Key Insights

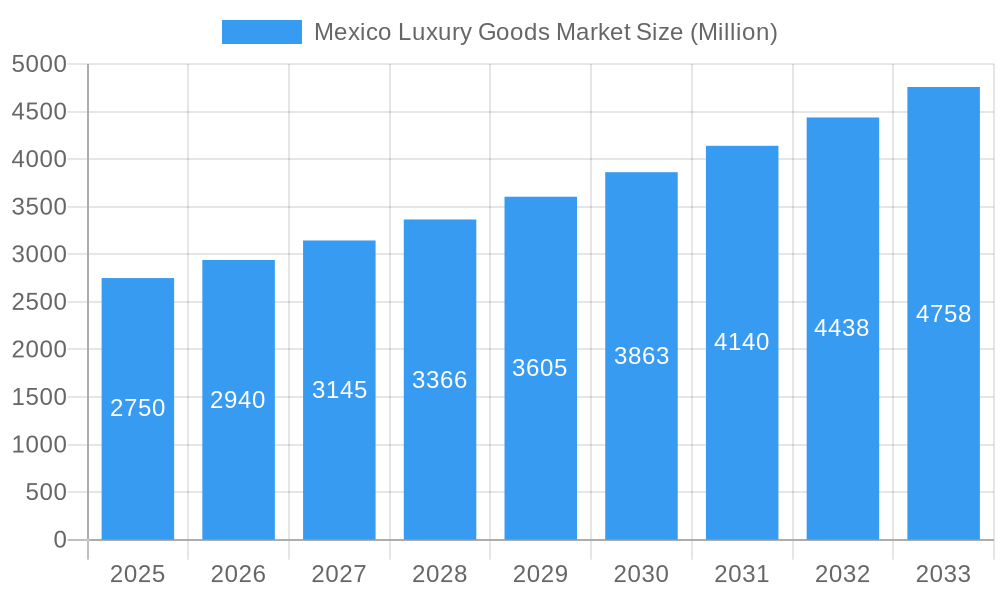

The Mexico luxury goods market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.83%. While the precise market size for 2025 is still being determined, based on available data and North American market trends, it is estimated to reach between $3.61 billion and a figure approaching $3 billion USD by 2025. This expansion is driven by increasing affluence among Mexico's high-net-worth individuals and a growing middle class with aspirations for premium brands. Furthermore, robust tourism, especially from the United States, significantly boosts sales, particularly in key tourist areas and border cities. The proliferation of e-commerce also broadens market access for both domestic and international luxury brands, accelerating overall growth. However, economic instability and currency fluctuations remain significant market restraints, potentially impacting consumer purchasing power and import costs. The market is segmented by product categories, including apparel, footwear, accessories, jewelry, and watches, and by distribution channels such as single-brand and multi-brand retail, and online platforms. Leading luxury conglomerates like LVMH, Richemont, and Kering hold considerable market share, but the rise of online retail offers new opportunities for both established and emerging brands to expand their reach. Future market dynamics will be influenced by economic conditions, evolving consumer preferences, and strategic digital marketing initiatives.

Mexico Luxury Goods Market Market Size (In Billion)

Mexico's luxury goods sector offers unique growth prospects. The established presence of key players, such as LVMH, alongside significant tourist inflow from the US, highlights considerable market potential. Luxury spending is concentrated in specific regions, including Mexico City and popular coastal destinations, presenting strategic opportunities for market penetration and targeted marketing. The expanding e-commerce landscape empowers smaller luxury brands to compete with larger incumbents. Future growth will be significantly influenced by government import duties and tax policies, which directly affect pricing and accessibility. Consumer confidence and spending patterns amidst economic uncertainty will also be critical determinants of the market's future trajectory.

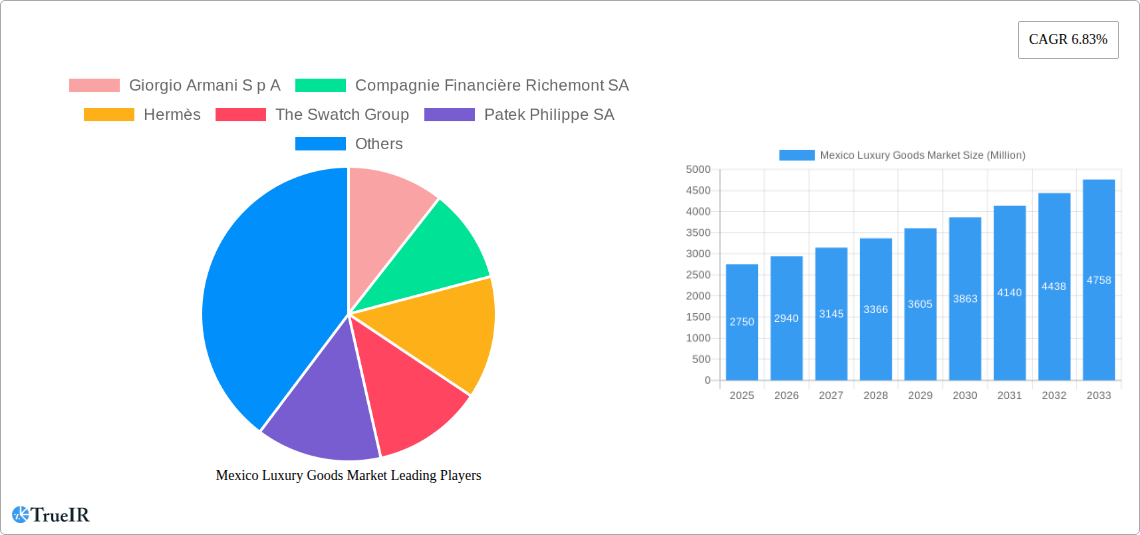

Mexico Luxury Goods Market Company Market Share

Mexico Luxury Goods Market: A Comprehensive Market Report (2019-2033)

This dynamic report offers an in-depth analysis of the burgeoning Mexico luxury goods market, providing crucial insights for investors, businesses, and industry stakeholders. With a detailed study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unveils the market's structure, trends, and future potential. Discover key growth drivers, challenges, and the dominant players shaping this lucrative sector. The report includes extensive quantitative and qualitative data, offering a 360-degree view of the Mexican luxury goods landscape.

Mexico Luxury Goods Market Structure & Competitive Landscape

The Mexican luxury goods market exhibits a moderately concentrated structure, with a few key players holding significant market share. The market concentration ratio (CR4) for 2024 is estimated at xx%, indicating the presence of several influential brands. Innovation is a key driver, with brands constantly striving to introduce unique designs and enhance customer experiences. Regulatory changes, particularly those impacting import/export and taxation, can significantly impact market dynamics. Product substitutes, primarily from the premium segment, pose a constant competitive threat. The market is segmented by end-users based on demographics (high net worth individuals, affluent millennials, etc.) and lifestyle preferences. Mergers and acquisitions (M&A) activity is relatively moderate, with an estimated xx Million USD in deal volume in 2024. Future M&A activity is predicted to increase based on the growing market size and potential for consolidation among players.

Mexico Luxury Goods Market Market Trends & Opportunities

The Mexico luxury goods market is experiencing dynamic and robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of **[Insert Specific CAGR Here]%** during the forecast period of 2025-2033. This upward trajectory is significantly influenced by a confluence of factors, including a rapidly expanding affluent population with burgeoning disposable incomes and a pronounced shift in consumer preferences towards aspirational luxury brands. The digital revolution is profoundly reshaping the market, with sophisticated e-commerce platforms and hyper-personalized marketing strategies opening new avenues for both well-established luxury houses and innovative emerging brands. Despite considerable progress, Mexico's luxury goods market penetration rates still lag behind more mature global markets, presenting substantial untapped potential and fertile ground for strategic expansion. Furthermore, a growing consumer consciousness regarding sustainability and ethical sourcing is increasingly dictating purchasing decisions, compelling brands to integrate these values into their offerings and operations. The competitive arena is characterized by its dynamism, with a keen rivalry between established domestic enterprises and international luxury giants vying for a significant share of this evolving market.

Dominant Markets & Segments in Mexico Luxury Goods Market

- Leading Region/Segment: Mexico City and its surrounding major metropolitan areas continue to be the epicenters of luxury consumption, benefiting from a concentrated higher purchasing power and a well-established awareness of international luxury brands. Within product categories, the Clothing and Apparel segment currently commands the largest market share, closely followed by the ever-popular categories of Bags and Watches.

- Growth Drivers:

- Expanding Affluent Class: The continuous increase in the number of high-net-worth individuals (HNWIs) and the upward mobility of the middle class are directly fueling the demand for premium and ultra-luxury goods.

- Tourism: Mexico's vibrant tourism sector, both domestic and international, remains a critical contributor to luxury goods sales. Popular tourist destinations, in particular, witness a surge in luxury purchases by global travelers seeking exclusive experiences and high-quality products.

- E-commerce Growth: The widespread adoption of online shopping, coupled with enhanced digital infrastructure and consumer trust in online luxury retail, is significantly broadening market reach, improving accessibility, and driving sales across all geographical locations.

- Distribution Channel Analysis: While single-brand stores continue to be the preferred channel for luxury purchases due to the immersive brand experience and the sense of exclusivity they offer, the landscape is rapidly diversifying. Multi-brand boutiques and sophisticated online retail channels are experiencing substantial growth, creating a more dynamic, competitive, and consumer-centric marketplace.

Mexico Luxury Goods Market Product Analysis

The Mexican luxury goods market is a vibrant hub of continuous product innovation. Brands are increasingly integrating cutting-edge technological advancements to elevate product features and appeal to the discerning tastes of contemporary consumers. This includes a significant focus on incorporating sustainable materials into product design and manufacturing, the development of smart luxury items with integrated advanced features (e.g., smartwatches), and offering unparalleled personalized customization options that cater to individual client desires. Furthermore, brands are strategically leveraging technological advancements across their manufacturing processes and supply chain management to enhance operational efficiency, optimize costs, and ultimately deliver superior products and a more compelling market offering, thereby solidifying their competitive advantage.

Key Drivers, Barriers & Challenges in Mexico Luxury Goods Market

Key Drivers:

- Rising disposable incomes among the affluent class.

- Increasing brand awareness and aspirational consumption.

- Growth of e-commerce and omnichannel strategies.

Challenges:

- Economic volatility and currency fluctuations can impact consumer spending.

- Counterfeit goods pose a significant threat to the market.

- High import duties and taxes can inflate prices, impacting affordability.

Growth Drivers in the Mexico Luxury Goods Market Market

The sustained and impressive growth of the Mexico luxury goods market is being propelled by a powerful synergy of key factors. The continuous expansion of the affluent demographic, coupled with a thriving tourism industry that attracts international spenders, provides a strong foundation for demand. The accelerating adoption of e-commerce channels democratizes access to luxury goods, reaching consumers beyond traditional retail hubs. Additionally, supportive government initiatives aimed at fostering economic growth and stability further contribute to creating an opportune environment for luxury brands to thrive and expand their presence.

Challenges Impacting Mexico Luxury Goods Market Growth

Economic instability, counterfeiting concerns, and high import duties create significant hurdles for growth. Supply chain disruptions caused by global events can also impact market performance.

Key Players Shaping the Mexico Luxury Goods Market Market

Significant Mexico Luxury Goods Market Industry Milestones

- October 2020: Hermès launched its first beauty line, Rouge Hermès, expanding its product portfolio and market reach.

- November 2021: Chanel opened a new store in Malaysia dedicated to its shoe collections, highlighting its continued expansion in Asia. While not directly in Mexico, this illustrates the global expansion strategies of major luxury players, relevant to the Mexican market.

- February 2022: TOUS launched a new concept store in Kuala Lumpur, showcasing its commitment to expanding its global presence and potentially signaling future expansion into new markets including potentially Mexico.

Future Outlook for Mexico Luxury Goods Market Market

The Mexico luxury goods market is strategically positioned for sustained and significant expansion in the coming years. This optimistic outlook is underpinned by a robust national economy and the ongoing growth of the affluent consumer base. Success in this evolving market will heavily rely on strategic investments in digital transformation, particularly in sophisticated e-commerce capabilities and highly personalized marketing approaches. The market presents a compelling landscape of significant opportunities for both established, globally recognized brands seeking to deepen their presence and for agile emerging players looking to carve out their niche, especially those championing sustainability and ethical sourcing practices. The forecast indicates a trajectory of continuous market expansion, which is expected to attract further investment and intensify competition, making it an exciting market to watch.

Mexico Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Watches

- 1.5. Jewelry

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

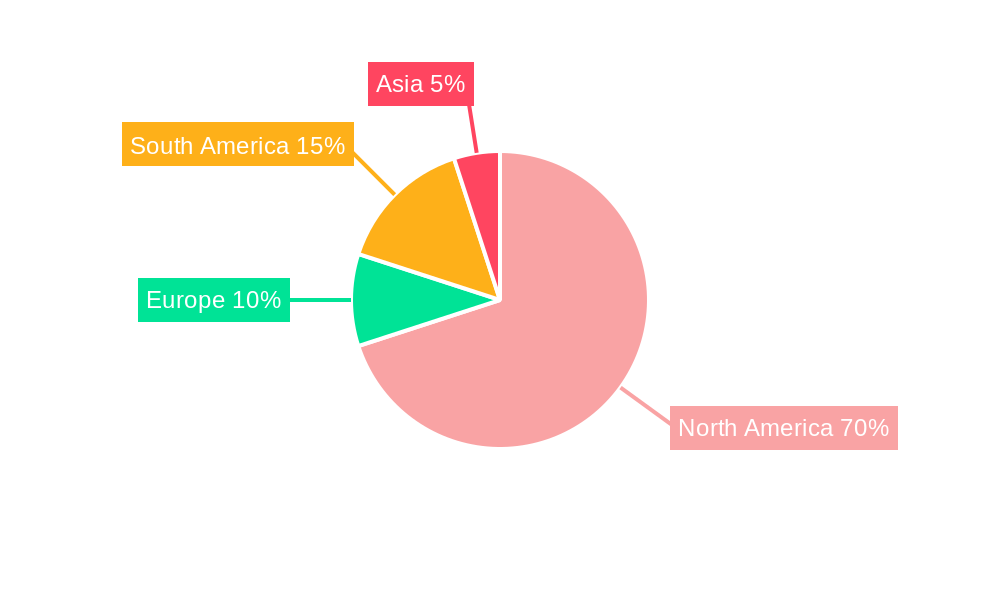

Mexico Luxury Goods Market Segmentation By Geography

- 1. Mexico

Mexico Luxury Goods Market Regional Market Share

Geographic Coverage of Mexico Luxury Goods Market

Mexico Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sunglasses As A Fashion Statement; Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Preference for E-commerce Platform to Purchase Luxury Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Watches

- 5.1.5. Jewelry

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermès

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Swatch Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Patek Philippe SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PRADA S P A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolex SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & M Hennes & Mauritz AB (H&M)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Estee Lauder Companies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Mexico Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Mexico Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Mexico Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Luxury Goods Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the Mexico Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Compagnie Financière Richemont SA, Hermès, The Swatch Group, Patek Philippe SA, PRADA S P A, LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive, Kering, Rolex SA, H & M Hennes & Mauritz AB (H&M), The Estee Lauder Companies.

3. What are the main segments of the Mexico Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Sunglasses As A Fashion Statement; Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Increasing Preference for E-commerce Platform to Purchase Luxury Goods.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In February 2022, TOUS, the Spanish luxury brand launched a new concept store in Kuala Lumpur, Malaysia. The new boutique features a large assortment of key categories including bags, jewelry, gemstones, and perfumes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Mexico Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence