Key Insights

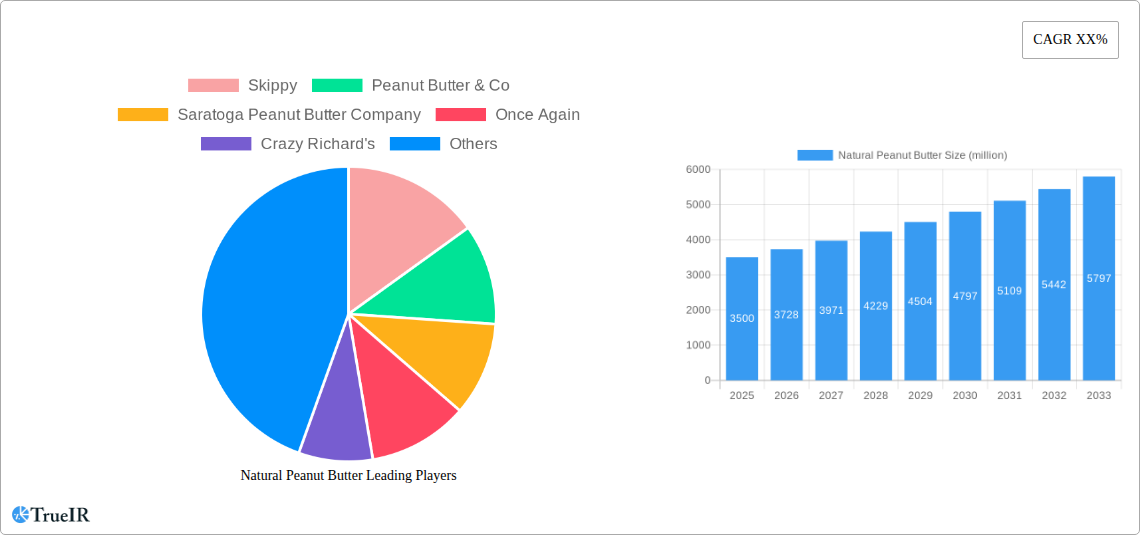

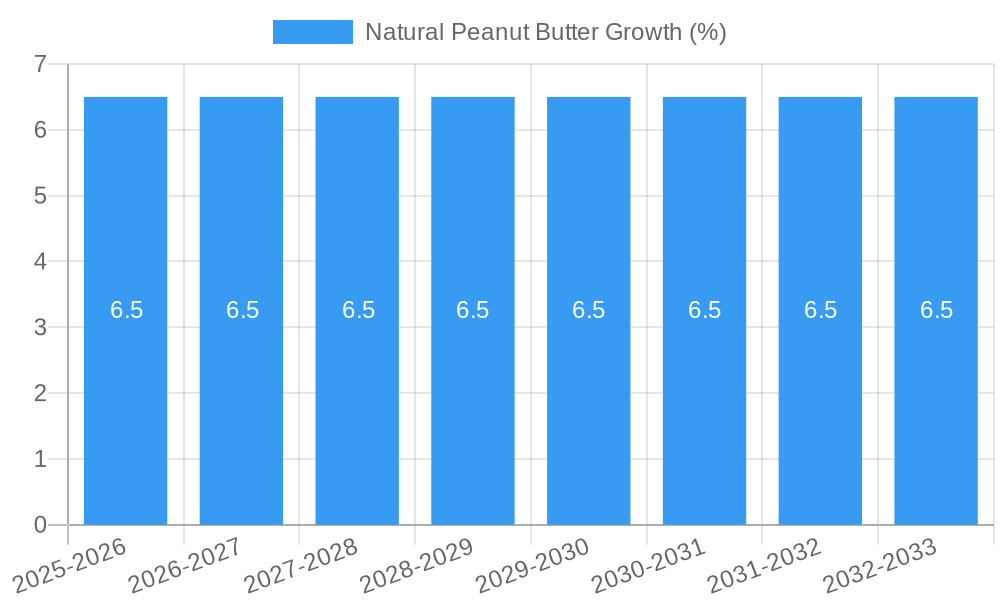

The global natural peanut butter market is poised for significant expansion, with an estimated market size of $3,500 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust growth is primarily fueled by increasing consumer health consciousness and a growing preference for natural, minimally processed food options. The demand for peanut butter free from added sugars, hydrogenated oils, and artificial ingredients is on the rise, aligning with broader wellness trends. Key drivers include the perception of peanut butter as a healthy protein source, its versatility in various culinary applications, and the increasing availability of diverse natural peanut butter varieties, including unsweetened, honey-sweetened, and flavored options. The market is also benefiting from enhanced distribution channels, particularly the surge in online sales, which offers consumers wider access to specialized brands and products. This accessibility, coupled with effective digital marketing strategies by leading companies, is further stimulating market penetration.

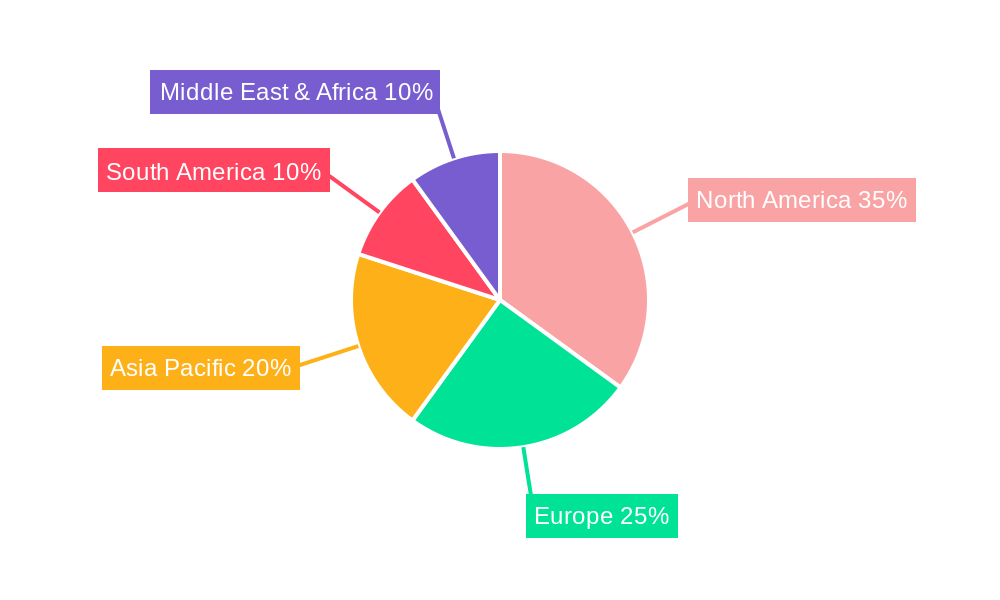

The market landscape is characterized by intense competition among established brands and emerging players, all vying to capture market share through product innovation and strategic marketing. Companies are focusing on premium ingredients, sustainable sourcing, and unique flavor profiles to differentiate themselves. For instance, the availability of specialty nut butters, such as those incorporating other nuts or seeds, is expanding consumer choices. However, the market also faces certain restraints, including the fluctuating prices of raw materials (peanuts) and the growing popularity of alternative protein sources and spreads. Nonetheless, the inherent nutritional benefits and widespread appeal of peanut butter are expected to sustain its dominance. Geographically, North America is expected to lead the market, driven by high consumer awareness of health and wellness, followed by Europe and the Asia Pacific region, where the market is experiencing rapid growth due to evolving dietary habits and increasing disposable incomes.

Natural Peanut Butter Market: Comprehensive Industry Analysis (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global natural peanut butter market. Leveraging high-volume keywords, this report is tailored for industry professionals seeking actionable insights into market structure, trends, opportunities, and competitive landscapes. Covering the study period of 2019–2033, with a base and estimated year of 2025, this report offers a detailed forecast for the period 2025–2033, building upon the historical performance from 2019–2024.

Natural Peanut Butter Market Structure & Competitive Landscape

The natural peanut butter market exhibits a moderate to highly concentrated structure, with several key players vying for market share. Innovation drivers are primarily focused on product diversification, ingredient sourcing transparency, and health-conscious formulations, catering to a growing demand for natural and organic products. Regulatory impacts, while present, are generally favorable, emphasizing food safety standards and clear labeling, which bolsters consumer trust. Product substitutes, such as almond butter, cashew butter, and other nut and seed spreads, pose a competitive threat, yet natural peanut butter maintains a strong market position due to its affordability and widespread consumer familiarity. End-user segmentation reveals significant penetration in health-conscious households, fitness enthusiasts, and the food service industry. Mergers and acquisitions (M&A) trends indicate strategic consolidation to expand product portfolios and distribution networks, with an estimated volume of over 50 M&A activities observed during the historical period. Concentration ratios are estimated to be around 65% for the top five players, signifying substantial market influence.

Natural Peanut Butter Market Trends & Opportunities

The global natural peanut butter market is experiencing robust growth, projected to reach over $10 billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is fueled by a confluence of evolving consumer preferences, technological advancements in production, and increasing awareness regarding the health benefits of peanut butter. Consumers are increasingly seeking products with minimal ingredients, no added sugars, and healthier fats, making natural peanut butter a preferred choice over conventional, processed alternatives. This shift is evident in the rising market penetration of natural peanut butter, which has climbed from an estimated 30% in 2019 to over 45% by 2025. Technological innovations are streamlining production processes, enabling a wider variety of textures and flavors while maintaining product integrity and shelf life. Automation in processing, advanced packaging solutions that preserve freshness, and enhanced quality control measures are all contributing to market efficiency. Furthermore, the e-commerce boom has significantly expanded accessibility, allowing brands to reach a broader consumer base through online sales channels. Competitive dynamics are characterized by continuous product innovation, with companies introducing gourmet flavors, allergen-free options, and single-serve packets. Strategic partnerships and endorsements from health and wellness influencers are also playing a crucial role in shaping consumer perception and driving demand. The market also presents opportunities in emerging economies where the adoption of Western dietary habits and a growing middle class are creating new consumer bases.

Dominant Markets & Segments in Natural Peanut Butter

The Offline Sales segment is currently the dominant distribution channel for natural peanut butter, accounting for an estimated 70% of the total market revenue in 2025. This dominance is driven by established retail infrastructure, including supermarkets, hypermarkets, and specialty food stores, which offer widespread product availability and immediate consumer access. Key growth drivers in this segment include strategic shelf placement, in-store promotions, and the traditional shopping habits of a significant portion of the consumer base. The Online Sales segment, while currently smaller, is exhibiting a significantly higher growth rate, projected to expand at a CAGR exceeding 12% from 2025 to 2033. This surge is attributed to the convenience of e-commerce, the ability of online platforms to offer a wider product selection, and the increasing comfort of consumers with online grocery shopping.

Among product types, Salted Peanut Butter holds a substantial market share, estimated at over 55% in 2025, due to its widespread appeal and versatility in both sweet and savory applications. However, the Sweet Peanut Butter segment is experiencing rapid growth, driven by evolving consumer tastes and the demand for ready-to-eat options, particularly among younger demographics. This segment is expected to capture a larger market share over the forecast period. The leading regions for natural peanut butter consumption are North America and Europe, collectively representing over 60% of the global market. North America, in particular, benefits from a mature market with high consumer awareness of health and wellness trends. Key growth drivers in these regions include robust supply chains, high disposable incomes, and extensive distribution networks. Emerging markets in Asia-Pacific and Latin America present significant untapped potential due to rising urbanization and increasing disposable incomes.

Natural Peanut Butter Product Analysis

Natural peanut butter product innovations are centered on purity and enhanced nutritional profiles. Companies are focusing on minimal ingredient lists, emphasizing whole roasted peanuts and a touch of salt, while actively excluding added sugars, hydrogenated oils, and artificial preservatives. Applications are expanding beyond traditional spreads to include ingredients in energy bars, protein shakes, and gourmet cooking. Competitive advantages are being built through unique flavor infusions (e.g., honey, cinnamon, chili), textural variations (e.g., super smooth, extra crunchy), and sustainable sourcing initiatives. Technological advancements in roasting techniques and micronization are creating superior textures and shelf stability, ensuring market fit with evolving consumer demands for clean-label, health-forward products.

Key Drivers, Barriers & Challenges in Natural Peanut Butter

The natural peanut butter market is propelled by a growing consumer inclination towards healthier, natural, and plant-based food options. Increased health consciousness, driven by awareness of the benefits of protein and healthy fats found in peanuts, is a primary driver. Economic factors, such as the affordability of peanuts compared to other nuts, also contribute to its sustained demand. Policy-driven factors, including clear labeling regulations that highlight natural ingredients and benefits, further bolster consumer trust.

Conversely, the market faces challenges from volatile raw material prices, impacting production costs and pricing strategies. Supply chain disruptions, particularly those related to agricultural yields and logistics, can lead to stockouts and increased expenses. Intense competitive pressures from a growing number of brands, including private labels and specialty producers, necessitate continuous innovation and marketing efforts. Regulatory complexities in international markets regarding ingredient standards and labeling can also present hurdles for expansion.

Growth Drivers in the Natural Peanut Butter Market

Key growth drivers for the natural peanut butter market include the escalating consumer demand for clean-label products, characterized by minimal and recognizable ingredients. The increasing global focus on health and wellness, particularly the dietary benefits of plant-based proteins and healthy fats, significantly fuels this demand. Technological advancements in processing and packaging are enabling improved product quality, extended shelf life, and more appealing textures and flavors, making natural peanut butter more accessible and desirable. Furthermore, the burgeoning e-commerce landscape provides a critical avenue for market expansion, allowing brands to reach a wider consumer base efficiently and offer a diverse range of products.

Challenges Impacting Natural Peanut Butter Growth

Despite strong growth prospects, the natural peanut butter market faces several challenges. Fluctuations in the price of raw peanuts, driven by climate conditions and global supply dynamics, can significantly impact manufacturing costs and profitability, potentially leading to price increases for consumers. Complex and varied regulatory environments across different regions, particularly concerning food safety standards, labeling requirements, and allergen declarations, can hinder market entry and expansion. Intensifying competitive pressures from an expanding array of brands, including established giants and emerging niche players, necessitate significant investment in marketing and product differentiation. Supply chain vulnerabilities, from agricultural sourcing to global distribution, can disrupt production and availability.

Key Players Shaping the Natural Peanut Butter Market

- Skippy

- Peanut Butter & Co

- Saratoga Peanut Butter Company

- Once Again

- Crazy Richard's

- Adams

- Laura Scudder’s

- Natural Way Food Group

- MaraNatha Nut Butters

- Smucker's

- Jif

- American Dream Nut Butter

Significant Natural Peanut Butter Industry Milestones

- 2019: Increased consumer adoption of plant-based diets drives demand for natural peanut butter alternatives.

- 2020: Expansion of e-commerce platforms accelerates online sales of natural peanut butter products.

- 2021: Launch of innovative flavor combinations and allergen-free natural peanut butter varieties by key players.

- 2022: Growing awareness of health benefits leads to increased market penetration in fitness and wellness segments.

- 2023: Strategic partnerships between natural food brands and online retailers to enhance distribution.

- 2024: Advancements in sustainable sourcing and production practices gain consumer traction.

Future Outlook for Natural Peanut Butter Market

The future outlook for the natural peanut butter market remains exceptionally positive, driven by sustained consumer preference for healthy, clean-label food products. The ongoing trend towards plant-based diets, coupled with a greater understanding of the nutritional benefits of peanuts, will continue to propel market expansion. Strategic opportunities lie in further product innovation, including the development of specialized formulations catering to specific dietary needs (e.g., keto-friendly, high-protein) and the introduction of novel flavor profiles. The growing e-commerce channel will play an increasingly vital role in market accessibility and penetration, especially in emerging economies. Continued investment in sustainable sourcing and transparent supply chains will also be critical for long-term brand loyalty and market leadership.

Natural Peanut Butter Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Salted Peanut Butter

- 2.2. Sweet Peanut Butter

Natural Peanut Butter Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Natural Peanut Butter REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Natural Peanut Butter Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Salted Peanut Butter

- 5.2.2. Sweet Peanut Butter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Natural Peanut Butter Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Salted Peanut Butter

- 6.2.2. Sweet Peanut Butter

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Natural Peanut Butter Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Salted Peanut Butter

- 7.2.2. Sweet Peanut Butter

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Natural Peanut Butter Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Salted Peanut Butter

- 8.2.2. Sweet Peanut Butter

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Natural Peanut Butter Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Salted Peanut Butter

- 9.2.2. Sweet Peanut Butter

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Natural Peanut Butter Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Salted Peanut Butter

- 10.2.2. Sweet Peanut Butter

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Skippy

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Peanut Butter & Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saratoga Peanut Butter Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Once Again

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Crazy Richard's

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adams

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Laura Scudder’s

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Natural Way Food Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MaraNatha Nut Butters

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Smucker's

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jif

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 American Dream Nut Butter

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Skippy

List of Figures

- Figure 1: Global Natural Peanut Butter Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Natural Peanut Butter Revenue (million), by Application 2024 & 2032

- Figure 3: North America Natural Peanut Butter Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Natural Peanut Butter Revenue (million), by Types 2024 & 2032

- Figure 5: North America Natural Peanut Butter Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Natural Peanut Butter Revenue (million), by Country 2024 & 2032

- Figure 7: North America Natural Peanut Butter Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Natural Peanut Butter Revenue (million), by Application 2024 & 2032

- Figure 9: South America Natural Peanut Butter Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Natural Peanut Butter Revenue (million), by Types 2024 & 2032

- Figure 11: South America Natural Peanut Butter Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Natural Peanut Butter Revenue (million), by Country 2024 & 2032

- Figure 13: South America Natural Peanut Butter Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Natural Peanut Butter Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Natural Peanut Butter Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Natural Peanut Butter Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Natural Peanut Butter Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Natural Peanut Butter Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Natural Peanut Butter Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Natural Peanut Butter Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Natural Peanut Butter Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Natural Peanut Butter Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Natural Peanut Butter Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Natural Peanut Butter Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Natural Peanut Butter Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Natural Peanut Butter Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Natural Peanut Butter Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Natural Peanut Butter Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Natural Peanut Butter Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Natural Peanut Butter Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Natural Peanut Butter Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Natural Peanut Butter Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Natural Peanut Butter Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Natural Peanut Butter Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Natural Peanut Butter Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Natural Peanut Butter Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Natural Peanut Butter Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Natural Peanut Butter Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Natural Peanut Butter Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Natural Peanut Butter Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Natural Peanut Butter Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Natural Peanut Butter Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Natural Peanut Butter Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Natural Peanut Butter Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Natural Peanut Butter Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Natural Peanut Butter Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Natural Peanut Butter Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Natural Peanut Butter Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Natural Peanut Butter Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Natural Peanut Butter Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Natural Peanut Butter Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Natural Peanut Butter?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Natural Peanut Butter?

Key companies in the market include Skippy, Peanut Butter & Co, Saratoga Peanut Butter Company, Once Again, Crazy Richard's, Adams, Laura Scudder’s, Natural Way Food Group, MaraNatha Nut Butters, Smucker's, Jif, American Dream Nut Butter.

3. What are the main segments of the Natural Peanut Butter?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Natural Peanut Butter," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Natural Peanut Butter report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Natural Peanut Butter?

To stay informed about further developments, trends, and reports in the Natural Peanut Butter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence