Key Insights

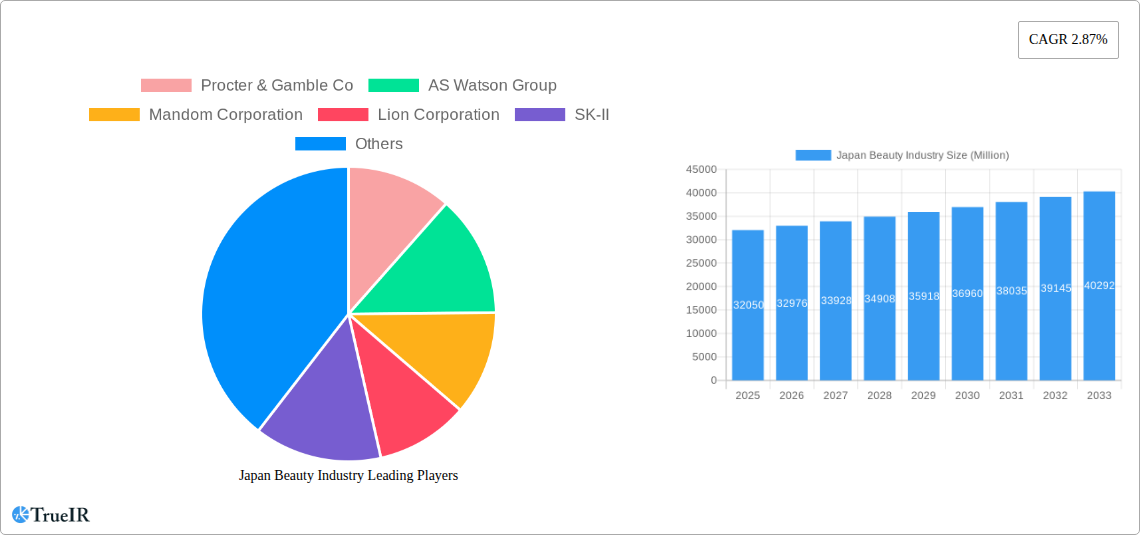

The Japanese beauty industry is a robust and evolving market, currently valued at approximately 32,050 million in 2025. This market is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 2.87% anticipated from 2025 to 2033. This sustained expansion is driven by several key factors. A significant driver is the increasing consumer demand for premium and specialized beauty products, reflecting a growing willingness to invest in high-quality skincare and cosmetic solutions. Furthermore, the aging population in Japan is contributing to a rise in demand for anti-aging and dermatological products, while also fostering innovation in the functional beauty segment. The trend towards personalized beauty experiences, enabled by advancements in technology and data analytics, is also shaping consumer preferences and product development. The robust presence of established domestic and international players, including Procter & Gamble, Unilever, L'Oreal, and Shiseido, indicates a competitive landscape that encourages continuous innovation and product diversification to meet discerning consumer needs.

Japan Beauty Industry Market Size (In Billion)

The market's segmentation reveals a strong emphasis on Personal Care, with Hair Care, Skin Care, and Oral Care products forming core segments. Within these, specific product types like facial care, hair shampoos, and toothpaste are highly sought after. The Cosmetics/Make-up segment, particularly color cosmetics, also plays a crucial role. Distribution channels are diverse, with Specialist Retail Stores, Supermarkets/Hypermarkets, and increasingly, Online Retail Channels, catering to a wide spectrum of consumers. The inclusion of "Mass Products" alongside "Premium Products" highlights the dual nature of the market, serving both budget-conscious and luxury-seeking demographics. While the provided data focuses on Japan, the broader Asian beauty market trends, such as the influence of K-beauty and the increasing demand for sustainable and ethical beauty products, are likely to indirectly impact and shape the trajectory of the Japanese beauty sector, pushing for more environmentally conscious and ingredient-focused offerings.

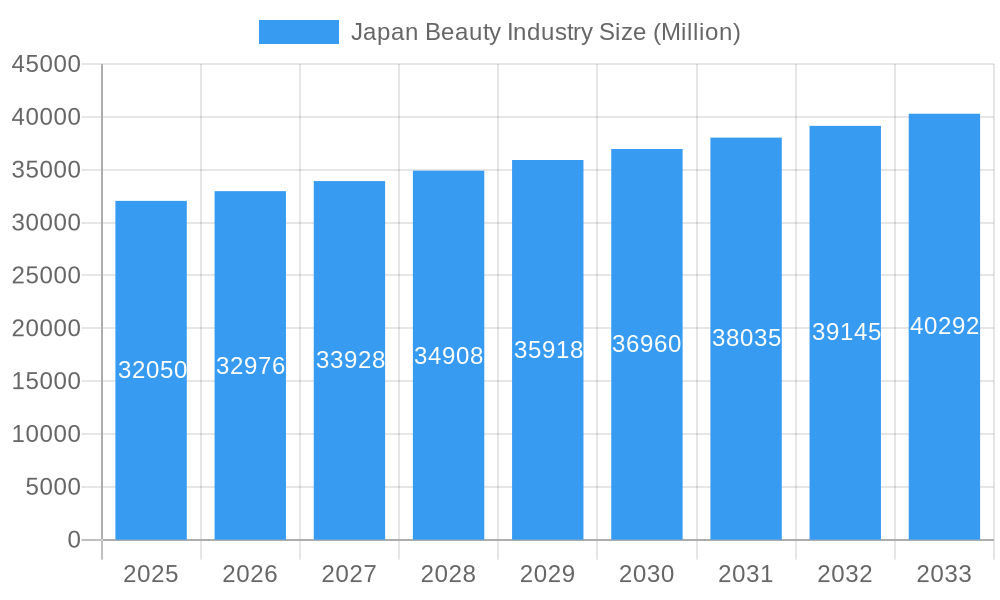

Japan Beauty Industry Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the Japan beauty industry, a sector experiencing significant growth and evolution. Leveraging high-volume keywords such as "Japan skincare market," "Japanese cosmetics trends," "beauty products Japan," and "personal care Japan," this report is meticulously crafted to enhance search rankings and engage a broad audience of industry professionals, investors, and market analysts. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033, this report offers unparalleled insights into market structure, trends, dominant segments, product innovations, key players, and future outlook.

Japan Beauty Industry Market Structure & Competitive Landscape

The Japan beauty industry exhibits a moderately concentrated market structure, with a few leading global and domestic players holding significant market share, alongside a vibrant landscape of niche and emerging brands. Innovation is a critical driver, fueled by intense R&D investment in cutting-edge formulations, sustainable ingredients, and advanced skincare technologies. Regulatory impacts are primarily driven by stringent quality control standards and evolving consumer safety guidelines, ensuring product efficacy and consumer trust. Product substitutes are abundant, ranging from DIY beauty solutions to innovative technological beauty devices, forcing brands to continuously differentiate. End-user segmentation is highly granular, with distinct preferences based on age, gender, skin concerns, and lifestyle. Mergers and acquisitions (M&A) trends are observable as larger entities seek to expand their portfolios, acquire innovative startups, and strengthen their market presence. For instance, M&A volumes have seen a steady increase, driven by consolidation and strategic partnerships aimed at capturing emerging market segments and technological advancements. Concentration ratios indicate a dynamic interplay between established giants and agile disruptors, shaping a competitive yet collaborative ecosystem.

Japan Beauty Industry Market Trends & Opportunities

The Japan beauty industry is projected to experience robust market size growth throughout the forecast period. This expansion is propelled by several key trends, including the increasing demand for premium skincare products driven by a sophisticated consumer base with a high disposable income, and the growing popularity of natural and organic beauty ingredients reflecting a heightened consumer awareness of health and environmental sustainability. Technological shifts are significantly influencing the market, with the rise of AI-powered skincare analysis, personalized beauty recommendations, and innovative application devices enhancing consumer experience and product efficacy. Furthermore, the proliferation of online retail channels and social commerce has democratized access to beauty products, enabling smaller brands to reach a wider audience and driving the adoption of e-commerce strategies by established players. Consumer preferences are increasingly shifting towards multi-functional products, minimalist routines, and personalized beauty solutions, creating opportunities for brands that can cater to these evolving demands. The competitive dynamics are characterized by fierce rivalry, with companies investing heavily in product innovation, digital marketing, and strategic partnerships to gain a competitive edge. The market penetration rate for key segments, such as advanced anti-aging skincare and sustainable beauty, continues to rise, indicating a receptive consumer base for innovative offerings. The Compound Annual Growth Rate (CAGR) for the Japan beauty industry is estimated to be approximately 5.5% over the forecast period, signaling sustained expansion.

Dominant Markets & Segments in Japan Beauty Industry

The Skincare segment stands as the dominant market within the Japan beauty industry, driven by a strong cultural emphasis on maintaining youthful and healthy skin. Within this segment, Facial Care Products are the primary revenue generators, encompassing a wide array of serums, creams, masks, and cleansers catering to diverse skin concerns. The Premium Products category commands a significant market share, reflecting consumers' willingness to invest in high-quality, efficacy-driven formulations and luxury brand experiences.

Key growth drivers for this dominance include:

- Advanced Technological Integration: The widespread adoption of advanced skincare technologies, such as personalized ingredient formulations and innovative delivery systems, appeals to the discerning Japanese consumer seeking cutting-edge solutions.

- Rising Disposable Income and Consumer Sophistication: A consistently strong economy and a highly educated populace contribute to a higher disposable income, allowing for greater expenditure on premium beauty items.

- Strong Cultural Emphasis on Aesthetics and Self-Care: Japanese culture places a high value on personal grooming and maintaining a youthful appearance, making skincare a priority.

- Effective Distribution Networks: The presence of well-established Specialist Retail Stores, alongside the rapidly growing Online Retail Channels, ensures broad accessibility and convenient purchasing options for consumers.

- Government Support for Innovation and Quality Standards: Policies that encourage research and development, coupled with rigorous quality control measures, foster consumer confidence in domestic and international beauty products.

The Cosmetics/Make-up Products segment also holds substantial importance, with Colour Cosmetics, particularly Facial Make-up Products, showing consistent demand. The Mass Products category, while significant, faces increasing competition from premium alternatives that offer enhanced benefits and unique brand narratives. Online Retail Channels are rapidly emerging as a crucial distribution avenue, capturing a substantial portion of sales due to convenience and wider product selection.

Japan Beauty Industry Product Analysis

Product innovations in the Japan beauty industry are characterized by a relentless pursuit of efficacy and a deep understanding of consumer needs. The market sees a continuous stream of advanced formulations in skincare, focusing on ingredients like peptides, ceramides, and botanical extracts that offer targeted solutions for aging, pigmentation, and hydration. Cosmetics are evolving towards hybrid formulations that offer skincare benefits alongside color payoff. Competitive advantages are built on technological advancements in product delivery systems, sustainable packaging solutions, and personalized product recommendations driven by AI. The market fit is optimized by catering to the Japanese consumer's preference for subtle elegance, scientifically backed claims, and a focus on long-term skin health.

Key Drivers, Barriers & Challenges in Japan Beauty Industry

Key Drivers: The Japan beauty industry is propelled by several dynamic forces. Technological advancements, particularly in ingredient research and product formulation, are paramount. The growing consumer demand for natural and sustainable beauty products is a significant economic driver. Government initiatives supporting R&D and quality standards further bolster market growth. The increasing integration of digital channels, including e-commerce and social media marketing, expands market reach and consumer engagement.

Barriers & Challenges: Supply chain disruptions, particularly for imported ingredients, pose a significant challenge. Regulatory hurdles and compliance with evolving safety standards can impact product development timelines. Intense competitive pressures from both domestic and international players necessitate continuous innovation and strategic differentiation. The aging population in Japan presents both opportunities and challenges, requiring product development tailored to mature skin concerns. Market saturation in certain product categories also demands creative marketing strategies and product diversification.

Growth Drivers in the Japan Beauty Industry Market

Key growth drivers in the Japan beauty industry are multifaceted, encompassing technological, economic, and regulatory factors. Technological innovation remains at the forefront, with ongoing research into novel ingredients and advanced formulation techniques, such as the development of highly effective anti-aging serums and personalized skincare solutions. Economically, a growing middle class and increasing disposable income contribute to higher consumer spending on beauty products, particularly in the premium and mass segments. Regulatory frameworks that encourage research and development and maintain high product safety standards foster consumer confidence and market expansion. The increasing adoption of digital marketing strategies and the rapid growth of e-commerce platforms are opening new avenues for market penetration and brand visibility, allowing smaller brands to compete effectively.

Challenges Impacting Japan Beauty Industry Growth

Several challenges impact the growth of the Japan beauty industry. Regulatory complexities surrounding new ingredient approvals and product claims can lead to extended development cycles. Supply chain volatility, particularly for ethically sourced or niche natural ingredients, can disrupt production and increase costs. Intense competitive pressures from a crowded market, both from established global players and agile local brands, necessitate continuous innovation and aggressive marketing to maintain market share. Furthermore, evolving consumer preferences towards sustainability and ethical sourcing require significant investment in research and development to align product offerings with these demands, while the aging demographic presents a need for specialized product development that can be a complex and costly undertaking.

Key Players Shaping the Japan Beauty Industry Market

- Procter & Gamble Co

- AS Watson Group

- Mandom Corporation

- Lion Corporation

- SK-II

- Shiseido Company

- Unilever PLC

- Makanai

- L'Oreal SA

- Kao Corporation

Significant Japan Beauty Industry Industry Milestones

- September 2021: Kao Corporation launched a new sheet mask called Smile Performer, claiming to add radiance and bounce to the skin, creating a smiling impression.

- April 2021: Kao Corporation, through its subsidiary Kao Salon Japan, launched its hair salon brand named Oribe in Japan, featuring 23 product line-ups widely available.

- February 2021: The Shiseido Company launched "Shiseido Men," a new range of men's skincare and makeup products, including "SHISEIDO MEN UltimuneTM Power Infusing Concentrate."

Future Outlook for Japan Beauty Industry Market

The future outlook for the Japan beauty industry remains exceptionally positive, driven by sustained consumer demand for innovative and personalized beauty solutions. Strategic opportunities lie in further exploiting the growth of online retail channels and the burgeoning men's grooming segment. The increasing consumer focus on sustainability and clean beauty presents a significant growth catalyst for brands that can genuinely integrate these principles into their product development and marketing strategies. Furthermore, the integration of digital technologies, such as AI-driven diagnostics and virtual try-on experiences, will continue to enhance consumer engagement and create new revenue streams. The market potential is substantial, with continued innovation in anti-aging, personalized skincare, and the expansion of niche product categories expected to fuel consistent growth throughout the forecast period.

Japan Beauty Industry Segmentation

-

1. Product Type

-

1.1. Personal Care

-

1.1.1. Hair Care

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioners

- 1.1.1.3. Other Products

-

1.1.2. Skin Care

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

-

1.1.3. Bath and Shower

- 1.1.3.1. Shower Gels

- 1.1.3.2. Soaps

-

1.1.4. Oral Care

- 1.1.4.1. Toothbrushes

- 1.1.4.2. Toothpaste

- 1.1.4.3. Mouthwashes and Rinses

- 1.1.5. Men's Grooming Products

- 1.1.6. Deodrants and Antiperspirants

-

1.1.1. Hair Care

-

1.2. Cosmetics/Make-up Products

-

1.2.1. Colour Cosmetics

- 1.2.1.1. Facial Make-up Products

- 1.2.1.2. Eye Make-up Products

- 1.2.1.3. Lip and Nail Make-up Products

- 1.2.1.4. Hair Styling and Coloring Products

-

1.2.1. Colour Cosmetics

-

1.1. Personal Care

-

2. Category

- 2.1. Premium Products

- 2.2. Mass Products

-

3. Distribution Channel

- 3.1. Specialist Retail Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience Stores

- 3.4. Pharmacies/Drug Stores

- 3.5. Online Retail Channels

- 3.6. Other Distribution Channels

Japan Beauty Industry Segmentation By Geography

- 1. Japan

Japan Beauty Industry Regional Market Share

Geographic Coverage of Japan Beauty Industry

Japan Beauty Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Natural/Organic Beauty and Personal Care Products; Skincare Trends Revolutionizing Beauty Industry

- 3.3. Market Restrains

- 3.3.1. Counterfeiting In the Cosmetics And Personal Care Sector

- 3.4. Market Trends

- 3.4.1. Rising Demand for Natural Cosmetics and Skincare Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Beauty Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care

- 5.1.1.1. Hair Care

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioners

- 5.1.1.1.3. Other Products

- 5.1.1.2. Skin Care

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.3. Bath and Shower

- 5.1.1.3.1. Shower Gels

- 5.1.1.3.2. Soaps

- 5.1.1.4. Oral Care

- 5.1.1.4.1. Toothbrushes

- 5.1.1.4.2. Toothpaste

- 5.1.1.4.3. Mouthwashes and Rinses

- 5.1.1.5. Men's Grooming Products

- 5.1.1.6. Deodrants and Antiperspirants

- 5.1.1.1. Hair Care

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Colour Cosmetics

- 5.1.2.1.1. Facial Make-up Products

- 5.1.2.1.2. Eye Make-up Products

- 5.1.2.1.3. Lip and Nail Make-up Products

- 5.1.2.1.4. Hair Styling and Coloring Products

- 5.1.2.1. Colour Cosmetics

- 5.1.1. Personal Care

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Premium Products

- 5.2.2. Mass Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialist Retail Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience Stores

- 5.3.4. Pharmacies/Drug Stores

- 5.3.5. Online Retail Channels

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Procter & Gamble Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AS Watson Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mandom Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lion Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SK-II

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shiseido Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unilever PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Makanai*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 L'Oreal SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kao Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Procter & Gamble Co

List of Figures

- Figure 1: Japan Beauty Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Beauty Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Beauty Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Japan Beauty Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 3: Japan Beauty Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Japan Beauty Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Japan Beauty Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Japan Beauty Industry Revenue Million Forecast, by Category 2020 & 2033

- Table 7: Japan Beauty Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Japan Beauty Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Beauty Industry?

The projected CAGR is approximately 2.87%.

2. Which companies are prominent players in the Japan Beauty Industry?

Key companies in the market include Procter & Gamble Co, AS Watson Group, Mandom Corporation, Lion Corporation, SK-II, Shiseido Company, Unilever PLC, Makanai*List Not Exhaustive, L'Oreal SA, Kao Corporation.

3. What are the main segments of the Japan Beauty Industry?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Natural/Organic Beauty and Personal Care Products; Skincare Trends Revolutionizing Beauty Industry.

6. What are the notable trends driving market growth?

Rising Demand for Natural Cosmetics and Skincare Products.

7. Are there any restraints impacting market growth?

Counterfeiting In the Cosmetics And Personal Care Sector.

8. Can you provide examples of recent developments in the market?

September 2021: Kao Corporation launched a new sheet mask called Smile Performer. The sheet mask claims to add radiance and bounce to the skin, which creates a smiling impression.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Beauty Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Beauty Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Beauty Industry?

To stay informed about further developments, trends, and reports in the Japan Beauty Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence