Key Insights

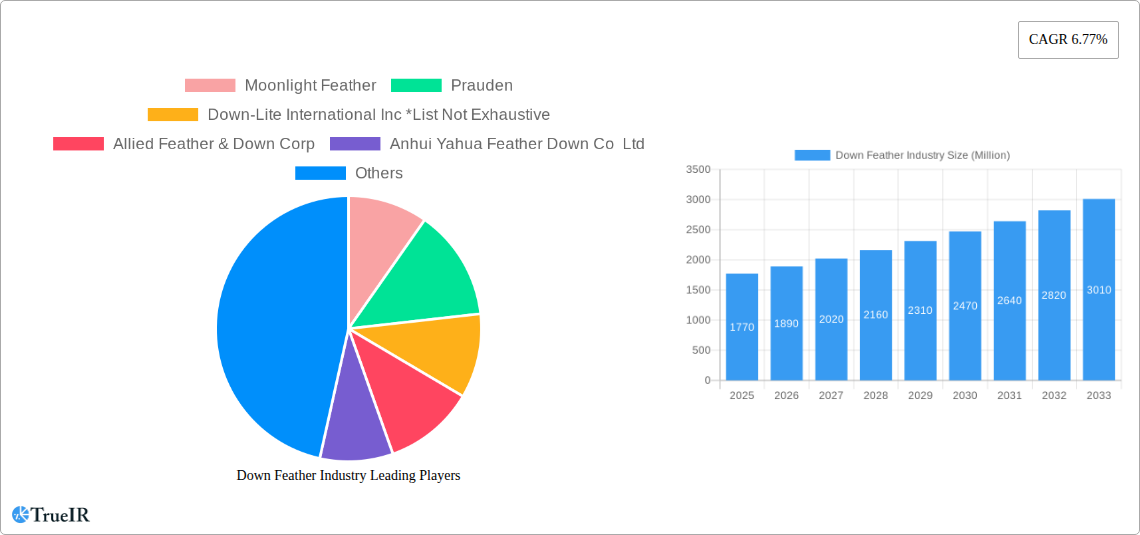

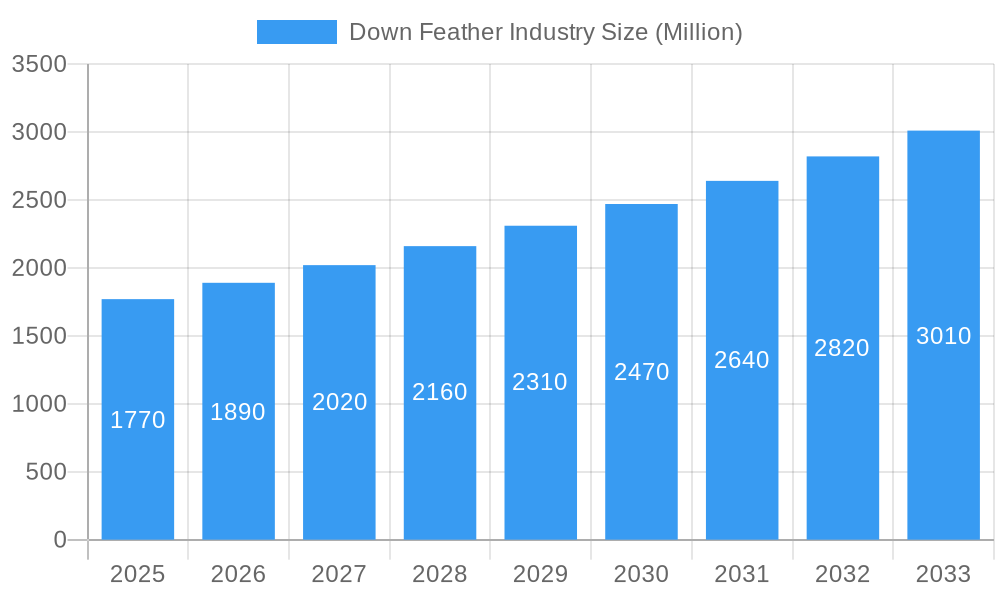

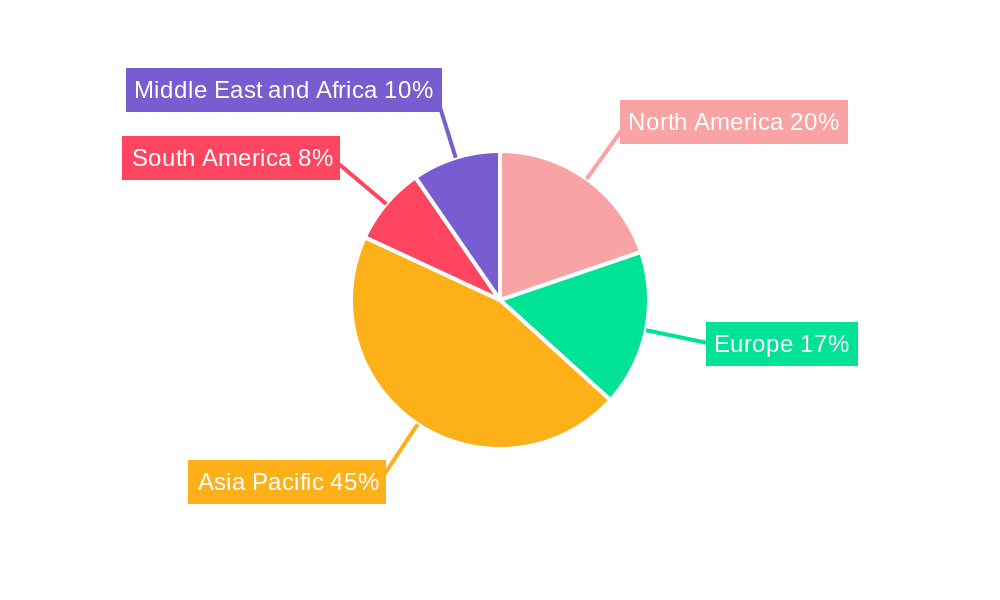

The global down feather market, valued at $1.77 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.77% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer demand for high-quality bedding and home textiles, particularly in developing economies with rising disposable incomes, is a significant factor. The inherent comfort, warmth, and hypoallergenic properties of down and feather products contribute to their sustained popularity. Furthermore, the growing awareness of sustainable sourcing practices within the industry is attracting environmentally conscious consumers, bolstering market growth. However, the market faces certain restraints, including fluctuating raw material prices influenced by seasonal variations in bird molting and concerns about animal welfare impacting the supply chain. Market segmentation reveals a strong preference for duck down over goose down in pillow applications, while goose down finds greater use in comforters and bedding due to its higher fill power. The leading companies, including Moonlight Feather, Prauden, and Allied Feather & Down, are actively engaged in developing innovative products and sustainable sourcing strategies to maintain their competitive edge. Geographical distribution shows a significant market presence in North America and Europe, with the Asia-Pacific region demonstrating considerable growth potential driven by increasing urbanization and changing lifestyles.

Down Feather Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, although the growth rate may slightly moderate towards the later years due to market saturation in developed regions and potential supply chain challenges. Strategic initiatives by key players, such as investing in technological advancements for improved down processing and focusing on ethical sourcing, will play a vital role in shaping the market's future trajectory. Diversification into new applications, such as outerwear and specialized medical products, is also likely to emerge as a significant growth avenue. The overall outlook for the down feather market remains positive, driven by the enduring appeal of natural filling materials and the industry's increasing commitment to sustainable and ethical practices.

Down Feather Industry Company Market Share

Down Feather Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global down feather industry, covering market size, trends, competitive landscape, and future outlook from 2019 to 2033. The study period spans from 2019-2033, with 2025 as the base and estimated year. The forecast period covers 2025-2033, and the historical period analyzed is 2019-2024. The report offers invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. The global market value is projected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period.

Down Feather Industry Market Structure & Competitive Landscape

The down feather industry is characterized by a moderately concentrated market structure, with a few key players holding significant market share. Major players include Moonlight Feather, Prauden, Down-Lite International Inc, Allied Feather & Down Corp, Anhui Yahua Feather Down Co Ltd, ROHDEX Bettfedern GmbH & Co KG, Sustainable Down Source, Feather Industries, KL Down, and United Feather & Down. However, the market also features numerous smaller regional players. The Herfindahl-Hirschman Index (HHI) for the industry is estimated at XX, indicating a moderately concentrated market.

Key factors shaping the competitive landscape include:

- Innovation: Companies are increasingly focusing on developing sustainable and ethically sourced down, incorporating traceability technologies, and introducing innovative product designs to cater to evolving consumer preferences.

- Regulatory Impacts: Growing awareness of animal welfare and environmental concerns is leading to stricter regulations concerning down sourcing and processing, impacting the production and pricing strategies of industry players.

- Product Substitutes: The market faces competition from synthetic alternatives like polyester fill, impacting market growth for natural down products.

- End-User Segmentation: The market is segmented into various applications, including pillows, comforters, bedding, and other specialized applications, each with unique growth drivers and competitive dynamics.

- M&A Trends: While specific M&A volumes are not available (XX), the industry has seen some consolidation in recent years, with larger players acquiring smaller companies to expand their market reach and product portfolios.

Down Feather Industry Market Trends & Opportunities

The global down feather market is experiencing significant growth, driven by factors such as rising disposable incomes, increasing demand for comfortable and high-quality bedding, and expanding e-commerce penetration. The market size, estimated at $XX Million in 2025, is projected to reach $XX Million by 2033, with a considerable CAGR of XX%. This growth is supported by a rising consumer preference for natural and sustainable products, particularly within the luxury bedding segment.

Technological advancements in down processing and treatment are enabling the creation of more resilient, hypoallergenic, and ethically sourced products. Furthermore, the increasing demand for eco-friendly and sustainable materials is further driving the adoption of ethically sourced and certified down, aligning with growing environmental consciousness. The market penetration rate for sustainable down products is increasing, with a projected XX% by 2033, indicating a considerable shift towards responsible sourcing. The competitive dynamics remain intense, characterized by product innovation, brand building, and pricing strategies.

Dominant Markets & Segments in Down Feather Industry

The North American and European regions currently dominate the global down feather market, owing to high consumer demand, established distribution networks, and the presence of key industry players. Within these regions, the United States and Germany hold significant market shares, respectively.

Key Growth Drivers:

- Strong consumer preference for natural bedding: A preference for natural materials over synthetic alternatives is fueling growth across all segments.

- Rising disposable incomes: Increased purchasing power in several key regions supports higher spending on premium bedding products.

- Expanding e-commerce market: The ease of online purchasing has expanded the market reach for down feather products.

Segment Analysis:

- Origin: The goose down segment currently holds a larger market share than duck down, attributed to its superior warmth-to-weight ratio. However, the duck down segment is witnessing robust growth due to its more affordable pricing.

- Application: The bedding segment (pillows, comforters, etc.) dominates market share, owing to its extensive use in homes and hotels. However, the other applications segment, including apparel and outerwear, is showing significant growth potential.

Down Feather Industry Product Analysis

Technological advancements in down processing have led to significant improvements in the quality, hygiene, and sustainability of down feather products. Innovations include advanced cleaning techniques, hypoallergenic treatments, and improved traceability systems that ensure ethical sourcing and transparency. These improvements have enhanced the market fit of down products, especially in premium segments that demand superior quality and sustainability.

Key Drivers, Barriers & Challenges in Down Feather Industry

Key Drivers:

- Growing consumer awareness of comfort and quality: Increased demand for high-quality bedding materials continues to drive market growth.

- Technological advancements in down processing and treatment: This increases the quality, hygiene, and sustainability of down feather products.

- Positive regulatory changes: New regulations support sustainable and ethical sourcing in this industry.

Challenges and Restraints:

- Supply chain disruptions: Fluctuations in raw material prices and availability pose challenges, impacting production costs and pricing. (XX% impact on profit margins in 2024 estimated)

- Environmental concerns and ethical sourcing: Stricter regulations and scrutiny regarding ethical practices increase costs and complexify supply chains.

- Competition from synthetic alternatives: Synthetic fill materials offer a cheaper and often more readily available alternative.

Growth Drivers in the Down Feather Industry Market

The key drivers for growth in the down feather industry include rising disposable incomes in emerging markets, increasing awareness of the comfort and warmth provided by down products, and technological innovations in down processing that enhance quality and hygiene. Growing consumer preference for natural products also fuels this market expansion.

Challenges Impacting Down Feather Industry Growth

Significant challenges facing the industry include fluctuating raw material prices, concerns about animal welfare and ethical sourcing, and competition from synthetic alternatives like polyester fill. Stricter environmental regulations also increase compliance costs for industry players.

Key Players Shaping the Down Feather Industry Market

- Allied Feather & Down Corp

- Anhui Yahua Feather Down Co Ltd

- Feather Industries

- KL Down

- Moonlight Feather

- Prauden

- ROHDEX Bettfedern GmbH & Co KG

- Sustainable Down Source

- United Feather & Down

- Down-Lite International Inc

Significant Down Feather Industry Industry Milestones

- November 2022: Allied Feather & Down partnered with Project Our Winters (POW) to enhance the sustainability and traceability of its products via the TrackMyDown system.

- March 2022: Allied Feather + Down launched a new jacket capsule collection in the US, collaborating with Mitsui & Ci and Pertex.

- January 2022: Emma introduced the Motion intelligent mattress featuring Contour Interaction technology and Diamond Degree temperature regulation.

Future Outlook for Down Feather Industry Market

The future of the down feather industry is promising, driven by continued innovation in product development, a focus on sustainable and ethical sourcing, and the increasing consumer demand for high-quality bedding products. Opportunities lie in expanding into new markets, developing innovative product lines, and leveraging technological advancements to improve efficiency and sustainability throughout the value chain. The industry's growth trajectory is expected to remain positive, particularly with continued focus on traceability and environmental responsibility.

Down Feather Industry Segmentation

-

1. Origin

- 1.1. Duck

- 1.2. Goose

-

2. Application

- 2.1. Pillow

- 2.2. Comforters

- 2.3. Bedding

- 2.4. Other Applications

Down Feather Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Down Feather Industry Regional Market Share

Geographic Coverage of Down Feather Industry

Down Feather Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure

- 3.3. Market Restrains

- 3.3.1. Counterfeit Goods Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sustainable Down and Feather

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Down Feather Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 5.1.1. Duck

- 5.1.2. Goose

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pillow

- 5.2.2. Comforters

- 5.2.3. Bedding

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 6. North America Down Feather Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 6.1.1. Duck

- 6.1.2. Goose

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pillow

- 6.2.2. Comforters

- 6.2.3. Bedding

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 7. Europe Down Feather Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 7.1.1. Duck

- 7.1.2. Goose

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pillow

- 7.2.2. Comforters

- 7.2.3. Bedding

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 8. Asia Pacific Down Feather Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 8.1.1. Duck

- 8.1.2. Goose

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pillow

- 8.2.2. Comforters

- 8.2.3. Bedding

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 9. South America Down Feather Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Origin

- 9.1.1. Duck

- 9.1.2. Goose

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pillow

- 9.2.2. Comforters

- 9.2.3. Bedding

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Origin

- 10. Middle East and Africa Down Feather Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Origin

- 10.1.1. Duck

- 10.1.2. Goose

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pillow

- 10.2.2. Comforters

- 10.2.3. Bedding

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Origin

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Moonlight Feather

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Prauden

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Down-Lite International Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allied Feather & Down Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Anhui Yahua Feather Down Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ROHDEX Bettfedern GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sustainable Down Source

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Feather Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KL Down

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 United Feather & Down

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Moonlight Feather

List of Figures

- Figure 1: Global Down Feather Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Down Feather Industry Revenue (Million), by Origin 2025 & 2033

- Figure 3: North America Down Feather Industry Revenue Share (%), by Origin 2025 & 2033

- Figure 4: North America Down Feather Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Down Feather Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Down Feather Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Down Feather Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Down Feather Industry Revenue (Million), by Origin 2025 & 2033

- Figure 9: Europe Down Feather Industry Revenue Share (%), by Origin 2025 & 2033

- Figure 10: Europe Down Feather Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Down Feather Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Down Feather Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Down Feather Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Down Feather Industry Revenue (Million), by Origin 2025 & 2033

- Figure 15: Asia Pacific Down Feather Industry Revenue Share (%), by Origin 2025 & 2033

- Figure 16: Asia Pacific Down Feather Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Down Feather Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Down Feather Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Down Feather Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Down Feather Industry Revenue (Million), by Origin 2025 & 2033

- Figure 21: South America Down Feather Industry Revenue Share (%), by Origin 2025 & 2033

- Figure 22: South America Down Feather Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Down Feather Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Down Feather Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Down Feather Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Down Feather Industry Revenue (Million), by Origin 2025 & 2033

- Figure 27: Middle East and Africa Down Feather Industry Revenue Share (%), by Origin 2025 & 2033

- Figure 28: Middle East and Africa Down Feather Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Down Feather Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Down Feather Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Down Feather Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Down Feather Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 2: Global Down Feather Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Down Feather Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Down Feather Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 5: Global Down Feather Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Down Feather Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Down Feather Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 12: Global Down Feather Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Down Feather Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Germany Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Italy Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Down Feather Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 21: Global Down Feather Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Down Feather Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Down Feather Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 29: Global Down Feather Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Down Feather Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Down Feather Industry Revenue Million Forecast, by Origin 2020 & 2033

- Table 35: Global Down Feather Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Down Feather Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Down Feather Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Down Feather Industry?

The projected CAGR is approximately 6.77%.

2. Which companies are prominent players in the Down Feather Industry?

Key companies in the market include Moonlight Feather, Prauden, Down-Lite International Inc *List Not Exhaustive, Allied Feather & Down Corp, Anhui Yahua Feather Down Co Ltd, ROHDEX Bettfedern GmbH & Co KG, Sustainable Down Source, Feather Industries, KL Down, United Feather & Down.

3. What are the main segments of the Down Feather Industry?

The market segments include Origin, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure.

6. What are the notable trends driving market growth?

Increasing Demand for Sustainable Down and Feather.

7. Are there any restraints impacting market growth?

Counterfeit Goods Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

In November 2022, Allied Feather & Down partnered with climate action organization Project Our Winters(POW) to build sustainable products and track the product origin until the purchase with the TrackMyDown system to improve transparency towards using sustainable down products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Down Feather Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Down Feather Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Down Feather Industry?

To stay informed about further developments, trends, and reports in the Down Feather Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence