Key Insights

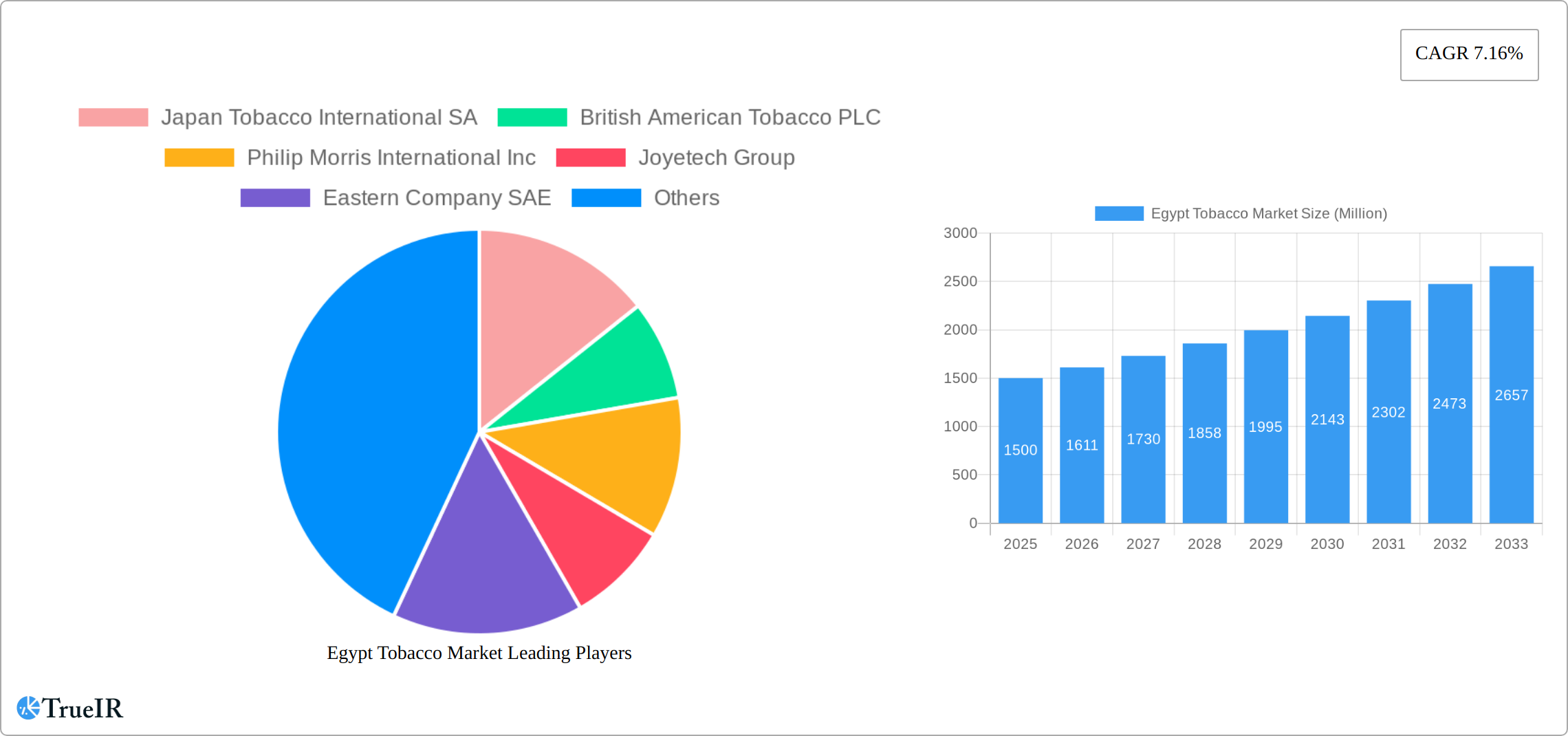

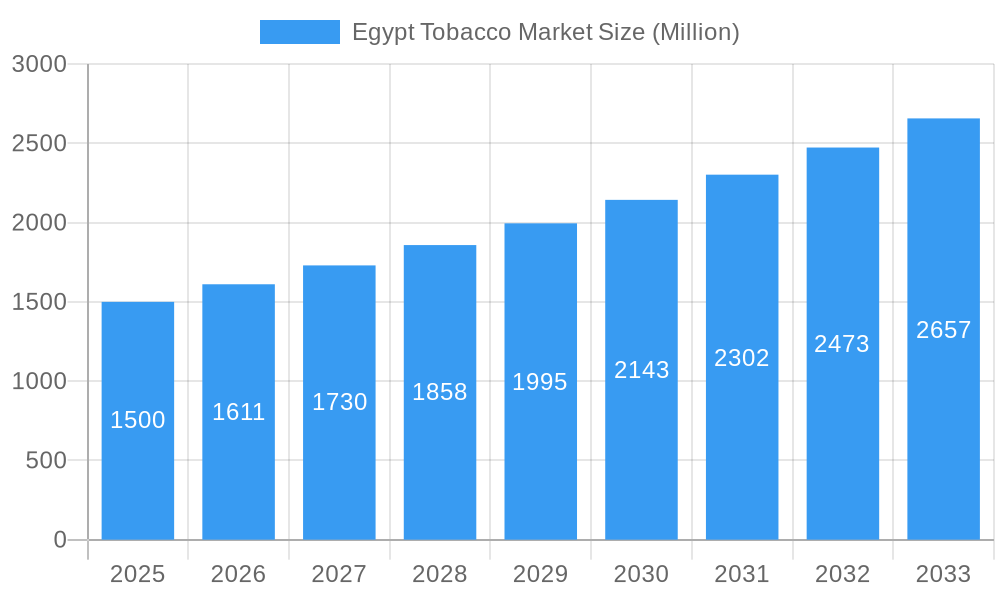

The Egypt tobacco market, valued at approximately $XX million in 2025, exhibits a robust Compound Annual Growth Rate (CAGR) of 7.16% from 2025 to 2033. This growth is fueled by several key factors. Firstly, a significant portion of the population engages in tobacco consumption, particularly among male users, creating a large established market. Convenience stores and small grocery shops represent a dominant distribution channel, facilitating widespread access. Secondly, the introduction of newer product types, such as e-cigarettes and heated tobacco products (HTPs), is driving market diversification and attracting new consumer segments. While traditional cigarettes continue to hold substantial market share, the increasing health consciousness among consumers, particularly females, is prompting a shift towards perceived less harmful alternatives like e-cigarettes. Despite this growth, the market faces challenges. Stringent government regulations aimed at curbing tobacco consumption, including taxation and advertising restrictions, present a significant restraint. Furthermore, increasing health awareness campaigns and rising healthcare costs associated with tobacco-related illnesses could negatively impact future growth. The market is dominated by major international players like Japan Tobacco International SA and British American Tobacco PLC, alongside local producers like Eastern Company SAE. The competitive landscape is dynamic, with companies focusing on product innovation, expansion of distribution networks, and targeted marketing campaigns to maintain and expand market share. Future growth will likely depend on navigating regulatory hurdles, effectively addressing health concerns, and catering to evolving consumer preferences.

Egypt Tobacco Market Market Size (In Billion)

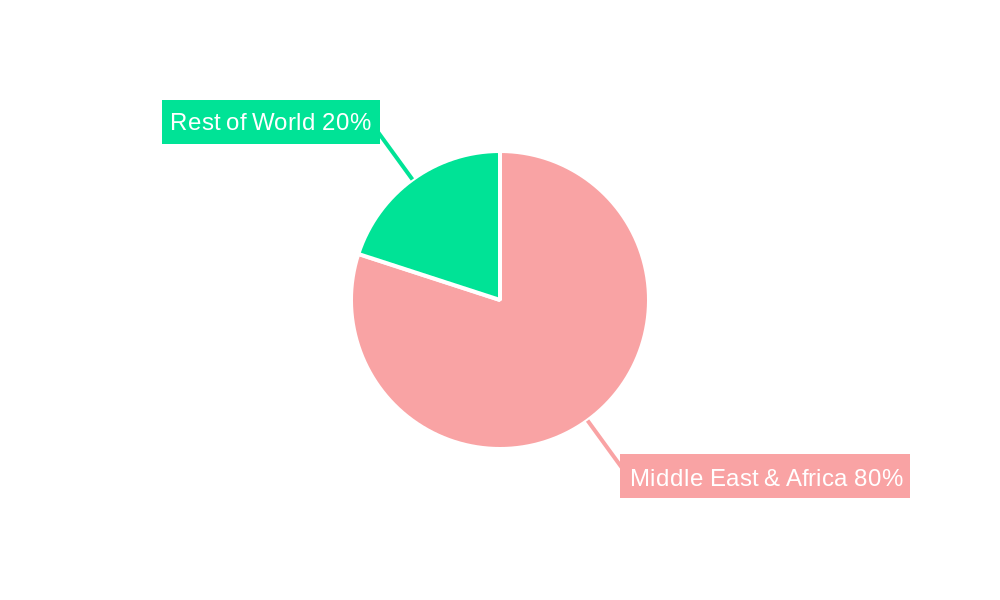

The Middle East and Africa region, particularly Egypt, presents a complex yet potentially lucrative market for tobacco companies. The future trajectory will hinge on the interplay between economic growth, evolving consumer behaviors, and the effectiveness of public health initiatives designed to reduce tobacco consumption. Specific regional growth within the MEA segment will be influenced by factors such as economic conditions, cultural norms, and the enforcement of anti-smoking regulations in specific countries like the UAE, South Africa and Saudi Arabia. Competition within the segment will be fierce, requiring companies to invest in product innovation, efficient supply chains, and strategic marketing to capture market share. Analyzing the shift in consumer preferences from traditional cigarettes to alternatives like e-cigarettes will be crucial to predicting the future market dynamics within this region.

Egypt Tobacco Market Company Market Share

Egypt Tobacco Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Egypt tobacco market, covering the period 2019-2033, with a focus on 2025. It offers invaluable insights into market structure, competitive dynamics, growth drivers, challenges, and future outlook, making it an essential resource for industry stakeholders, investors, and researchers. Leveraging extensive data and expert analysis, this report unveils the multifaceted landscape of the Egyptian tobacco industry, exploring both traditional and emerging segments like e-cigarettes.

Egypt Tobacco Market Market Structure & Competitive Landscape

The Egyptian tobacco market demonstrates a moderately concentrated structure, dominated by key players such as Japan Tobacco International (JTI), British American Tobacco (BAT), Philip Morris International (PMI), Eastern Company SAE, and Imperial Brands PLC. These companies hold substantial market share, resulting in an estimated CR4 (four-firm concentration ratio) of [Insert Updated CR4 Percentage]% in 2025, indicating a moderately competitive landscape. Market dynamism is fueled by ongoing innovation, particularly within the rapidly expanding e-cigarette and heated tobacco product (HTP) segments. However, the market faces significant headwinds from stringent regulations concerning tobacco advertising, taxation, and product labeling. The emergence of substitute nicotine products, including vaping devices and nicotine patches, presents a growing competitive challenge, although their market penetration remains relatively low at [Insert Updated Penetration Percentage]% in 2025. The consumer base is predominantly male, although a steadily increasing female segment is emerging. The market has witnessed notable mergers and acquisitions (M&A) activity, reflecting strategic expansion and diversification efforts by major players. The total value of M&A transactions within the Egyptian tobacco market from 2019 to 2024 reached approximately USD [Insert Updated USD Amount] Million.

Egypt Tobacco Market Market Trends & Opportunities

The Egypt tobacco market is projected to witness a CAGR of xx% during the forecast period (2025-2033), driven by factors such as population growth, rising disposable incomes, and evolving consumer preferences. The market size in 2025 is estimated at USD xx Million, with cigarettes dominating the product type segment. However, the e-cigarette/HTP segment is experiencing significant growth, showcasing a penetration rate of xx% in 2025, and is projected to reach xx% by 2033. Technological advancements in e-cigarette technology, including improved battery life and flavor profiles, are fueling this growth. Consumer preferences are shifting towards less harmful alternatives to traditional cigarettes, creating opportunities for innovative product offerings. The competitive landscape remains fiercely contested, with established players and new entrants vying for market share. The increasing adoption of online sales channels presents both opportunities and challenges. Regulatory changes and evolving consumer health awareness continuously shape market dynamics.

Dominant Markets & Segments in Egypt Tobacco Market

- Product Type: Cigarettes maintain their position as the dominant product type, holding an approximate market share of [Insert Updated Percentage]% in 2025. Nevertheless, the e-cigarette/HTP segment exhibits the fastest growth rate, showcasing considerable future potential.

- End User: Males continue to constitute the largest portion of tobacco consumers in Egypt, representing approximately [Insert Updated Percentage]% of the market in 2025. While the female consumer segment is expanding, its growth rate remains comparatively slower.

- Distribution Channel: Convenience stores and small grocery stores remain the primary distribution channels, accounting for approximately [Insert Updated Percentage]% of sales in 2025, reflecting the preference for convenient access. Supermarkets and hypermarkets also play a significant role, particularly in offering a wider variety of products. Specialty tobacco stores contribute a smaller, but nonetheless notable, percentage to overall sales.

The continued dominance of cigarettes can primarily be attributed to established consumer habits and ubiquitous product availability. Conversely, the growth of e-cigarettes/HTPs is driven by technological advancements and the perception of reduced health risks compared to traditional cigarettes. The dominance of convenience stores and smaller grocery stores as distribution channels underscores consumers' preference for convenient access to tobacco products. Robust retail infrastructure and government policies are pivotal in shaping market access and distribution patterns.

Egypt Tobacco Market Product Analysis

Technological advancements are driving product innovation in the Egyptian tobacco market. The introduction of e-cigarettes and HTPs offers consumers alternatives to traditional cigarettes, catering to evolving health concerns and preferences. These newer products feature enhanced designs, improved battery technology, and a broader range of flavors. However, regulatory scrutiny and consumer education remain crucial aspects of integrating these newer products into the market successfully, ensuring their market fit while addressing potential risks.

Key Drivers, Barriers & Challenges in Egypt Tobacco Market

Key Drivers: Growth in disposable incomes, population increase, and evolving consumer preferences towards newer, potentially less harmful products are key market drivers. Government policies aimed at regulating and taxing the tobacco industry exert a substantial influence on market dynamics.

Challenges: Stringent regulations on tobacco advertising and sales, increasing taxes on tobacco products, and the growing appeal of alternative nicotine products pose considerable challenges to market growth. Supply chain disruptions and escalating manufacturing costs further complicate the operational landscape. Furthermore, the inherent health risks associated with tobacco consumption and heightened consumer awareness of these risks exert significant downward pressure on market demand, potentially leading to a reduction in consumption by [Insert Updated Unit Reduction] million units by 2033.

Growth Drivers in the Egypt Tobacco Market Market

Technological advancements in e-cigarette technology, increasing disposable incomes among younger consumers, and the ongoing expansion of retail distribution channels contribute significantly to market growth. Government regulations, while posing some challenges, also provide a framework for orderly market development.

Challenges Impacting Egypt Tobacco Market Growth

Regulatory obstacles, particularly stringent taxation policies and advertising restrictions, impose significant limitations on market expansion. The rising popularity of alternative nicotine delivery systems intensifies competitive pressure. Supply chain complexities and increasing production costs negatively impact profitability and growth potential.

Key Players Shaping the Egypt Tobacco Market Market

- Japan Tobacco International SA

- British American Tobacco PLC

- Philip Morris International Inc

- Joyetech Group

- Eastern Company SAE

- Innokin Technology Co Ltd

- J Well France SARL

- Imperial Brands PLC

Significant Egypt Tobacco Market Industry Milestones

- December 2021: Eastern Company and Al-Mansour International Distribution Company formed a strategic partnership, signing a distribution agreement for the manufacturing of Davidoff Evolve cigarettes, expanding product offerings and market reach.

- June 2022: Philip Morris secured a new license to manufacture both traditional and electronic cigarettes after a USD 450 Million payment to the Egyptian government, signifying substantial investment and expansion plans within the Egyptian market.

- September 2022: Philip Morris announced that its UTC subsidiary would commence manufacturing its products for the Egyptian market, illustrating a strategic shift in production strategy and a strengthening of its local presence.

Future Outlook for Egypt Tobacco Market Market

The Egypt tobacco market is poised for continued growth, driven by evolving consumer preferences, increasing disposable incomes, and ongoing product innovation. Strategic partnerships, new product launches, and expansion into emerging distribution channels will be vital factors in shaping the market's future trajectory. The rise of e-cigarettes and HTPs will significantly contribute to this growth, though regulatory developments will play a crucial role in guiding this expansion.

Egypt Tobacco Market Segmentation

-

1. Product Type

- 1.1. Cigarettes

- 1.2. Cigar, Cigarillos, and Cigar Pipes

- 1.3. E-Cigarette/HTP's

-

2. End User

- 2.1. Male

- 2.2. Female

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarket

- 3.2. Convenience/Small Grocery Stores

- 3.3. Specialty/Tobacco Stores

- 3.4. Other Distribution Channels

Egypt Tobacco Market Segmentation By Geography

- 1. Egypt

Egypt Tobacco Market Regional Market Share

Geographic Coverage of Egypt Tobacco Market

Egypt Tobacco Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Cigarettes across the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Tobacco Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cigarettes

- 5.1.2. Cigar, Cigarillos, and Cigar Pipes

- 5.1.3. E-Cigarette/HTP's

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarket

- 5.3.2. Convenience/Small Grocery Stores

- 5.3.3. Specialty/Tobacco Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Tobacco International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 British American Tobacco PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philip Morris International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Joyetech Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eastern Company SAE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Innokin Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 J Well France SARL*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Imperial Brands PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Japan Tobacco International SA

List of Figures

- Figure 1: Egypt Tobacco Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Tobacco Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Egypt Tobacco Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Egypt Tobacco Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Tobacco Market?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Egypt Tobacco Market?

Key companies in the market include Japan Tobacco International SA, British American Tobacco PLC, Philip Morris International Inc, Joyetech Group, Eastern Company SAE, Innokin Technology Co Ltd, J Well France SARL*List Not Exhaustive, Imperial Brands PLC.

3. What are the main segments of the Egypt Tobacco Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Rising Consumption of Cigarettes across the Country.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Philip Morris announced that its United Tobacco Co. (UTC) subsidiary would begin manufacturing its products for the Egyptian market. Philip Morris' cigarettes will continue to be manufactured by Eastern Co. until its production stock is depleted.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Tobacco Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Tobacco Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Tobacco Market?

To stay informed about further developments, trends, and reports in the Egypt Tobacco Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence