Key Insights

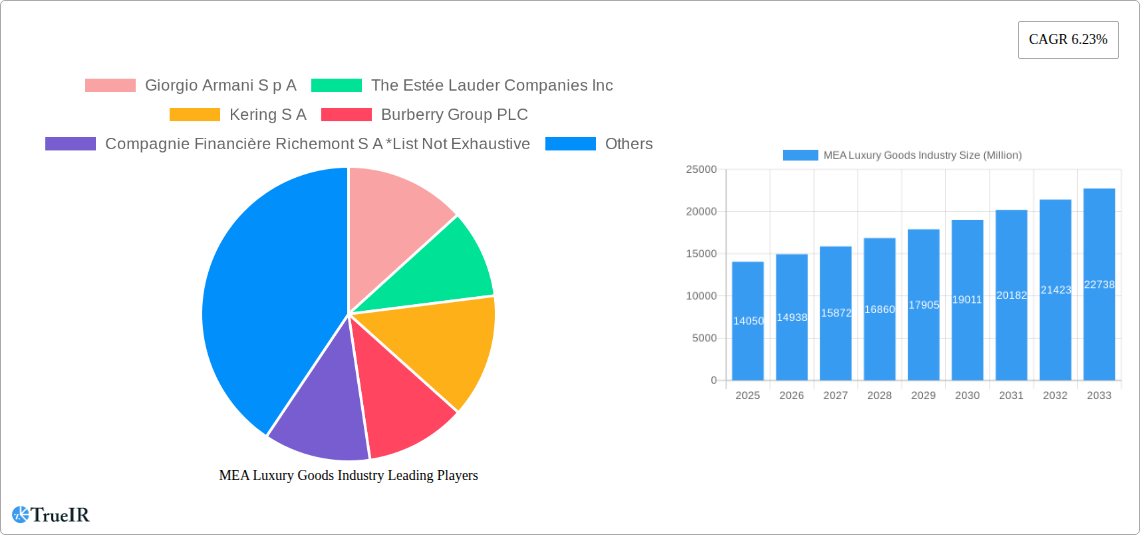

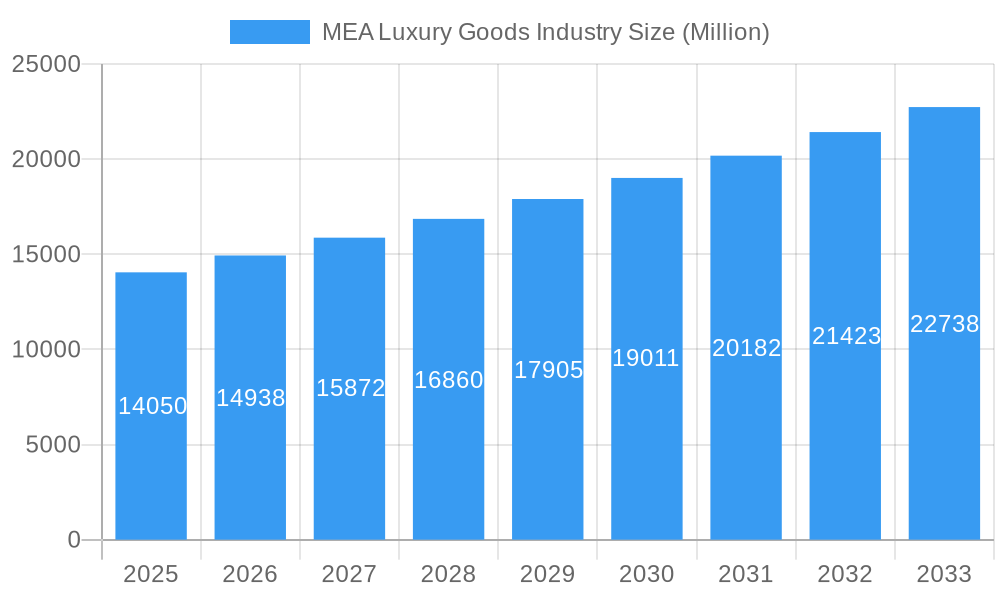

The Middle East and Africa (MEA) luxury goods market, valued at $14.05 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.23% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the rising affluence of the region's burgeoning middle class, particularly in countries like Saudi Arabia and the UAE, is significantly boosting consumer spending on luxury items. Secondly, the increasing popularity of online retail channels provides greater accessibility to luxury brands, expanding the market reach beyond traditional brick-and-mortar stores. Tourism also plays a crucial role, with international travelers contributing significantly to luxury goods sales. Furthermore, the preference for high-quality, prestigious products, coupled with strong brand loyalty, further fuels market demand. The market is segmented across product categories – clothing and apparel, footwear, bags, jewelry, watches, and other accessories – with each showing unique growth trajectories. The distribution channels vary widely, including single-branded stores, multi-brand stores, and the rapidly growing online retail segment. Major players like LVMH, Kering, Richemont, and Armani compete intensely, each leveraging their distinct brand identities and strategies to capture market share.

MEA Luxury Goods Industry Market Size (In Billion)

However, challenges remain. Economic fluctuations within the MEA region can impact consumer spending on discretionary items like luxury goods. Geopolitical instability in certain areas can also create uncertainty and affect market growth. Competition is fierce, necessitating continuous innovation, strong brand management, and effective marketing strategies to maintain market leadership. Furthermore, the increasing focus on sustainability and ethical sourcing within the luxury sector presents both an opportunity and a challenge for companies, requiring adjustments in their supply chains and production processes. Successfully navigating these dynamics will be critical for luxury brands aiming to capitalize on the MEA region's considerable growth potential. The continued diversification of product offerings and expansion into emerging online marketplaces will be key to future success.

MEA Luxury Goods Industry Company Market Share

MEA Luxury Goods Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) luxury goods market, offering invaluable insights for businesses, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to paint a clear picture of current market dynamics and future trends. The report covers a market valued at $xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Key players such as LVMH Moët Hennessy Louis Vuitton, Chanel S A, and others are analyzed to reveal competitive landscapes and growth strategies.

MEA Luxury Goods Industry Market Structure & Competitive Landscape

The MEA luxury goods market is characterized by a moderately concentrated structure, with a few dominant players and a larger number of smaller niche brands. Key industry players include LVMH Moët Hennessy Louis Vuitton, Chanel S A, and others. The Herfindahl-Hirschman Index (HHI) for this market is estimated at xx, indicating a moderately concentrated landscape.

- Market Concentration: The market is dominated by established international brands, but local players and emerging brands are gaining traction, leading to increased competition. The market share of the top five players is estimated at approximately xx%.

- Innovation Drivers: Technological advancements in design, manufacturing, and retail experiences are driving innovation. Personalization, e-commerce integration, and sustainable practices are key focus areas.

- Regulatory Impacts: Government regulations related to import duties, taxes, and intellectual property rights impact market dynamics and profitability. Changes in these regulations could significantly shift the market balance.

- Product Substitutes: While luxury goods have a unique value proposition, consumers might choose experiences or other luxury items as substitutes depending on economic conditions and individual preferences. The substitute market's impact is estimated to be around xx% of the total luxury goods market.

- End-User Segmentation: The MEA luxury goods market is segmented by demographics (age, income, lifestyle), geography, and cultural factors. High-net-worth individuals and millennials represent key customer segments.

- M&A Trends: The industry has witnessed significant M&A activity in recent years. Consolidation is expected to continue as larger players seek to expand their market share and product portfolio. The total value of M&A deals within the MEA luxury goods sector between 2019 and 2024 totaled an estimated $xx Million.

MEA Luxury Goods Industry Market Trends & Opportunities

The MEA luxury goods market is experiencing robust growth, fueled by rising disposable incomes, a burgeoning middle class, and a growing preference for luxury goods amongst consumers in the region. The market size is projected to reach $xx Million by 2033. Key trends driving growth include:

- Market Size Growth: The market exhibits significant growth potential driven by increasing tourism, a rising affluent population, and the expansion of e-commerce.

- Technological Shifts: Omnichannel retail strategies, personalized experiences through data analytics, and the integration of augmented and virtual reality technologies are transforming the customer journey.

- Consumer Preferences: Sustainability, ethical sourcing, and personalized luxury experiences are increasingly important factors influencing purchasing decisions. Consumers are also displaying a preference for unique, handcrafted items reflecting regional heritage.

- Competitive Dynamics: Competition is intensifying with both established international brands and emerging local brands vying for market share.

Dominant Markets & Segments in MEA Luxury Goods Industry

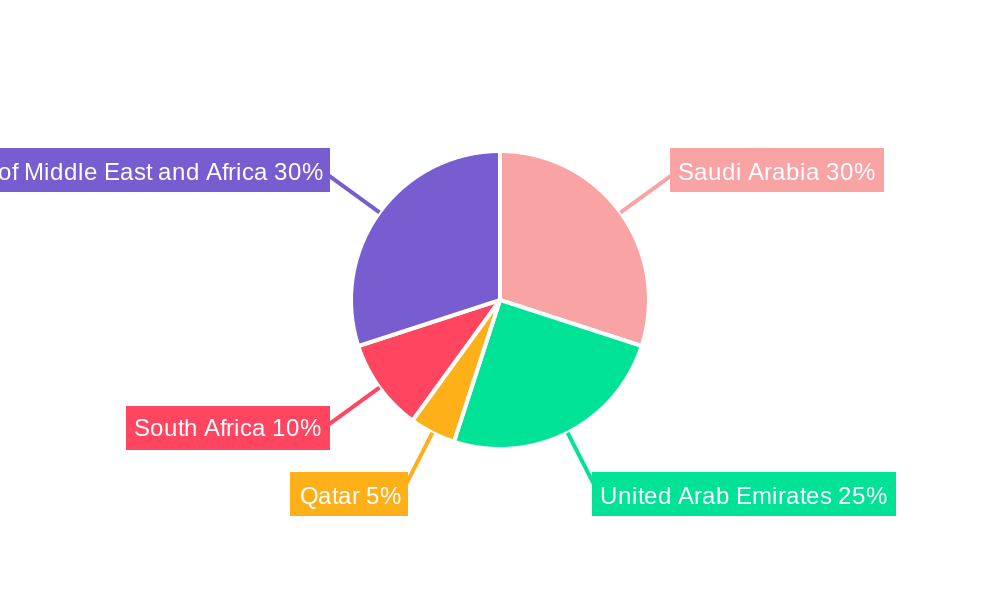

The UAE and Saudi Arabia represent the largest markets within the MEA region, driven by high purchasing power and strong tourism.

- Leading Regions: The UAE, Saudi Arabia, and other GCC countries dominate the market due to high per capita income, robust tourism, and favorable government policies.

- Leading Countries: The UAE and Saudi Arabia account for approximately xx% of the total market share. Other significant markets include Qatar, Kuwait, and Egypt.

- Leading Product Types: Watches and jewelry consistently demonstrate high demand, followed closely by bags and apparel. Other accessories show significant growth potential.

- Leading Distribution Channels: Single-branded stores maintain a dominant market share due to brand exclusivity and curated customer experiences. Online retail stores are witnessing rapid growth, while multi-brand stores offer a more diverse range.

Key Growth Drivers (Bullet Points):

- Strong economic growth in several MEA countries.

- Increasing tourism in popular luxury destinations.

- Government initiatives promoting the luxury goods sector.

- Development of modern retail infrastructure.

MEA Luxury Goods Industry Product Analysis

The MEA luxury goods market exhibits a strong focus on high-quality materials, craftsmanship, and innovative designs. Technological advancements in materials science, manufacturing processes, and personalized customization are enhancing product offerings and driving brand differentiation. Brands are adapting their products to the unique tastes and preferences of regional consumers, incorporating elements of local culture and tradition. Sustainability and ethical sourcing are becoming integral aspects of product development.

Key Drivers, Barriers & Challenges in MEA Luxury Goods Industry

Key Drivers:

The MEA luxury goods market is fueled by robust economic growth in key regions, a thriving tourism sector, and increasing disposable incomes among the affluent population. Government initiatives to support the luxury retail sector also contribute to market expansion.

Challenges:

The market faces challenges including fluctuating economic conditions, regional political instability, and increased competition. Supply chain disruptions and rising operational costs can negatively impact profitability. Counterfeit products represent a major threat, potentially impacting sales and brand reputation. The market's vulnerability to global economic downturns also presents a significant obstacle. Estimated losses due to counterfeiting are around $xx Million annually.

Growth Drivers in the MEA Luxury Goods Industry Market

Rising disposable incomes, increased tourism, and government initiatives promoting luxury retail are key drivers of market growth. Furthermore, the increasing adoption of e-commerce platforms and expansion of luxury retail infrastructure play a crucial role.

Challenges Impacting MEA Luxury Goods Industry Growth

Economic instability, supply chain disruptions, and counterfeiting remain significant hurdles. Strict regulations and import duties can impact market access. The intense competition among established and emerging players further presents a challenge.

Key Players Shaping the MEA Luxury Goods Industry Market

- Giorgio Armani S p A

- The Estée Lauder Companies Inc

- Kering S A

- Burberry Group PLC

- Compagnie Financière Richemont S A

- Alshaya franchise group (Tribe of 6 Aerie)

- Dolce & Gabbana Luxembourg S À R L

- Rolex SA

- Prada S P A

- Roberto Cavalli S P A

- Chanel S A

- LVMH Moët Hennessy Louis Vuitton

- Chopard Group

Significant MEA Luxury Goods Industry Industry Milestones

- May 2021: A new Rolex Boutique opened at the Galleria Al Maryah Island in Abu Dhabi, signifying the brand's commitment to the UAE market and enhancing the luxury retail landscape.

- May 2022: PRADA Tropico's pop-up boutique launch in Dubai Mall showcased innovative retail strategies and capitalized on the city's high tourist traffic.

- November 2022: Cartier's launch of the Santos de Cartier jewelry collection demonstrated the ongoing demand for high-end jewelry and the brand's ability to innovate within existing product categories.

Future Outlook for MEA Luxury Goods Industry Market

The MEA luxury goods market is poised for continued expansion, driven by robust economic growth, increasing tourism, and the evolving preferences of discerning consumers. Strategic partnerships, innovative retail experiences, and focus on sustainable practices will be critical for success. The market presents significant opportunities for both established and emerging players, with a strong potential for growth across various product categories and distribution channels.

MEA Luxury Goods Industry Segmentation

-

1. Product Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. South Africa

- 3.5. Rest of Middle East and Africa

MEA Luxury Goods Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. South Africa

- 5. Rest of Middle East and Africa

MEA Luxury Goods Industry Regional Market Share

Geographic Coverage of MEA Luxury Goods Industry

MEA Luxury Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure

- 3.3. Market Restrains

- 3.3.1. Counterfeit Goods Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. South Africa

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. South Africa

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewelry

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single-branded Stores

- 6.2.2. Multi-brand Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. South Africa

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewelry

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single-branded Stores

- 7.2.2. Multi-brand Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. South Africa

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewelry

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single-branded Stores

- 8.2.2. Multi-brand Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. South Africa

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Africa MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewelry

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single-branded Stores

- 9.2.2. Multi-brand Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. South Africa

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Middle East and Africa MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewelry

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single-branded Stores

- 10.2.2. Multi-brand Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Qatar

- 10.3.4. South Africa

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Giorgio Armani S p A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Estée Lauder Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kering S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burberry Group PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Compagnie Financière Richemont S A *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alshaya franchise group (Tribe of 6 Aerie)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dolce & Gabbana Luxembourg S À R L

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rolex SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Prada S P A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Roberto Cavalli S P A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chanel S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LVMH Moët Hennessy Louis Vuitton

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chopard Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: MEA Luxury Goods Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MEA Luxury Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: MEA Luxury Goods Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Luxury Goods Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the MEA Luxury Goods Industry?

Key companies in the market include Giorgio Armani S p A, The Estée Lauder Companies Inc, Kering S A, Burberry Group PLC, Compagnie Financière Richemont S A *List Not Exhaustive, Alshaya franchise group (Tribe of 6 Aerie), Dolce & Gabbana Luxembourg S À R L, Rolex SA, Prada S P A, Roberto Cavalli S P A, Chanel S A, LVMH Moët Hennessy Louis Vuitton, Chopard Group.

3. What are the main segments of the MEA Luxury Goods Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure.

6. What are the notable trends driving market growth?

Rise in Tourism Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Counterfeit Goods Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Santos de Cartier launched new series of jewelry collections that consists of rings, bracelets, and necklaces. The collection consists of a gold chain in two colors, mounted with a single or double row of coffee beans decorated with diamonds of various sizes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Luxury Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Luxury Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Luxury Goods Industry?

To stay informed about further developments, trends, and reports in the MEA Luxury Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence