Key Insights

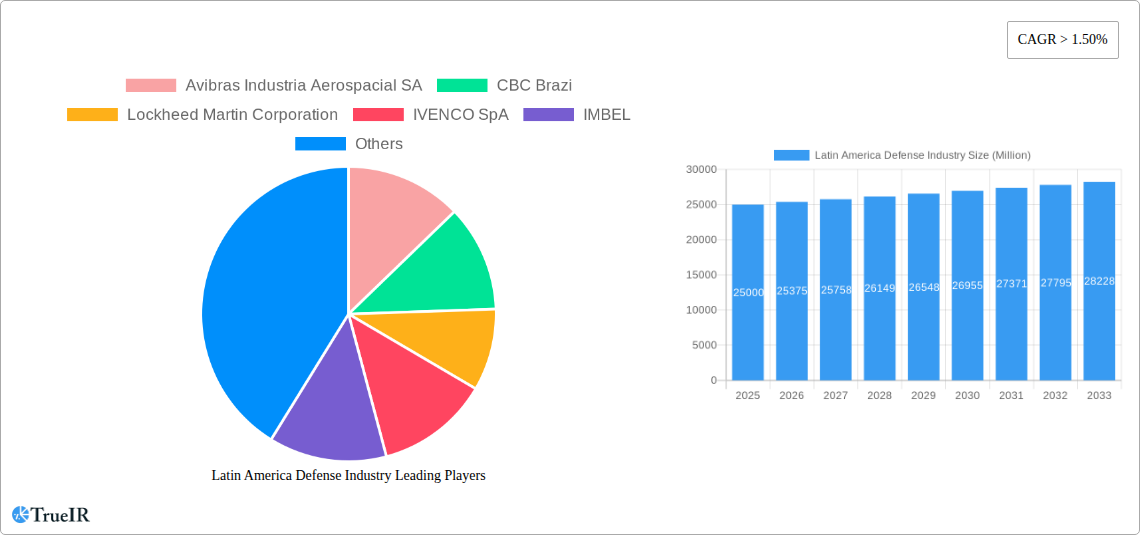

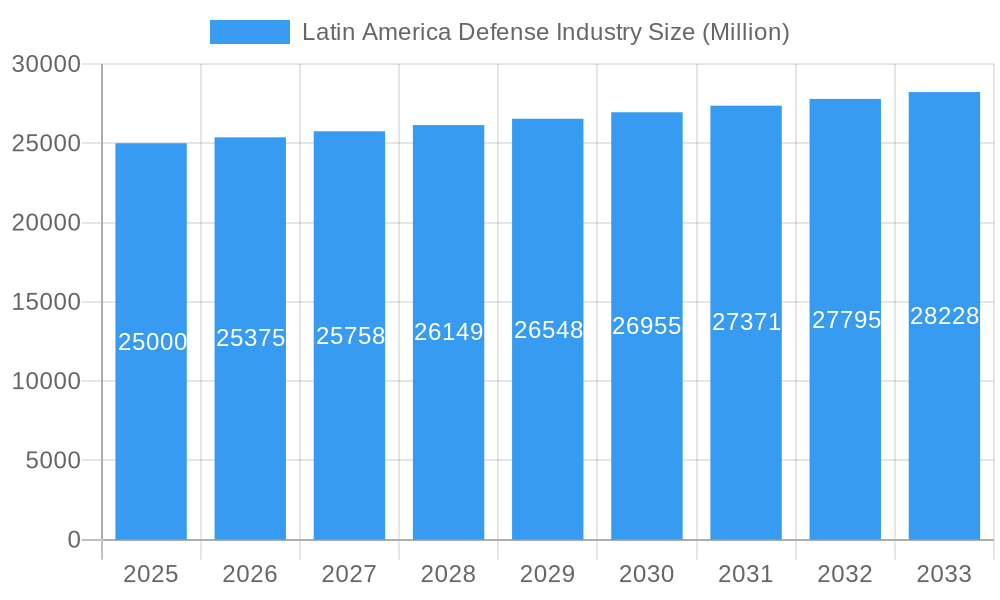

The Latin American defense industry is forecast to reach $61.36 billion by 2024, with a projected Compound Annual Growth Rate (CAGR) of 4.8% from 2025 to 2033. This anticipated expansion is driven by escalating geopolitical instability, necessitating increased defense expenditures across the region. Modernization initiatives, including the acquisition of advanced communication systems and precision-guided munitions, are key growth catalysts. The expanding influence of Private Military and Security Companies (PMSCs) also contributes to market dynamics. Segment growth is particularly pronounced in weapons and ammunition procurement, influenced by regional conflict concerns and cross-border security challenges. Demand for personnel training and protection equipment is also on the rise, aligning with enhanced military readiness and counter-terrorism strategies. Despite potential economic volatility impacting defense budgets in specific countries, the overall market is poised for sustained growth.

Latin America Defense Industry Market Size (In Billion)

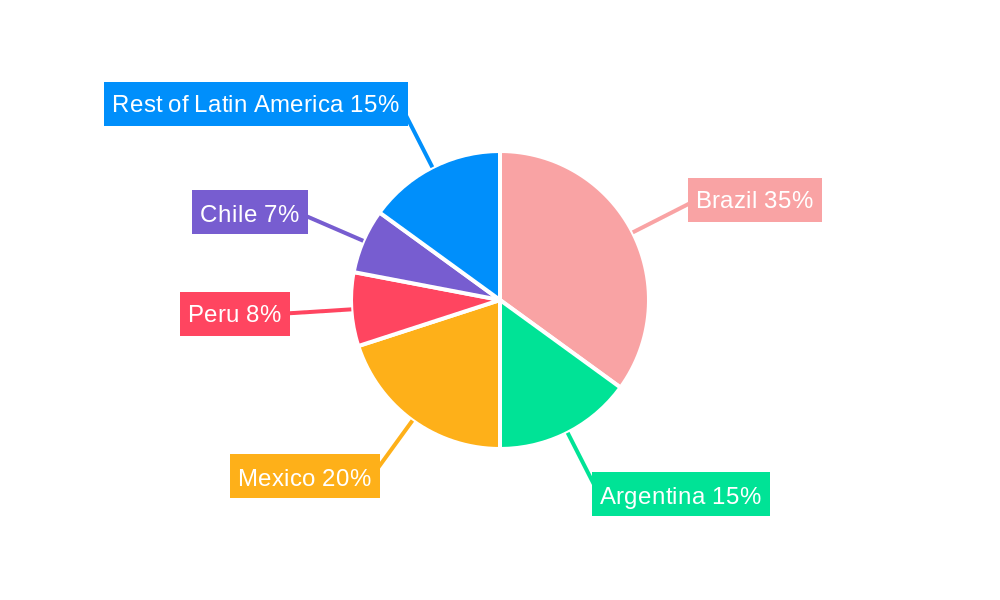

The market is segmented into procurement categories including personnel training and protection, communication systems, weapons and ammunition, and vehicles, alongside maintenance, repair, and operations (MRO) for communication systems, weapons and ammunition, and vehicles. Leading industry players such as Avibras Industria Aerospacial SA, CBC Brazil, Lockheed Martin Corporation, IVENCO SpA, IMBEL, FAMAE, Thales Group, Embraer SA, INDUMIL, Northrop Grumman Corporation, Saab AB, and The Boeing Company are actively engaged in market competition. Brazil, Argentina, Mexico, Peru, and Chile are identified as the primary markets within Latin America, though other regional nations contribute significantly to broad-based expansion. Future market development will be shaped by government defense spending policies, technological innovations, and the evolving geopolitical environment.

Latin America Defense Industry Company Market Share

Latin America Defense Industry Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Latin America defense industry, encompassing market size, segmentation, competitive landscape, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for industry stakeholders, investors, and policymakers. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. Key segments analyzed include Procurement (Personnel Training and Protection, Communication Systems, Weapons and Ammunition, Vehicles) and MRO (Maintenance, Repair, and Overhaul) for Communication Systems, Weapons and Ammunition, and Vehicles. The report features key players such as Avibras Industria Aerospacial SA, CBC Brazil, Lockheed Martin Corporation, IVENCO SpA, IMBEL, FAMAE, Thales Group, Embraer SA, INDUMIL, Northrop Grumman Corporation, Saab AB, and The Boeing Company. The report projects a market value exceeding $XX Million by 2033.

Latin America Defense Industry Market Structure & Competitive Landscape

The Latin American defense industry exhibits a moderately concentrated market structure, with a Herfindahl-Hirschman Index (HHI) of approximately xx, indicating a blend of large multinational corporations and regional players. Innovation is driven by the need to modernize aging equipment, counter emerging threats, and enhance operational capabilities. Regulatory frameworks, varying across countries, significantly impact market access and investment decisions. Product substitutes, particularly in areas like communication systems, exert competitive pressure. End-user segmentation comprises national armed forces, law enforcement agencies, and paramilitary groups, with each exhibiting unique procurement priorities. M&A activity has been relatively low in recent years, with a total transaction value of approximately $xx Million during the 2019-2024 period, reflecting a cautious investment climate and the region's unique geopolitical dynamics. However, strategic partnerships and joint ventures are increasing, signaling future consolidation.

- Market Concentration: HHI of approximately xx.

- M&A Volume (2019-2024): $xx Million

- Key Regulatory Influences: Varying national defense procurement policies and import regulations.

- Innovation Drivers: Modernization needs, technological advancements, and emerging security threats.

Latin America Defense Industry Market Trends & Opportunities

The Latin America defense industry is poised for significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by escalating geopolitical instability, rising defense budgets, and modernization initiatives across the region. Market penetration rates for advanced technologies, particularly in areas such as communication systems and unmanned aerial vehicles, remain relatively low, presenting substantial opportunities for expansion. Technological shifts towards AI-powered systems, cyber warfare capabilities, and advanced surveillance technologies are shaping the industry landscape. Consumer preferences are increasingly focused on cost-effectiveness, interoperability, and technological sophistication. However, fluctuating economic conditions, budget constraints in some nations, and regional conflicts pose both challenges and opportunities for market players. The increasing focus on asymmetric warfare and internal security challenges presents specific opportunities for smaller, specialized firms.

Dominant Markets & Segments in Latin America Defense Industry

While the entire Latin American region presents growth opportunities, Brazil and Mexico stand out as the largest national markets, driven by their relatively larger economies and defense budgets. Within the Procurement segment, Weapons and Ammunition consistently represents the largest segment, followed by Communication Systems, with Vehicles showing modest growth. In MRO, Weapons and Ammunition and Communication Systems represent significant portions of the market due to the ongoing need for maintenance and upgrade of existing assets. Key growth drivers across segments include:

- Weapons and Ammunition: Rising internal security concerns, cross-border conflicts, and modernization of existing arsenals.

- Communication Systems: Demand for advanced communication networks and cybersecurity solutions.

- Vehicles: Investments in armored vehicles, logistics support, and specialized transportation systems.

- Personnel Training and Protection: Growing demand for advanced training programs and personal protective equipment.

The dominance of these segments stems from the ongoing need for robust defense capabilities across the region, coupled with the continuous modernization and replacement of aging equipment.

Latin America Defense Industry Product Analysis

The Latin American defense industry witnesses continuous innovation in weapons and ammunition, incorporating advanced materials, precision-guided munitions, and improved lethality. Communication systems increasingly integrate advanced encryption, cyber defense, and satellite communications. Vehicle technology focuses on enhanced mobility, survivability, and adaptability to varied terrains. These advancements cater to specific regional needs and emphasize cost-effective solutions that balance functionality and affordability. This approach emphasizes improving the operational effectiveness of the region's armed forces and law enforcement agencies.

Key Drivers, Barriers & Challenges in Latin America Defense Industry

Key Drivers: The primary drivers include escalating geopolitical tensions, increasing defense budgets in several nations, modernization of aging equipment, and technological advancements. Economic growth in certain countries fuels increased defense spending. Government policies promoting domestic defense industry growth and technological self-reliance serve as additional catalysts.

Key Challenges: Supply chain disruptions, particularly concerning imported components, pose significant challenges. Varying and complex regulatory frameworks across nations create hurdles for market entry and operations. Intense competition from international players with greater financial resources and technological capabilities places pressure on regional manufacturers. These factors combine to impede consistent growth and limit the sector's overall potential. These restraints account for an estimated xx% reduction in projected market growth.

Growth Drivers in the Latin America Defense Industry Market

Technological advancements, particularly in areas like AI, cyber warfare, and autonomous systems, are driving industry growth. Increasing defense budgets in key countries are fueling the demand for new equipment and services. Government initiatives to support domestic defense industries and strengthen national security enhance industry development. Regional geopolitical instability and cross-border conflicts drive continuous demand for defense solutions.

Challenges Impacting Latin America Defense Industry Growth

Regulatory complexities, especially concerning import/export controls and licensing, create obstacles for businesses. Supply chain vulnerabilities, impacting the timely procurement of critical components, pose substantial risks. Competition from well-funded multinational corporations presents a challenge to smaller regional companies. These factors combine to restrain market growth, and may impact projected growth rates by xx%.

Key Players Shaping the Latin America Defense Industry Market

- Avibras Industria Aerospacial SA

- CBC Brazil

- Lockheed Martin Corporation

- IVENCO SpA

- IMBEL

- FAMAE

- Thales Group

- Embraer SA

- INDUMIL

- Northrop Grumman Corporation

- Saab AB

- The Boeing Company

Significant Latin America Defense Industry Industry Milestones

- 2020: Brazil announces a significant investment in modernizing its air force fleet.

- 2021: Mexico signs a major contract for the acquisition of advanced communication systems.

- 2022: A joint venture between a Brazilian and Argentinian company is formed to develop new armored vehicles.

- 2023: Chile invests heavily in upgrading its naval capabilities.

Future Outlook for Latin America Defense Industry Market

The Latin America defense industry is poised for continued growth, driven by ongoing modernization initiatives, increasing defense budgets, and the evolving regional security landscape. Strategic partnerships and collaborations between national companies and international players will be pivotal. The focus on technological advancements, including AI, cyber capabilities, and unmanned systems, will further shape the industry's trajectory. The market holds significant potential for growth, with opportunities for both established players and new entrants. The ability to adapt to evolving geopolitical dynamics and address supply chain challenges will be crucial for success.

Latin America Defense Industry Segmentation

-

1. Procurement

- 1.1. Personnel Training and Protection

- 1.2. Communication Systems

- 1.3. Weapons and Ammunition

-

1.4. Vehicles

- 1.4.1. Land-based Vehicles

- 1.4.2. Sea-based Vehicles

- 1.4.3. Air-based Vehicles

-

2. MRO

- 2.1. Communication Systems

- 2.2. Weapons and Ammunition

- 2.3. Vehicles

-

3. Geography

- 3.1. Brazil

- 3.2. Colombia

- 3.3. Mexico

- 3.4. Chile

- 3.5. Rest of Latin America

Latin America Defense Industry Segmentation By Geography

- 1. Brazil

- 2. Colombia

- 3. Mexico

- 4. Chile

- 5. Rest of Latin America

Latin America Defense Industry Regional Market Share

Geographic Coverage of Latin America Defense Industry

Latin America Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Vehicles Segment to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Procurement

- 5.1.1. Personnel Training and Protection

- 5.1.2. Communication Systems

- 5.1.3. Weapons and Ammunition

- 5.1.4. Vehicles

- 5.1.4.1. Land-based Vehicles

- 5.1.4.2. Sea-based Vehicles

- 5.1.4.3. Air-based Vehicles

- 5.2. Market Analysis, Insights and Forecast - by MRO

- 5.2.1. Communication Systems

- 5.2.2. Weapons and Ammunition

- 5.2.3. Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Colombia

- 5.3.3. Mexico

- 5.3.4. Chile

- 5.3.5. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Colombia

- 5.4.3. Mexico

- 5.4.4. Chile

- 5.4.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Procurement

- 6. Brazil Latin America Defense Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Procurement

- 6.1.1. Personnel Training and Protection

- 6.1.2. Communication Systems

- 6.1.3. Weapons and Ammunition

- 6.1.4. Vehicles

- 6.1.4.1. Land-based Vehicles

- 6.1.4.2. Sea-based Vehicles

- 6.1.4.3. Air-based Vehicles

- 6.2. Market Analysis, Insights and Forecast - by MRO

- 6.2.1. Communication Systems

- 6.2.2. Weapons and Ammunition

- 6.2.3. Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Colombia

- 6.3.3. Mexico

- 6.3.4. Chile

- 6.3.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Procurement

- 7. Colombia Latin America Defense Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Procurement

- 7.1.1. Personnel Training and Protection

- 7.1.2. Communication Systems

- 7.1.3. Weapons and Ammunition

- 7.1.4. Vehicles

- 7.1.4.1. Land-based Vehicles

- 7.1.4.2. Sea-based Vehicles

- 7.1.4.3. Air-based Vehicles

- 7.2. Market Analysis, Insights and Forecast - by MRO

- 7.2.1. Communication Systems

- 7.2.2. Weapons and Ammunition

- 7.2.3. Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Colombia

- 7.3.3. Mexico

- 7.3.4. Chile

- 7.3.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Procurement

- 8. Mexico Latin America Defense Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Procurement

- 8.1.1. Personnel Training and Protection

- 8.1.2. Communication Systems

- 8.1.3. Weapons and Ammunition

- 8.1.4. Vehicles

- 8.1.4.1. Land-based Vehicles

- 8.1.4.2. Sea-based Vehicles

- 8.1.4.3. Air-based Vehicles

- 8.2. Market Analysis, Insights and Forecast - by MRO

- 8.2.1. Communication Systems

- 8.2.2. Weapons and Ammunition

- 8.2.3. Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Colombia

- 8.3.3. Mexico

- 8.3.4. Chile

- 8.3.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Procurement

- 9. Chile Latin America Defense Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Procurement

- 9.1.1. Personnel Training and Protection

- 9.1.2. Communication Systems

- 9.1.3. Weapons and Ammunition

- 9.1.4. Vehicles

- 9.1.4.1. Land-based Vehicles

- 9.1.4.2. Sea-based Vehicles

- 9.1.4.3. Air-based Vehicles

- 9.2. Market Analysis, Insights and Forecast - by MRO

- 9.2.1. Communication Systems

- 9.2.2. Weapons and Ammunition

- 9.2.3. Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Colombia

- 9.3.3. Mexico

- 9.3.4. Chile

- 9.3.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Procurement

- 10. Rest of Latin America Latin America Defense Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Procurement

- 10.1.1. Personnel Training and Protection

- 10.1.2. Communication Systems

- 10.1.3. Weapons and Ammunition

- 10.1.4. Vehicles

- 10.1.4.1. Land-based Vehicles

- 10.1.4.2. Sea-based Vehicles

- 10.1.4.3. Air-based Vehicles

- 10.2. Market Analysis, Insights and Forecast - by MRO

- 10.2.1. Communication Systems

- 10.2.2. Weapons and Ammunition

- 10.2.3. Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Colombia

- 10.3.3. Mexico

- 10.3.4. Chile

- 10.3.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Procurement

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Avibras Industria Aerospacial SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CBC Brazi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IVENCO SpA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IMBEL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FAMAE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thales Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Embraer SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 INDUMIL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Northrop Grumman Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Saab AB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Boeing Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Avibras Industria Aerospacial SA

List of Figures

- Figure 1: Latin America Defense Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Defense Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Defense Industry Revenue billion Forecast, by Procurement 2020 & 2033

- Table 2: Latin America Defense Industry Revenue billion Forecast, by MRO 2020 & 2033

- Table 3: Latin America Defense Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Latin America Defense Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Defense Industry Revenue billion Forecast, by Procurement 2020 & 2033

- Table 6: Latin America Defense Industry Revenue billion Forecast, by MRO 2020 & 2033

- Table 7: Latin America Defense Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Latin America Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Latin America Defense Industry Revenue billion Forecast, by Procurement 2020 & 2033

- Table 10: Latin America Defense Industry Revenue billion Forecast, by MRO 2020 & 2033

- Table 11: Latin America Defense Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Latin America Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Latin America Defense Industry Revenue billion Forecast, by Procurement 2020 & 2033

- Table 14: Latin America Defense Industry Revenue billion Forecast, by MRO 2020 & 2033

- Table 15: Latin America Defense Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Latin America Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Latin America Defense Industry Revenue billion Forecast, by Procurement 2020 & 2033

- Table 18: Latin America Defense Industry Revenue billion Forecast, by MRO 2020 & 2033

- Table 19: Latin America Defense Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Defense Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Latin America Defense Industry Revenue billion Forecast, by Procurement 2020 & 2033

- Table 22: Latin America Defense Industry Revenue billion Forecast, by MRO 2020 & 2033

- Table 23: Latin America Defense Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Latin America Defense Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Defense Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Latin America Defense Industry?

Key companies in the market include Avibras Industria Aerospacial SA, CBC Brazi, Lockheed Martin Corporation, IVENCO SpA, IMBEL, FAMAE, Thales Group, Embraer SA, INDUMIL, Northrop Grumman Corporation, Saab AB, The Boeing Company.

3. What are the main segments of the Latin America Defense Industry?

The market segments include Procurement, MRO, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 61.36 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Vehicles Segment to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Defense Industry?

To stay informed about further developments, trends, and reports in the Latin America Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence