Key Insights

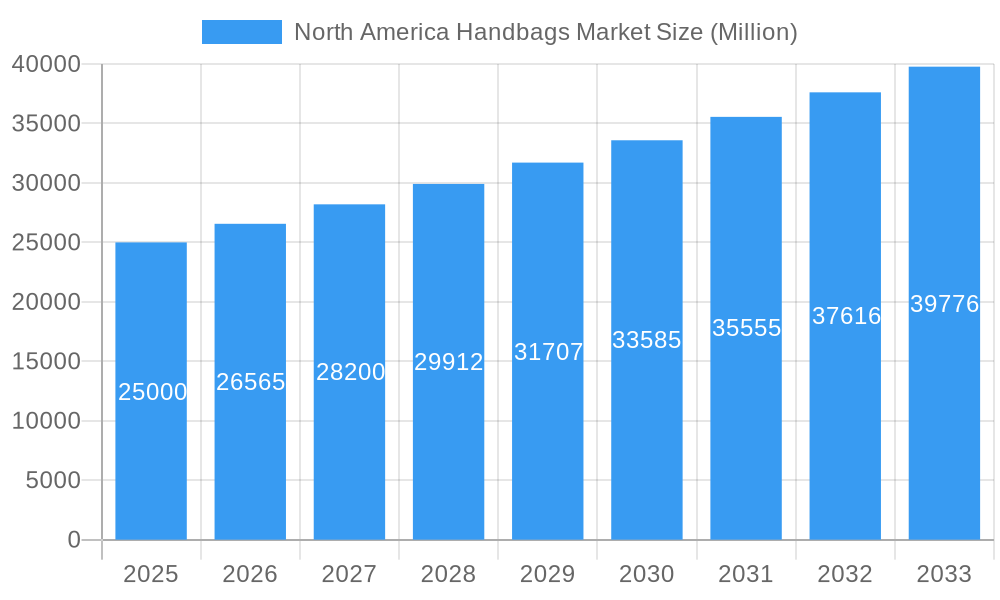

The North American handbag market, valued at approximately $14.91 billion in 2025, is projected for significant growth through 2033, with an estimated Compound Annual Growth Rate (CAGR) of 9.4%. Key growth drivers include rising disposable incomes among millennials and Gen Z, boosting demand for premium and luxury handbags across various styles like satchels, clutches, and tote bags. The expansion of e-commerce and online shopping platforms further enhances market accessibility for both established brands such as LVMH and Kering, and emerging labels like Pixie Mood. Evolving fashion trends and the continuous introduction of innovative designs and materials also contribute to market dynamism. The market is segmented by distribution channel (online and offline) and product type, catering to diverse consumer preferences and budgets. The competitive landscape is characterized by a blend of established luxury houses, recognized brands, and emerging independent designers, fostering both innovation and brand loyalty.

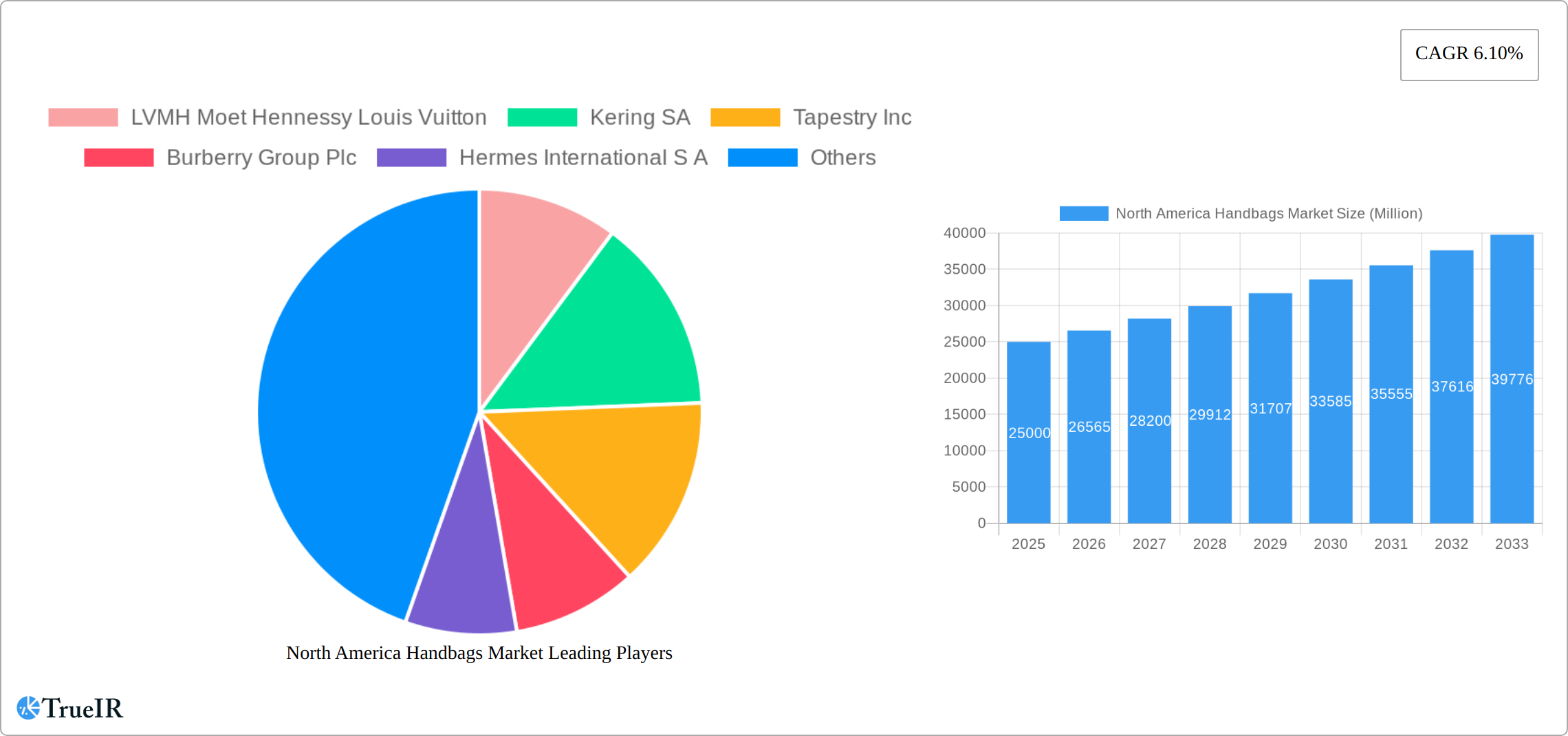

North America Handbags Market Market Size (In Billion)

Challenges influencing the market include fluctuations in raw material costs, particularly for premium materials like leather, which can affect profitability and pricing. The growing demand for sustainable and ethically sourced products also necessitates brands adopting more responsible sourcing practices. Counterfeit products remain a concern, requiring brands to prioritize brand protection and consumer education. Despite these hurdles, the North American handbag market is expected to maintain an upward trajectory, driven by consumer demand and strategic initiatives from market players. The sustained growth in online sales and the increasing emphasis on premiumization will be critical in shaping the market's future.

North America Handbags Market Company Market Share

North America Handbags Market Analysis: Size, Trends, and Forecast (2025-2033)

This comprehensive report offers a detailed analysis of the North American handbag market, providing critical insights for businesses, investors, and market researchers. Utilizing historical data from 2019-2024 and a base year of 2025, this report examines market size, segmentation, competitive dynamics, and future growth projections through 2033. The market is forecasted to reach a substantial valuation by 2033, exhibiting a robust CAGR during the forecast period.

North America Handbags Market Structure & Competitive Landscape

The North America handbags market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Major players, including LVMH Moet Hennessy Louis Vuitton, Kering SA, Tapestry Inc, Burberry Group Plc, Hermes International S A, Tory Burch LLC, Pixie Mood, Michael Kors (USA) Inc, Fossil Group Inc, and Prada Holding SpA, drive innovation through product diversification, marketing campaigns, and strategic acquisitions. However, the presence of numerous smaller players and emerging brands adds competitive intensity.

Regulatory impacts, including labeling requirements and import/export regulations, influence market dynamics. Product substitutes, such as backpacks and crossbody bags, exert pressure on specific segments. End-user segmentation, based on demographics, lifestyle, and purchasing power, is crucial for targeted marketing and product development. M&A activity has been moderate in recent years, with xx significant transactions recorded between 2019 and 2024, primarily focused on expanding product portfolios and strengthening market presence.

- Market Concentration: HHI estimated at xx.

- Innovation Drivers: Product diversification, technological advancements in materials and manufacturing.

- Regulatory Impacts: Labeling, import/export regulations.

- Product Substitutes: Backpacks, crossbody bags.

- End-User Segmentation: Demographics, lifestyle, purchasing power.

- M&A Trends: xx significant transactions between 2019 and 2024.

North America Handbags Market Market Trends & Opportunities

The North American handbags market exhibits robust growth, fueled by rising disposable incomes, evolving fashion trends, and the burgeoning online retail sector. Market valuation reached an estimated XX million in 2025 and is projected to achieve XX million by 2033, representing a significant expansion. This growth is significantly shaped by technological advancements, including the integration of sustainable materials and personalized design tools, catering to the increasing demand for ethical and unique products. Consumer preferences are shifting towards ethically sourced, uniquely designed, and versatile handbags. The competitive landscape is dynamic, featuring established luxury brands and emerging direct-to-consumer (DTC) brands vying for market share. This creates opportunities for innovative product development, strategic niche market penetration, and mutually beneficial partnerships. The market penetration rate for online sales is projected to reach XX% by 2033, reflecting a strong consumer preference for convenient e-commerce channels. Furthermore, the influence of social media marketing and influencer collaborations cannot be overstated in shaping consumer perceptions and driving sales.

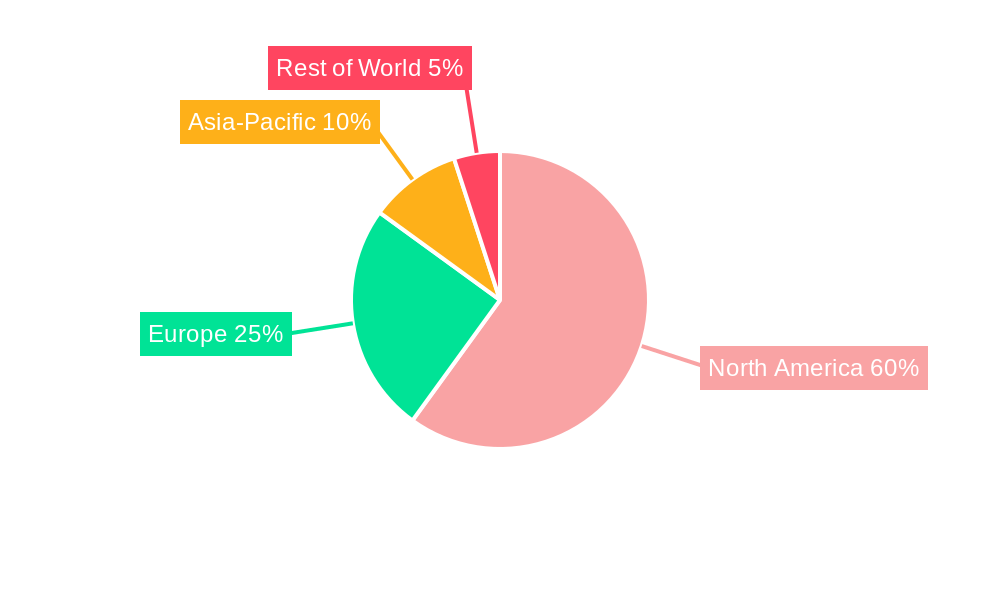

Dominant Markets & Segments in North America Handbags Market

The United States dominates the North America handbags market, owing to its large consumer base and high purchasing power. Within the market, the online retail channel displays significant growth potential, driven by the convenience and accessibility it offers. Furthermore, the tote bag segment continues to maintain a dominant market position, although satchel and sling bag segments also show considerable growth.

- Key Growth Drivers (United States):

- Large consumer base with high disposable incomes

- Established retail infrastructure

- Strong fashion-conscious culture

- Key Growth Drivers (Online Stores):

- Convenience and accessibility

- Wider product selection

- Targeted advertising and personalized recommendations

- Key Growth Drivers (Tote Bags):

- Versatility and practicality

- Wide range of styles and designs

- Suitable for various occasions

North America Handbags Market Product Analysis

Product innovation in the North America handbags market focuses on sustainable materials, such as recycled leather and vegan alternatives, along with technological integrations such as RFID blocking and smart features. The emphasis is on enhancing functionality, durability, and aesthetic appeal to meet diverse consumer needs and preferences. Competitive advantages are derived from unique designs, brand recognition, and superior quality. Market fit is evaluated based on consumer demand, price point, distribution channels, and brand positioning.

Key Drivers, Barriers & Challenges in North America Handbags Market

Key Drivers:

Rising disposable incomes, evolving fashion trends, expanding e-commerce, and the increasing popularity of luxury goods are propelling market growth. Technological advancements in materials and manufacturing processes also contribute significantly.

Key Challenges:

Supply chain disruptions, increasing raw material costs, intense competition, and fluctuating exchange rates pose significant challenges. Regulatory changes, particularly regarding sustainable practices, also present complexities for businesses. These challenges can negatively impact production costs, profitability, and overall market expansion. For example, a 10% increase in raw material costs could translate to a xx Million reduction in industry profits.

Growth Drivers in the North America Handbags Market Market

The North American handbags market is primarily driven by increased consumer spending, particularly amongst millennials and Gen Z, who exhibit a strong preference for fashion accessories. The proliferation of e-commerce platforms and the expansion of online retail channels contribute significantly to wider product reach and accessibility. The growing adoption of sustainable and ethical production practices, driven by increasing consumer awareness and a heightened sense of social responsibility, is another crucial growth catalyst. This includes demand for transparency in supply chains and the use of recycled or eco-friendly materials.

Challenges Impacting North America Handbags Market Growth

Key challenges impacting market growth include supply chain disruptions, leading to increased lead times and production costs. Fluctuating raw material prices, particularly for leather and other high-quality materials, also exert pressure on profitability. Competition from both established players and emerging brands intensifies pressure to maintain pricing competitiveness and innovate rapidly.

Key Players Shaping the North America Handbags Market Market

Significant North America Handbags Market Industry Milestones

- March 2022: Aranyani, an Indian luxury handbag brand, expands into the US market.

- September 2021: Pixie Mood redesigns its website and launches its Fall/Winter '21 collection.

- October 2020: Schutz launches its handbags line in the United States.

Future Outlook for North America Handbags Market Market

The North American handbags market is poised for sustained growth, driven by consistent consumer demand, ongoing technological advancements, and the accelerating adoption of sustainable and ethical business practices. Significant opportunities exist for businesses to leverage emerging trends, such as personalized design capabilities, innovative and sustainable materials, and sophisticated e-commerce strategies that enhance the customer experience. The market's continued expansion will be influenced by economic growth, evolving consumer preferences, and disruptive technological innovations, presenting substantial potential for market players to increase their market share and improve profitability. The integration of augmented reality (AR) and virtual reality (VR) technologies for online shopping experiences is also expected to play a significant role in future market growth.

North America Handbags Market Segmentation

-

1. Type

- 1.1. Satchel

- 1.2. Clutch

- 1.3. Tote Bag

- 1.4. Sling Bag

- 1.5. Others

-

2. Distibution Channel

- 2.1. Online Stores

- 2.2. Offline Stores

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Handbags Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Handbags Market Regional Market Share

Geographic Coverage of North America Handbags Market

North America Handbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Luxury Handbags

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satchel

- 5.1.2. Clutch

- 5.1.3. Tote Bag

- 5.1.4. Sling Bag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Online Stores

- 5.2.2. Offline Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satchel

- 6.1.2. Clutch

- 6.1.3. Tote Bag

- 6.1.4. Sling Bag

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Online Stores

- 6.2.2. Offline Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satchel

- 7.1.2. Clutch

- 7.1.3. Tote Bag

- 7.1.4. Sling Bag

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Online Stores

- 7.2.2. Offline Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satchel

- 8.1.2. Clutch

- 8.1.3. Tote Bag

- 8.1.4. Sling Bag

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Online Stores

- 8.2.2. Offline Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Satchel

- 9.1.2. Clutch

- 9.1.3. Tote Bag

- 9.1.4. Sling Bag

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Online Stores

- 9.2.2. Offline Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LVMH Moet Hennessy Louis Vuitton

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kering SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tapestry Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Burberry Group Plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hermes International S A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tory Burch LLC*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pixie Mood

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Michael Kors (USA) Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fossil Group Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prada Holding SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 LVMH Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: North America Handbags Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Handbags Market Share (%) by Company 2025

List of Tables

- Table 1: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Handbags Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 7: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 11: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 15: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 19: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Handbags Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the North America Handbags Market?

Key companies in the market include LVMH Moet Hennessy Louis Vuitton, Kering SA, Tapestry Inc, Burberry Group Plc, Hermes International S A, Tory Burch LLC*List Not Exhaustive, Pixie Mood, Michael Kors (USA) Inc, Fossil Group Inc, Prada Holding SpA.

3. What are the main segments of the North America Handbags Market?

The market segments include Type, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors.

6. What are the notable trends driving market growth?

Increase in Demand for Luxury Handbags.

7. Are there any restraints impacting market growth?

Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus.

8. Can you provide examples of recent developments in the market?

In March 2022, Aranyani, an Indian luxury handbag brand expanded its presence in the United States and launched its products in New York at the Consulate General of India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Handbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Handbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Handbags Market?

To stay informed about further developments, trends, and reports in the North America Handbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence