Key Insights

The North American home fitness equipment market is poised for substantial growth, projected at a CAGR of 11.6%. This expansion is driven by heightened health consciousness, the demand for convenient at-home exercise solutions, and continuous innovation in fitness technology. Key product categories, including treadmills, ellipticals, stationary bikes, and strength training apparatus, are experiencing strong consumer interest. E-commerce platforms are becoming increasingly dominant, facilitating market penetration and sales. Major players like Peloton, NordicTrack, and Life Fitness are strengthening their market positions through cutting-edge products and effective marketing strategies. Despite challenges such as price sensitivity and intense competition, the burgeoning popularity of connected fitness and subscription services presents significant avenues for future market development and expansion. The estimated market size for 2025 is $19.98 billion.

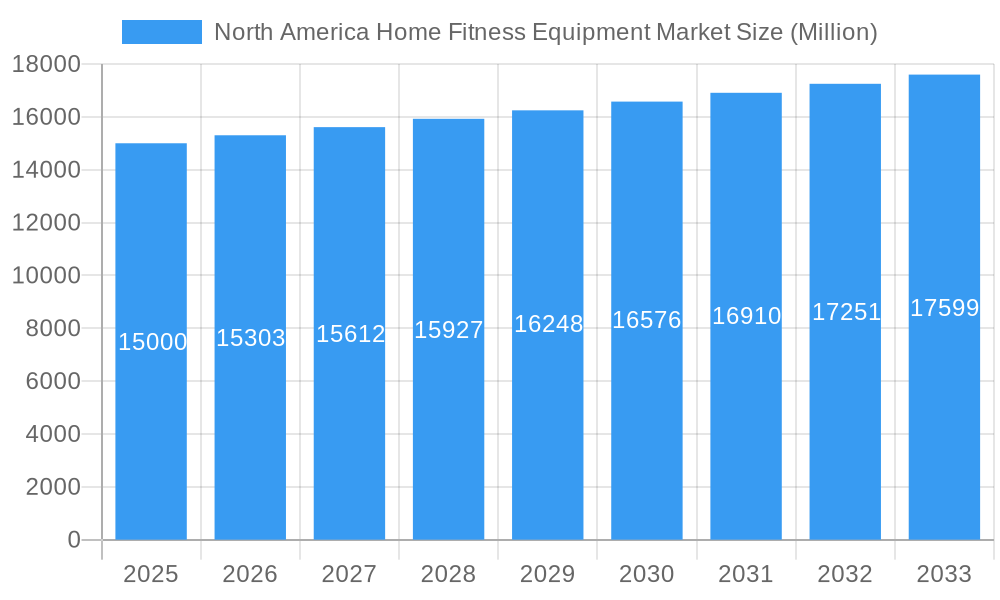

North America Home Fitness Equipment Market Market Size (In Billion)

The United States, Canada, and Mexico form the core of the North American home fitness equipment market, demonstrating a strong commitment to personal health and wellness. This regional focus translates to higher adoption rates for fitness equipment. Future market growth will be fueled by the integration of smart technologies, the development of personalized fitness programs, and a growing consumer preference for high-end, feature-rich equipment. The increasing adoption of virtual fitness classes and interactive workout experiences will further accelerate market expansion.

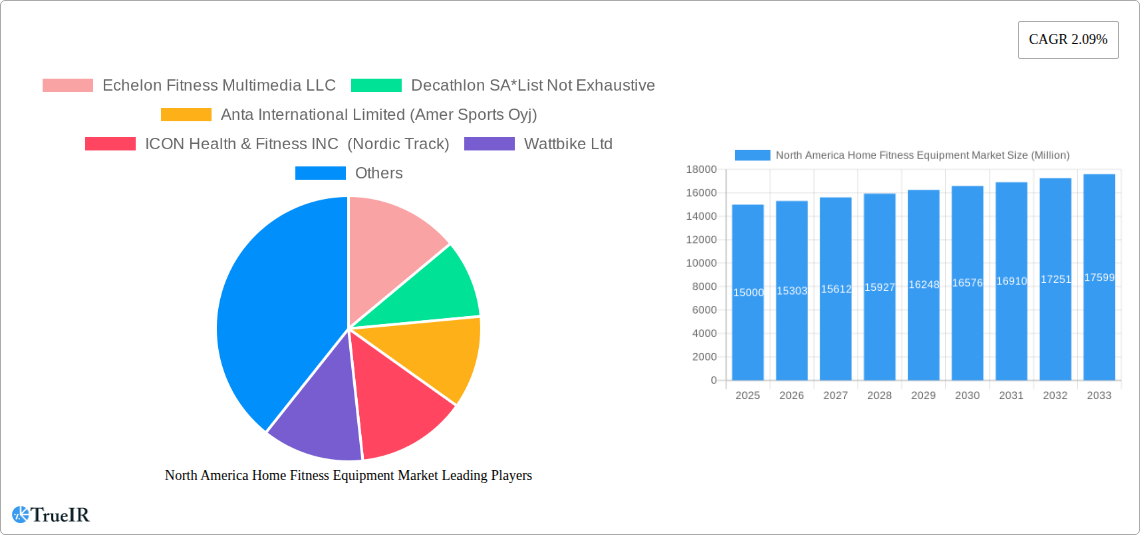

North America Home Fitness Equipment Market Company Market Share

North America Home Fitness Equipment Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America home fitness equipment market, covering the period from 2019 to 2033. It examines market size, growth drivers, competitive dynamics, and future opportunities within this dynamic sector. The report offers invaluable insights for industry stakeholders, investors, and anyone seeking a deeper understanding of this rapidly evolving market. With a focus on key segments like treadmills, elliptical machines, and connected fitness solutions, this report is an essential resource for strategic decision-making.

North America Home Fitness Equipment Market Structure & Competitive Landscape

The North America home fitness equipment market exhibits a moderately concentrated structure, with several major players commanding significant market share. However, the presence of numerous smaller niche players and the continuous emergence of innovative startups fosters a dynamic competitive landscape. The market’s competitive intensity is driven by factors including product innovation, pricing strategies, brand recognition, and distribution channel expansion. Concentration ratios (e.g., CR4 and CR8) indicate xx% and xx% market share respectively, reflecting a balance between established players and emerging competitors.

- Innovation Drivers: Technological advancements, such as connected fitness features (e.g., interactive apps, virtual classes) and improvements in product ergonomics and design, are crucial innovation drivers.

- Regulatory Impacts: Safety standards and regulations related to product durability and performance influence market dynamics. Compliance costs impact profit margins, necessitating proactive compliance strategies.

- Product Substitutes: Outdoor activities, gym memberships, and online fitness programs pose challenges as viable alternatives. Market players are striving to offer unique value propositions to retain market share.

- End-User Segmentation: The market caters to a wide demographic, including fitness enthusiasts, casual users, and health-conscious individuals. Segmentation by age, income, and fitness goals is vital for effective product positioning and marketing.

- M&A Trends: The market has witnessed several mergers and acquisitions (M&A) activities in recent years, with xx M&A deals recorded between 2019 and 2024. This reflects the consolidation trend and the strategic pursuit of growth through acquisition. The value of these deals has totaled approximately USD xx Million.

North America Home Fitness Equipment Market Market Trends & Opportunities

The North America home fitness equipment market is experiencing robust growth, projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Increased awareness of health and wellness, coupled with the rising popularity of home workouts, has significantly boosted demand. The COVID-19 pandemic played a pivotal role, accelerating the shift towards home-based fitness solutions. Technological advancements, such as the integration of smart features and connected fitness platforms, have enhanced the user experience and expanded the market’s appeal.

Consumer preferences are shifting towards versatile, space-saving equipment, and personalized fitness experiences. This trend necessitates continuous innovation and product diversification among market players. The market penetration rate for connected fitness equipment is currently estimated at xx%, expected to grow significantly over the forecast period. Competitive dynamics are characterized by intense rivalry, with companies focusing on product differentiation, branding, and strategic partnerships to gain a competitive edge.

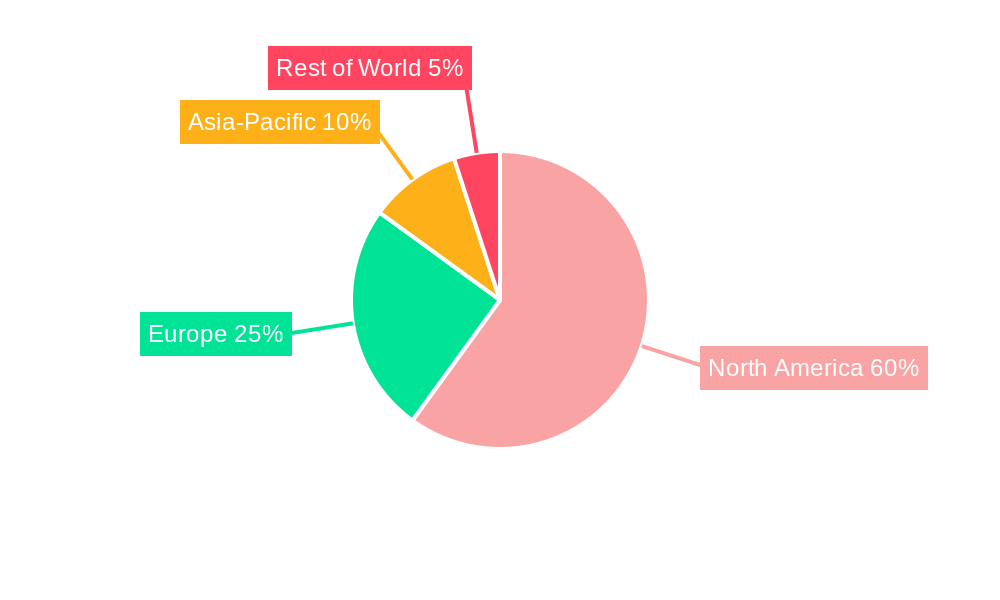

Dominant Markets & Segments in North America Home Fitness Equipment Market

The United States remains the dominant market within North America, accounting for the largest share of revenue, followed by Canada and Mexico.

Product Type:

- Treadmills: Remain the most popular segment, driven by their versatility and effectiveness for cardiovascular exercise. Growth is fueled by the integration of innovative features such as interactive screens and virtual running experiences.

- Stationary Cycles: Exhibit strong growth, owing to their effectiveness in cardiovascular workouts and suitability for individuals of various fitness levels.

- Elliptical Machines: Enjoy consistent demand, attracting customers due to their low-impact nature and suitability for individuals with joint issues.

- Strength Training Equipment: Demonstrate consistent market penetration, driven by the increased focus on building strength and muscle mass.

- Rowing Machines: This segment is experiencing notable growth, influenced by the rising interest in HIIT training and full-body workouts.

Distribution Channel:

- Online Retail Stores: Show significant growth owing to their ease of access and competitive pricing. Amazon, among others, plays a crucial role.

- Offline Retail Stores: Maintain a substantial market share, benefiting from the in-person experience and immediate product availability. Dick's Sporting Goods and other large sporting goods retailers are major players.

- Direct Selling: Is gaining traction, facilitated by the rise of subscription-based fitness programs offered directly by manufacturers such as Peloton.

Key Growth Drivers:

- The increasing prevalence of chronic diseases is fueling demand for home fitness solutions to mitigate health risks.

- Rising disposable incomes and improved living standards are allowing consumers to invest in high-quality home fitness equipment.

- Government initiatives promoting health and wellness are encouraging individuals to adopt healthier lifestyles and engage in regular physical activity.

North America Home Fitness Equipment Market Product Analysis

The market features a diverse range of products, encompassing treadmills, elliptical trainers, stationary bikes, rowing machines, and strength training equipment. Technological advancements have resulted in significant improvements in product design, functionality, and connectivity. Many products now incorporate smart features such as interactive screens, personalized training programs, and data tracking capabilities, enhancing user engagement and effectiveness. The competitive advantage lies in offering innovative features, superior quality, and exceptional user experiences. Market fit is determined by a product's alignment with consumer preferences, such as convenience, space efficiency, and personalized fitness goals.

Key Drivers, Barriers & Challenges in North America Home Fitness Equipment Market

Key Drivers:

- Increased health awareness and the growing prevalence of sedentary lifestyles are driving demand for home fitness solutions.

- Technological advancements, such as connected fitness and virtual reality features, are enhancing user experience and product appeal.

- Government initiatives promoting physical activity and wellness are indirectly boosting market growth.

Challenges:

- Supply chain disruptions have impacted the availability and pricing of components, impacting manufacturing and delivery timelines.

- High manufacturing and transportation costs affect profit margins and product prices, potentially limiting consumer accessibility.

- Intense competition from established and emerging players requires continuous innovation and differentiation to maintain market share. The market is highly competitive, with several established brands battling for market share.

Growth Drivers in the North America Home Fitness Equipment Market Market

The market is propelled by rising health consciousness, technological innovations such as smart home gym solutions, and supportive government initiatives promoting fitness. Consumer preference for convenient at-home workout options further fuels growth.

Challenges Impacting North America Home Fitness Equipment Market Growth

High product costs, supply chain vulnerabilities, and intense competition among manufacturers pose challenges. Evolving consumer preferences also necessitate continuous product innovation and adaptation.

Key Players Shaping the North America Home Fitness Equipment Market Market

- Echelon Fitness Multimedia LLC

- Decathlon SA

- Anta International Limited (Amer Sports Oyj)

- ICON Health & Fitness INC (Nordic Track)

- Wattbike Ltd

- Johnson Health Tech Co Ltd

- Nautilus Inc

- Technogym SpA

- TRUE Fitness

- Peloton Interactive Inc (Precor Incorporated)

- SportsArt

- KPS Capital Partners (Life Fitness)

Significant North America Home Fitness Equipment Market Industry Milestones

- November 2022: Nautilus Inc. launched the Bowflex BXT8J Treadmill with JRNY adaptive fitness app.

- September 2022: Peloton Interactive Inc. introduced a range of rowing machines and partnered with Amazon.

- June 2022: SportsArt added the G866 Front-Drive Elliptical to their ECO-POWR line.

Future Outlook for North America Home Fitness Equipment Market Market

The North America home fitness equipment market is poised for continued growth, driven by ongoing technological advancements, the increasing popularity of connected fitness, and the sustained focus on health and wellness. The market presents significant opportunities for manufacturers who can offer innovative, user-friendly products that cater to evolving consumer preferences. Strategic partnerships, expansion into new markets, and the development of value-added services will be critical for maintaining a competitive edge.

North America Home Fitness Equipment Market Segmentation

-

1. Product Type

- 1.1. Treadmills

- 1.2. Elliptical Machines

- 1.3. Stationary Cycles

- 1.4. Rowing Machines

- 1.5. Strength Training Equipment

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

- 2.3. Direct Selling

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Home Fitness Equipment Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Home Fitness Equipment Market Regional Market Share

Geographic Coverage of North America Home Fitness Equipment Market

North America Home Fitness Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Private Label and Indigenous Brands; Internet Penetration Proliferated the eCommerce Sales of Hair Care Products

- 3.3. Market Restrains

- 3.3.1. Counterfeiting In Hair Care Products

- 3.4. Market Trends

- 3.4.1. Consumers’ Interest in Customized Workout Regimes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Treadmills

- 5.1.2. Elliptical Machines

- 5.1.3. Stationary Cycles

- 5.1.4. Rowing Machines

- 5.1.5. Strength Training Equipment

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.2.3. Direct Selling

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Treadmills

- 6.1.2. Elliptical Machines

- 6.1.3. Stationary Cycles

- 6.1.4. Rowing Machines

- 6.1.5. Strength Training Equipment

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.2.3. Direct Selling

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Treadmills

- 7.1.2. Elliptical Machines

- 7.1.3. Stationary Cycles

- 7.1.4. Rowing Machines

- 7.1.5. Strength Training Equipment

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.2.3. Direct Selling

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Treadmills

- 8.1.2. Elliptical Machines

- 8.1.3. Stationary Cycles

- 8.1.4. Rowing Machines

- 8.1.5. Strength Training Equipment

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.2.3. Direct Selling

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Treadmills

- 9.1.2. Elliptical Machines

- 9.1.3. Stationary Cycles

- 9.1.4. Rowing Machines

- 9.1.5. Strength Training Equipment

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.2.3. Direct Selling

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Echelon Fitness Multimedia LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Decathlon SA*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Anta International Limited (Amer Sports Oyj)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ICON Health & Fitness INC (Nordic Track)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Wattbike Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Johnson Health Tech Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nautilus Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Technogym SpA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TRUE Fitness

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Peloton Interactive Inc (Precor Incorporated)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SportsArt

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 KPS Capital Partners (Life Fitness)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Echelon Fitness Multimedia LLC

List of Figures

- Figure 1: North America Home Fitness Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Home Fitness Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: North America Home Fitness Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Home Fitness Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 19: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 35: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Fitness Equipment Market?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the North America Home Fitness Equipment Market?

Key companies in the market include Echelon Fitness Multimedia LLC, Decathlon SA*List Not Exhaustive, Anta International Limited (Amer Sports Oyj), ICON Health & Fitness INC (Nordic Track), Wattbike Ltd, Johnson Health Tech Co Ltd, Nautilus Inc, Technogym SpA, TRUE Fitness, Peloton Interactive Inc (Precor Incorporated), SportsArt, KPS Capital Partners (Life Fitness).

3. What are the main segments of the North America Home Fitness Equipment Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Private Label and Indigenous Brands; Internet Penetration Proliferated the eCommerce Sales of Hair Care Products.

6. What are the notable trends driving market growth?

Consumers’ Interest in Customized Workout Regimes.

7. Are there any restraints impacting market growth?

Counterfeiting In Hair Care Products.

8. Can you provide examples of recent developments in the market?

In November 2022, Nautilus Inc. launched the Bowflex BXT8J Treadmill with JRNY adaptive fitness app in limited retail outlets such as Amazon, Dick's Sporting Goods, Academy, Best Buy, and Nebraska Furniture Mart. The product has a wide range of running belts, a Comfort Tech cushioning system, speeds up to 12 mph, and a 15% motorized incline.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Fitness Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Fitness Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Fitness Equipment Market?

To stay informed about further developments, trends, and reports in the North America Home Fitness Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence