Key Insights

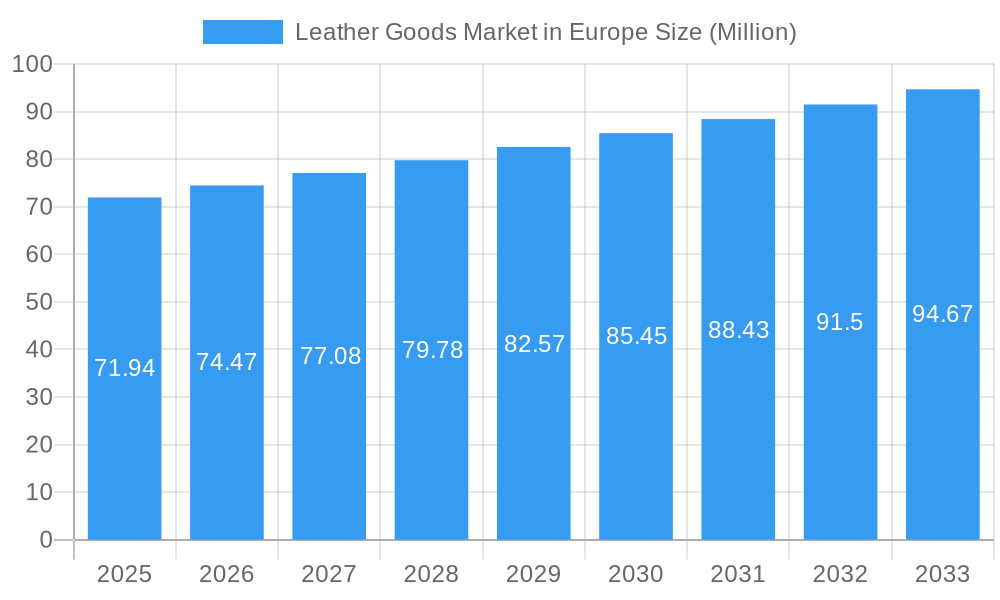

The European leather goods market, valued at €71.94 million in 2025, is projected to experience steady growth, driven by increasing disposable incomes, a rising preference for luxury and high-quality goods, and the growing popularity of online retail channels. The market is segmented into footwear, luggage, and accessories, with offline retail stores currently dominating distribution. However, the online segment is experiencing significant growth, fueled by the convenience and wider selection offered by e-commerce platforms. Key players like Hermes, LVMH, Kering, and Prada are driving innovation and setting trends within the market, focusing on sustainable practices and personalized customer experiences to maintain their competitive edge. The market’s growth, while steady at a CAGR of 3.36%, is expected to be influenced by fluctuating economic conditions and increasing competition from synthetic material alternatives. Germany, France, Italy, and the UK are the major contributors to the European market's revenue, reflecting strong consumer demand and established luxury retail infrastructure in these regions. The market's future growth trajectory will likely be shaped by effective marketing strategies targeting younger demographics, sustainable production practices appealing to environmentally conscious consumers, and the continuous expansion of e-commerce capabilities to cater to changing consumer preferences.

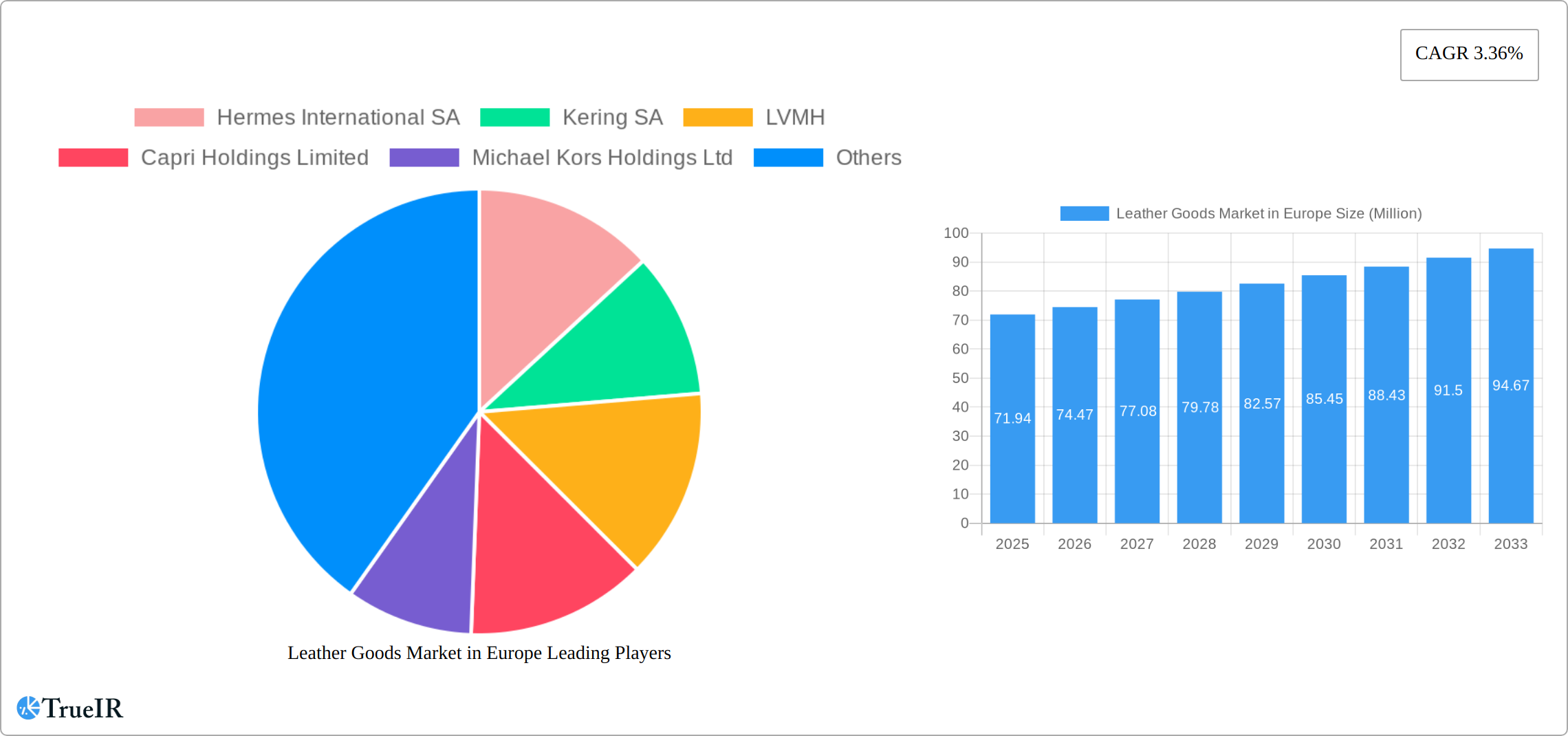

Leather Goods Market in Europe Market Size (In Million)

The forecast period (2025-2033) anticipates a continued, albeit moderate, expansion in the European leather goods market. Factors such as changing fashion trends, technological advancements in manufacturing and product design, and shifts in consumer spending habits will all play significant roles in determining the market's precise growth trajectory. The segment comprising luxury leather goods is likely to perform better than the more mass-market segments, owing to its resilience to economic fluctuations. Growth in the online segment will likely outpace that of offline retail as consumer behavior continues to evolve. Maintaining brand reputation, ensuring product authenticity, and investing in effective supply chain management will be crucial for market players aiming to achieve sustainable growth within this competitive landscape.

Leather Goods Market in Europe Company Market Share

Leather Goods Market in Europe: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European leather goods market, encompassing market size, growth projections, competitive landscape, and future trends. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for businesses, investors, and market researchers seeking to understand this dynamic sector. The report leverages extensive data analysis to project a xx Million market value by 2033, offering a detailed breakdown by product type (footwear, luggage, accessories) and distribution channel (offline and online retail stores).

Leather Goods Market in Europe Market Structure & Competitive Landscape

The European leather goods market is characterized by a mix of established luxury brands and emerging players, leading to a moderately concentrated market structure. While precise concentration ratios require further data analysis, the dominance of luxury conglomerates such as LVMH, Kering, and Hermès suggests a high level of market concentration in the premium segment. The market displays significant innovation, driven by both established players and newcomers introducing sustainable and technologically advanced materials.

Regulatory frameworks concerning environmental standards and ethical sourcing significantly impact market participants. The increasing consumer preference for sustainable and ethically sourced products is also a noteworthy trend. Product substitutes, such as vegan leather alternatives, are gaining traction, posing a challenge to traditional leather goods manufacturers. The market is segmented by end-users, catering to diverse demographics with varying preferences and price sensitivities.

Mergers and acquisitions (M&A) activity is a significant dynamic, with large players strategically acquiring smaller, specialized brands to expand their product portfolios and market reach. The estimated M&A volume in the past five years was approximately xx Million, highlighting the consolidating nature of the industry. For example, LVMH's acquisition of Robins and Ally Projects showcases the strategic investment in high-end leather manufacturing.

Leather Goods Market in Europe Market Trends & Opportunities

The European leather goods market is experiencing dynamic growth, projected to achieve a Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors: rising disposable incomes, particularly in Western European nations, shifting consumer preferences towards premium and sustainable products, and the burgeoning demand for luxury goods. Technological advancements, including innovative materials like plant-based leathers and sustainable tanning processes, are revolutionizing the industry. Simultaneously, the robust expansion of e-commerce channels is significantly impacting distribution, with online retail stores emerging as a dominant force, driving increased sales and market penetration.

Consumers are increasingly conscious of ethical and environmental considerations, demanding transparency and sustainability in their purchases. This heightened awareness has created a significant opportunity for brands committed to responsible sourcing and production. We are witnessing the rise of companies championing biodegradable materials (e.g., Anya Hindmarch's innovative designs) and vegan leather alternatives (e.g., Hermès and Stella McCartney's exploration of mushroom leather), catering to this growing segment. However, the market remains fiercely competitive, with established luxury brands and disruptive newcomers vying for market share. This competitive landscape necessitates continuous innovation, strategic marketing, and a compelling value proposition to resonate with discerning consumers.

Dominant Markets & Segments in Leather Goods Market in Europe

Leading Regions/Countries: Western European countries like France, Italy, and Germany are currently dominant due to their established luxury goods industries, strong consumer purchasing power, and well-developed retail infrastructure. However, Eastern European markets show potential for future growth.

Dominant Segments: The luxury segment within the accessories category (handbags, wallets, etc.) remains the most dominant, driven by high demand and pricing power. The offline retail store channel continues to hold a major share, but online sales are rapidly growing.

Key Growth Drivers:

- Strong consumer spending: Particularly in Western Europe, disposable incomes are relatively high.

- Tourism: Tourist spending contributes significantly to the demand for luxury leather goods.

- E-commerce growth: Online sales are rapidly expanding, offering broader reach.

- Infrastructure development: Well-established retail infrastructure enhances market accessibility.

- Favorable Government policies: Supportive regulations encourage the growth of the luxury goods sector.

The dominance of Western European countries is attributed to factors such as a high concentration of luxury brands, well-established retail infrastructure, and higher consumer spending compared to other regions in Europe. Growth in Eastern Europe is expected to be driven by increased purchasing power and improving retail infrastructure.

Leather Goods Market in Europe Product Analysis

Product innovation is a key competitive advantage in the European leather goods market. Brands continuously introduce new designs, materials, and manufacturing techniques to cater to evolving consumer preferences. Technological advancements, such as the use of sustainable and innovative materials (e.g., biodegradable leather, mushroom leather), are playing an increasingly significant role. The market fit for these innovations depends on factors such as consumer acceptance, price points, and brand positioning. The success of products like Chanel's CHANEL 22 Bag exemplifies the importance of design innovation and targeted marketing.

Key Drivers, Barriers & Challenges in Leather Goods Market in Europe

Key Drivers:

- Rising Disposable Incomes and Affluent Consumer Base: Increased purchasing power, especially in Western Europe, fuels demand across various price points, from affordable to luxury leather goods.

- E-commerce Expansion and Omnichannel Strategies: Online retail channels provide expanded market access, facilitating direct-to-consumer sales and boosting overall market reach.

- Innovation in Materials and Design: The development of sustainable, innovative materials (e.g., recycled leather, plant-based alternatives) and cutting-edge designs are key differentiators attracting environmentally and fashion-conscious consumers.

- Growing Emphasis on Sustainability and Ethical Sourcing: Consumers are increasingly prioritizing brands committed to ethical labor practices and environmentally responsible production methods.

- Experiential Retail and Brand Storytelling: Luxury brands are investing in immersive retail experiences to enhance customer engagement and brand loyalty.

Key Challenges:

- Supply Chain Disruptions and Raw Material Scarcity: Geopolitical instability, raw material price fluctuations, and logistical bottlenecks pose significant challenges, impacting production timelines and costs. The impact is estimated at a [Insert Updated Percentage]% reduction in production for some key brands.

- Intense Competition and Market Saturation: The market's competitive landscape necessitates continuous innovation and a strong brand identity to stand out.

- Economic Volatility and Consumer Sentiment: Economic downturns can significantly affect consumer spending on discretionary items like luxury goods.

- Evolving Regulatory Landscape and Compliance Costs: Stringent environmental regulations and ethical sourcing standards add to operational complexity and costs.

- Counterfeit Goods and Brand Protection: The proliferation of counterfeit leather goods undermines brand value and impacts market integrity.

Growth Drivers in the Leather Goods Market in Europe Market

The European leather goods market's robust growth trajectory is primarily driven by the aforementioned rising consumer spending power, particularly in Western Europe. This fuels demand across a wide range of products—from everyday accessories to high-end luxury items. The proliferation of online retail channels empowers brands to reach broader audiences, fostering sales growth and market expansion. Furthermore, continuous innovation in materials (including sustainable alternatives), product design, and personalized experiences are critical growth drivers. The integration of technology, such as personalized recommendations and augmented reality experiences, also enhances customer engagement and boosts sales.

Challenges Impacting Leather Goods Market in Europe Growth

Significant challenges facing the European leather goods market include supply chain disruptions impacting raw material sourcing and production timelines. This is particularly acute for manufacturers reliant on exotic leathers or specialized components. Economic downturns directly influence consumer spending patterns, particularly impacting the luxury segment. Regulatory compliance, especially regarding environmental and ethical standards, adds to operational costs and complexity. The fierce competition mandates ongoing innovation, strategic marketing, and a robust brand image to secure and maintain market share. Counterfeit goods pose a significant threat to brand integrity and revenue streams.

Key Players Shaping the Leather Goods Market in Europe Market

- Hermes International SA

- Kering SA

- LVMH

- Capri Holdings Limited

- Michael Kors Holdings Ltd

- Prada SpA

- Chanel SA

- Ralph Lauren Corporation

- Bata Corporation

- Samsonite International SA

Significant Leather Goods Market in Europe Industry Milestones

- September 2022: LVMH Métiers d'art acquires Robins and Ally Projects, strengthening its position in high-end leather manufacturing.

- February 2022: Hermès announces new leather goods factories in France to increase Birkin bag production.

- January 2022: Chanel launches the CHANEL 22 Bag, a new design focused on lightweight functionality.

- October 2021: Anya Hindmarch launches a collection of biodegradable leather bags.

- March 2021: Hermès and Stella McCartney launch mushroom leather products, promoting sustainable alternatives.

Future Outlook for Leather Goods Market in Europe Market

The European leather goods market anticipates sustained growth, propelled by ongoing consumer spending and the continued expansion of e-commerce. Future growth will be shaped by the adoption of sustainable and innovative materials, advanced manufacturing technologies, and a focus on circular economy principles. Strategic partnerships, mergers, and acquisitions will continue to reshape the market landscape. Success will depend on brands' ability to adapt to evolving consumer preferences, build resilient supply chains, and navigate the complexities of environmental and ethical regulations. Brands effectively integrating sustainability, technology, and compelling storytelling are best positioned to capture a significant share of this dynamic and growing market.

Leather Goods Market in Europe Segmentation

-

1. Type

- 1.1. Footwear

- 1.2. Luggage

- 1.3. Accessories

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Leather Goods Market in Europe Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Leather Goods Market in Europe Regional Market Share

Geographic Coverage of Leather Goods Market in Europe

Leather Goods Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Demand for Personalized Leather Goods Increasing Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Leather Goods Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Footwear

- 5.1.2. Luggage

- 5.1.3. Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Leather Goods Market in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Footwear

- 6.1.2. Luggage

- 6.1.3. Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Leather Goods Market in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Footwear

- 7.1.2. Luggage

- 7.1.3. Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain Leather Goods Market in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Footwear

- 8.1.2. Luggage

- 8.1.3. Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Leather Goods Market in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Footwear

- 9.1.2. Luggage

- 9.1.3. Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Leather Goods Market in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Footwear

- 10.1.2. Luggage

- 10.1.3. Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Leather Goods Market in Europe Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Footwear

- 11.1.2. Luggage

- 11.1.3. Accessories

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Offline Retail Stores

- 11.2.2. Online Retail Stores

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Leather Goods Market in Europe Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Footwear

- 12.1.2. Luggage

- 12.1.3. Accessories

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Offline Retail Stores

- 12.2.2. Online Retail Stores

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Hermes International SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Kering SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 LVMH

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Capri Holdings Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Michael Kors Holdings Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Prada SpA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Chanel SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ralph Lauren Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bata Corporation*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Samsonite International SA

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Hermes International SA

List of Figures

- Figure 1: Leather Goods Market in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Leather Goods Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Leather Goods Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Leather Goods Market in Europe Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Leather Goods Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Leather Goods Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Leather Goods Market in Europe Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Leather Goods Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Leather Goods Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Leather Goods Market in Europe Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Leather Goods Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Leather Goods Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Leather Goods Market in Europe Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Leather Goods Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Leather Goods Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Leather Goods Market in Europe Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Leather Goods Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Leather Goods Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Leather Goods Market in Europe Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Leather Goods Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Leather Goods Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Leather Goods Market in Europe Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Leather Goods Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Leather Goods Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Leather Goods Market in Europe Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Leather Goods Market in Europe Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Leather Goods Market in Europe?

The projected CAGR is approximately 3.36%.

2. Which companies are prominent players in the Leather Goods Market in Europe?

Key companies in the market include Hermes International SA, Kering SA, LVMH, Capri Holdings Limited, Michael Kors Holdings Ltd, Prada SpA, Chanel SA, Ralph Lauren Corporation, Bata Corporation*List Not Exhaustive, Samsonite International SA.

3. What are the main segments of the Leather Goods Market in Europe?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Demand for Personalized Leather Goods Increasing Consumption.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In September 2022, LVMH Métiers d'art announced major investments in two renowned Italian manufacturers: Robins and Ally Projects. The exotic leather tannery Ally Projects and the high-end leather ready-to-wear maker Robins has acquired by LVMH Métiers d'art. This is the most recent investment in a long progression.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Leather Goods Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Leather Goods Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Leather Goods Market in Europe?

To stay informed about further developments, trends, and reports in the Leather Goods Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence