Key Insights

The European winter sports equipment market is projected to reach €17.78 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.87% from 2025 to 2033. This growth is propelled by rising engagement in winter sports such as skiing and snowboarding across all demographics. Increased disposable incomes and a growing preference for adventure tourism and active lifestyles in European nations are significant market drivers. Innovations in equipment, including lighter materials, enhanced performance, and improved safety features, are also stimulating sales. The market is segmented by sport, with skiing and snowboarding leading, followed by end-user categories (men, women, children), and distribution channels (online and offline retail). A competitive environment exists, driven by established brands and emerging niche players.

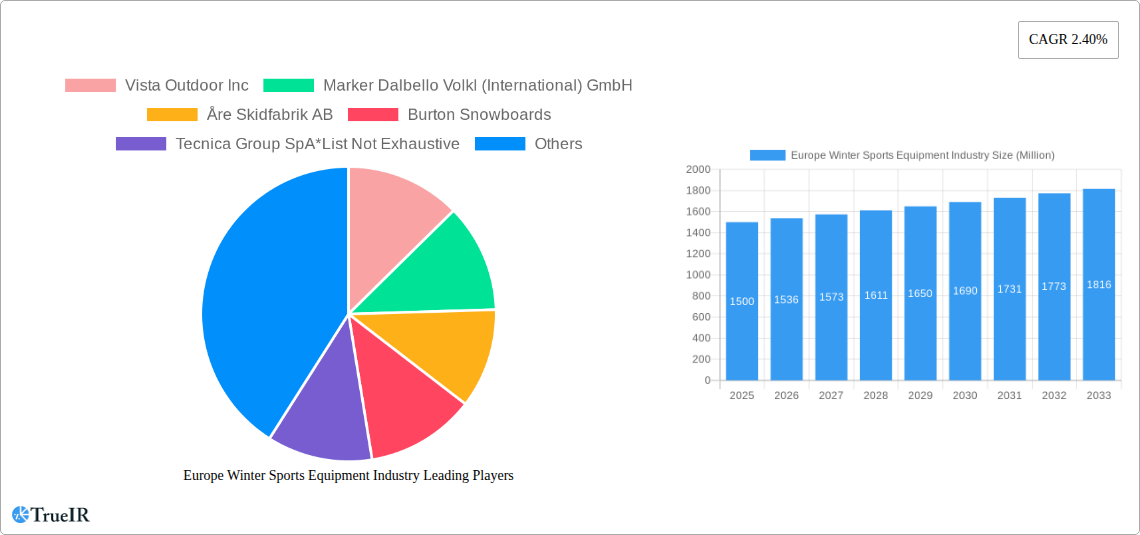

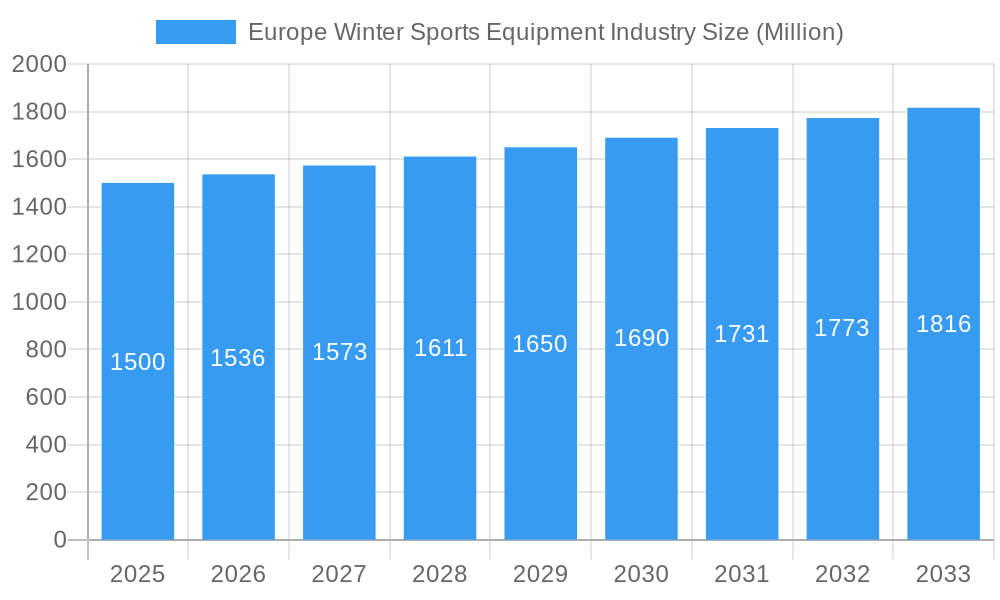

Europe Winter Sports Equipment Industry Market Size (In Billion)

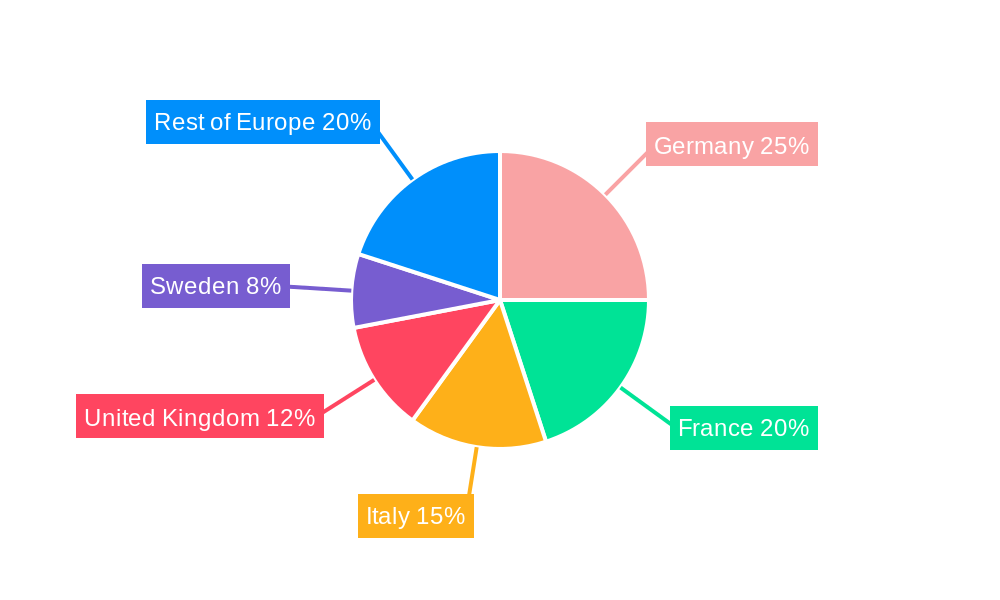

Key European markets include Germany, France, Italy, the United Kingdom, and Sweden, collectively representing a substantial share of total sales. While offline retail channels continue to dominate, online sales are experiencing growth, particularly among younger consumers. Companies are increasingly focusing on sustainable and eco-friendly product development to cater to environmentally conscious consumers. The competitive landscape is characterized by product innovation, strategic collaborations, and targeted marketing efforts. The forecast indicates a positive trajectory for the European winter sports equipment market, contingent on economic stability and favorable environmental conditions.

Europe Winter Sports Equipment Industry Company Market Share

Europe Winter Sports Equipment Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Europe winter sports equipment industry, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report illuminates market dynamics, competitive landscapes, and future trends. The estimated market size in 2025 is expected to reach xx Million. This in-depth analysis uses high-volume keywords like "Europe winter sports equipment market," "ski equipment market," "snowboard equipment market," and "winter sports industry trends" to enhance search visibility and reach a targeted audience.

Europe Winter Sports Equipment Industry Market Structure & Competitive Landscape

This section analyzes the competitive dynamics of the European winter sports equipment market. The market exhibits a moderately concentrated structure, with key players like Vista Outdoor Inc, Marker Dalbello Volkl (International) GmbH, Åre Skidfabrik AB, Burton Snowboards, Tecnica Group SpA, Groupe Rossignol, Amer Sports Oyj, UVEX group, Alpina d o o, Clarus Corporation, and Fischer Beteiligungsverwaltungs GmbH holding significant market share. However, the presence of numerous smaller niche players also contributes to a dynamic landscape.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated to be around xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in material science (e.g., lighter, stronger skis and snowboards), binding systems, and boot design are key innovation drivers. Sustainability initiatives are also gaining traction.

- Regulatory Impacts: EU regulations regarding product safety and environmental standards significantly influence manufacturing and distribution processes. Compliance costs can vary.

- Product Substitutes: The market faces competition from alternative leisure activities and experiences.

- End-User Segmentation: The market is segmented by sport (skiing, snowboarding), end-user (men, women, children), and distribution channel (online and offline retail). The men's segment currently holds the largest market share.

- M&A Trends: The industry has witnessed several mergers and acquisitions in recent years, driven by efforts to achieve economies of scale and expand product portfolios. The volume of M&A activity is estimated to be xx deals in the past five years.

Europe Winter Sports Equipment Industry Market Trends & Opportunities

The European winter sports equipment market is experiencing robust and dynamic growth, fueled by a confluence of factors including increasing disposable incomes, a surge in participation across diverse winter sports, and relentless technological innovation. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). This upward trajectory is further bolstered by the burgeoning popularity of snowboarding among younger demographics and the emergence of exciting new winter sports activities. Cutting-edge technological advancements, such as the development of lighter, more responsive ski and snowboard designs, enhanced safety features like integrated impact protection, and the incorporation of smart technologies for performance tracking and connectivity, are significantly driving market expansion. Furthermore, the rapidly evolving online retail sector presents unprecedented opportunities for manufacturers to expand their reach and engage with a broader global audience. A notable shift in consumer preferences is also evident, with a growing demand for sustainable and ethically sourced products, creating a fertile ground for brands that champion environmental responsibility and transparent manufacturing practices. The competitive landscape remains intensely dynamic, characterized by major industry players continuously striving for innovation and the refinement of their product portfolios. Market penetration rates for specialized equipment are steadily increasing, particularly within rapidly growing niche segments such as freeride skiing, backcountry touring, and advanced snowboarding disciplines.

Dominant Markets & Segments in Europe Winter Sports Equipment Industry

The iconic Alpine regions of France, Switzerland, Austria, and Italy form the bedrock of the European winter sports equipment market, representing its largest and most influential territories. Germany and the Scandinavian countries also contribute substantially to market volume and value, owing to their strong winter sports culture and well-developed infrastructure.

By Sport:

- Skiing: Continues to reign supreme as the dominant segment, underpinned by extensive and well-maintained ski resort infrastructure and consistently high participation rates across all age groups.

- Snowboarding: Is experiencing remarkable growth, capturing the attention and engagement of younger consumers and increasingly diversifying its appeal to broader demographics.

- Other Winter Sports: Including cross-country skiing, snowshoeing, and winter hiking, are also witnessing steady interest and niche market development.

By End-User:

- Men: Historically represents the largest segment, driven by higher overall participation rates and a strong historical association with the sports.

- Women: Is exhibiting particularly strong and consistent growth, propelled by increased female participation, targeted marketing efforts, and the development of women-specific equipment.

- Children: Constitutes a significant and vital segment, though it can be subject to fluctuations influenced by economic conditions, family disposable income, and evolving seasonal participation trends.

By Distribution Channel:

- Offline Retail Stores: Still command a substantial market share, offering the invaluable advantage of allowing consumers to physically inspect, try on, and receive expert advice on products before purchase.

- Online Retail Stores: Are experiencing exponential growth, driven by their unparalleled convenience, expansive product selection, competitive pricing, and the ease of accessing niche and specialized items.

Key Growth Drivers:

- The unparalleled and extensive ski resort infrastructure, particularly within the European Alps, remains a primary catalyst for the industry.

- Supportive government policies promoting winter tourism, investing in sports development, and enhancing accessibility to mountain regions are crucial enablers.

- The sustained increase in disposable incomes across key European nations directly translates to higher consumer spending on recreational activities and premium sports equipment.

- A growing global consciousness towards health and wellness is driving more individuals to embrace outdoor activities like winter sports.

Europe Winter Sports Equipment Industry Product Analysis

Innovation is the lifeblood of the Europe winter sports equipment industry, with a relentless focus on enhancing materials, refining design aesthetics, and optimizing functionality. Advancements in materials science have led to the development of exceptionally lightweight yet incredibly durable composites, revolutionizing ski and snowboard construction for improved performance and reduced fatigue. Binding systems are continuously being re-engineered to offer superior safety through precise release mechanisms, while advanced boot technology focuses on customizable fit, enhanced thermal insulation, and optimized energy transfer for unparalleled comfort and athletic performance. The market is witnessing a significant integration of smart technologies, from GPS tracking and real-time performance monitoring sensors embedded in skis and boots to connectivity features that allow for data analysis and social sharing of achievements. This technological integration is not merely a trend but a strategic approach to address specific user needs, elevate the overall user experience, and cultivate deeper brand engagement, thereby driving sustained market demand. In this highly competitive arena, product differentiation, driven by unique technological features, superior materials, and compelling design, is paramount for success.

Key Drivers, Barriers & Challenges in Europe Winter Sports Equipment Industry

Key Drivers: Technological advancements, rising disposable incomes in key European markets, increased tourism, and favorable government policies promoting winter sports are major growth drivers. The growing popularity of snowboarding and other winter sports activities further propels market growth.

Challenges: Economic downturns can significantly impact consumer spending on recreational equipment. Fluctuations in weather patterns influence participation rates and equipment demand. Supply chain disruptions and increasing raw material costs represent significant challenges. Competition from lower-cost manufacturers, particularly from Asia, also poses a threat. Environmental regulations and sustainability concerns increasingly influence manufacturing processes and material choices.

Growth Drivers in the Europe Winter Sports Equipment Industry Market

The market is driven by technological innovations, increased participation in winter sports, and supportive government policies in several European countries. Rising disposable incomes and expanding tourism further fuel market expansion. Sustainability is becoming a critical factor influencing both production and consumer choices.

Challenges Impacting Europe Winter Sports Equipment Industry Growth

Economic uncertainties, unpredictable weather patterns, and supply chain vulnerabilities can significantly impact market growth. Intense competition and increasing manufacturing costs are also critical constraints. Stringent environmental regulations present further challenges for manufacturers.

Key Players Shaping the Europe Winter Sports Equipment Industry Market

- Vista Outdoor Inc

- Marker Dalbello Volkl (International) GmbH

- Åre Skidfabrik AB

- Burton Snowboards

- Tecnica Group SpA

- Groupe Rossignol

- Amer Sports Oyj

- UVEX group

- Alpina d o o

- Clarus Corporation

- Fischer Beteiligungsverwaltungs GmbH

Significant Europe Winter Sports Equipment Industry Industry Milestones

- 2020: A significant wave of product launches focused on eco-friendly materials and sustainable manufacturing processes across several leading brands.

- 2021: A major strategic merger within the ski binding segment, consolidating market share and fostering innovation through combined expertise.

- 2022: Substantial investments in research and development were directed towards the advancement and integration of smart ski technology, promising enhanced performance tracking and connectivity.

- 2023: A notable industry trend emerged with multiple companies unveiling innovative new lightweight ski designs, prioritizing performance and user comfort.

- 2024: The industry witnessed an intensified focus on the ethical sourcing of raw materials and the implementation of sustainable production practices, reflecting growing consumer and regulatory pressure.

Future Outlook for Europe Winter Sports Equipment Industry Market

The European winter sports equipment market is poised for continued growth, driven by technological innovation, increasing participation, and the growing emphasis on sustainable practices. Strategic partnerships and investments in R&D are expected to drive further innovation. Opportunities exist in developing specialized equipment for niche segments and expanding online distribution channels. The market's future success hinges on adapting to evolving consumer preferences, addressing sustainability concerns, and navigating potential economic and geopolitical uncertainties. The market is expected to reach xx Million by 2033.

Europe Winter Sports Equipment Industry Segmentation

-

1. Sport

-

1.1. Ski

- 1.1.1. Skis and Poles

- 1.1.2. Ski Boots

- 1.1.3. Other Protective Gear and Accessories

- 1.2. Snowboard

-

1.1. Ski

-

2. End-User

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Online Retail Stores

- 3.2. Offline Retail Stores

Europe Winter Sports Equipment Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Switzerland

- 6. Austria

- 7. Spain

- 8. Rest of Europe

Europe Winter Sports Equipment Industry Regional Market Share

Geographic Coverage of Europe Winter Sports Equipment Industry

Europe Winter Sports Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Growing Number Of Ski Destinations Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sport

- 5.1.1. Ski

- 5.1.1.1. Skis and Poles

- 5.1.1.2. Ski Boots

- 5.1.1.3. Other Protective Gear and Accessories

- 5.1.2. Snowboard

- 5.1.1. Ski

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online Retail Stores

- 5.3.2. Offline Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Switzerland

- 5.4.6. Austria

- 5.4.7. Spain

- 5.4.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Sport

- 6. United Kingdom Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sport

- 6.1.1. Ski

- 6.1.1.1. Skis and Poles

- 6.1.1.2. Ski Boots

- 6.1.1.3. Other Protective Gear and Accessories

- 6.1.2. Snowboard

- 6.1.1. Ski

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online Retail Stores

- 6.3.2. Offline Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Sport

- 7. Germany Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sport

- 7.1.1. Ski

- 7.1.1.1. Skis and Poles

- 7.1.1.2. Ski Boots

- 7.1.1.3. Other Protective Gear and Accessories

- 7.1.2. Snowboard

- 7.1.1. Ski

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online Retail Stores

- 7.3.2. Offline Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Sport

- 8. France Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sport

- 8.1.1. Ski

- 8.1.1.1. Skis and Poles

- 8.1.1.2. Ski Boots

- 8.1.1.3. Other Protective Gear and Accessories

- 8.1.2. Snowboard

- 8.1.1. Ski

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online Retail Stores

- 8.3.2. Offline Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Sport

- 9. Italy Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sport

- 9.1.1. Ski

- 9.1.1.1. Skis and Poles

- 9.1.1.2. Ski Boots

- 9.1.1.3. Other Protective Gear and Accessories

- 9.1.2. Snowboard

- 9.1.1. Ski

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Children

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online Retail Stores

- 9.3.2. Offline Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Sport

- 10. Switzerland Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sport

- 10.1.1. Ski

- 10.1.1.1. Skis and Poles

- 10.1.1.2. Ski Boots

- 10.1.1.3. Other Protective Gear and Accessories

- 10.1.2. Snowboard

- 10.1.1. Ski

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Children

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online Retail Stores

- 10.3.2. Offline Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Sport

- 11. Austria Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Sport

- 11.1.1. Ski

- 11.1.1.1. Skis and Poles

- 11.1.1.2. Ski Boots

- 11.1.1.3. Other Protective Gear and Accessories

- 11.1.2. Snowboard

- 11.1.1. Ski

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Men

- 11.2.2. Women

- 11.2.3. Children

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Online Retail Stores

- 11.3.2. Offline Retail Stores

- 11.1. Market Analysis, Insights and Forecast - by Sport

- 12. Spain Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Sport

- 12.1.1. Ski

- 12.1.1.1. Skis and Poles

- 12.1.1.2. Ski Boots

- 12.1.1.3. Other Protective Gear and Accessories

- 12.1.2. Snowboard

- 12.1.1. Ski

- 12.2. Market Analysis, Insights and Forecast - by End-User

- 12.2.1. Men

- 12.2.2. Women

- 12.2.3. Children

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Online Retail Stores

- 12.3.2. Offline Retail Stores

- 12.1. Market Analysis, Insights and Forecast - by Sport

- 13. Rest of Europe Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Sport

- 13.1.1. Ski

- 13.1.1.1. Skis and Poles

- 13.1.1.2. Ski Boots

- 13.1.1.3. Other Protective Gear and Accessories

- 13.1.2. Snowboard

- 13.1.1. Ski

- 13.2. Market Analysis, Insights and Forecast - by End-User

- 13.2.1. Men

- 13.2.2. Women

- 13.2.3. Children

- 13.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.3.1. Online Retail Stores

- 13.3.2. Offline Retail Stores

- 13.1. Market Analysis, Insights and Forecast - by Sport

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Vista Outdoor Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Marker Dalbello Volkl (International) GmbH

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Åre Skidfabrik AB

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Burton Snowboards

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Tecnica Group SpA*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Groupe Rossignol

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Amer Sports Oyj

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 UVEX group

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Alpina d o o

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Clarus Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Fischer Beteiligungsverwaltungs GmbH

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Vista Outdoor Inc

List of Figures

- Figure 1: Europe Winter Sports Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Winter Sports Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 2: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 3: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 5: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 10: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 11: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 13: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 18: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 19: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 21: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 26: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 27: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 29: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 34: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 35: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 37: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 38: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 39: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 42: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 43: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 44: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 45: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 50: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 51: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 52: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 53: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 54: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 55: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 57: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 58: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 59: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 60: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 61: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 62: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 63: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 64: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 65: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 66: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 67: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 68: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 69: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 71: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Winter Sports Equipment Industry?

The projected CAGR is approximately 5.87%.

2. Which companies are prominent players in the Europe Winter Sports Equipment Industry?

Key companies in the market include Vista Outdoor Inc, Marker Dalbello Volkl (International) GmbH, Åre Skidfabrik AB, Burton Snowboards, Tecnica Group SpA*List Not Exhaustive, Groupe Rossignol, Amer Sports Oyj, UVEX group, Alpina d o o, Clarus Corporation, Fischer Beteiligungsverwaltungs GmbH.

3. What are the main segments of the Europe Winter Sports Equipment Industry?

The market segments include Sport, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Growing Number Of Ski Destinations Drives the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Winter Sports Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Winter Sports Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Winter Sports Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Winter Sports Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence