Key Insights

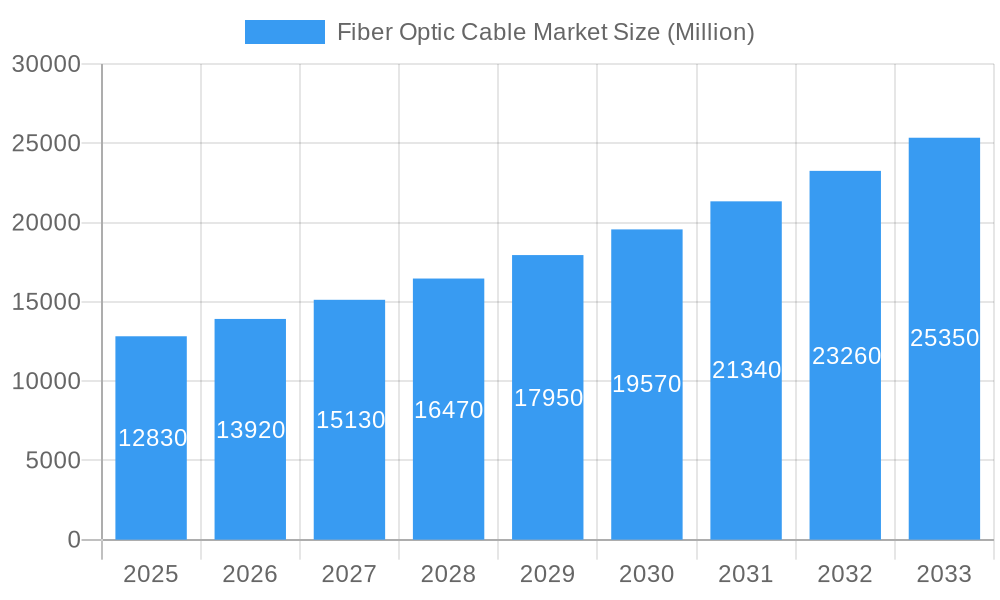

The fiber optic cable market, valued at $12.83 billion in 2025, is projected to experience robust growth, driven by the increasing demand for high-speed data transmission across various sectors. The Compound Annual Growth Rate (CAGR) of 8.46% from 2025 to 2033 indicates a significant expansion, fueled primarily by the burgeoning telecommunications industry's need for enhanced network infrastructure to support 5G rollout and the growing adoption of cloud computing and data centers. Further growth drivers include the expanding power utility sector's reliance on fiber optics for smart grid applications and the increasing demand for secure communication within the defense and military sectors. The market is segmented by end-user industry, with telecommunications holding the largest market share, followed by power utilities, defense/military, industrial, medical, and others. While technological advancements and government initiatives supporting digital infrastructure development contribute positively, potential restraints include high initial investment costs for infrastructure deployment and competition from alternative technologies. Geographical analysis reveals a strong presence across North America, Europe, and particularly the Asia-Pacific region, with countries like China, India, and Japan leading in market adoption. The market's continuous evolution anticipates further expansion fueled by the relentless drive towards higher bandwidth and faster data speeds globally.

Fiber Optic Cable Market Market Size (In Billion)

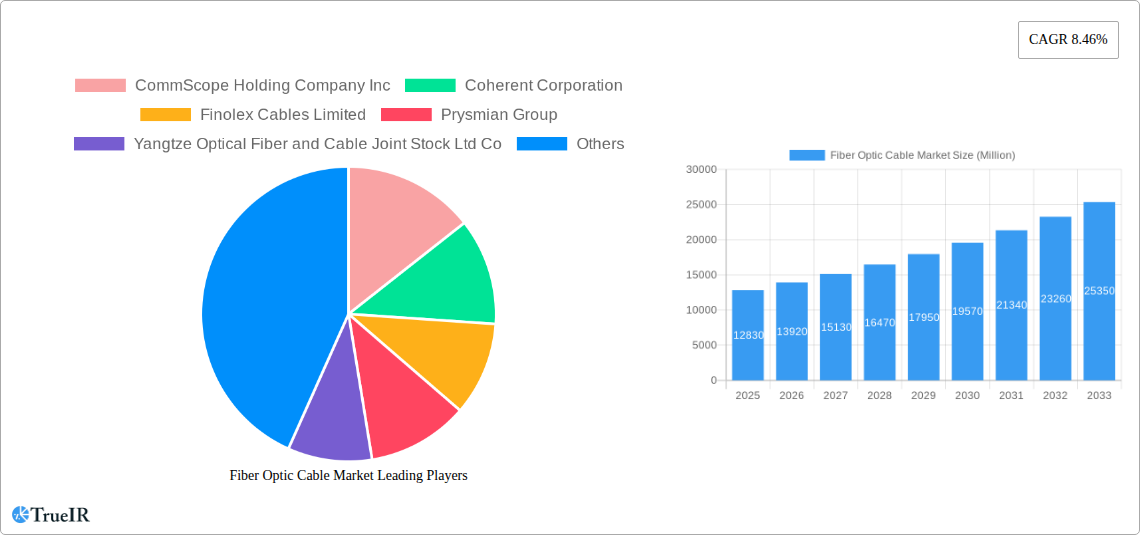

The forecast period (2025-2033) suggests a steady expansion of the fiber optic cable market. Competitive dynamics are intense, with key players like CommScope, Coherent, Finolex Cables, Prysmian Group, Yangtze Optical Fiber, Sterlite Technologies, Proterial Cable America, Corning, Sumitomo Electric, and Furukawa Electric vying for market share through technological innovation and strategic partnerships. Regional variations in market growth are anticipated, reflecting the varying levels of digital infrastructure development and economic growth across different regions. The Asia-Pacific region, with its large and rapidly growing economies, is expected to witness particularly strong growth throughout the forecast period. Ongoing research and development efforts focused on improving fiber optic cable technology, such as the development of higher-bandwidth fibers and more efficient manufacturing processes, will contribute to market expansion and sustained growth over the long term. Understanding these factors is crucial for businesses seeking to navigate and succeed in this dynamic market.

Fiber Optic Cable Market Company Market Share

Fiber Optic Cable Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Fiber Optic Cable Market, covering market structure, competitive landscape, trends, opportunities, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data analysis to provide invaluable insights for businesses operating in or seeking to enter this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Fiber Optic Cable Market Market Structure & Competitive Landscape

The fiber optic cable market exhibits a moderately concentrated structure, with several key players dominating significant market shares. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a competitive yet consolidated market. Innovation, particularly in fiber types and transmission technologies, serves as a crucial driver of market growth. Stringent regulatory frameworks related to infrastructure deployment and data security significantly influence market dynamics. Product substitutes, primarily traditional copper cabling, face diminishing market share due to the superior bandwidth and speed of fiber optics. The market is segmented by end-user industry, including telecommunications (the largest segment), power utilities, defense/military, industrial, medical, and other end-user industries.

M&A activity in the industry is relatively frequent, driven by consolidation among manufacturers and expansion into new geographical markets. Over the period 2019-2024, an estimated xx Million worth of M&A transactions occurred. These activities often result in increased market share for the acquiring companies and technological advancements through the integration of R&D capabilities. The competitive landscape is characterized by both intense price competition and a focus on product differentiation through technological innovation and customized solutions.

Fiber Optic Cable Market Market Trends & Opportunities

The fiber optic cable market is experiencing exponential growth, fueled by the increasing demand for high-speed data transmission across various sectors. The global market size is valued at xx Million in 2025 and is projected to reach xx Million by 2033. This represents a significant expansion, driven by factors such as the proliferation of 5G networks, the rise of cloud computing, and the increasing adoption of IoT devices. Technological advancements, including the development of higher bandwidth fibers and more efficient transmission systems, further contribute to market expansion.

Consumer preferences are shifting towards higher bandwidth, lower latency solutions, driving innovation in fiber optic cable technologies. This demand is particularly pronounced in the telecommunications sector, which represents the largest end-user segment of the market. Competitive dynamics are shaped by the constant push for technological innovation and cost optimization. Companies are investing heavily in R&D to develop new fiber optic cable designs and manufacturing processes to maintain a competitive edge.

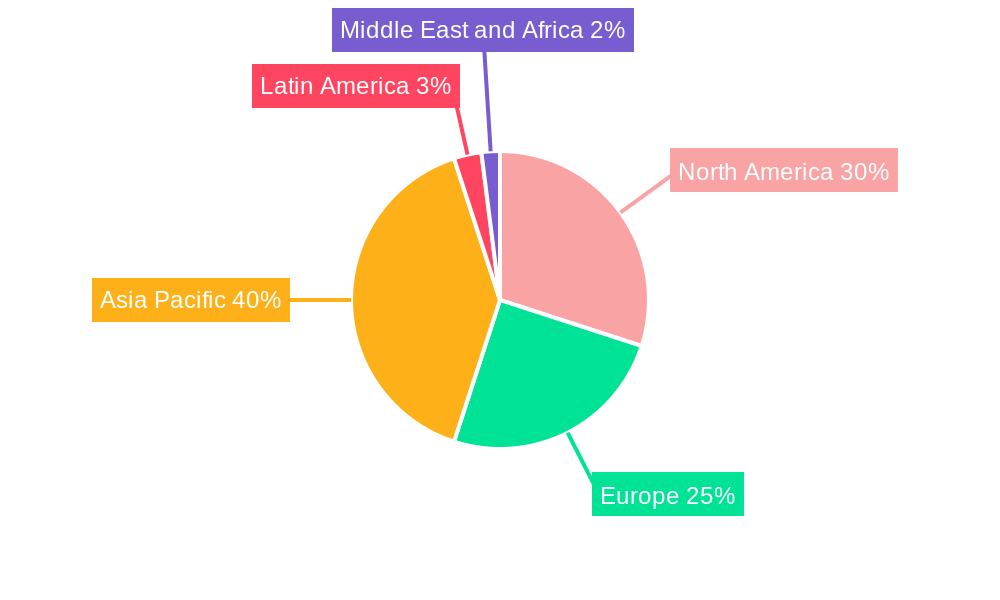

Dominant Markets & Segments in Fiber Optic Cable Market

The Asia-Pacific region currently dominates the fiber optic cable market, driven by substantial investments in infrastructure development and the rapid expansion of telecommunication networks in countries like China, India, and Japan.

- Key Growth Drivers in Asia-Pacific:

- Massive infrastructure projects (5G rollout, data center expansion)

- Government initiatives promoting digitalization

- Increasing adoption of high-speed internet services

The Telecommunications sector consistently accounts for the largest market share, owing to the crucial role fiber optic cables play in supporting high-speed data transmission and connectivity.

- Key Growth Drivers in the Telecommunications Sector:

- Growing demand for high-bandwidth applications (video streaming, online gaming)

- Increasing adoption of cloud-based services

- Expansion of 5G and fiber-to-the-home (FTTH) networks

North America and Europe also exhibit strong growth, although at a slightly slower pace compared to the Asia-Pacific region. Factors contributing to growth in these regions include ongoing network upgrades and the growing adoption of smart city initiatives.

Fiber Optic Cable Market Product Analysis

Significant product innovations focus on enhancing bandwidth, reducing signal loss, and improving cable durability and flexibility. Advancements like the recent development of a 160-micron optical fiber by Sterlite Technologies exemplifies the trend toward smaller, higher-performance cables. These innovations find applications across various sectors, from high-speed data transmission in telecommunications to improved imaging capabilities in the medical field. The competitive advantage lies in offering superior performance characteristics, cost-effectiveness, and ease of installation.

Key Drivers, Barriers & Challenges in Fiber Optic Cable Market

Key Drivers:

- Increasing demand for high-speed internet and data transmission.

- Expansion of 5G and FTTH networks.

- Growth of cloud computing and data centers.

- Government initiatives promoting digital infrastructure development.

Key Challenges:

- High initial investment costs associated with fiber optic cable infrastructure deployment.

- Competition from existing copper cabling infrastructure.

- Potential supply chain disruptions impacting raw material availability and production capacity. This could lead to a xx% increase in production costs.

- Regulatory hurdles and permitting processes can delay project timelines.

Growth Drivers in the Fiber Optic Cable Market Market

The market's growth is propelled by the escalating demand for high-speed data transmission, fueled by the proliferation of 5G networks, the cloud, and IoT. Government investments in digital infrastructure and supportive regulatory frameworks also play a significant role. Technological advancements, such as the development of slimmer, higher-bandwidth fibers, continuously enhance the capabilities of fiber optic cables.

Challenges Impacting Fiber Optic Cable Market Growth

Major hurdles include the high capital expenditure needed for deployment, competition from established copper networks, and potential supply chain disruptions that can inflate costs. Complex regulatory processes and permit acquisitions further impede project execution. These challenges necessitate strategic planning and risk mitigation for market participants.

Key Players Shaping the Fiber Optic Cable Market Market

- CommScope Holding Company Inc

- Coherent Corporation

- Finolex Cables Limited

- Prysmian Group

- Yangtze Optical Fiber and Cable Joint Stock Ltd Co

- Sterlite Technologies

- Proterial Cable America Inc (Proterial Ltd)

- Corning Inc

- Sumitomo Electric Industries Ltd

- Furukawa Electric

Significant Fiber Optic Cable Market Industry Milestones

- October 2023: Sterlite Technologies Ltd (STL) announced the development and patenting of a 160-micron optical fiber, one of the world’s slimmest, significantly enhancing telecommunication capabilities.

- September 2023: Coherent Corp. launched a 1200 mW pump laser module, addressing capacity limits in optical communications and expanding transmission windows.

Future Outlook for Fiber Optic Cable Market Market

The fiber optic cable market is poised for continued robust growth, driven by ongoing investments in 5G and broadband infrastructure, expansion of data centers, and the rise of cloud-based services. Strategic opportunities exist for companies focused on innovation in fiber design, efficient manufacturing processes, and tailored solutions for emerging sectors. The market's long-term prospects remain exceptionally positive, indicating substantial growth potential in the coming years.

Fiber Optic Cable Market Segmentation

-

1. End-user Industry

- 1.1. Telecommunication

- 1.2. Power Utilities

- 1.3. Defense/Military

- 1.4. Industrial

- 1.5. Medical

- 1.6. Other End-user Industries

Fiber Optic Cable Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Fiber Optic Cable Market Regional Market Share

Geographic Coverage of Fiber Optic Cable Market

Fiber Optic Cable Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of Internet and High Data Traffic; Increasing Adoption of 5G and FTTX; Rising Number of Data Center Facilities

- 3.3. Market Restrains

- 3.3.1. ; High installation and Maintenance Cost is Hindering the Market Growth

- 3.4. Market Trends

- 3.4.1. Telecommunications Sector Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fiber Optic Cable Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Telecommunication

- 5.1.2. Power Utilities

- 5.1.3. Defense/Military

- 5.1.4. Industrial

- 5.1.5. Medical

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Fiber Optic Cable Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Telecommunication

- 6.1.2. Power Utilities

- 6.1.3. Defense/Military

- 6.1.4. Industrial

- 6.1.5. Medical

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Fiber Optic Cable Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Telecommunication

- 7.1.2. Power Utilities

- 7.1.3. Defense/Military

- 7.1.4. Industrial

- 7.1.5. Medical

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Fiber Optic Cable Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Telecommunication

- 8.1.2. Power Utilities

- 8.1.3. Defense/Military

- 8.1.4. Industrial

- 8.1.5. Medical

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America Fiber Optic Cable Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Telecommunication

- 9.1.2. Power Utilities

- 9.1.3. Defense/Military

- 9.1.4. Industrial

- 9.1.5. Medical

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Fiber Optic Cable Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Telecommunication

- 10.1.2. Power Utilities

- 10.1.3. Defense/Military

- 10.1.4. Industrial

- 10.1.5. Medical

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CommScope Holding Company Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Coherent Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Finolex Cables Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Prysmian Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yangtze Optical Fiber and Cable Joint Stock Ltd Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sterlite Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Proterial Cable America Inc (Proterial Ltd)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corning Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sumitomo Electric Industries Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Furukawa Electric

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CommScope Holding Company Inc

List of Figures

- Figure 1: Global Fiber Optic Cable Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fiber Optic Cable Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: North America Fiber Optic Cable Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Fiber Optic Cable Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Fiber Optic Cable Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Fiber Optic Cable Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe Fiber Optic Cable Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Fiber Optic Cable Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Fiber Optic Cable Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Fiber Optic Cable Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Fiber Optic Cable Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Fiber Optic Cable Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Fiber Optic Cable Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Fiber Optic Cable Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Latin America Fiber Optic Cable Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Latin America Fiber Optic Cable Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Fiber Optic Cable Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Fiber Optic Cable Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Fiber Optic Cable Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Fiber Optic Cable Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Fiber Optic Cable Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fiber Optic Cable Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Fiber Optic Cable Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Fiber Optic Cable Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Fiber Optic Cable Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Fiber Optic Cable Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Fiber Optic Cable Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Fiber Optic Cable Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Fiber Optic Cable Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Fiber Optic Cable Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Fiber Optic Cable Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Fiber Optic Cable Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Fiber Optic Cable Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fiber Optic Cable Market?

The projected CAGR is approximately 8.46%.

2. Which companies are prominent players in the Fiber Optic Cable Market?

Key companies in the market include CommScope Holding Company Inc, Coherent Corporation, Finolex Cables Limited, Prysmian Group, Yangtze Optical Fiber and Cable Joint Stock Ltd Co, Sterlite Technologies, Proterial Cable America Inc (Proterial Ltd), Corning Inc, Sumitomo Electric Industries Ltd, Furukawa Electric.

3. What are the main segments of the Fiber Optic Cable Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Internet and High Data Traffic; Increasing Adoption of 5G and FTTX; Rising Number of Data Center Facilities.

6. What are the notable trends driving market growth?

Telecommunications Sector Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High installation and Maintenance Cost is Hindering the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023 - Sterlite Technologies Ltd (STL) announced that the company had developed a 160-micron optical fiber, among the world’s slimmest fiber for telecommunication. This innovation was conceptualized and developed indigenously at STL’s Centre of Excellence in Maharashtra. With this launch, the company has become the first to develop and patent this technology globally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fiber Optic Cable Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fiber Optic Cable Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fiber Optic Cable Market?

To stay informed about further developments, trends, and reports in the Fiber Optic Cable Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence