sensors for continuous monitoring of fluid levels and skin condition, offering proactive management and data-driven insights for healthcare providers. These technological strides not only improve patient quality of life but also address the growing need for efficient and personalized healthcare solutions within the continent.

Key Drivers, Barriers & Challenges in Europe Incontinence Devices and Ostomy Industry

Key Drivers:

The Europe incontinence devices and ostomy industry is primarily propelled by a confluence of demographic, technological, and healthcare-driven factors. An aging population across Europe, with a rising percentage of individuals over 65, significantly increases the incidence of incontinence, directly fueling demand for absorbent products and supportive devices. Technological advancements are pivotal, with continuous innovation in material science leading to more effective, comfortable, and discreet products, such as advanced absorbents and secure ostomy appliances. The increasing prevalence of chronic diseases, including diabetes, cancer (colorectal, bladder), and neurological conditions, often leads to incontinence or the need for ostomy surgery, thus acting as a substantial market driver. Growing awareness and de-stigmatization of incontinence are encouraging more individuals to seek appropriate management solutions, expanding the addressable market. Furthermore, supportive government policies and reimbursement schemes for medical devices in many European countries facilitate access and adoption.

Barriers & Challenges:

Despite the strong growth trajectory, the industry faces several hurdles. Regulatory complexities and stringent approval processes for new medical devices across different European nations can pose significant challenges and prolong time-to-market, impacting innovation speed and investment. The high cost of some advanced ostomy and incontinence management systems can be a barrier for price-sensitive consumers and healthcare systems with limited budgets, potentially leading to the preference for lower-cost, less sophisticated alternatives. Supply chain disruptions, exacerbated by geopolitical events and global economic fluctuations, can impact the availability and cost of raw materials and finished products, affecting manufacturers' production capacity and pricing strategies. Intense competition from both established global players and emerging local manufacturers leads to price pressures and necessitates continuous investment in R&D and marketing to maintain market share. Moreover, public perception and the lingering stigma associated with incontinence and ostomy can still hinder open discussion and proactive management, particularly in certain demographics or regions.

Growth Drivers in the Europe Incontinence Devices and Ostomy Industry Market

The Europe incontinence devices and ostomy market's expansion is primarily fueled by several interconnected growth drivers. The demographic shift towards an aging population is a fundamental catalyst, as the incidence of urinary and fecal incontinence naturally increases with age. Technological innovation is another significant driver, with companies investing heavily in developing advanced absorbent materials, more secure and discreet ostomy appliances, and smart monitoring solutions that improve user comfort and quality of life. The rising prevalence of chronic diseases, such as colorectal cancer, bladder cancer, diabetes, and inflammatory bowel diseases, directly contributes to the demand for both incontinence care products and ostomy supplies. Furthermore, increasing awareness and education campaigns are helping to de-stigmatize these conditions, encouraging more individuals to seek timely and effective management solutions. Favorable reimbursement policies and government initiatives promoting home healthcare and patient support also play a crucial role in market accessibility and growth.

Challenges Impacting Europe Incontinence Devices and Ostomy Industry Growth

The growth of the Europe incontinence devices and ostomy industry is not without its challenges. Stringent and varied regulatory landscapes across different European countries can complicate market entry and product approval, leading to increased compliance costs and time delays. The high cost associated with advanced and innovative incontinence and ostomy devices can be a significant barrier, especially for individuals with limited disposable income or healthcare systems facing budget constraints. Supply chain vulnerabilities, including the availability and cost of raw materials and manufacturing components, can lead to production delays and price fluctuations. Intense market competition among numerous global and local players necessitates continuous investment in R&D and marketing, potentially impacting profitability. Finally, although decreasing, the societal stigma surrounding incontinence and ostomy can still deter individuals from seeking help or openly discussing their needs, thereby limiting market penetration in certain segments.

Key Players Shaping the Europe Incontinence Devices and Ostomy Industry Market

- Unicharm Corporation

- Abena AS

- ConvaTec

- Hollister Inc

- Kimberly-Clark Corporation

- B Braun Melsungen AG

- Salts Healthcare

Significant Europe Incontinence Devices and Ostomy Industry Industry Milestones

- June 2022: Ontex launched the Orizon digital incontinence management service in late 2022 or early 2023. The solution contains printed sensors, transmitters clipped onto diapers, and a mobile and web application. This development signifies a move towards connected health solutions in incontinence management, enhancing patient monitoring and care efficiency.

- March 2022: The European Investment Bank (EIB) provided Innsbruck-based biotech firm Innovacell with a venture debt loan of up to EUR 15 Million (USD 15.8 Million) to finance its EUR 40 Million (USD 42.29 Million) investment plan over the next three years. The investment will focus on fecal and urinary incontinence conditions. This financial backing underscores the growing investor confidence in innovative solutions for incontinence management and signals potential advancements in treatment and product development within the European market.

Future Outlook for Europe Incontinence Devices and Ostomy Industry Market

The future outlook for the Europe incontinence devices and ostomy industry remains highly positive, with sustained growth anticipated through 2033. Key growth catalysts include the continued aging of the European population, driving consistent demand for incontinence care products. The ongoing innovation pipeline promises a new generation of smarter, more personalized devices, including advanced smart absorbent technologies and next-generation ostomy appliances that enhance user comfort and skin health. Opportunities lie in the expansion of digital health platforms and connected care solutions that integrate with these devices, offering remote patient monitoring and data-driven insights for healthcare providers. Strategic collaborations between manufacturers, healthcare institutions, and technology providers will be crucial for developing integrated solutions and expanding market reach. Furthermore, a growing emphasis on preventative care and improved quality of life for individuals managing these conditions will continue to shape product development and market strategies, solidifying the industry's importance within the European healthcare landscape.

Europe Incontinence Devices and Ostomy Industry Segmentation

-

1. Product Type

-

1.1. Incontinence Care Products

- 1.1.1. Absorbents

- 1.1.2. Incontinence Bags

- 1.1.3. Other Product Types

-

1.2. Ostomy Care Products

-

1.2.1. Ostomy Bags

- 1.2.1.1. Colostomy Bags

- 1.2.1.2. Ileostomy Bags

- 1.2.1.3. Urostomy Bags

- 1.2.2. Skin Barriers

- 1.2.3. Irrigation Products

- 1.2.4. Other Ostomy Products

-

1.2.1. Ostomy Bags

-

1.1. Incontinence Care Products

-

2. Application

- 2.1. Bladder Cancer

- 2.2. Colorectal Cancer

- 2.3. Crohn's Disease

- 2.4. Kidney Stone

- 2.5. Chronic Kidney Failure

- 2.6. Other Applications

Europe Incontinence Devices and Ostomy Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

Europe Incontinence Devices and Ostomy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric and Obese Populations; Increasing Prevalence of Renal Diseases and Nephrological Injuries

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Reimbursement; Complications Associated with Ostomy and Usage of Incontinence Products

- 3.4. Market Trends

- 3.4.1. Colorectal Cancer is Expected to Hold a Significant Share in the Growth of the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Incontinence Care Products

- 5.1.1.1. Absorbents

- 5.1.1.2. Incontinence Bags

- 5.1.1.3. Other Product Types

- 5.1.2. Ostomy Care Products

- 5.1.2.1. Ostomy Bags

- 5.1.2.1.1. Colostomy Bags

- 5.1.2.1.2. Ileostomy Bags

- 5.1.2.1.3. Urostomy Bags

- 5.1.2.2. Skin Barriers

- 5.1.2.3. Irrigation Products

- 5.1.2.4. Other Ostomy Products

- 5.1.2.1. Ostomy Bags

- 5.1.1. Incontinence Care Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bladder Cancer

- 5.2.2. Colorectal Cancer

- 5.2.3. Crohn's Disease

- 5.2.4. Kidney Stone

- 5.2.5. Chronic Kidney Failure

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Incontinence Care Products

- 6.1.1.1. Absorbents

- 6.1.1.2. Incontinence Bags

- 6.1.1.3. Other Product Types

- 6.1.2. Ostomy Care Products

- 6.1.2.1. Ostomy Bags

- 6.1.2.1.1. Colostomy Bags

- 6.1.2.1.2. Ileostomy Bags

- 6.1.2.1.3. Urostomy Bags

- 6.1.2.2. Skin Barriers

- 6.1.2.3. Irrigation Products

- 6.1.2.4. Other Ostomy Products

- 6.1.2.1. Ostomy Bags

- 6.1.1. Incontinence Care Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bladder Cancer

- 6.2.2. Colorectal Cancer

- 6.2.3. Crohn's Disease

- 6.2.4. Kidney Stone

- 6.2.5. Chronic Kidney Failure

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Incontinence Care Products

- 7.1.1.1. Absorbents

- 7.1.1.2. Incontinence Bags

- 7.1.1.3. Other Product Types

- 7.1.2. Ostomy Care Products

- 7.1.2.1. Ostomy Bags

- 7.1.2.1.1. Colostomy Bags

- 7.1.2.1.2. Ileostomy Bags

- 7.1.2.1.3. Urostomy Bags

- 7.1.2.2. Skin Barriers

- 7.1.2.3. Irrigation Products

- 7.1.2.4. Other Ostomy Products

- 7.1.2.1. Ostomy Bags

- 7.1.1. Incontinence Care Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bladder Cancer

- 7.2.2. Colorectal Cancer

- 7.2.3. Crohn's Disease

- 7.2.4. Kidney Stone

- 7.2.5. Chronic Kidney Failure

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Incontinence Care Products

- 8.1.1.1. Absorbents

- 8.1.1.2. Incontinence Bags

- 8.1.1.3. Other Product Types

- 8.1.2. Ostomy Care Products

- 8.1.2.1. Ostomy Bags

- 8.1.2.1.1. Colostomy Bags

- 8.1.2.1.2. Ileostomy Bags

- 8.1.2.1.3. Urostomy Bags

- 8.1.2.2. Skin Barriers

- 8.1.2.3. Irrigation Products

- 8.1.2.4. Other Ostomy Products

- 8.1.2.1. Ostomy Bags

- 8.1.1. Incontinence Care Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bladder Cancer

- 8.2.2. Colorectal Cancer

- 8.2.3. Crohn's Disease

- 8.2.4. Kidney Stone

- 8.2.5. Chronic Kidney Failure

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Incontinence Care Products

- 9.1.1.1. Absorbents

- 9.1.1.2. Incontinence Bags

- 9.1.1.3. Other Product Types

- 9.1.2. Ostomy Care Products

- 9.1.2.1. Ostomy Bags

- 9.1.2.1.1. Colostomy Bags

- 9.1.2.1.2. Ileostomy Bags

- 9.1.2.1.3. Urostomy Bags

- 9.1.2.2. Skin Barriers

- 9.1.2.3. Irrigation Products

- 9.1.2.4. Other Ostomy Products

- 9.1.2.1. Ostomy Bags

- 9.1.1. Incontinence Care Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bladder Cancer

- 9.2.2. Colorectal Cancer

- 9.2.3. Crohn's Disease

- 9.2.4. Kidney Stone

- 9.2.5. Chronic Kidney Failure

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Incontinence Care Products

- 10.1.1.1. Absorbents

- 10.1.1.2. Incontinence Bags

- 10.1.1.3. Other Product Types

- 10.1.2. Ostomy Care Products

- 10.1.2.1. Ostomy Bags

- 10.1.2.1.1. Colostomy Bags

- 10.1.2.1.2. Ileostomy Bags

- 10.1.2.1.3. Urostomy Bags

- 10.1.2.2. Skin Barriers

- 10.1.2.3. Irrigation Products

- 10.1.2.4. Other Ostomy Products

- 10.1.2.1. Ostomy Bags

- 10.1.1. Incontinence Care Products

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bladder Cancer

- 10.2.2. Colorectal Cancer

- 10.2.3. Crohn's Disease

- 10.2.4. Kidney Stone

- 10.2.5. Chronic Kidney Failure

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Incontinence Care Products

- 11.1.1.1. Absorbents

- 11.1.1.2. Incontinence Bags

- 11.1.1.3. Other Product Types

- 11.1.2. Ostomy Care Products

- 11.1.2.1. Ostomy Bags

- 11.1.2.1.1. Colostomy Bags

- 11.1.2.1.2. Ileostomy Bags

- 11.1.2.1.3. Urostomy Bags

- 11.1.2.2. Skin Barriers

- 11.1.2.3. Irrigation Products

- 11.1.2.4. Other Ostomy Products

- 11.1.2.1. Ostomy Bags

- 11.1.1. Incontinence Care Products

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Bladder Cancer

- 11.2.2. Colorectal Cancer

- 11.2.3. Crohn's Disease

- 11.2.4. Kidney Stone

- 11.2.5. Chronic Kidney Failure

- 11.2.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Germany Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Incontinence Devices and Ostomy Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Unicharm Corporation

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Abena AS

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 ConvaTec

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Hollister Inc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Kimberly-Clark Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 B Braun Melsungen AG

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Salts Healthcare

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.1 Unicharm Corporation

List of Figures

- Figure 1: Europe Incontinence Devices and Ostomy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Incontinence Devices and Ostomy Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Incontinence Devices and Ostomy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Incontinence Devices and Ostomy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Incontinence Devices and Ostomy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Incontinence Devices and Ostomy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Incontinence Devices and Ostomy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Incontinence Devices and Ostomy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Incontinence Devices and Ostomy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 29: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Europe Incontinence Devices and Ostomy Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Incontinence Devices and Ostomy Industry?

The projected CAGR is approximately 10.10%.

2. Which companies are prominent players in the Europe Incontinence Devices and Ostomy Industry?

Key companies in the market include Unicharm Corporation, Abena AS, ConvaTec, Hollister Inc, Kimberly-Clark Corporation, B Braun Melsungen AG, Salts Healthcare.

3. What are the main segments of the Europe Incontinence Devices and Ostomy Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric and Obese Populations; Increasing Prevalence of Renal Diseases and Nephrological Injuries.

6. What are the notable trends driving market growth?

Colorectal Cancer is Expected to Hold a Significant Share in the Growth of the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Proper Reimbursement; Complications Associated with Ostomy and Usage of Incontinence Products.

8. Can you provide examples of recent developments in the market?

June 2022: Ontex launched the Orizon digital incontinence management service in late 2022 or early 2023. The solution contains printed sensors, transmitters clipped onto diapers, and a mobile and web application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Incontinence Devices and Ostomy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Incontinence Devices and Ostomy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Incontinence Devices and Ostomy Industry?

To stay informed about further developments, trends, and reports in the Europe Incontinence Devices and Ostomy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence