Key Insights

The Northern Virginia data center market is experiencing explosive growth, fueled by a confluence of factors. Its strategic location, boasting robust network infrastructure and proximity to major technology hubs, makes it a highly desirable location for hyperscale providers, cloud giants, and enterprises alike. The region benefits from access to abundant renewable energy sources, further incentivizing data center development. The demand is driven by the increasing adoption of cloud computing, big data analytics, artificial intelligence, and the burgeoning Internet of Things (IoT), all of which require significant data storage and processing capabilities. Furthermore, government agencies and defense contractors contribute significantly to the market's expansion due to the region's proximity to Washington D.C. and its robust security infrastructure. While land availability and power constraints pose challenges, ongoing infrastructure investments, such as upgrades to power grids and fiber optic networks, are mitigating these limitations. The market is segmented by data center size (small, medium, large, massive, mega), tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption (utilized, colocation), and end-user sector (cloud & IT, telecom, media & entertainment, government, BFSI, manufacturing, e-commerce, etc.). The competitive landscape is robust, with established players like Equinix, Digital Realty, and CyrusOne competing alongside newer entrants.

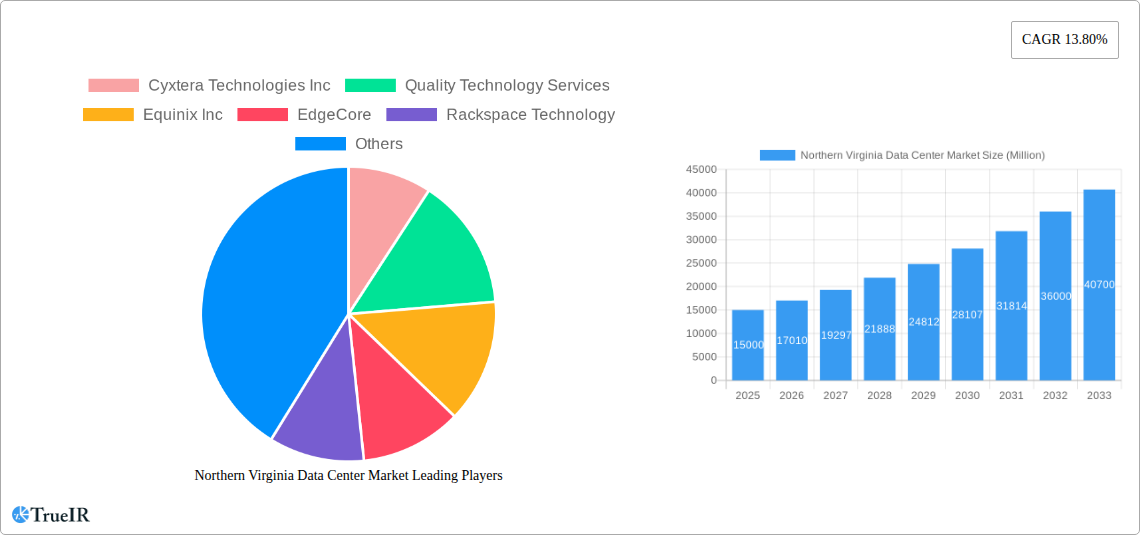

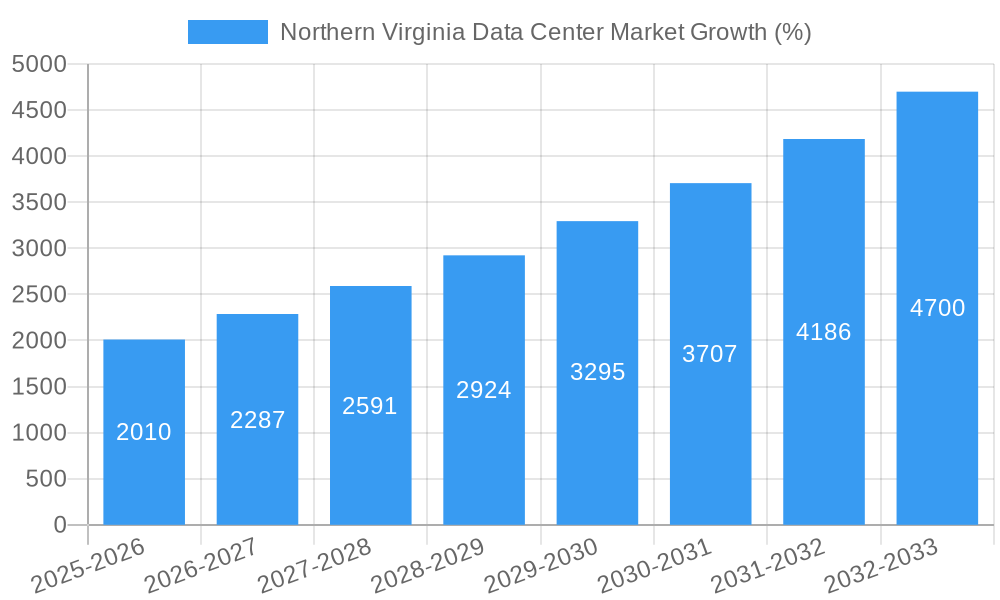

The projected CAGR of 13.80% indicates significant sustained growth potential throughout the forecast period (2025-2033). This growth trajectory is expected to be further amplified by continued investments in 5G technology and edge computing, which will further decentralize data processing and create demand for smaller, strategically located data centers. However, factors such as increasing energy costs, regulatory hurdles, and the potential for oversupply in specific sub-segments pose potential risks. Nevertheless, the overall outlook remains overwhelmingly positive, with Northern Virginia firmly established as a dominant force in the global data center market. The market is expected to see a shift towards larger, more energy-efficient data centers, particularly in the hyperscale segment, driven by the increasing demand for capacity from cloud providers and other large enterprises.

Northern Virginia Data Center Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the thriving Northern Virginia data center market, offering invaluable insights for investors, operators, and industry professionals. Leveraging extensive data analysis covering the period 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033, this report unravels the market's structure, competitive dynamics, and future trajectory. We examine key segments, including DC size (Small, Medium, Large, Massive, Mega), Tier type (Tier 1, Tier 2, Tier 3), absorption (Utilized, Non-Utilized), colocation type (Retail, Wholesale, Hyperscale), and end-user sectors (Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, Other). Discover the dominant players, analyze recent industry milestones, and understand the growth catalysts shaping this dynamic landscape. The report also identifies key challenges and barriers to growth, providing a holistic understanding of the Northern Virginia data center market.

Northern Virginia Data Center Market Structure & Competitive Landscape

The Northern Virginia data center market exhibits a high level of concentration, with a handful of major players controlling a significant share of the market. This concentration is driven by substantial capital investment requirements, economies of scale, and the need for extensive infrastructure. Innovation in areas such as AI, cloud computing, and edge computing continuously pushes demand, while regulatory impacts, particularly around energy consumption and environmental concerns, influence operational strategies. Product substitutes, such as cloud services offered by hyperscale providers, exert competitive pressure. However, the market's strength stems from its diverse end-user base, including major cloud providers, government agencies, and large enterprises. M&A activity is robust, with several high-profile acquisitions in recent years, driving consolidation and shaping the competitive landscape. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market. Over the historical period (2019-2024), M&A volume in the Northern Virginia data center market totaled approximately $xx Million.

- Market Concentration: High, with a few dominant players.

- Innovation Drivers: AI, cloud computing, edge computing.

- Regulatory Impacts: Energy consumption, environmental regulations.

- Product Substitutes: Cloud services from hyperscale providers.

- End-User Segmentation: Diverse, including cloud providers, government, and enterprises.

- M&A Trends: Significant consolidation through mergers and acquisitions.

Northern Virginia Data Center Market Market Trends & Opportunities

The Northern Virginia data center market is experiencing substantial growth, driven by increasing demand for data storage and processing capacity. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, exceeding the national average. This growth is fueled by technological advancements such as the increasing adoption of 5G technology, the expansion of cloud computing services, and the rise of the Internet of Things (IoT). Consumer preferences are shifting towards faster internet speeds and readily available content, leading to a constant need for greater data center capacity. The market is becoming increasingly competitive with new entrants, but established players are maintaining strong positions through strategic expansion and partnerships. Market penetration rates for hyperscale colocation facilities are currently at xx% and are projected to increase to xx% by 2033. This growth creates significant opportunities for companies involved in the design, construction, and operation of data centers.

Dominant Markets & Segments in Northern Virginia Data Center Market

The Northern Virginia data center market is dominated by the Ashburn and Culpeper regions, owing to their robust infrastructure, proximity to major fiber optic networks, and supportive government policies.

Key Growth Drivers:

- Robust Infrastructure: Extensive fiber optic network connectivity and abundant power supply.

- Supportive Government Policies: Incentives for data center development.

- Strategic Location: Proximity to major East Coast markets.

Dominant Segments:

- DC Size: Large and Mega data centers are the fastest-growing segments.

- Tier Type: Tier III data centers are the most prevalent.

- Absorption: Utilized capacity is very high, with limited non-utilized space.

- Colocation Type: Wholesale and Hyperscale colocation dominate the market.

- End User: Cloud & IT services, government, and telecom sectors are the leading end-users.

The dominance of specific segments reflects a combination of high demand from specific sectors (such as cloud computing) and the strategic advantage of large-scale facilities offering economies of scale.

Northern Virginia Data Center Market Product Analysis

The Northern Virginia data center market is characterized by ongoing innovation in areas such as energy efficiency, cooling technologies, and modular design. These advancements are aimed at improving operational efficiency, reducing costs, and increasing data center density. Companies are increasingly focusing on providing highly reliable and scalable solutions that can meet the evolving needs of their clients. The market is driven by an increasing adoption of sustainable and environmentally friendly technologies. The competitive advantages lie in providing customized solutions, superior network connectivity, and advanced security features.

Key Drivers, Barriers & Challenges in Northern Virginia Data Center Market

Key Drivers:

- Technological advancements in cloud computing, AI, and IoT.

- Increasing demand for data storage and processing capacity from various sectors.

- Supportive government policies and incentives for data center development.

- Strategic location and robust infrastructure in Northern Virginia.

Challenges:

- Land Availability: Limited availability of suitable land for new data center construction.

- Energy Consumption: The high energy demands of data centers raise environmental concerns.

- Regulatory Hurdles: Navigating permitting and regulatory processes can be complex and time-consuming, potentially creating delays. The impact of these delays can result in xx Million in lost revenue annually.

- Competitive Pressure: The market is intensely competitive, with both established and new players vying for market share.

Growth Drivers in the Northern Virginia Data Center Market Market

Growth in the Northern Virginia data center market is primarily driven by the expanding adoption of cloud computing, the growth of big data analytics, and the increasing demand for high-performance computing. Furthermore, supportive government policies and incentives, along with the strategic location and robust infrastructure of the region, play a crucial role in attracting new investments. The continuous improvement of technological advancements also provides fuel for significant growth.

Challenges Impacting Northern Virginia Data Center Market Growth

The primary challenges to growth include the limited availability of land for new data center construction, concerns regarding energy consumption and environmental impact, and the complexities associated with navigating permitting and regulatory processes. Competition from other data center hubs and potential supply chain disruptions are further barriers to sustained growth.

Key Players Shaping the Northern Virginia Data Center Market Market

- Cyxtera Technologies Inc

- Quality Technology Services

- Equinix Inc

- EdgeCore

- Rackspace Technology

- PhoenixNAP

- Iron Mountain

- 365 data centers

- DataBank

- Evocative

- CyrusOne

- EdgeConneX Inc

- Flexential

- Cogent

- Cologix

- Evoque

- Vantage Data Center

- CoreSite

- H5 Data centers

- Digital Realty Trust Inc

- Stack Infrastructure

- NTT Ltd

Significant Northern Virginia Data Center Market Industry Milestones

- May 2023: Culpeper County approves rezoning for over four million square feet of new data center construction. This signals significant future growth in the region.

- April 2023: GI Partners acquires a 98-acre data center campus in Ashburn, highlighting continued investment in existing facilities and their potential for expansion.

Future Outlook for Northern Virginia Data Center Market Market

The Northern Virginia data center market is poised for continued strong growth, driven by sustained demand from the cloud computing, government, and other sectors. Strategic opportunities exist in the development of sustainable and energy-efficient data centers, along with continued investment in expanding network connectivity and infrastructure. The market's robust fundamentals, coupled with supportive government policies and the region's strategic location, paint a picture of sustained market expansion and robust growth potential.

Northern Virginia Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

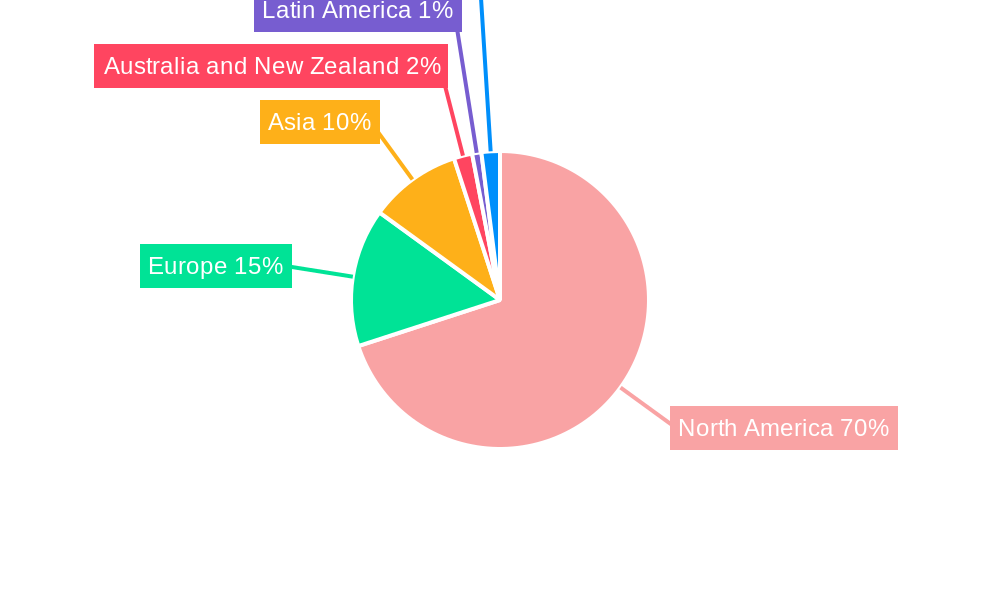

Northern Virginia Data Center Market Segmentation By Geography

- 1. Virginia

Northern Virginia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Virginia

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Northern Virginia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cyxtera Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Quality Technology Services

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 EdgeCore

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rackspace Technology

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PhoenixNAP

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Iron Mountain

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 365 data centers

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DataBank

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Evocative

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 CyrusOne

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 EdgeConneX Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Flexential

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Cogent

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Cologix

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Evoque

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Vantage Data Center

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 CoreSite

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 H5 Data centers

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Digital Realty Trust Inc

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.21 Stack Infrastructure

- 12.2.21.1. Overview

- 12.2.21.2. Products

- 12.2.21.3. SWOT Analysis

- 12.2.21.4. Recent Developments

- 12.2.21.5. Financials (Based on Availability)

- 12.2.22 NTT Ltd

- 12.2.22.1. Overview

- 12.2.22.2. Products

- 12.2.22.3. SWOT Analysis

- 12.2.22.4. Recent Developments

- 12.2.22.5. Financials (Based on Availability)

- 12.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: Northern Virginia Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Northern Virginia Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Northern Virginia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Northern Virginia Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Northern Virginia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Northern Virginia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Northern Virginia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Northern Virginia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Northern Virginia Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Northern Virginia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Northern Virginia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Northern Virginia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Northern Virginia Data Center Market?

The projected CAGR is approximately 13.80%.

2. Which companies are prominent players in the Northern Virginia Data Center Market?

Key companies in the market include Cyxtera Technologies Inc, Quality Technology Services, Equinix Inc, EdgeCore, Rackspace Technology, PhoenixNAP, Iron Mountain, 365 data centers, DataBank, Evocative, CyrusOne, EdgeConneX Inc , Flexential, Cogent, Cologix, Evoque, Vantage Data Center, CoreSite, H5 Data centers, Digital Realty Trust Inc, Stack Infrastructure, NTT Ltd.

3. What are the main segments of the Northern Virginia Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

May 2023: Culpeper County, Virginia, may soon see the building of more than four million square feet of data centers. The Culpeper Town and County Councils have received rezoning proposals allowing the construction of about 17 structures on two campuses on the town's border alongside McDevitt Drive. According to the Culpeper Star-Exponent, the Culpeper County Planning Commission voted 7-1 last week to approve an application to rezone approximately 34.4 acres from RA (Rural Areas) to LI (Light Industrial) over Route 799 (McDevitt Drive) and Route 699 (East Chandler Street) in the StevensburgMagisterial area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Northern Virginia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Northern Virginia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Northern Virginia Data Center Market?

To stay informed about further developments, trends, and reports in the Northern Virginia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence