Key Insights

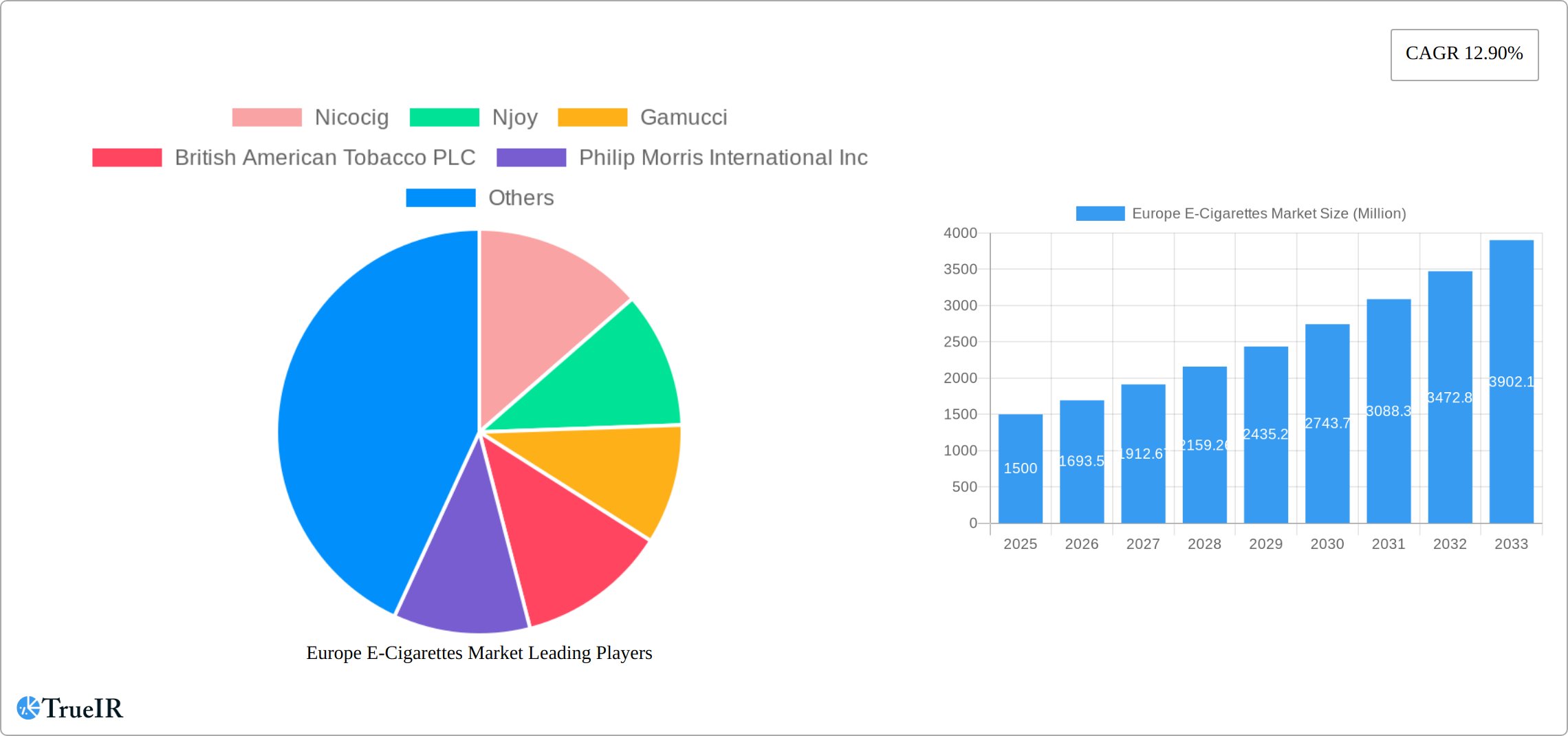

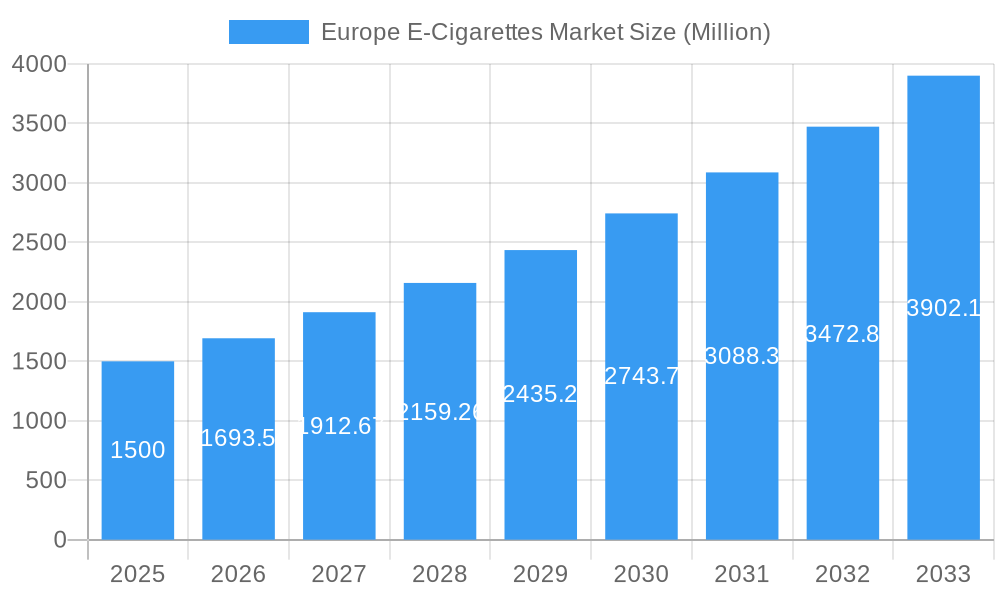

The European e-cigarette market, valued at approximately €27.691 billion in 2025, is poised for substantial growth, projected to expand at a compound annual growth rate (CAGR) of 12.9% from 2025 to 2033. Key growth drivers include heightened awareness of e-cigarettes as a harm reduction alternative to traditional smoking, coupled with effective smoking cessation campaigns. The increasing availability of diverse product types, from disposable to rechargeable and customizable vaporizers, appeals to a broader consumer base. Market segmentation by battery type, distinguishing between automatic and manual e-cigarettes, further demonstrates consumer demand for varied convenience and control. Major industry players, including Nicocig, Njoy, Gamucci, British American Tobacco PLC, and Philip Morris International Inc., are actively driving innovation and market development through strategic marketing, intensifying competition.

Europe E-Cigarettes Market Market Size (In Billion)

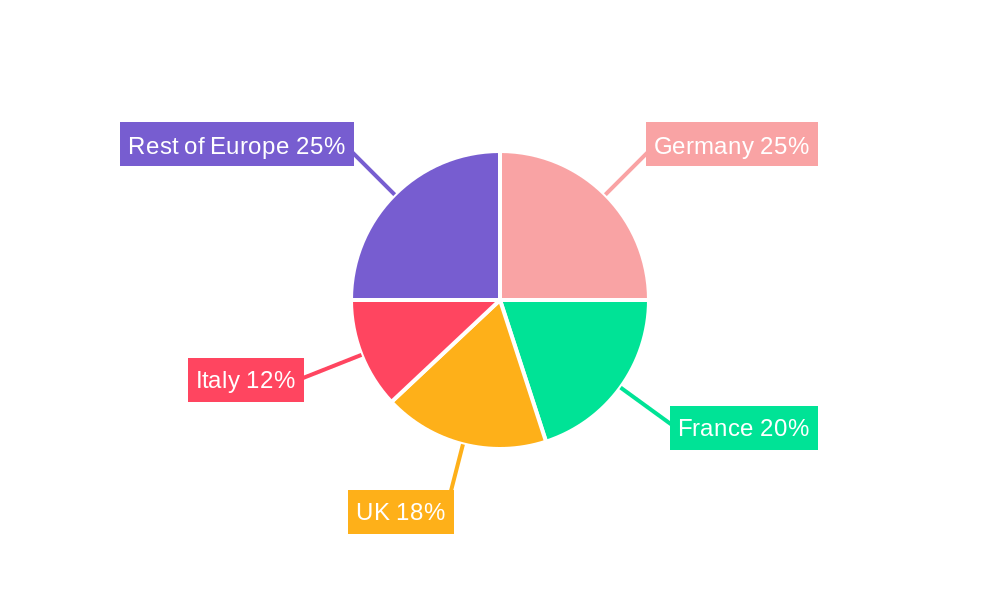

Despite the positive outlook, regulatory hurdles present challenges. Stricter regulations on e-cigarette advertising and sales in key markets like the UK and Germany may temper growth. Concerns surrounding the long-term health impacts of vaping and a shifting consumer preference towards alternative nicotine delivery systems also pose potential restraints. Nevertheless, the European e-cigarette market offers significant opportunities, particularly in leading economies such as Germany, France, the United Kingdom, and Italy, which command a considerable market share. Regional variations in regulatory frameworks and consumer attitudes will continue to shape market dynamics. The forecast predicts a sustained increase in market value, with the market size projected to surpass €70 billion by 2033.

Europe E-Cigarettes Market Company Market Share

Europe E-Cigarettes Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Europe e-cigarettes market, offering invaluable insights for industry stakeholders. With a focus on key market trends, competitive dynamics, and future growth projections, this report is an essential resource for businesses seeking to navigate this rapidly evolving landscape. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe E-Cigarettes Market Structure & Competitive Landscape

The European e-cigarette market exhibits a moderately concentrated structure, with key players like British American Tobacco PLC, Philip Morris International Inc, Imperial Brands PLC, and Japan Tobacco Inc holding significant market share. However, smaller, innovative companies like Aquios Labs and Nicocig are also making considerable contributions, driving competition and innovation.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market. This suggests some level of competition, but also the potential for significant market power held by a few large firms.

Innovation Drivers: Continuous product innovation, particularly in areas like disposable devices, personalized vaporizers, and heated tobacco products, are key drivers. This is fueled by both large multinational tobacco companies and smaller, specialized e-cigarette manufacturers.

Regulatory Impacts: Stringent regulations surrounding e-cigarette sales and marketing, including restrictions on flavors and advertising, significantly impact market growth and dynamics. These regulations vary across different European countries, creating a complex regulatory landscape.

Product Substitutes: Traditional cigarettes remain the primary substitute for e-cigarettes, although the growing popularity of heated tobacco products poses a competitive challenge to both traditional and e-cigarettes.

End-User Segmentation: The market is segmented primarily by demographics (age, income), smoking habits (frequency, brand preference), and health consciousness. This is further stratified by product type and battery mode preference.

M&A Trends: The market has witnessed a significant number of mergers and acquisitions (M&A) activities, primarily driven by large tobacco companies seeking to expand their presence in the e-cigarette sector and by smaller companies aiming for better access to market and resources. xx M&A deals were recorded in the past 5 years, with an average deal value of xx Million.

Europe E-Cigarettes Market Market Trends & Opportunities

The European e-cigarette market is experiencing robust growth, fueled by a confluence of factors. A significant shift in consumer preferences towards reduced-risk tobacco products, coupled with heightened awareness of the health risks associated with traditional cigarettes, is a primary driver. This trend is further amplified by continuous technological advancements in device design, battery technology, and e-liquid formulations, leading to more appealing and efficient products.

The market is undergoing a dramatic reshaping of consumer habits, with a marked preference for disposable e-cigarettes. Sales of completely disposable e-cigarettes are projected to experience substantial growth, driven by their ease of use and affordability. While rechargeable but disposable cartomizer devices maintain a significant market share due to their balanced cost and performance profile, the disposable segment's rapid expansion is undeniable. This trend is particularly pronounced amongst younger demographics.

Simultaneously, personalized vaporizers, offering consumers a higher degree of customization and control, are experiencing steady market penetration. This segment's growth is fueled by evolving consumer behavior, particularly among younger generations who seek advanced features and personalized experiences. The increasing acceptance of heated tobacco products (HTPs), such as Pulze 2.0, is also impacting the market share of both traditional cigarettes and e-cigarettes, adding another layer of complexity to the competitive landscape.

The competitive landscape remains dynamic, with established multinational corporations and innovative startups vying for market dominance through product innovation, aggressive marketing strategies, and strategic acquisitions. Despite the impressive growth trajectory, the market faces significant challenges stemming from evolving regulatory hurdles across different European nations and the ever-changing consumer perceptions surrounding vaping products. The economic impact of rising production costs (estimated at xx% increase in 2024) is also impacting profitability for several companies.

Dominant Markets & Segments in Europe E-Cigarettes Market

The United Kingdom and Germany currently command the largest shares of the European e-cigarette market, followed by France and Italy. This dominance is attributable to a combination of factors:

- High Smoking Prevalence: These countries exhibit relatively high rates of smoking prevalence, providing a substantial potential customer base.

- Elevated Consumer Awareness: Greater awareness of reduced-risk alternatives to traditional cigarettes and a stronger understanding of vaping technologies exists in these regions.

- Established Regulatory Landscapes: While regulations vary across the EU, these major markets generally possess established frameworks that facilitate market growth and minimize uncertainty.

Leading Product Segments:

- Completely Disposable Model: This segment continues to exhibit the most rapid growth, propelled by its convenience and affordability, particularly appealing to younger demographics.

- Rechargeable but Disposable Cartomizer: This segment retains a significant market share, catering to users seeking a balance between convenience and cost-effectiveness.

- Personalized Vaporizer: This segment demonstrates sustained growth, driven by the increasing preference for customizable devices with advanced features and functionalities.

Leading Battery Modes:

- Automatic E-cigarette: This mode maintains its market dominance due to its user-friendly nature and simplified operation.

- Manual E-cigarette: This segment, offering superior customization options, appeals to more experienced users who prioritize control and fine-tuning.

Key Growth Drivers (by region): While regional variations exist, key factors driving growth include favorable regulatory environments (in select areas), burgeoning consumer awareness, persistent high smoking rates, and effective marketing initiatives employed by leading brands.

Europe E-Cigarettes Market Product Analysis

Recent innovations in the e-cigarette market revolve around improved battery technology, enhanced flavor profiles, and the development of more discreet and user-friendly devices. The introduction of water-based e-liquids and improved heating technologies represent significant advancements in product quality and consumer experience. The market fit of these new products is largely dependent on regulatory approvals, pricing strategies, and effective marketing campaigns. Companies are focusing on disposable and rechargeable devices to accommodate the varying preferences of consumers.

Key Drivers, Barriers & Challenges in Europe E-Cigarettes Market

Key Drivers: Technological advancements (e.g., enhanced battery life, innovative e-liquid formulations), evolving consumer preferences (a sustained shift toward less harmful alternatives), and strategic marketing campaigns by major players are key drivers of market expansion. Furthermore, relatively lenient regulatory environments in some European countries contribute significantly to growth.

Key Challenges: Stringent and often disparate regulations across various European countries present considerable hurdles. Supply chain disruptions and escalating raw material costs exert pressure on profitability. The intensely competitive market, characterized by established players and new entrants, creates downward pressure on pricing and profit margins. Public health concerns and the potential for negative media coverage represent ongoing challenges. The substantial xx% increase in production costs during 2024 significantly impacted profit margins for several companies in the industry.

Growth Drivers in the Europe E-Cigarettes Market Market

The market's robust growth is fueled by the increasing adoption of e-cigarettes as a harm reduction strategy, ongoing technological innovation resulting in superior products, and impactful marketing efforts. Evolving consumer preferences, particularly the surging popularity of disposable devices, are also significant contributors. Finally, expansion into new markets and previously untapped demographics presents substantial further growth potential.

Challenges Impacting Europe E-Cigarettes Market Growth

Regulatory hurdles (flavor bans, advertising restrictions), supply chain complexities (e.g., delays in obtaining raw materials, logistics challenges), and fierce competition (price wars, product differentiation challenges) are major barriers to growth. These factors significantly impact market expansion and company profitability.

Key Players Shaping the Europe E-Cigarettes Market Market

- Nicocig

- Njoy

- Gamucci

- British American Tobacco PLC

- Philip Morris International Inc

- J Well France SARL

- Japan Tobacco Inc

- Aquios Labs

- BecoVape

- Blu Cigs

- Imperial Brands PLC

- Altria Group Inc

Significant Europe E-Cigarettes Market Industry Milestones

- November 2021: Imperial Blue launched heated cigarette products in the Czech Republic, signaling a strategic shift towards next-generation products.

- March 2022: BAT launched Vuse Go, a disposable e-cigarette in the UK, expanding its product portfolio and targeting a new segment.

- February 2023: Imperial Brands launched the Pulze 2.0 heated tobacco device, showcasing technological advancement and market expansion in Italy, Poland, Czech Republic and Greece.

- March 2023: Aquios Labs launched a water-based e-liquid technology in collaboration with Innokin Technology, introducing an innovation aimed at improving the smoking experience.

Future Outlook for Europe E-Cigarettes Market Market

The Europe e-cigarette market is poised for continued growth driven by technological innovation, evolving consumer preferences, and strategic expansion by key players. New product launches, particularly in the disposable segment, will continue to fuel market expansion. However, navigating the complex regulatory landscape and addressing consumer concerns will be crucial for sustained success. The market's future depends on striking a balance between innovation, compliance, and responsible marketing.

Europe E-Cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-Cigarette

- 2.2. Manual E-Cigarette

Europe E-Cigarettes Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

Europe E-Cigarettes Market Regional Market Share

Geographic Coverage of Europe E-Cigarettes Market

Europe E-Cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Ban Disposable E-Cigarettes

- 3.4. Market Trends

- 3.4.1. Rising Dual-Use E-Cigarette Among Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-Cigarette

- 5.2.2. Manual E-Cigarette

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-Cigarette

- 6.2.2. Manual E-Cigarette

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-Cigarette

- 7.2.2. Manual E-Cigarette

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-Cigarette

- 8.2.2. Manual E-Cigarette

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-Cigarette

- 9.2.2. Manual E-Cigarette

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-Cigarette

- 10.2.2. Manual E-Cigarette

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-Cigarette

- 11.2.2. Manual E-Cigarette

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Completely Disposable Model

- 12.1.2. Rechargeable but Disposable Cartomizer

- 12.1.3. Personalized Vaporizer

- 12.2. Market Analysis, Insights and Forecast - by Battery Mode

- 12.2.1. Automatic E-Cigarette

- 12.2.2. Manual E-Cigarette

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nicocig

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Njoy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Gamucci

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 British American Tobacco PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Philip Morris International Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 J Well France SARL

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Japan Tobacco Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Aquios Labs

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BecoVape*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Blu Cigs

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Imperial Brands PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Altria Group Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Nicocig

List of Figures

- Figure 1: Europe E-Cigarettes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe E-Cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 4: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 5: Europe E-Cigarettes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe E-Cigarettes Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 10: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 11: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 15: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 16: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 17: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 21: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 22: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 23: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 28: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 29: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 34: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 35: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 39: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 40: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 41: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 43: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 45: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 46: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 47: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe E-Cigarettes Market?

The projected CAGR is approximately 12.9%.

2. Which companies are prominent players in the Europe E-Cigarettes Market?

Key companies in the market include Nicocig, Njoy, Gamucci, British American Tobacco PLC, Philip Morris International Inc, J Well France SARL, Japan Tobacco Inc, Aquios Labs, BecoVape*List Not Exhaustive, Blu Cigs, Imperial Brands PLC, Altria Group Inc.

3. What are the main segments of the Europe E-Cigarettes Market?

The market segments include Product Type, Battery Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.691 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes.

6. What are the notable trends driving market growth?

Rising Dual-Use E-Cigarette Among Consumers.

7. Are there any restraints impacting market growth?

Government Initiatives to Ban Disposable E-Cigarettes.

8. Can you provide examples of recent developments in the market?

March 2023: Aquios Labs, a Britain-based company, announced its new innovation, where it developed a water-based technology and launched a commercial product in cooperation with Innokin Technology to offer smokers a better smoking experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe E-Cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe E-Cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe E-Cigarettes Market?

To stay informed about further developments, trends, and reports in the Europe E-Cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence