Key Insights

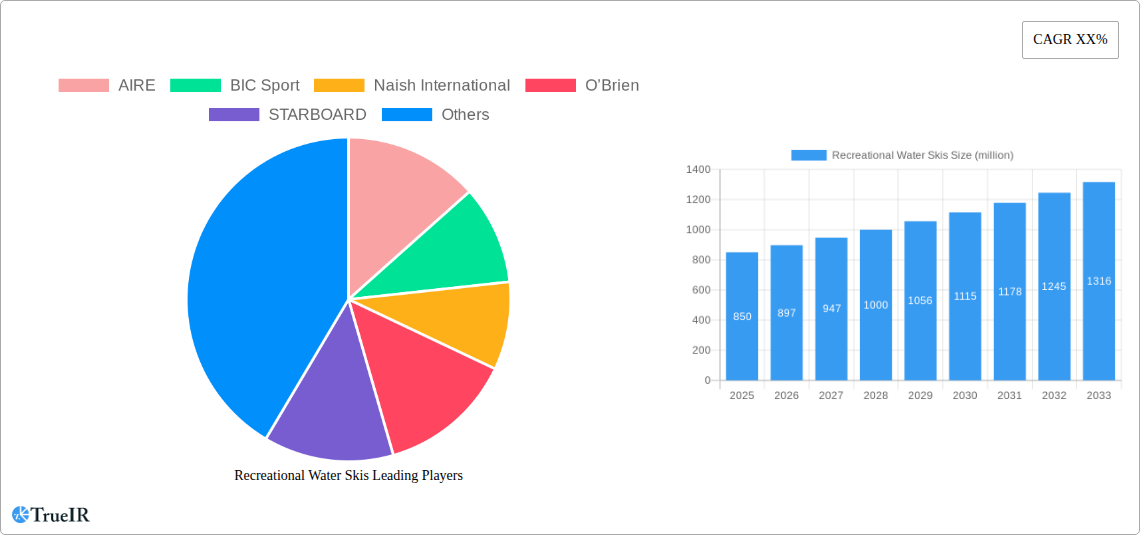

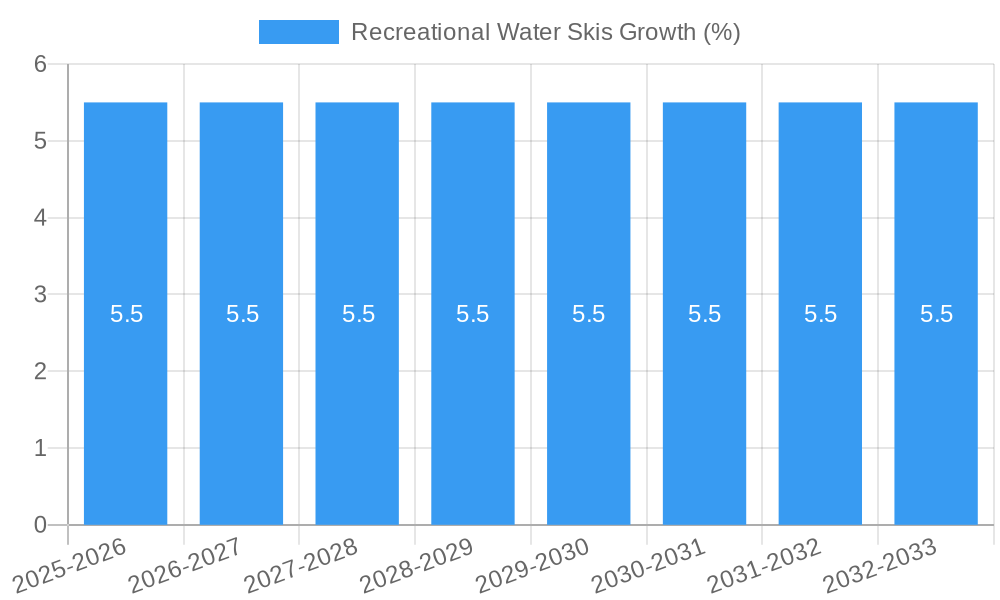

The global recreational water skis market is poised for substantial growth, estimated to reach approximately $850 million in 2025. This dynamic sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.5% through 2033, signifying a robust upward trajectory. This growth is primarily propelled by an increasing global disposable income, leading to greater consumer spending on leisure activities and water sports. The rising popularity of water skiing as a recreational pastime, coupled with advancements in ski technology that enhance performance and user experience, are significant drivers. Furthermore, the proliferation of coastal tourism and the development of water sports facilities in emerging economies are creating new avenues for market expansion. The market is segmented by application into Commercial and Personal use, with personal use currently dominating due to the increasing adoption of water skiing for individual leisure.

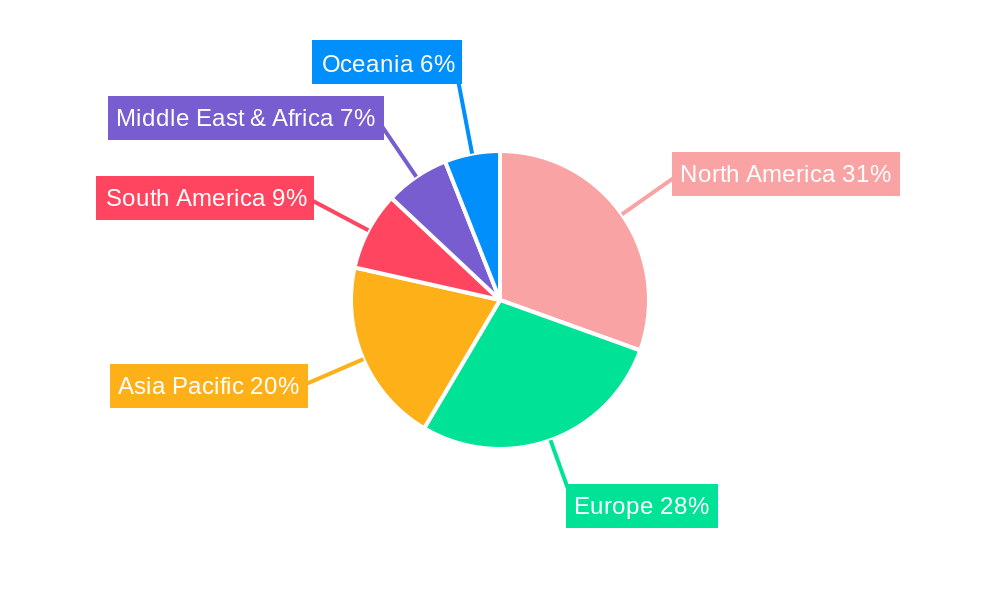

The market for recreational water skis is characterized by diverse material types, including Wood, Aluminum, and Fibreglass, with Fibreglass leading due to its durability and performance characteristics. Innovations in lighter and more responsive materials are expected to further fuel demand. However, the market faces certain restraints, such as the relatively high initial cost of equipment and the need for access to suitable water bodies and training, which can limit widespread adoption in certain regions. Despite these challenges, key players like AIRE, BIC Sport, Naish International, O’Brien, and STARBOARD are actively investing in research and development to introduce innovative products and expand their distribution networks. The Asia Pacific region is anticipated to witness the fastest growth, driven by a burgeoning middle class and increasing participation in water sports. North America and Europe currently hold significant market shares, underpinned by established water sports cultures and a strong consumer base.

Absolutely! Here's a dynamic, SEO-optimized report description for Recreational Water Skis, ready for immediate use without modifications.

Recreational Water Skis Market Structure & Competitive Landscape

The recreational water skis market exhibits a moderate to high level of concentration, with leading players investing significantly in research and development to drive innovation in materials and design. This includes advancements in lightweight composite materials and ergonomic binding systems that enhance performance and user comfort, a key innovation driver. Regulatory impacts, particularly concerning environmental sustainability and safety standards for water sports equipment, are influencing product development and market entry. The threat of product substitutes, such as wakeboards and towable tubes, remains a consideration, though specialized water skis cater to distinct user preferences and skill levels. End-user segmentation primarily divides the market into Commercial (rental operations, resorts) and Personal (individual enthusiasts) applications, with the Personal segment representing the larger share. Mergers and acquisitions (M&A) activity is present, driven by a desire for market consolidation and expanded product portfolios. Over the historical period (2019-2024), an estimated xx billion in M&A deals occurred, signaling strategic moves to capture greater market share. The competitive landscape is characterized by a mix of established global brands and emerging niche manufacturers, each vying for dominance through product differentiation and brand building.

Recreational Water Skis Market Trends & Opportunities

The global recreational water skis market is poised for substantial expansion, projected to reach an estimated market size of over $7,500 million by 2033. Fueled by a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033, this growth trajectory is underpinned by a confluence of favorable market trends and emerging opportunities. Technological shifts are at the forefront, with manufacturers increasingly integrating advanced materials like carbon fiber and specialized resins to create lighter, more durable, and higher-performing skis. This innovation directly addresses growing consumer demand for improved performance, whether for competitive slalom skiing, freestyle tricks, or leisurely cruising. The development of adaptive water skis, designed for individuals with disabilities, is also carving out a significant niche, broadening the market's inclusivity.

Consumer preferences are evolving, leaning towards personalized experiences and eco-friendly products. Brands that can offer customizable ski designs, catering to individual skill levels and aesthetic tastes, are likely to gain a competitive edge. Furthermore, a growing environmental consciousness among consumers is driving demand for water skis manufactured using sustainable materials and production processes. This trend presents a significant opportunity for companies prioritizing green manufacturing. Competitive dynamics are intensifying, with established players like O’Brien and Jetpilot investing heavily in marketing and product development to maintain market leadership. Simultaneously, innovative startups are leveraging online platforms and direct-to-consumer models to challenge incumbents and capture market share, particularly among younger demographics.

The burgeoning adventure tourism sector globally is another powerful catalyst. As more individuals seek thrilling recreational activities, the demand for high-quality water sports equipment, including recreational water skis, is expected to surge. This is particularly evident in coastal regions and areas with abundant freshwater bodies, where water skiing is a popular pastime. Market penetration rates are expected to climb as awareness of water skiing as an accessible and enjoyable sport increases, driven by social media influence and accessible training programs. The integration of smart technologies, such as GPS tracking and performance analytics within ski bindings, is also an emerging trend, offering enthusiasts data-driven insights into their performance and further enhancing the user experience. The market is ripe for strategic partnerships between ski manufacturers and tour operators, as well as the development of integrated rental and training packages that lower the barrier to entry for new participants.

Dominant Markets & Segments in Recreational Water Skis

The Personal Application segment stands as the dominant force within the recreational water skis market, driven by a global surge in individual participation and a growing appreciation for watersports as a leisure activity. This segment alone is projected to account for over 70% of the market's value throughout the forecast period. The Fibreglass type of recreational water skis also commands a significant market share, valued at approximately $3,000 million in the base year of 2025. This dominance is attributable to the material's excellent strength-to-weight ratio, inherent buoyancy, and cost-effectiveness, making it a preferred choice for a wide range of recreational applications.

Leading Regions and Countries:

- North America: This region consistently leads the global recreational water skis market, with the United States being the primary contributor. Key growth drivers include a well-established watersports culture, a high disposable income, extensive coastlines and numerous freshwater lakes, and significant investment in recreational infrastructure. Government initiatives promoting outdoor recreation further bolster market growth. The presence of major manufacturers and a strong consumer base for high-performance equipment solidifies its leading position.

- Europe: Another substantial market, Europe benefits from a long summer season and a strong tradition of outdoor activities. Countries like France, Spain, and Italy, with their extensive coastlines and numerous lakes, are key consumers. Favorable weather conditions, a growing middle class with increasing leisure spending, and the popularity of watersports at holiday resorts contribute to sustained growth. Regulatory support for aquatic sports and increasing investments in marina and watersports facilities also play a crucial role.

- Asia Pacific: This region is emerging as a high-growth market, driven by rapidly developing economies, increasing disposable incomes, and a growing interest in adventure tourism. Countries like China, Australia, and Southeast Asian nations are witnessing a surge in demand for recreational water skis. The expansion of coastal tourism and the increasing availability of watersports facilities are key drivers. Government support for promoting tourism and recreational activities is also contributing to the market's expansion.

Dominant Segments:

- Application:

- Personal: This segment's dominance is fueled by individual purchasing power, the desire for personal recreation, and the growing trend of owning watersports equipment. The increasing popularity of staycations and the accessibility of rental options also contribute significantly.

- Commercial: While smaller, the commercial segment remains vital, encompassing ski schools, rental shops at beaches and lakes, and resorts offering watersports packages. Growth in this segment is tied to the overall expansion of the tourism and hospitality industries.

- Types:

- Fibreglass: Its widespread appeal is due to its durability, performance characteristics across various disciplines (slalom, trick, jump), and a balance of cost and quality.

- Wood: While traditionally significant, wood skis are now often favored for their aesthetic appeal and nostalgic value, catering to a niche segment of enthusiasts.

- Aluminum: Primarily used in some entry-level or specialized skis, offering a blend of lightness and affordability.

- Others: This category includes newer composite materials and hybrid constructions that offer advanced performance features and are gaining traction among professional and serious amateur skiers.

Recreational Water Skis Product Analysis

- Application:

- Personal: This segment's dominance is fueled by individual purchasing power, the desire for personal recreation, and the growing trend of owning watersports equipment. The increasing popularity of staycations and the accessibility of rental options also contribute significantly.

- Commercial: While smaller, the commercial segment remains vital, encompassing ski schools, rental shops at beaches and lakes, and resorts offering watersports packages. Growth in this segment is tied to the overall expansion of the tourism and hospitality industries.

- Types:

- Fibreglass: Its widespread appeal is due to its durability, performance characteristics across various disciplines (slalom, trick, jump), and a balance of cost and quality.

- Wood: While traditionally significant, wood skis are now often favored for their aesthetic appeal and nostalgic value, catering to a niche segment of enthusiasts.

- Aluminum: Primarily used in some entry-level or specialized skis, offering a blend of lightness and affordability.

- Others: This category includes newer composite materials and hybrid constructions that offer advanced performance features and are gaining traction among professional and serious amateur skiers.

Recreational Water Skis Product Analysis

Product innovation in recreational water skis is sharply focused on enhancing performance, durability, and user experience. Manufacturers are leveraging advanced composite materials such as carbon fiber and specialized epoxy resins to create skis that are significantly lighter, more rigid, and more responsive. This translates to improved maneuverability and higher speeds for competitive skiers and a more enjoyable experience for recreational users. Innovations in binding technology, including quick-release mechanisms and improved adjustability, are also crucial for safety and comfort. Furthermore, ergonomic design principles are being applied to optimize the ski's shape and flex for specific disciplines, from precise slalom turns to freestyle tricks, ensuring a competitive edge and broader market appeal.

Key Drivers, Barriers & Challenges in Recreational Water Skis

Key Drivers:

The recreational water skis market is propelled by a confluence of factors. Firstly, the escalating global interest in outdoor and adventure tourism fuels demand as individuals seek engaging recreational activities. Secondly, technological advancements in materials science, leading to lighter, more durable, and higher-performing skis, significantly enhance user experience. Thirdly, rising disposable incomes in emerging economies allow a larger consumer base to invest in watersports equipment. Finally, supportive government policies promoting tourism and recreational infrastructure development create a conducive environment for market expansion. The popularity of watersports as a lifestyle choice and the influence of social media in showcasing these activities also act as significant catalysts.

Challenges and Restraints:

Despite the positive outlook, the market faces several challenges. High initial manufacturing costs for advanced materials can lead to premium pricing, potentially limiting affordability for some consumer segments. Fluctuations in raw material prices, such as carbon fiber and resins, can impact production costs and profit margins. Stringent environmental regulations regarding water usage and emissions from motorized watercraft can indirectly affect the market by limiting access to suitable waterways. Furthermore, intense competition from alternative watersports equipment like wakeboards and paddleboards presents a constant challenge in capturing consumer attention and spending. Seasonal dependency in many regions also limits sales opportunities to specific periods of the year.

Growth Drivers in the Recreational Water Skis Market

The recreational water skis market is experiencing robust growth driven by increasing global participation in water-based recreational activities and adventure tourism. Technological innovations, particularly in the development of lightweight composite materials like carbon fiber and advanced resin systems, are enhancing ski performance and durability, directly appealing to enthusiasts seeking superior experiences. Rising disposable incomes in both developed and emerging economies are empowering more consumers to invest in leisure equipment, including high-quality water skis. Furthermore, supportive government initiatives aimed at promoting tourism and developing aquatic recreational facilities are creating new market opportunities and improving accessibility for a wider audience. The growing trend of prioritizing active lifestyles and the influence of social media in popularizing watersports are also significant growth catalysts.

Challenges Impacting Recreational Water Skis Growth

The growth of the recreational water skis market is somewhat constrained by several factors. The high cost associated with advanced materials and sophisticated manufacturing processes can lead to premium product pricing, potentially limiting affordability for a broader consumer base. Fluctuations in the prices of raw materials, such as carbon fiber, can introduce volatility into production costs and impact profitability. Environmental concerns and increasingly stringent regulations regarding water usage and emissions from associated watercraft can also pose challenges, potentially restricting access to suitable waters or increasing operational costs for commercial operators. Moreover, the market faces strong competition from alternative watersports equipment, such as wakeboards, paddleboards, and towables, which vie for consumer leisure spending and attention. The inherently seasonal nature of water skiing in many geographical regions also presents a challenge by limiting the sales window.

Key Players Shaping the Recreational Water Skis Market

- AIRE

- BIC Sport

- Naish International

- O’Brien

- STARBOARD

- Jettribe

- Kawasaki Motors

- Sea-Doo

- Yamaha Motor

- Bellasi

- Billabong

- BomBoard

- Cressi

- Dive Rite

- Jetpilot

- Quadrofoil

- Rave Sports

Significant Recreational Water Skis Industry Milestones

- 2019: Introduction of advanced carbon composite skis offering unparalleled stiffness and weight reduction.

- 2020: Emergence of eco-friendly manufacturing processes utilizing recycled materials gaining traction.

- 2021: Significant increase in demand for adaptive water skis catering to individuals with disabilities.

- 2022: Advancements in binding technology with enhanced adjustability and safety features.

- 2023: Growth in direct-to-consumer (DTC) sales channels for ski manufacturers.

- 2024: Focus on smart integration in skis, including performance tracking sensors.

- 2025: Projected increase in M&A activity for market consolidation and portfolio expansion.

- 2026: Expected development of hybrid ski designs combining different materials for optimal performance.

- 2027: Greater emphasis on sustainability throughout the product lifecycle.

- 2028: Introduction of customizable ski graphics and designs through advanced digital printing.

- 2029: Potential for new lightweight aluminum alloys to impact entry-level ski production.

- 2030: Expansion of watersports tourism infrastructure in emerging markets.

- 2031: Continued innovation in buoyancy control for all-level skiers.

- 2032: Anticipated collaborations between ski brands and influencer marketing platforms.

- 2033: Forecasted significant market growth driven by expanding global participation.

Future Outlook for Recreational Water Skis Market

The future outlook for the recreational water skis market is exceptionally promising, driven by sustained growth catalysts and evolving consumer preferences. The increasing global emphasis on health and wellness, coupled with the enduring appeal of adventure tourism, will continue to fuel demand for engaging outdoor activities like water skiing. Technological advancements are expected to play a pivotal role, with ongoing innovations in materials science promising even lighter, more responsive, and eco-friendly skis. The market will likely see a greater integration of smart technologies for performance tracking and personalized training experiences. Furthermore, the expansion of accessible watersports facilities and supportive government policies in emerging economies are set to unlock new consumer bases. Companies that focus on sustainability, customization, and delivering superior performance are well-positioned to capitalize on the significant market potential and achieve substantial growth in the coming years.

Recreational Water Skis Segmentation

-

1. Application

- 1.1. Commerical

- 1.2. Personal

-

2. Types

- 2.1. Wood

- 2.2. Aluminum

- 2.3. Fibreglass

- 2.4. Others

Recreational Water Skis Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Recreational Water Skis REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Recreational Water Skis Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commerical

- 5.1.2. Personal

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wood

- 5.2.2. Aluminum

- 5.2.3. Fibreglass

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Recreational Water Skis Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commerical

- 6.1.2. Personal

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wood

- 6.2.2. Aluminum

- 6.2.3. Fibreglass

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Recreational Water Skis Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commerical

- 7.1.2. Personal

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wood

- 7.2.2. Aluminum

- 7.2.3. Fibreglass

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Recreational Water Skis Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commerical

- 8.1.2. Personal

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wood

- 8.2.2. Aluminum

- 8.2.3. Fibreglass

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Recreational Water Skis Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commerical

- 9.1.2. Personal

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wood

- 9.2.2. Aluminum

- 9.2.3. Fibreglass

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Recreational Water Skis Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commerical

- 10.1.2. Personal

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wood

- 10.2.2. Aluminum

- 10.2.3. Fibreglass

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AIRE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BIC Sport

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Naish International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 O’Brien

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 STARBOARD

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jettribe

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kawasaki Motors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sea-Doo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yamaha Motor

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bellasi

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Billabong

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BomBoard

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Cressi

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dive Rite

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Jetpilot

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Quadrofoil

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Rave Sports

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 AIRE

List of Figures

- Figure 1: Global Recreational Water Skis Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Recreational Water Skis Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Recreational Water Skis Revenue (million), by Application 2024 & 2032

- Figure 4: North America Recreational Water Skis Volume (K), by Application 2024 & 2032

- Figure 5: North America Recreational Water Skis Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Recreational Water Skis Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Recreational Water Skis Revenue (million), by Types 2024 & 2032

- Figure 8: North America Recreational Water Skis Volume (K), by Types 2024 & 2032

- Figure 9: North America Recreational Water Skis Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Recreational Water Skis Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Recreational Water Skis Revenue (million), by Country 2024 & 2032

- Figure 12: North America Recreational Water Skis Volume (K), by Country 2024 & 2032

- Figure 13: North America Recreational Water Skis Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Recreational Water Skis Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Recreational Water Skis Revenue (million), by Application 2024 & 2032

- Figure 16: South America Recreational Water Skis Volume (K), by Application 2024 & 2032

- Figure 17: South America Recreational Water Skis Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Recreational Water Skis Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Recreational Water Skis Revenue (million), by Types 2024 & 2032

- Figure 20: South America Recreational Water Skis Volume (K), by Types 2024 & 2032

- Figure 21: South America Recreational Water Skis Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Recreational Water Skis Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Recreational Water Skis Revenue (million), by Country 2024 & 2032

- Figure 24: South America Recreational Water Skis Volume (K), by Country 2024 & 2032

- Figure 25: South America Recreational Water Skis Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Recreational Water Skis Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Recreational Water Skis Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Recreational Water Skis Volume (K), by Application 2024 & 2032

- Figure 29: Europe Recreational Water Skis Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Recreational Water Skis Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Recreational Water Skis Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Recreational Water Skis Volume (K), by Types 2024 & 2032

- Figure 33: Europe Recreational Water Skis Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Recreational Water Skis Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Recreational Water Skis Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Recreational Water Skis Volume (K), by Country 2024 & 2032

- Figure 37: Europe Recreational Water Skis Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Recreational Water Skis Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Recreational Water Skis Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Recreational Water Skis Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Recreational Water Skis Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Recreational Water Skis Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Recreational Water Skis Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Recreational Water Skis Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Recreational Water Skis Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Recreational Water Skis Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Recreational Water Skis Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Recreational Water Skis Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Recreational Water Skis Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Recreational Water Skis Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Recreational Water Skis Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Recreational Water Skis Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Recreational Water Skis Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Recreational Water Skis Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Recreational Water Skis Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Recreational Water Skis Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Recreational Water Skis Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Recreational Water Skis Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Recreational Water Skis Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Recreational Water Skis Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Recreational Water Skis Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Recreational Water Skis Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Recreational Water Skis Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Recreational Water Skis Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Recreational Water Skis Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Recreational Water Skis Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Recreational Water Skis Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Recreational Water Skis Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Recreational Water Skis Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Recreational Water Skis Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Recreational Water Skis Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Recreational Water Skis Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Recreational Water Skis Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Recreational Water Skis Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Recreational Water Skis Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Recreational Water Skis Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Recreational Water Skis Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Recreational Water Skis Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Recreational Water Skis Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Recreational Water Skis Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Recreational Water Skis Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Recreational Water Skis Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Recreational Water Skis Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Recreational Water Skis Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Recreational Water Skis Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Recreational Water Skis Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Recreational Water Skis Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Recreational Water Skis Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Recreational Water Skis Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Recreational Water Skis Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Recreational Water Skis Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Recreational Water Skis Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Recreational Water Skis Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Recreational Water Skis Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Recreational Water Skis Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Recreational Water Skis Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Recreational Water Skis Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Recreational Water Skis Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Recreational Water Skis Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Recreational Water Skis Volume K Forecast, by Country 2019 & 2032

- Table 81: China Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Recreational Water Skis Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Recreational Water Skis Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recreational Water Skis?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Recreational Water Skis?

Key companies in the market include AIRE, BIC Sport, Naish International, O’Brien, STARBOARD, Jettribe, Kawasaki Motors, Sea-Doo, Yamaha Motor, Bellasi, Billabong, BomBoard, Cressi, Dive Rite, Jetpilot, Quadrofoil, Rave Sports.

3. What are the main segments of the Recreational Water Skis?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Recreational Water Skis," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Recreational Water Skis report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Recreational Water Skis?

To stay informed about further developments, trends, and reports in the Recreational Water Skis, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence