Key Insights

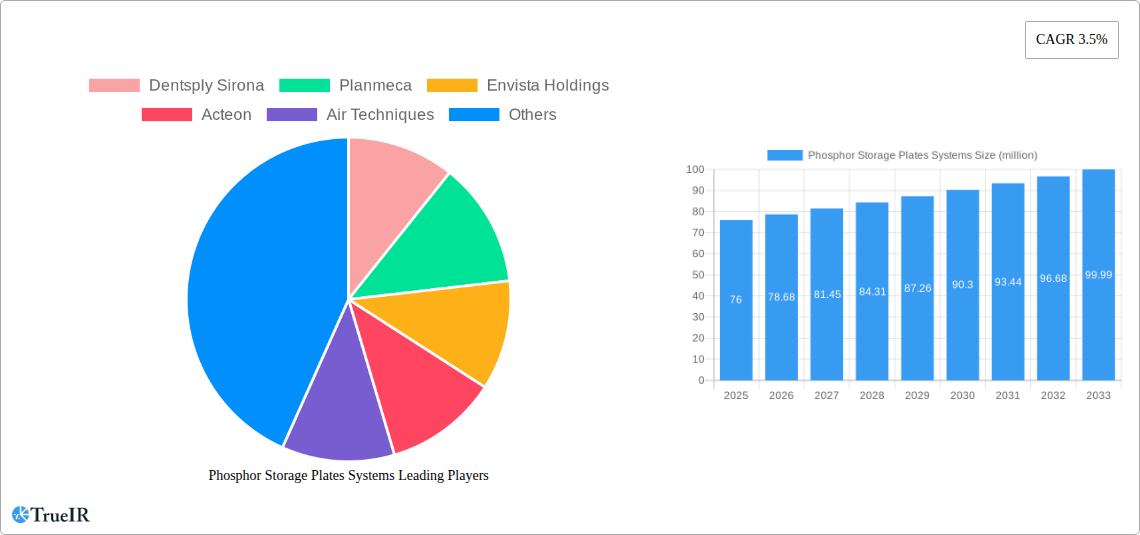

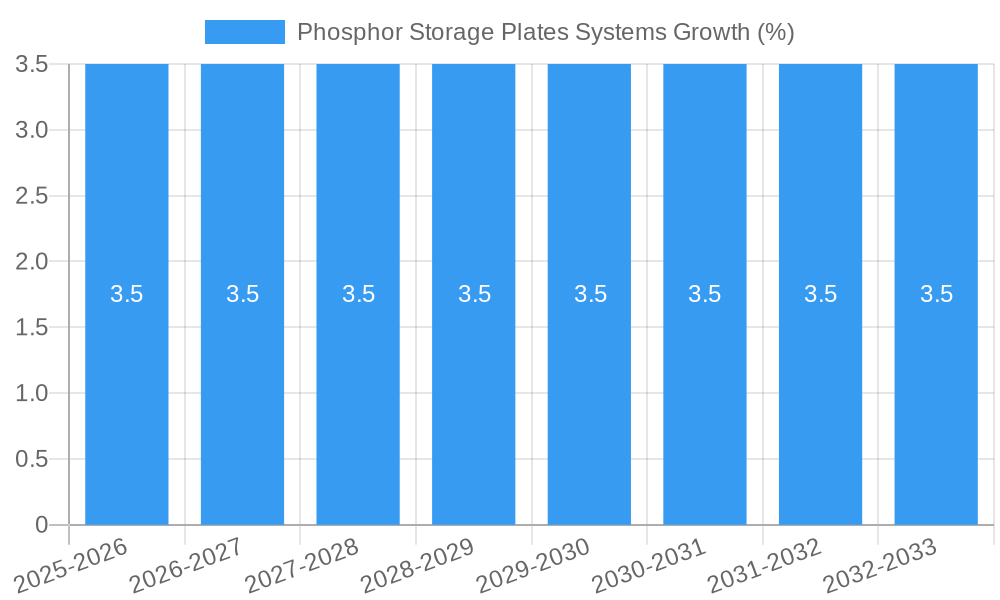

The global Phosphor Storage Plates (PSP) Systems market is poised for steady expansion, projected to reach an estimated $76 million by 2025, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 3.5% during the forecast period of 2025-2033. This growth is primarily fueled by the increasing adoption of digital radiography in dental practices, driven by the need for enhanced diagnostic accuracy, reduced radiation exposure for patients and practitioners, and improved workflow efficiency. Dental clinics, as a major application segment, are expected to lead this expansion due to the widespread integration of PSP systems for routine dental imaging. The market also benefits from advancements in image resolution and processing capabilities, making PSP systems a cost-effective yet high-performing alternative to traditional film-based radiography and even some direct digital radiography solutions. Emerging economies, particularly in the Asia Pacific region, are presenting significant growth opportunities as dental healthcare infrastructure develops and awareness of advanced imaging technologies increases.

Despite the positive outlook, the PSP Systems market faces certain restraints. The rising popularity and continuous technological evolution of direct radiography (DR) systems, which offer real-time imaging and potentially higher resolution in some applications, present a competitive challenge. Furthermore, the initial investment cost for PSP systems, although lower than some DR alternatives, can still be a barrier for smaller dental practices or those in budget-constrained regions. However, the inherent benefits of PSP systems, such as their flexibility in handling various intraoral and extraoral imaging needs and their established reliability, are expected to sustain their market presence. The market is segmented by size, with smaller sizes catering to intraoral diagnostics and larger sizes for extraoral procedures, indicating a diverse range of applications. Key players are actively engaged in research and development to enhance image quality, reduce processing times, and improve the overall user experience of their PSP systems.

The global Phosphor Storage Plates (PSP) Systems market, valued at approximately xx million in 2025, exhibits a moderately concentrated competitive landscape. Leading players such as Dentsply Sirona, Planmeca, and Envista Holdings command significant market share, driven by extensive product portfolios and established distribution networks. Innovation remains a critical driver, with companies continuously investing in R&D to enhance plate resolution, reduce scanning times, and improve image processing capabilities. Regulatory impacts, particularly evolving standards for digital radiography and data security, shape product development and market entry strategies. Product substitutes, primarily direct radiography (DR) systems, present a competitive challenge, though PSP systems offer a compelling balance of cost-effectiveness and image quality for many dental practices. End-user segmentation reveals a strong reliance on dental clinics, which constitute over xx million in market value, followed by dental hospitals. Mergers and acquisitions (M&A) are strategic maneuvers employed by key players to expand their market reach and acquire innovative technologies. For instance, recent M&A activities have focused on consolidating market presence and integrating advanced imaging solutions. The concentration ratio is estimated to be around xx%, indicating a significant but not entirely monopolistic market.

Phosphor Storage Plates Systems Market Trends & Opportunities

The global Phosphor Storage Plates (PSP) Systems market is poised for substantial growth, projected to expand from approximately xx million in 2025 to an estimated xx million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period of 2025–2033. This robust expansion is fueled by several interconnected trends and emerging opportunities. A primary trend is the increasing adoption of digital imaging technologies in dentistry, driven by the pursuit of enhanced diagnostic accuracy, improved workflow efficiency, and reduced radiation exposure for both patients and practitioners. PSP systems, with their inherent flexibility and relatively lower initial investment compared to traditional film-based radiography or even some DR systems, are particularly attractive to a broad spectrum of dental practices, from small independent clinics to larger hospital departments.

Technological advancements are a significant catalyst for market penetration. Innovations are focused on developing thinner, more durable PSPs with higher spatial resolution, leading to clearer and more detailed diagnostic images. Furthermore, faster scanning and processing times are crucial for improving chairside efficiency, a key consideration for busy dental professionals. The integration of AI-powered image analysis software with PSP systems presents a nascent but promising opportunity, offering automated detection of dental anomalies and streamlining the diagnostic process.

Consumer preferences are also subtly shifting. Patients are increasingly aware of and concerned about radiation exposure, making digital imaging solutions that offer dose reduction a preferred choice. Dentists, in turn, are leveraging these technologies to provide a more transparent and patient-centric experience, showcasing diagnostic images directly to patients.

The competitive dynamics within the PSP systems market are characterized by both intense rivalry among established players and the emergence of new entrants, particularly from regions with rapidly growing healthcare sectors. Companies are differentiating themselves through superior image quality, user-friendly software interfaces, comprehensive customer support, and competitive pricing strategies. The global market penetration rate for PSP systems, while significant, still has considerable room for growth, especially in developing economies where the transition from analog to digital radiography is gaining momentum. The demand for intraoral PSPs, in particular, is expected to surge as dentists seek seamless integration of imaging into their daily clinical workflows.

Dominant Markets & Segments in Phosphor Storage Plates Systems

The global Phosphor Storage Plates (PSP) Systems market exhibits distinct regional dominance and segment penetration, driven by a confluence of economic, technological, and healthcare infrastructure factors. Within the Application segment, Dental Clinics represent the dominant force, accounting for an estimated xx million of the market value in 2025. This dominance is attributed to the sheer volume of dental practices worldwide, where PSP systems offer an optimal blend of diagnostic capability and cost-effectiveness for routine dental imaging needs. The shift towards digital workflows in general dentistry is a primary growth driver, enabling faster patient throughput and improved patient communication through readily shareable digital images.

Dental Hospitals, while representing a smaller but significant segment (estimated xx million market value in 2025), contribute to market growth through their demand for advanced imaging solutions for more complex diagnostic procedures and treatment planning. The growing emphasis on specialized dental care within hospital settings necessitates sophisticated imaging technologies, where PSP systems can complement or integrate with existing digital radiography infrastructure.

The Types segment, categorized by Sizes (0 to 4) and Sizes (0 to 3), reflects specific clinical requirements. Sizes (0 to 4), encompassing intraoral and panoramic imaging plates, likely hold a larger market share due to their widespread application in general dentistry. The versatility of these sizes for capturing detailed intraoral radiographs and comprehensive panoramic views makes them indispensable for daily diagnostics. Sizes (0 to 3), often catering to specialized intraoral applications or pediatric dentistry, also contribute to market diversity, albeit with a potentially smaller market footprint.

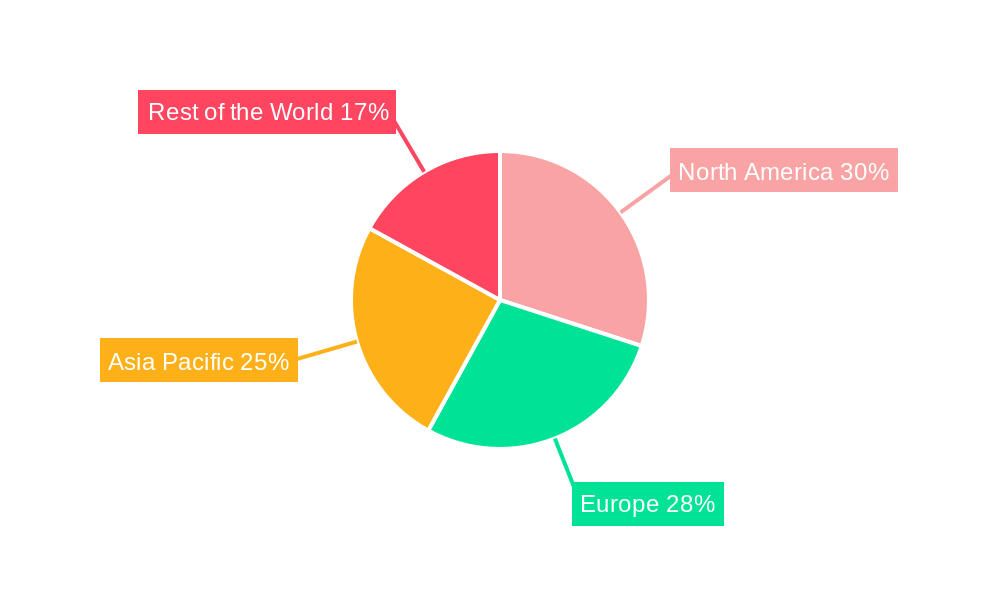

Geographically, North America and Europe currently lead the market, driven by advanced healthcare infrastructure, high disposable incomes, and early adoption of digital dental technologies. However, the Asia-Pacific region is emerging as a significant growth engine, propelled by increasing healthcare expenditure, a growing dentist population, and a rising awareness of digital imaging benefits. Favorable government initiatives promoting digitalization in healthcare and the presence of a burgeoning middle class further bolster market expansion in this region. Infrastructure development, particularly in emerging economies, coupled with supportive policies aimed at enhancing dental care accessibility, are key growth drivers for PSP systems.

Phosphor Storage Plates Systems Product Analysis

The Phosphor Storage Plates (PSP) Systems market is characterized by continuous product innovation aimed at enhancing diagnostic precision and operational efficiency. Key advancements include the development of thinner, more flexible PSPs with superior resolution, enabling clearer visualization of intricate dental structures. Improved plate materials are also enhancing durability and ease of disinfection, crucial for infection control in clinical settings. Furthermore, rapid scanning and image retrieval technologies are significantly reducing patient waiting times and improving workflow for dental professionals. The integration of advanced image processing software, offering features like noise reduction and contrast enhancement, further optimizes diagnostic capabilities. These product advancements provide competitive advantages by offering a cost-effective yet high-performance alternative to traditional film and, in some cases, even direct radiography systems.

Key Drivers, Barriers & Challenges in Phosphor Storage Plates Systems

Key Drivers: The Phosphor Storage Plates Systems market is propelled by several critical factors. Technological advancements in sensor technology and image processing software are enhancing diagnostic accuracy and workflow efficiency, making digital radiography more accessible and appealing. Increasing adoption of digital imaging in dental practices, driven by the need for improved patient care and operational streamlining, is a major growth catalyst. Growing awareness of radiation safety among both patients and practitioners fuels the demand for digital solutions that offer dose reduction capabilities. Cost-effectiveness compared to some other digital imaging modalities makes PSP systems an attractive option, particularly for smaller clinics and in emerging markets. Supportive government initiatives promoting healthcare digitalization and improved dental access also play a crucial role.

Barriers & Challenges: Despite its growth potential, the market faces several impediments. Competition from Direct Radiography (DR) systems presents a significant challenge, as DR offers real-time imaging. High initial investment for scanners and software, although lower than some DR systems, can still be a barrier for certain practices. The need for continuous technological upgrades and software compatibility issues can create ongoing costs and operational complexities. Data security and privacy concerns related to digital patient records require robust cybersecurity measures, adding to the operational burden. Supply chain disruptions and availability of skilled technicians for maintenance and repair can impact market growth, particularly in remote areas. Regulatory hurdles and evolving standards for digital diagnostic equipment also pose ongoing challenges for manufacturers and users.

Growth Drivers in the Phosphor Storage Plates Systems Market

Key growth drivers for the Phosphor Storage Plates Systems market are multifaceted, encompassing technological innovation, economic incentives, and policy support. Technological advancements in phosphor material science and scanner design are leading to higher image resolution, faster acquisition times, and improved durability of PSPs, directly enhancing diagnostic capabilities. Economically, the cost-effectiveness of PSP systems, offering a compelling balance between initial investment and performance compared to direct radiography, is a significant draw for dental practices of all sizes, especially in price-sensitive markets. Government initiatives and favorable healthcare policies that encourage the adoption of digital diagnostic tools and improve dental care accessibility further stimulate market expansion. The increasing emphasis on preventative dentistry and early disease detection necessitates advanced imaging, which PSP systems effectively provide, thereby driving their demand.

Challenges Impacting Phosphor Storage Plates Systems Growth

Several challenges can impede the growth of the Phosphor Storage Plates Systems market. Intense competition from Direct Radiography (DR) systems, which offer real-time imaging, remains a primary restraint. While PSP systems offer a lower entry cost, the immediate feedback of DR can be a significant advantage in high-volume practices. The requirement for periodic plate replacement and maintenance of scanners introduces ongoing operational costs that can be a deterrent for some users. Evolving cybersecurity regulations and data privacy concerns necessitate continuous investment in robust IT infrastructure and compliance measures, adding to the overall cost of ownership. Supply chain vulnerabilities and potential disruptions in the availability of key components or finished products can impact market stability and timely delivery. Furthermore, the learning curve associated with adopting new digital workflows and ensuring proper staff training can present an initial hurdle for some dental professionals, impacting the pace of adoption.

Key Players Shaping the Phosphor Storage Plates Systems Market

- Dentsply Sirona

- Planmeca

- Envista Holdings

- Acteon

- Air Techniques

- Carestream Dental

- Digiray

- Nical

- Trident

- CRUXELL Corp

Significant Phosphor Storage Plates Systems Industry Milestones

- 2019: Launch of ultra-thin PSPs with enhanced resolution, improving image quality and patient comfort.

- 2020: Introduction of AI-powered image analysis software integrated with PSP workflows, offering preliminary diagnostic assistance.

- 2021: Major manufacturers announce initiatives to develop more robust and easily disinfectable PSPs to meet evolving infection control standards.

- 2022: Increased M&A activity as larger players consolidate market share and acquire innovative imaging technologies.

- 2023: Development of faster scanning protocols for PSPs, significantly reducing image acquisition and processing times.

- 2024: Focus on wireless connectivity solutions for PSP scanners to enhance practice workflow flexibility.

Future Outlook for Phosphor Storage Plates Systems Market

- 2019: Launch of ultra-thin PSPs with enhanced resolution, improving image quality and patient comfort.

- 2020: Introduction of AI-powered image analysis software integrated with PSP workflows, offering preliminary diagnostic assistance.

- 2021: Major manufacturers announce initiatives to develop more robust and easily disinfectable PSPs to meet evolving infection control standards.

- 2022: Increased M&A activity as larger players consolidate market share and acquire innovative imaging technologies.

- 2023: Development of faster scanning protocols for PSPs, significantly reducing image acquisition and processing times.

- 2024: Focus on wireless connectivity solutions for PSP scanners to enhance practice workflow flexibility.

Future Outlook for Phosphor Storage Plates Systems Market

The future outlook for the Phosphor Storage Plates (PSP) Systems market is characterized by sustained growth driven by ongoing technological advancements and expanding global adoption. The continuous refinement of PSP technology, focusing on higher resolution, faster scanning, and increased durability, will ensure their competitive edge. The integration of artificial intelligence for image analysis and workflow automation presents a significant opportunity to enhance diagnostic capabilities and practice efficiency. As digital imaging becomes increasingly standard in dental care, especially in emerging economies, PSP systems are well-positioned to capture a substantial share due to their favorable cost-performance ratio. Strategic partnerships and potential acquisitions among key players will likely continue to shape the competitive landscape, driving innovation and market consolidation. The increasing emphasis on preventative care and patient-centric treatment models will further fuel the demand for accessible and high-quality digital imaging solutions, cementing the role of PSP systems in the future of dentistry.

Phosphor Storage Plates Systems Segmentation

-

1. Application

- 1.1. Dental Clinics

- 1.2. Dental Hospitals

- 1.3. Others

-

2. Types

- 2.1. Sizes (0 to 4)

- 2.2. Sizes (0 to 3)

Phosphor Storage Plates Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Phosphor Storage Plates Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Phosphor Storage Plates Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dental Clinics

- 5.1.2. Dental Hospitals

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Sizes (0 to 4)

- 5.2.2. Sizes (0 to 3)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Phosphor Storage Plates Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dental Clinics

- 6.1.2. Dental Hospitals

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Sizes (0 to 4)

- 6.2.2. Sizes (0 to 3)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Phosphor Storage Plates Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dental Clinics

- 7.1.2. Dental Hospitals

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Sizes (0 to 4)

- 7.2.2. Sizes (0 to 3)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Phosphor Storage Plates Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dental Clinics

- 8.1.2. Dental Hospitals

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Sizes (0 to 4)

- 8.2.2. Sizes (0 to 3)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Phosphor Storage Plates Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dental Clinics

- 9.1.2. Dental Hospitals

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Sizes (0 to 4)

- 9.2.2. Sizes (0 to 3)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Phosphor Storage Plates Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dental Clinics

- 10.1.2. Dental Hospitals

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Sizes (0 to 4)

- 10.2.2. Sizes (0 to 3)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dentsply Sirona

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Planmeca

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Envista Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Acteon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Air Techniques

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Carestream Dental

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Digiray

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trident

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CRUXELL Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dentsply Sirona

List of Figures

- Figure 1: Global Phosphor Storage Plates Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Phosphor Storage Plates Systems Revenue (million), by Application 2024 & 2032

- Figure 3: North America Phosphor Storage Plates Systems Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Phosphor Storage Plates Systems Revenue (million), by Types 2024 & 2032

- Figure 5: North America Phosphor Storage Plates Systems Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Phosphor Storage Plates Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America Phosphor Storage Plates Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Phosphor Storage Plates Systems Revenue (million), by Application 2024 & 2032

- Figure 9: South America Phosphor Storage Plates Systems Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Phosphor Storage Plates Systems Revenue (million), by Types 2024 & 2032

- Figure 11: South America Phosphor Storage Plates Systems Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Phosphor Storage Plates Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America Phosphor Storage Plates Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Phosphor Storage Plates Systems Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Phosphor Storage Plates Systems Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Phosphor Storage Plates Systems Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Phosphor Storage Plates Systems Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Phosphor Storage Plates Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Phosphor Storage Plates Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Phosphor Storage Plates Systems Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Phosphor Storage Plates Systems Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Phosphor Storage Plates Systems Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Phosphor Storage Plates Systems Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Phosphor Storage Plates Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Phosphor Storage Plates Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Phosphor Storage Plates Systems Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Phosphor Storage Plates Systems Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Phosphor Storage Plates Systems Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Phosphor Storage Plates Systems Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Phosphor Storage Plates Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Phosphor Storage Plates Systems Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Phosphor Storage Plates Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Phosphor Storage Plates Systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Phosphor Storage Plates Systems Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Phosphor Storage Plates Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Phosphor Storage Plates Systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Phosphor Storage Plates Systems Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Phosphor Storage Plates Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Phosphor Storage Plates Systems Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Phosphor Storage Plates Systems Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Phosphor Storage Plates Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Phosphor Storage Plates Systems Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Phosphor Storage Plates Systems Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Phosphor Storage Plates Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Phosphor Storage Plates Systems Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Phosphor Storage Plates Systems Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Phosphor Storage Plates Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Phosphor Storage Plates Systems Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Phosphor Storage Plates Systems Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Phosphor Storage Plates Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Phosphor Storage Plates Systems Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phosphor Storage Plates Systems?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Phosphor Storage Plates Systems?

Key companies in the market include Dentsply Sirona, Planmeca, Envista Holdings, Acteon, Air Techniques, Carestream Dental, Digiray, Nical, Trident, CRUXELL Corp.

3. What are the main segments of the Phosphor Storage Plates Systems?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 76 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Phosphor Storage Plates Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Phosphor Storage Plates Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Phosphor Storage Plates Systems?

To stay informed about further developments, trends, and reports in the Phosphor Storage Plates Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence