Key Insights

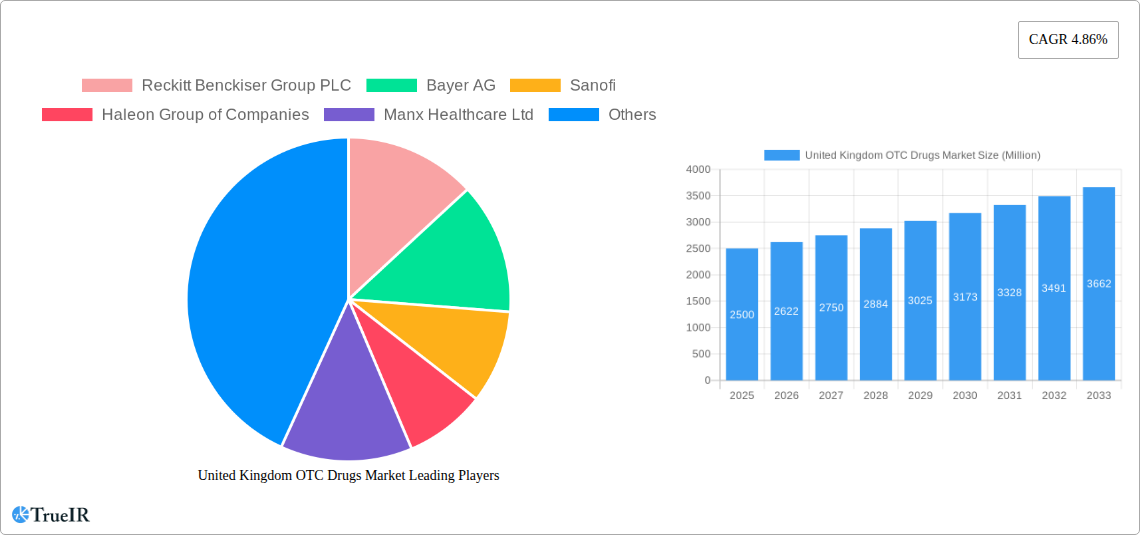

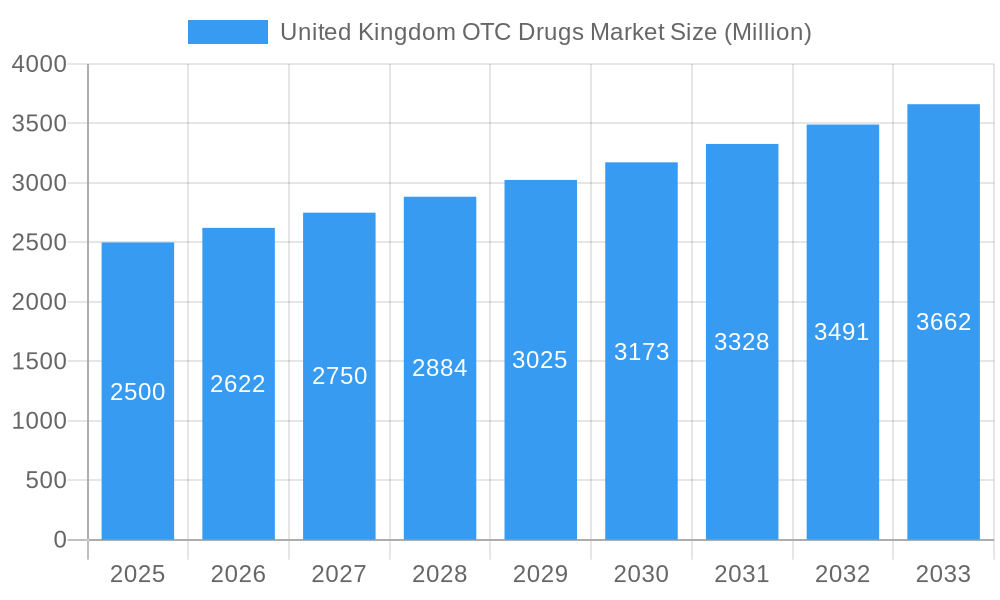

The United Kingdom Over-the-Counter (OTC) drug market, valued at approximately £2.5 billion in 2025, is projected to experience robust growth, driven by factors such as an aging population with increased healthcare needs, rising prevalence of chronic conditions requiring self-medication, and increasing consumer awareness of OTC options. The market's Compound Annual Growth Rate (CAGR) of 4.86% over the forecast period (2025-2033) reflects this positive trajectory. Key product segments, including analgesics, cough, cold, and flu remedies, and dermatology products, are expected to contribute significantly to this growth. The convenience of e-pharmacies is also a significant trend, though traditional retail pharmacies continue to dominate distribution channels. Regulatory changes impacting OTC product availability and pricing will undoubtedly influence market dynamics, while potential economic downturns could act as a restraint on spending on non-essential healthcare products. Competition among major players like Reckitt Benckiser, Bayer, Sanofi, and Haleon is fierce, driving innovation and product differentiation. The UK market’s unique regulatory environment and healthcare system will shape future growth.

United Kingdom OTC Drugs Market Market Size (In Billion)

Within the UK OTC drug market, specific growth drivers include the rising prevalence of self-treatable conditions, increased consumer preference for convenient and accessible healthcare solutions, and a growing emphasis on preventative healthcare. The increasing accessibility of online pharmacies further facilitates market expansion. However, challenges remain, including concerns regarding potential misuse of OTC medications, the need for improved patient education and adherence to instructions, and the potential impact of government policies on pricing and availability. The segment of gastrointestinal products is expected to see particularly strong growth due to changing lifestyle factors and increased awareness of digestive health. Further segmentation by route of administration (oral, topical, parenteral) highlights diverse consumer preferences and treatment approaches. The strategic initiatives of major players, encompassing product launches, acquisitions, and expansion into digital platforms, are shaping the competitive landscape and driving overall market growth.

United Kingdom OTC Drugs Market Company Market Share

This dynamic report provides a detailed analysis of the United Kingdom's over-the-counter (OTC) drug market, offering invaluable insights for stakeholders across the pharmaceutical industry. With a comprehensive study period spanning 2019-2033 (base year 2025, estimated year 2025, forecast period 2025-2033, historical period 2019-2024), this report delves into market size, segmentation, competitive landscape, and future growth projections, incorporating the latest regulatory changes. Discover key trends, challenges, and opportunities shaping this dynamic market, valued at £xx Million in 2025 and projected to reach £xx Million by 2033.

United Kingdom OTC Drugs Market Market Structure & Competitive Landscape

The UK OTC drug market exhibits a moderately concentrated structure, with several multinational pharmaceutical giants holding significant market share. Key players include Reckitt Benckiser Group PLC, Bayer AG, Sanofi, Haleon Group of Companies, Manx Healthcare Ltd, Johnson & Johnson, Perrigo Company plc, Novo Nordisk A/S, Pfizer Inc, and many others. The market's concentration ratio (CR4) is estimated at xx%, indicating a presence of both large players and smaller niche players. Innovation in formulation, delivery systems (e.g., transdermal patches, inhalers), and digital health integration are key drivers, while regulatory changes significantly impact market dynamics. Product substitution, particularly with generic equivalents and herbal remedies, poses ongoing competitive pressure. The market is segmented by end-user (adults, children, elderly) and therapeutic area, leading to varied pricing and marketing strategies. Recent years have witnessed moderate M&A activity, with xx deals recorded between 2019 and 2024, largely focused on expanding product portfolios and geographical reach. This consolidation trend is expected to continue, driven by the need to achieve economies of scale and enhance market competitiveness.

- Market Concentration: CR4 estimated at xx%

- Innovation Drivers: New formulations, digital health integration

- Regulatory Impacts: Significant influence on product availability and pricing

- Product Substitutes: Generic drugs, herbal remedies, homeopathic options

- End-User Segmentation: Adults, children, elderly driving distinct product needs

- M&A Trends: Moderate activity with xx deals (2019-2024), focused on portfolio expansion.

United Kingdom OTC Drugs Market Market Trends & Opportunities

The UK OTC drug market demonstrates robust growth, driven by factors such as an aging population, rising prevalence of chronic diseases, increasing healthcare expenditure, and growing self-medication practices. The market is estimated to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements, including the rise of e-pharmacies and telehealth, are reshaping distribution channels and enhancing consumer access. Changing consumer preferences towards natural and herbal remedies present both opportunities and challenges for established players. Competitive dynamics are characterized by intense pricing pressure, the rise of private label brands, and the need for innovative product development to stay ahead of the competition. Market penetration rates for various product categories show a steady increase, particularly for analgesics and dermatology products. The shift towards preventative healthcare further fuels market growth, with consumers increasingly focusing on self-care and wellness solutions. This trend necessitates the development of innovative OTC products that address these changing needs effectively.

Dominant Markets & Segments in United Kingdom OTC Drugs Market

The UK OTC drug market is geographically concentrated, with the highest sales volume observed in England, followed by Scotland and Wales. Among product types, Analgesics hold the largest market share, followed by Cough, Cold, and Flu Products. Oral administration remains the most prevalent route, while retail pharmacies dominate the distribution channel.

Key Growth Drivers:

- Increasing prevalence of chronic diseases: High rates of conditions requiring OTC medication.

- Aging population: Increased demand for self-medication among older adults.

- Rising healthcare costs: Driving consumer preference for affordable OTC options.

- Improved access to information: Online resources increasing self-medication awareness.

- Expansion of e-pharmacy: Convenient access and broader reach.

Market Dominance Analysis:

Analgesics lead due to high prevalence of pain-related conditions. Retail pharmacy dominance is attributed to consumer familiarity and accessibility. The oral route's prevalence is due to ease of administration and patient preference.

United Kingdom OTC Drugs Market Product Analysis

Recent product innovations focus on improved formulations for better efficacy and convenience, including extended-release analgesics, targeted dermatological treatments, and advanced formulations for gastrointestinal issues. Technological advancements in drug delivery systems and diagnostic tools further enhance the efficacy and convenience of OTC products. The market success of these products hinges on their ability to address specific unmet needs, offer superior efficacy and safety, and appeal to evolving consumer preferences.

Key Drivers, Barriers & Challenges in United Kingdom OTC Drugs Market

Key Drivers:

- Growing self-medication trend: Consumers actively seeking OTC solutions for minor ailments.

- Technological advancements: Improved formulations, convenient delivery systems.

- Increased awareness of health and wellness: Consumer focus on proactive health management.

Key Challenges:

- Stringent regulatory environment: Compliance costs and potential delays in product launches.

- Price competition: Pressure from generic and private-label products.

- Supply chain disruptions: Impacting product availability and pricing. Estimates show a xx% increase in supply chain costs since 2019.

Growth Drivers in the United Kingdom OTC Drugs Market Market

The market is primarily fueled by the rising prevalence of chronic diseases like arthritis and allergies, an aging population increasingly reliant on self-medication, and consumer preference for readily available solutions. Technological advancements in drug delivery, such as improved topical formulations and digital health integration, contribute significantly to market growth. Favorable government policies promoting self-care also play a pivotal role.

Challenges Impacting United Kingdom OTC Drugs Market Growth

Significant challenges include stringent regulations, increasing competition from both established players and new entrants, and potential supply chain disruptions. Price competition is particularly intense, while fluctuating currency exchange rates and raw material prices can significantly impact profitability.

Key Players Shaping the United Kingdom OTC Drugs Market Market

- Reckitt Benckiser Group PLC

- Bayer AG

- Sanofi

- Haleon Group of Companies

- Manx Healthcare Ltd

- Johnson & Johnson

- Perrigo Company plc

- Novo Nordisk A/S

- Pfizer Inc

Significant United Kingdom OTC Drugs Market Industry Milestones

- July 2023: The MHRA initiated consultations on reclassifying codeine linctus from OTC to prescription-only. This is expected to reduce misuse and enhance patient safety.

- March 2023: The MHRA reclassified Cialis Together (tadalafil) for OTC availability. This broadened access to treatment for erectile dysfunction.

Future Outlook for United Kingdom OTC Drugs Market Market

The UK OTC drug market is poised for continued growth, driven by an aging population, increasing self-medication trends, and technological advancements. Strategic opportunities exist in developing innovative products addressing unmet needs, leveraging digital health platforms, and optimizing supply chain efficiency. The market's future success depends on adapting to evolving consumer preferences, navigating regulatory hurdles, and fostering sustainable growth while prioritizing patient safety.

United Kingdom OTC Drugs Market Segmentation

-

1. Product Type

- 1.1. Cough, Cold, and Flu Products

- 1.2. Analgesics

- 1.3. Dermatology Products

- 1.4. Gastrointestinal Products

- 1.5. Other Product Types

-

2. Route of Administration

- 2.1. Oral

- 2.2. Topical

- 2.3. Parenteral

-

3. Distribution Channel

- 3.1. Retail Pharmacy

- 3.2. Hospital Pharmacy

- 3.3. E-Pharmacy

United Kingdom OTC Drugs Market Segmentation By Geography

- 1. United Kingdom

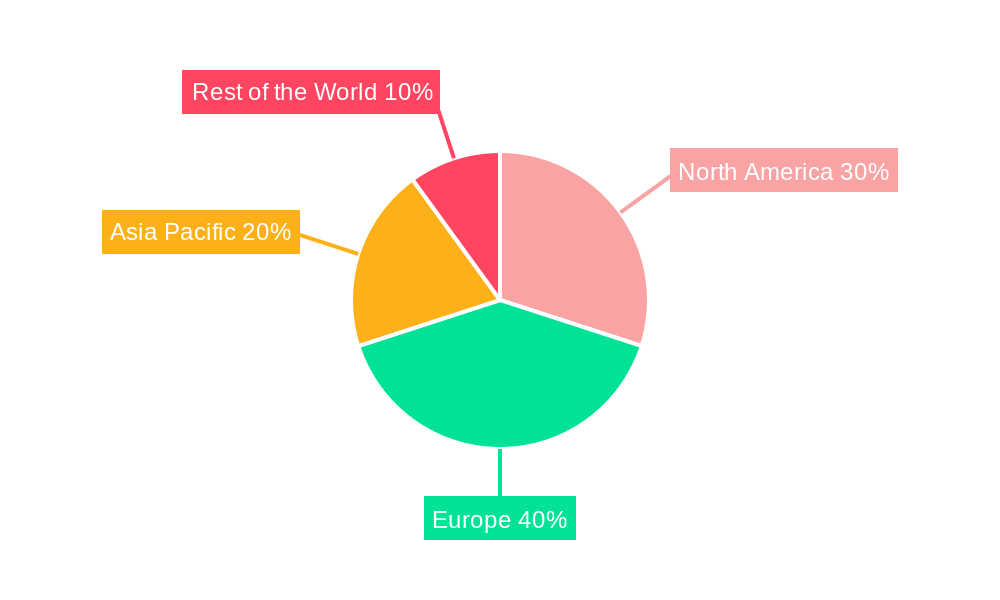

United Kingdom OTC Drugs Market Regional Market Share

Geographic Coverage of United Kingdom OTC Drugs Market

United Kingdom OTC Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Self-medication; Increasing Number of Product Launches

- 3.3. Market Restrains

- 3.3.1. High Probability of OTC Drug Abuse and Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Analgesics are Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom OTC Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cough, Cold, and Flu Products

- 5.1.2. Analgesics

- 5.1.3. Dermatology Products

- 5.1.4. Gastrointestinal Products

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Oral

- 5.2.2. Topical

- 5.2.3. Parenteral

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Retail Pharmacy

- 5.3.2. Hospital Pharmacy

- 5.3.3. E-Pharmacy

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reckitt Benckiser Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sanofi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haleon Group of Companies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Manx Healthcare Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Perrigo Company plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novo Nordisk A/S*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pfizer Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: United Kingdom OTC Drugs Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom OTC Drugs Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom OTC Drugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United Kingdom OTC Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 3: United Kingdom OTC Drugs Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United Kingdom OTC Drugs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United Kingdom OTC Drugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United Kingdom OTC Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 7: United Kingdom OTC Drugs Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United Kingdom OTC Drugs Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom OTC Drugs Market?

The projected CAGR is approximately 4.86%.

2. Which companies are prominent players in the United Kingdom OTC Drugs Market?

Key companies in the market include Reckitt Benckiser Group PLC, Bayer AG, Sanofi, Haleon Group of Companies, Manx Healthcare Ltd, Johnson & Johnson, Perrigo Company plc, Novo Nordisk A/S*List Not Exhaustive, Pfizer Inc.

3. What are the main segments of the United Kingdom OTC Drugs Market?

The market segments include Product Type, Route of Administration, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Self-medication; Increasing Number of Product Launches.

6. What are the notable trends driving market growth?

Analgesics are Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Probability of OTC Drug Abuse and Lack of Awareness.

8. Can you provide examples of recent developments in the market?

July 2023: The Medicines and Healthcare Products Regulatory Agency (MHRA) started consulting on the reclassification of codeine linctus from over-the-counter in pharmacies to a prescription-only medicine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom OTC Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom OTC Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom OTC Drugs Market?

To stay informed about further developments, trends, and reports in the United Kingdom OTC Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence