Key Insights

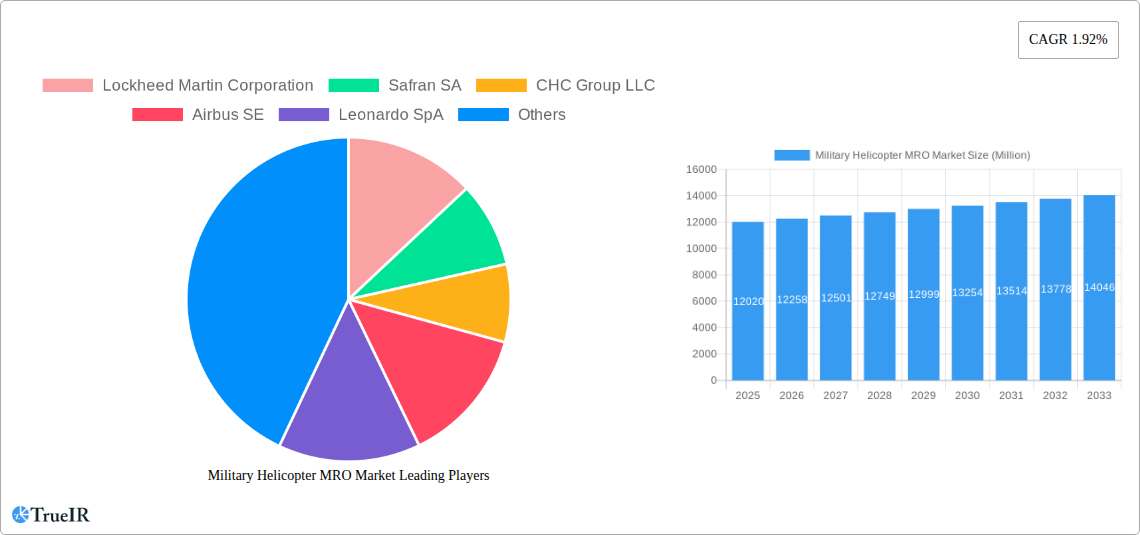

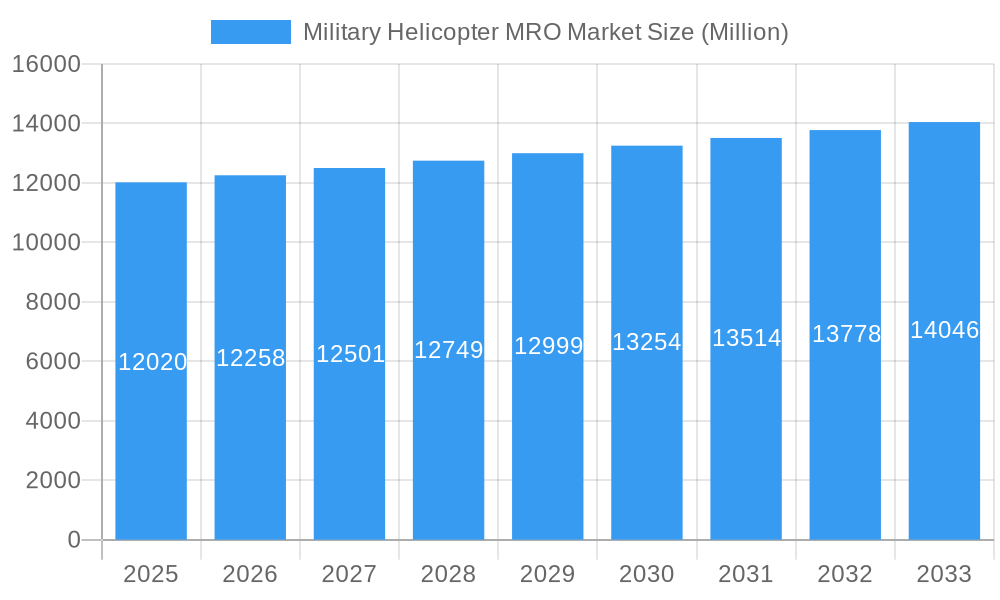

The Military Helicopter MRO (Maintenance, Repair, and Overhaul) market, valued at $12.02 billion in 2025, is projected to experience steady growth, driven by the aging fleet of military helicopters globally and the increasing operational demands in various conflict zones and peacekeeping missions. A Compound Annual Growth Rate (CAGR) of 1.92% from 2025 to 2033 indicates a continuous need for MRO services to maintain operational readiness. Key drivers include the rising need for modernization and upgrades of existing fleets, the implementation of stringent safety and regulatory compliance measures, and increasing government spending on defense budgets in several key regions. Technological advancements, such as the integration of advanced diagnostics and predictive maintenance technologies, are shaping the future of the market. The increasing adoption of these technologies improves efficiency and reduces downtime, contributing to market expansion. While certain geopolitical uncertainties could potentially act as restraints, the overall positive outlook for military spending in the coming years is anticipated to counterbalance these challenges and sustain market growth. The market is segmented by helicopter type (light, medium, heavy), MRO service type (repair, overhaul, maintenance), and geography. Major players like Lockheed Martin, Safran, and Airbus are at the forefront, engaging in strategic partnerships and acquisitions to enhance their market positioning and service offerings.

Military Helicopter MRO Market Market Size (In Billion)

The competitive landscape within the Military Helicopter MRO market is highly consolidated, with major players holding significant market share. These companies are increasingly focusing on expanding their global reach through strategic partnerships and acquisitions. The competitive edge in this market lies in providing comprehensive and specialized services, offering advanced technological solutions, and maintaining strong relationships with military clients. The integration of digital technologies for data analytics, inventory management, and predictive maintenance is becoming a crucial element for efficient operations and cost-effective solutions. Future growth will depend heavily on the technological innovation in MRO services and adapting to evolving military requirements. The adoption of Industry 4.0 principles and data-driven decision making within this sector is projected to drive further optimization and efficiency, contributing to sustained market expansion over the forecast period.

Military Helicopter MRO Market Company Market Share

Military Helicopter MRO Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Military Helicopter MRO Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this study dissects market trends, competitive landscapes, and future growth prospects. The report incorporates extensive quantitative data and qualitative analysis, ensuring a holistic understanding of this crucial sector. The market is projected to reach xx Million by 2033.

Military Helicopter MRO Market Structure & Competitive Landscape

The Military Helicopter MRO market exhibits a moderately concentrated structure, with a handful of major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Key players, including Lockheed Martin Corporation, Safran SA, Airbus SE, and Leonardo SpA, leverage their technological expertise and established customer relationships to maintain market leadership. However, the market also features several regional players and specialized MRO providers, creating a dynamic competitive landscape.

Market Concentration:

- High concentration in certain segments (e.g., engine MRO).

- Moderate concentration overall.

- Increased competition from emerging players in specific geographical regions.

Innovation Drivers:

- Technological advancements in helicopter design and materials.

- Demand for improved operational efficiency and reduced maintenance costs.

- Adoption of digital technologies, including predictive maintenance and AI-powered diagnostics.

Regulatory Impacts:

- Stringent safety regulations influence MRO processes and standards.

- Government policies and defense budgets significantly impact market growth.

- Export controls and trade restrictions influence international market dynamics.

Product Substitutes:

- Limited direct substitutes exist due to the specialized nature of military helicopter MRO.

- However, outsourcing and cost-reduction strategies can indirectly influence market competition.

End-User Segmentation:

- The market is segmented by military branches (Army, Navy, Air Force) and geographic regions.

- Government agencies and defense contractors represent the primary end-users.

M&A Trends:

- A moderate level of M&A activity has been observed in recent years, with strategic acquisitions aimed at expanding service offerings and geographical reach. The total value of M&A deals in the past 5 years is estimated at xx Million.

Military Helicopter MRO Market Trends & Opportunities

The global Military Helicopter MRO market is experiencing robust growth, driven by aging helicopter fleets, increasing defense budgets in several key regions, and the growing demand for advanced maintenance and repair solutions. Technological advancements, including the integration of digital technologies and predictive analytics, are transforming MRO operations, enhancing efficiency and reducing downtime. The market exhibits a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further fueled by the increasing adoption of extended service agreements and performance-based contracts. Market penetration rates vary across different regions and helicopter types, with mature markets exhibiting higher penetration than emerging ones. The competitive landscape is characterized by both established players and emerging niche providers, creating both opportunities and challenges for market participants. Strategic partnerships and collaborations are becoming increasingly important as companies strive to expand their capabilities and access new markets. The trend towards outsourcing MRO services is expected to continue, offering opportunities for specialized MRO providers. Finally, the focus on sustainability and environmental considerations is influencing the adoption of greener technologies and practices within the MRO industry.

Dominant Markets & Segments in Military Helicopter MRO Market

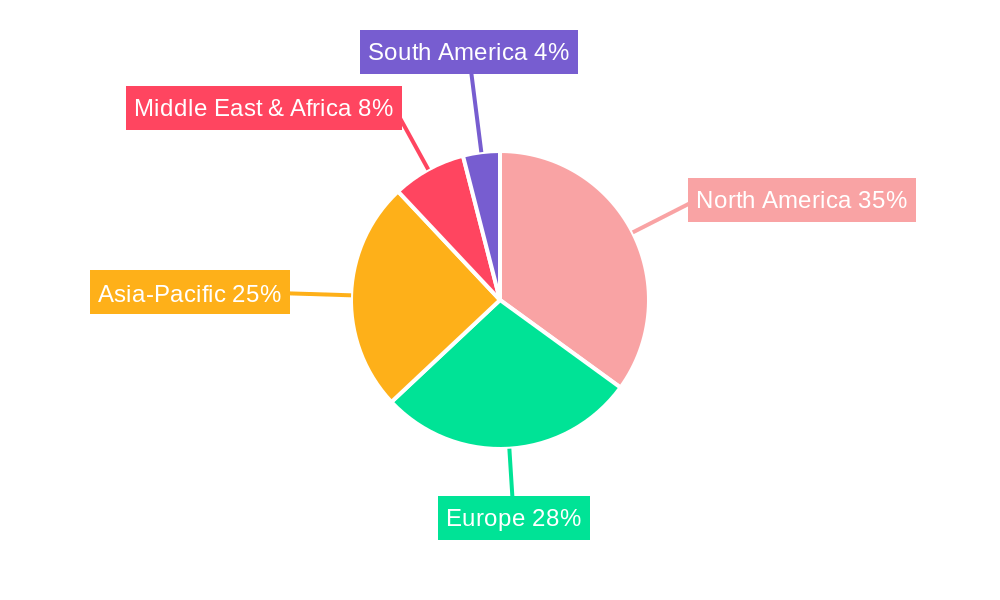

The North American and European markets currently dominate the Military Helicopter MRO landscape, driven by significant defense budgets, a large installed base of military helicopters, and a well-established MRO infrastructure. The Asia-Pacific region is witnessing substantial growth, driven by increased defense spending and modernization programs. Within the segments, engine MRO and airframe MRO represent the largest portions of the market.

Key Growth Drivers in Dominant Regions:

- North America: High defense spending, advanced technology adoption, and presence of major MRO providers.

- Europe: Significant defense budgets, technological advancements, and established MRO infrastructure.

- Asia-Pacific: Rapidly growing defense budgets, modernization of military helicopter fleets, and increasing focus on indigenous capabilities.

Market Dominance Analysis:

The dominance of North America and Europe stems from their mature aerospace industries, robust regulatory frameworks, and concentration of major Original Equipment Manufacturers (OEMs). The Asia-Pacific region’s growth is fueled by the increasing demand for modernizing its aging fleets and the expanding defense budgets of countries in the region. This growth is expected to continue over the forecast period due to ongoing military investments and government initiatives.

Military Helicopter MRO Market Product Analysis

The Military Helicopter MRO market encompasses a range of products and services, including engine overhaul and repair, airframe maintenance, avionics upgrades, and component replacement. Technological advancements are driving the adoption of advanced diagnostics, predictive maintenance, and data analytics, which improve operational efficiency and reduce maintenance costs. These innovations provide a competitive advantage to MRO providers that can integrate these technologies effectively. The market also sees increasing demand for customized MRO solutions tailored to specific operational requirements and aircraft types. The focus is shifting towards performance-based contracts that incentivize reduced downtime and improved operational reliability.

Key Drivers, Barriers & Challenges in Military Helicopter MRO Market

Key Drivers:

- Aging military helicopter fleets requiring extensive maintenance and upgrades.

- Increased defense budgets driving demand for enhanced operational readiness.

- Technological advancements leading to improved efficiency and reduced costs.

- Growing focus on extending the service life of existing helicopters.

Key Challenges & Restraints:

- Supply chain disruptions impacting the availability of critical parts and components. This has resulted in xx% increase in lead times, affecting project timelines and costs.

- Strict regulatory compliance requirements and certification processes.

- Intense competition among MRO providers, potentially leading to price pressure.

- Skilled labor shortages, hindering efficient MRO operations.

Growth Drivers in the Military Helicopter MRO Market

The primary growth drivers include: the increasing age of military helicopter fleets requiring more frequent maintenance, rising defense budgets globally, and ongoing technological advancements that enhance operational efficiency. Government initiatives promoting indigenous MRO capabilities are also boosting market growth in several regions.

Challenges Impacting Military Helicopter MRO Market Growth

Challenges include supply chain complexities, leading to potential delays and increased costs, stringent regulatory requirements, and intense competition among MRO providers. Labor shortages and the need for highly skilled technicians present another significant obstacle to growth.

Key Players Shaping the Military Helicopter MRO Market

- Lockheed Martin Corporation

- Safran SA

- CHC Group LLC

- Airbus SE

- Leonardo SpA

- Saudi Rotorcraft Support Company Ltd

- Elbit Systems Ltd

- Honeywell International Ltd

- AAR Corp

- MTU Aero Engines A

Significant Military Helicopter MRO Market Industry Milestones

- June 2023: Airbus Helicopters, Kongsberg Defence & Aerospace, and KONGSBERG signed an MoU for customized maintenance services for the Norwegian Army's new helicopter fleet. This highlights the growing trend of tailored MRO solutions.

- February 2024: Airbus Helicopter secured agreements with PT Garuda Maintenance Facility (GMF) Aero Asia and PT LEN Industri in Indonesia, boosting local MRO capabilities and showcasing the expansion of MRO partnerships in the Asia-Pacific region. This signifies the increasing importance of strategic partnerships for market expansion.

Future Outlook for Military Helicopter MRO Market

The Military Helicopter MRO market is poised for continued growth, driven by sustained defense spending, technological advancements, and the increasing focus on extending the service life of existing fleets. Strategic partnerships, the adoption of digital technologies, and a focus on sustainability will shape the future of the market. Opportunities exist for innovative MRO providers that can offer tailored solutions, leverage data analytics, and provide efficient and cost-effective services. The market is expected to witness significant growth in the Asia-Pacific region as countries continue to invest in modernizing their military helicopter capabilities.

Military Helicopter MRO Market Segmentation

-

1. MRO Type

- 1.1. Engine MRO

- 1.2. Component and Modifications MRO

- 1.3. Airframe MRO

- 1.4. Field Maintenance

Military Helicopter MRO Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Military Helicopter MRO Market Regional Market Share

Geographic Coverage of Military Helicopter MRO Market

Military Helicopter MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Engine Maintenance Segment is Projected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Engine MRO

- 5.1.2. Component and Modifications MRO

- 5.1.3. Airframe MRO

- 5.1.4. Field Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Engine MRO

- 6.1.2. Component and Modifications MRO

- 6.1.3. Airframe MRO

- 6.1.4. Field Maintenance

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Engine MRO

- 7.1.2. Component and Modifications MRO

- 7.1.3. Airframe MRO

- 7.1.4. Field Maintenance

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Engine MRO

- 8.1.2. Component and Modifications MRO

- 8.1.3. Airframe MRO

- 8.1.4. Field Maintenance

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Engine MRO

- 9.1.2. Component and Modifications MRO

- 9.1.3. Airframe MRO

- 9.1.4. Field Maintenance

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Engine MRO

- 10.1.2. Component and Modifications MRO

- 10.1.3. Airframe MRO

- 10.1.4. Field Maintenance

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lockheed Martin Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Safran SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CHC Group LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leonardo SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saudi Rotorcraft Support Company Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elbit Systems Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Honeywell International Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AAR Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MTU Aero Engines A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: Global Military Helicopter MRO Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Military Helicopter MRO Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 4: North America Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 5: North America Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 6: North America Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 7: North America Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 12: Europe Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 13: Europe Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 14: Europe Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 15: Europe Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 20: Asia Pacific Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 21: Asia Pacific Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 22: Asia Pacific Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 23: Asia Pacific Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 28: Latin America Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 29: Latin America Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 30: Latin America Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 31: Latin America Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Latin America Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Latin America Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 36: Middle East and Africa Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 37: Middle East and Africa Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 38: Middle East and Africa Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 39: Middle East and Africa Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 2: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 3: Global Military Helicopter MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Military Helicopter MRO Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 6: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 7: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: US Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: US Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 14: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 15: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: France Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Germany Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Germany Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Russia Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 28: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 29: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: China Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: China Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: India Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Japan Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Korea Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Asia Pacific Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 42: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 43: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: Brazil Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Brazil Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Latin America Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Latin America Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 50: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 51: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 53: Saudi Arabia Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Saudi Arabia Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: United Arab Emirates Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: United Arab Emirates Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Middle East and Africa Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Middle East and Africa Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Helicopter MRO Market?

The projected CAGR is approximately 1.92%.

2. Which companies are prominent players in the Military Helicopter MRO Market?

Key companies in the market include Lockheed Martin Corporation, Safran SA, CHC Group LLC, Airbus SE, Leonardo SpA, Saudi Rotorcraft Support Company Ltd, Elbit Systems Ltd, Honeywell International Ltd, AAR Corp, MTU Aero Engines A.

3. What are the main segments of the Military Helicopter MRO Market?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.02 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Engine Maintenance Segment is Projected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2024: European helicopter manufacturer Airbus Helicopter solidified maintenance, repair, and overhaul (MRO) agreements with two Indonesian aerospace firms. The initial pact was with MRO specialist PT Garuda Maintenance Facility (GMF) Aero Asia. In this collaboration, Airbus committed to lending its expertise and technical support for designing, manufacturing, and retrofitting five AS332 Super Puma helicopters, which were part of the Indonesian Air Force's fleet. Additionally, Airbus signed a memorandum of understanding (MoU) with state-owned defense entity PT LEN Industri (Defend ID), focusing on aerostructure production, bolstering helicopter manufacturing, and enhancing local MRO capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Helicopter MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Helicopter MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Helicopter MRO Market?

To stay informed about further developments, trends, and reports in the Military Helicopter MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence