Key Insights

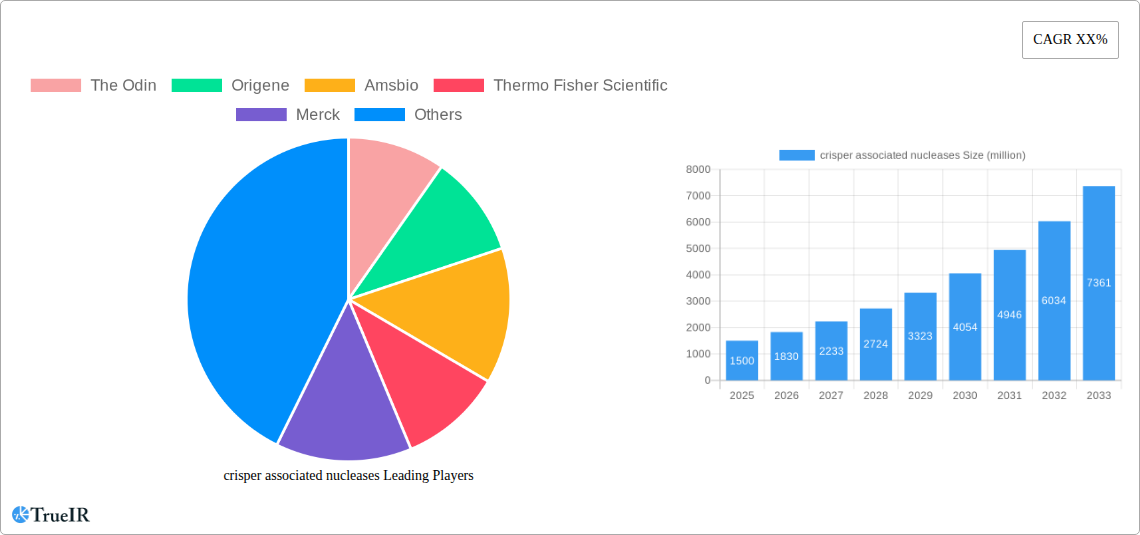

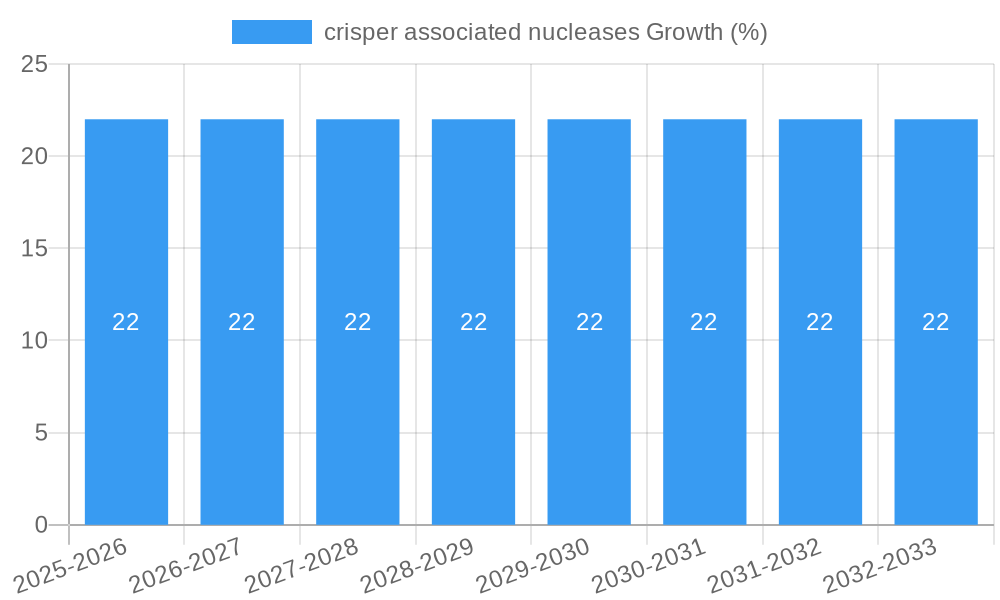

The CRISPR-associated nucleases market is experiencing robust growth, driven by the transformative potential of gene editing technologies across numerous research and therapeutic applications. With an estimated market size of USD 1,500 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 22% from 2025 to 2033, the market is poised for significant expansion. This surge is fueled by increasing investments in biotechnology research, a growing understanding of genetic diseases, and the expanding pipeline of CRISPR-based therapeutics. Key applications, including gene therapy, drug discovery, diagnostics, and agricultural biotechnology, are all contributing to this upward trajectory. The development of novel CRISPR systems and delivery mechanisms is further enhancing the precision and efficiency of gene editing, paving the way for groundbreaking advancements in personalized medicine and disease treatment.

The market's expansion is further supported by a growing number of research collaborations between academic institutions and leading biotechnology companies. Companies like Thermo Fisher Scientific, Merck, and Editas are at the forefront of developing and commercializing innovative CRISPR-associated nucleases and related tools. While the market presents substantial opportunities, certain restraints, such as the ethical considerations surrounding gene editing, stringent regulatory hurdles, and the high cost of developing and implementing these technologies, need to be carefully navigated. Despite these challenges, the relentless pursuit of novel treatments for genetic disorders and the increasing adoption of CRISPR in basic research and applied fields are expected to maintain the market's strong growth momentum. The market is segmented by application into gene therapy, drug discovery, diagnostics, and agricultural biotechnology, and by types into Cas9, Cas12a, and other variants, each showcasing distinct growth patterns.

crisper associated nucleases Market Structure & Competitive Landscape

The global crisper associated nucleases market exhibits a moderately consolidated structure, with several million-dollar players actively engaged in research and development, product innovation, and strategic alliances. The market is propelled by substantial innovation drivers, including breakthroughs in gene editing technologies, advancements in diagnostic tools, and the burgeoning demand for novel therapeutic interventions for genetic diseases. Regulatory landscapes, while evolving, present both opportunities and challenges, influencing market access and product development timelines. Key restraints include the high cost of R&D, the complexity of clinical trials, and ethical considerations surrounding gene editing. Product substitutes are emerging, primarily in the form of other gene editing platforms, but crisper associated nucleases currently maintain a significant technological edge. End-user segmentation is diverse, spanning academic research institutions, pharmaceutical and biotechnology companies, and contract research organizations. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their technological portfolios, enhance market reach, and consolidate their competitive positions. For instance, the historical period from 2019–2024 witnessed approximately XXX million-dollar M&A deals, indicating a strategic consolidation phase. The concentration ratio for the top five players is estimated to be around xx%, signifying a competitive yet consolidated market.

- Innovation Drivers:

- Breakthroughs in CRISPR-Cas9 and related gene editing systems.

- Growing understanding of genetic diseases and their molecular basis.

- Advancements in delivery mechanisms for nucleases.

- Increasing investment in genomic research.

- Regulatory Impacts:

- FDA and EMA guidelines for gene therapy development.

- Ethical review boards and public perception influencing research.

- Patent landscapes and intellectual property disputes.

- End-User Segmentation:

- Academic and Government Research Institutes.

- Pharmaceutical and Biotechnology Companies.

- Contract Research Organizations (CROs).

- Diagnostic Laboratories.

- M&A Trends:

- Acquisitions to gain access to novel CRISPR technologies.

- Mergers to expand therapeutic pipelines.

- Collaborations to accelerate drug discovery and development.

crisper associated nucleases Market Trends & Opportunities

The global crisper associated nucleases market is poised for substantial expansion, driven by an escalating demand for precision medicine, the burgeoning oncology research landscape, and significant advancements in gene therapy. The market size is projected to surge from approximately $XXX million in the base year of 2025 to an estimated $XXX million by the end of the forecast period in 2033, reflecting a compound annual growth rate (CAGR) of xx%. This impressive growth trajectory is underpinned by transformative technological shifts. The continuous refinement of CRISPR-Cas systems, including the development of more precise and efficient variants like base editing and prime editing, is opening up unprecedented therapeutic avenues. Furthermore, the integration of AI and machine learning in gene editing target identification and off-target effect prediction is accelerating research and development cycles, leading to faster clinical translation.

Consumer preferences are increasingly leaning towards personalized treatment strategies, a trend that aligns perfectly with the capabilities of crisper associated nucleases in addressing individual genetic predispositions and diseases. The market penetration rate for gene editing therapies, while still in its nascent stages, is expected to witness a significant uptick as more gene therapies receive regulatory approval and gain wider clinical adoption. Competitive dynamics are intensifying, with established pharmaceutical giants and agile biotechnology startups vying for market dominance. Strategic collaborations and partnerships are becoming commonplace, fostering an ecosystem of innovation and resource sharing. The rising prevalence of chronic and rare genetic disorders, coupled with a growing awareness among patient populations and healthcare providers about the potential of gene editing, further fuels market growth. The sheer volume of ongoing clinical trials utilizing crisper associated nucleases for a myriad of indications, from sickle cell anemia and cystic fibrosis to various cancers, underscores the immense market opportunity. The development of ex vivo and in vivo gene editing approaches offers distinct advantages for different therapeutic scenarios, broadening the applicability of these technologies. Opportunities also lie in developing novel delivery systems, improving the specificity and efficiency of gene editing, and establishing robust regulatory frameworks that can support rapid innovation while ensuring patient safety. The projected market value of approximately $XXX million for the crisper associated nucleases market in 2025 signifies a robust foundation for this dynamic sector.

Dominant Markets & Segments in crisper associated nucleases

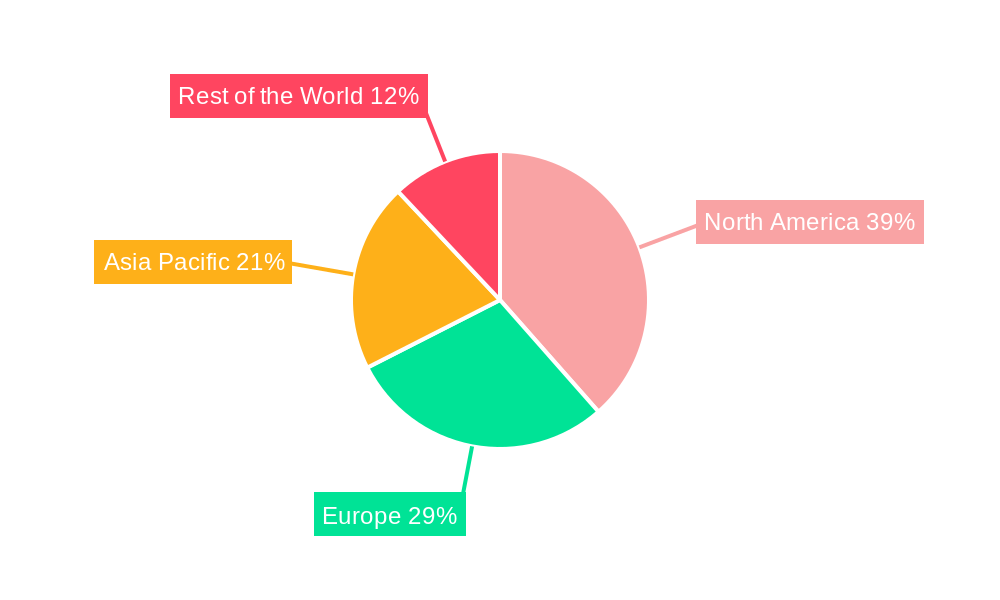

The global crisper associated nucleases market is characterized by distinct regional dominance and segment leadership, driven by a confluence of factors including research infrastructure, government funding, and clinical trial activity.

Leading Region: North America, particularly the United States, currently dominates the crisper associated nucleases market. This leadership is attributable to several key growth drivers:

- Robust Research Ecosystem: The presence of world-renowned research institutions and universities, such as Harvard, MIT, and Stanford, fosters cutting-edge research in genomics and gene editing. This academic excellence translates directly into a strong pipeline of innovation and skilled personnel.

- Significant Government Funding: Government agencies like the National Institutes of Health (NIH) allocate substantial funding towards basic and applied research in genetic technologies, propelling the development and application of crisper associated nucleases.

- Vibrant Biotechnology and Pharmaceutical Industry: A well-established biotechnology and pharmaceutical sector, coupled with substantial venture capital investment, provides the necessary financial backing and infrastructure for translating research into commercial products and therapies.

- Favorable Regulatory Environment: While stringent, the US regulatory framework, spearheaded by the FDA, has a clear pathway for the approval of novel gene therapies, encouraging companies to pursue clinical development.

Dominant Application Segment: The Therapeutics application segment is the primary growth engine for crisper associated nucleases. This dominance is fueled by:

- Oncology: Crisper associated nucleases are extensively utilized in developing novel cancer immunotherapies and gene therapies targeting specific oncogenic mutations. The unmet medical need in cancer treatment creates a vast market for these advanced therapeutic modalities.

- Rare Genetic Diseases: The ability of crisper associated nucleases to correct genetic defects makes them a promising solution for treating rare inherited disorders such as sickle cell disease, cystic fibrosis, and Duchenne muscular dystrophy. The development of therapies for these conditions is a significant focus area.

- Infectious Diseases: Research is actively exploring the use of crisper associated nucleases to target and eliminate viral DNA, with potential applications against HIV and other persistent viral infections.

Dominant Type Segment: Among the types of crisper associated nucleases, CRISPR-Cas9 continues to be the most widely adopted and researched. Its dominance stems from:

- Established Efficacy and Versatility: CRISPR-Cas9 has demonstrated robust gene editing capabilities across a wide range of cell types and organisms, making it a versatile tool for research and therapeutic development.

- Extensive Research Data: A vast body of scientific literature and research data supports the use of CRISPR-Cas9, providing a solid foundation for further innovation and clinical application.

- Availability of Reagents and Kits: A well-developed market for CRISPR-Cas9 reagents, enzymes, and delivery systems from key players facilitates its widespread use in laboratories worldwide.

While other CRISPR systems like CRISPR-Cas12 (Cpf1) and newer engineered nucleases are gaining traction due to their unique advantages, CRISPR-Cas9 remains the benchmark and the most significant contributor to the current market landscape. The estimated market size for this segment in 2025 is in the range of $XXX million.

crisper associated nucleases Product Analysis

Crisper associated nucleases are revolutionizing genetic research and therapeutic development with their unparalleled precision and versatility. Product innovations are primarily focused on enhancing specificity, reducing off-target effects, and optimizing delivery mechanisms. Companies are developing engineered nucleases with improved guide RNA binding, nickase variants for double-strand break reduction, and all-in-one viral vectors for in vivo delivery. These advancements are enabling a wider range of applications, from basic gene function studies and disease modeling to the development of gene therapies for monogenic disorders and cancer. The competitive advantage lies in the modularity of the CRISPR-Cas system, allowing for rapid adaptation to new targets and the development of multiplex editing strategies. The market fit for these products is strong across academic research, drug discovery, and the rapidly evolving gene therapy landscape.

Key Drivers, Barriers & Challenges in crisper associated nucleases

Key Drivers:

- Technological Advancements: Continuous innovation in CRISPR-Cas systems, including base editing and prime editing, offers enhanced precision and expanded therapeutic potential.

- Growing Understanding of Genetic Diseases: Increased knowledge of disease genomics is identifying new targets for gene editing therapies.

- Demand for Precision Medicine: The shift towards personalized treatments aligns perfectly with the targeted nature of gene editing.

- Significant Investment: Increased venture capital and government funding are accelerating R&D and clinical translation.

- Expanding Applications: Beyond therapeutics, applications in diagnostics and agriculture are growing.

Barriers & Challenges:

- Regulatory Hurdles: Navigating complex and evolving regulatory pathways for gene therapies can be time-consuming and costly.

- Off-Target Effects: Ensuring the complete absence of unintended edits remains a critical concern for clinical safety.

- Delivery Efficiency: Developing safe and effective methods for delivering nucleases to target cells in vivo is a significant technical challenge.

- Ethical Considerations: Societal debates surrounding germline editing and potential misuse of the technology require careful consideration and public engagement.

- High Cost of Development and Treatment: The extensive R&D required and the potentially high cost of gene therapies can limit accessibility.

Growth Drivers in the crisper associated nucleases Market

The crisper associated nucleases market is propelled by several interconnected growth drivers. Technologically, the continuous refinement of CRISPR-Cas systems, such as the development of prime editing and base editing, offers unprecedented levels of precision and reduces the risk of off-target edits, thereby expanding the therapeutic potential. Economically, significant investments from venture capital firms and government grants are fueling innovation and accelerating the translation of research into viable treatments. For example, numerous companies have secured multi-million dollar funding rounds in the past few years to advance their gene editing pipelines. Regulatory drivers also play a crucial role, with agencies like the FDA and EMA establishing pathways for the approval of gene therapies, encouraging further development. The increasing prevalence of genetic diseases, coupled with a growing demand for personalized medicine, creates a strong market pull for crisper associated nucleases as transformative therapeutic solutions.

Challenges Impacting crisper associated nucleases Growth

Several significant challenges impact the growth of the crisper associated nucleases market. Regulatory complexities surrounding gene therapies, including rigorous safety and efficacy testing requirements, can lead to lengthy approval processes and substantial development costs. For instance, clinical trials for novel gene therapies can extend for several years, representing millions in expenditure. Supply chain issues related to the manufacturing of high-quality reagents, viral vectors, and specialized delivery systems can also pose a bottleneck, especially as demand escalates. Competitive pressures are intensifying as more players enter the market, leading to patent disputes and a race for technological superiority. Furthermore, the high cost associated with developing and administering gene editing therapies can limit patient access and create significant reimbursement challenges for healthcare systems, potentially hindering widespread adoption.

Key Players Shaping the crisper associated nucleases Market

- The Odin

- Origene

- Amsbio

- Thermo Fisher Scientific

- Merck

- Boai Nky Medical Holdings Ltd

- Biocompare

- BioLabs, Inc.

- Inscripta

- Sherlock Biosciences

- Editas

Significant crisper associated nucleases Industry Milestones

- 2019: Launch of advanced CRISPR-Cas9 kits by leading suppliers, enabling more precise gene editing.

- 2020: First successful clinical trials demonstrating the efficacy of CRISPR-based therapies for sickle cell disease and beta-thalassemia.

- 2021: Emergence of prime editing technology, offering even greater precision and versatility in gene editing.

- 2022: Significant increase in M&A activity as larger pharmaceutical companies acquire innovative CRISPR startups.

- 2023: Regulatory submissions for novel CRISPR-based therapeutics for rare genetic disorders accelerate.

- 2024: Advancements in ex vivo and in vivo delivery systems broaden the applicability of crisper associated nucleases.

Future Outlook for crisper associated nucleases Market

- 2019: Launch of advanced CRISPR-Cas9 kits by leading suppliers, enabling more precise gene editing.

- 2020: First successful clinical trials demonstrating the efficacy of CRISPR-based therapies for sickle cell disease and beta-thalassemia.

- 2021: Emergence of prime editing technology, offering even greater precision and versatility in gene editing.

- 2022: Significant increase in M&A activity as larger pharmaceutical companies acquire innovative CRISPR startups.

- 2023: Regulatory submissions for novel CRISPR-based therapeutics for rare genetic disorders accelerate.

- 2024: Advancements in ex vivo and in vivo delivery systems broaden the applicability of crisper associated nucleases.

Future Outlook for crisper associated nucleases Market

The future outlook for the crisper associated nucleases market is exceptionally promising, driven by continued technological innovation and expanding therapeutic applications. The market is expected to witness sustained growth as more gene therapies move through clinical development and gain regulatory approval for a wider array of diseases. Strategic opportunities lie in the development of next-generation CRISPR systems with enhanced precision and reduced immunogenicity, as well as in improving the efficiency and safety of delivery methods for in vivo gene editing. The increasing focus on rare genetic diseases and complex conditions like cancer presents a substantial market potential. Furthermore, advancements in multiplex editing and the integration of AI in gene editing design will further unlock novel therapeutic avenues, solidifying crisper associated nucleases as a cornerstone of 21st-century medicine. The market size is anticipated to reach millions in value over the next decade.

crisper associated nucleases Segmentation

- 1. Application

- 2. Types

crisper associated nucleases Segmentation By Geography

- 1. CA

crisper associated nucleases REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. crisper associated nucleases Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 The Odin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Origene

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amsbio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thermo Fisher Scientific

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merck

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boai Nky Medical Holdings Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Biocompare

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BioLabs

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Inc.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Inscripta

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sherlock Biosciences

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Editas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 The Odin

List of Figures

- Figure 1: crisper associated nucleases Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: crisper associated nucleases Share (%) by Company 2024

List of Tables

- Table 1: crisper associated nucleases Revenue million Forecast, by Region 2019 & 2032

- Table 2: crisper associated nucleases Revenue million Forecast, by Application 2019 & 2032

- Table 3: crisper associated nucleases Revenue million Forecast, by Types 2019 & 2032

- Table 4: crisper associated nucleases Revenue million Forecast, by Region 2019 & 2032

- Table 5: crisper associated nucleases Revenue million Forecast, by Application 2019 & 2032

- Table 6: crisper associated nucleases Revenue million Forecast, by Types 2019 & 2032

- Table 7: crisper associated nucleases Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the crisper associated nucleases?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the crisper associated nucleases?

Key companies in the market include The Odin, Origene, Amsbio, Thermo Fisher Scientific, Merck, Boai Nky Medical Holdings Ltd, Biocompare, BioLabs, Inc., Inscripta, Sherlock Biosciences, Editas.

3. What are the main segments of the crisper associated nucleases?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "crisper associated nucleases," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the crisper associated nucleases report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the crisper associated nucleases?

To stay informed about further developments, trends, and reports in the crisper associated nucleases, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence