Key Insights

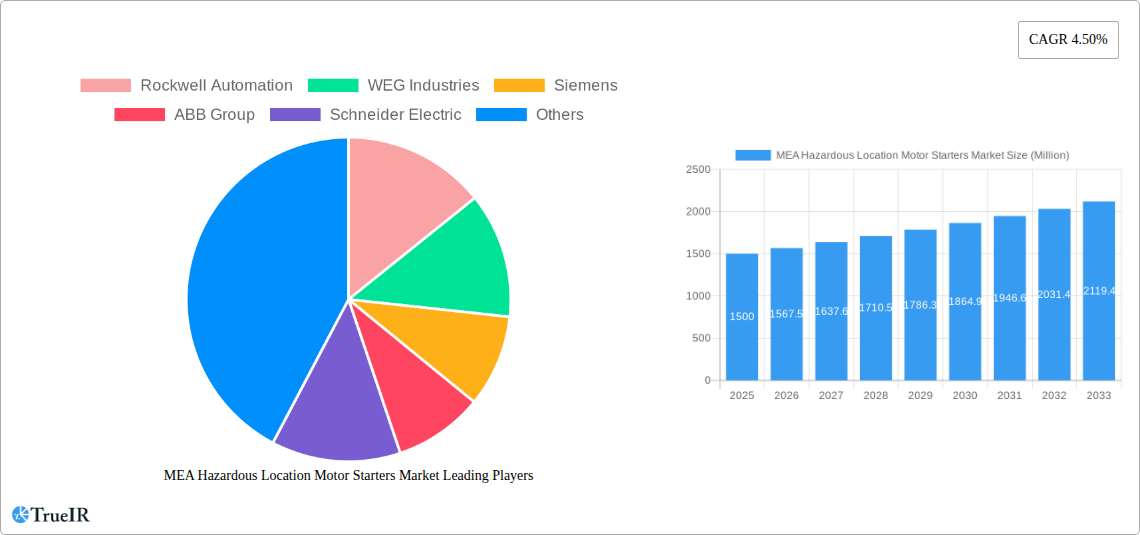

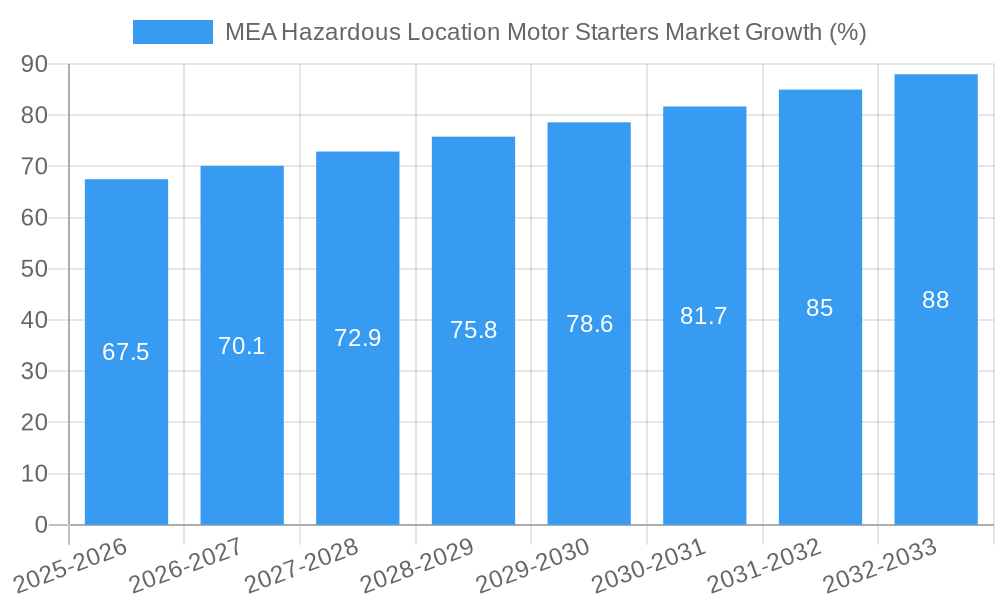

The Middle East and Africa (MEA) Hazardous Location Motor Starters market is experiencing steady growth, projected at a 4.5% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by the increasing demand for safety and reliability in hazardous environments across diverse industries. The oil and gas sector, including oil refineries and petrochemical facilities, remains a significant driver, necessitating robust and explosion-proof motor starters. Growth is also fueled by rising investments in infrastructure projects, particularly in the UAE and Saudi Arabia, leading to increased adoption in applications like sewage treatment plants, coal preparation plants, and chemical storage facilities. The market is segmented by application (paint storage, coal plants, sewage treatment, oil refineries, chemical handling, grain elevators, petrochemical facilities/oil rigs, others), type (low voltage, full voltage, manual, magnetic, others), class (I, II, III), and region (UAE, Saudi Arabia, South Africa, Qatar, others). Competition is intense, with major players like Rockwell Automation, WEG Industries, Siemens, ABB Group, Schneider Electric, and others vying for market share through technological innovation and strategic partnerships. The increasing adoption of smart motor starters with advanced features like remote monitoring and predictive maintenance is expected to further shape the market landscape in the coming years.

The substantial growth in the MEA region is attributable to several factors, including robust economic growth in key nations, a focus on industrial safety regulations, and increasing automation across industries. However, certain challenges persist, such as fluctuating oil prices impacting investment cycles, and the need for skilled workforce to install and maintain these specialized starters. Despite these restraints, the market is poised for sustained growth, particularly with the expansion of renewable energy projects and the increasing demand for efficient and safe industrial operations across the region. The diverse range of applications and the continued investment in infrastructure development will propel this market towards its projected size in the coming years. Focus on compliance with stringent safety standards and technological advancements in the motor starter technology will further fuel its growth trajectory.

MEA Hazardous Location Motor Starters Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa (MEA) Hazardous Location Motor Starters Market, offering valuable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and future prospects. The market is segmented by application, country, type, class, and division, providing granular insights into various market aspects. Key players like Rockwell Automation, WEG Industries, Siemens, ABB Group, Schneider Electric, R Stahl Inc, Heatrex, Eaton, Emerson Industrial Automation, and GE Industrial Solutions are analyzed, shedding light on their strategies and market positions.

MEA Hazardous Location Motor Starters Market Structure & Competitive Landscape

The MEA Hazardous Location Motor Starters Market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. This concentration is driven by the significant investments made by major players in research and development, resulting in innovative product offerings and strong brand recognition. Regulatory compliance and stringent safety standards in hazardous locations significantly impact market dynamics. The market witnesses continuous innovation, with players focusing on enhancing safety features, improving energy efficiency, and developing smart motor starters with advanced monitoring capabilities. Product substitution is minimal due to the specialized nature of hazardous location motor starters, necessitating compliance with stringent safety standards.

The market is primarily segmented by end-users across various industries, including oil and gas, chemical processing, and manufacturing. Mergers and acquisitions (M&A) activity has been moderate, with a total M&A volume of approximately xx deals in the historical period (2019-2024), largely driven by efforts to expand market reach and product portfolios. Significant technological advancements have driven several key acquisitions.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: R&D investment in safety features, energy efficiency, and smart technology.

- Regulatory Impacts: Stringent safety standards and compliance requirements.

- Product Substitutes: Minimal due to specialized nature and safety regulations.

- End-User Segmentation: Oil & gas, chemical processing, manufacturing, etc.

- M&A Trends: Moderate activity, approximately xx deals (2019-2024).

MEA Hazardous Location Motor Starters Market Market Trends & Opportunities

The MEA Hazardous Location Motor Starters Market is poised for robust growth during the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily fueled by increasing industrialization across the MEA region, particularly in the oil and gas, chemical, and petrochemical sectors. The rising demand for enhanced safety and operational efficiency in hazardous environments is a major driver. Technological advancements, such as the integration of smart sensors and IoT capabilities, are transforming the market, offering enhanced monitoring and predictive maintenance capabilities. Consumer preferences are shifting towards energy-efficient and environmentally friendly solutions, impacting product demand.

Competitive dynamics are intense, with major players focusing on product differentiation, strategic partnerships, and geographic expansion. Market penetration rates vary significantly across different segments and countries within the MEA region, with higher penetration in developed economies compared to emerging markets. The increasing adoption of automation and digitalization in industrial processes creates substantial growth opportunities for advanced motor starters with integrated smart functionalities. The market's expansion is also influenced by favorable government policies promoting industrial growth and infrastructure development in the region. The shift towards Industry 4.0 and the adoption of smart manufacturing practices will further drive demand for advanced motor starters.

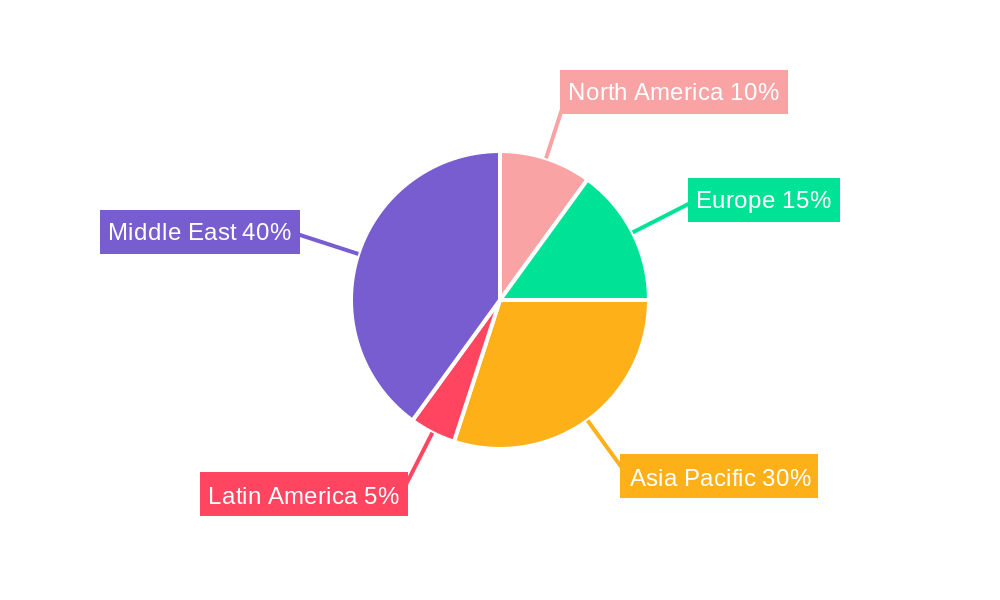

Dominant Markets & Segments in MEA Hazardous Location Motor Starters Market

The Saudi Arabian market is projected to be the leading national market, accounting for an estimated xx% of the total market revenue in 2025. This is driven by substantial investments in infrastructure development and the growth of its oil and gas sector. Other significant markets include the United Arab Emirates and South Africa.

By Application: Oil refineries and petrochemical facilities represent the largest application segments, driven by the high concentration of these industries in the region and the stringent safety requirements they entail. Chemical storage and handling facilities and paint storage areas also contribute significantly.

By Country:

- Saudi Arabia: Largest market, driven by oil & gas and infrastructure development.

- United Arab Emirates: Strong growth due to industrial diversification and infrastructural projects.

- South Africa: Significant market share due to established industrial base and mining activities.

- Qatar: Growth driven by investments in energy infrastructure.

- Other Countries: Show moderate growth with developing industries.

By Type: Magnetic motor starters dominate the market due to their reliability and cost-effectiveness.

By Class & Division/Zone: Class I and Division 1/Zone 0 dominate due to the prevalence of hazardous environments.

- Growth Drivers (Various Segments):

- Oil & Gas: High safety standards and operational efficiency demands.

- Chemical Processing: Stringent regulatory compliance needs.

- Infrastructure Development: Increased investments in power generation and water treatment plants.

- Government Policies: Support for industrial growth and improved safety regulations.

MEA Hazardous Location Motor Starters Market Product Analysis

Technological advancements are driving product innovation in the MEA hazardous location motor starters market. Manufacturers are focusing on developing energy-efficient, compact designs with enhanced safety features and improved monitoring capabilities. Smart motor starters with integrated connectivity features for predictive maintenance are gaining traction. The market features a wide range of products, catering to different voltage levels, application requirements, and safety standards, providing solutions that optimize both safety and performance in diverse hazardous environments. Competition focuses on providing solutions with superior safety features, longer lifespans, and greater operational efficiency, adapting to the unique challenges presented by the hazardous locations across the MEA region.

Key Drivers, Barriers & Challenges in MEA Hazardous Location Motor Starters Market

Key Drivers:

- Increasing industrialization: Growth in the oil and gas, chemical, and manufacturing sectors.

- Stringent safety regulations: Compulsory compliance with international and regional safety standards.

- Demand for energy efficiency: Focus on reducing operational costs and environmental impact.

- Technological advancements: Integration of smart technologies for enhanced monitoring and predictive maintenance.

Challenges:

- Supply chain disruptions: Global supply chain vulnerabilities impacting the availability of raw materials and components. This results in xx% increase in cost of certain components (2024).

- Regulatory complexities: Varying safety standards across different countries within the MEA region.

- Competitive pressure: Intense competition among major players necessitates continuous innovation and cost optimization.

Growth Drivers in the MEA Hazardous Location Motor Starters Market Market

Increased industrialization, particularly in the oil and gas and petrochemical sectors, is a major driver. Stringent safety regulations mandate the adoption of explosion-proof motor starters, fostering market growth. Technological advancements, including the integration of smart sensors and IoT, enhance operational efficiency and create demand for advanced motor starters. Favorable government policies supporting industrial growth also play a significant role.

Challenges Impacting MEA Hazardous Location Motor Starters Market Growth

Supply chain disruptions caused by global events can lead to price increases and component shortages. Regulatory complexities vary across MEA nations, adding to compliance costs. Intense competition from established players necessitates continuous product innovation and cost optimization strategies to maintain market share.

Key Players Shaping the MEA Hazardous Location Motor Starters Market Market

- Rockwell Automation

- WEG Industries

- Siemens

- ABB Group

- Schneider Electric

- R Stahl Inc

- Heatrex

- Eaton

- Emerson Industrial Automation

- GE Industrial Solutions

Significant MEA Hazardous Location Motor Starters Market Industry Milestones

- February 2023: ABB launched its ABB Ability™ Symphony Plus distributed control system, enhancing digital transformation in power generation and water industries.

- February 2022: ABB launched MS116, MS132, and MS165 manual motor starters, expanding its product portfolio and providing educational resources.

Future Outlook for MEA Hazardous Location Motor Starters Market Market

The MEA Hazardous Location Motor Starters Market is projected to experience sustained growth, driven by ongoing industrial expansion, increased automation, and the adoption of advanced technologies. Strategic partnerships, technological advancements, and focused marketing efforts will play crucial roles in shaping future market dynamics. The market holds significant potential for growth, particularly in emerging markets within the MEA region, as industrialization progresses and safety standards become increasingly stringent. Opportunities exist for companies that can offer innovative, energy-efficient, and cost-effective solutions.

MEA Hazardous Location Motor Starters Market Segmentation

-

1. Type

- 1.1. Low Voltage Motor Starter

- 1.2. Full Voltage Motor Starter

- 1.3. Manual Motor Starter

- 1.4. Magnetic Motor Starter

- 1.5. Other Types

-

2. Class

- 2.1. Class I

- 2.2. Class II

- 2.3. Class III

-

3. Division

- 3.1. Division 1

- 3.2. Division 2

-

4. Zone

- 4.1. Zone 0

- 4.2. Zone 1

- 4.3. Zone 21

- 4.4. Zone 22

-

5. Applications

- 5.1. Paint Storage Areas

- 5.2. Coal Preparation Plants

- 5.3. Sewage Treatment Plants

- 5.4. Oil Refineries

- 5.5. Chemical Storage and Handling Facilities

- 5.6. Grain Elevators

- 5.7. Petrochemical Facilities/Oil Rigs

- 5.8. Other Applications

MEA Hazardous Location Motor Starters Market Segmentation By Geography

- 1. Africa

MEA Hazardous Location Motor Starters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Safety Measures; Increasing Demand for Energy Efficient Motors

- 3.3. Market Restrains

- 3.3.1. Regulations and Compliance; High Installation Cost for Material and Labor Compared to Non-explosion Proof Motors

- 3.4. Market Trends

- 3.4.1. Coal Preparation Plants Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Hazardous Location Motor Starters Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Low Voltage Motor Starter

- 5.1.2. Full Voltage Motor Starter

- 5.1.3. Manual Motor Starter

- 5.1.4. Magnetic Motor Starter

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Class

- 5.2.1. Class I

- 5.2.2. Class II

- 5.2.3. Class III

- 5.3. Market Analysis, Insights and Forecast - by Division

- 5.3.1. Division 1

- 5.3.2. Division 2

- 5.4. Market Analysis, Insights and Forecast - by Zone

- 5.4.1. Zone 0

- 5.4.2. Zone 1

- 5.4.3. Zone 21

- 5.4.4. Zone 22

- 5.5. Market Analysis, Insights and Forecast - by Applications

- 5.5.1. Paint Storage Areas

- 5.5.2. Coal Preparation Plants

- 5.5.3. Sewage Treatment Plants

- 5.5.4. Oil Refineries

- 5.5.5. Chemical Storage and Handling Facilities

- 5.5.6. Grain Elevators

- 5.5.7. Petrochemical Facilities/Oil Rigs

- 5.5.8. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America MEA Hazardous Location Motor Starters Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe MEA Hazardous Location Motor Starters Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific MEA Hazardous Location Motor Starters Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America MEA Hazardous Location Motor Starters Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East MEA Hazardous Location Motor Starters Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Rockwell Automation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WEG Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ABB Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schneider Electric

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 R Stahl Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Heatrex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eaton

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Emerson Industrial Automation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GE Industrial Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rockwell Automation

List of Figures

- Figure 1: MEA Hazardous Location Motor Starters Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MEA Hazardous Location Motor Starters Market Share (%) by Company 2024

List of Tables

- Table 1: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Class 2019 & 2032

- Table 4: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Division 2019 & 2032

- Table 5: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Zone 2019 & 2032

- Table 6: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 7: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: MEA Hazardous Location Motor Starters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: MEA Hazardous Location Motor Starters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: MEA Hazardous Location Motor Starters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: MEA Hazardous Location Motor Starters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: MEA Hazardous Location Motor Starters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Class 2019 & 2032

- Table 20: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Division 2019 & 2032

- Table 21: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Zone 2019 & 2032

- Table 22: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 23: MEA Hazardous Location Motor Starters Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Hazardous Location Motor Starters Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the MEA Hazardous Location Motor Starters Market?

Key companies in the market include Rockwell Automation, WEG Industries, Siemens, ABB Group, Schneider Electric, R Stahl Inc, Heatrex, Eaton, Emerson Industrial Automation, GE Industrial Solutions.

3. What are the main segments of the MEA Hazardous Location Motor Starters Market?

The market segments include Type, Class, Division, Zone, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Safety Measures; Increasing Demand for Energy Efficient Motors.

6. What are the notable trends driving market growth?

Coal Preparation Plants Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Regulations and Compliance; High Installation Cost for Material and Labor Compared to Non-explosion Proof Motors.

8. Can you provide examples of recent developments in the market?

February 2023- ABB launched its latest ABB AbilityTM Symphony Plus distributed control system to support digital transformation for power generation and water industries. With over 40 years of experience in total plant automation, the company offers the latest version of Symphony Plus to support customers' digital journey via a simplified and secure OPC UA1 connection to the Cloud and Edge without interfering with core control and automation functionalities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Hazardous Location Motor Starters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Hazardous Location Motor Starters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Hazardous Location Motor Starters Market?

To stay informed about further developments, trends, and reports in the MEA Hazardous Location Motor Starters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence