Key Insights

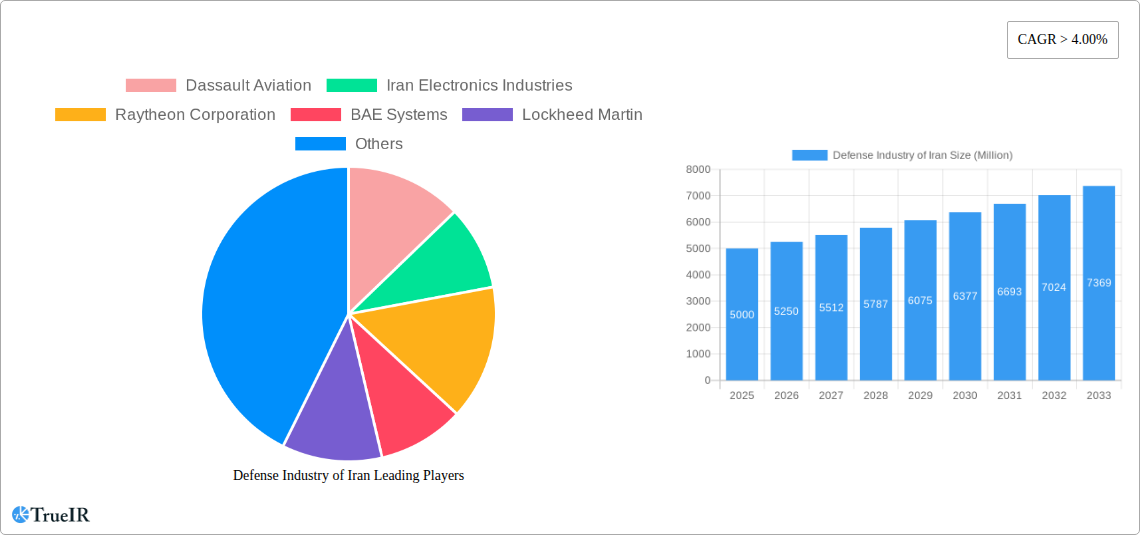

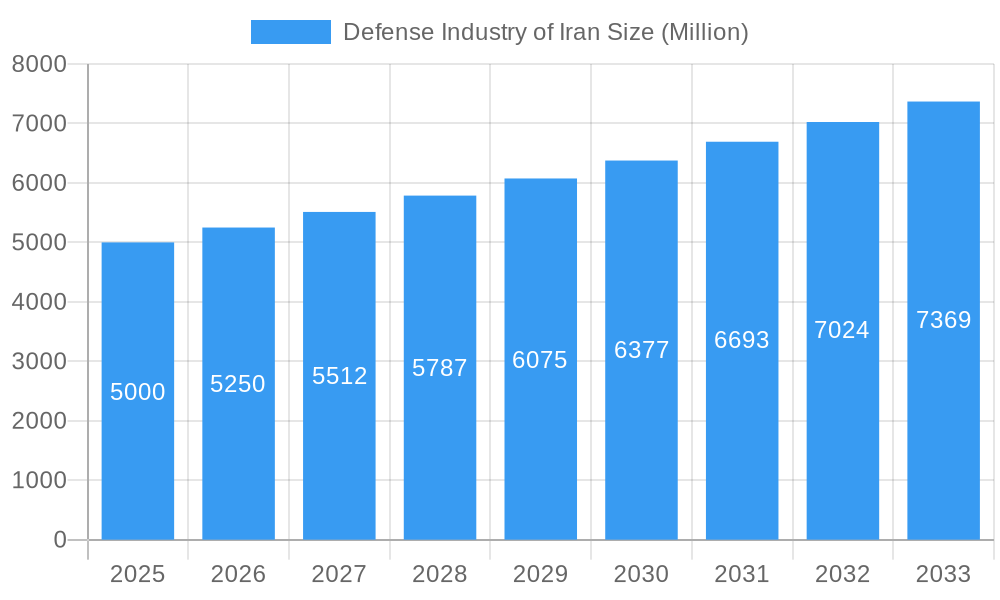

Iran's defense industry operates within a challenging international sanctions environment, presenting a complex and dynamic market. The estimated market size for 2025 is $506.9 billion, reflecting Iran's strategic geopolitical positioning within the global defense landscape. Key growth drivers include the imperative for national security self-reliance, regional instability, and ongoing modernization initiatives to address perceived external threats. This domestic focus leads to the production of infantry weapons, missiles, and select aircraft and naval technologies, though the sophistication of these indigenous capabilities is subject to ongoing assessment. Constraints, including limited access to advanced technologies, import restrictions due to sanctions, and potential limitations in skilled labor and R&D investment, contribute to a more moderated growth trajectory compared to global peers. The industry primarily serves domestic requirements, with export potential significantly curtailed by sanctions. Despite these challenges, a Compound Annual Growth Rate (CAGR) of approximately 3.88% is projected for the forecast period (2025-2033), fueled by sustained government investment in defense modernization and the essential need to maintain a strong military posture.

Defense Industry of Iran Market Size (In Billion)

The segmentation of Iran's defense industry aligns with global trends, with substantial investment in missile systems and infantry weapons underscoring national strategic priorities. While air force and naval segments are present, resource allocation is likely to favor ground forces and missile programs. Considering the overall market size and projected global CAGR, annual market expansion is estimated between $200 million and $300 million. This growth signifies Iran's dedication to bolstering its defensive capabilities within the existing framework of international sanctions and budgetary considerations. Comprehensive analysis necessitates detailed segmentation breakdowns and deeper insight into Iran's defense budget allocations, which are often not publicly disclosed. Nevertheless, the current trajectory indicates a consistent, albeit moderate, expansion of the Iranian defense market in the foreseeable future.

Defense Industry of Iran Company Market Share

Defense Industry of Iran: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Iranian defense industry, offering crucial insights into market structure, competitive dynamics, growth drivers, and future outlook. Covering the period 2019-2033, with a focus on 2025, this report is an essential resource for industry professionals, investors, and policymakers seeking a clear understanding of this complex and evolving market. The report leverages extensive market research and data analysis to deliver actionable intelligence.

Defense Industry of Iran Market Structure & Competitive Landscape

The Iranian defense industry is characterized by a complex interplay of state-owned enterprises, private sector involvement, and international collaborations (albeit limited due to sanctions). Market concentration is high, with a few dominant players controlling significant market share. We estimate a Herfindahl-Hirschman Index (HHI) of xx in 2025, indicating a moderately concentrated market. Innovation is driven primarily by national security needs, necessitating indigenous development and adaptation of foreign technologies. Stringent regulatory oversight and sanctions significantly impact market dynamics, limiting access to advanced technologies and international collaborations. The primary product substitutes are older, domestically produced equipment, often with reduced capabilities.

End-user segmentation is heavily influenced by government priorities, with a significant focus on the military (Army, Air Force, Navy), along with the internal security forces. M&A activity is limited due to sanctions and the predominantly state-controlled nature of the industry. However, we project xx Million in M&A volume for the forecast period (2025-2033), primarily driven by consolidation within the state-owned sector.

- Market Concentration: High, with HHI estimated at xx in 2025.

- Innovation Drivers: National security, technological self-reliance.

- Regulatory Impact: Significant, due to sanctions and domestic regulations.

- Product Substitutes: Older domestically produced equipment.

- End-User Segmentation: Primarily military (Army, Air Force, Navy), and internal security forces.

- M&A Trends: Limited, with projected xx Million in volume during 2025-2033.

Defense Industry of Iran Market Trends & Opportunities

The Iranian defense industry is experiencing moderate growth, driven by geopolitical factors and the need for modernization. Market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, representing a CAGR of xx%. This growth is largely attributed to increased defense spending, despite economic challenges. Technological advancements, particularly in areas such as drone technology and missile systems, represent significant opportunities. Consumer preferences, influenced by national security needs, are focused on affordability, reliability, and domestic production capabilities. Competitive dynamics are characterized by a mix of state-owned enterprises and limited private sector participation, with intense competition focused on securing government contracts. Market penetration rates for advanced technologies remain low due to sanctions.

Dominant Markets & Segments in Defense Industry of Iran

The Iranian defense market is dominated by the military segment, with significant investments directed towards missile systems, infantry weapons, and UAV technology. Within the types of defense equipment, missile systems exhibit the highest growth trajectory, driven by regional geopolitical tensions.

Key Growth Drivers:

- Increased defense spending.

- Geopolitical instability in the region.

- Focus on indigenous technological development.

- Government policies prioritizing national security.

Dominant Segments:

- Type: Missile Systems, Infantry Weapons, UAVs.

- End-User: Military (Army, Air Force, Navy)

The Air Force segment is also a key driver, with ongoing investment in upgrading fighter aircraft and developing domestic capabilities. However, sanctions limit the availability of advanced technologies, forcing the country to focus on developing indigenous alternatives. Naval modernization is less pronounced but shows potential, with ongoing investments in small-scale naval vessels and coastal defense.

Defense Industry of Iran Product Analysis

The Iranian defense industry focuses on producing a range of products, from small arms to sophisticated missile systems and UAVs. Indigenous development is prioritized due to sanctions, leading to a focus on cost-effective solutions. While often lacking the technological sophistication of Western counterparts, domestically produced systems offer competitive advantages in terms of cost and adaptability to specific operational environments. Recent technological advancements have focused on enhancing precision-guided munitions, improving UAV capabilities, and upgrading existing weapon systems.

Key Drivers, Barriers & Challenges in Defense Industry of Iran

Key Drivers: The primary drivers include heightened regional security concerns, the need for self-reliance in defense capabilities, and a focus on indigenous technological development driven by sanctions. Government policies prioritizing national security are also a major factor.

Challenges and Restraints: The industry faces significant challenges, including international sanctions that limit access to advanced technologies and international collaboration. Supply chain vulnerabilities and potential sanctions-related disruptions pose significant risks. Competition from other regional powers also presents a challenge. The quantifiable impact of these restraints is a projected xx% reduction in market growth compared to a non-sanctioned scenario.

Growth Drivers in the Defense Industry of Iran Market

The key drivers for growth are the ongoing regional conflicts, resulting in consistent high demand for defense products. National security concerns and strategic autonomy also support the growth, pushing Iran to invest in domestic production and technological advancement. The government's unwavering commitment to self-reliance in defense also fuels this expansion.

Challenges Impacting Defense Industry of Iran Growth

The most significant challenge is the impact of international sanctions, which severely limit access to advanced technologies and international collaboration, hindering technological advancements and hindering the modernization of the defense industry. These sanctions create supply chain vulnerabilities and increase production costs. Furthermore, competition from other regional players with access to advanced technologies also impacts the industry's growth.

Key Players Shaping the Defense Industry of Iran Market

- Dassault Aviation (limited involvement due to sanctions)

- Iran Electronics Industries

- Raytheon Corporation (limited involvement due to sanctions)

- BAE Systems (limited involvement due to sanctions)

- Lockheed Martin (limited involvement due to sanctions)

- General Dynamics (limited involvement due to sanctions)

- Northrop Grumman (limited involvement due to sanctions)

- SAAB AB (limited involvement due to sanctions)

- The Boeing Company (limited involvement due to sanctions)

- Thales Group (limited involvement due to sanctions)

- List Not Exhaustive

Significant Defense Industry of Iran Industry Milestones

- 2020: Successful test of a new domestically produced long-range missile system.

- 2022: Unveiling of an advanced unmanned aerial vehicle (UAV) with enhanced capabilities.

- 2023: Launch of a new indigenous fighter jet prototype. (Dates are approximate and based on publicly available information).

Future Outlook for Defense Industry of Iran Market

The Iranian defense industry's future hinges on navigating the challenges posed by international sanctions while continuing to prioritize national security and technological self-reliance. Strategic investments in R&D, focusing on indigenous technological development, are crucial for growth. The continuing geopolitical instability in the region is likely to sustain demand for defense products, creating opportunities for growth. However, the long-term outlook depends significantly on the easing of sanctions and the ability of Iran to access international markets and technology.

Defense Industry of Iran Segmentation

-

1. Type

- 1.1. Infantry Weapons

- 1.2. Vehicles

- 1.3. Fighter Aircraft

- 1.4. Other Fixed Wing Aircraft

- 1.5. Helicopters

- 1.6. Submarines

- 1.7. Ships

- 1.8. Missile Systems

-

2. End-User

- 2.1. Airforce

- 2.2. Navy

- 2.3. Military

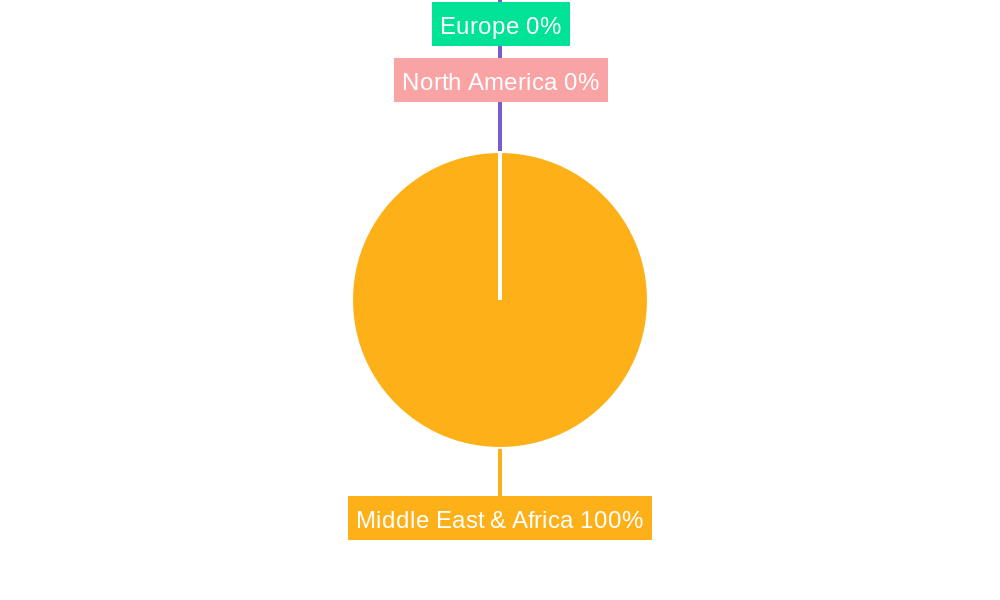

Defense Industry of Iran Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Defense Industry of Iran Regional Market Share

Geographic Coverage of Defense Industry of Iran

Defense Industry of Iran REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Ships Will Remain a Opportunity Pocket in Iran Defense Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defense Industry of Iran Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Infantry Weapons

- 5.1.2. Vehicles

- 5.1.3. Fighter Aircraft

- 5.1.4. Other Fixed Wing Aircraft

- 5.1.5. Helicopters

- 5.1.6. Submarines

- 5.1.7. Ships

- 5.1.8. Missile Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Airforce

- 5.2.2. Navy

- 5.2.3. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Defense Industry of Iran Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Infantry Weapons

- 6.1.2. Vehicles

- 6.1.3. Fighter Aircraft

- 6.1.4. Other Fixed Wing Aircraft

- 6.1.5. Helicopters

- 6.1.6. Submarines

- 6.1.7. Ships

- 6.1.8. Missile Systems

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Airforce

- 6.2.2. Navy

- 6.2.3. Military

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Defense Industry of Iran Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Infantry Weapons

- 7.1.2. Vehicles

- 7.1.3. Fighter Aircraft

- 7.1.4. Other Fixed Wing Aircraft

- 7.1.5. Helicopters

- 7.1.6. Submarines

- 7.1.7. Ships

- 7.1.8. Missile Systems

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Airforce

- 7.2.2. Navy

- 7.2.3. Military

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Defense Industry of Iran Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Infantry Weapons

- 8.1.2. Vehicles

- 8.1.3. Fighter Aircraft

- 8.1.4. Other Fixed Wing Aircraft

- 8.1.5. Helicopters

- 8.1.6. Submarines

- 8.1.7. Ships

- 8.1.8. Missile Systems

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Airforce

- 8.2.2. Navy

- 8.2.3. Military

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Defense Industry of Iran Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Infantry Weapons

- 9.1.2. Vehicles

- 9.1.3. Fighter Aircraft

- 9.1.4. Other Fixed Wing Aircraft

- 9.1.5. Helicopters

- 9.1.6. Submarines

- 9.1.7. Ships

- 9.1.8. Missile Systems

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Airforce

- 9.2.2. Navy

- 9.2.3. Military

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Defense Industry of Iran Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Infantry Weapons

- 10.1.2. Vehicles

- 10.1.3. Fighter Aircraft

- 10.1.4. Other Fixed Wing Aircraft

- 10.1.5. Helicopters

- 10.1.6. Submarines

- 10.1.7. Ships

- 10.1.8. Missile Systems

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Airforce

- 10.2.2. Navy

- 10.2.3. Military

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dassault Aviation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Iran Electronics Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Raytheon Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BAE Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lockheed Martin

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 General Dynamics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Northrop Grumman

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SAAB AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Boeing Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thales Group*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dassault Aviation

List of Figures

- Figure 1: Global Defense Industry of Iran Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Defense Industry of Iran Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Defense Industry of Iran Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Defense Industry of Iran Revenue (billion), by End-User 2025 & 2033

- Figure 5: North America Defense Industry of Iran Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Defense Industry of Iran Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Defense Industry of Iran Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Defense Industry of Iran Revenue (billion), by Type 2025 & 2033

- Figure 9: South America Defense Industry of Iran Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Defense Industry of Iran Revenue (billion), by End-User 2025 & 2033

- Figure 11: South America Defense Industry of Iran Revenue Share (%), by End-User 2025 & 2033

- Figure 12: South America Defense Industry of Iran Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Defense Industry of Iran Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Defense Industry of Iran Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Defense Industry of Iran Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Defense Industry of Iran Revenue (billion), by End-User 2025 & 2033

- Figure 17: Europe Defense Industry of Iran Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Europe Defense Industry of Iran Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Defense Industry of Iran Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Defense Industry of Iran Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa Defense Industry of Iran Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Defense Industry of Iran Revenue (billion), by End-User 2025 & 2033

- Figure 23: Middle East & Africa Defense Industry of Iran Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East & Africa Defense Industry of Iran Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Defense Industry of Iran Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Defense Industry of Iran Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Defense Industry of Iran Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Defense Industry of Iran Revenue (billion), by End-User 2025 & 2033

- Figure 29: Asia Pacific Defense Industry of Iran Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific Defense Industry of Iran Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Defense Industry of Iran Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Defense Industry of Iran Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Defense Industry of Iran Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Global Defense Industry of Iran Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Defense Industry of Iran Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Defense Industry of Iran Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Defense Industry of Iran Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Defense Industry of Iran Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Defense Industry of Iran Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Global Defense Industry of Iran Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Defense Industry of Iran Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Defense Industry of Iran Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global Defense Industry of Iran Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Defense Industry of Iran Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Defense Industry of Iran Revenue billion Forecast, by End-User 2020 & 2033

- Table 30: Global Defense Industry of Iran Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Defense Industry of Iran Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Defense Industry of Iran Revenue billion Forecast, by End-User 2020 & 2033

- Table 39: Global Defense Industry of Iran Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Defense Industry of Iran Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defense Industry of Iran?

The projected CAGR is approximately 3.88%.

2. Which companies are prominent players in the Defense Industry of Iran?

Key companies in the market include Dassault Aviation, Iran Electronics Industries, Raytheon Corporation, BAE Systems, Lockheed Martin, General Dynamics, Northrop Grumman, SAAB AB, The Boeing Company, Thales Group*List Not Exhaustive.

3. What are the main segments of the Defense Industry of Iran?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 506.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Ships Will Remain a Opportunity Pocket in Iran Defense Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defense Industry of Iran," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defense Industry of Iran report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defense Industry of Iran?

To stay informed about further developments, trends, and reports in the Defense Industry of Iran, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence