Key Insights

The Latin American smartwatch market, valued at $7.28 billion in 2025, is projected for significant expansion, with a Compound Annual Growth Rate (CAGR) of 7.57% from 2025 to 2033. This growth is propelled by rising disposable incomes in key economies such as Brazil, Argentina, and Mexico, enabling greater consumer investment in wearable technology. The escalating adoption of health and fitness-conscious lifestyles further drives demand for smartwatches with advanced health tracking functionalities. The increasing prevalence of mobile payments and contactless transactions also contributes to market dynamics, with smartwatches serving as a vital component in this evolving transaction landscape. The market is segmented by operating system (WatchOS, Wear OS, others), display type (AMOLED, PMOLED, TFT LCD), and application (personal assistance, medical, sports, others). While the widespread availability of affordable smartphones may present a restraint, the increasing integration of smartwatches into daily routines and the introduction of innovative features are expected to mitigate this challenge. Intense competition among leading brands, including Apple, Samsung, Fitbit, and Garmin, fosters continuous innovation and competitive pricing.

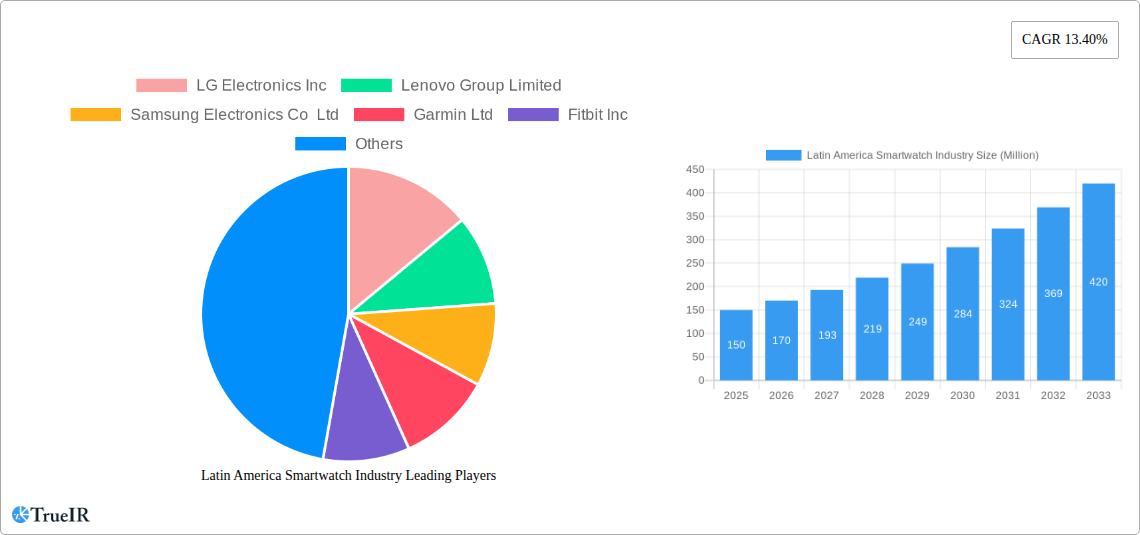

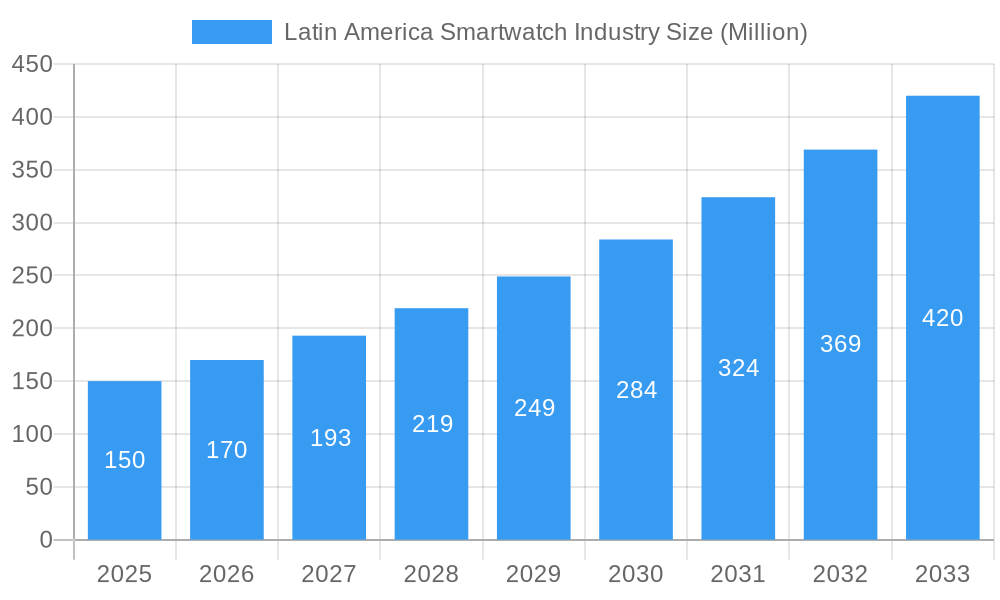

Latin America Smartwatch Industry Market Size (In Billion)

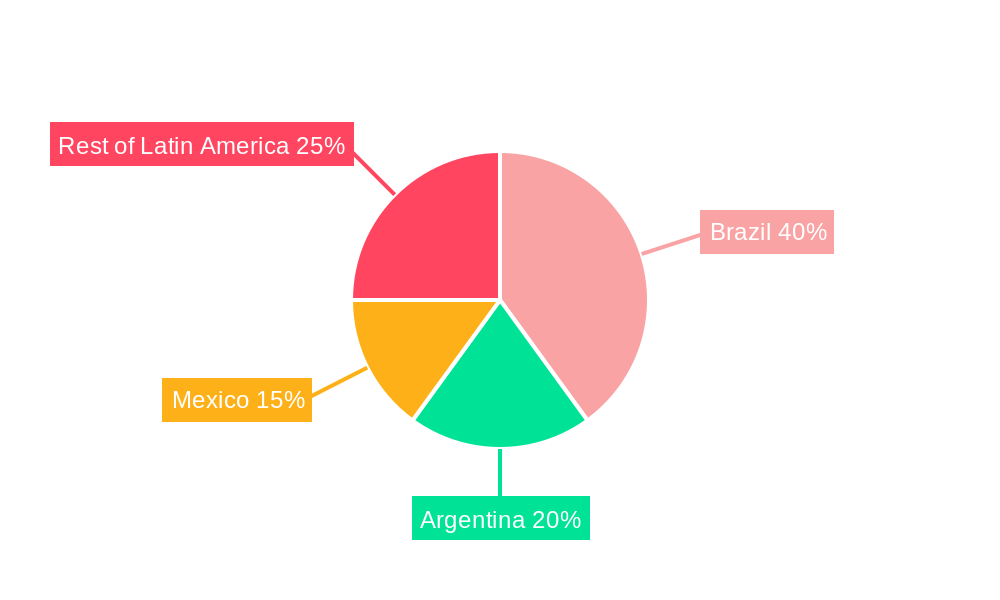

Brazil and Argentina emerge as dominant markets within Latin America, with Mexico and other regional nations following. The ongoing growth of e-commerce and enhancements in logistics are expanding the accessibility of smartwatch brands to more remote locations. Regional preferences for specific features vary, with certain applications, such as sports tracking, exhibiting higher demand in particular countries. The forecast period anticipates substantial growth potential, primarily attributed to increasing smartphone penetration, device affordability, and the expansion of 4G/5G networks facilitating seamless connectivity. Ongoing advancements in battery life, design, and health monitoring capabilities will be critical in shaping the future trajectory of the Latin American smartwatch market. Moreover, the growing emphasis on integrating smartwatches with other IoT devices and broadening their functionality beyond fitness and health will likely stimulate considerable market expansion.

Latin America Smartwatch Industry Company Market Share

Latin America Smartwatch Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America smartwatch industry, covering market size, growth trends, competitive landscape, and future outlook from 2019 to 2033. The report leverages extensive data and insights to offer a robust understanding of this dynamic sector, equipping businesses with the knowledge necessary to navigate the market effectively. With a focus on key players like Samsung, Apple, and Huawei, this report offers invaluable market intelligence for strategic decision-making.

Latin America Smartwatch Industry Market Structure & Competitive Landscape

The Latin American smartwatch market is characterized by moderate concentration, with a few major players dominating the market share, but with significant opportunities for smaller players to grow through innovation and niche market penetration. The market structure is influenced by several factors, including technological innovation, regulatory frameworks, and the availability of substitute products such as basic fitness trackers.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Latin American smartwatch market in 2024 was approximately xx, indicating a moderately concentrated market. The top 5 players account for approximately xx% of the total market revenue.

Innovation Drivers: Continuous advancements in processor technology, display resolution, battery life, and sensor capabilities are driving innovation. The integration of health and fitness features, such as heart rate monitoring and sleep tracking, is also a major driver.

Regulatory Impacts: Regulatory frameworks concerning data privacy and health information are influencing the market, requiring companies to adapt their products and practices to comply with local laws.

Product Substitutes: Basic fitness trackers and simpler wearable devices pose a competitive threat, particularly in the lower price segments.

End-User Segmentation: The market is segmented by demographics (age, income, lifestyle), with significant growth potential among younger demographics and those with increasing disposable income.

M&A Trends: The Latin American smartwatch market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years. The total value of M&A transactions in the period 2019-2024 is estimated at xx Million. These activities primarily aim to consolidate market share and expand product portfolios.

Latin America Smartwatch Industry Market Trends & Opportunities

The Latin American smartwatch market has demonstrated significant growth over the past five years, fueled by rising smartphone penetration, increasing disposable incomes, and a growing awareness of health and fitness. The market is projected to experience robust expansion in the coming years.

Market Size: The market size in 2024 was estimated at xx Million and is projected to reach xx Million by 2033, representing a CAGR of xx%. This growth is driven by several factors:

Technological Advancements: Improved battery life, enhanced processing power, and advanced sensor technology are making smartwatches more appealing to consumers. The introduction of 5G connectivity is also poised to further boost market growth.

Consumer Preferences: Consumers in Latin America are increasingly demanding smarter, more functional devices, with a focus on health and fitness features.

Competitive Dynamics: The presence of numerous major players, along with smaller, more agile companies offering specialized features, is contributing to increased innovation and competition in the market.

E-commerce Growth: The rising popularity of e-commerce platforms is facilitating access to a wider range of smartwatch products, fueling market expansion.

Market Penetration: The smartwatch penetration rate in Latin America is expected to rise significantly, from xx% in 2024 to xx% by 2033.

Dominant Markets & Segments in Latin America Smartwatch Industry

The Brazilian market currently holds the largest share of the Latin American smartwatch market, followed by Argentina and the Rest of Latin America. The dominance of Brazil is primarily attributed to its larger population and higher smartphone penetration rate. The key growth drivers for each market segment are as follows:

Country:

- Brazil: Strong smartphone penetration, increasing disposable income, and a relatively developed e-commerce infrastructure.

- Argentina: Growing demand for smart wearable devices and increasing consumer awareness of health and fitness.

- Rest of Latin America: Emerging markets with high growth potential. The market is fragmented, creating opportunities for both regional and international brands.

Operating Systems:

- Android/Wear OS: The most prevalent operating system, owing to its widespread compatibility and diverse app ecosystem.

- Watch OS: Holds a smaller but growing market share, particularly among Apple device users.

- Other Operating Systems: This segment represents a smaller portion of the market but showcases the emergence of alternative platforms.

Display Type:

- AMOLED: The dominant display type, due to its superior color reproduction and power efficiency.

- PMOLED: Holds a smaller market share, largely due to AMOLED displays dominating the premium segment.

- TFT LCD: A relatively lower-cost option that maintains a small presence, mostly in the budget segment.

Application:

- Personal Assistance: The most popular application, owing to functions such as notifications, communication, and calendar management.

- Sports: This segment is expanding rapidly, with smartwatches becoming more sophisticated fitness trackers.

- Medical: Growing potential in remote health monitoring.

- Other Applications: This niche comprises specific-purpose applications, further diversifying the market.

Latin America Smartwatch Industry Product Analysis

Smartwatch product innovation in Latin America focuses on enhancing user experience through improved health and fitness tracking, longer battery life, and seamless integration with smartphones. Key innovations include advanced sensors, improved display technologies (like AMOLED), and faster processors. Competitive advantages are achieved through superior design, unique features (e.g., advanced health monitoring), and strong brand recognition. The market is seeing a shift towards more stylish and versatile devices that cater to diverse lifestyles and budgets.

Key Drivers, Barriers & Challenges in Latin America Smartwatch Industry

Key Drivers:

- Increasing smartphone penetration and internet access.

- Growing awareness of health and fitness.

- Rising disposable incomes, especially in the middle class.

- Technological advancements in display technology, battery life, and sensor capabilities.

Challenges:

- High import tariffs and taxes which increase the cost of smartwatches.

- Economic instability in some countries impacting consumer spending.

- Competition from low-cost Chinese brands.

- Supply chain disruptions causing delays and impacting pricing.

Growth Drivers in the Latin America Smartwatch Industry Market

The Latin American smartwatch market is driven by technological advancements, rising disposable incomes, and increasing health consciousness. Government initiatives promoting digitalization and health technology also contribute. The expansion of e-commerce further facilitates market access.

Challenges Impacting Latin America Smartwatch Industry Growth

Challenges include economic volatility affecting consumer spending, high import costs increasing device prices, and intense competition from established global players and emerging Chinese brands. Supply chain disruptions can lead to delays and price fluctuations.

Key Players Shaping the Latin America Smartwatch Industry Market

Significant Latin America Smartwatch Industry Industry Milestones

- January 2022: Fossil and Razer launched a co-branded smartwatch.

- May 2022: Google debuted its Pixel Watch, integrating Wear OS with Fitbit technology. Huawei launched several new wearables.

- July 2022: Qualcomm announced the Snapdragon W5+ Gen 1 and W5 Gen 1 platforms for wearables.

- August 2022: Samsung unveiled the Galaxy Watch5 and Watch5 Pro.

Future Outlook for Latin America Smartwatch Industry Market

The Latin American smartwatch market is poised for continued growth, driven by technological innovation, increasing affordability, and expanding health awareness. Strategic opportunities exist for companies focusing on localized features, affordable pricing, and robust distribution networks. The market's potential is significant, presenting a lucrative landscape for both established players and new entrants.

Latin America Smartwatch Industry Segmentation

-

1. Operating Systems

- 1.1. Watch OS

- 1.2. Android/Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

Latin America Smartwatch Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Smartwatch Industry Regional Market Share

Geographic Coverage of Latin America Smartwatch Industry

Latin America Smartwatch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices and Limited Use of Features

- 3.3.2 augmented With Security Risks

- 3.4. Market Trends

- 3.4.1. Medical and Fitness to Account for a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Smartwatch Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 5.1.1. Watch OS

- 5.1.2. Android/Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Garmin Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fitbit Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Technologies Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fossil Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apple Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Polar Electro OY

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sony Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LG Electronics Inc

List of Figures

- Figure 1: Latin America Smartwatch Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Smartwatch Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Smartwatch Industry Revenue billion Forecast, by Operating Systems 2020 & 2033

- Table 2: Latin America Smartwatch Industry Volume K Unit Forecast, by Operating Systems 2020 & 2033

- Table 3: Latin America Smartwatch Industry Revenue billion Forecast, by Display Type 2020 & 2033

- Table 4: Latin America Smartwatch Industry Volume K Unit Forecast, by Display Type 2020 & 2033

- Table 5: Latin America Smartwatch Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Latin America Smartwatch Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Latin America Smartwatch Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Latin America Smartwatch Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Latin America Smartwatch Industry Revenue billion Forecast, by Operating Systems 2020 & 2033

- Table 10: Latin America Smartwatch Industry Volume K Unit Forecast, by Operating Systems 2020 & 2033

- Table 11: Latin America Smartwatch Industry Revenue billion Forecast, by Display Type 2020 & 2033

- Table 12: Latin America Smartwatch Industry Volume K Unit Forecast, by Display Type 2020 & 2033

- Table 13: Latin America Smartwatch Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Latin America Smartwatch Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Latin America Smartwatch Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Smartwatch Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Brazil Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Brazil Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Argentina Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Chile Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Chile Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Colombia Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Colombia Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Mexico Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Mexico Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Peru Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Peru Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Venezuela Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Venezuela Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Ecuador Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Ecuador Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Bolivia Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Bolivia Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Paraguay Latin America Smartwatch Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Paraguay Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Smartwatch Industry?

The projected CAGR is approximately 7.57%.

2. Which companies are prominent players in the Latin America Smartwatch Industry?

Key companies in the market include LG Electronics Inc, Lenovo Group Limited, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit Inc, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Polar Electro OY, Sony Corporation.

3. What are the main segments of the Latin America Smartwatch Industry?

The market segments include Operating Systems, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer.

6. What are the notable trends driving market growth?

Medical and Fitness to Account for a Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices and Limited Use of Features. augmented With Security Risks.

8. Can you provide examples of recent developments in the market?

August 2022 : Samsung Electronics Co., Ltd. unveiled the Galaxy Watch5 and Galaxy Watch5 Pro, which will help shape fitness and wellness behaviors through intelligent insights, sophisticated features, and significantly more robust capabilities. The Galaxy Watch5 improves aspects that users depend on daily, while the Galaxy Watch5 Pro, the new introduction to the Galaxy Watch series, is Samsung's most robust and feature-packed wristwatch ever.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Smartwatch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Smartwatch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Smartwatch Industry?

To stay informed about further developments, trends, and reports in the Latin America Smartwatch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence