Key Insights

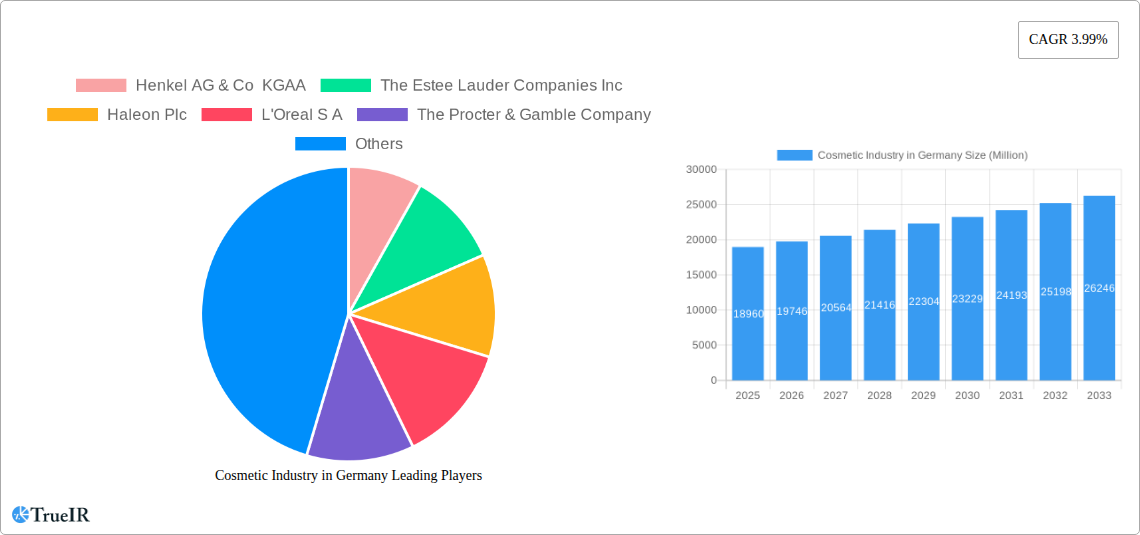

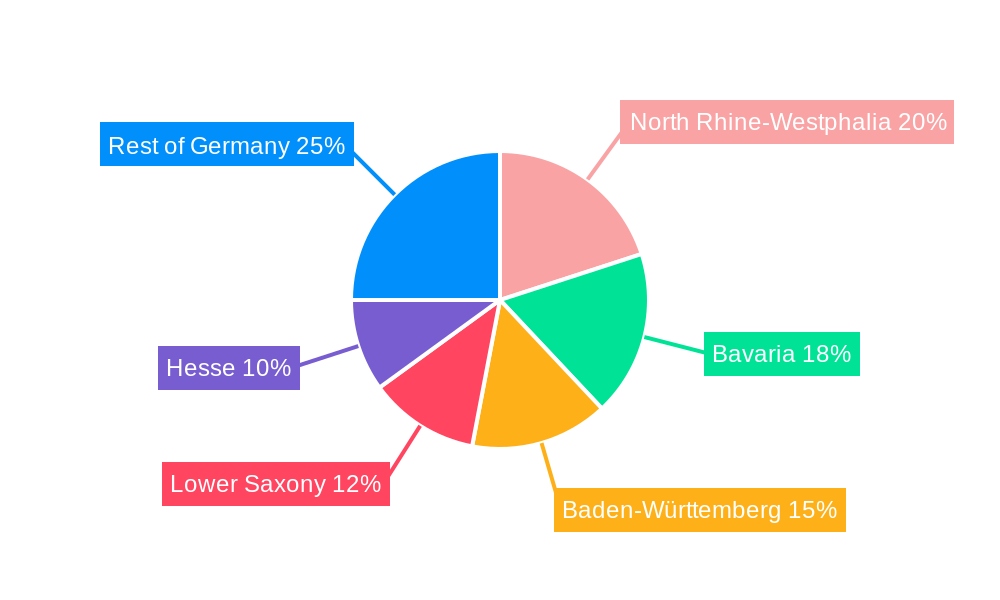

The German cosmetic market, valued at €18.96 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 3.99% from 2025 to 2033. This growth is fueled by several key drivers. Increasing consumer awareness of skincare and personal care, coupled with rising disposable incomes, particularly within the premium segment, is significantly impacting market expansion. The strong presence of established international brands alongside innovative German cosmetic companies creates a competitive landscape fostering product diversification and quality improvement. Furthermore, the increasing popularity of online retail channels provides convenient access to a wider product range, boosting market growth. However, factors like stringent regulations regarding cosmetic product formulations and the rising cost of raw materials pose potential challenges. The market segmentation reveals a strong preference for premium products, with specialist retail stores and online channels emerging as dominant distribution channels. Regional variations within Germany demonstrate that states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, with their higher population densities and stronger purchasing power, represent key market hubs. The market's historical performance (2019-2024) provides a solid foundation for these projections.

Cosmetic Industry in Germany Market Size (In Billion)

The forecast period (2025-2033) indicates sustained growth driven by consumer demand for natural and organic products, a trend amplified by growing environmental awareness. The successful integration of sustainable and ethical sourcing practices by major players will further shape the market. Competition among established international and domestic companies will remain intense, leading to product innovation, marketing strategies focused on targeted consumer segments (e.g., millennials and Gen Z), and a continuous emphasis on delivering high-quality products aligned with evolving consumer preferences. The German cosmetic market's future trajectory suggests considerable opportunities for established brands and new entrants alike, provided they adapt to the evolving consumer demands and market dynamics.

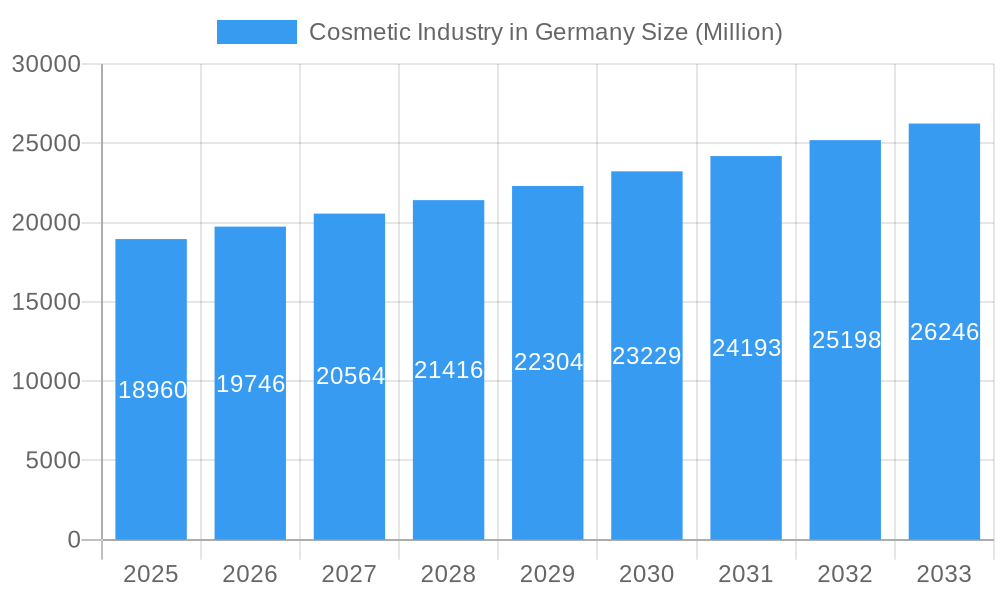

Cosmetic Industry in Germany Company Market Share

Germany Cosmetic Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the German cosmetic industry, covering market structure, trends, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. The report leverages extensive data and insights to offer a clear understanding of this dynamic market, valuable for businesses, investors, and industry professionals. The German cosmetic market, valued at €XX Billion in 2024, is projected to reach €XX Billion by 2033, exhibiting a CAGR of XX%.

Cosmetic Industry in Germany Market Structure & Competitive Landscape

The German cosmetic market is characterized by a blend of multinational giants and strong domestic players. Market concentration is moderate, with a Herfindahl-Hirschman Index (HHI) of approximately XX, indicating neither perfect competition nor complete dominance by a few firms. Key innovation drivers include the rising demand for natural and organic products, personalized cosmetics, and sustainable packaging. Stringent EU regulations significantly impact the industry, influencing product formulations and marketing claims. Product substitutes, such as homemade remedies and alternative therapies, pose a moderate competitive threat, particularly within the mass-market segment. End-user segmentation is diverse, spanning age groups, genders, and income levels, with a growing emphasis on specific needs and preferences. M&A activity has been significant in recent years, with approximately XX Billion in transactions recorded between 2019 and 2024, primarily driven by consolidation efforts and the acquisition of niche brands with specialized expertise.

- Market Concentration: Moderate, HHI of approximately XX.

- Innovation Drivers: Natural & organic products, personalization, sustainable packaging.

- Regulatory Impacts: Stringent EU regulations on ingredients and labeling.

- Product Substitutes: Homemade remedies, alternative therapies.

- End-User Segmentation: Diverse, based on age, gender, income, and specific needs.

- M&A Trends: Significant activity (XX Billion between 2019-2024), driven by consolidation and niche brand acquisitions.

Cosmetic Industry in Germany Market Trends & Opportunities

The German cosmetic market demonstrates robust growth, driven by increasing consumer spending on beauty and personal care products. Technological advancements, including AI-powered personalization tools and advanced formulation techniques, are shaping the industry landscape. Consumer preferences are shifting towards natural, sustainable, and ethically sourced products, creating significant opportunities for brands committed to transparency and responsible sourcing. The market is witnessing a rise in e-commerce, providing new distribution channels and expanding reach. Competitive dynamics remain intense, with both established players and emerging brands vying for market share. The market shows strong potential for premium and specialized products that cater to niche consumer segments. This is further boosted by the increasing disposable income and the growing awareness of self-care. The market has shown a compound annual growth rate (CAGR) of XX% during the historical period (2019-2024), a trend expected to continue albeit at a slightly moderated pace during the forecast period. The market penetration rate of organic and natural cosmetics has increased from XX% in 2019 to XX% in 2024 and is projected to reach XX% by 2033.

Dominant Markets & Segments in Cosmetic Industry in Germany

While the German market is relatively unified, regional variations exist in consumer preferences and purchasing habits. However, no single region displays overwhelming dominance. In terms of product types, skin care products represent the largest segment, followed by hair care and personal care products. Within categories, the premium segment shows higher growth potential driven by increasing disposable incomes and a desire for higher quality products. Online retail channels are rapidly expanding, while specialist retail stores remain crucial for premium brands.

- Leading Segment: Skin care products, followed by hair care and personal care products.

- Fastest-Growing Category: Premium products.

- Fastest-Growing Distribution Channel: Online retail channels.

- Key Growth Drivers: Rising disposable incomes, increasing awareness of beauty and self-care, and the rise of e-commerce.

Cosmetic Industry in Germany Product Analysis

Product innovation is a key driver of growth in the German cosmetic market. Technological advancements in formulation, packaging, and delivery systems are enabling the development of more effective, sustainable, and personalized products. This includes the growing use of natural and organic ingredients, personalized skincare regimens guided by AI, and innovative sustainable packaging. The market is witnessing the launch of new product formats and formulations that cater to specific consumer needs and preferences, leading to greater market differentiation and competitive advantage.

Key Drivers, Barriers & Challenges in Cosmetic Industry in Germany

Key Drivers: Rising disposable incomes, increasing consumer awareness of beauty and wellness, technological advancements in formulation and personalization, the growing popularity of e-commerce, and government support for sustainable practices. For example, the increasing adoption of eco-friendly practices is driving demand for sustainable packaging and natural ingredients.

Key Challenges: Increasing competition, stringent regulations regarding ingredients and labeling, supply chain disruptions (particularly concerning raw materials), and fluctuating economic conditions. These challenges exert significant pressure on profit margins and necessitate strategic adaptation by market players. For example, supply chain disruptions caused by the pandemic and geopolitical instability have led to increased raw material costs and reduced availability. The market faces competitive pressures from both established players and new entrants.

Growth Drivers in the Cosmetic Industry in Germany Market

Technological advancements such as AI-powered personalization and sustainable packaging are driving market growth. The growing preference for natural and organic products combined with increased disposable income and the expanding e-commerce sector are also significant contributors to the market's expansion. Government regulations promoting sustainability further encourage environmentally conscious practices within the industry, adding to the growth trajectory.

Challenges Impacting Cosmetic Industry in Germany Growth

The cosmetic industry in Germany faces challenges from fluctuating raw material costs, intensified competition, and stringent regulatory requirements related to product safety and labeling. Supply chain vulnerabilities and evolving consumer preferences necessitate agility and adaptation. Furthermore, the market is susceptible to economic downturns, which may lead to reduced consumer spending on non-essential goods.

Key Players Shaping the Cosmetic Industry in Germany Market

Significant Cosmetic Industry in Germany Industry Milestones

- December 2023: L’Oréal SA brand Aesop opened a new retail store in Munich, expanding its premium skincare and haircare offerings in the German market.

- December 2023: Unilever acquired the premium biotech haircare brand K18, strengthening its position in the high-growth premium segment.

- January 2024: Unilever brand Axe gained PETA approval and joined the Beauty Without Bunnies list, enhancing its brand image and appeal to ethically conscious consumers.

Future Outlook for Cosmetic Industry in Germany Market

The German cosmetic market is poised for continued growth, fueled by technological innovations, shifting consumer preferences, and the expansion of e-commerce. Strategic opportunities lie in developing personalized, sustainable, and ethically sourced products that cater to niche market segments. The market's potential is substantial, driven by rising disposable incomes and a growing focus on beauty and personal care. Brands that adapt to evolving consumer demands and leverage technological advancements are best positioned for success.

Cosmetic Industry in Germany Segmentation

-

1. Product Type

-

1.1. Personal Care Products

-

1.1.1. Hair Care Products

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioners

- 1.1.1.3. Other Hair Care Products

-

1.1.2. Skin Care Products

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

- 1.1.2.4. Bath and Shower Productrs

-

1.1.3. Oral Care

- 1.1.3.1. Toothbrushes

- 1.1.3.2. Toothpaste

- 1.1.3.3. Mouthwashes and Rinses

- 1.1.3.4. Other Oral Care Products

- 1.1.4. Deodrants and Antiperspirants

-

1.1.1. Hair Care Products

-

1.2. Cosmetics/Make-up Products

- 1.2.1. Facial Cosmetics

- 1.2.2. Eye Cosmetic Products

- 1.2.3. Lip and Nail Make-up Products

- 1.2.4. Hair styling and colouring products

-

1.1. Personal Care Products

-

2. Category

- 2.1. Mass Products

- 2.2. Premium Products

-

3. Distribution Channel

- 3.1. Specialist Retail Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Pharmacies/Drug Stores

- 3.4. Online Retail Channels

- 3.5. Other Distribution Channel

Cosmetic Industry in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cosmetic Industry in Germany Regional Market Share

Geographic Coverage of Cosmetic Industry in Germany

Cosmetic Industry in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Awareness About Effective Skincare

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care Products

- 5.1.1.1. Hair Care Products

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioners

- 5.1.1.1.3. Other Hair Care Products

- 5.1.1.2. Skin Care Products

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.2.4. Bath and Shower Productrs

- 5.1.1.3. Oral Care

- 5.1.1.3.1. Toothbrushes

- 5.1.1.3.2. Toothpaste

- 5.1.1.3.3. Mouthwashes and Rinses

- 5.1.1.3.4. Other Oral Care Products

- 5.1.1.4. Deodrants and Antiperspirants

- 5.1.1.1. Hair Care Products

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Facial Cosmetics

- 5.1.2.2. Eye Cosmetic Products

- 5.1.2.3. Lip and Nail Make-up Products

- 5.1.2.4. Hair styling and colouring products

- 5.1.1. Personal Care Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass Products

- 5.2.2. Premium Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialist Retail Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Pharmacies/Drug Stores

- 5.3.4. Online Retail Channels

- 5.3.5. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Personal Care Products

- 6.1.1.1. Hair Care Products

- 6.1.1.1.1. Shampoo

- 6.1.1.1.2. Conditioners

- 6.1.1.1.3. Other Hair Care Products

- 6.1.1.2. Skin Care Products

- 6.1.1.2.1. Facial Care Products

- 6.1.1.2.2. Body Care Products

- 6.1.1.2.3. Lip Care Products

- 6.1.1.2.4. Bath and Shower Productrs

- 6.1.1.3. Oral Care

- 6.1.1.3.1. Toothbrushes

- 6.1.1.3.2. Toothpaste

- 6.1.1.3.3. Mouthwashes and Rinses

- 6.1.1.3.4. Other Oral Care Products

- 6.1.1.4. Deodrants and Antiperspirants

- 6.1.1.1. Hair Care Products

- 6.1.2. Cosmetics/Make-up Products

- 6.1.2.1. Facial Cosmetics

- 6.1.2.2. Eye Cosmetic Products

- 6.1.2.3. Lip and Nail Make-up Products

- 6.1.2.4. Hair styling and colouring products

- 6.1.1. Personal Care Products

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass Products

- 6.2.2. Premium Products

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Specialist Retail Stores

- 6.3.2. Supermarkets/Hypermarkets

- 6.3.3. Pharmacies/Drug Stores

- 6.3.4. Online Retail Channels

- 6.3.5. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Personal Care Products

- 7.1.1.1. Hair Care Products

- 7.1.1.1.1. Shampoo

- 7.1.1.1.2. Conditioners

- 7.1.1.1.3. Other Hair Care Products

- 7.1.1.2. Skin Care Products

- 7.1.1.2.1. Facial Care Products

- 7.1.1.2.2. Body Care Products

- 7.1.1.2.3. Lip Care Products

- 7.1.1.2.4. Bath and Shower Productrs

- 7.1.1.3. Oral Care

- 7.1.1.3.1. Toothbrushes

- 7.1.1.3.2. Toothpaste

- 7.1.1.3.3. Mouthwashes and Rinses

- 7.1.1.3.4. Other Oral Care Products

- 7.1.1.4. Deodrants and Antiperspirants

- 7.1.1.1. Hair Care Products

- 7.1.2. Cosmetics/Make-up Products

- 7.1.2.1. Facial Cosmetics

- 7.1.2.2. Eye Cosmetic Products

- 7.1.2.3. Lip and Nail Make-up Products

- 7.1.2.4. Hair styling and colouring products

- 7.1.1. Personal Care Products

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass Products

- 7.2.2. Premium Products

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Specialist Retail Stores

- 7.3.2. Supermarkets/Hypermarkets

- 7.3.3. Pharmacies/Drug Stores

- 7.3.4. Online Retail Channels

- 7.3.5. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Personal Care Products

- 8.1.1.1. Hair Care Products

- 8.1.1.1.1. Shampoo

- 8.1.1.1.2. Conditioners

- 8.1.1.1.3. Other Hair Care Products

- 8.1.1.2. Skin Care Products

- 8.1.1.2.1. Facial Care Products

- 8.1.1.2.2. Body Care Products

- 8.1.1.2.3. Lip Care Products

- 8.1.1.2.4. Bath and Shower Productrs

- 8.1.1.3. Oral Care

- 8.1.1.3.1. Toothbrushes

- 8.1.1.3.2. Toothpaste

- 8.1.1.3.3. Mouthwashes and Rinses

- 8.1.1.3.4. Other Oral Care Products

- 8.1.1.4. Deodrants and Antiperspirants

- 8.1.1.1. Hair Care Products

- 8.1.2. Cosmetics/Make-up Products

- 8.1.2.1. Facial Cosmetics

- 8.1.2.2. Eye Cosmetic Products

- 8.1.2.3. Lip and Nail Make-up Products

- 8.1.2.4. Hair styling and colouring products

- 8.1.1. Personal Care Products

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass Products

- 8.2.2. Premium Products

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Specialist Retail Stores

- 8.3.2. Supermarkets/Hypermarkets

- 8.3.3. Pharmacies/Drug Stores

- 8.3.4. Online Retail Channels

- 8.3.5. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Personal Care Products

- 9.1.1.1. Hair Care Products

- 9.1.1.1.1. Shampoo

- 9.1.1.1.2. Conditioners

- 9.1.1.1.3. Other Hair Care Products

- 9.1.1.2. Skin Care Products

- 9.1.1.2.1. Facial Care Products

- 9.1.1.2.2. Body Care Products

- 9.1.1.2.3. Lip Care Products

- 9.1.1.2.4. Bath and Shower Productrs

- 9.1.1.3. Oral Care

- 9.1.1.3.1. Toothbrushes

- 9.1.1.3.2. Toothpaste

- 9.1.1.3.3. Mouthwashes and Rinses

- 9.1.1.3.4. Other Oral Care Products

- 9.1.1.4. Deodrants and Antiperspirants

- 9.1.1.1. Hair Care Products

- 9.1.2. Cosmetics/Make-up Products

- 9.1.2.1. Facial Cosmetics

- 9.1.2.2. Eye Cosmetic Products

- 9.1.2.3. Lip and Nail Make-up Products

- 9.1.2.4. Hair styling and colouring products

- 9.1.1. Personal Care Products

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass Products

- 9.2.2. Premium Products

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Specialist Retail Stores

- 9.3.2. Supermarkets/Hypermarkets

- 9.3.3. Pharmacies/Drug Stores

- 9.3.4. Online Retail Channels

- 9.3.5. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Personal Care Products

- 10.1.1.1. Hair Care Products

- 10.1.1.1.1. Shampoo

- 10.1.1.1.2. Conditioners

- 10.1.1.1.3. Other Hair Care Products

- 10.1.1.2. Skin Care Products

- 10.1.1.2.1. Facial Care Products

- 10.1.1.2.2. Body Care Products

- 10.1.1.2.3. Lip Care Products

- 10.1.1.2.4. Bath and Shower Productrs

- 10.1.1.3. Oral Care

- 10.1.1.3.1. Toothbrushes

- 10.1.1.3.2. Toothpaste

- 10.1.1.3.3. Mouthwashes and Rinses

- 10.1.1.3.4. Other Oral Care Products

- 10.1.1.4. Deodrants and Antiperspirants

- 10.1.1.1. Hair Care Products

- 10.1.2. Cosmetics/Make-up Products

- 10.1.2.1. Facial Cosmetics

- 10.1.2.2. Eye Cosmetic Products

- 10.1.2.3. Lip and Nail Make-up Products

- 10.1.2.4. Hair styling and colouring products

- 10.1.1. Personal Care Products

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Mass Products

- 10.2.2. Premium Products

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Specialist Retail Stores

- 10.3.2. Supermarkets/Hypermarkets

- 10.3.3. Pharmacies/Drug Stores

- 10.3.4. Online Retail Channels

- 10.3.5. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGAA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Estee Lauder Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Haleon Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L'Oreal S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Procter & Gamble Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Natura & Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Colgate - Palmolive Company*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beiersdorf AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGAA

List of Figures

- Figure 1: Global Cosmetic Industry in Germany Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 5: North America Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 11: South America Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 13: South America Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 14: South America Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 21: Europe Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 22: Europe Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 29: Middle East & Africa Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 30: Middle East & Africa Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 37: Asia Pacific Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 38: Asia Pacific Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 3: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Cosmetic Industry in Germany Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 7: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 14: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 21: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 34: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 44: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Industry in Germany?

The projected CAGR is approximately 3.99%.

2. Which companies are prominent players in the Cosmetic Industry in Germany?

Key companies in the market include Henkel AG & Co KGAA, The Estee Lauder Companies Inc, Haleon Plc, L'Oreal S A, The Procter & Gamble Company, Natura & Co, Johnson & Johnson Services Inc, Colgate - Palmolive Company*List Not Exhaustive, Beiersdorf AG.

3. What are the main segments of the Cosmetic Industry in Germany?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands.

6. What are the notable trends driving market growth?

Increasing Awareness About Effective Skincare.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2024: Unilever brand Axe gained PETA approval and joined the Beauty Without Bunnies list.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetic Industry in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetic Industry in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetic Industry in Germany?

To stay informed about further developments, trends, and reports in the Cosmetic Industry in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence