Key Insights

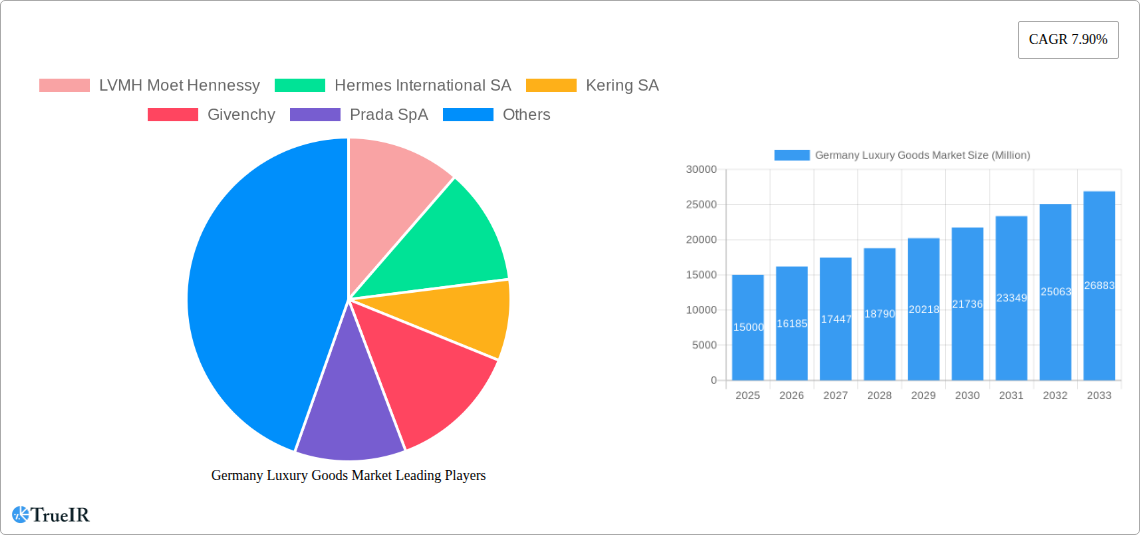

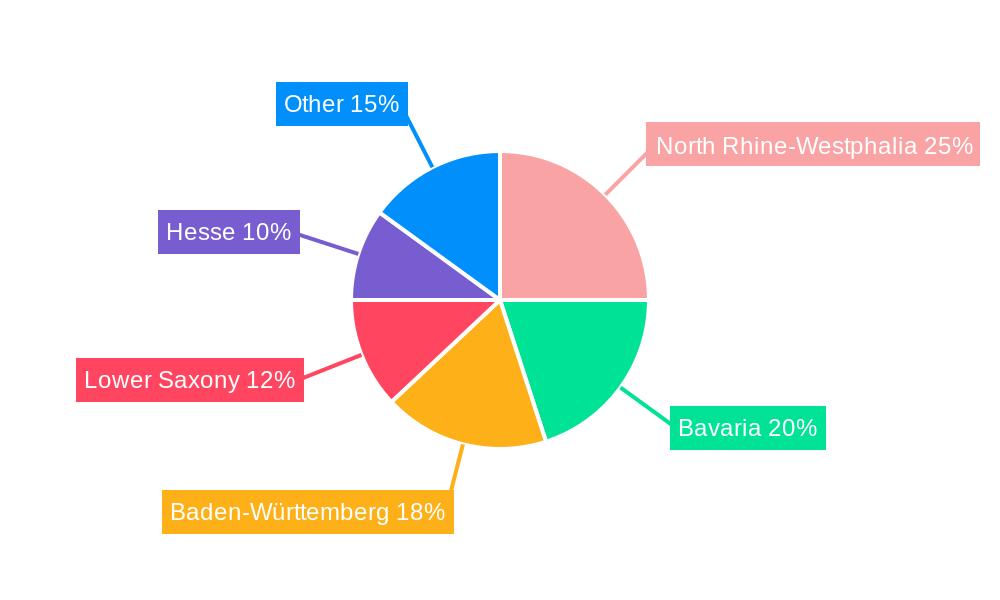

The German luxury goods market, spanning apparel, footwear, accessories, jewelry, and watches, presents a significant and growing opportunity. Driven by a substantial affluent consumer base, particularly in North Rhine-Westphalia, Bavaria, and Baden-Württemberg, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.90%. This expansion is supported by rising disposable incomes among high-net-worth individuals, a preference for premium quality and durable products, and the increasing appeal of aspirational lifestyles. Key market segments and distribution channels, including online platforms and single-brand boutiques, are experiencing robust growth, reflecting shifting consumer preferences and technological adoption. Major players like LVMH Moet Hennessy, Hermes International SA, and Kering SA lead the market, emphasizing the critical role of brand equity and heritage in luxury. Economic volatility and potential changes in consumer spending patterns may present moderate headwinds.

Germany Luxury Goods Market Market Size (In Billion)

Market analysis indicates a substantial market value exceeding €15 billion by 2025, based on comparative European market data and Germany's economic standing. With the projected CAGR, the market is expected to continue its upward trend through 2033, with opportunities for expansion into new segments and the introduction of innovative luxury products and retail strategies. Targeted marketing efforts in affluent regions can capitalize on specific growth potential. The combination of established luxury brands and a discerning consumer base makes Germany an attractive market for both existing and emerging luxury brands. Sustained success hinges on adaptability to evolving consumer demands, effective digital channel utilization, and proactive responses to global economic shifts.

Germany Luxury Goods Market Company Market Share

Germany Luxury Goods Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the lucrative German luxury goods market, offering invaluable insights for industry professionals, investors, and strategic planners. With a comprehensive analysis spanning the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, competitive landscape, growth drivers, challenges, and future outlook. Discover key trends, segment dominance, and the impact of leading players like LVMH Moët Hennessy, Hermès International SA, and Kering SA, among others. The report leverages high-volume keywords to ensure maximum search engine visibility and is designed for immediate use without modification.

Germany Luxury Goods Market Market Structure & Competitive Landscape

The German luxury goods market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with companies constantly striving to introduce new designs, materials, and technologies to appeal to discerning consumers. Stringent regulatory frameworks concerning labeling, product safety, and sustainability impact market operations. The market faces competition from both established luxury brands and emerging designers, with product substitution impacting sales across segments. End-user segmentation is primarily based on demographics (age, income, lifestyle), with high-net-worth individuals representing the core customer base. M&A activity is fairly frequent in the luxury goods sector, contributing to market consolidation and expanding product portfolios. For example, in 2023, xx Million in M&A transactions occurred. This activity is driven by a combination of factors, including brand expansion and portfolio diversification.

Germany Luxury Goods Market Market Trends & Opportunities

The German luxury goods market is experiencing robust growth, with an estimated market size of xx Million in 2025. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%, driven by factors such as rising disposable incomes, increasing consumer demand for high-quality goods, and the expansion of online retail channels. Technological advancements, including personalization through AI and AR/VR experiences, are reshaping customer engagement. Consumer preferences are shifting towards sustainable and ethically sourced products, creating opportunities for brands committed to environmentally friendly practices. Competitive dynamics are intensifying, with brands investing heavily in marketing and product innovation to gain market share. Market penetration for online luxury goods is increasing at a rate of xx% annually, demonstrating the expanding reach of e-commerce.

Dominant Markets & Segments in Germany Luxury Goods Market

By Type: Watches and jewelry currently represent the largest segments within the German luxury goods market, with market shares of xx% and xx% respectively in 2025, driven by strong consumer preference and enduring value. Clothing and apparel retain a significant market share at xx%, while bags and other accessories hold xx% and xx% respectively. Footwear is the smallest segment at xx%.

By Distribution Channel: Single-brand stores remain the dominant distribution channel, holding approximately xx% of the market share, providing a controlled brand experience. Multi-brand stores hold xx% of the market share, offering diverse luxury choices within one location. Online stores have been exhibiting substantial growth, accounting for xx% and projected to increase significantly in the coming years, providing convenience and accessibility. Other distribution channels, including wholesale and pop-up stores, contribute a smaller share of xx%.

Growth in these dominant segments is driven by a strong luxury consumer base, well-developed retail infrastructure, and an increasing preference for exclusive and personalized shopping experiences. Government policies supportive of luxury retail and tourism are also significant contributors to this growth.

Germany Luxury Goods Market Product Analysis

Product innovation is a critical factor in the German luxury goods market. Brands are constantly introducing new designs, materials, and technologies to enhance product appeal and functionality. The focus is shifting towards sustainable and ethical practices, with companies using eco-friendly materials and production processes. Luxury brands are leveraging digital technology to create personalized shopping experiences, fostering brand loyalty and driving sales. This combination of innovation, sustainability, and personalized experiences leads to a strong market fit.

Key Drivers, Barriers & Challenges in Germany Luxury Goods Market

Key Drivers: Rising disposable incomes, increasing demand for luxury goods, technological advancements in personalized experiences, and supportive government policies are key drivers fueling market growth.

Challenges: Supply chain disruptions, increasing raw material costs, economic uncertainty, and intense competition from both established and emerging brands represent significant challenges. The impact of these challenges is estimated to decrease the overall CAGR by approximately xx% in the short term.

Growth Drivers in the Germany Luxury Goods Market Market

The German luxury goods market's growth is fueled by a robust high-net-worth individual population with a high spending propensity. Technological advancements allow for bespoke product offerings and personalized shopping experiences, further enhancing market appeal. Government initiatives and infrastructural support bolster the industry's progress and market accessibility.

Challenges Impacting Germany Luxury Goods Market Growth

Economic downturns, fluctuating currency exchange rates, rising production costs, and counterfeit product proliferation pose significant threats to market growth. Stringent regulations concerning sustainability and ethical sourcing also present challenges for some companies. Supply chain vulnerabilities due to global events can disrupt production and distribution, impacting market stability.

Key Players Shaping the Germany Luxury Goods Market Market

- LVMH Moët Hennessy

- Hermès International SA

- Kering SA

- Givenchy

- Prada SpA

- L'Oréal SA

- Chanel SA

- Rolex SA

- HUGO BOSS AG

- Marc O Polo Group

Significant Germany Luxury Goods Market Industry Milestones

- March 2021: MCM launched its first fragrance globally, expanding its product portfolio and diversifying revenue streams.

- January 2022: Givenchy launched the GIV1 sneaker, expanding its product line and targeting a broader consumer base.

- February 2022: HUGO BOSS partnered with HeiQ AeoniQ to promote sustainability, showcasing commitment to ethical practices and potentially attracting environmentally conscious consumers.

Future Outlook for Germany Luxury Goods Market Market

The German luxury goods market is poised for continued growth, driven by strong consumer demand and ongoing innovation within the industry. Strategic opportunities lie in embracing sustainability, leveraging digital technologies to personalize customer experiences, and expanding into new markets. The market's potential remains significant, with continued expansion expected across various product categories and distribution channels. The emphasis on personalized experiences and sustainability will be critical to success in the years to come.

Germany Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Germany Luxury Goods Market Segmentation By Geography

- 1. Germany

Germany Luxury Goods Market Regional Market Share

Geographic Coverage of Germany Luxury Goods Market

Germany Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Booming E-commerce Fashion Retail

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LVMH Moet Hennessy

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hermes International SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kering SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Givenchy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prada SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oreal SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chanel SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rolex SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HUGO BOSS AG*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Marc O Polo Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LVMH Moet Hennessy

List of Figures

- Figure 1: Germany Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Germany Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Germany Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Germany Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Germany Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Germany Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Germany Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Germany Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Germany Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Germany Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Luxury Goods Market?

The projected CAGR is approximately 0.88%.

2. Which companies are prominent players in the Germany Luxury Goods Market?

Key companies in the market include LVMH Moet Hennessy, Hermes International SA, Kering SA, Givenchy, Prada SpA, L'Oreal SA, Chanel SA, Rolex SA, HUGO BOSS AG*List Not Exhaustive, Marc O Polo Group.

3. What are the main segments of the Germany Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.66 billion as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Booming E-commerce Fashion Retail.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In February 2022, HUGO BOSS entered into a long-term, strategic partnership with HeiQ AeoniQ LLC, a fully owned subsidiary of Swiss innovator HeiQ Plc to promote sustainability within the fashion industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Germany Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence