Key Insights

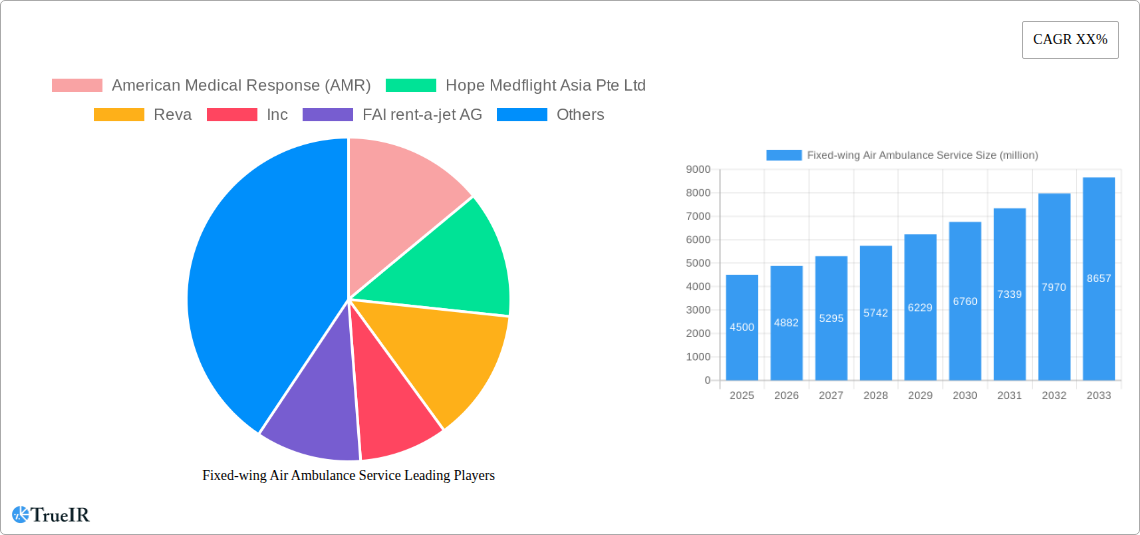

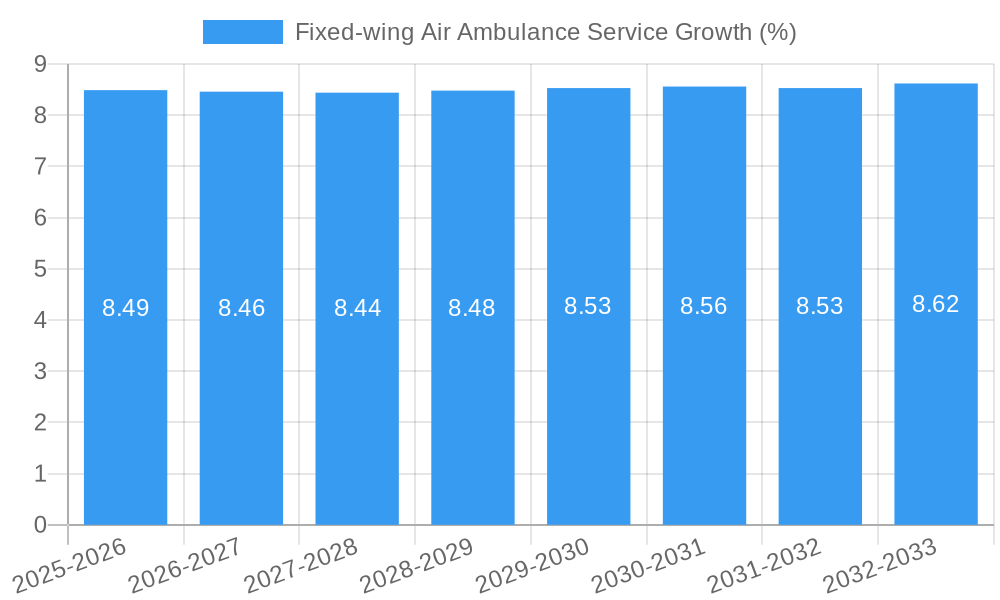

The global Fixed-wing Air Ambulance Service market is poised for substantial growth, projected to reach an estimated value of $4,500 million by 2025. This expansion is driven by an anticipated Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025-2033. Key growth drivers include the increasing prevalence of chronic diseases, a rising demand for specialized medical care in remote or underserved areas, and the growing need for rapid patient transfers for critical procedures or treatments. The industry is witnessing a significant shift towards advanced medical technologies onboard air ambulances, enhancing their capability to provide critical care during transit. Furthermore, an aging global population and the increasing complexity of medical emergencies are contributing to the sustained demand for these life-saving services.

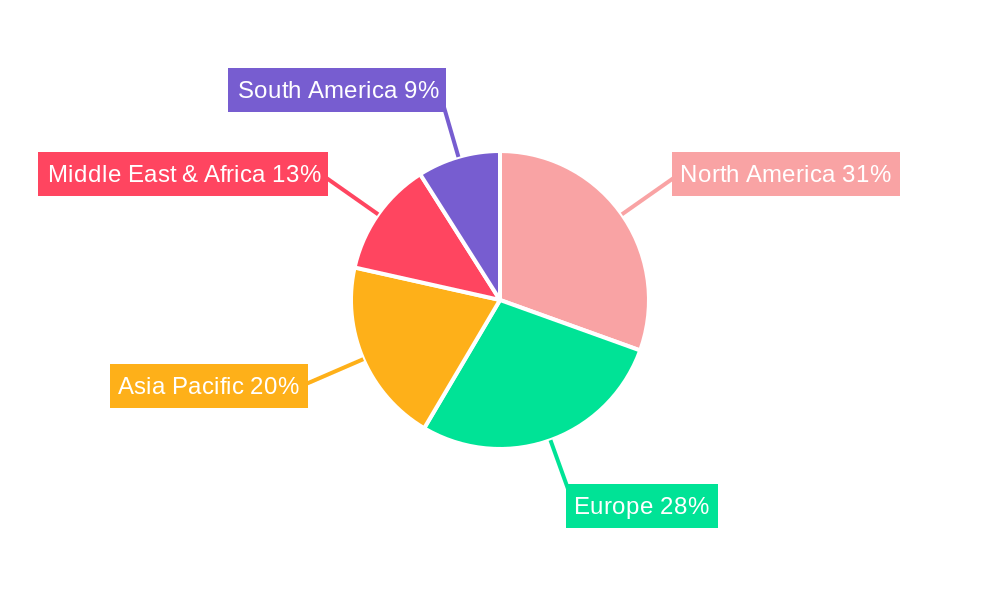

The market is segmented into Community Based and Hospital Based applications, with Hospital Based services expected to dominate due to the established infrastructure and resources within healthcare facilities. In terms of service types, Medical Repatriation and Medical Escort Services are the primary categories. Medical Repatriation is likely to see robust demand owing to globalization and the increasing number of individuals traveling internationally. Geographically, North America and Europe currently hold significant market share, driven by well-developed healthcare systems, advanced aviation infrastructure, and high disposable incomes. However, the Asia Pacific region is expected to exhibit the fastest growth, fueled by rapid economic development, expanding healthcare access, and a growing awareness of air ambulance services. Restraints such as high operational costs and stringent regulatory compliances are present but are being mitigated by technological advancements and strategic partnerships within the industry.

This in-depth market research report provides a dynamic and SEO-optimized analysis of the global Fixed-wing Air Ambulance Service market. Leveraging high-volume keywords such as "air ambulance," "medical repatriation," "medical escort service," "emergency medical transport," and "fixed-wing medical evacuation," this report is designed to enhance search rankings and engage critical industry audiences, including healthcare providers, emergency services, aviation companies, and investors. The report covers a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, providing robust insights into past trends, current dynamics, and future opportunities.

Fixed-wing Air Ambulance Service Market Structure & Competitive Landscape

The global Fixed-wing Air Ambulance Service market exhibits a moderately concentrated structure, characterized by a mix of established global players and specialized regional providers. Key innovation drivers include advancements in medical technology onboard aircraft, real-time patient monitoring systems, and enhanced communication capabilities, fostering significant improvements in patient care during transit. Regulatory frameworks governing air safety, medical licensing, and international patient transport play a crucial role in shaping market entry and operational standards. Product substitutes, such as advanced ground ambulances and commercial airline medical escorts for less critical cases, present a degree of competitive pressure. The end-user segmentation is primarily driven by the needs of community-based healthcare facilities and hospital-based healthcare systems, both requiring rapid and specialized medical transport solutions. Merger and acquisition (M&A) trends are influenced by the desire to expand geographical reach, consolidate service offerings, and achieve economies of scale, with an estimated XX significant M&A activities recorded during the historical period. Concentration ratios are estimated to be around XX% for the top 5 players.

- Market Concentration: Moderate, with key players and regional specialists.

- Innovation Drivers: Medical technology, communication systems, aircraft efficiency.

- Regulatory Impacts: Air safety, medical certifications, cross-border regulations.

- Product Substitutes: Ground ambulances, commercial medical escorts.

- End-User Segmentation: Community-based and hospital-based healthcare.

- M&A Trends: Expansion, consolidation, service integration.

Fixed-wing Air Ambulance Service Market Trends & Opportunities

The Fixed-wing Air Ambulance Service market is poised for significant expansion, driven by a confluence of escalating demand for specialized medical care, an aging global population, and the increasing prevalence of chronic and critical illnesses. The market size is projected to grow from an estimated value of $XX million in 2019 to exceed $XX million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of approximately XX%. Technological shifts are central to this growth, with ongoing advancements in telemedicine, portable diagnostic equipment, and advanced life support systems enabling a higher standard of care during critical evacuations. Consumer preferences are increasingly leaning towards swift, efficient, and medically sophisticated transport solutions, particularly for complex cases requiring intensive care or specialized surgical interventions. Competitive dynamics are intensifying, with companies focusing on service differentiation through specialized medical teams, advanced aircraft configurations, and comprehensive logistical support. Market penetration rates for fixed-wing air ambulance services are expected to rise, particularly in emerging economies where healthcare infrastructure is rapidly developing. The growing trend of medical tourism also fuels demand for international medical repatriation services. Furthermore, the increasing acceptance and integration of air ambulance services into national healthcare emergency response plans underscore their growing indispensability. The market is also witnessing a trend towards greater collaboration between air ambulance providers, hospitals, and insurance companies to streamline patient transfer processes and optimize cost-effectiveness, further boosting market accessibility and utilization. The strategic importance of rapid response times in saving lives further propels the adoption of fixed-wing air ambulances over slower ground-based alternatives for long-distance or complex medical emergencies.

Dominant Markets & Segments in Fixed-wing Air Ambulance Service

The Medical Repatriation segment is identified as a dominant force within the Fixed-wing Air Ambulance Service market, driven by a globalized population, increased international travel for business and leisure, and the growing trend of medical tourism. Regions with a high volume of expatriate populations and significant medical tourism activity, such as North America and Europe, are leading markets for this service. The Hospital Based application segment also holds substantial dominance, as hospitals frequently rely on fixed-wing air ambulances for inter-facility transfers of critically ill patients requiring specialized care or advanced treatments not available at their current location. Key growth drivers for this dominance include robust healthcare infrastructure, established networks of specialized medical centers, and strong government initiatives supporting emergency medical services.

- Leading Region: North America, owing to advanced healthcare infrastructure and high demand for complex medical transfers.

- Leading Country: United States, with a well-developed network of air ambulance providers and a significant aging population requiring specialized care.

- Dominant Application Segment: Hospital Based, due to the necessity of inter-facility transfers for specialized treatments.

- Dominant Type Segment: Medical Repatriation, fueled by globalization and medical tourism.

Growth Drivers in the Dominant Segments:

- Robust Healthcare Infrastructure: Availability of advanced medical facilities and personnel in key regions.

- Aging Global Population: Increased incidence of age-related chronic and critical illnesses requiring specialized transport.

- Medical Tourism: Growing trend of seeking medical treatment abroad, necessitating repatriation services.

- Government Policies & Initiatives: Supportive regulations and funding for emergency medical services and patient transport.

- Technological Advancements: Improved medical equipment and communication systems enhancing patient care during transit.

Fixed-wing Air Ambulance Service Product Analysis

The Fixed-wing Air Ambulance Service product offering is characterized by highly specialized aircraft configurations equipped with state-of-the-art medical equipment, designed to provide advanced life support and critical care during air medical transport. These services encompass a range of aircraft types, from smaller turboprops for shorter distances to larger jets capable of long-haul international medical evacuations. Key innovations focus on miniaturization of medical devices, real-time patient monitoring, and seamless integration of onboard medical teams with ground-based medical facilities. Competitive advantages are derived from rapid response times, global reach, specialized medical expertise of flight crews, and comprehensive logistical support, ensuring efficient and safe patient transfers. The market fit is exceptionally high for critically ill or injured patients requiring immediate, advanced medical intervention and swift transport over significant distances.

Key Drivers, Barriers & Challenges in Fixed-wing Air Ambulance Service

The Fixed-wing Air Ambulance Service market is propelled by several key drivers. Technological advancements in medical equipment and aviation safety enable more sophisticated patient care and extended operational capabilities. The increasing global demand for specialized medical care, coupled with rising healthcare costs and the trend of medical tourism, also significantly fuels market growth. Favorable regulatory environments in many regions that prioritize emergency medical services further support the industry.

Key challenges and restraints include high operational costs, including aircraft maintenance, fuel, and specialized personnel, which can impact affordability. Complex regulatory hurdles and varying international aviation and medical protocols can create logistical complexities for cross-border operations. Supply chain issues, particularly for specialized medical equipment and parts, and intense competitive pressures from both established and emerging players can also pose significant restraints. The estimated impact of these challenges on market growth is approximately XX%.

Growth Drivers in the Fixed-wing Air Ambulance Service Market

The growth trajectory of the Fixed-wing Air Ambulance Service market is primarily dictated by several potent forces. Technological innovation remains a cornerstone, with continuous improvements in onboard medical technology—such as advanced ventilators, portable diagnostic imaging, and real-time remote monitoring systems—enhancing the quality and safety of patient care. Economically, the increasing global disposable income and the expanding medical tourism sector are creating a larger pool of individuals who can afford and require these services for elective or emergent medical needs abroad. Government initiatives and favorable policies in many countries, aimed at strengthening emergency medical infrastructure and ensuring access to critical care, further catalyze market expansion. The growing burden of chronic diseases and aging demographics worldwide also translates into a sustained and growing demand for rapid and effective medical transport solutions.

Challenges Impacting Fixed-wing Air Ambulance Service Growth

Despite its robust growth prospects, the Fixed-wing Air Ambulance Service market faces significant headwinds. Regulatory complexities and disparities across different countries and jurisdictions present substantial challenges in terms of obtaining permits, adhering to diverse medical standards, and navigating international air traffic control. High operational and capital expenditures associated with maintaining specialized aircraft, employing highly trained medical and flight crews, and investing in advanced medical equipment represent a significant financial barrier. Supply chain vulnerabilities, particularly concerning the availability of critical spare parts and specialized medical consumables, can disrupt service delivery. Furthermore, intense competitive pressures from both established global providers and emerging regional players necessitate continuous innovation and cost optimization to maintain market share.

Key Players Shaping the Fixed-wing Air Ambulance Service Market

- American Medical Response (AMR)

- Hope Medflight Asia Pte Ltd

- Reva, Inc.

- FAI rent-a-jet AG

Significant Fixed-wing Air Ambulance Service Industry Milestones

- 2019: Increased adoption of telemedicine and remote patient monitoring systems in air ambulances.

- 2020: Surge in medical evacuation flights during the global pandemic, highlighting the critical role of air ambulance services.

- 2021: Advancements in lightweight, portable medical equipment reducing aircraft payload constraints.

- 2022: Growing focus on sustainable aviation fuel for air ambulance operations.

- 2023: Expansion of integrated air and ground medical transport networks.

Future Outlook for Fixed-wing Air Ambulance Service Market

- 2019: Increased adoption of telemedicine and remote patient monitoring systems in air ambulances.

- 2020: Surge in medical evacuation flights during the global pandemic, highlighting the critical role of air ambulance services.

- 2021: Advancements in lightweight, portable medical equipment reducing aircraft payload constraints.

- 2022: Growing focus on sustainable aviation fuel for air ambulance operations.

- 2023: Expansion of integrated air and ground medical transport networks.

Future Outlook for Fixed-wing Air Ambulance Service Market

The future outlook for the Fixed-wing Air Ambulance Service market is exceptionally promising, driven by continued technological advancements, increasing global healthcare demands, and favorable demographic trends. Strategic opportunities lie in expanding service offerings to emerging markets, developing specialized medical transport solutions for niche patient populations (e.g., neonatal, transplant), and leveraging digital technologies for enhanced operational efficiency and patient experience. The market is expected to witness further consolidation and strategic partnerships aimed at creating comprehensive, end-to-end medical transport solutions. The increasing integration of artificial intelligence for flight planning and resource allocation will also play a pivotal role in optimizing services. The market potential is substantial, with a projected growth trajectory that underscores the indispensable nature of fixed-wing air ambulance services in modern healthcare systems.

Fixed-wing Air Ambulance Service Segmentation

-

1. Application

- 1.1. Community Based

- 1.2. Hospital Based

-

2. Types

- 2.1. Medical Repatriation

- 2.2. Medical Escort Service

Fixed-wing Air Ambulance Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fixed-wing Air Ambulance Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed-wing Air Ambulance Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Community Based

- 5.1.2. Hospital Based

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Medical Repatriation

- 5.2.2. Medical Escort Service

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fixed-wing Air Ambulance Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Community Based

- 6.1.2. Hospital Based

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Medical Repatriation

- 6.2.2. Medical Escort Service

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fixed-wing Air Ambulance Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Community Based

- 7.1.2. Hospital Based

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Medical Repatriation

- 7.2.2. Medical Escort Service

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fixed-wing Air Ambulance Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Community Based

- 8.1.2. Hospital Based

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Medical Repatriation

- 8.2.2. Medical Escort Service

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fixed-wing Air Ambulance Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Community Based

- 9.1.2. Hospital Based

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Medical Repatriation

- 9.2.2. Medical Escort Service

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fixed-wing Air Ambulance Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Community Based

- 10.1.2. Hospital Based

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Medical Repatriation

- 10.2.2. Medical Escort Service

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 American Medical Response (AMR)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hope Medflight Asia Pte Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Reva

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FAI rent-a-jet AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 American Medical Response (AMR)

List of Figures

- Figure 1: Global Fixed-wing Air Ambulance Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fixed-wing Air Ambulance Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fixed-wing Air Ambulance Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fixed-wing Air Ambulance Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Fixed-wing Air Ambulance Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Fixed-wing Air Ambulance Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fixed-wing Air Ambulance Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fixed-wing Air Ambulance Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fixed-wing Air Ambulance Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fixed-wing Air Ambulance Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Fixed-wing Air Ambulance Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Fixed-wing Air Ambulance Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fixed-wing Air Ambulance Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fixed-wing Air Ambulance Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fixed-wing Air Ambulance Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fixed-wing Air Ambulance Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Fixed-wing Air Ambulance Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Fixed-wing Air Ambulance Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fixed-wing Air Ambulance Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fixed-wing Air Ambulance Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fixed-wing Air Ambulance Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fixed-wing Air Ambulance Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Fixed-wing Air Ambulance Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Fixed-wing Air Ambulance Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fixed-wing Air Ambulance Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fixed-wing Air Ambulance Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fixed-wing Air Ambulance Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fixed-wing Air Ambulance Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Fixed-wing Air Ambulance Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Fixed-wing Air Ambulance Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fixed-wing Air Ambulance Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Fixed-wing Air Ambulance Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fixed-wing Air Ambulance Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed-wing Air Ambulance Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Fixed-wing Air Ambulance Service?

Key companies in the market include American Medical Response (AMR), Hope Medflight Asia Pte Ltd, Reva, Inc, FAI rent-a-jet AG.

3. What are the main segments of the Fixed-wing Air Ambulance Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed-wing Air Ambulance Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed-wing Air Ambulance Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed-wing Air Ambulance Service?

To stay informed about further developments, trends, and reports in the Fixed-wing Air Ambulance Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence