Key Insights

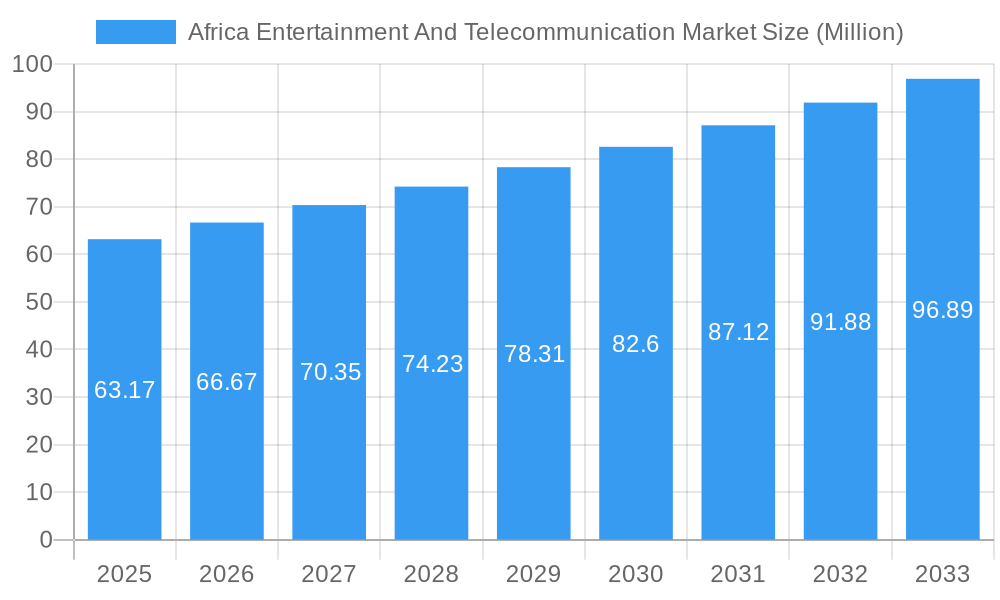

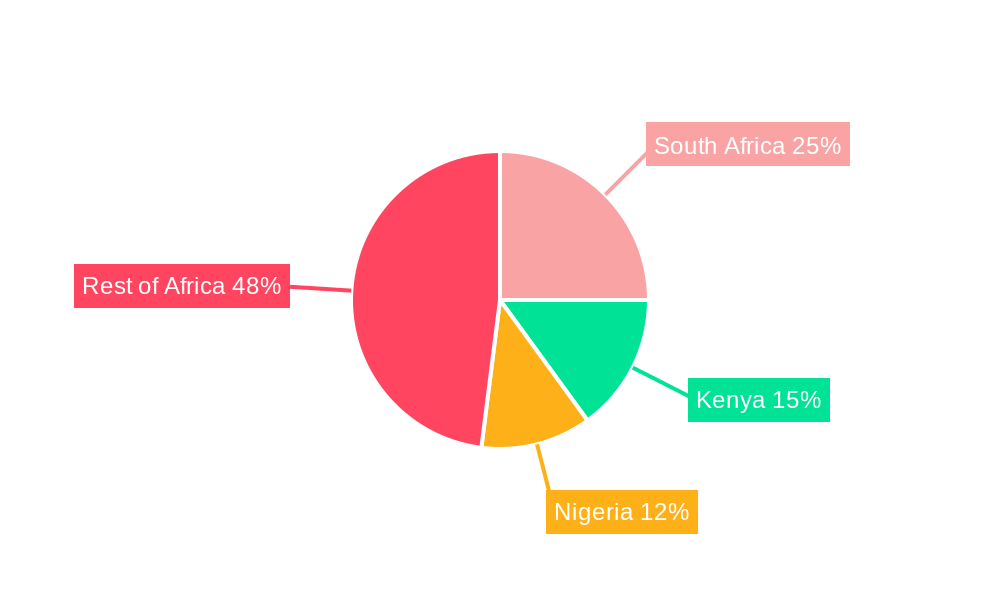

The African Entertainment and Telecommunication market, valued at $63.17 million in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising internet access, and a burgeoning young population eager to consume digital entertainment. This expansion is further fueled by the increasing adoption of mobile money systems, facilitating seamless transactions for digital content and services. The market's segmentation reveals diverse avenues for growth; the smartphone segment is expected to dominate, reflecting the continent's mobile-first approach to technology. While the PC and gaming console segments hold potential, their growth will likely be slower compared to the mobile-led expansion. The downloaded/box PC and browser PC segments represent opportunities for tailored content delivery strategies. Key players such as Dell Technologies, IBM Corporation, and Cisco Systems are strategically positioning themselves within this dynamic landscape, leveraging their expertise in infrastructure and technology solutions to capture market share. Growth will be uneven across regions, with countries like South Africa, Kenya, and Nigeria showing higher adoption rates due to better infrastructure and higher disposable incomes. However, the "Rest of Africa" segment shows significant untapped potential, presenting opportunities for expansion through targeted investments in infrastructure and localized content.

Africa Entertainment And Telecommunication Market Market Size (In Million)

The market's 5.44% CAGR from 2025-2033 indicates sustained growth, though challenges remain. Regulatory hurdles, digital literacy gaps, and infrastructure limitations in some regions could hinder growth. Addressing these issues through public-private partnerships and strategic investments in digital infrastructure will be crucial for unlocking the market’s full potential. The emergence of local content creation and distribution platforms represents a significant trend, fostering cultural relevance and addressing the diverse linguistic and cultural landscape of Africa. Furthermore, the increasing integration of telecommunications and entertainment services, such as bundled packages and convergent offerings, will drive efficiency and consumer adoption. The success of companies in this market will rely on their ability to adapt to the unique challenges and opportunities presented by this rapidly evolving landscape, focusing on affordable access, localized content, and robust infrastructure solutions.

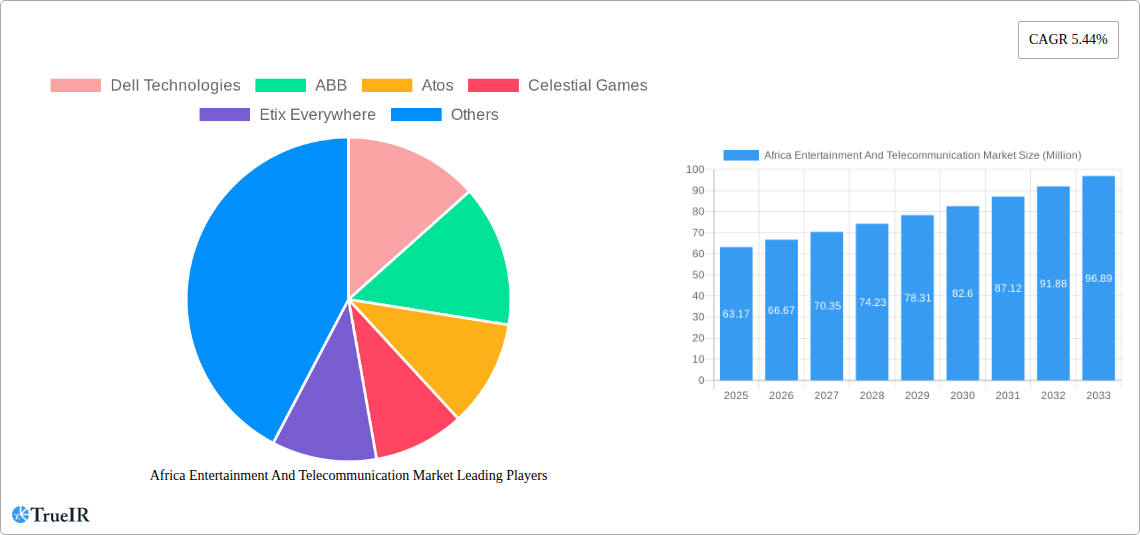

Africa Entertainment And Telecommunication Market Company Market Share

This dynamic report provides a deep dive into the burgeoning Africa Entertainment and Telecommunication Market, offering invaluable insights for investors, industry professionals, and strategic planners. Leveraging extensive research and data analysis spanning the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report paints a comprehensive picture of market structure, trends, opportunities, and challenges. The report utilizes high-impact keywords like "Africa Entertainment Market," "Telecommunication Market Africa," "Gaming Market Africa," and "African Tech Industry" to ensure maximum visibility and relevance in online searches. The market is estimated at XX Million in 2025 and projected to reach XX Million by 2033.

Africa Entertainment And Telecommunication Market Market Structure & Competitive Landscape

The African entertainment and telecommunication market is characterized by a dynamic interplay of established players and emerging innovators. Market concentration is moderate, with a Herfindahl-Hirschman Index (HHI) estimated at xx, indicating a moderately competitive landscape. Key innovation drivers include the proliferation of mobile devices, increasing internet penetration, and the rise of local content creation. Regulatory impacts vary significantly across countries, with some promoting competition and investment while others impose stricter controls. Product substitutes, such as traditional media and offline entertainment options, are declining in relevance as digital platforms gain traction.

End-user segmentation is predominantly driven by demographics, with youth cohorts exhibiting high engagement with digital entertainment and communication services. Mergers and acquisitions (M&A) activity is moderate, primarily focusing on enhancing technological capabilities and expanding market reach. The volume of M&A transactions in the last five years is estimated at xx deals, with a total value of xx Million.

- High fragmentation in certain segments: The market shows high fragmentation, particularly in the gaming and app development sectors.

- Growing influence of regional players: Local companies are increasingly playing a significant role, challenging established international brands.

- Regulatory uncertainty: The regulatory environment across different African nations poses a considerable challenge for market players.

- Focus on mobile-first strategies: The prevalence of smartphones and limited fixed-line infrastructure necessitate mobile-first strategies for most players.

Africa Entertainment And Telecommunication Market Market Trends & Opportunities

The African entertainment and telecommunication market is experiencing robust growth, driven by rising disposable incomes, expanding internet penetration, and a burgeoning youth population. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). Market penetration rates for mobile internet usage are increasing rapidly, creating opportunities for mobile gaming, streaming services, and other digital entertainment platforms. Technological shifts, including the adoption of 5G technology and the growth of cloud computing, are further fueling this expansion. Consumer preferences are shifting towards localized content, personalized experiences, and affordable data plans.

Competitive dynamics are marked by intense rivalry, particularly among mobile network operators and digital content providers. Strategic partnerships and collaborations are becoming increasingly important to navigate the complexities of the market and reach a wider audience. The growth of mobile money services is creating innovative business models and expanding access to digital entertainment and communication services. The demand for high-speed internet and reliable infrastructure continues to be a key factor in shaping market trends.

Dominant Markets & Segments in Africa Entertainment And Telecommunication Market

The Smartphone segment currently dominates the African entertainment and telecommunication market, driven by affordability and widespread accessibility. However, significant growth is expected in the Gaming Console and Downloaded/Box PC segments as incomes rise and internet penetration increases.

Key Growth Drivers by Segment:

- Smartphone: Affordability, widespread mobile network coverage, and the popularity of mobile gaming and social media.

- Gaming Console: Rising disposable incomes, increasing urbanization, and the growing popularity of esports.

- Downloaded/Box PC: Expanding internet access and the demand for high-quality digital entertainment.

- Browser PC: Ease of access and relatively low cost of entry.

- Tablet: Convenience and portability, particularly among younger demographics.

Dominant Regions/Countries: Nigeria, South Africa, Kenya, and Egypt are currently the leading markets, but rapid growth is anticipated in other regions as infrastructure improves and internet penetration expands.

Africa Entertainment And Telecommunication Market Product Analysis

Product innovations are largely focused on enhancing user experience, developing affordable solutions, and catering to local preferences. New gaming titles and mobile apps are constantly emerging, while streaming services are expanding their content libraries and improving video quality. Competitive advantages stem from offering innovative features, superior user interfaces, localized content, and aggressive pricing strategies. The integration of Artificial Intelligence (AI) and advanced data analytics is also gaining traction, enabling personalized content recommendations and targeted advertising.

Key Drivers, Barriers & Challenges in Africa Entertainment And Telecommunication Market

Key Drivers:

- Rising Smartphone Penetration: The rapid increase in smartphone adoption is driving growth in mobile gaming, streaming, and social media.

- Growing Internet Access: Increased broadband penetration is fueling demand for digital content and services.

- Government Initiatives: Many governments are investing in digital infrastructure and promoting the development of the digital economy.

Challenges:

- Infrastructure Gaps: Limited internet access in rural areas and inconsistent network quality remain major barriers to growth.

- Regulatory Hurdles: Complex and inconsistent regulatory frameworks across different countries pose challenges to market players.

- Affordability: The cost of data and devices remains a significant barrier for many consumers.

Growth Drivers in the Africa Entertainment And Telecommunication Market Market

The market is propelled by several factors including: increasing smartphone penetration, rising internet usage, growing adoption of mobile money, and the rising popularity of digital entertainment. Government initiatives supporting digital infrastructure and investment from international players also play a crucial role.

Challenges Impacting Africa Entertainment And Telecommunication Market Growth

Significant hurdles include infrastructure limitations (especially in rural areas), regulatory inconsistencies across nations, digital literacy gaps, and affordability concerns. Addressing these challenges is critical to unlocking the full potential of this rapidly expanding market.

Key Players Shaping the Africa Entertainment And Telecommunication Market Market

- Dell Technologies

- ABB

- Atos

- Celestial Games

- Etix Everywhere

- Eaton Corporation

- Kucheza

- NetApp

- IBM Corporation

- Kuluya

- Callaghan Engineering

- Lupp Group

- Arup Group

- Hewlett Packard Enterprise

- Kagiso Interactive

- Broadcom Inc

- Arista Networks

- Huawei

- Gamesole

- Chopup

- Nyamakop

- Cisco Systems

- Clockwork Acorn

Significant Africa Entertainment And Telecommunication Market Industry Milestones

- November 2023: MTN South Africa's R1.9 Billion spectrum fee payment to ICASA signals significant investment in expanding network infrastructure and capacity. This will directly impact the availability and affordability of data services.

Future Outlook for Africa Entertainment And Telecommunication Market Market

The future of the African entertainment and telecommunication market is exceptionally bright. Continued investment in infrastructure, increasing internet penetration, and the growing adoption of mobile money services will fuel growth across all segments. Strategic partnerships between international and local companies will be crucial to navigating the unique challenges and opportunities presented by this dynamic market. The focus on developing localized content and affordable solutions will be key to driving further market expansion and maximizing its potential.

Africa Entertainment And Telecommunication Market Segmentation

-

1. Platform

- 1.1. PC

- 1.2. Smartphone

- 1.3. Tablets

- 1.4. Gaming Console

- 1.5. Downloaded/Box PC

- 1.6. Browser PC

-

2. Geography

- 2.1. Nigeria

- 2.2. Ethipia

- 2.3. Egypt

- 2.4. Morocco

- 2.5. Kenya

- 2.6. Algeria

- 2.7. Zimbabwe

Africa Entertainment And Telecommunication Market Segmentation By Geography

- 1. Nigeria

- 2. Ethipia

- 3. Egypt

- 4. Morocco

- 5. Kenya

- 6. Algeria

- 7. Zimbabwe

Africa Entertainment And Telecommunication Market Regional Market Share

Geographic Coverage of Africa Entertainment And Telecommunication Market

Africa Entertainment And Telecommunication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income; Improvement in Technology and Internet Network Access

- 3.3. Market Restrains

- 3.3.1 Issues Such as Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. Data Access and Availability of Internet Access to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. PC

- 5.1.2. Smartphone

- 5.1.3. Tablets

- 5.1.4. Gaming Console

- 5.1.5. Downloaded/Box PC

- 5.1.6. Browser PC

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Ethipia

- 5.2.3. Egypt

- 5.2.4. Morocco

- 5.2.5. Kenya

- 5.2.6. Algeria

- 5.2.7. Zimbabwe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Ethipia

- 5.3.3. Egypt

- 5.3.4. Morocco

- 5.3.5. Kenya

- 5.3.6. Algeria

- 5.3.7. Zimbabwe

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Nigeria Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. PC

- 6.1.2. Smartphone

- 6.1.3. Tablets

- 6.1.4. Gaming Console

- 6.1.5. Downloaded/Box PC

- 6.1.6. Browser PC

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Ethipia

- 6.2.3. Egypt

- 6.2.4. Morocco

- 6.2.5. Kenya

- 6.2.6. Algeria

- 6.2.7. Zimbabwe

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Ethipia Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. PC

- 7.1.2. Smartphone

- 7.1.3. Tablets

- 7.1.4. Gaming Console

- 7.1.5. Downloaded/Box PC

- 7.1.6. Browser PC

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Ethipia

- 7.2.3. Egypt

- 7.2.4. Morocco

- 7.2.5. Kenya

- 7.2.6. Algeria

- 7.2.7. Zimbabwe

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Egypt Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. PC

- 8.1.2. Smartphone

- 8.1.3. Tablets

- 8.1.4. Gaming Console

- 8.1.5. Downloaded/Box PC

- 8.1.6. Browser PC

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Ethipia

- 8.2.3. Egypt

- 8.2.4. Morocco

- 8.2.5. Kenya

- 8.2.6. Algeria

- 8.2.7. Zimbabwe

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Morocco Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. PC

- 9.1.2. Smartphone

- 9.1.3. Tablets

- 9.1.4. Gaming Console

- 9.1.5. Downloaded/Box PC

- 9.1.6. Browser PC

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Ethipia

- 9.2.3. Egypt

- 9.2.4. Morocco

- 9.2.5. Kenya

- 9.2.6. Algeria

- 9.2.7. Zimbabwe

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Kenya Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. PC

- 10.1.2. Smartphone

- 10.1.3. Tablets

- 10.1.4. Gaming Console

- 10.1.5. Downloaded/Box PC

- 10.1.6. Browser PC

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Nigeria

- 10.2.2. Ethipia

- 10.2.3. Egypt

- 10.2.4. Morocco

- 10.2.5. Kenya

- 10.2.6. Algeria

- 10.2.7. Zimbabwe

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Algeria Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 11.1.1. PC

- 11.1.2. Smartphone

- 11.1.3. Tablets

- 11.1.4. Gaming Console

- 11.1.5. Downloaded/Box PC

- 11.1.6. Browser PC

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Nigeria

- 11.2.2. Ethipia

- 11.2.3. Egypt

- 11.2.4. Morocco

- 11.2.5. Kenya

- 11.2.6. Algeria

- 11.2.7. Zimbabwe

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 12. Zimbabwe Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Platform

- 12.1.1. PC

- 12.1.2. Smartphone

- 12.1.3. Tablets

- 12.1.4. Gaming Console

- 12.1.5. Downloaded/Box PC

- 12.1.6. Browser PC

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Nigeria

- 12.2.2. Ethipia

- 12.2.3. Egypt

- 12.2.4. Morocco

- 12.2.5. Kenya

- 12.2.6. Algeria

- 12.2.7. Zimbabwe

- 12.1. Market Analysis, Insights and Forecast - by Platform

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dell Technologies

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Atos

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Celestial Games

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Etix Everywhere

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Eaton Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kucheza

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 NetApp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 IBM Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Kuluya

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Callaghan Engineering

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Lupp Group

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Arup Group

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Hewlett Packard Enterprise

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kagiso Interactive

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Broadcom Inc

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Arista Networks

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Huawei

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Gamesole

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Chopup

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.21 Nyamakop

- 13.2.21.1. Overview

- 13.2.21.2. Products

- 13.2.21.3. SWOT Analysis

- 13.2.21.4. Recent Developments

- 13.2.21.5. Financials (Based on Availability)

- 13.2.22 Cisco Systems

- 13.2.22.1. Overview

- 13.2.22.2. Products

- 13.2.22.3. SWOT Analysis

- 13.2.22.4. Recent Developments

- 13.2.22.5. Financials (Based on Availability)

- 13.2.23 Clockwork Acorn

- 13.2.23.1. Overview

- 13.2.23.2. Products

- 13.2.23.3. SWOT Analysis

- 13.2.23.4. Recent Developments

- 13.2.23.5. Financials (Based on Availability)

- 13.2.1 Dell Technologies

List of Figures

- Figure 1: Africa Entertainment And Telecommunication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Entertainment And Telecommunication Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 11: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 14: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 17: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 20: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 23: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Entertainment And Telecommunication Market?

The projected CAGR is approximately 5.44%.

2. Which companies are prominent players in the Africa Entertainment And Telecommunication Market?

Key companies in the market include Dell Technologies, ABB, Atos, Celestial Games, Etix Everywhere, Eaton Corporation, Kucheza, NetApp, IBM Corporation, Kuluya, Callaghan Engineering, Lupp Group, Arup Group, Hewlett Packard Enterprise, Kagiso Interactive, Broadcom Inc, Arista Networks, Huawei, Gamesole, Chopup, Nyamakop, Cisco Systems, Clockwork Acorn.

3. What are the main segments of the Africa Entertainment And Telecommunication Market?

The market segments include Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income; Improvement in Technology and Internet Network Access.

6. What are the notable trends driving market growth?

Data Access and Availability of Internet Access to Drive the Growth.

7. Are there any restraints impacting market growth?

Issues Such as Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

November 2023 - MTN South Africa has paid the Independent Communications Authority of South Africa (ICASA) R1.9 billion to settle outstanding spectrum fees. While ICASA granted MTN and other telecom companies, such as Vodacom and Telkom, until October 2023 to pay their bills, MTN said it would make its R1.9 billion payment to expand the country's spectrum deployment in the second half of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Entertainment And Telecommunication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Entertainment And Telecommunication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Entertainment And Telecommunication Market?

To stay informed about further developments, trends, and reports in the Africa Entertainment And Telecommunication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence