Key Insights

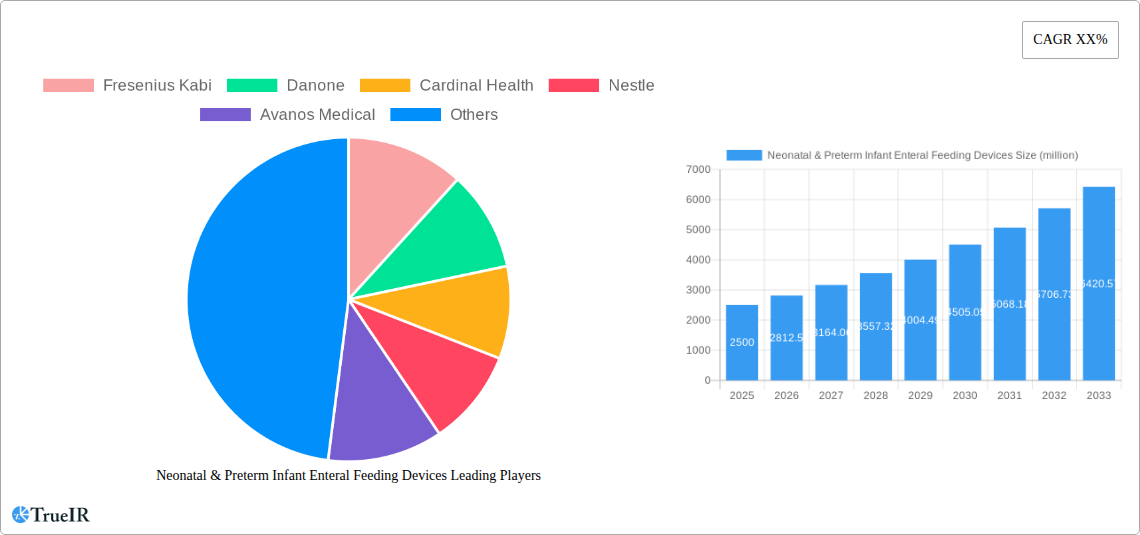

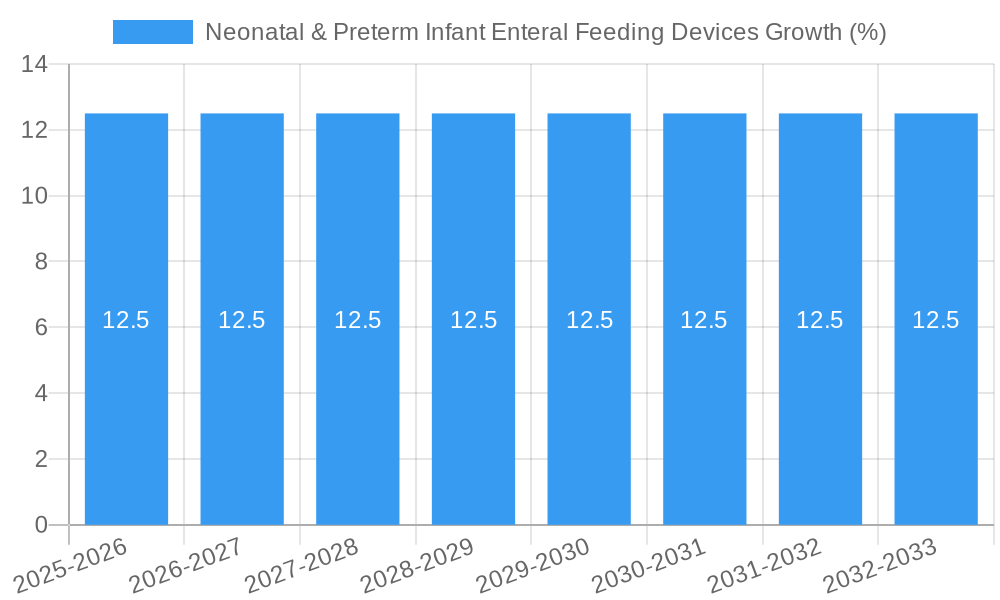

The global market for Neonatal & Preterm Infant Enteral Feeding Devices is poised for robust growth, projected to reach an estimated $2,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025-2033. This significant expansion is primarily driven by a confluence of factors including the increasing incidence of preterm births worldwide, advancements in medical technology leading to more sophisticated and user-friendly feeding devices, and a growing awareness among healthcare professionals and parents regarding the critical role of timely and appropriate nutrition in neonatal development. The rise in premature births, often attributed to factors like delayed pregnancies, lifestyle choices, and advancements in assisted reproductive technologies, directly translates to a higher demand for specialized enteral feeding solutions. Furthermore, the shift towards home care settings for neonatal care, driven by cost-effectiveness and parental preference, is fueling the demand for portable and easy-to-operate devices, thereby contributing to market expansion.

The market is segmented into key applications, with Hospitals representing the dominant segment due to the critical care requirements of newborns and preterm infants, followed by the rapidly growing Home Care segment. Within product types, Enteral Feeding Tubes are expected to capture a substantial market share, owing to their essential function in delivering nutrition directly to the infant's gastrointestinal tract. However, Enteral Feeding Pumps are witnessing accelerated growth due to their ability to provide precise and controlled feeding, crucial for vulnerable neonates. Key industry players like Fresenius Kabi, Danone, Cardinal Health, Nestle, and Abbott are actively investing in research and development to introduce innovative products, expand their geographical reach, and strengthen their market presence. While the market is generally optimistic, potential restraints could include stringent regulatory hurdles for medical devices and the high cost of advanced feeding technologies, which might pose challenges in certain developing regions. Nevertheless, the overall outlook remains highly positive, driven by an unwavering commitment to improving neonatal health outcomes.

Neonatal & Preterm Infant Enteral Feeding Devices Market: Comprehensive Growth Analysis (2019-2033)

This in-depth market research report provides a definitive analysis of the global Neonatal & Preterm Infant Enteral Feeding Devices market, meticulously examining its structure, trends, opportunities, and competitive landscape from 2019 to 2033. With a base year of 2025, the report offers precise forecasts and strategic insights for industry stakeholders, covering market size projected to reach several million, CAGR expected in the high single digits, and penetration rates poised for significant expansion. Leveraging high-volume keywords such as "neonatal feeding," "preterm infant nutrition," "enteral feeding pumps," "enteral feeding tubes," "pediatric medical devices," and "infant care solutions," this report is optimized for maximum search visibility and engagement within the healthcare industry.

Neonatal & Preterm Infant Enteral Feeding Devices Market Structure & Competitive Landscape

The Neonatal & Preterm Infant Enteral Feeding Devices market is characterized by a moderately concentrated landscape, with key players like Abbott, Nestle, Fresenius Kabi, Danone, and Cardinal Health holding significant market shares, estimated to be in the hundreds of millions. Innovation remains a primary driver, fueled by the increasing demand for safer, more user-friendly, and technologically advanced feeding solutions. Regulatory impacts, particularly stringent approvals for infant medical devices by bodies like the FDA and EMA, shape product development and market entry, leading to an estimated hundreds of regulatory hurdles annually. Product substitutes, while limited in specialized neonatal care, include parenteral nutrition, but the preference for enteral feeding due to its gastrointestinal benefits drives market growth. End-user segmentation predominantly favors hospitals, accounting for over 80% of the market value, with home care settings showing a substantial growth trajectory. Mergers and acquisitions (M&A) are a recurring theme, with an estimated volume of several M&A activities annually, as larger companies seek to consolidate their portfolios and expand their reach.

Neonatal & Preterm Infant Enteral Feeding Devices Market Trends & Opportunities

The global Neonatal & Preterm Infant Enteral Feeding Devices market is experiencing robust growth, projected to reach hundreds of millions in value by 2033, driven by an estimated CAGR of over 7%. This expansion is underpinned by a confluence of technological advancements, shifting consumer preferences, and evolving healthcare practices. Technological innovation is at the forefront, with the integration of smart features into enteral feeding pumps, such as real-time monitoring, data logging, and enhanced safety protocols. This includes the development of user-friendly interfaces and portable devices that facilitate a seamless transition from hospital to home care. Consumer preferences are increasingly leaning towards solutions that minimize infant discomfort and optimize nutrient delivery. Parents and caregivers are actively seeking devices that are easy to operate, reduce the risk of feeding-related complications, and promote the overall well-being of preterm infants. The growing awareness about the benefits of early and appropriate enteral nutrition for preterm infants, including improved gut health and neurodevelopmental outcomes, further fuels demand. Competitive dynamics are intensifying, with established players investing heavily in R&D to introduce next-generation feeding devices. Emerging companies are also carving out niches by focusing on specialized technologies or underserved market segments. Market penetration rates for advanced enteral feeding devices are expected to rise significantly, particularly in developing economies with improving healthcare infrastructure and increasing access to specialized neonatal care. The trend towards personalized nutrition, where feeding regimens are tailored to individual infant needs, presents a significant opportunity for device manufacturers to develop adaptable and intelligent feeding systems. The rising incidence of premature births globally, estimated to be in the millions annually, directly translates into a larger patient pool requiring specialized enteral feeding solutions. Furthermore, the increasing focus on reducing hospital readmission rates for preterm infants is driving the adoption of home-based enteral feeding solutions, presenting a substantial opportunity for market expansion in the home care segment. The development of specialized feeding tubes with improved biocompatibility and reduced risk of trauma during insertion is another area of significant innovation and market opportunity. The overall market outlook is highly positive, with ample room for growth driven by these multifaceted trends and opportunities.

Dominant Markets & Segments in Neonatal & Preterm Infant Enteral Feeding Devices

The global Neonatal & Preterm Infant Enteral Feeding Devices market is dominated by the Hospitals segment, which accounts for a significant majority of the market's value, estimated to be over 80%, with a market size in the hundreds of millions. This dominance is attributed to several key growth drivers.

- Infrastructure: Hospitals, particularly tertiary and quaternary care facilities, are equipped with the advanced infrastructure necessary for the administration of neonatal and preterm infant enteral feeding. This includes specialized neonatal intensive care units (NICUs) with dedicated feeding teams and the necessary support systems.

- Policies: Healthcare policies and guidelines that emphasize early enteral nutrition for preterm infants as a standard of care further bolster hospital-based demand. Reimbursement structures also largely favor hospital settings for initial treatment and device utilization.

- Complexity of Care: The critical care needs of preterm infants often necessitate constant monitoring and immediate intervention, which are best provided within a hospital environment. This includes the management of potential complications and the precise delivery of specialized formulas.

Within the Types segmentation, Enteral Feeding Pumps represent the largest and fastest-growing segment, with a market share estimated to be over 50% and a market size in the hundreds of millions.

- Technological Advancement: The continuous innovation in enteral feeding pump technology, including features like peristaltic mechanisms, high-precision flow rates, and integrated safety alarms, makes them indispensable for accurate and safe feeding.

- Ease of Use: Modern pumps are designed for user-friendliness, enabling healthcare professionals to manage complex feeding protocols efficiently.

- Data Integration: The ability of advanced pumps to integrate with electronic health records (EHRs) provides valuable data for monitoring infant progress and optimizing feeding strategies.

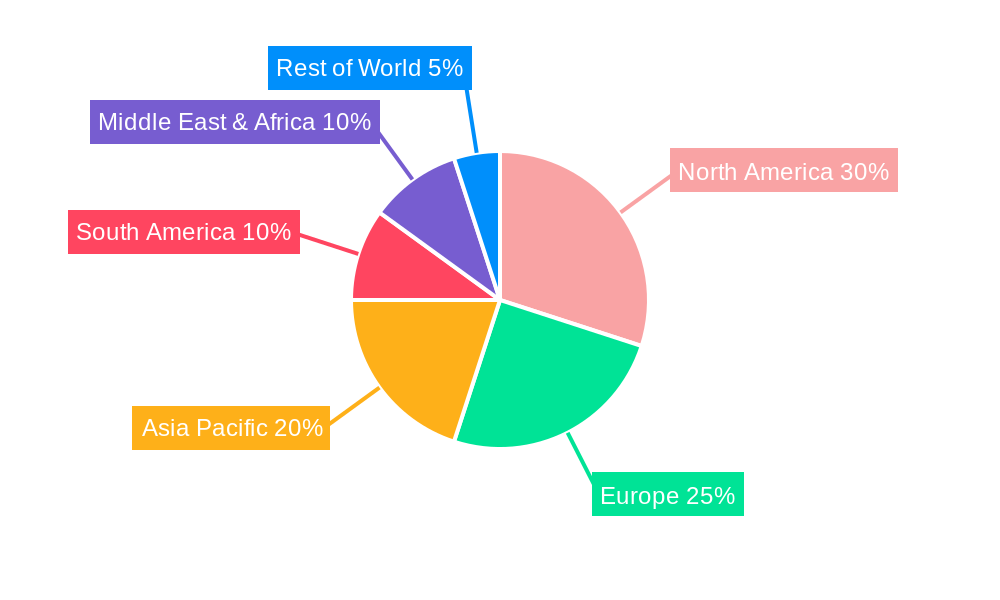

The North America region stands out as a leading market, with a market size in the hundreds of millions, driven by several factors:

- Advanced Healthcare System: The presence of a highly developed healthcare infrastructure, extensive NICU facilities, and a high concentration of specialized pediatricians and neonatologists.

- High Incidence of Premature Births: While global rates are concerning, North America consistently reports a significant number of preterm births annually, creating a substantial patient base.

- Technological Adoption: A rapid adoption rate for advanced medical technologies and devices, with a strong emphasis on innovation and patient outcomes.

- Favorable Reimbursement Policies: Robust reimbursement frameworks that support the use of advanced enteral feeding devices in both hospital and home care settings.

The Home Care segment, though smaller than hospitals, is exhibiting the highest growth rate, with an estimated CAGR exceeding 8%. This surge is driven by initiatives to reduce hospital stays, improve infant comfort, and empower parents with effective home-based feeding solutions, making it a critical area for future market expansion.

Neonatal & Preterm Infant Enteral Feeding Devices Product Analysis

The Neonatal & Preterm Infant Enteral Feeding Devices market is witnessing a wave of product innovations focused on enhanced safety, precision, and usability. Key advancements include smart enteral feeding pumps with integrated data logging and remote monitoring capabilities, designed to minimize feeding errors and improve patient outcomes. Enteral feeding tubes are evolving with improved biocompatibility, smaller diameters, and advanced tip designs to reduce infant discomfort and the risk of gastrointestinal trauma. The competitive advantage lies in the development of integrated systems that streamline the feeding process, from formula preparation to delivery and monitoring, catering to the critical needs of vulnerable preterm infants and offering peace of mind to caregivers.

Key Drivers, Barriers & Challenges in Neonatal & Preterm Infant Enteral Feeding Devices

Key Drivers: The Neonatal & Preterm Infant Enteral Feeding Devices market is propelled by several critical drivers. The increasing global incidence of preterm births, estimated in the millions annually, directly expands the patient pool requiring these specialized devices. Technological advancements, such as smart pumps with enhanced safety features and improved enteral feeding tubes, are crucial for accurate and safe nutrition delivery. Furthermore, growing awareness among healthcare professionals and parents about the benefits of enteral nutrition for infant development and health is a significant impetus. Supportive government initiatives and favorable reimbursement policies in many regions also contribute to market growth.

Barriers & Challenges: Despite the positive outlook, the market faces notable barriers and challenges. Stringent regulatory approval processes for medical devices used in neonates can lead to lengthy product development cycles and increased costs, with an estimated hundreds of regulatory submissions annually. Supply chain disruptions, particularly in the wake of global events, can impact the availability of raw materials and finished products, leading to potential shortages valued in the millions. The high cost of advanced feeding devices can also be a barrier to adoption, especially in resource-limited settings. Intense competition among established players and the emergence of new entrants can lead to price pressures, impacting profit margins, estimated to be around 15-20% for certain devices.

Growth Drivers in the Neonatal & Preterm Infant Enteral Feeding Devices Market

The growth of the Neonatal & Preterm Infant Enteral Feeding Devices market is significantly driven by the escalating number of preterm births worldwide, estimated in the millions each year, creating a persistent and growing demand for specialized feeding solutions. Technological innovation is a cornerstone, with the continuous development of more sophisticated enteral feeding pumps offering enhanced precision, safety features like anti-free-flow protection, and data connectivity for better patient management. The increasing emphasis on early and optimized enteral nutrition as a critical component of neonatal intensive care, contributing to improved gut health and long-term developmental outcomes, is a major driving force. Furthermore, supportive government healthcare policies and improving reimbursement landscapes in various countries are fostering wider adoption of these essential medical devices, making them more accessible.

Challenges Impacting Neonatal & Preterm Infant Enteral Feeding Devices Growth

Several challenges can impact the growth trajectory of the Neonatal & Preterm Infant Enteral Feeding Devices market. The stringent and often lengthy regulatory approval processes for infant medical devices, requiring extensive clinical trials and documentation, can significantly delay market entry and increase development costs, with an estimated expenditure of several million per approval. Supply chain vulnerabilities, as observed during recent global disruptions, can lead to shortages and price volatility for critical components and finished products, affecting market availability and costing millions in lost revenue. The high initial investment and ongoing maintenance costs associated with advanced enteral feeding systems can pose a significant barrier to adoption, especially for smaller healthcare facilities and in emerging economies. Intense competition also exerts downward pressure on pricing, potentially impacting profitability for manufacturers.

Key Players Shaping the Neonatal & Preterm Infant Enteral Feeding Devices Market

- Fresenius Kabi

- Danone

- Cardinal Health

- Nestle

- Avanos Medical

- B. Braun

- Abbott

- Moog

- Applied Medical Technology

- Cook Medical

- Boston Scientific

- Vygon

- ConMed

- BD

- Alcor Scientific

Significant Neonatal & Preterm Infant Enteral Feeding Devices Industry Milestones

- 2019: Launch of advanced enteral feeding pumps with AI-driven feeding protocols, enhancing precision and reducing complications.

- 2020: Introduction of novel, biocompatible feeding tubes designed for enhanced infant comfort and reduced insertion trauma.

- 2021: Increased M&A activity as major players sought to consolidate market share and expand product portfolios in the neonatal segment.

- 2022: Significant advancements in wireless monitoring capabilities for enteral feeding devices, enabling remote patient assessment.

- 2023: Emergence of user-friendly, portable enteral feeding devices facilitating seamless transition to home care for preterm infants.

- 2024: Growing adoption of smart feeding systems integrating with electronic health records for comprehensive infant nutritional management.

Future Outlook for Neonatal & Preterm Infant Enteral Feeding Devices Market

The future outlook for the Neonatal & Preterm Infant Enteral Feeding Devices market is exceptionally promising, with continued expansion driven by ongoing innovation and increasing global demand. Strategic opportunities lie in the development of more personalized and intelligent feeding systems that can adapt to individual infant needs in real-time. The burgeoning home care segment presents a substantial growth catalyst, fueled by the trend towards de-hospitalization and empowering parents with advanced, yet user-friendly, feeding solutions. Investments in emerging markets, coupled with a focus on cost-effectiveness and accessibility, will be crucial for capturing a larger market share. The integration of telemedicine and remote monitoring technologies will further revolutionize infant enteral feeding, ensuring optimal outcomes for preterm infants and contributing to sustained market growth projected to be in the hundreds of millions.

Neonatal & Preterm Infant Enteral Feeding Devices Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Home Care

-

2. Types

- 2.1. Enteral Feeding Pumps

- 2.2. Enteral Feeding Tubes

- 2.3. Other

Neonatal & Preterm Infant Enteral Feeding Devices Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Neonatal & Preterm Infant Enteral Feeding Devices REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Neonatal & Preterm Infant Enteral Feeding Devices Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Home Care

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Enteral Feeding Pumps

- 5.2.2. Enteral Feeding Tubes

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Neonatal & Preterm Infant Enteral Feeding Devices Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Home Care

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Enteral Feeding Pumps

- 6.2.2. Enteral Feeding Tubes

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Neonatal & Preterm Infant Enteral Feeding Devices Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Home Care

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Enteral Feeding Pumps

- 7.2.2. Enteral Feeding Tubes

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Neonatal & Preterm Infant Enteral Feeding Devices Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Home Care

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Enteral Feeding Pumps

- 8.2.2. Enteral Feeding Tubes

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Home Care

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Enteral Feeding Pumps

- 9.2.2. Enteral Feeding Tubes

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Home Care

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Enteral Feeding Pumps

- 10.2.2. Enteral Feeding Tubes

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fresenius Kabi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danone

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cardinal Health

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nestle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avanos Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 B. Braun

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbott

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Moog

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Applied Medical Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cook Medical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Boston Scientific

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vygon

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ConMed

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BD

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Alcor Scientific

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Fresenius Kabi

List of Figures

- Figure 1: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Application 2024 & 2032

- Figure 4: North America Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Application 2024 & 2032

- Figure 5: North America Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Types 2024 & 2032

- Figure 8: North America Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Types 2024 & 2032

- Figure 9: North America Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Country 2024 & 2032

- Figure 12: North America Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Country 2024 & 2032

- Figure 13: North America Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Application 2024 & 2032

- Figure 16: South America Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Application 2024 & 2032

- Figure 17: South America Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Types 2024 & 2032

- Figure 20: South America Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Types 2024 & 2032

- Figure 21: South America Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Country 2024 & 2032

- Figure 24: South America Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Country 2024 & 2032

- Figure 25: South America Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Application 2024 & 2032

- Figure 29: Europe Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Types 2024 & 2032

- Figure 33: Europe Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Country 2024 & 2032

- Figure 37: Europe Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Neonatal & Preterm Infant Enteral Feeding Devices Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Neonatal & Preterm Infant Enteral Feeding Devices Volume K Forecast, by Country 2019 & 2032

- Table 81: China Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Neonatal & Preterm Infant Enteral Feeding Devices Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Neonatal & Preterm Infant Enteral Feeding Devices?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Neonatal & Preterm Infant Enteral Feeding Devices?

Key companies in the market include Fresenius Kabi, Danone, Cardinal Health, Nestle, Avanos Medical, B. Braun, Abbott, Moog, Applied Medical Technology, Cook Medical, Boston Scientific, Vygon, ConMed, BD, Alcor Scientific.

3. What are the main segments of the Neonatal & Preterm Infant Enteral Feeding Devices?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Neonatal & Preterm Infant Enteral Feeding Devices," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Neonatal & Preterm Infant Enteral Feeding Devices report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Neonatal & Preterm Infant Enteral Feeding Devices?

To stay informed about further developments, trends, and reports in the Neonatal & Preterm Infant Enteral Feeding Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence